CVS Group Bundle

How Does CVS Group Navigate the UK Veterinary Market's Competitive Waters?

The UK's veterinary industry is booming, driven by a surge in pet ownership and a corresponding demand for animal healthcare. With sector income reaching £6.73 billion in 2023, the stakes are high, and competition is fierce. This dynamic environment presents both opportunities and challenges for key players like CVS Group.

Founded in 1999, CVS Group has grown to become a major force in the CVS Group SWOT Analysis, offering a wide range of services, from veterinary practices to online pharmacies. Understanding the CVS Group analysis is crucial to grasping its competitive landscape, its market share CVS, and the strategies it employs to maintain its position. This exploration will uncover who CVS Group competitors are and how CVS Group's business strategy shapes its future within the veterinary industry.

Where Does CVS Group’ Stand in the Current Market?

The CVS Group holds a significant market position within the UK veterinary services sector. With approximately 500 practices in the UK and 30 in Australia as of December 2024, the company demonstrates a broad operational footprint. Their core business revolves around providing comprehensive veterinary care, including first opinion practices, specialist referrals, diagnostic services, and pet cremation, alongside an online retail presence through Animed Direct.

The company's strategic focus is primarily on the UK and Australian markets. This is a result of divesting operations in the Netherlands and the Republic of Ireland in 2024. This strategic shift allows for more focused resource allocation and market penetration in key areas. The CVS Group's commitment to preventative healthcare is evident in its Healthy Pet Club, which had 507,000 members as of December 31, 2024.

Financially, CVS Group has demonstrated strong performance. For the year ended June 30, 2024, revenue from continuing operations reached £647.3 million, reflecting a 9.9% increase. Adjusted EBITDA grew to £127.3 million, a 4.7% increase. For the six months ended December 31, 2024, group sales increased by 6.6% to £341.8 million. The company's leverage remains controlled at 1.66x as of December 31, 2024, well within its target.

In the UK, CVS Group holds a market share of about 8%. The company's strategic decision to concentrate on the UK and Australian markets underscores its commitment to these regions. This focus allows for more efficient resource allocation and market penetration.

The service portfolio of CVS Group includes a wide range of offerings, such as first opinion practices, specialist referrals, and diagnostic services. The inclusion of Animed Direct, an online retail business, expands its reach. This comprehensive approach aims to cater to all aspects of veterinary care.

The financial results for the year ended June 30, 2024, show robust growth in revenue and adjusted EBITDA. The company's sales growth in the six months ended December 31, 2024, further indicates its financial strength. These positive financial indicators reflect the company's strong market position and effective operational strategies.

The Healthy Pet Club, with over 500,000 members, highlights the company's focus on preventative care. The divestment of operations in certain regions and concentration on the UK and Australia are key strategic moves. These initiatives are designed to enhance operational efficiency and market competitiveness.

The CVS Group's strong market position is supported by its extensive network of practices, diverse service offerings, and consistent financial performance. The company's strategic focus on the UK and Australian markets, coupled with its preventative healthcare initiatives, strengthens its competitive advantages. Understanding the Marketing Strategy of CVS Group can provide further insights into their approach.

- Extensive network of veterinary practices in the UK and Australia.

- Diversified service offerings, including first opinion, specialist referrals, and online retail.

- Healthy Pet Club, demonstrating a focus on preventative healthcare.

- Consistent revenue growth and controlled leverage.

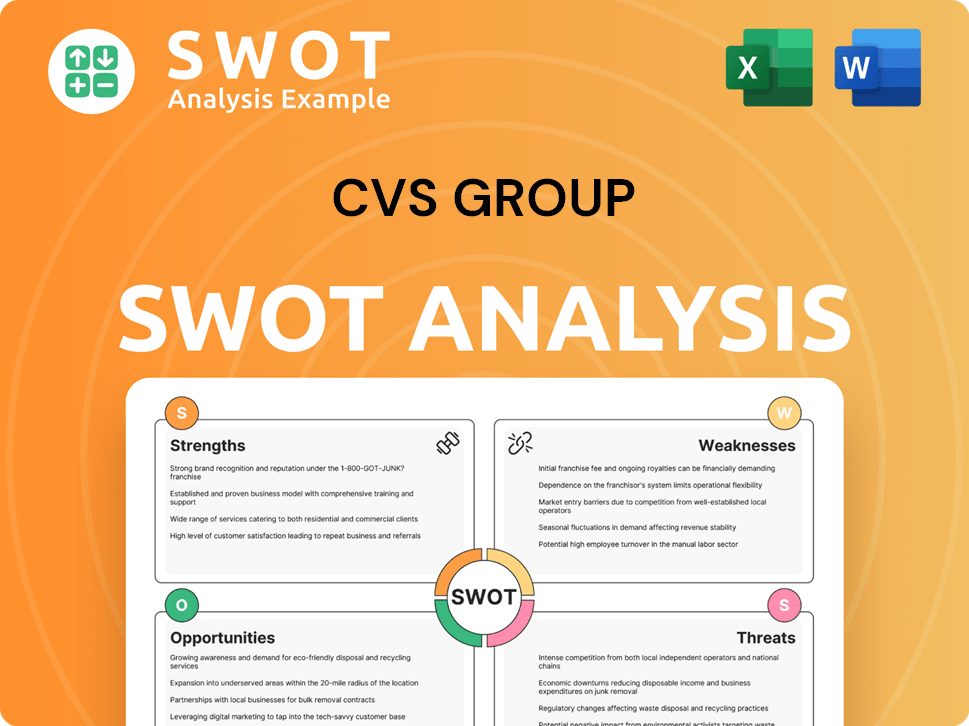

CVS Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CVS Group?

The Revenue Streams & Business Model of CVS Group faces a dynamic competitive landscape within the UK veterinary market. The industry is highly consolidated, with a significant shift from independent practices to large corporate groups. Understanding the key players and their strategies is crucial for assessing the company's market position and future prospects.

The veterinary sector in the UK has seen considerable consolidation. The shift from independent practices, which accounted for 89% in 2013, to around 40% in 2024, highlights this trend. This consolidation has reshaped the competitive dynamics, with large corporate groups now controlling a significant portion of the market. The top six corporate groups own approximately 3,000 practices, representing about 56% of all veterinary practices.

CVS Group's competitive landscape is shaped by several key players and market dynamics. The company's ability to navigate these challenges and capitalize on opportunities will be crucial for its continued success in the veterinary industry.

The primary competitors of CVS Group in the UK veterinary market include large corporate groups. These companies compete on various fronts, including scale, pricing, and innovation. Understanding their strategies is essential for a comprehensive CVS Group analysis.

IVC Evidensia is a major competitor, backed by private equity. It operates an extensive network of practices, challenging CVS Group through its scale and geographic reach. This company's market share CVS is a key factor in the competitive landscape.

Medivet is another significant competitor with a substantial network of practices. It competes with CVS Group through its scale and potential service offerings. Medivet's strategy impacts the overall competitive landscape.

VetPartners is a key player in the veterinary market, competing with CVS Group. Its operations and strategies contribute to the overall competitive dynamics. VetPartners' approach influences the industry's competitive environment.

Linnaeus is a notable competitor in the veterinary sector, impacting CVS Group's market position. It competes by offering specialized services and potentially through its geographic reach. Linnaeus' activities are a factor in the CVS Group analysis.

Pets at Home operates veterinary practices and competes with CVS Group. It leverages its brand and retail presence to attract customers. The company's strategy influences the CVS Group's competitive advantages.

The competitive landscape is shaped by various factors, including scale, pricing, innovation, and mergers and acquisitions. The Competition and Markets Authority (CMA) is scrutinizing the industry's consolidation, which could lead to changes in competitive dynamics by November 2025.

- Scale and Reach: Competitors like IVC Evidensia and Medivet operate extensive networks, offering broader geographic coverage.

- Pricing and Service Bundling: Competitors may offer competitive pricing and integrated service packages. The CMA has raised concerns about pricing transparency.

- Innovation and Technology: Investment in telemedicine and digital health tools is crucial for attracting tech-savvy pet owners.

- Brand and Customer Loyalty: Building strong brand equity and fostering customer loyalty are critical.

- Mergers and Acquisitions: The veterinary market has high consolidation activity. The CMA has previously required divestments due to competition concerns.

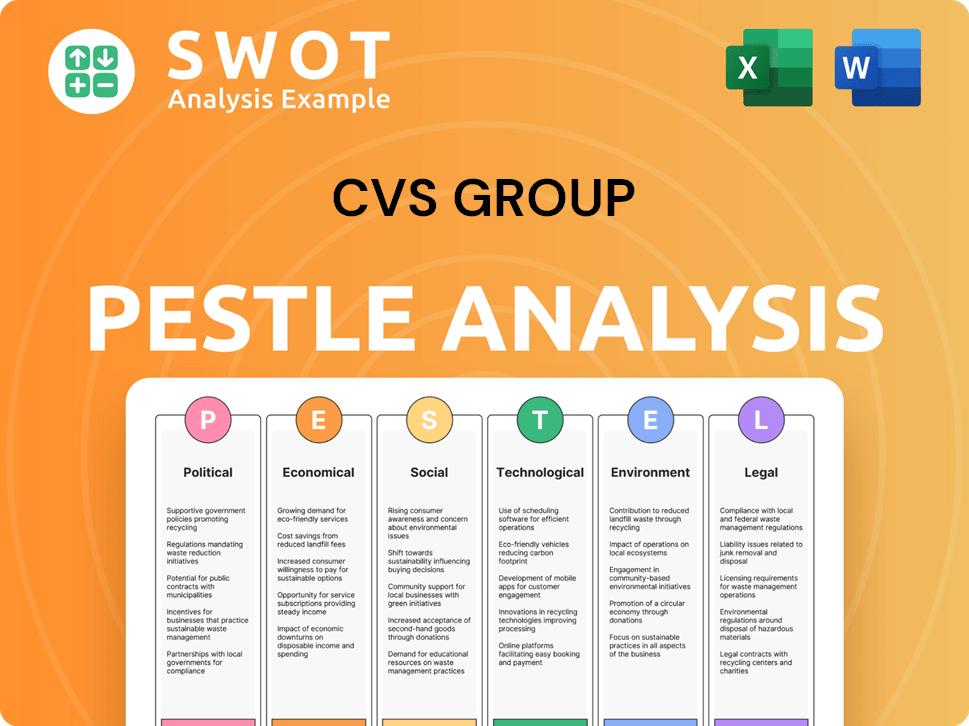

CVS Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CVS Group a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of CVS Group requires a deep dive into its strategic strengths. CVS Group has carved a significant niche in the veterinary industry, primarily in the UK and Australia. This analysis explores the key elements that define its competitive advantages and market position.

The company's strategic moves and operational choices are designed to enhance its market share. The following sections will outline the core strengths that position CVS Group favorably against its competitors. These include its extensive network of veterinary practices, integrated service offerings, and investments in people and facilities. This approach is critical for understanding the company's overall growth prospects.

As of December 2024, CVS Group operates approximately 500 practices in the UK and 30 in Australia, showcasing a broad geographic presence. This extensive network allows for widespread access to veterinary care. This widespread reach is a key factor in its competitive advantage. For a deeper understanding of their strategic approach, consider exploring the Growth Strategy of CVS Group.

CVS Group's expansive network of veterinary practices is a cornerstone of its competitive advantage. With a significant presence in the UK and Australia, the company ensures widespread access to veterinary services. This large footprint facilitates economies of scale, particularly in procurement and operational management, which enhances profitability.

The integrated service model of CVS Group provides a significant edge in the veterinary market. This includes general veterinary practices, diagnostic laboratories, crematoria, and an online retail business. This diversification supports multiple revenue streams and allows for comprehensive pet care, enhancing customer loyalty.

CVS Group invests in its employees and facilities to maintain a competitive edge. Investments in capital projects, such as £43.1 million in 2024, demonstrate a commitment to high-quality care and modern facilities. The company's focus on employee engagement and well-being is also a key factor in its success.

CVS Group is committed to technological advancement. The company is actively migrating its practice management system to the cloud. The launch of a new website for Animed Direct in January 2025 demonstrates the company's dedication to improving operational efficiency and client experience. These innovations support long-term growth.

CVS Group's competitive advantages are multifaceted, contributing to its strong market position. The company's focus on integrated services, geographical reach, and investment in its workforce and facilities are key differentiators. These elements collectively drive sustainable growth and customer loyalty.

- Extensive Network: Approximately 500 practices in the UK and 30 in Australia as of December 2024.

- Integrated Services: Includes practices, labs, crematoria, and online retail.

- Customer Engagement: Healthy Pet Club reached 507,000 members by December 2024.

- Employee Focus: Employee Net Promoter Score increased to +3.8 in December 2024.

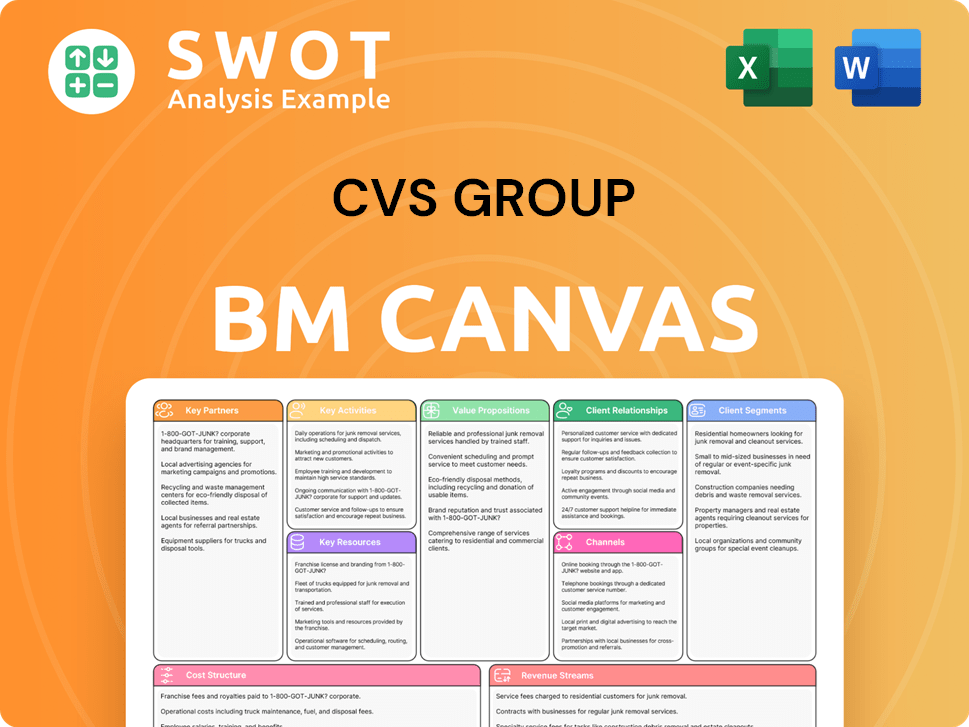

CVS Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CVS Group’s Competitive Landscape?

The competitive landscape for CVS Group is shaped by dynamic industry trends and significant challenges. The company navigates a market influenced by the 'humanization of pets,' technological advancements, and regulatory scrutiny. Understanding the Owners & Shareholders of CVS Group and its competitive positioning is crucial for assessing its future outlook.

CVS Group's strategic decisions are heavily influenced by market dynamics and regulatory changes. The company's financial performance and expansion strategies are closely tied to its ability to adapt to these evolving conditions. This analysis explores the key trends, challenges, and opportunities impacting CVS Group's competitive position within the veterinary services industry.

The veterinary services industry is experiencing growth driven by the 'humanization of pets,' leading to increased spending on care. Technological advancements, such as telemedicine and AI, are also shaping the market. The UK veterinary services revenue is projected to reach £6.9 billion through 2024-2025.

A persistent shortage of veterinary professionals poses a significant challenge. Increased employment costs, estimated at approximately £11 million annually from April 2025, will impact operational expenses. Regulatory scrutiny, particularly the CMA investigation, creates uncertainty for CVS Group.

CVS Group has opportunities to expand in Australia, where regulatory stability is higher. Investing in technology, such as Animed Direct's new website and cloud-based systems, can drive growth. Cost synergies and efficiencies in the UK can mitigate rising expenses.

The company focuses on expanding in Australia, completing 22 acquisitions in the year ended June 30, 2024. Investments in technology and practice facilities are key. CVS Group is targeting cost synergies and efficiencies to manage challenges.

CVS Group's competitive advantages include its strategic expansion into stable markets like Australia and investments in technology. The company faces challenges from regulatory investigations and rising costs, but is adapting. The veterinary medicine market in the UK was estimated at USD 2.64 billion in 2024 and is projected to grow at a CAGR of 7.8% from 2025 to 2030.

- Market Share CVS: CVS Group's market share is influenced by its strategic moves and competitive environment.

- CVS Group market position in UK: The company's position is affected by regulatory scrutiny and market dynamics.

- CVS Group competitive advantages: Expansion in Australia and technology investments are key advantages.

- CVS Group future outlook: The company's future depends on its ability to navigate challenges and capitalize on opportunities.

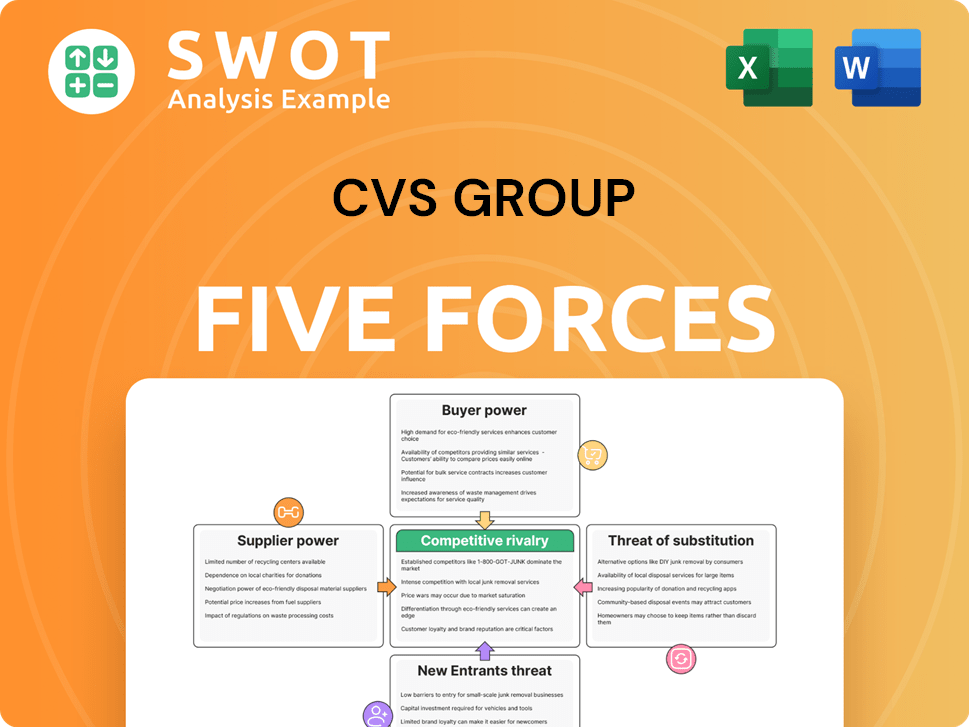

CVS Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CVS Group Company?

- What is Growth Strategy and Future Prospects of CVS Group Company?

- How Does CVS Group Company Work?

- What is Sales and Marketing Strategy of CVS Group Company?

- What is Brief History of CVS Group Company?

- Who Owns CVS Group Company?

- What is Customer Demographics and Target Market of CVS Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.