Computer Age Management Services Bundle

How Does Computer Age Management Services Thrive in India's Financial Sector?

Computer Age Management Services (CAMS) is a dominant force in India's financial infrastructure, but how does it maintain its leading position? As a technology-driven provider, CAMS supports mutual funds and financial institutions, holding a substantial market share. Its partnerships with major players like SBI, ICICI Prudential, and HDFC AMC highlight its crucial role in the industry's growth.

The Indian mutual fund industry's impressive growth, with a projected 19% CAGR, underscores the significance of companies like CAMS. To truly understand CAMS's success, consider the Computer Age Management Services SWOT Analysis. This deep dive into its operations and revenue strategies reveals its competitive advantages. Understanding Computer age management and its role in IT asset management is key to grasping CAMS's future potential, especially considering the benefits of IT asset lifecycle management in a rapidly evolving market. Exploring topics like IT services, Asset tracking, and Software deployment further enriches this understanding.

What Are the Key Operations Driving Computer Age Management Services’s Success?

The core operations of Computer Age Management Services (CAMS) revolve around providing technology-enabled financial services. They act as a crucial link between investors, distributors, and asset management companies (AMCs). Their primary focus is being a Registrar and Transfer Agency (RTA) for mutual funds, where they hold a significant market share.

CAMS offers a wide range of services that are supported by proprietary technology platforms. Their Transfer Agency platform is the largest in India, designed for efficient management of complex mutual fund operations. They also provide services to alternative investment funds (AIFs), insurance companies, and payment aggregators.

The value proposition of CAMS lies in its comprehensive service offerings and robust technology infrastructure. They streamline financial processes, improve efficiency, and ensure data security. This allows clients to focus on their core business activities, knowing that their operational needs are handled by a reliable and technologically advanced partner.

CAMS provides a wide array of services, including investor services, transaction processing, and customer support. They also offer digital onboarding, fund accounting, and record management for various financial instruments. Their services extend to KYC registration and account aggregation, making them a one-stop solution for financial institutions.

CAMS operates its own data centers using virtualized Hyper Converge Infrastructure (HCI). They have developed hundreds of applications and APIs to support their services. Their technology infrastructure is designed for scalability, security, and efficiency, ensuring reliable service delivery. Their data security is ISO/IEC 27001:2013 certified.

CAMS holds a significant market share in the RTA segment for mutual funds, with approximately a 68% market share based on AAUM. This strong market position is a testament to their service quality and technological capabilities. The company's focus on automation and operational efficiencies helps maintain profitability.

CAMS supports its services through a pan-India network of 286 service centers, a white-label call center, and online portals like myCAMS. They also offer mobile apps and chatbots to enhance customer service. This extensive reach ensures accessibility and convenience for their clients and investors.

CAMS differentiates itself through its robust technology infrastructure, stringent data security, and focus on automation. This allows them to provide reliable and efficient services, even with potential pricing adjustments. They are a key player in the IT services sector.

- Scalable Technology: Their platform is designed to handle large volumes of transactions.

- Data Security: ISO/IEC 27001:2013 certification ensures data protection.

- Operational Efficiency: Automation and streamlined processes improve profitability.

- Comprehensive Services: Offering a wide range of financial services.

Computer Age Management Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Computer Age Management Services Make Money?

The revenue streams and monetization strategies of Computer Age Management Services (CAMS) are primarily centered on its Registrar and Transfer Agency (RTA) services. These services are mainly for mutual funds. In 9M FY25, these services accounted for a significant 87% of the company's revenue.

CAMS reported a total income of ₹1,475.1 crore for FY25, with a net profit of ₹464.7 crore. The company has diversified its revenue streams beyond its core RTA services. This diversification includes services for alternative investment funds, insurance companies, and the National Pension System (NPS).

In Q4 FY25, CAMS achieved a total revenue of ₹369.6 crore, reflecting a 14.8% year-on-year increase. Non-MF revenue increased by 15.8% year-on-year in the same quarter. This contributed 13.7% to the total revenue. The digital payments division, CAMSPay, saw a 53% revenue growth in Q3 FY25.

CAMS's monetization is largely driven by transaction volumes and assets under management. The company anticipates a revenue growth of approximately 14% CAGR from FY25E to FY27E, supported by an expected 19% CAGR in AUM. The company aims to maintain profitability through automation and operational efficiencies. This is even with potential yield compression. For more insights, explore the Growth Strategy of Computer Age Management Services.

- Mutual Fund RTA Services: Core revenue generator, contributing the majority of income.

- Diversified Services: Expanding into alternative investment funds, insurance, and NPS to reduce reliance on a single revenue stream.

- Digital Transformation and Software Solutions: Offering services to financial institutions to tap into the growing demand for digital solutions.

- CAMSPay: Growing digital payments division, contributing to revenue growth.

Computer Age Management Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Computer Age Management Services’s Business Model?

The evolution of Computer Age Management Services (CAMS) showcases significant milestones and strategic initiatives that have shaped its operational and financial landscape. These developments highlight the company's adaptability and forward-thinking approach in the IT services sector. The company has consistently expanded its service offerings and market reach, solidifying its position as a key player in the industry.

Strategic moves, such as securing new RTA mandates and expanding internationally, have been crucial for CAMS's growth. These actions, coupled with investments in digital transformation, demonstrate its commitment to innovation and efficiency. CAMS's competitive edge is further enhanced by its substantial market share and extensive service network, allowing it to effectively serve a growing customer base.

CAMS secured RTA mandates for new mutual funds, including Jio BlackRock MF, positioning it as a preferred partner for new Asset Management Companies (AMCs). The company also expanded internationally, winning its first international MF-RTA mandate from CeyBank AMC. Additionally, CAMSREP, a subsidiary, entered an agreement with Life Insurance Corporation of India (LIC) to provide insurance repository services.

CAMS partnered with Google Cloud to develop a cloud-native platform to modernize India's mutual fund industry, incorporating AI-driven tools and enhanced data management. In December 2024, the board approved an additional investment of ₹8 crore in CAMS Financial Information Services (CAMS FIS) to maintain its minimum net worth as per aggregator regulations. These moves highlight CAMS's focus on innovation and regulatory compliance.

CAMS holds a dominant market share of 68% in the mutual fund RTA space. It operates an extensive physical network of 286 service centers across 25 states and 5 union territories as of December 2024. CAMS can onboard approximately 0.8 million investors monthly, which is 1.5 times the rate of its competitors. This operational efficiency is a key factor in its success.

CAMS has actively embraced digital transformation, including a partnership with Google Cloud to develop a cloud-native platform. The company is investing in Robotic Process Automation (RPA) bots and adopting AI and Machine Learning (ML) technologies. These initiatives are aimed at enhancing efficiency, accuracy, and ensuring zero-downtime deployments, contributing to its competitive advantage in the IT asset management sector.

CAMS focuses on IT asset management and IT lifecycle management, offering comprehensive IT services. The company's proprietary technology platforms are known for their capability, functionality, integration, and scalability. CAMS's approach to IT asset management involves continuous improvement and adaptation to market trends.

- Dominant market share in the mutual fund RTA space.

- Extensive physical network and robust technology platforms.

- Focus on digital transformation through AI and ML technologies.

- Commitment to innovation and regulatory compliance. For more insights, explore the Marketing Strategy of Computer Age Management Services.

Computer Age Management Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Computer Age Management Services Positioning Itself for Continued Success?

The company, a leading player in India's financial services sector, holds a strong industry position as a Registrar and Transfer Agent (RTA) for mutual funds. As of April 2025, it commanded a significant market share of 68% based on average assets under management (AAUM). This dominance is further highlighted by its service to 26 out of 50 mutual funds, including 10 of the top 15, which collectively manage a substantial portion of the industry's AUM. This market leadership is reinforced by its 64% market share in new SIP registrations as of December 2024.

Despite its robust market position, the company faces several risks. The financial services sector is vulnerable to regulatory changes, and a lack of skilled resources and ongoing training are significant risks in the broader financial crime landscape. The increasing use of generative AI by criminals for fraud and cybercrime also poses an evolving external threat. Market sentiment and geopolitical uncertainties can impact trading volumes and mutual fund inflows, potentially affecting revenue and profitability. For more insights, you can explore the Competitors Landscape of Computer Age Management Services.

The company is a leading RTA in India's mutual fund industry. It holds a substantial market share, servicing a significant number of mutual funds. Market share is based on AAUM and new SIP registrations.

The company faces risks from regulatory changes, and financial crime. Generative AI-driven fraud and cybercrime are growing threats. Market sentiment and geopolitical factors can also impact the business.

The company aims to grow revenue, expecting a 14% CAGR from FY25E to FY27E. Strategic initiatives include technology platform investments and expanding service offerings. The CEO anticipates a strong FY25 with margin expansion.

The company plans to capitalize on India's underpenetrated mutual fund market. MF AUM as a percentage of GDP in India is 18%, compared to a world average of approximately 65%. This presents significant growth potential.

The company is focused on sustaining and expanding its revenue generation capabilities. Key strategies include technology investments, such as the Google Cloud partnership, and expanding its portfolio of services to include other financial services.

- Continued investment in technology platforms.

- Expansion of services to include other financial services.

- Focus on execution and margin expansion.

- Leveraging the underpenetrated Indian mutual fund market.

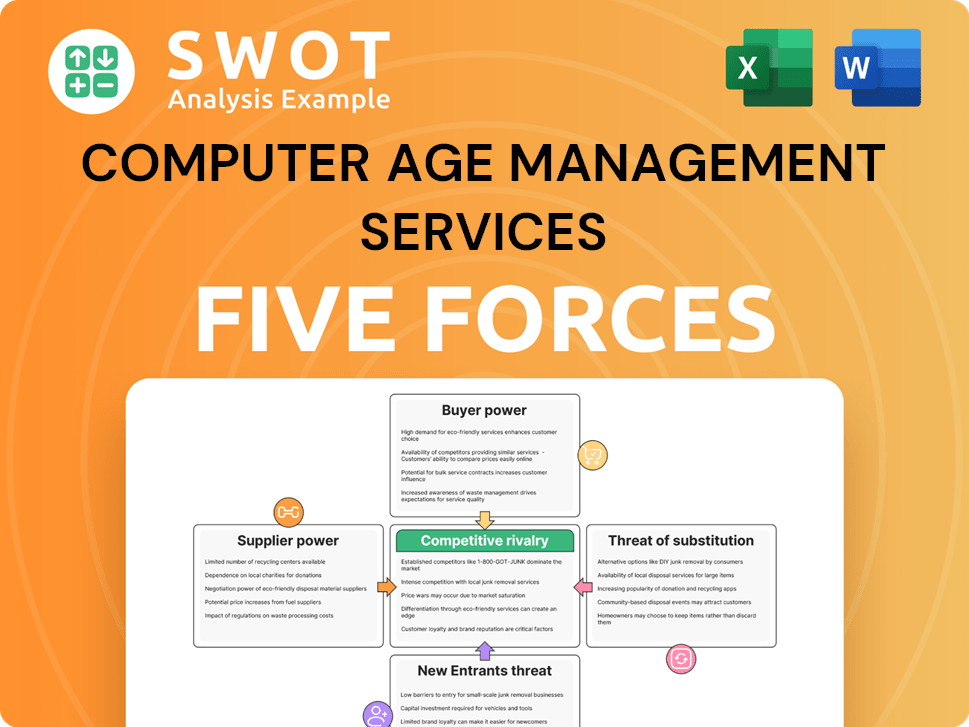

Computer Age Management Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Computer Age Management Services Company?

- What is Competitive Landscape of Computer Age Management Services Company?

- What is Growth Strategy and Future Prospects of Computer Age Management Services Company?

- What is Sales and Marketing Strategy of Computer Age Management Services Company?

- What is Brief History of Computer Age Management Services Company?

- Who Owns Computer Age Management Services Company?

- What is Customer Demographics and Target Market of Computer Age Management Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.