BRF Bundle

Can BRF Conquer the Global Food Market?

In the ever-evolving world of food, understanding the BRF SWOT Analysis is crucial for investors and industry watchers alike. BRF S.A., a powerhouse born from Brazilian roots, faces a dynamic BRF competitive landscape shaped by global giants and agile startups. This analysis delves into the strategies, rivals, and market dynamics that define BRF's position in the food industry.

This in-depth exploration of the BRF market analysis will uncover the key BRF competitors and the factors driving its performance. From its origins in the Brazilian food industry to its global ambitions, we'll examine how BRF navigates challenges and leverages opportunities. We'll also explore its competitive advantages of BRF and how it stacks up against industry titans like JBS, providing valuable insights for strategic decision-making through comprehensive competitive analysis.

Where Does BRF’ Stand in the Current Market?

BRF holds a significant position in the global food industry, particularly in poultry and pork. The company is a major exporter of poultry and a leader in the Brazilian market for processed foods. Its core operations involve the production and distribution of a wide range of food products, including fresh and frozen meats, processed items like sausages and ham, and, to a lesser extent, dairy products.

The company's value proposition centers on providing accessible and high-quality food products to a global consumer base. It emphasizes its strong brands, extensive distribution networks, and strategic focus on higher-margin processed goods. BRF aims to meet diverse consumer needs through a broad product portfolio and a commitment to operational efficiency.

BRF is a prominent player in the global food market. While specific market share figures for 2024-2025 are subject to change, the company consistently ranks among the top poultry exporters worldwide. It holds a dominant position within Brazil's processed food sector, demonstrating its strong foothold in key markets.

BRF has a broad global presence, operating and selling in over 100 countries across the Americas, Europe, Asia, and the Middle East. This extensive reach allows the company to serve diverse customer segments, including retail, foodservice, and industrial clients. Its international footprint is a key aspect of its competitive strategy.

BRF has strategically shifted its focus to higher-margin processed products and expanded into resilient international markets, particularly in the Halal segment. This diversification aims to reduce reliance on volatile commodity markets and strengthen brand presence. These moves are crucial for sustainable growth and market leadership.

BRF's financial performance reflects efforts to improve its financial health. For Q1 2024, BRF reported net revenue of R$ 14.4 billion, a 1.7% increase compared to Q1 2023. The adjusted EBITDA reached R$ 1.3 billion, with an EBITDA margin of 9.1%. These figures indicate the company's scale and profitability relative to industry benchmarks.

BRF's market position is shaped by several key factors. The company's strong presence in Brazil and key export markets like the Middle East is driven by its established brands and distribution networks. However, it faces intense competition in other regions, requiring continuous strategic adjustments and innovation. Understanding the Target Market of BRF is crucial for navigating this competitive landscape.

- Market Share: BRF is a leading player in the global poultry market and holds a dominant position in Brazil.

- Geographic Focus: Operations span over 100 countries, with a strong presence in the Americas, Europe, Asia, and the Middle East.

- Financial Health: The company is focused on improving profitability and deleveraging, as seen in its Q1 2024 results.

- Competitive Landscape: BRF faces intense competition, necessitating continuous strategic adjustments.

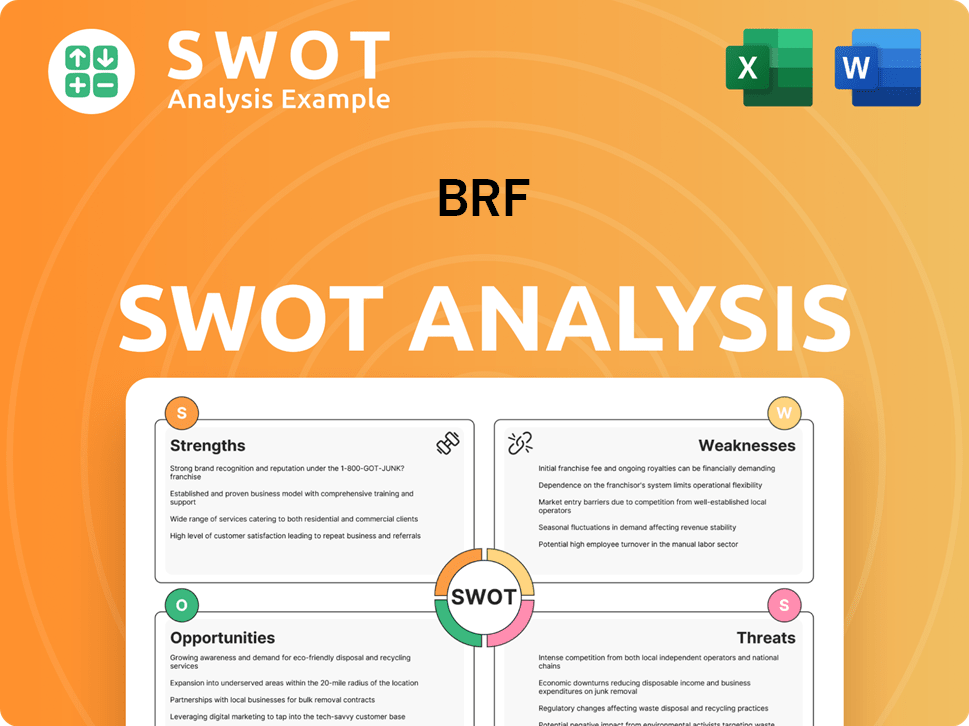

BRF SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging BRF?

The Growth Strategy of BRF is significantly shaped by the competitive landscape in the global food market. Understanding the key players and their strategies is crucial for assessing BRF's position and future prospects. This competitive analysis helps to identify challenges and opportunities for BRF, guiding strategic decisions in areas like product development, market expansion, and operational efficiency.

BRF's competitive environment involves a complex interplay of direct and indirect competitors, ranging from large multinational corporations to regional specialists. The company's success depends on its ability to navigate this landscape, leveraging its strengths while mitigating its weaknesses. Analyzing the competitive dynamics provides insights into how BRF can maintain and improve its market share.

BRF faces intense competition in the global protein market. The main rivals include large players like JBS S.A. and Marfrig Global Foods S.A.

JBS, a Brazilian multinational, is a significant direct competitor. JBS is larger in terms of revenue and global reach. JBS challenges BRF across multiple protein categories.

Marfrig, another Brazilian company, competes with BRF, particularly in beef and processed meat. Marfrig has a strong presence in North and South America.

BRF competes with regional and international food companies. Companies like Tyson Foods and Pilgrim's Pride pose significant competition.

In Asia and the Middle East, BRF faces competition from local producers and global exporters. These competitors may have cost advantages or tailored product offerings.

Emerging players focused on plant-based alternatives pose an indirect threat. Mergers and acquisitions reshape the competitive landscape.

The BRF competitive landscape is dynamic, with companies constantly adapting their strategies. Key factors influencing the BRF market analysis include price competition, innovation, branding, and distribution. BRF's competitors constantly strive to gain market share through various means. Understanding these competitive dynamics is essential for BRF SA to maintain and improve its position in the Brazilian food industry.

Several factors influence the competitive dynamics in the protein market. These factors determine the success of companies like BRF.

- Price Competition: Constant pressure, especially in commodity meat markets.

- Innovation: Focus on convenience, health, and sustainability in processed foods.

- Branding and Marketing: Crucial for capturing consumer loyalty.

- Distribution Networks: Essential for market penetration.

- Mergers and Acquisitions: Reshaping the competitive landscape, such as JBS's acquisitions.

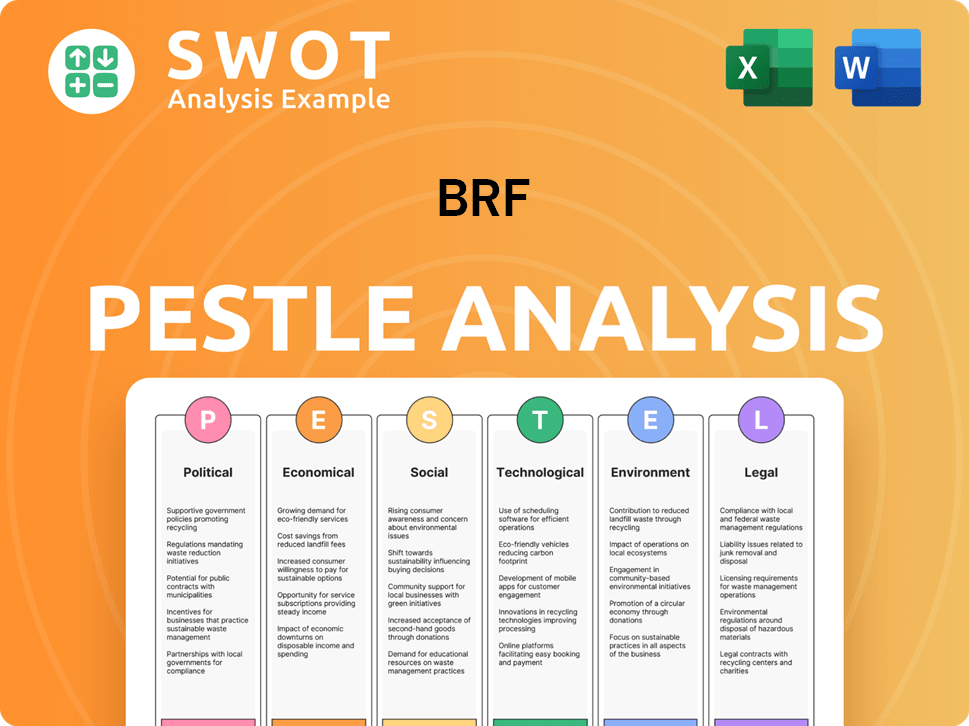

BRF PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives BRF a Competitive Edge Over Its Rivals?

The competitive advantages of BRF, a major player in the Brazilian food industry, are multifaceted, stemming from its operational scale, brand strength, and strategic market positioning. Understanding the Marketing Strategy of BRF is crucial for grasping how these advantages are leveraged. These factors collectively shape BRF's competitive landscape and its ability to maintain a strong position in the global food market. A thorough BRF market analysis reveals the significance of these elements in driving its success.

BRF's core strengths include an extensive, integrated production chain, particularly within Brazil, which allows for significant economies of scale. This integrated model, from sourcing raw materials to distribution, enhances cost efficiencies and operational control. Furthermore, BRF's established brand equity, especially with its Sadia and Perdigão brands, fosters customer loyalty and pricing power. These advantages are critical in navigating the competitive landscape.

The company's expertise in the Halal food market also provides a significant competitive edge, particularly in the Middle East. This specialized knowledge, combined with its global distribution network, allows BRF to efficiently serve diverse markets. Continuous investment in research and development, focusing on product innovation and food safety, further strengthens its competitive position. These combined elements contribute to the overall BRF competitive landscape.

BRF's extensive production network and integrated supply chain, particularly in Brazil, drive economies of scale. This operational efficiency is vital for cost management and market competitiveness. The company's vast distribution capabilities enhance its ability to serve diverse markets effectively.

The Sadia and Perdigão brands hold significant recognition and trust, particularly within Brazil. This brand loyalty supports pricing power and resilient demand. Strong brand recognition is a key factor in the competitive analysis of BRF.

BRF's established presence in the Halal food market provides a competitive advantage, especially in the Middle East. This expertise in Halal food production and certification is a key differentiator. This specialized knowledge allows BRF to tap into a significant and growing market segment.

Continuous investment in research and development drives product innovation, particularly in healthier and convenient food options. This focus on innovation helps BRF meet evolving consumer preferences. Robust supply chain management ensures product consistency and safety.

BRF's competitive advantages are multifaceted, including its operational scale, strong brand equity, and expertise in the Halal food market. These strengths are reinforced by continuous investments in research and development and a focus on product innovation. The company's strategic moves and market positioning contribute significantly to its success.

- Integrated Production: BRF's vertically integrated model, particularly in Brazil, enhances cost efficiencies.

- Brand Recognition: Sadia and Perdigão brands have strong customer loyalty, supporting pricing power.

- Halal Market Leadership: Expertise in Halal food production provides a competitive edge.

- Innovation: Continuous R&D efforts drive new product development and market responsiveness.

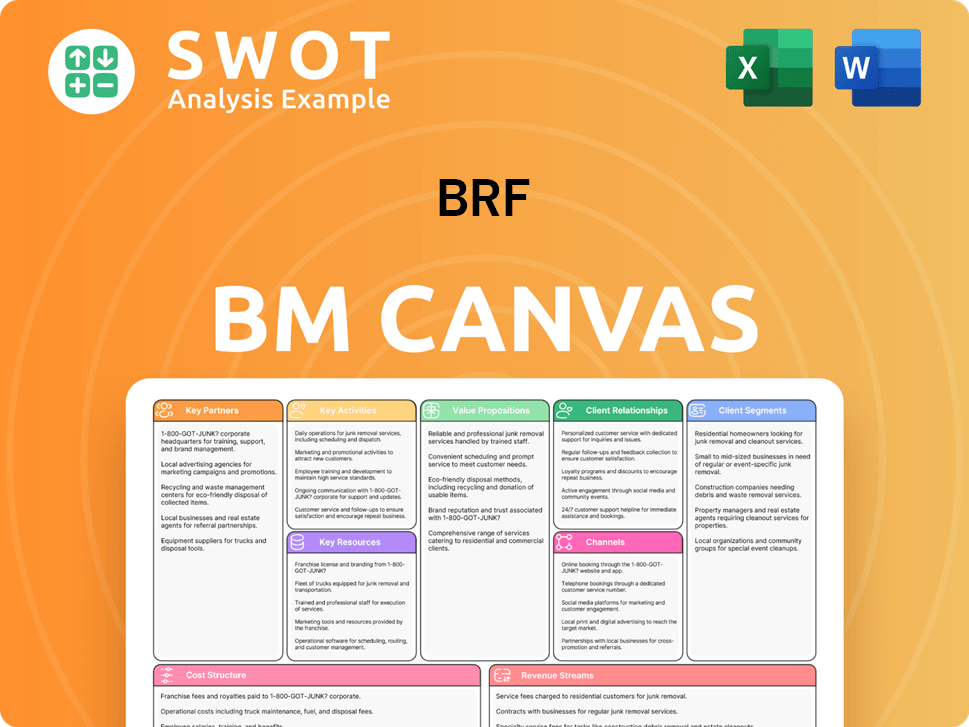

BRF Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping BRF’s Competitive Landscape?

The BRF competitive landscape is significantly influenced by industry trends, future challenges, and emerging opportunities. The Brazilian food industry, where BRF SA operates, faces a dynamic environment shaped by technological advancements, evolving consumer preferences, and global economic shifts. A thorough BRF market analysis reveals the need for strategic adaptation and innovation to maintain a strong market position. Understanding BRF's competitors and their strategies is crucial for effective decision-making.

BRF's industry position requires careful navigation of risks and proactive pursuit of opportunities. The rise of plant-based alternatives, stringent regulations, and economic volatility pose challenges. However, BRF can leverage its strengths through product innovation, strategic partnerships, and expansion into high-growth markets. For further insights into the company's global presence, consider exploring the perspectives of Owners & Shareholders of BRF.

Technological advancements like automation and data analytics are driving efficiency. Regulatory changes concerning food safety and sustainability are increasing. Consumers are demanding healthier and more sustainable food options, alongside convenience.

The rise of alternative proteins and changing business models pose disruptions. Declining demand for traditional meat in certain markets and increased regulatory scrutiny are potential threats. Aggressive competition in key export regions also presents challenges.

Emerging markets offer substantial growth potential due to rising incomes and population growth. Product innovations, such as plant-based offerings, can capture new consumer segments. Strategic partnerships can enhance market access and operational efficiency.

BRF is focusing on operational efficiency, deleveraging, and sustainable growth. The company aims to strengthen its presence in key markets and optimize its product portfolio. Embracing sustainable practices is crucial to adapt to evolving industry dynamics.

BRF is actively addressing industry trends through strategic initiatives. These include investments in technology to improve efficiency and reduce costs. The company is also expanding its portfolio to include plant-based products and other value-added items to meet changing consumer preferences. BRF's approach involves a mix of organic growth and strategic partnerships to strengthen its market position.

- Operational efficiency improvements to reduce costs.

- Expansion of plant-based product offerings.

- Strategic partnerships for market access and distribution.

- Focus on sustainable practices and environmental responsibility.

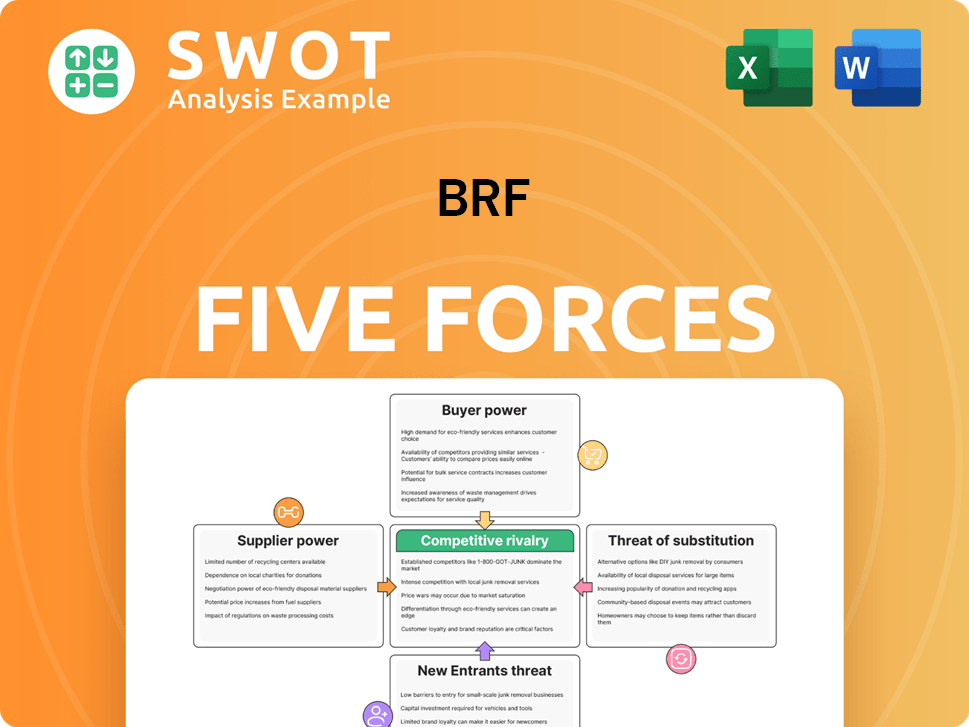

BRF Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BRF Company?

- What is Growth Strategy and Future Prospects of BRF Company?

- How Does BRF Company Work?

- What is Sales and Marketing Strategy of BRF Company?

- What is Brief History of BRF Company?

- Who Owns BRF Company?

- What is Customer Demographics and Target Market of BRF Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.