Computer Age Management Services Bundle

Can CAMS Continue to Dominate India's Financial Services Landscape?

Computer Age Management Services (CAMS) has quietly revolutionized India's Computer Age Management Services SWOT Analysis financial services sector, becoming a cornerstone for the mutual fund industry. From its humble beginnings in 1988, CAMS has evolved into a market leader, processing transactions and providing crucial technological infrastructure. But what does the future hold for this financial powerhouse?

This deep dive into CAMS will explore its Growth Strategy, examining how it plans to capitalize on the evolving financial landscape. We'll conduct a thorough Market Analysis, analyzing CAMS's competitive positioning and identifying key drivers for future success in the Mutual Funds sector. Understanding the Future prospects of CAMS in India is crucial for investors and strategists alike.

How Is Computer Age Management Services Expanding Its Reach?

The expansion initiatives of Computer Age Management Services (CAMS) are designed to bolster its market leadership and diversify its revenue streams. A key focus involves broadening its service offerings beyond the mutual funds sector into other financial services. This strategic move is essential for accessing new customer bases and reducing reliance on a single industry. CAMS is leveraging its established technological infrastructure and expertise in transaction processing and record-keeping to achieve this diversification.

Geographical expansion, particularly within India, also remains a priority for CAMS. The company is enhancing its physical presence and digital reach to cater to a broader investor base, including those in semi-urban and rural areas. This aligns with the increasing financial inclusion initiatives across the country. Furthermore, CAMS is exploring new business models, such as offering technology-as-a-service (TaaS) to smaller financial institutions.

CAMS's consistent investment in technology and its track record of strategic partnerships indicate a clear trajectory toward broader market penetration and service diversification. The company's ability to adapt and innovate is crucial for its long-term growth potential. For a deeper understanding of the company's origins, you can read the Brief History of Computer Age Management Services.

CAMS is expanding into the alternative investment fund (AIF) and insurance sectors. This diversification aims to replicate its success in the mutual fund RTA space. The company's technological infrastructure supports these expansions.

CAMS is enhancing its physical and digital presence across India. This expansion targets a wider investor base, including those in semi-urban and rural areas. This aligns with the country's financial inclusion initiatives.

CAMS is exploring the TaaS model to support smaller financial institutions. This approach generates new revenue streams and strengthens CAMS's position as a financial technology provider. This model helps smaller firms access advanced technology without in-house development.

CAMS consistently invests in technology and forms strategic partnerships. These actions support broader market penetration and service diversification. The company's track record indicates a strong commitment to growth.

The future prospects of CAMS are promising, with a clear focus on expanding its services and market reach. The company's growth strategy involves diversification, geographical expansion, and the adoption of new business models. These initiatives are designed to capitalize on the evolving needs of the financial services sector.

- Expanding into AIF and insurance sectors to diversify revenue streams.

- Enhancing physical and digital presence across India to reach a broader investor base.

- Offering Technology-as-a-Service (TaaS) to smaller financial institutions.

- Consistent investment in technology and strategic partnerships to drive growth.

Computer Age Management Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Computer Age Management Services Invest in Innovation?

The core of Computer Age Management Services' (CAMS) strategy for growth is deeply rooted in innovation and technology. This approach is essential for maintaining its position in the competitive Financial Services sector. CAMS consistently invests in research and development to improve its existing platforms and introduce new solutions, which is critical for long-term success.

Digital transformation is a central element of CAMS's strategy. The company focuses heavily on automation to boost efficiency and cut operational costs. This commitment to technology is vital for adapting to changing market trends and maintaining a competitive edge. By leveraging technology, CAMS aims to enhance its service offerings and improve the overall customer experience.

CAMS has adopted advanced technologies like artificial intelligence (AI) and machine learning (ML) to enhance its data analytics, improve customer service, and streamline complex processes. This technological integration supports its growth strategy. The company's ability to adapt and implement new technologies is key to its future prospects in the Indian financial ecosystem.

CAMS consistently invests in research and development (R&D) to enhance its existing platforms and develop new solutions. This investment is crucial for staying ahead in the financial services industry. R&D efforts support the company's long-term growth strategy.

Digital transformation is a key aspect of CAMS's strategy, with a strong emphasis on automation to improve efficiency and reduce operational costs. This involves streamlining processes and leveraging technology to optimize operations. Digital initiatives are essential for adapting to the changing market.

CAMS has been at the forefront of adopting technologies such as artificial intelligence (AI) and machine learning (ML) to enhance its data analytics capabilities. These technologies improve customer service through AI-powered chatbots. AI and ML streamline complex transaction processes.

The company continuously upgrades its investor service platforms, making them more user-friendly and accessible. This includes developing robust mobile applications and self-service portals. These improvements empower investors with greater control over their mutual fund portfolios.

CAMS is exploring the potential of blockchain technology for secure and transparent record-keeping. While widespread implementation in the Indian financial sector is still evolving, CAMS is staying ahead. Blockchain could enhance data security.

CAMS's consistent upgrades and adoption of new technologies underscore its leadership in providing advanced financial infrastructure solutions. This ongoing commitment to innovation is a key driver of its success. These upgrades ensure CAMS remains competitive.

CAMS's technology strategy focuses on several key areas to drive growth and improve service offerings. These initiatives are designed to enhance operational efficiency, improve customer experience, and adapt to changing market trends. The company's investment in these areas is a key part of its long-term strategy for the financial sector.

- AI-Powered Solutions: Implementing AI for data analytics, customer service (chatbots), and transaction processing.

- Mobile and Web Platforms: Developing user-friendly mobile applications and self-service portals.

- Blockchain Technology: Exploring blockchain for secure and transparent record-keeping.

- Automation: Automating processes to reduce operational costs and increase efficiency.

- Continuous Upgrades: Regularly updating platforms and services to incorporate new technologies.

Computer Age Management Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Computer Age Management Services’s Growth Forecast?

The financial outlook for CAMS (Computer Age Management Services) is robust, supported by its strong performance and strategic initiatives. For the fiscal year ending March 31, 2024, the company demonstrated healthy revenue growth from operations. This growth is a key indicator of CAMS's ability to capitalize on the expanding Indian financial services market, particularly within the mutual fund sector.

CAMS's profit after tax (PAT) also experienced a significant increase, reflecting efficient cost management and the scalability of its operations. This financial health is crucial for funding future expansion and maintaining shareholder value. The company's strategic focus on diversification and technological innovation further strengthens its financial position, allowing it to adapt to evolving market dynamics and maintain its competitive edge. The company's commitment to shareholder returns is evident through consistent dividend payouts and share buyback programs.

Analysts generally anticipate continued revenue growth for CAMS in the coming years, driven by the expansion of the Indian mutual fund industry and the company's diversification into new service areas, such as alternative investment funds (AIFs) and insurance. This positive outlook is supported by CAMS's strong operating margins, a testament to its technology-driven business model and the scalability of its services. The company's asset-light model contributes to healthy cash flow generation, further bolstering its financial stability and enabling strategic investments in growth opportunities. For more insights into the company's core values, explore Mission, Vision & Core Values of Computer Age Management Services.

CAMS's revenue growth is primarily driven by the expansion of the Indian mutual fund industry. Diversification into new service areas, such as AIFs and insurance, also contributes to revenue growth. Technological advancements and digital transformation initiatives further enhance service offerings and customer acquisition strategies.

Strong operating margins are a key feature of CAMS's financial performance, reflecting the efficiency of its technology-driven model. The asset-light business model contributes to healthy cash flow generation, supporting investments in future growth and expansion. This efficient model allows CAMS to maintain a competitive edge in the market.

Key financial indicators include revenue from operations, profit after tax (PAT), and operating margins. Consistent dividend payouts and share buyback programs indicate a robust financial position and commitment to shareholder returns. These indicators reflect CAMS's ability to generate sustainable financial results.

The growth of CAMS is closely tied to the overall expansion of the Indian financial services sector. Market analysis reveals increasing demand for services related to mutual funds, AIFs, and insurance. CAMS is strategically positioned to capitalize on these trends through its diversified service offerings.

Future prospects for CAMS are positive, with continued growth expected in the coming years. Investment in future expansion and digital transformation initiatives will be critical. CAMS's long-term growth potential is significant, supported by its strong market position and strategic initiatives.

Challenges facing CAMS include adapting to changing market trends and maintaining a competitive edge. The company's strategies involve continuous innovation, customer acquisition, and service diversification. Addressing these challenges is crucial for sustaining growth.

Computer Age Management Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Computer Age Management Services’s Growth?

Even with a strong position, Computer Age Management Services (CAMS) faces risks. These challenges could impact its growth strategy and future prospects in the Financial Services sector. Understanding these potential obstacles is crucial for a comprehensive Market Analysis.

Competition, regulatory changes, and technological disruptions are key areas of concern. CAMS must navigate these challenges to maintain its market share and achieve sustained Growth Strategy. The company's ability to adapt will be critical to its long-term success.

Internal resource constraints, particularly in attracting and retaining skilled technology talent, could also hinder growth initiatives. CAMS needs to address these issues proactively to ensure its continued expansion and maintain its competitive edge.

Increased competition could arise from new entrants or aggressive moves by existing smaller players. This could affect CAMS's Market Analysis and its ability to maintain its current market share. The CAMS business model analysis must account for these shifts.

New regulations from SEBI or other financial authorities pose a significant risk. Changes in fee structures or data privacy regulations could require major operational adjustments. The company's Growth Strategy must adapt to these evolving requirements.

The rapid pace of innovation in the fintech sector presents a constant threat. New technologies or business models could bypass or alter traditional RTA services. Impact of technology on CAMS services is a key consideration.

Attracting and retaining skilled technology talent is crucial for growth. Internal resource limitations could hinder CAMS's expansion plans. Investment in CAMS future expansion is essential to address these challenges.

Increasing cyber threats and stringent data privacy regulations necessitate robust security measures. Any data breaches or failures to comply with regulations could severely damage CAMS's reputation. This impacts CAMS customer acquisition strategies.

Economic slowdowns could reduce investment activity, affecting CAMS's revenue streams. Market volatility and reduced investor confidence can significantly impact CAMS revenue growth drivers. This needs to be factored into the CAMS financial performance analysis.

CAMS addresses these risks through continuous engagement with regulatory bodies and ongoing investment in cybersecurity. The company focuses on diversifying its service offerings to build resilience against unforeseen challenges. This helps in navigating the Challenges facing CAMS growth.

CAMS is actively pursuing digital transformation initiatives to stay ahead of market trends. This includes exploring new technologies and enhancing its service offerings for mutual funds. This aligns with CAMS digital transformation initiatives and CAMS service offerings for mutual funds.

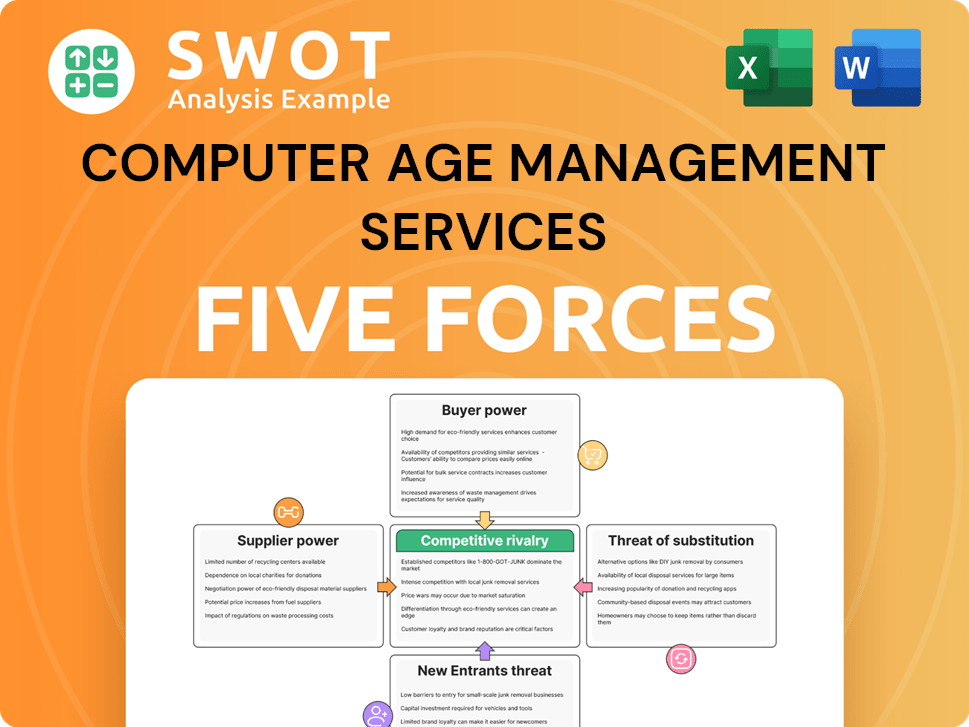

Computer Age Management Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Computer Age Management Services Company?

- What is Competitive Landscape of Computer Age Management Services Company?

- How Does Computer Age Management Services Company Work?

- What is Sales and Marketing Strategy of Computer Age Management Services Company?

- What is Brief History of Computer Age Management Services Company?

- Who Owns Computer Age Management Services Company?

- What is Customer Demographics and Target Market of Computer Age Management Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.