Calumet Bundle

Who Really Owns Calumet, Inc.?

Understanding the ownership structure of a company is crucial for any investor or business strategist. Calumet, Inc., a leading North American producer of specialty hydrocarbon products, recently underwent a significant transformation. This shift from a master limited partnership (MLP) to a C-Corporation in July 2024 has reshaped its investor landscape and strategic direction.

This exploration into Calumet SWOT Analysis will uncover the evolution of Calumet Company ownership, from its early days as Calumet Refining Company to its current status as a publicly traded entity. We will examine who the major shareholders of Calumet Company are, the influence of its leadership, and how these factors impact the company's financial performance and future prospects. Discover the answers to questions like: Is Calumet Company publicly traded, and how has its stock performed? Learn about the company's history, including its headquarters location and the key figures driving its success.

Who Founded Calumet?

The [Company Name] was founded in 1990 by Bill Grube and Fred M. Fehsenfeld, Jr. Understanding the early ownership structure is key to grasping the company's foundational dynamics. Before its initial public offering (IPO) in 2006, the company was part of the Fehsenfeld family's private business holdings.

The company's roots extend back to 1919 with the establishment of Calumet Refining Company in Illinois. This historical context is important for understanding the evolution of the company's ownership. The Fehsenfeld family, known for founding Heritage Environmental Services, played a significant role in the company's early years.

The exact equity split between the founders at the company's inception isn't available in public records. However, The Heritage Group, the Fehsenfeld family's umbrella entity, held a 15% stake before the 2006 IPO. The leadership of Bill Grube, who served as CEO from 1990 to 2015, was instrumental in the company's growth.

Bill Grube and Fred M. Fehsenfeld, Jr. co-founded the company in 1990. Their vision shaped the company's initial direction and growth. Grube served as CEO from 1990 to 2015.

Before the 2006 IPO, the company was part of the Fehsenfeld family's private business. The Heritage Group, the Fehsenfeld family's umbrella entity, was the largest shareholder. The company's history is linked to Calumet Refining Company, established in 1919.

The initial public offering in 2006 marked a significant shift in ownership structure. The IPO allowed the company to raise capital and expand its operations. Publicly traded status changed the dynamics of ownership.

The company's origins in 1919 with Calumet Refining Company provide a historical perspective. This early focus on medicinal white oils and lubrication products is relevant. The Fehsenfeld family's influence is important.

Specific equity splits at the company's founding are not readily available. The Heritage Group held a 15% stake before the IPO. Understanding the early ownership is key to the company's history.

Bill Grube's tenure as CEO from 1990 to 2015 was crucial for the company. His leadership drove record profitability and acquisitions. The executive team's decisions influenced the company's direction.

Understanding the early ownership of the company is crucial for investors and stakeholders. The founders, Bill Grube and Fred M. Fehsenfeld, Jr., set the stage for the company's future. The Fehsenfeld family's involvement and the 2006 IPO are important milestones. For more insights, consider reading about the Competitors Landscape of Calumet.

- The company's history began in 1990 with the founders.

- The Fehsenfeld family played a significant role in early ownership.

- The IPO in 2006 marked a transition to public ownership.

- Bill Grube's leadership was instrumental in the company's growth.

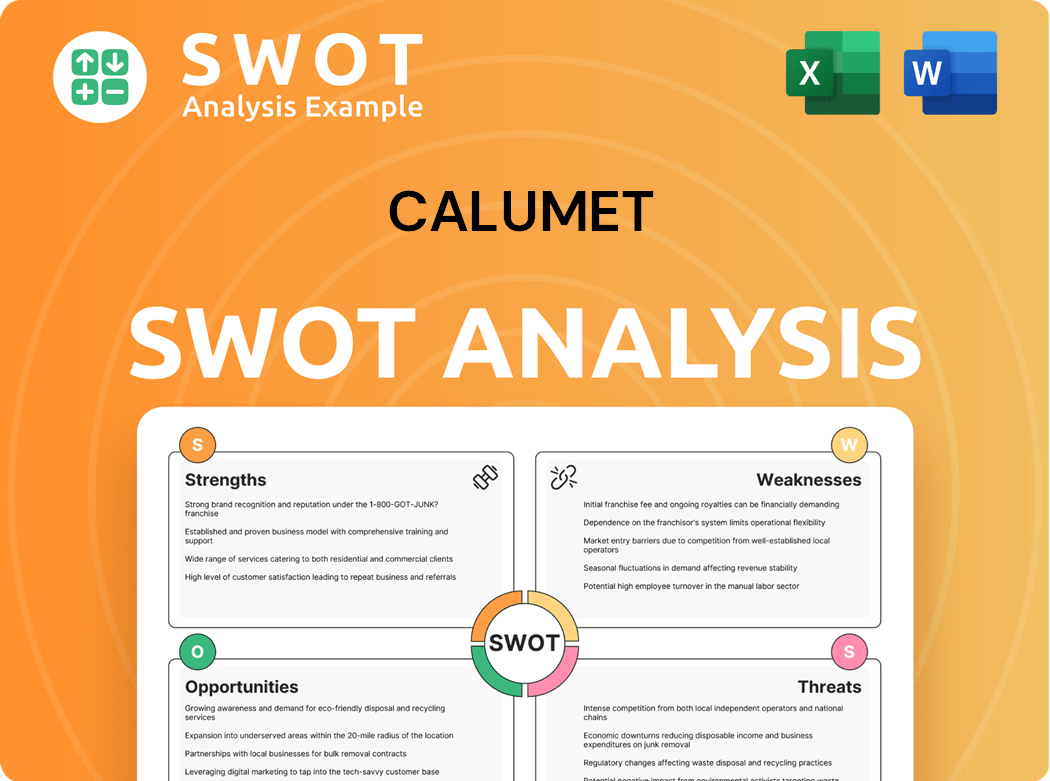

Calumet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Calumet’s Ownership Changed Over Time?

The ownership structure of the company has evolved significantly since its initial public offering (IPO) on January 31, 2006. The IPO saw common units priced at $32.94. Before the IPO, the Fehsenfeld family, through The Heritage Group, was the largest shareholder, holding a 15% stake. The company's journey includes a notable shift in its legal structure.

On July 10, 2024, the company completed its conversion from a master limited partnership (MLP) to a C-Corporation, now known as Calumet, Inc. This conversion involved exchanging approximately 80.4 million common units for an equal number of shares of common stock in New Calumet. Additionally, 5.5 million shares and 2.0 million warrants were issued to the Sponsor Parties. This change is expected to broaden the shareholder base and potentially impact the company's stock performance.

| Shareholder Type | Percentage of Shares (May 2025) | Details |

|---|---|---|

| Institutional Investors | 40.60% | Significant holders of the company's stock. |

| Mutual Funds | 12.86% | Represent a substantial portion of the shareholder base. |

| Insider Holdings | 4.05% (May 2025) | Decreased slightly from 4.10% in May 2024. |

As of May 2025, institutional investors held 40.60% of the company's shares, and mutual funds held 12.86%. Insider holdings slightly decreased to 4.05% in May 2025. Major institutional shareholders reported in 2024 include Wasserstein Debt Opportunities Management L.P. with 6,891,314 shares (8.572% ownership as of August 2, 2024), and Adams Asset Advisors LLC with 5,251,160 shares (6.532% ownership as of July 10, 2024). The conversion to a C-Corporation is anticipated to attract more institutional investors, which could influence the company's stock and overall market perception. For more in-depth information, you can explore this article about the company's history and financials.

The ownership structure of the company has evolved significantly, marked by its IPO and the recent conversion to a C-Corporation.

- Institutional investors and mutual funds are major shareholders.

- Insider holdings show a slight decrease.

- The C-Corporation conversion aims to broaden the shareholder base.

- Understanding the company's ownership is essential for investors.

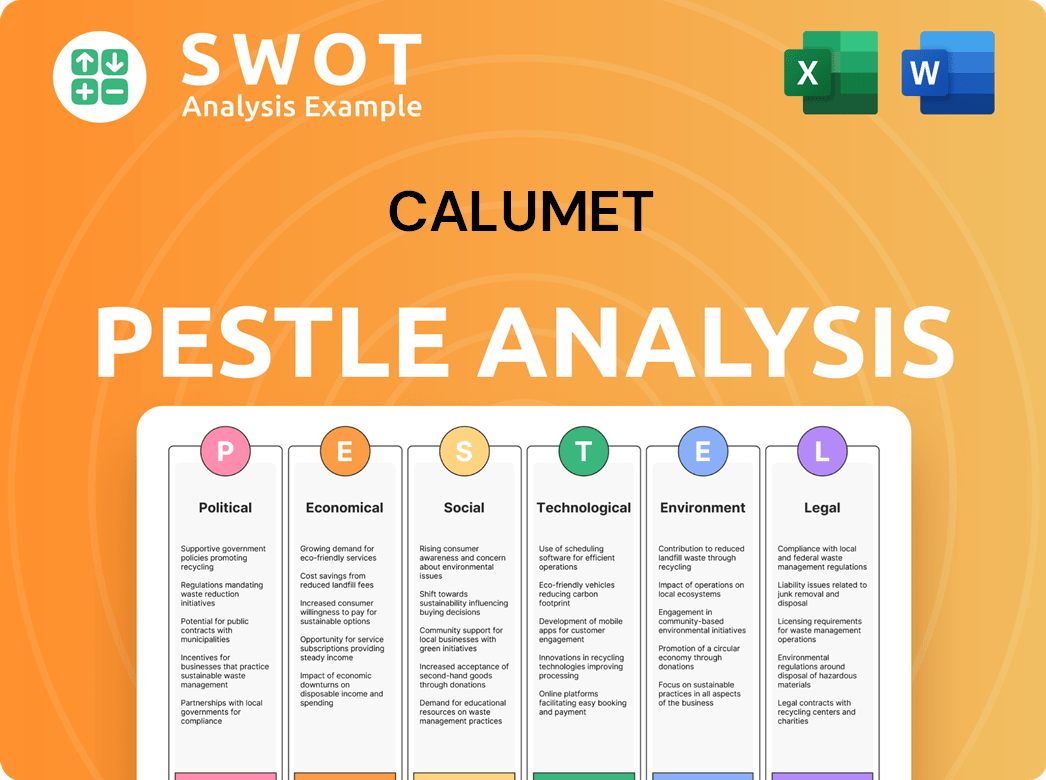

Calumet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Calumet’s Board?

Following the transition to a C-Corporation on July 10, 2024, the Board of Directors now oversees the business and operations of the company. As of April 28, 2025, the Board comprises ten directors. A significant portion of the board is independent, with 8 out of 10 directors and director nominees meeting this criterion. Furthermore, 4 out of 10 board members are women, reflecting a commitment to diversity.

The current CEO of the company is Todd Borgmann. The leadership structure also includes Stephen Mawer as the Executive Chairman of Calumet GP, LLC, and Bruce A. Fleming as the Executive VP of Montana Renewables & Corp. Devel. of Calumet GP, LLC. Jennifer G. Straumins, representing the Grube family, has been a member of the Board of Directors of Calumet GP, LLC, since February 2021.

| Board Member | Title | Affiliation |

|---|---|---|

| Todd Borgmann | CEO | Calumet, Inc. |

| Stephen Mawer | Executive Chairman | Calumet GP, LLC |

| Bruce A. Fleming | Executive VP | Calumet GP, LLC |

The voting structure of the company is straightforward: one share equals one vote. This structure means that each share of common stock carries equal voting power. In the election of directors, holders of common stock do not have cumulative voting rights. Before the conversion to a C-Corporation, unitholders had limited voting rights. The Heritage Group (THG), a major shareholder, has specific rights regarding board nominations. As a significant owner, THG has the right to nominate directors to the Board. For as long as THG owns at least 16.7% of the outstanding common stock, they can nominate two directors. If their ownership falls below 16.7% but remains at 5% or more, they can nominate one director. For more information, a Brief History of Calumet provides additional context.

Understanding the ownership structure is key to assessing the company's governance. The board of directors plays a critical role in shaping the company's strategy and overseeing its operations. Knowing who owns Calumet and how voting rights are distributed is essential for investors.

- The company's board consists of ten directors.

- The Heritage Group has specific nomination rights based on their ownership stake.

- The voting structure is one-share-one-vote.

- The company's history includes a transition from a partnership to a C-Corporation.

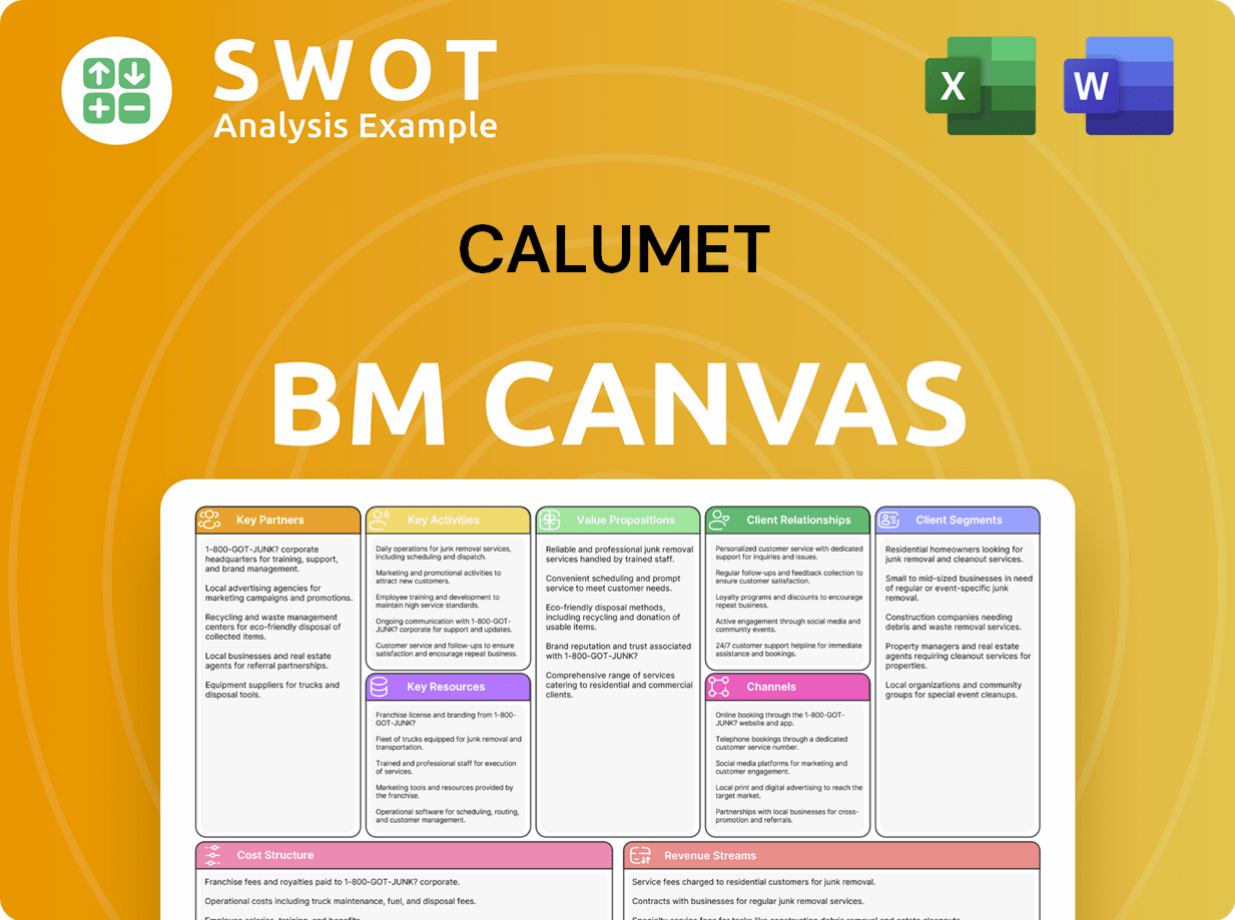

Calumet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Calumet’s Ownership Landscape?

Recent years have brought significant changes to Calumet, Inc., formerly known as Calumet Specialty Products Partners, L.P. A major shift occurred on July 10, 2024, when the company transitioned from a master limited partnership (MLP) to a C-Corporation. This strategic move aimed to broaden its investor base. As a result of this conversion, former unitholders received approximately 80.4 million shares of common stock. Additionally, the Sponsor Parties received an extra 5.5 million shares and 2.0 million warrants.

The company has also been actively managing its debt, including repaying $50 million of its 2025 notes. In late 2024, Calumet exchanged a substantial portion of its 11.00% Senior Notes due 2025 for new notes due in 2026. This was followed by a full redemption of the remaining 2025 notes. Industry trends show an increase in institutional ownership, and this conversion positions Calumet to benefit from this trend. For more details, you can review the Growth Strategy of Calumet.

| Metric | May 2025 | Change |

|---|---|---|

| Institutional Ownership | 40.60% | |

| Mutual Fund Ownership | 12.86% | |

| Insider Holdings | 4.05% | Slight Decrease |

Calumet has also made strategic moves to optimize its portfolio. In February 2025, the company sold its Royal Purple industrial business for $110 million. Also in February 2025, Montana Renewables, a segment of Calumet, received initial funding from a $1.44 billion conditional commitment from the U.S. Department of Energy (DOE) for its renewable fuels and biomass energy facility.

The company's ownership structure has evolved with the conversion to a C-Corp. Institutional investors now hold a significant portion of the company's stock.

Todd Borgmann is the current CEO. Leadership changes and strategic shifts reflect the company's adaptability in the market.

Calumet has focused on debt management and strategic asset sales to strengthen its financial position. The sale of Royal Purple is an example of this.

With the DOE funding for Montana Renewables, Calumet is positioned to benefit from the renewable fuels market. The company's focus on attracting a broader investor base is a key part of its strategy.

Calumet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Calumet Company?

- What is Competitive Landscape of Calumet Company?

- What is Growth Strategy and Future Prospects of Calumet Company?

- How Does Calumet Company Work?

- What is Sales and Marketing Strategy of Calumet Company?

- What is Brief History of Calumet Company?

- What is Customer Demographics and Target Market of Calumet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.