CVS Group Bundle

How Did CVS Group Become a Veterinary Powerhouse?

CVS Group, a leading name in veterinary services, has a compelling story of growth and strategic adaptation. From its inception in 1999, the company set out to revolutionize animal healthcare, primarily in the UK and Australia. This journey, marked by acquisitions and innovative service offerings, has transformed CVS Group into a comprehensive pet care provider.

The CVS Group SWOT Analysis highlights the key strengths and weaknesses that have shaped CVS Group's trajectory. Understanding the CVS history is crucial for investors and industry observers alike. This brief history of CVS Group plc will explore how the company evolved from a collection of veterinary practices into an integrated animal health leader, examining its key milestones, expansion strategy, and commitment to animal welfare and pet care.

What is the CVS Group Founding Story?

The founding of CVS Group plc in August 1999 marked the beginning of a significant player in the veterinary services sector. The company's inception was driven by a clear strategy: to consolidate and manage established veterinary practices throughout the UK. This approach targeted independent surgeries with a proven track record of quality service.

The primary goal was to create a network of veterinary practices. This was achieved through strategic acquisitions. This model allowed for rapid expansion and the ability to leverage economies of scale within a fragmented market. Financial backing from firms like Sovereign Capital was crucial in supporting the initial acquisition program.

CVS Group was founded in August 1999 to acquire and manage veterinary practices in the UK.

- The initial strategy focused on acquiring small-animal veterinary practices.

- Financial backing from Sovereign Capital supported the company's acquisition program.

- The company aimed to consolidate independent veterinary surgeries.

- A skilled management team, including Simon Innes as CEO, was assembled to drive the acquisition process.

The early focus was on acquiring small-animal veterinary practices, allowing for rapid expansion and leveraging economies of scale. The company's strategy involved bringing together a skilled management team, led by Simon Innes as CEO, to oversee the acquisition and integration of practices. The Owners & Shareholders of CVS Group have played a significant role in the company's development.

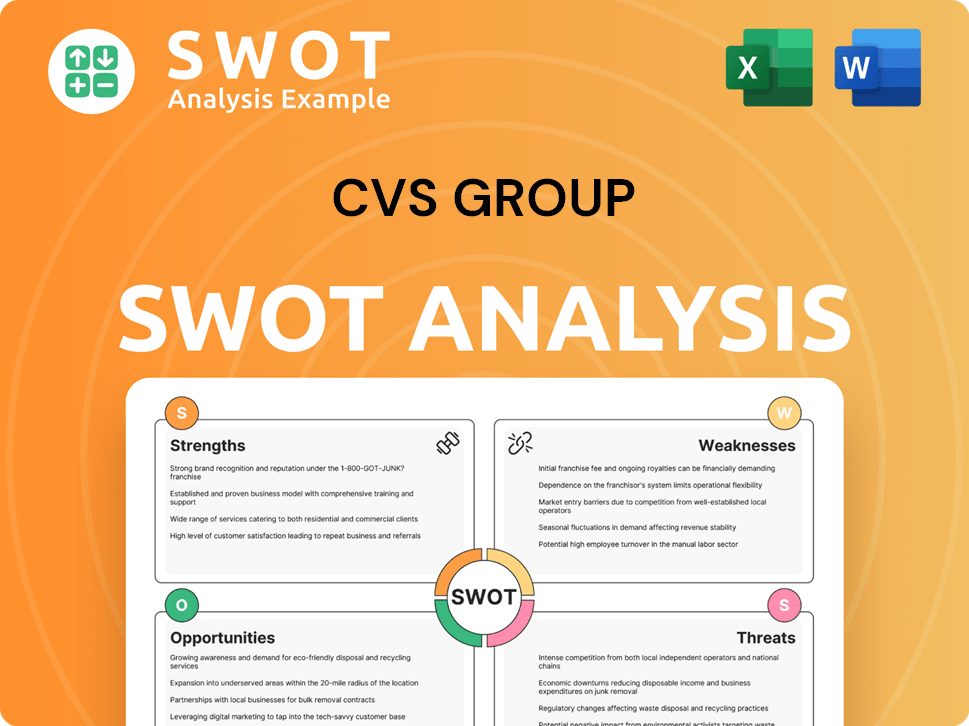

CVS Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CVS Group?

The early years of CVS Group were marked by a strategic acquisition approach, primarily within the UK. This focused strategy allowed for rapid expansion in the veterinary services market. The company's growth was fueled by both acquisitions and organic expansion, quickly establishing a significant presence in the industry.

From its founding in 1999, CVS systematically acquired small-animal veterinary practices. By October 2007, the company had grown to include 127 small animal veterinary surgeries, an equine practice, a referral practice, and three veterinary laboratories. This rapid expansion outpaced many competitors in the animal health sector.

In the financial year ending June 30, 2024, CVS completed 22 acquisitions in Australia, comprising 28 practice sites, and a further 5 practices (6 sites) in the UK. As of April 2025, the company has 28 practices across 42 sites in Australia. Strategic decisions were made to divest underperforming operations, such as those in the Netherlands and Republic of Ireland in May 2024.

Despite challenges, including softer demand in the UK and scrutiny from the Competition and Markets Authority (CMA), CVS demonstrated growth. Revenue from continuing operations increased by 9.9% to £647.3 million in the year ended June 30, 2024, with adjusted EBITDA growing by 4.7% to £127.3 million. The preventative Healthy Pet Club scheme continued to expand, reaching 503,000 members by June 2024, and 507,000 by December 2024.

CVS has increased investment in its facilities and equipment, with a total capital expenditure of £43.1 million in the year ended June 30, 2024. This included the rollout of a new cloud-based practice management system. These investments are part of a broader strategy to support future growth and improve operational efficiency within the veterinary services sector.

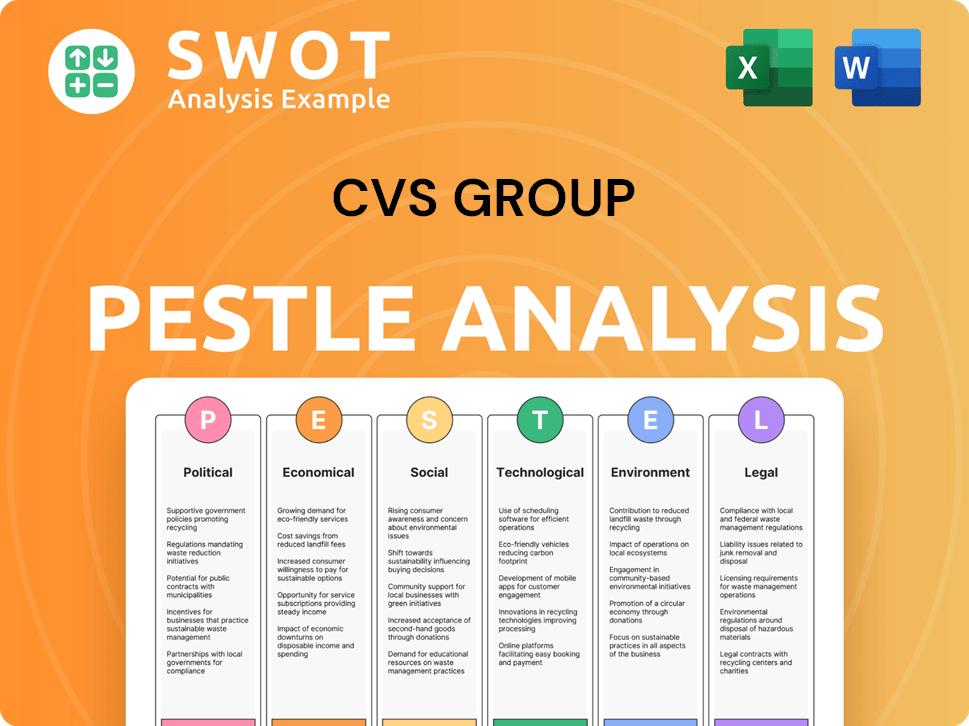

CVS Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CVS Group history?

The CVS Group has achieved several important milestones throughout its CVS history, significantly impacting the veterinary services and animal health sectors. These achievements have been crucial in establishing the company as a leader in pet care.

| Year | Milestone |

|---|---|

| Ongoing | Consistent growth through strategic acquisitions, solidifying its position as a leading veterinary service provider in the UK and expanding into Australia. |

| June 30, 2024 | Capital expenditure of £43.1 million, including the rollout of a new cloud-based practice management system across 375 practice sites, enhancing client engagement. |

| June 2024 | Healthy Pet Club preventative healthcare scheme reached 503,000 members, demonstrating strong customer engagement. |

| December 2024 | Healthy Pet Club membership grew to 507,000, showcasing continued success. |

| June 30, 2024 | Increased the average number of vets employed by 5.8% (10.7% including acquisitions), highlighting commitment to its workforce. |

| April 2025 | Sold their crematoria operations for £42.4 million, providing additional capital for investment. |

CVS Group has invested in innovative solutions to improve its services. This includes the implementation of a new cloud-based practice management system and the expansion of the Healthy Pet Club.

The rollout of a new cloud-based practice management system across 375 practice sites by June 30, 2024, is a key innovation. This system aims to improve client engagement and create new revenue streams.

The continued success and growth of the Healthy Pet Club, reaching 503,000 members by June 2024 and 507,000 by December 2024, demonstrate a focus on preventative care. This program enhances client relationships and supports long-term animal health.

Divesting sub-scale and loss-making operations in the Netherlands and the Republic of Ireland in May 2024. This strategic move allows CVS Group to focus on core markets and improve financial performance.

Improving retention and increasing the average number of vets employed by 5.8% (10.7% including acquisitions) in the year ended June 30, 2024. This focus enhances the quality of care and supports sustainable growth.

Significant capital expenditure of £43.1 million in the year ended June 30, 2024, including investments in infrastructure. These investments aim to modernize operations and improve service delivery.

The sale of crematoria operations for £42.4 million in April 2025. This provides additional capital for investments in the UK and Australia.

Despite its successes, CVS Group has faced several challenges. These include the CMA investigation and a cyber incident, which have impacted the company's financial performance.

The ongoing Competition and Markets Authority (CMA) market investigation into the veterinary services sector in the UK, expected to conclude by November 2025. This has created short-term headwinds, including softer demand and a pause in acquisitions.

A cyber incident in April 2024 caused disruption and incurred one-off exceptional costs. This incident impacted operations and added to financial pressures.

Profit before tax decreased by 37.1% to £38.2 million in the year ended June 30, 2024. This was due to increased finance expenses, depreciation, and costs related to the cyber incident and the CMA investigation.

Increased employment costs and other operational expenses. The company is addressing these through cost synergies in Australia and efficiencies in the UK.

Softer demand in the UK market and a pause in UK acquisition activity. These factors have impacted the company's growth trajectory.

Divesting sub-scale and loss-making operations in the Netherlands and the Republic of Ireland in May 2024. This strategic move allows CVS Group to focus on core markets and improve financial performance.

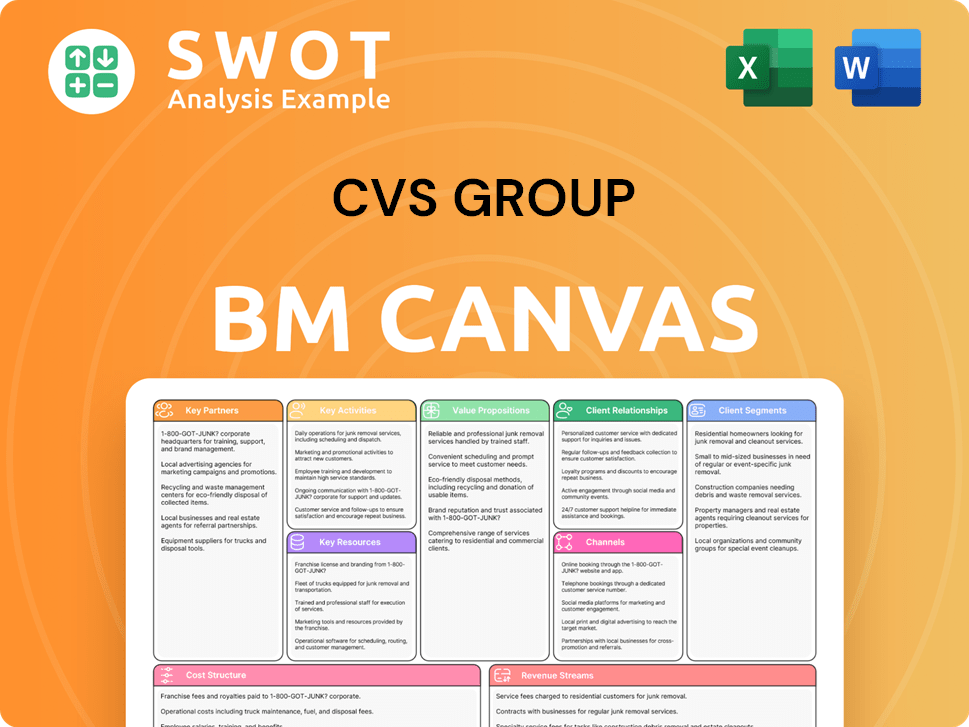

CVS Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CVS Group?

The CVS Group has a rich history marked by strategic acquisitions and expansion. Founded in 1999, the company quickly established itself in the veterinary services sector. A successful flotation on AIM in October 2007 marked a significant milestone, followed by a series of developments, including acquisitions, divestitures, and a focus on geographical expansion, particularly in Australia. The company has demonstrated robust financial performance, with revenue reaching £647.3 million in September 2024 and a strong membership in the Healthy Pet Club.

| Year | Key Event |

|---|---|

| 1999 | CVS Group plc is founded, initiating its strategy of acquiring veterinary practices in the UK. |

| October 2007 | Sovereign Capital's investment is realized through CVS Group's successful flotation on AIM. |

| November 2022 | CVS Group unveils its plan to double adjusted EBITDA over five years during its Capital Markets Day. |

| February 2024 | CVS Group acquires Ark Vets. |

| April 2024 | CVS detects and intercepts a cyber incident affecting its IT servers. |

| May 2024 | CVS Group divests its Netherlands and Republic of Ireland operations. |

| June 30, 2024 | CVS Group reports revenue from continuing operations of £647.3 million and adjusted EBITDA of £127.3 million for the financial year. |

| September 2024 | CVS Group reports a 9.9% increase in full-year revenue to £647.3 million. |

| November 2024 | CVS Group makes three acquisitions in Australia. |

| December 31, 2024 | Membership in the Healthy Pet Club reaches 507,000. |

| January 2025 | CVS launches a new website for Animed Direct, improving speed and usability. |

| February 2025 | CVS Group releases interim results for the six months ended December 31, 2024, showing revenue growth of 6.6% to £341.8 million. |

| April 2025 | CVS Group completes the sale of its crematoria operations for £42.4 million. CVS Australia acquires six new veterinary practices, bringing its total in Australia to 42 across 6 states. |

| November 2025 | The CMA market investigation into the UK veterinary services market is expected to conclude. |

The CVS Group is heavily focused on expanding its operations in Australia. The company sees significant opportunities and regulatory stability in the Australian market. They are actively pursuing acquisitions to grow their presence across the country. As of April 2025, CVS Australia operates 42 veterinary practices across 6 states.

Due to the ongoing CMA investigation, acquisitions in the UK are paused. However, CVS Group continues to invest in UK facilities, equipment, and IT. The company is targeting cost synergies and efficiencies in the UK to offset increasing employment costs. This reflects a balanced approach to growth and operational improvements.

CVS Group is aiming to deliver full-year 2025 results in line with market expectations. The company's long-term goal, outlined in November 2022, is to double adjusted EBITDA within five years. This demonstrates a commitment to sustainable growth and high-quality clinical care within the animal health sector.

The veterinary services market benefits from a strong fundamental need for high-quality pet care. An increasing pet population and growing demand for advanced diagnostics and treatments support this trend. This positive market environment provides a solid foundation for CVS Group's continued growth and success in the animal health industry.

CVS Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CVS Group Company?

- What is Growth Strategy and Future Prospects of CVS Group Company?

- How Does CVS Group Company Work?

- What is Sales and Marketing Strategy of CVS Group Company?

- What is Brief History of CVS Group Company?

- Who Owns CVS Group Company?

- What is Customer Demographics and Target Market of CVS Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.