Calumet Bundle

What's the Story Behind the Rise of Calumet Company?

From its humble beginnings to its current status as a leading North American producer, the Calumet Company has a fascinating story. This journey includes a significant shift from a master limited partnership (MLP) to a C-Corporation in July 2024, a move designed to attract a broader investor base. But what were the key moments that shaped Calumet's evolution?

Calumet's story began in 1919, and it has since become a major player in the refining and marketing of specialty hydrocarbon products and fuels. The company's strategic pivot towards higher-margin specialty products and renewable fuels, including its Montana Renewables (MRL) facility, marks a significant chapter in its Calumet SWOT Analysis. With a substantial revenue reported as of Q1 2024, understanding the brief history of Calumet Company is crucial for investors and industry watchers alike. The company's legacy is one of adaptation and innovation, making it a compelling case study in the energy sector.

What is the Calumet Founding Story?

The brief history of the Calumet Company begins with its co-founding by Bill Grube and Fred M. Fehsenfeld, Jr. in 1990. While the exact day is not specified, the company's roots in hydrocarbon products stretch back to 1919. The primary aim was to establish a leading independent producer of high-quality, refined hydrocarbon products across North America.

Headquartered in Indianapolis, Indiana, the company initially focused on refining and processing crude oil and other feedstocks. This process produced a wide array of products. These included lubricating oils, white oils, solvents, petrolatums, asphalts, and waxes, as well as fuels like gasoline, diesel, and jet fuel. These specialty products were sold as raw materials to customers both domestically and internationally. For more information, you can explore the Competitors Landscape of Calumet.

Early details, such as the selection of the company name, initial funding sources, or challenges during its establishment, are not readily available in the provided information. However, the economic climate of the time likely played a significant role in its creation. There was a consistent demand for specialized petroleum products to serve various industrial and consumer needs.

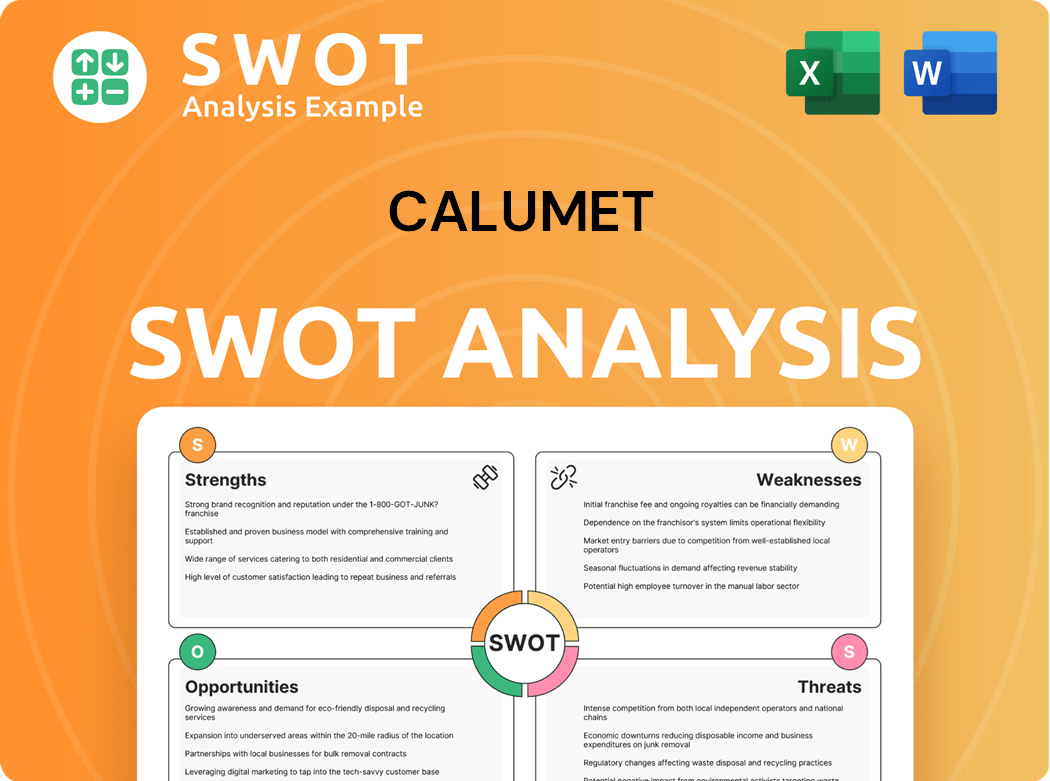

Calumet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Calumet?

The early growth of the Calumet Company was marked by significant milestones, including its initial public offering and entry into the Fortune 500. The company's expansion strategy involved over a dozen acquisitions within its first quarter-century. This period saw the diversification of its product portfolio, focusing on specialty hydrocarbon products and fuels.

Key acquisitions during this time included Montana Refining Company, Inc. and a Hercules Incorporated plant. Additionally, the company acquired Royal Purple, LLC and TruSouth Oil, LLC, which strengthened its performance brands segment. These strategic moves helped shape the Calumet's product offerings and market position.

F.W. Grube served as CEO from 1990 to 2015, a period during which Calumet achieved record profitability. Tim Go succeeded him in January 2016. In 2021, the company re-segmented its financials into three segments: Specialty Products & Solutions (SPS), Performance Brands (PB), and Montana/Renewables (MRL). This restructuring aimed to provide greater investor transparency. Further information can be found in Growth Strategy of Calumet.

The company strategically deleveraged its balance sheet, including a $70 million sale-leaseback transaction for fuels terminal assets in 2021, which helped redeem $150 million in 2022 notes. Calumet's ability to adapt to industry trends, particularly its shift towards higher-margin specialty products and renewable fuels, is expected to positively influence its market reception.

Currently, Calumet is headquartered in Indianapolis, Indiana, and operates 12 specialty product manufacturing and production facilities across North America. This operational footprint supports its diverse product offerings and market reach. The company's focus remains on adapting to market demands and enhancing its financial performance.

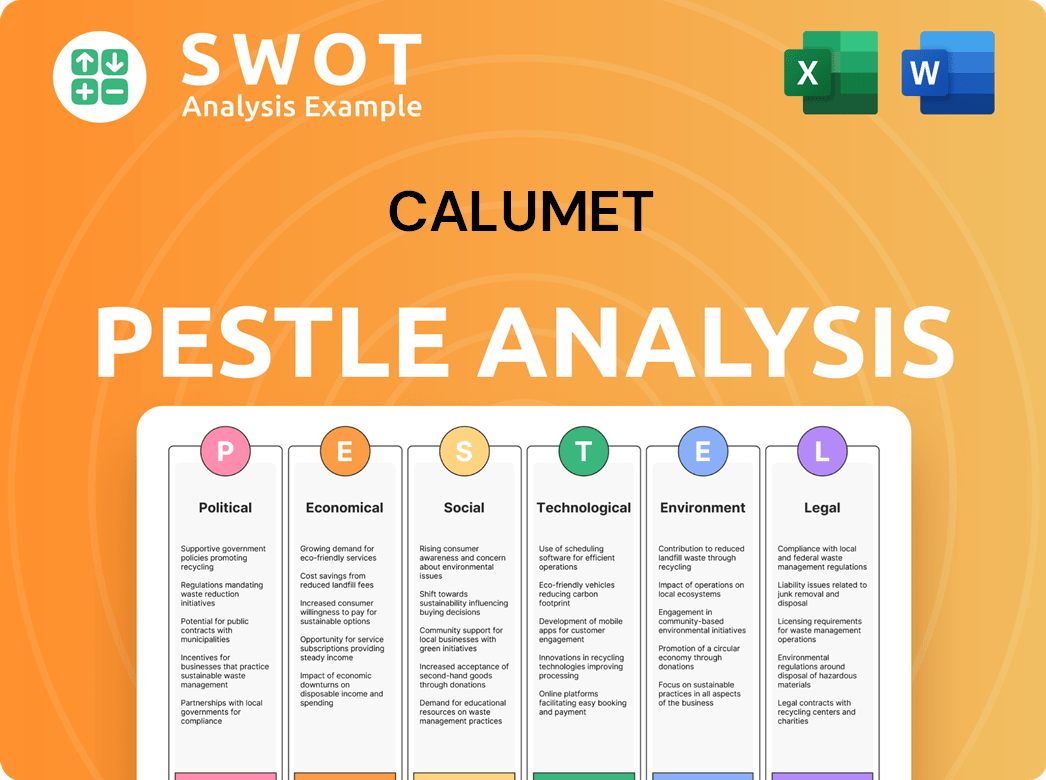

Calumet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Calumet history?

The Calumet Company has achieved several significant milestones throughout its history, including its initial public offering and becoming a Fortune 500 company within its first 25 years. The Calumet history is marked by strategic shifts and significant growth in the energy sector.

| Year | Milestone |

|---|---|

| Early Years | The company achieved early success and recognition in the industry. |

| Within 25 Years | Became a Fortune 500 company, demonstrating significant growth and market presence. |

| July 2024 | Completed the conversion from a master limited partnership (MLP) to a C-Corporation. |

| February 2025 | Announced the sale of its Royal Purple Industrial business for $110 million. |

A key innovation and strategic pivot has been the transformation of its Montana facility into a leading renewable fuel producer, now known as Montana Renewables (MRL). MRL is currently the largest producer of sustainable aviation fuel (SAF) in North America. The company has also secured patents related to its specialty products.

The transformation of the Montana facility into Montana Renewables (MRL) is a significant innovation. MRL is now the largest producer of sustainable aviation fuel (SAF) in North America, showcasing a commitment to renewable energy.

The company's shift towards renewable fuels and specialty products reflects a strategic adaptation to market demands. This pivot has positioned the company for growth in emerging sectors.

Securing patents related to specialty products indicates a focus on innovation and differentiation. This protects the company's unique offerings in the market.

Challenges have included market downturns, competitive threats, and operational issues. In 2023, the Montana Renewables facility experienced operational delays, including a cracked steam drum and weather events, impacting financial results.

The Montana Renewables facility faced operational challenges, including a cracked steam drum and weather events. These issues negatively impacted the company's financial performance in 2023.

Refinancing risks, particularly with the April 2025 notes, have presented challenges. As of May 2024, $364 million was outstanding, requiring active debt management.

The company has faced challenges related to market downturns and competitive pressures. These factors can impact profitability and market share.

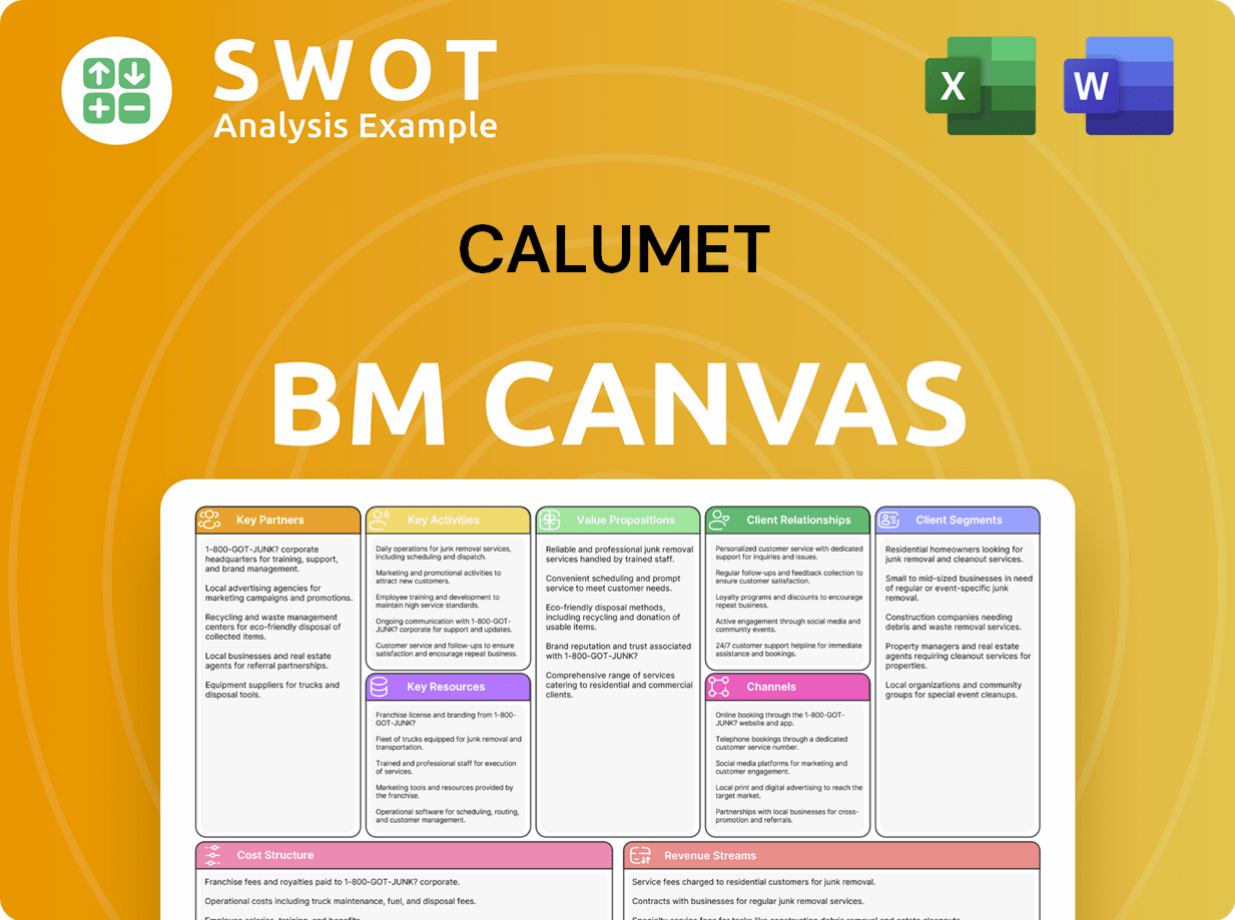

Calumet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Calumet?

The Calumet Company has a rich history, evolving from its early roots in hydrocarbon products to its current focus on specialty products and renewable fuels. The company's journey, marked by strategic shifts and financial milestones, reflects its adaptation to market changes and commitment to sustainability. Here's a look at some key moments in its history.

| Year | Key Event |

|---|---|

| 1919 | The company's origins trace back to its beginnings in hydrocarbon products. |

| 1990 | Calumet Specialty Products Partners, L.P. was co-founded by Bill Grube and Fred M. Fehsenfeld, Jr. |

| 2015 | F.W. Grube retired as CEO, and Calumet celebrated its 25th anniversary. |

| January 2016 | Tim Go became CEO. |

| 2021 Q1 | Calumet restructured its financial reporting into Specialty Products & Solutions (SPS), Performance Brands (PB), and Montana/Renewables (MRL). |

| February 2021 | A $70 million sale-leaseback transaction was closed for fuels terminal assets at the Shreveport refinery. |

| November 2021 | Montana Renewables, LLC (MRL) was established as a pure-play renewables subsidiary, with Oaktree Capital Management, L.P. investing $300 million in convertible debt. |

| August 2022 | Warburg Pincus invested $250 million in MRL, and Stonebriar Commercial Finance invested an additional $350 million. |

| December 2023 | Montana Renewables (MRL) returned to normal operations after facing operational challenges. |

| February 2024 | Calumet reported a full-year 2023 net income of $48.1 million and announced its intent to convert to a C-Corp. |

| March 2024 | Calumet completed a refinancing transaction, raising $200 million in 9.25% senior secured notes due 2029. |

| July 2024 | Calumet Specialty Products Partners, L.P. completed its conversion to a C-Corporation, now named Calumet, Inc., and its common stock began trading on Nasdaq under the symbol 'CLMT' on July 11, 2024. |

| November 2024 | Montana Renewables completed a planned turnaround and achieved a 50 million gallon annualized SAF run rate. |

| February 2025 | Montana Renewables received its first drawdown of approximately $782 million from its $1.44 billion guaranteed loan facility with the U.S. Department of Energy. Also, Calumet announced the sale of its Royal Purple Industrial business for $110 million. |

| April 2025 | Calumet sold assets related to the industrial portion of its Royal Purple business. |

Calumet is focused on reducing debt and expanding its specialty products and renewable fuels sectors. The company anticipates maintaining specialty margins above $60 per barrel in 2025. Calumet aims to be a leader in Sustainable Aviation Fuel (SAF), targeting 150 million gallons of SAF production by 2026 and a long-term goal of 300 million gallons.

For 2025, Calumet plans to spend between $60-$90 million on capital expenditures, with additional funds allocated to the MaxApp expansion. The company aims to achieve an $800 million debt target through free cash flow, asset sales, and potential monetization of Montana Renewables. Analyst predictions suggest the company will be profitable in 2025.

The transition to a C-Corp structure is expected to improve cash flow and financial flexibility. This strategic move supports the company's core vision of producing high-quality hydrocarbon products while prioritizing sustainable solutions. This forward-looking strategy is a key element of Calumet's future.

The company's commitment to Sustainable Aviation Fuel (SAF) and renewable fuels highlights its dedication to environmental responsibility. This focus aligns with the growing demand for sustainable energy solutions in the aviation industry. Calumet's investments in renewable fuels position it for long-term growth and success.

Calumet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Calumet Company?

- What is Growth Strategy and Future Prospects of Calumet Company?

- How Does Calumet Company Work?

- What is Sales and Marketing Strategy of Calumet Company?

- What is Brief History of Calumet Company?

- Who Owns Calumet Company?

- What is Customer Demographics and Target Market of Calumet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.