Computer Age Management Services Bundle

Who Really Owns Computer Age Management Services?

Understanding a company's ownership structure is crucial for investors and analysts alike. Computer Age Management Services (CAMS), a key player in India's financial landscape, offers a fascinating case study in how ownership evolves. From its founding in 1988 to its 2020 IPO, the journey of CAMS has been marked by significant shifts in its shareholder base.

This exploration into Computer Age Management Services SWOT Analysis will uncover the intricate details of CAMS ownership, from its initial founders to the current CAMS shareholders, including key institutional investors and the impact of its public listing. We'll examine the CAMS history, its financial performance, and the strategic implications of its ownership structure, providing valuable insights for anyone interested in the CAMS company profile and its future trajectory within the Indian financial market. Discover who is the current owner of CAMS and how this has shaped its success.

Who Founded Computer Age Management Services?

The story of Computer Age Management Services (CAMS) begins in early 1988, with V. Shankar at the helm. Shankar, bringing expertise in software development and computer education, laid the foundation for what would become a significant player in India's financial services sector. Initially, the CAMS company started with a modest team of about 20 staff members.

From its inception, CAMS focused on processing transfer agency operations. This early focus involved handling Initial Public Offerings (IPOs) and NCD issues for various entities. This strategic direction set the stage for CAMS's evolution and its eventual expansion into platform-based services.

A key moment in CAMS's history was the investment by HDFC Group in 2000. This investment provided a strategic boost, helping CAMS secure new clients and further solidify its position in the market. The National Stock Exchange (NSE) also acquired a stake in the company in early 2014, demonstrating the growing importance of CAMS within the financial ecosystem.

V. Shankar, the founder of Computer Age Management Services, led the company for its first two decades, establishing a strong legacy. CAMS played a crucial role in processing significant financial events, including IPOs and NCD issues. The company's early focus on technology and its pivot to domestic financial services during the Y2K period were pivotal.

- In 1996, CAMS processed the first-ever allotment of Ford Escorts for Ford India Pvt Ltd, showcasing its operational capabilities.

- The investment from HDFC Group in 2000 was a turning point, providing strategic impetus.

- In 2011, there were reports of HDFC Group and Advent International considering selling their stakes.

- While specific equity splits for the founders at inception are not publicly detailed, V. Shankar's leadership was central.

Computer Age Management Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Computer Age Management Services’s Ownership Changed Over Time?

The ownership structure of Computer Age Management Services (CAMS) has seen significant changes, especially after its Initial Public Offering (IPO). The IPO in October 2020, which was an offer for sale by existing shareholders, raised approximately ₹2,240 crores. This move transformed CAMS into a publicly listed company, increasing its visibility and attracting a diverse group of investors. The shares were initially listed around ₹1,360 on the National Stock Exchange (NSE), marking a pivotal moment in the company's history.

The transition to a publicly listed entity has broadened the shareholder base of CAMS, influencing its strategic direction and governance. The IPO and subsequent market activities have led to a shift in ownership, with a notable increase in institutional investor participation. This shift reflects a move towards broader institutional ownership and public participation, which can influence company strategy and governance by increasing scrutiny and demand for transparency.

| Date | Event | Impact |

|---|---|---|

| October 2020 | IPO | Public listing; raised ₹2,240 crores; shares listed on NSE. |

| December 31, 2024 | FII Holding | FIIs held 57.63% of shares. |

| March 2025 | FII Holding | FIIs held approximately 55% of shares, valued at ₹10,100 crore. |

As of March 2025, Foreign Institutional Investors (FIIs) held approximately 55% of CAMS shares, valued at around ₹10,100 crore. Mutual funds held 10.69% of the shares, represented by 32 schemes, while individual investors held 21.21%. White Oak Capital Management, Inc. and The Vanguard Group, Inc. are among the top institutional shareholders. The evolution of CAMS ownership, from its founding to its current structure, highlights the company's growth and its integration into the broader financial market. For more insights into the company's strategic direction, consider reading about the Growth Strategy of Computer Age Management Services.

The ownership of CAMS has shifted significantly since its IPO, with a strong presence of institutional investors.

- FIIs hold a substantial portion of the shares.

- Mutual funds and individual investors also have notable stakes.

- The absence of pledged promoter holdings indicates a stable ownership structure.

- The IPO marked a significant transition for the CAMS company.

Computer Age Management Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Computer Age Management Services’s Board?

The Board of Directors of Computer Age Management Services (CAMS) is structured to include a mix of independent directors, non-executive nominee directors, and the Managing Director. This composition reflects a professionally managed and institutionally owned entity. As of the latest available information, the board includes key members such as Mr. Dinesh Kumar Mehrotra as Chairman and Independent Director, and Mrs. Vijayalakshmi Rajaram Iyer as an Independent Director and Women Director. Mr. Anuj Kumar serves as the Managing Director. Mr. Narendra Ostawal, a nominee director, represents Great Terrain Investment Limited, one of the promoters.

The board's structure is designed to incorporate diverse perspectives, with independent directors providing oversight and nominee directors representing major shareholders. This setup is typical for publicly listed companies in India, ensuring a balance between management and shareholder interests. The voting structure generally follows a one-share-one-vote principle. The significant institutional ownership, particularly by Foreign Institutional Investors (FIIs) at approximately 55% as of March 2025, suggests that the board likely considers the preferences of these large shareholders. There have been no widely reported proxy battles or governance controversies, indicating a relatively stable governance environment. The board and management team collaborate on annual reports, taking responsibility for their accuracy and providing a holistic overview of the company's value creation process to help investors make informed decisions.

| Board Member | Position | Nominated By |

|---|---|---|

| Dinesh Kumar Mehrotra | Chairman & Independent Director | N/A |

| Vijayalakshmi Rajaram Iyer | Independent Director & Women Director | N/A |

| Anuj Kumar | Managing Director | N/A |

| Narendra Ostawal | Non-Executive Nominee Director | Great Terrain Investment Limited |

The board of the CAMS company includes independent and nominee directors. The voting structure is primarily one-share-one-vote. Institutional investors hold a significant stake, influencing board decisions.

- Independent directors provide oversight.

- Nominee directors represent major shareholders.

- Institutional ownership is a key factor.

- Stable governance with no major controversies.

Computer Age Management Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Computer Age Management Services’s Ownership Landscape?

Over the past few years, significant shifts have occurred in the ownership structure of Computer Age Management Services (CAMS). Foreign Institutional Investors (FIIs) have notably increased their stake, reaching 57.63% as of December 31, 2024, and holding approximately ₹10,100 crore by March 2025, which indicates a strong interest from international investors. This positions CAMS as a company with substantial foreign ownership.

Conversely, the promoter holdings have decreased, dropping to 0% as of the last reported quarter in February 2024, reflecting a shift in the company's ownership dynamics. Domestic Institutional Investors (DIIs) have also increased their holdings, rising from 16.06% to 23.08%, further illustrating the trend of institutional investment in CAMS. This evolution in CAMS's shareholder base is typical as companies mature and transition, especially after going public.

| Ownership Category | December 31, 2024 | March 2025 |

|---|---|---|

| Foreign Institutional Investors (FIIs) | 57.63% | 55% |

| Promoter Holdings | 19.87% (in previous periods) | 0% (as of Feb 2024) |

| Domestic Institutional Investors (DIIs) | 16.06% (in previous periods) | 23.08% |

CAMS has shown robust financial performance. For the fiscal year ending March 2023, the company reported a total revenue of ₹1,200 crores and a net profit of ₹350 crores, demonstrating a year-on-year revenue growth of about 15%. The earnings per share (EPS) have also increased, rising from ₹26.75 in March 2019 to ₹95.12 in March 2025. The company continues to expand its service offerings, which is detailed in this Target Market of Computer Age Management Services article, and market reach, with several platforms launched in recent years. This expansion, coupled with strong financial results, highlights the company's growth trajectory.

FIIs increased their holdings, while promoter holdings decreased. DIIs also increased their stake, showing growing institutional interest in CAMS. This shift reflects a maturing company with a diversified shareholder base.

CAMS reported ₹1,200 crores in revenue and ₹350 crores in net profit for the fiscal year ending March 2023. Earnings per share have risen significantly, indicating strong financial health and growth.

CAMS is expanding its service offerings and market reach with new platforms. The company's focus on innovation and diversification positions it well for future growth.

As of March 2022, CAMS had six wholly-owned subsidiaries and one recently acquired subsidiary. This expansion strategy supports its market presence and service capabilities.

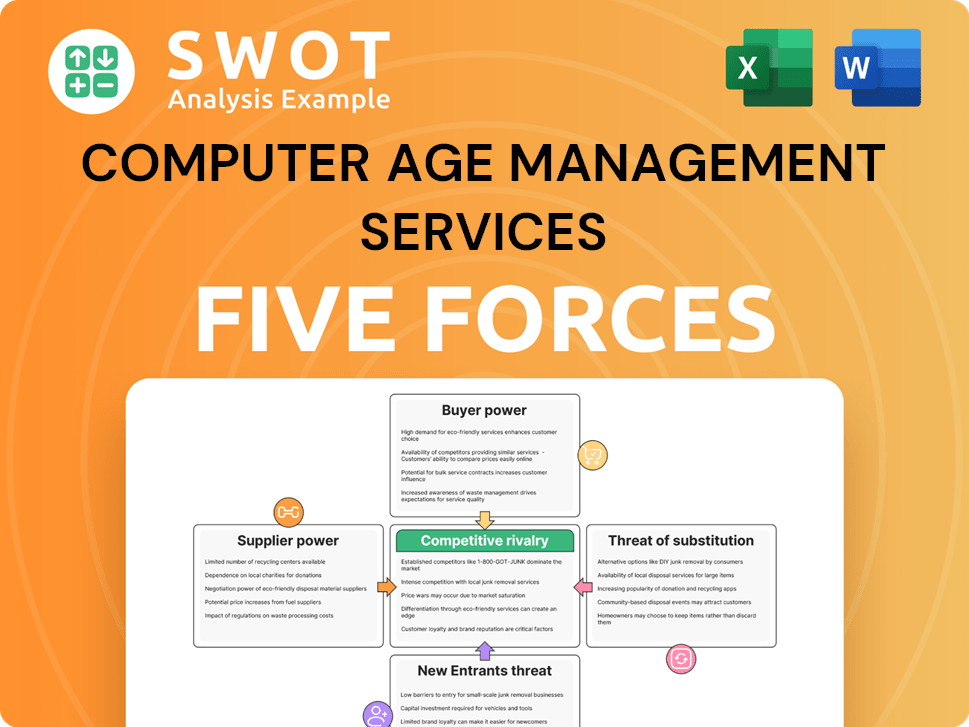

Computer Age Management Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Computer Age Management Services Company?

- What is Competitive Landscape of Computer Age Management Services Company?

- What is Growth Strategy and Future Prospects of Computer Age Management Services Company?

- How Does Computer Age Management Services Company Work?

- What is Sales and Marketing Strategy of Computer Age Management Services Company?

- What is Brief History of Computer Age Management Services Company?

- What is Customer Demographics and Target Market of Computer Age Management Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.