Calumet Bundle

Unveiling Calumet Company: How Does It Thrive in a Changing Market?

Calumet, Inc., formerly Calumet Specialty Products Partners, L.P., has undergone a significant transformation, reshaping its structure to capitalize on new investment opportunities. This strategic shift to a C-Corporation in July 2024 is just one example of its forward-thinking approach. With a diverse portfolio spanning specialty hydrocarbon products and fuels, the company's adaptability is key to its success.

This analysis will explore the Calumet SWOT Analysis, detailing the company's strengths, weaknesses, opportunities, and threats, providing a comprehensive understanding of its position in the market. We'll examine the Calumet business model, its Calumet operations, and how it generates revenue, including its strategic focus on renewable fuels and its impressive Calumet products portfolio. Understanding the Calumet Company is crucial for anyone looking to navigate the complexities of the energy sector.

What Are the Key Operations Driving Calumet’s Success?

The core of the Calumet Company's operations revolves around transforming crude oil and other feedstocks into a diverse array of specialized hydrocarbon products and fuels. This integrated approach allows the company to create value across multiple segments, ensuring flexibility and direct access to various markets. The Calumet business model is designed to optimize production and distribution, catering to industrial, consumer, and automotive sectors.

Calumet operations are structured around three primary segments: Specialty Products and Solutions (SPS), Performance Brands (PB), and Montana Renewables (MR). Each segment contributes to the company's overall value proposition by leveraging specific assets and expertise. This strategic diversification enables Calumet to meet a wide range of customer needs while adapting to market trends, including the growing demand for sustainable fuel alternatives.

The company's value proposition is centered on delivering high-performance products and providing solutions that sustain and enhance essential goods. Through its integrated model, Calumet ensures quality and efficiency, positioning itself as a reliable supplier in the energy and specialty products markets. For more insight, you can explore Owners & Shareholders of Calumet.

The SPS segment processes crude oil and other feedstocks into customized products like lubricating oils, solvents, waxes, and synthetic lubricants. These are sold as raw materials for various industries. The segment operates ten production plants, including refineries in northwest Louisiana, producing fuels and asphalt in addition to specialty products.

The PB segment focuses on blending and marketing specialty products under brands such as Royal Purple and Bel-Ray. Manufacturing facilities are strategically located across North America, enhancing distribution networks. This segment serves a passionate customer base, with diversification across global trends.

MR converts renewable feedstocks into low-emission sustainable fuel alternatives. Located in Great Falls, Montana, this segment is a leader in North America's energy transition. The segment focuses on advanced technology for renewable diesel and Sustainable Aviation Fuel (SAF) production.

Calumet's core capabilities translate into customer benefits through high-performance products and solutions. The company's ability to secure advantageous product placement and purchase advantaged feedstock is a key differentiator. The company's strategic focus on renewable fuels positions it well for future growth.

Calumet products are known for their quality and performance, serving various sectors. The company's integrated model allows for efficient production and distribution. The company's focus on sustainable fuels highlights its commitment to innovation and environmental responsibility.

- Integrated operations for flexibility and efficiency.

- Strategic brand portfolio for market diversification.

- Focus on renewable fuels for future growth.

- Strong customer relationships and market presence.

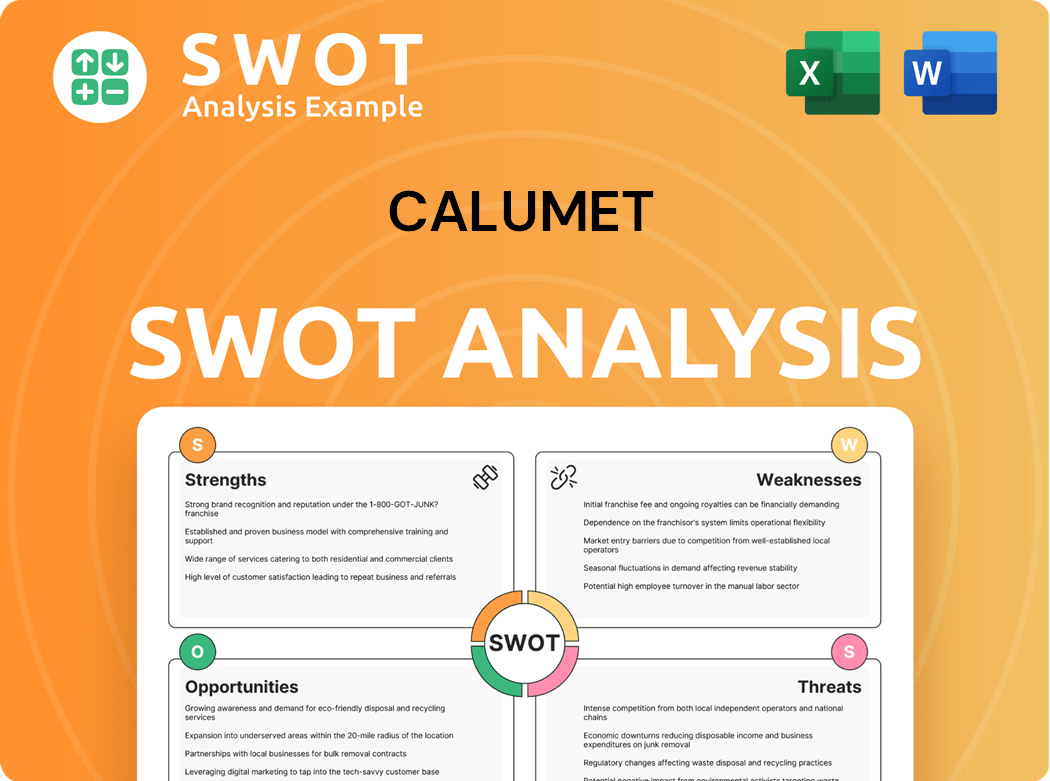

Calumet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Calumet Make Money?

The Calumet Company generates revenue through a diversified approach across its key segments: Specialty Products and Solutions (SPS), Performance Brands (PB), and Montana Renewables (MR). This strategy, coupled with the sale of fuel products, has allowed the company to maintain a strong financial position. The company’s ability to adapt and capitalize on market opportunities, particularly in renewable fuels, is a key aspect of its business model.

In 2025, the Calumet Company reported a total revenue (TTM) of $4.17 billion USD. This figure demonstrates the company's significant market presence and its capacity to generate substantial income. The company's financial performance reflects its strategic focus on specialized products and renewable energy solutions.

The company's operational success is further detailed in an analysis of its target market, which you can explore further in this article: Target Market of Calumet.

The SPS segment benefits from stable customer relationships due to the specialized nature of its products. This segment's performance is a testament to the company's ability to maintain and grow unit margins, especially as raw material costs moderate.

The PB segment contributes significantly to revenue, with a notable increase in volumes. This segment's performance shows the company's strength in the market and its capacity to expand its market share.

The MR segment is crucial, especially given its focus on renewable fuels. The company's ability to capture a premium for its Sustainable Aviation Fuel (SAF) products is a key monetization strategy.

Revenue is also generated from fuel products, including gasoline, diesel, and jet fuel. The company strategically manages its exposure to crude oil price fluctuations.

SPS reported an Adjusted EBITDA of $43.4 million in Q4 2024 and $56.3 million in Q1 2025. PB delivered $57.4 million in adjusted EBITDA for the full year 2024. MR reported $10.9 million of Adjusted EBITDA in Q4 2024 and $16.7 million in Q1 2025.

The company has strategically divested non-core assets, such as the industrial portion of its Royal Purple business for $110 million in the first half of 2025, to primarily pay down debt and optimize its portfolio.

The Calumet business model focuses on several key strategies to maximize revenue and profitability. These strategies include:

- Leveraging its position as a leading SAF producer to capture premium pricing.

- Managing crude oil price fluctuations by passing on feedstock costs to customers in the specialty products segment.

- Strategic divestitures to optimize the portfolio and reduce debt.

- Focusing on segments with strong growth potential, such as Montana Renewables.

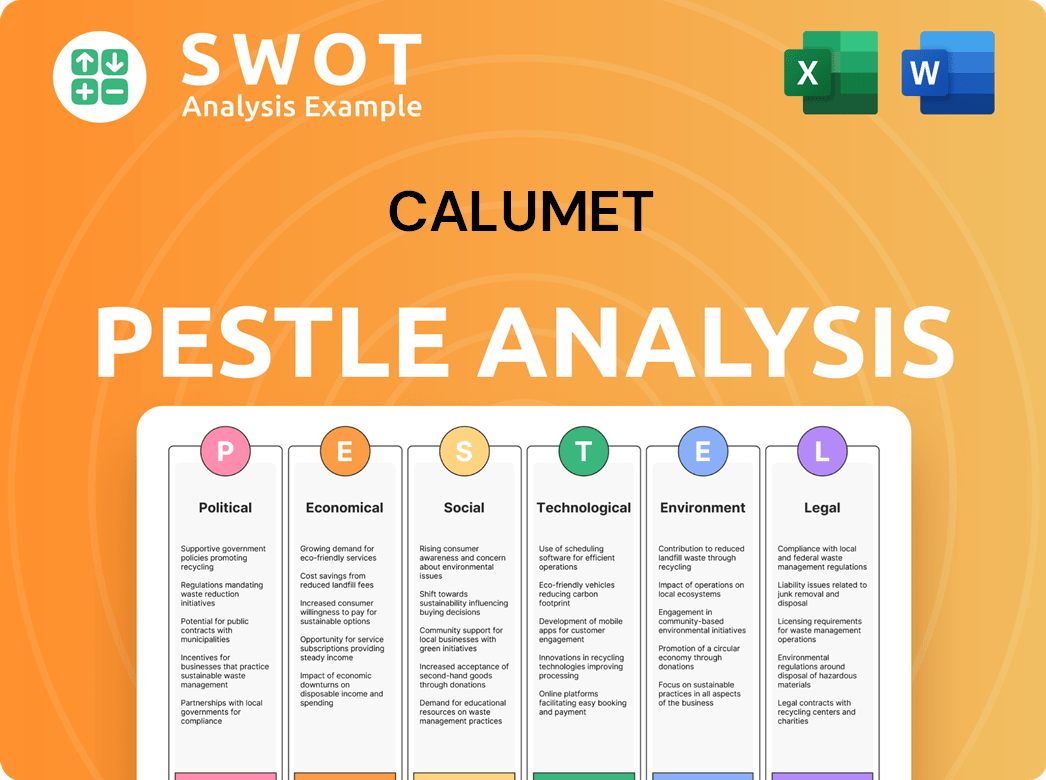

Calumet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Calumet’s Business Model?

The evolution of the Calumet Company has been marked by strategic shifts and significant milestones, particularly in recent years. These moves have reshaped its operational focus and financial structure. A notable change was the conversion from a Master Limited Partnership (MLP) to a C-Corporation, completed in July 2024. This transition is designed to broaden its investor base, potentially attracting institutional investors and index funds.

Operationally, the company has heavily invested in its Montana Renewables (MRL) facility, a key element of its growth strategy. In February 2025, MRL received its initial drawdown of approximately $782 million from a $1.44 billion loan facility provided by the U.S. Department of Energy (DOE) Loan Programs Office. This funding supports the construction and expansion of the renewable fuels facility. This positions the company to increase its annual production capacity to roughly 300 million gallons of sustainable aviation fuel (SAF) and 330 million gallons of combined SAF and renewable diesel by 2028.

The company's focus on cost reduction, with expectations of over $20 million in savings in 2025, is another key aspect of its strategy. These moves, along with debt management and asset portfolio optimization, are crucial for navigating market dynamics and enhancing shareholder value. The company's strategic moves are designed to strengthen its position in the market and ensure long-term sustainability.

The conversion to a C-Corporation in July 2024 is a pivotal milestone, aiming to attract a broader investor base. The initial drawdown of $782 million from the DOE loan facility in February 2025 supports the expansion of the Montana Renewables facility. This expansion is crucial for increasing production capacity and solidifying its position in the renewable fuels market.

The company has focused on optimizing its asset portfolio and deleveraging its balance sheet. It issued $200 million in new senior secured notes in March 2024 to manage debt. The sale of the industrial portion of Royal Purple for $110 million in February 2025 is intended for debt reduction. These moves are aimed at improving financial health and strategic alignment.

The company's competitive edge is enhanced by its investment in renewable fuels. The MRL facility expansion positions it as a major player in the sustainable aviation fuel market. Strong performance in its core specialties business, with volume growth in 2024, further strengthens its market position. This focus on innovation and efficiency sets the company apart.

The company is focused on cost reduction, with expectations of over $20 million in savings in 2025. In 2024, the Specialty Products and Solutions teams grew volume by 7% year-over-year, and Performance Brands volumes grew by 22%. These financial strategies and operational efficiencies are designed to improve financial performance and shareholder value.

The company's operational and financial strategies are designed to enhance its market position and financial health. This includes investment in renewable fuels, debt management, and cost reduction initiatives. The focus on sustainable aviation fuel production and the expansion of the MRL facility are key components of its growth strategy.

- The conversion to a C-Corporation aims to broaden the investor base.

- The DOE loan facility provides significant funding for renewable fuel production.

- The company is actively managing its debt structure through strategic financial moves.

- Focus on cost reduction and operational efficiency to improve financial performance.

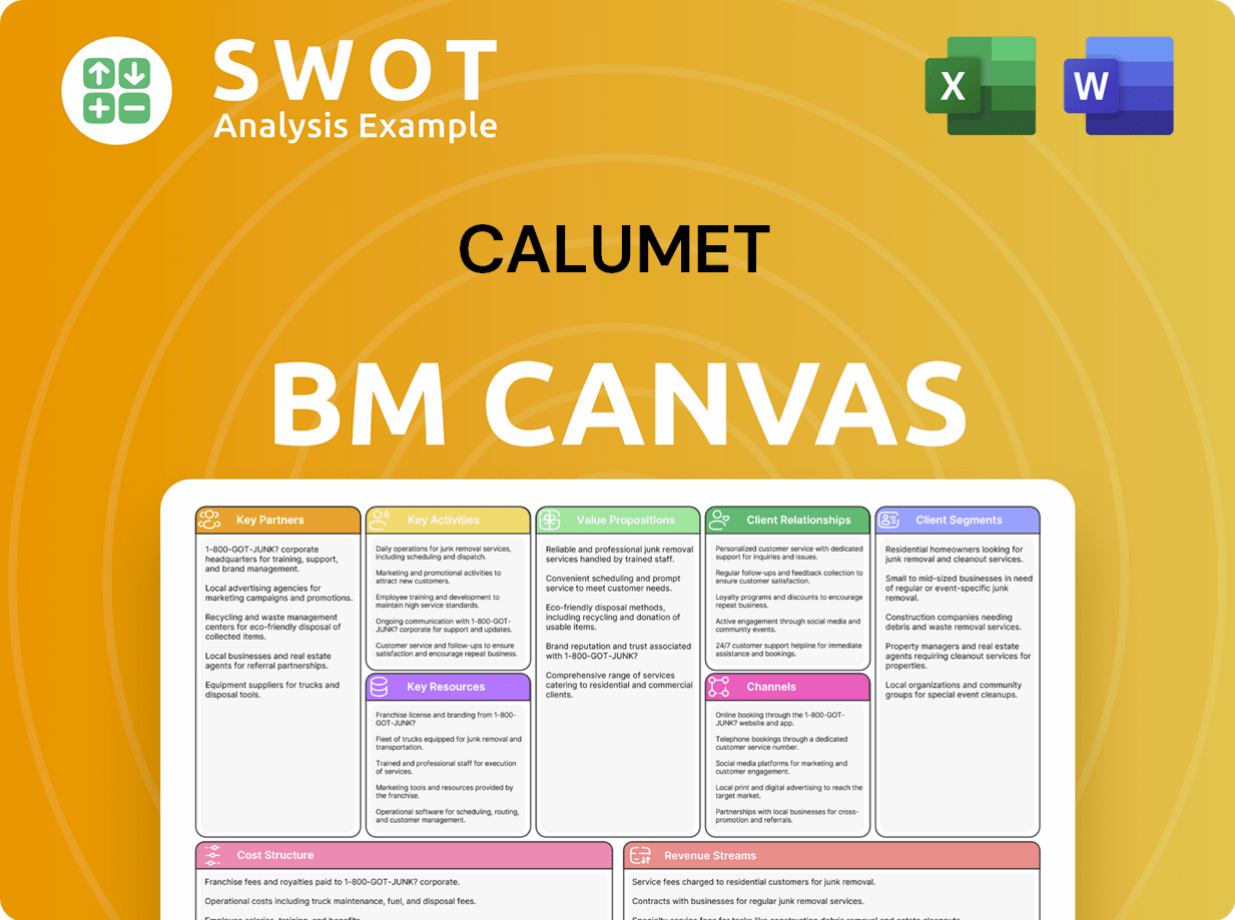

Calumet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Calumet Positioning Itself for Continued Success?

The company, a prominent independent producer, holds a significant position in North America's specialty hydrocarbon products and fuels market. The shift to a C-Corporation structure in July 2024 is expected to broaden its investor base, potentially enhancing liquidity and reducing capital costs. This strategic move could further strengthen its market position, particularly in the burgeoning sustainable aviation fuel (SAF) sector, where it is positioned as a key player.

However, the company faces risks, including refinancing concerns related to its April 2025 notes. Operational disruptions and volatile market conditions also pose challenges. Despite these obstacles, the company is focused on deleveraging its balance sheet and growing cash flows, aiming to sustain profitability by focusing on specialty products and renewable fuels segments.

The company is a leading independent producer of specialty hydrocarbon products and fuels in North America. Its conversion to a C-Corporation in July 2024 could broaden its investor base, potentially enhancing market standing. The Montana Renewables segment is a significant player in the SAF market, positioning the company as the largest SAF producer in North America.

Refinancing risk is a concern, especially with the $364 million of April 2025 notes. Operational disruptions and potential Renewable Identification Numbers (RINs) obligations could impact financial metrics. The petroleum refining sector is subject to volatile market conditions, including fluctuating fuel pricing and raw material costs.

The company focuses on deleveraging and growing cash flows, with initial funds from the DOE loan for Montana Renewables' expansion. Management expects to maintain specialty margins over $60 a barrel in its Specialty Products and Solutions segment. It plans to optimize its asset portfolio and focus on businesses with stable cash flows, particularly in specialties and renewable fuels.

The company's operations are centered on refining and producing specialty products. The strategic focus includes deleveraging, growing cash flow, and expanding in renewable fuels. The company aims to sustain its ability to make money by focusing on businesses with stable cash flows and growing end markets, particularly within its specialties and renewable fuels segments. For more detailed information on the company's strategic growth, you can refer to Growth Strategy of Calumet.

The company's future outlook is influenced by its strategic initiatives and market dynamics. The MaxSAF project is expected to significantly increase SAF production capacity. Management anticipates maintaining strong margins in its Specialty Products and Solutions segment.

- The company's refinancing risk is a key concern, especially regarding the $364 million notes due in April 2025.

- The initial funds from the DOE loan for Montana Renewables' expansion are expected to provide significant financial support for the MaxSAF project.

- Management expects to maintain specialty margins over $60 a barrel, even in challenging market conditions.

- The company is focused on optimizing its asset portfolio and redeploying capital into projects aligned with its core business strategy.

Calumet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Calumet Company?

- What is Competitive Landscape of Calumet Company?

- What is Growth Strategy and Future Prospects of Calumet Company?

- What is Sales and Marketing Strategy of Calumet Company?

- What is Brief History of Calumet Company?

- Who Owns Calumet Company?

- What is Customer Demographics and Target Market of Calumet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.