CVS Group Bundle

Who Truly Controls CVS Group?

Unraveling the CVS Group SWOT Analysis reveals a complex ownership structure that dictates its strategic moves. Understanding who owns CVS Group plc is paramount for investors, analysts, and anyone interested in the veterinary services sector. This exploration will dissect the CVS Group ownership, from its inception to its current standing as a major European player.

The evolution of CVS Group's ownership, from its founders to its current parent company, is a fascinating case study in business growth. Examining the CVS Group structure provides insights into its strategic decisions, market positioning, and financial performance. This analysis will explore key aspects, including major shareholders, acquisitions, and the impact of being a publicly listed company, to give you a complete picture of who owns CVS.

Who Founded CVS Group?

The founding of CVS Group plc in 1999 marked the beginning of its journey in the veterinary services sector. While detailed information on the initial equity split among the founders is not readily available in public records, it's understood that the early structure likely involved a small group of veterinary professionals or entrepreneurs.

These individuals pooled their resources to acquire and operate veterinary practices. The initial ownership would have been concentrated among these founders, reflecting their direct investment and commitment to establishing the business. This early structure set the foundation for the company's future growth.

The early stages of CVS Group relied on capital from the founders, potentially supplemented by early backers such as angel investors or loans from financial institutions. These early agreements often included vesting schedules to ensure founder commitment over time and buy-sell clauses to manage the transfer of shares. The founding team's vision for consolidating and professionalizing veterinary services was central to the initial distribution of control and strategic direction.

The initial ownership of CVS Group, a key aspect of understanding the CVS Group ownership, was likely concentrated among the founders. These were primarily veterinary professionals or entrepreneurs. Their early vision focused on consolidating and professionalizing veterinary services, influencing the initial distribution of control and strategic direction. The early ownership structure was crucial for the company's subsequent expansion and eventual public listing.

- Initial capital came from founders and potentially angel investors or loans.

- Early agreements included vesting schedules to ensure founder commitment.

- Buy-sell clauses were likely in place to manage share transfers.

- The early structure laid the groundwork for later growth and public listing.

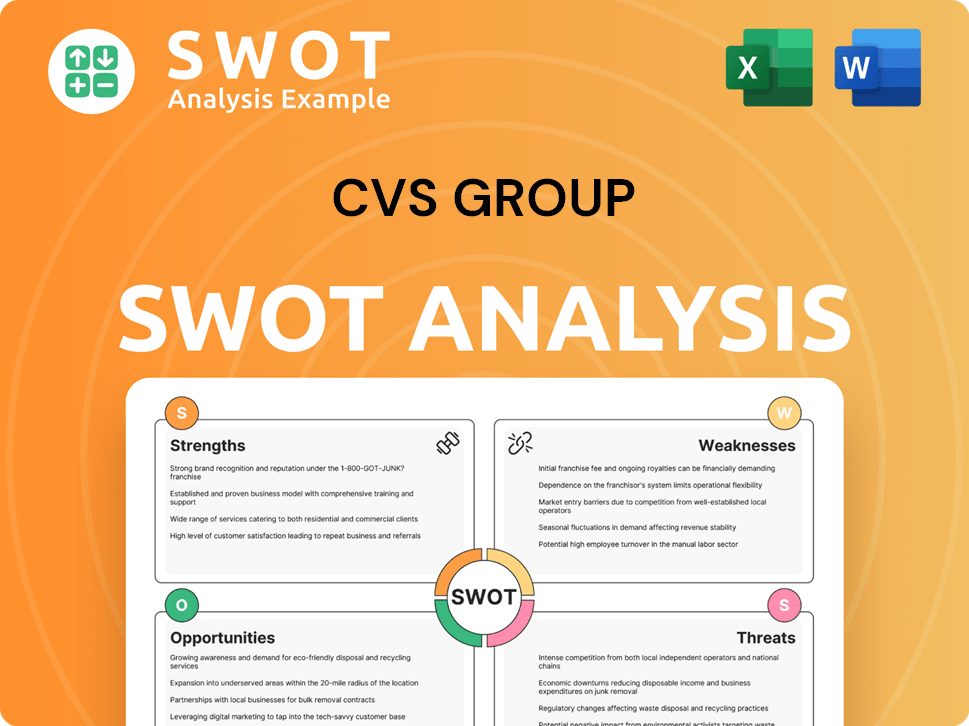

CVS Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CVS Group’s Ownership Changed Over Time?

The evolution of CVS Group plc's ownership has been marked by significant milestones, particularly its transition from a privately held entity to a publicly traded company. This transformation began in 2007 when CVS Group went public, listing on the London Stock Exchange's Alternative Investment Market (AIM). This initial public offering (IPO) was a pivotal event, broadening the ownership base beyond the original founders and early investors. The move to the main market further solidified its status and provided access to greater capital.

The IPO facilitated substantial growth through strategic acquisitions. CVS Group strategically used the capital raised to acquire numerous veterinary practices across the UK, Ireland, and the Netherlands. This acquisition strategy has been a key driver of its expansion and market presence, contributing to its current position in the veterinary services sector. This approach has allowed CVS Group to consolidate its market share and expand its geographical footprint.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | 2007 | Broadened ownership base, increased access to capital. |

| Transition to Main Market | Later than 2007 | Enhanced credibility and access to a wider investor pool. |

| Acquisitions of Veterinary Practices | Ongoing | Consolidated market share and expanded geographical presence. |

Currently, the major stakeholders in CVS Group plc are predominantly institutional investors. As of April 2025, significant shareholders include entities like BlackRock, holding a notable percentage of the company's shares. Other major institutional investors include mutual funds, pension funds, and asset management firms. These institutional holdings significantly influence the company's governance through their voting power. While founders may retain some shares, their overall percentage tends to dilute over time with subsequent share offerings and the entry of large institutional investors. This shift towards institutional ownership has increasingly influenced CVS Group's strategy, with a focus on sustainable growth, operational efficiency, and shareholder returns. For more insights, you can explore the Target Market of CVS Group.

CVS Group ownership has evolved significantly since its IPO in 2007.

- Institutional investors are the primary stakeholders.

- Acquisitions have been a key strategy for growth.

- The company's focus is on sustainable growth and shareholder returns.

- The ownership structure influences strategic decisions and market positioning.

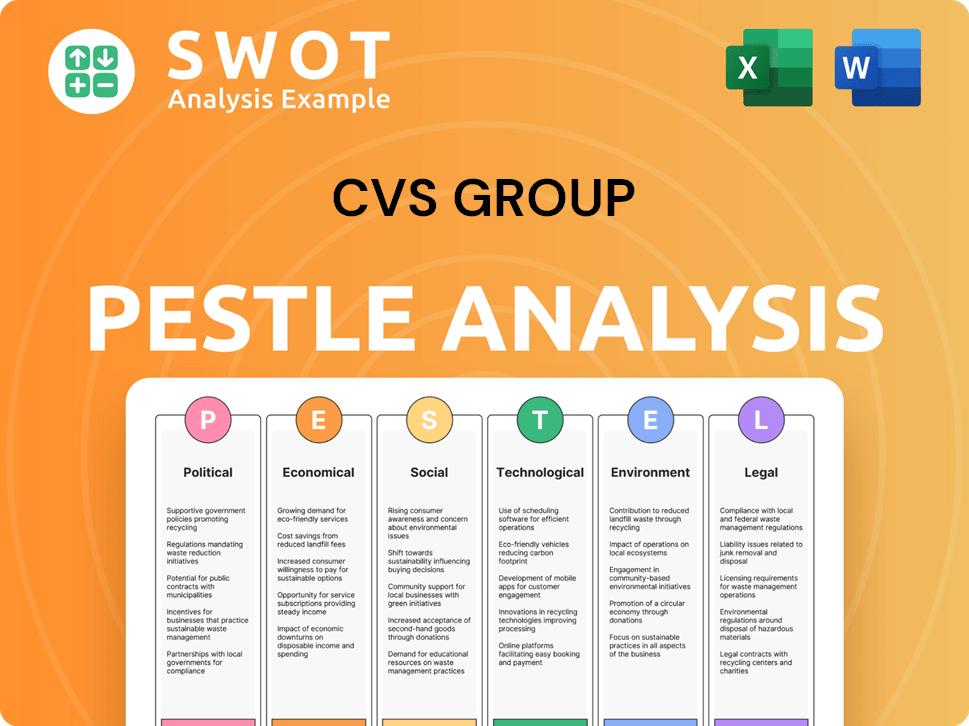

CVS Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CVS Group’s Board?

The current Board of Directors of CVS Group plc oversees the company's strategic direction and governance. The board comprises executive directors, non-executive directors, and independent members, each bringing expertise from the veterinary and business sectors. The composition of the board reflects a balance of interests, including those of significant institutional investors. Independent non-executive directors are appointed to provide objective oversight and represent the broader shareholder base. Understanding the CVS Group structure is key to grasping its operational dynamics.

As of the most recent reports, the board includes individuals with extensive experience in the veterinary and business sectors. Their collective expertise guides the company's strategic initiatives and ensures adherence to best practices in corporate governance. The board's decisions are subject to shareholder scrutiny, ensuring accountability. For more information on CVS Group's financial aspects, consider exploring the Revenue Streams & Business Model of CVS Group.

| Board Member | Role | Relevant Experience |

|---|---|---|

| Richard Fairman | Non-Executive Chairman | Extensive experience in the healthcare sector and previous roles in financial management. |

| Simon Rigby | Chief Executive Officer | Significant experience within the veterinary services industry, with a focus on operational management. |

| Robin Day | Chief Financial Officer | Financial expertise, with experience in managing financial strategies and reporting. |

CVS Group operates under a one-share-one-vote structure, ensuring that voting power is directly proportionate to the number of shares held. This standard governance model means that each ordinary share carries equal voting rights. There are no publicly reported instances of dual-class shares or special voting arrangements that would grant outsized control to specific individuals or entities. The influence of large institutional shareholders is exercised through their votes at annual general meetings and their engagement with the board on strategic matters. This structure ensures accountability and adherence to corporate governance best practices, making it clear who owns CVS Group.

The board of directors is composed of executive and non-executive members with relevant industry experience, ensuring strategic oversight. The one-share-one-vote structure provides equal voting rights to all shareholders, promoting fairness.

- The board's composition reflects a balance of interests, including those of major institutional investors.

- Independent non-executive directors provide objective oversight and represent the broader shareholder base.

- The voting structure ensures that voting power is directly proportionate to the number of shares held.

- Large institutional shareholders influence decisions through voting and engagement.

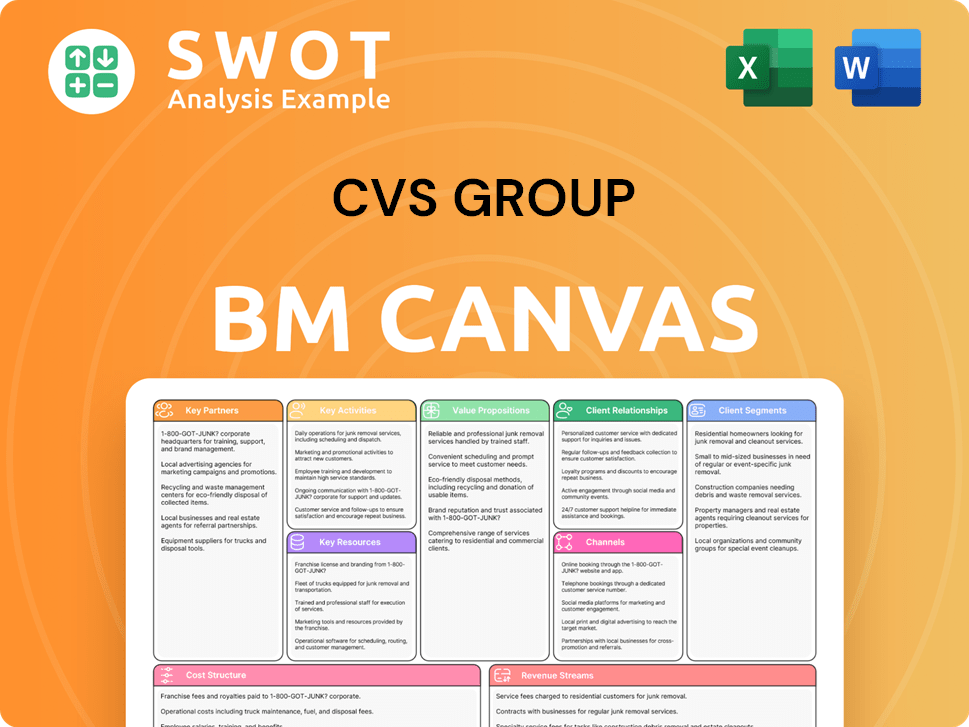

CVS Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CVS Group’s Ownership Landscape?

Over the past few years, Growth Strategy of CVS Group has involved significant consolidation within the veterinary sector. This has led to shifts in its ownership profile. The company's strategy of acquiring independent veterinary practices, funded through a combination of debt and equity, has influenced the company's financial structure. This may lead to share dilution for existing shareholders but also broadens the company's market reach.

The ownership trends for companies like CVS Group show an increasing institutional ownership. Larger asset managers and investment funds seek exposure to defensive sectors such as pet healthcare. The veterinary sector has also seen increased private equity interest. There have been no public statements by the company or analysts about immediate plans for privatization or major founder departures. The focus remains on strategic growth through acquisition and organic means, with ownership trends reflecting a maturing public company within a consolidating industry.

The company's financial structure and ownership dynamics are reshaped as new shares may be issued or debt taken on through its continuous acquisition strategy. As of the latest financial reports, the company's market capitalization and the distribution of its shares among various institutional investors and retail shareholders reflect these ongoing changes. The specific percentages held by major shareholders and the impact of any share buybacks or secondary offerings are closely watched by investors to understand the evolving ownership landscape of CVS Group plc.

CVS Group's ownership structure has been shaped by its active acquisition strategy. Institutional investors are increasingly holding shares in the company. These trends reflect a maturing public company in a consolidating veterinary market.

Major shareholders include institutional investors, whose holdings are regularly updated. The company's annual reports provide details on the distribution of shares. These reports are crucial for understanding the current ownership structure.

Acquisitions of veterinary practices influence the company's financial structure. Funding these acquisitions can lead to share dilution. This strategy helps expand the company's market presence.

The veterinary sector is experiencing increased institutional investment. CVS Group's strategic focus remains on growth through acquisitions and organic means. The company's ownership structure will likely continue to evolve.

CVS Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CVS Group Company?

- What is Competitive Landscape of CVS Group Company?

- What is Growth Strategy and Future Prospects of CVS Group Company?

- How Does CVS Group Company Work?

- What is Sales and Marketing Strategy of CVS Group Company?

- What is Brief History of CVS Group Company?

- What is Customer Demographics and Target Market of CVS Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.