Calumet Bundle

Can Calumet Company Thrive in Tomorrow's Energy Market?

Calumet Specialty Products Partners, L.P. has evolved from a small Louisiana refinery to a major player in the North American specialty hydrocarbon market. Founded in 1913, the company's journey reflects a commitment to adapting and innovating within the ever-changing energy sector. Its transformation highlights a strategic focus on specialized petroleum products, setting the stage for its future endeavors.

This Calumet SWOT Analysis will delve into the Calumet Company Growth Strategy and explore the Calumet Company Future Prospects, examining its Calumet Company Business model and market position. We'll analyze the company's Calumet Company Performance within the competitive landscape, considering its expansion plans, technological advancements, and financial strategies. Understanding these elements is crucial for assessing the Calumet Company Analysis and its potential for long-term success.

How Is Calumet Expanding Its Reach?

The focus of the Calumet Company's growth strategy involves several key expansion initiatives designed to boost its market presence and diversify its revenue streams. A primary area of focus is optimizing its existing asset base. This includes projects such as the Montana Renewables (MRL) facility, which is crucial for increasing the production of sustainable aviation fuel (SAF) and renewable diesel.

This strategic direction is driven by the growing demand for lower-carbon energy solutions and the need to align with evolving industry trends and regulatory landscapes that favor renewable fuels. The company is actively working to expand MRL's capacity, with projections for significant increases in SAF production in the coming years. This expansion allows the company to access new customer segments focused on sustainability.

Furthermore, the company is exploring strategic partnerships and collaborations to accelerate its growth in specific product categories. These partnerships could involve joint ventures for new product development or distribution agreements that extend the company's reach into new geographical markets. The company's capital allocation strategy prioritizes projects that offer strong returns and contribute to its long-term strategic objectives, including further investment in its specialty products segment to maintain its competitive edge in customized hydrocarbon solutions.

The expansion of the Montana Renewables (MRL) facility is a significant part of the Calumet Company growth strategy. This initiative aims to increase the production of sustainable aviation fuel (SAF) and renewable diesel. The company is actively working to expand MRL's capacity to meet the growing demand for lower-carbon energy solutions.

Calumet Company is exploring opportunities for strategic partnerships and collaborations. These partnerships are designed to accelerate growth in specific product categories. They may include joint ventures for new product development or distribution agreements to extend the company's reach into new markets.

The company's capital allocation strategy prioritizes projects that offer strong returns. This includes investments in the specialty products segment to maintain its competitive edge in customized hydrocarbon solutions. This approach supports the company's long-term strategic objectives and ensures sustainable growth.

Calumet Company's expansion plans also include extending its geographic footprint. This is achieved through strategic acquisitions and partnerships that extend the company's reach into new geographical markets. This strategy helps diversify the company's revenue streams and increase its market share.

Calumet Company's future prospects are closely tied to its expansion initiatives, focusing on renewable fuels and strategic partnerships. These initiatives are designed to capitalize on market trends and drive revenue growth. The company's performance is expected to benefit from these strategic moves.

- MRL Facility Expansion: Increasing SAF and renewable diesel production.

- Strategic Partnerships: Collaborations for new product development and market expansion.

- Capital Allocation: Prioritizing projects with strong returns and long-term strategic benefits.

- Geographic Expansion: Extending market reach through acquisitions and partnerships.

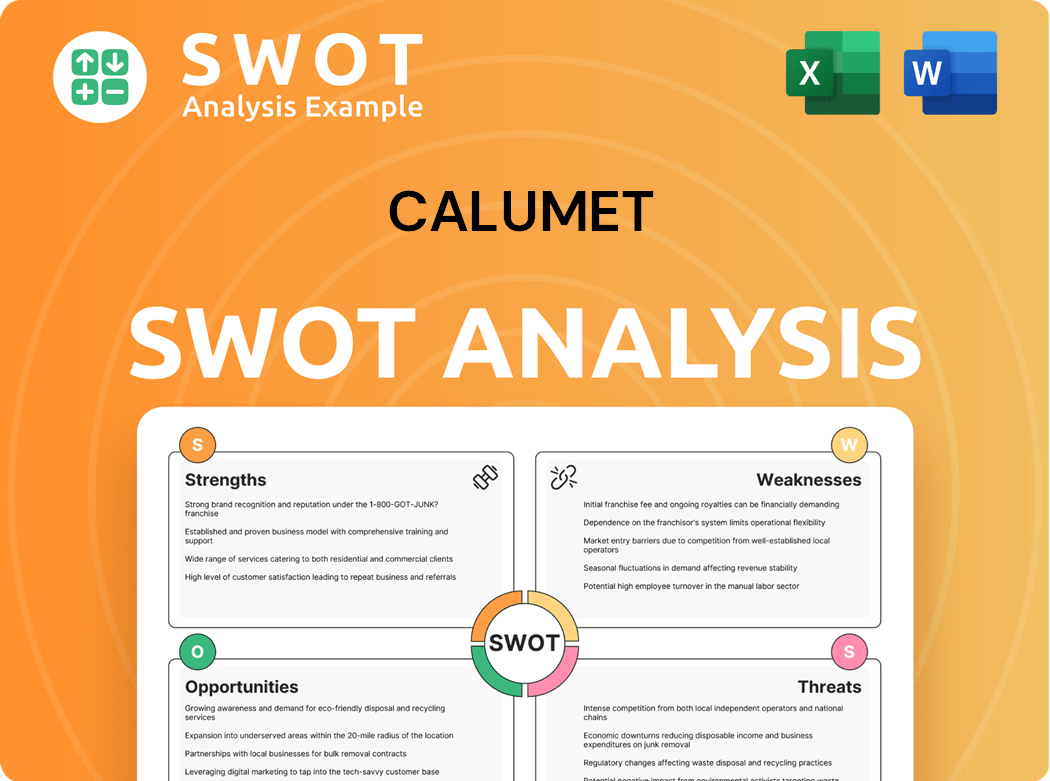

Calumet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Calumet Invest in Innovation?

The growth strategy of the company is heavily reliant on innovation and technology, particularly within its Montana Renewables segment. This focus is crucial for driving future prospects in the evolving energy market.

The company's investments in research and development are key to its ability to produce sustainable aviation fuel (SAF) and renewable diesel, positioning it as a leader in the renewable fuels sector. This commitment to technological advancement supports its overall business strategy.

Technological advancements are also applied to its traditional specialty products, improving operational efficiency and product quality. This continuous innovation ensures the company remains competitive and responsive to market needs, contributing to its long-term financial performance.

The company is actively investing in research and development to optimize its hydrotreating technology. This allows for processing a wider range of renewable feedstocks, improving efficiency and product yield. This is a core component of its Calumet Company Analysis.

Automation and digital transformation initiatives are being implemented across refining operations. These initiatives aim to improve operational efficiency and reduce costs. This helps to maintain a competitive edge in the market.

The company is dedicated to maintaining a technological edge through continuous investment in facility upgrades and new processing techniques. This ensures the delivery of high-performance, customized hydrocarbon solutions. This commitment is vital for sustained growth.

The focus on cutting-edge technologies is crucial for meeting the increasing demand for sustainable energy solutions. This positions the company as a key player in the renewable fuels sector. This strategic approach supports its long-term vision.

The ongoing commitment to innovation ensures that the company remains competitive and responsive to evolving market needs. This adaptability is key to navigating the dynamic energy landscape. This contributes to the company's overall financial health.

The company's investments in SAF and renewable diesel production are expected to drive future growth. As of 2024, the renewable diesel market is experiencing significant expansion, with projections indicating continued growth. This strategic focus aligns with the broader industry trends.

The company’s innovation strategy includes several key initiatives aimed at improving efficiency and expanding its product offerings. These efforts are designed to enhance the company's competitive position and drive future growth. These are crucial for the company’s

- Hydrotreating Technology: Optimizing this technology to process a broader range of renewable feedstocks.

- Process Automation: Implementing automation across refining operations to enhance efficiency.

- Digital Transformation: Utilizing digital initiatives to improve operational effectiveness.

- Facility Upgrades: Continuous investment in upgrading facilities to adopt new processing techniques.

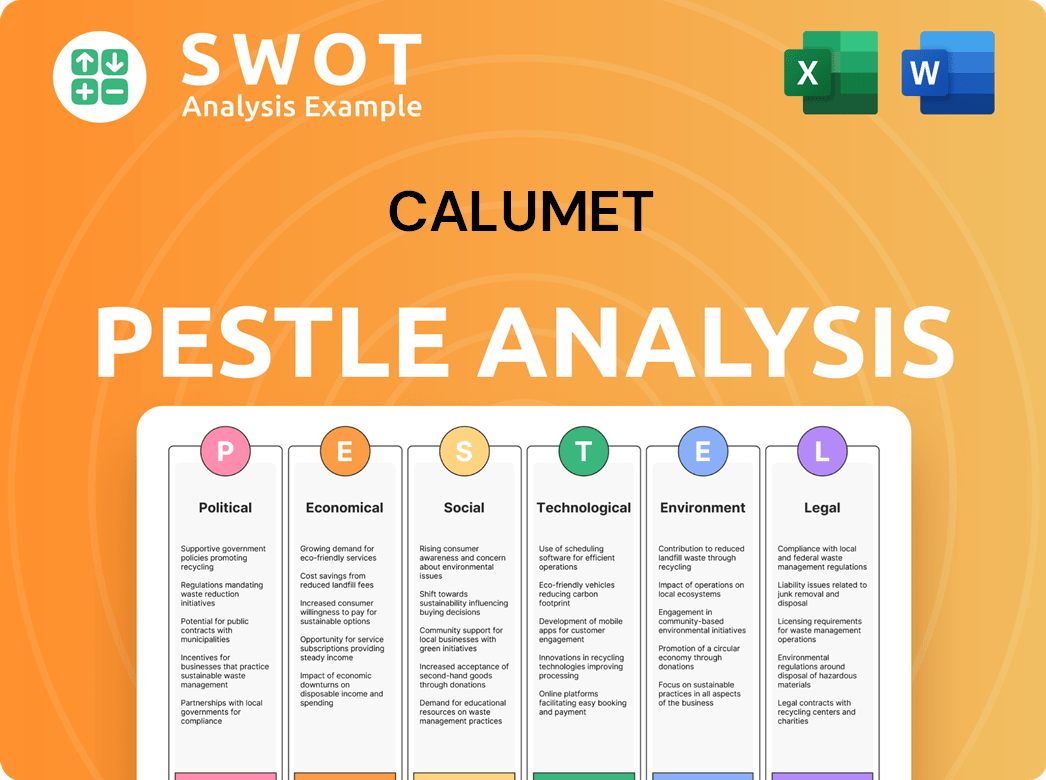

Calumet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Calumet’s Growth Forecast?

The financial outlook for Calumet Specialty Products Partners is significantly influenced by its strategic shift towards specialty products and the burgeoning renewable fuels market. The company demonstrated improved financial performance in the fourth quarter of 2023, reporting a net income of $50.3 million, a substantial improvement from the prior year's net loss. This positive trend is expected to continue, supported by the strong performance of its specialty products segment and the anticipated ramp-up of its Montana Renewables (MRL) facility. This strategic focus is a key aspect of the Calumet Company Growth Strategy.

Analysts are closely monitoring the MRL project, anticipating substantial contributions to future revenue streams as production of sustainable aviation fuel (SAF) and renewable diesel increases. The company's financial strategy includes disciplined capital allocation, prioritizing investments that offer high returns and align with its long-term growth objectives. This approach is critical for understanding the Calumet Company Future Prospects.

Calumet aims to enhance its profitability by optimizing operations, managing costs, and expanding its higher-margin specialty and renewable product offerings. The company's ability to reduce its net debt by approximately $140 million in 2023 further strengthens its financial position, providing flexibility for future growth initiatives. This financial narrative underscores a strategic shift towards a more resilient and profitable business model, leveraging its diversified portfolio to navigate market fluctuations. For a broader perspective on the competitive environment, consider examining the Competitors Landscape of Calumet.

The primary drivers of revenue growth for Calumet include the expansion of its specialty products segment and the increasing production capacity of its renewable fuels projects. The company's strategic investments in these areas are designed to capitalize on growing market demand and higher profit margins. The success of the MRL facility, particularly its SAF and renewable diesel production, is expected to be a significant factor in future revenue growth.

Calumet focuses on improving profitability through operational efficiencies, cost management, and a shift towards higher-margin products. This includes optimizing production processes, reducing operating expenses, and strategically pricing its products to maximize returns. The company's efforts to reduce net debt also contribute to improved financial health and profitability.

Key financial indicators to watch include revenue growth, gross margins, operating income, and net income. The fourth-quarter 2023 net income of $50.3 million signals a positive trend, and future performance will be evaluated based on the continued growth of these metrics. Investors will also monitor the company's debt levels and cash flow generation.

Calumet's capital allocation strategy prioritizes investments that offer high returns and align with its long-term growth objectives. This includes investments in its specialty products segment, renewable fuels projects like MRL, and initiatives aimed at improving operational efficiency. The company's focus on disciplined capital allocation is crucial for sustainable growth and value creation.

Calumet faces challenges such as market volatility and commodity price fluctuations. However, the company has significant opportunities, including the growing demand for specialty products and renewable fuels. Strategic investments in these areas, along with operational improvements, can help mitigate risks and capitalize on favorable market conditions. Understanding these aspects is vital for a comprehensive Calumet Company Analysis.

- Market volatility and commodity price fluctuations.

- Growing demand for specialty products and renewable fuels.

- Strategic investments in renewable fuels projects.

- Operational improvements.

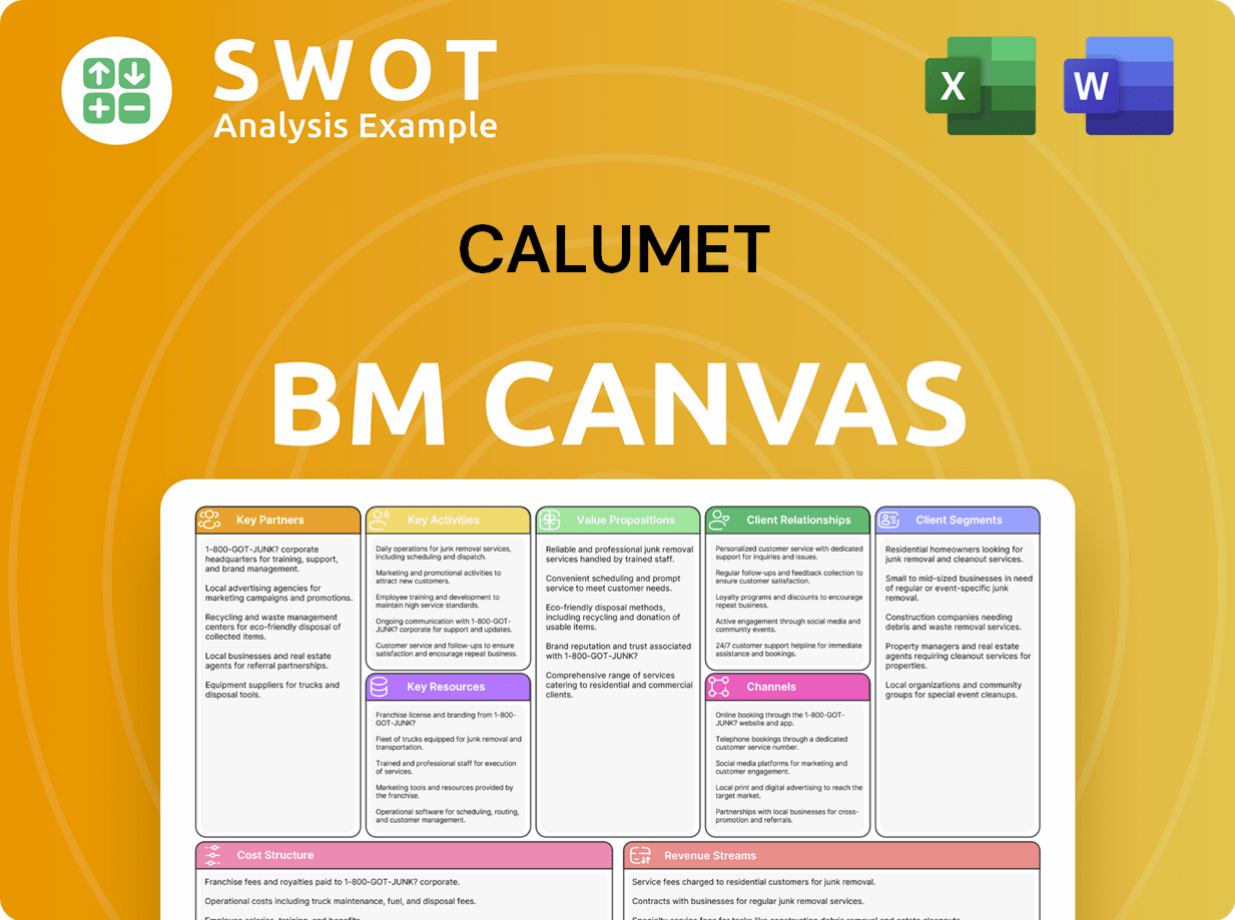

Calumet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Calumet’s Growth?

The Calumet Company Analysis reveals several potential risks and obstacles that could influence its growth strategy and future prospects. These challenges span market dynamics, operational complexities, and regulatory environments. Understanding these risks is crucial for assessing the company's long-term viability and investment potential.

A significant risk is the volatility of crude oil and feedstock prices, which directly impacts operational costs and profit margins. The specialty hydrocarbon and renewable fuels sectors face intense market competition, potentially eroding market share or profitability. Furthermore, regulatory changes, particularly those related to environmental policies, pose a considerable risk to Calumet's operations.

Successful execution of strategic initiatives, such as the Montana Renewables expansion, hinges on effective project management and operational efficiency. Supply chain disruptions and the availability of specific feedstocks also present operational challenges. The company's ability to navigate these risks will significantly influence its financial performance and overall success.

Fluctuations in crude oil and feedstock prices directly impact Calumet's operational costs and profit margins. For example, a sudden increase in crude oil prices could significantly raise the cost of raw materials, squeezing profit margins. This volatility necessitates robust risk management strategies, including hedging and supply chain diversification, to protect against adverse price movements. According to recent reports, crude oil prices have shown significant fluctuations, impacting the profitability of companies in the refining sector. Data from the U.S. Energy Information Administration (EIA) indicates that crude oil prices can vary substantially within short periods, influencing operational costs and financial forecasts.

Calumet faces intense competition within both the specialty hydrocarbon and renewable fuels sectors. Competitors may introduce new products, employ aggressive pricing strategies, or leverage technological advancements. This competitive pressure could erode Calumet's market share and profitability. To maintain its competitive edge, Calumet must continually innovate, improve operational efficiencies, and strategically position its products. According to industry analysis, the specialty hydrocarbon market is highly competitive, with numerous players vying for market share. The renewable fuels sector is also experiencing rapid growth, attracting new entrants and increasing competitive intensity, according to the Renewable Fuels Association.

Regulatory changes, particularly those related to environmental policies and renewable energy mandates, pose a considerable risk. Shifts in government incentives or stricter emissions standards could impact the viability and profitability of its operations, especially for its conventional fuel products. Calumet must adapt to evolving regulatory landscapes and invest in sustainable practices to mitigate these risks. The implementation of stricter environmental regulations, such as those aimed at reducing carbon emissions, can significantly affect refining operations. Government incentives for renewable fuels can also create both opportunities and challenges, requiring companies to adapt to changing market dynamics. Recent data from environmental agencies shows an increasing trend toward stricter emissions standards, which will impact the refining industry.

Supply chain vulnerabilities, including disruptions in transportation or the availability of specific feedstocks, could hinder production and delivery. These disruptions can lead to increased costs and operational delays. Calumet must develop robust supply chain management strategies, including diversifying suppliers and maintaining strategic inventory levels, to mitigate these risks. Recent events, such as geopolitical tensions and extreme weather events, have highlighted the vulnerability of supply chains. The availability of specific feedstocks can be affected by various factors, including geopolitical events and natural disasters, as reported by supply chain analysts.

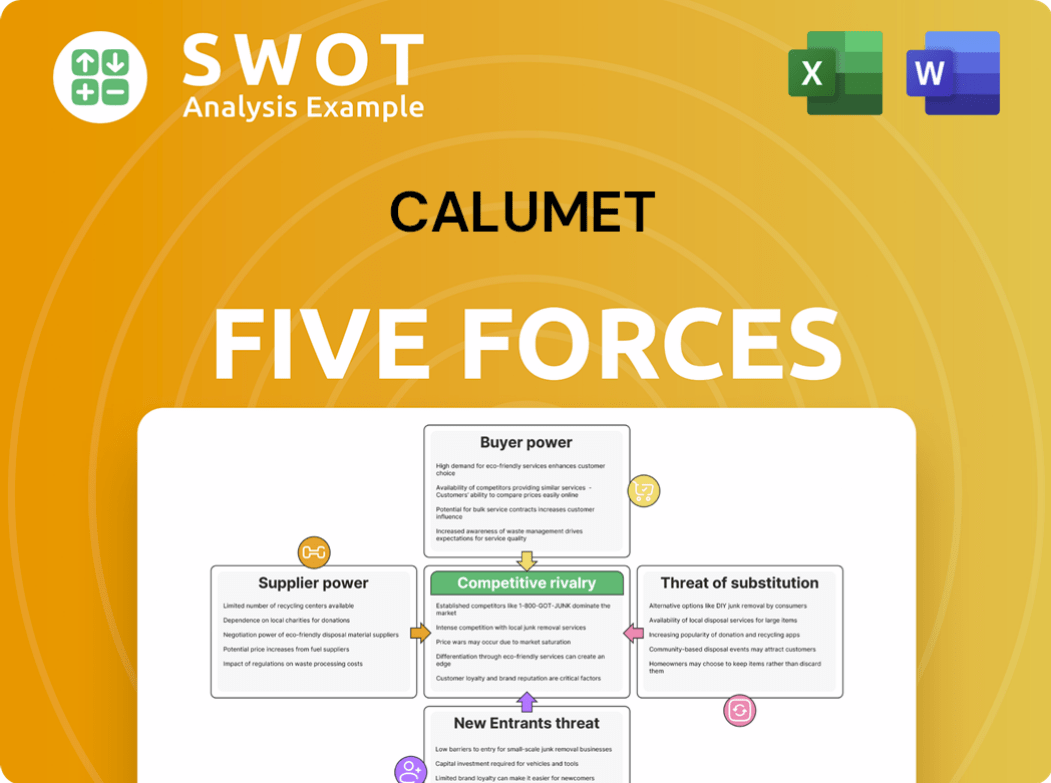

Calumet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Calumet Company?

- What is Competitive Landscape of Calumet Company?

- How Does Calumet Company Work?

- What is Sales and Marketing Strategy of Calumet Company?

- What is Brief History of Calumet Company?

- Who Owns Calumet Company?

- What is Customer Demographics and Target Market of Calumet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.