Computer Age Management Services Bundle

How did Computer Age Management Services revolutionize India's financial landscape?

The Indian mutual fund industry's success story is intertwined with the technological advancements spearheaded by companies like Computer Age Management Services (CAMS). Established in 1988 in Chennai, the Computer Age Management Services SWOT Analysis reveals the company's strategic moves. Its inception transformed manual processes, setting the stage for a more accessible and efficient mutual fund environment.

This Brief history CAMS explores the evolution of CAMS India, a leading technology-driven financial services provider. From its early days, the CAMS company has played a crucial role in the growth of mutual fund services. Understanding the CAMS company background is key to grasping its enduring impact on the financial services sector.

What is the Computer Age Management Services Founding Story?

The story of Computer Age Management Services (CAMS) company began on October 24, 1988. V. Shankar established the company with the goal of fixing the operational inefficiencies that were common in the growing Indian mutual fund industry. This marked the start of a significant player in the financial services sector.

At that time, mutual fund transactions were mostly done manually, which meant a lot of paperwork and a higher chance of mistakes and delays. Shankar saw the need for automation and technology to make these processes faster, more accurate, and able to handle more volume. This vision set the stage for CAMS to become a key provider of services to the financial industry.

CAMS initially focused on providing registrar and transfer agency (RTA) services. This meant they acted as a back-office support system for mutual funds. Their first offerings included services for processing investor applications, managing unit holdings, and handling dividend payouts. The company started with its own funds and early earnings to get things off the ground. The economic changes in India during the late 1980s, with a more open economy and growing interest in financial markets, created a good environment for this type of specialized financial service provider.

CAMS began by addressing the manual processes in the Indian mutual fund industry, offering solutions to improve efficiency and accuracy. The company's initial services were crucial for the operational needs of mutual funds.

- The company's early success was built on providing essential back-office support for mutual funds.

- CAMS focused on automating and streamlining processes to reduce errors and delays.

- The economic environment in India during the late 1980s supported the growth of specialized financial services.

- CAMS's early services included processing investor applications and managing unit holdings.

CAMS quickly became a key player in the mutual fund industry, providing essential services to many fund houses. They helped manage the back-office operations, which included handling investor applications, managing unit holdings, and distributing dividends. This allowed mutual funds to focus on their core investment strategies. Over the years, CAMS expanded its services and technology to meet the changing needs of the financial market. The company's growth reflects the increasing demand for efficient and reliable financial services in India.

The company's ability to adapt to the evolving financial landscape has been a key factor in its continued success. CAMS has consistently invested in technology and infrastructure to improve its services. This has helped them stay ahead of the competition and maintain their position as a leading service provider. For more details on how CAMS generates revenue, you can read about the Revenue Streams & Business Model of Computer Age Management Services.

As of the latest financial reports, CAMS continues to show strong financial performance, reflecting its crucial role in the Indian financial ecosystem. The company's long-term success is a testament to its initial vision and its ability to adapt and innovate within the financial services sector. The company's focus on technology and customer service has helped it maintain a strong market position and attract new clients. CAMS's history is a good example of how a company can grow and succeed by meeting the needs of a growing industry.

Computer Age Management Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Computer Age Management Services?

The early years of the Computer Age Management Services, or CAMS company, were marked by substantial growth. This expansion was fueled by the increasing popularity of mutual funds in India and the efficiency of its automated services. The company quickly established itself as a key player in the financial services sector.

CAMS launched enhanced transaction processing platforms to streamline operations. It also introduced improved investor communication tools to enhance client relationships. These early product offerings set the stage for its future growth in the mutual fund services market.

The company secured its first major clients among the pioneering asset management companies in India. This early success helped CAMS establish itself as a reliable partner in the financial industry. These partnerships were crucial for the company's initial growth and market penetration.

Initial team expansion focused on recruiting skilled IT professionals and operational experts. The company's first office was established in Chennai, strategically located to serve the growing financial sector. This expansion was vital for supporting its growing client base and service offerings.

As the mutual fund industry expanded geographically, CAMS broadened its reach. It established service centers across various Indian cities to cater to a wider investor base. This expansion strategy helped CAMS company increase its market presence.

Computer Age Management Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Computer Age Management Services history?

The CAMS company has achieved significant milestones throughout its history, solidifying its position as a key player in the financial services sector. From its inception, Computer Age Management Services has consistently expanded its services and technological capabilities, adapting to the evolving needs of the mutual fund industry and broader financial landscape. The company's journey reflects a commitment to innovation and strategic growth, driven by the goal of enhancing investor experience and operational efficiency.

| Year | Milestone |

|---|---|

| Early Years | Foundation of the company, marking the beginning of its journey in providing mutual fund services. |

| Mid-2000s | Introduction of electronic transaction processing and digital investor services, revolutionizing the industry. |

| 2010s | Securing patents for proprietary technology platforms and forming major partnerships with leading asset management companies. |

| Recent Years | Recognition for technological prowess and service quality, along with strategic acquisitions to expand service offerings. |

CAMS India has consistently introduced innovations to improve its services. A notable innovation was the implementation of electronic transaction processing, which significantly reduced paper-based transactions and enhanced investor convenience. Furthermore, the company's investment in digital platforms has improved customer service.

The introduction of electronic transaction processing revolutionized the industry by reducing paper-based transactions. This innovation significantly improved efficiency and convenience for both investors and asset management companies.

Digital investor services enhanced investor convenience by providing online access to account information and transaction capabilities. This shift towards digital platforms improved customer service.

The development of proprietary technology platforms has provided a competitive edge. These platforms have enabled CAMS to offer customized services and solutions to meet the specific needs of its clients.

Strategic partnerships with leading asset management companies have expanded CAMS' market reach. These collaborations have strengthened its position in the financial services sector.

Continuous investment in research and development has allowed CAMS to stay ahead of technological advancements. This commitment ensures that the company remains at the forefront of innovation in the industry.

A strong focus on customer-centricity has enabled CAMS to build lasting relationships with its clients. This approach ensures that the company consistently meets and exceeds customer expectations.

Despite its successes, Computer Age Management Services has faced several challenges. These include intense competition from other RTAs and in-house solutions, as well as the need to constantly upgrade technology. Adapting to new regulatory mandates, such as SEBI's push for greater transparency, has also required strategic adjustments. To learn more about the company's ownership and structure, you can read about the Owners & Shareholders of Computer Age Management Services.

Market downturns have impacted the financial performance of CAMS. These periods require strategic adjustments to maintain stability and growth.

Intense competition from other RTAs and in-house solutions poses a constant challenge. CAMS must continually innovate to maintain its market position.

The need to upgrade technology to keep pace with rapid advancements is a continuous challenge. This requires ongoing investment in R&D and infrastructure.

Adapting to new regulatory mandates requires significant strategic pivots. Compliance with evolving regulations is crucial for maintaining operational integrity.

Economic fluctuations and market volatility can affect the financial performance. CAMS must be prepared to navigate economic uncertainties.

Changes in investor behavior and preferences require CAMS to adapt its services. Understanding and responding to these shifts is essential for long-term success.

Computer Age Management Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Computer Age Management Services?

The Brief History of Computer Age Management Services (CAMS) company reflects its evolution from a technology-focused service provider to a key player in India's financial services sector. Founded in 1988, CAMS has consistently adapted to technological advancements and market demands, shaping its trajectory through strategic initiatives and innovations. Its journey highlights a commitment to leveraging technology to enhance efficiency and investor experience within the mutual fund industry and beyond.

| Year | Key Event |

|---|---|

| 1988 | CAMS was established, marking the beginning of its journey in providing services to the financial sector. |

| Early 1990s | Launched its first automated RTA (Registrar and Transfer Agent) services, a pivotal move towards automation. |

| 2000s | Expanded its service center network significantly, increasing its reach across India. |

| 2010s | Introduced digital platforms for investors, responding to the growing demand for online services. |

| 2020 | Successfully completed its Initial Public Offering (IPO), a significant milestone in its corporate journey. |

| 2024-2025 | Continues to enhance its technological infrastructure, focusing on AI and blockchain integration for improved efficiency and security. |

CAMS is focused on expanding its digital offerings, including enhanced mobile applications and online portals to improve user experience. The company is investing in artificial intelligence and blockchain technologies to streamline operations and enhance security. These technological advancements aim to support the growing number of digital transactions within the financial services sector.

CAMS plans to capitalize on the expansion of the Indian financial market, especially the increasing penetration of mutual funds. The company is exploring opportunities to diversify its services beyond mutual funds, potentially entering new segments within the financial services industry. This strategic move aims to broaden its revenue streams and strengthen its market position.

CAMS aims to expand its reach and service offerings across the financial landscape. This includes leveraging data analytics to provide personalized services and improve customer engagement. The company is committed to enhancing its technological infrastructure to meet the evolving demands of the financial sector.

Analysts predict that CAMS will continue to play a critical role in the digital transformation of India's financial infrastructure. The company's robust technology and extensive network position it well to support the growth of the financial sector. The future outlook for CAMS is strongly tied to its founding vision of using technology to empower the financial ecosystem.

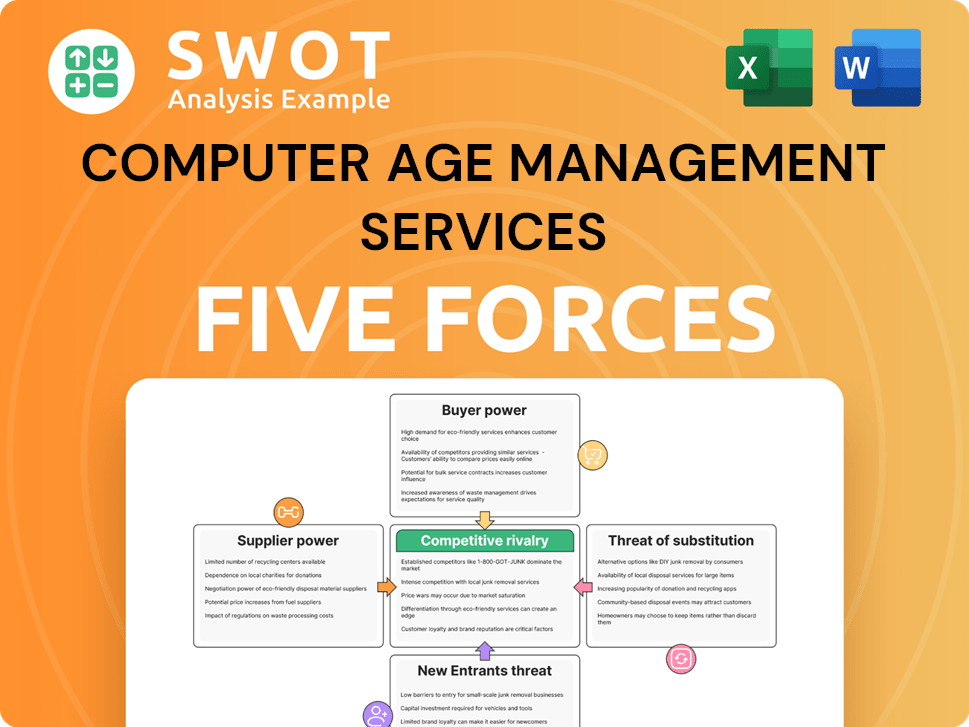

Computer Age Management Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Computer Age Management Services Company?

- What is Growth Strategy and Future Prospects of Computer Age Management Services Company?

- How Does Computer Age Management Services Company Work?

- What is Sales and Marketing Strategy of Computer Age Management Services Company?

- What is Brief History of Computer Age Management Services Company?

- Who Owns Computer Age Management Services Company?

- What is Customer Demographics and Target Market of Computer Age Management Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.