Calumet Bundle

How Does Calumet Company Navigate the Cutthroat Specialty Hydrocarbon Market?

Calumet Specialty Products Partners, L.P. is a key player in the North American specialty hydrocarbon industry, constantly adapting to energy market shifts and industrial demands. Its strategic moves, including the Montana Renewables spin-off, highlight a focus on high-value specialty products and renewable fuels. This signals intense competitive pressures and the need for innovation, setting the stage for a detailed look at Calumet's competitive landscape.

Founded in 1990, Calumet has evolved from a regional refiner to a prominent force in specialty chemicals and renewable fuels. This Calumet SWOT Analysis provides a deeper dive into the company's competitive advantages and disadvantages. Understanding Calumet Company's market share analysis and its industry position is crucial. This report will also explore who are Calumet Company's main competitors, its recent acquisitions and mergers, and its overall business strategy within the industry overview through comprehensive competitor analysis and market analysis.

Where Does Calumet’ Stand in the Current Market?

Calumet Specialty Products Partners, L.P. holds a significant position in the North American specialty hydrocarbon and renewable fuels markets. The company is a leading independent producer, specializing in customized lubricating oils, solvents, and waxes. This focus on specialty products provides a niche advantage within the broader energy sector. The recent spin-off of Montana Renewables further emphasizes its strategic shift towards high-growth segments, including renewable fuels.

The company's primary operations involve a diverse range of specialty products, including white oils, petrolatums, waxes, and custom-blended lubricants. These products serve various customer segments across industrial, consumer, and automotive markets. Calumet's geographic presence is primarily concentrated in North America, leveraging its refining and processing facilities throughout the United States. The company's strategic realignment, including the divestment of non-core assets, reflects a deliberate effort to enhance profitability and market relevance. The Owners & Shareholders of Calumet benefit from the company's strategic moves.

Calumet's financial health is demonstrated by its adjusted EBITDA of $95.5 million in the first quarter of 2024 and a projected full-year 2024 adjusted EBITDA of approximately $410 million. This performance underscores its scale and operational efficiency within the industry. The company aims to capitalize on the growing demand for sustainable solutions through its Montana Renewables segment, which is positioned to become a significant producer of sustainable aviation fuel (SAF) and renewable diesel.

Calumet Company maintains a strong market position in the North American specialty hydrocarbon and renewable fuels sectors. It is a leading independent producer of customized lubricating oils, solvents, and waxes. This focus allows it to compete effectively within specific market niches.

The company emphasizes higher-margin specialty products and invests in renewable energy capabilities. The spin-off of Montana Renewables is a key move towards high-growth, high-value segments. This strategic shift indicates a move towards more sustainable and premium markets.

Calumet reported an adjusted EBITDA of $95.5 million in Q1 2024. The projected full-year 2024 adjusted EBITDA is approximately $410 million. These figures demonstrate the company's scale and operational efficiency.

Calumet aims to capitalize on the growing demand for sustainable solutions. The Montana Renewables segment is positioned to become a significant producer of sustainable aviation fuel (SAF) and renewable diesel. The company's focus on renewables is a key element of its business strategy.

The competitive landscape for Calumet Company involves both traditional and renewable energy sectors. The company's strategic focus on specialty products provides a niche advantage. The growing demand for sustainable solutions is a key market driver.

- Strong position in specialty product niches.

- Emphasis on high-growth, high-value segments like renewable fuels.

- Strategic realignment to enhance profitability and market relevance.

- Focus on sustainable aviation fuel (SAF) and renewable diesel production.

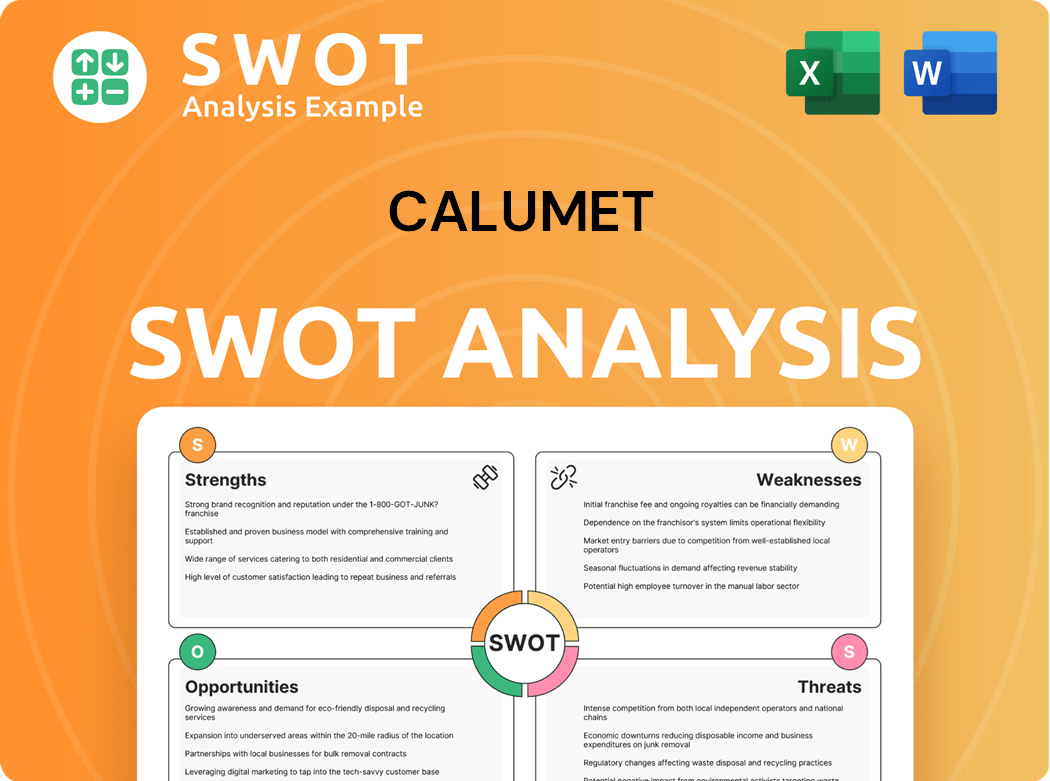

Calumet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Calumet?

The Calumet Company operates within a dynamic competitive landscape, facing a diverse range of competitors across its various business segments. A thorough market analysis reveals that the company's strategic positioning and financial performance are significantly influenced by these competitive dynamics. Understanding the strengths and weaknesses of key rivals is crucial for assessing Calumet Company's long-term prospects and formulating effective business strategy.

The Calumet Company's ability to adapt to market changes and leverage its competitive advantages will determine its success. This industry overview highlights the key players and the strategic moves shaping the future of the energy and specialty products sectors. For a deeper dive into Calumet's strategic approach, consider exploring the Growth Strategy of Calumet.

The Calumet Company competes in several markets, each with distinct players and competitive pressures. The company's success hinges on its ability to navigate these complex environments and maintain a competitive edge. A detailed competitor analysis is essential for understanding the challenges and opportunities facing Calumet Company.

In the specialty hydrocarbon products segment, Calumet Company faces competition from major integrated oil companies. These companies often have larger economies of scale and broader distribution networks. Smaller, specialized players also compete in niche markets.

Key competitors include ExxonMobil, Shell, and Chevron. These companies produce a range of lubricants, waxes, and solvents. Smaller, specialized players focus on specific applications or regional markets.

Competition is driven by factors such as production costs, product quality, and distribution capabilities. The ability to innovate and develop specialized products is also crucial. Market share is highly contested.

In the fuels segment, Calumet Company competes with numerous refiners across North America. These refiners often have larger refining capacities and more extensive retail distribution networks. Crude oil prices and refining margins significantly impact the competitive landscape.

Major competitors include Marathon Petroleum, Valero Energy, and Phillips 66. These companies have substantial refining capacities and established distribution networks. Regulatory changes also influence competition.

Competition is highly sensitive to crude oil prices, refining margins, and regulatory changes. Efficiency in refining operations and access to distribution channels are critical. Market volatility is a key factor.

With its strategic pivot towards renewable fuels, Calumet Company enters a new competitive arena. This market is characterized by significant investments in renewable feedstock processing technologies. Competition revolves around securing feedstock and obtaining off-take agreements.

- Key Competitors: Neste, Renewable Energy Group (now part of Chevron), and Diamond Green Diesel (a joint venture between Valero and Darling Ingredients).

- Competitive Dynamics: The growth in demand for sustainable fuels attracts new entrants and fosters strategic alliances. Securing feedstock, optimizing conversion technologies, and off-take agreements are key.

- Market Trends: The sustainable aviation fuel (SAF) and renewable diesel markets are experiencing rapid growth. Strategic partnerships and technological advancements are key to success.

- Recent Data: In 2024, the renewable diesel market is projected to continue growing, driven by increasing demand and government incentives. The SAF market is also expected to grow significantly.

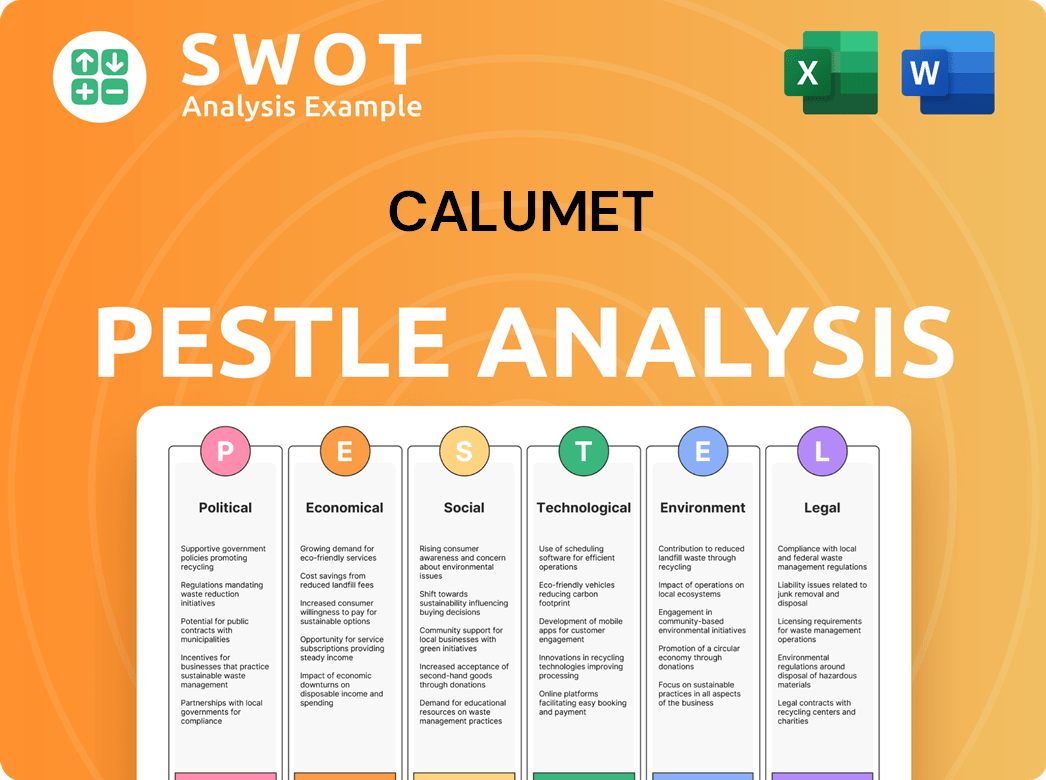

Calumet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Calumet a Competitive Edge Over Its Rivals?

The competitive landscape for Calumet Company is shaped by its strategic focus on specialty products and renewable fuels. A detailed market analysis reveals that Calumet has carved a niche through its specialized product portfolio, including lubricants, solvents, and waxes. This contrasts with many larger refiners that concentrate on fuels. This specialization allows Calumet to serve niche markets, leading to higher margins and stronger customer relationships.

Key milestones include the strategic investment in and spin-off of Montana Renewables, a significant move into renewable fuels. This segment leverages existing infrastructure and is positioned to become a major producer of sustainable aviation fuel (SAF) and renewable diesel. This early mover advantage in scaled renewable fuel production differentiates Calumet from traditional refiners, positioning it favorably for future growth. Understanding the Revenue Streams & Business Model of Calumet provides further insight into its operations.

Calumet's operational flexibility and strategic facility locations across North America provide a logistical advantage, enabling efficient distribution and responsiveness. The company's ability to adapt its asset base and product mix, as demonstrated by strategic divestitures and investments in renewables, highlights an agile management approach. This adaptability, combined with a focus on high-value specialty products and emerging renewable energy markets, contributes to sustainable advantages.

Calumet's focus on customized lubricating oils, solvents, and waxes allows it to serve niche markets. This specialization leads to higher margins and stronger customer relationships. The company's proprietary formulations and process technologies support this competitive edge.

Strategic facility locations and efficient distribution networks provide a logistical advantage. This enables efficient distribution and responsiveness to customer needs. The company can quickly adapt to market changes.

The strategic investment in Montana Renewables positions Calumet in the growing renewable fuels sector. This segment leverages existing infrastructure for feedstock processing. It is poised to become a significant producer of sustainable aviation fuel (SAF) and renewable diesel.

Calumet's ability to adapt its asset base and product mix is a key advantage. Strategic divestitures and investments in renewables demonstrate an agile approach. This adaptability contributes to sustainable advantages.

Calumet's competitive advantages include a specialized product portfolio, operational flexibility, and a strategic move into renewable fuels. These factors contribute to higher margins and market differentiation. However, challenges include market shifts and the need for ongoing innovation.

- Specialization: Focus on high-value specialty products.

- Renewables: Early mover advantage in renewable fuels.

- Adaptability: Agile management and asset base adjustments.

- Challenges: Market volatility and the need for continuous innovation.

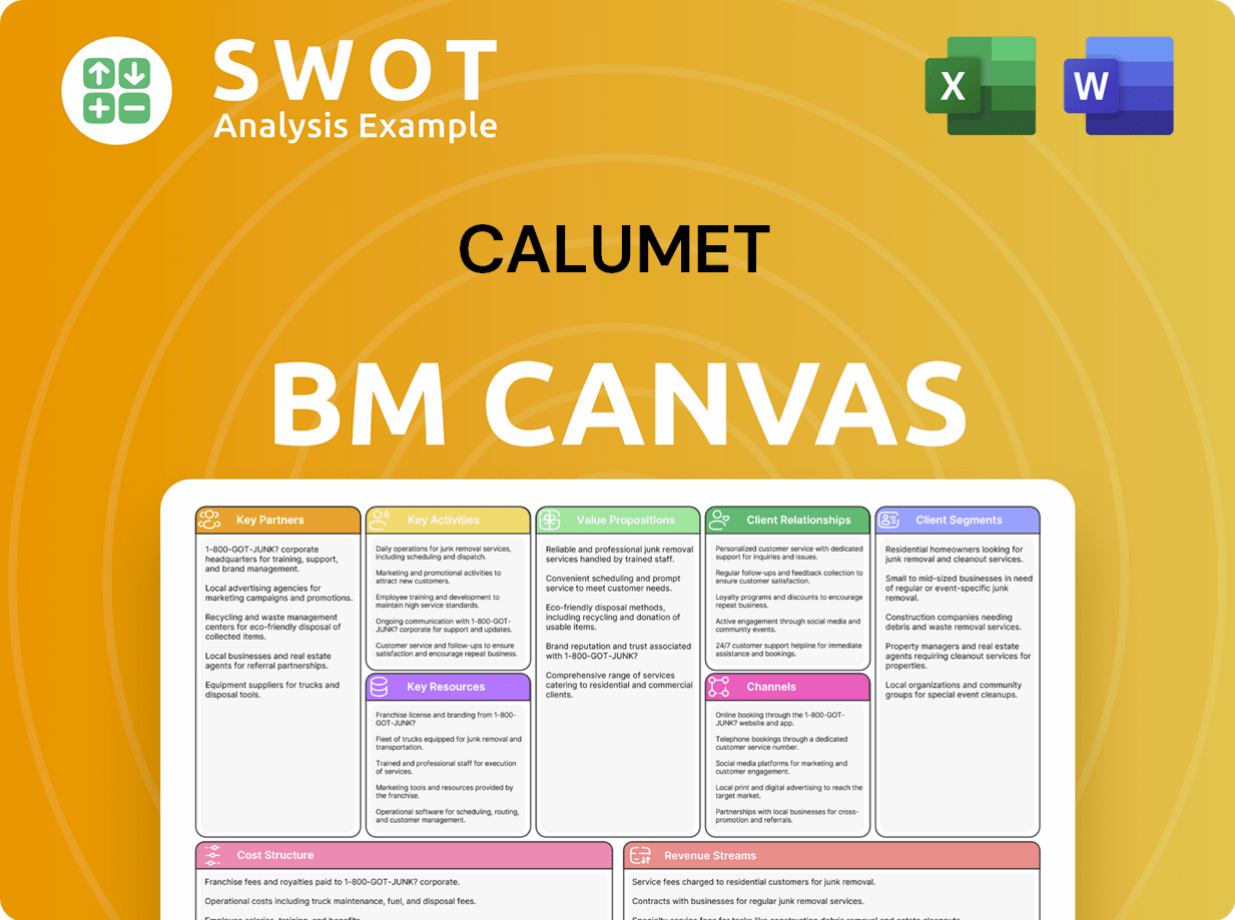

Calumet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Calumet’s Competitive Landscape?

The competitive landscape for the company is significantly influenced by industry trends, future challenges, and opportunities. A thorough market analysis reveals that the company's position is shaped by the shift towards decarbonization and sustainable energy solutions. This transition impacts the demand for renewable fuels, presenting both opportunities and challenges.

Understanding the industry overview and competitor analysis is crucial for evaluating the company's strategic direction. Regulatory changes and technological advancements are key factors. The company needs to navigate commodity price volatility and supply chain disruptions to maintain profitability.

The industry is seeing a strong push toward decarbonization and sustainable energy. This shift drives demand for renewable fuels, like sustainable aviation fuel (SAF) and renewable diesel. Regulatory changes, such as emission standards and incentives, also play a significant role.

A key challenge is managing the shift from traditional hydrocarbon products to renewables. This requires substantial capital investment. Potential threats include new competitors entering the renewable fuels market and increased regulation on traditional products.

Significant growth opportunities exist in emerging markets for SAF and renewable diesel. Developing new, high-performance specialty products also presents opportunities. Strategic partnerships and collaborations could unlock new markets and technologies.

The company's competitive position is evolving toward a more diversified energy company, with a strong emphasis on renewable fuels and high-value specialty products. Strategies will focus on optimizing its asset base and investing in sustainable technologies.

The company's ability to adapt to the changing energy landscape will be crucial. The Inflation Reduction Act in the United States offers tax credits that could significantly benefit renewable fuel production. The company's Montana Renewables segment is well-positioned to capitalize on these opportunities. For more details, consider reading a brief history of the company.

- Focus on renewable fuels and specialty products.

- Capitalize on tax incentives for renewable energy.

- Develop strategic partnerships to expand market reach.

- Manage risks associated with the transition to renewables.

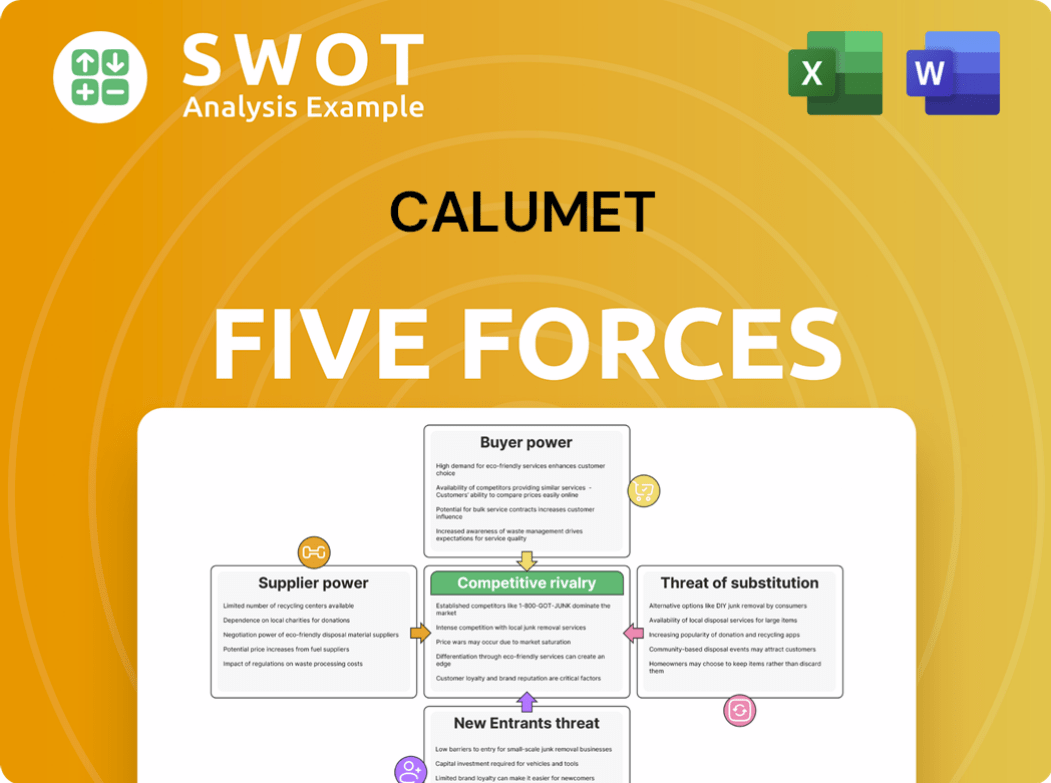

Calumet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Calumet Company?

- What is Growth Strategy and Future Prospects of Calumet Company?

- How Does Calumet Company Work?

- What is Sales and Marketing Strategy of Calumet Company?

- What is Brief History of Calumet Company?

- Who Owns Calumet Company?

- What is Customer Demographics and Target Market of Calumet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.