CVS Group Bundle

Can CVS Group Continue its Reign in the Veterinary Services Market?

CVS Group, a leading name in the animal healthcare industry, has charted a course of impressive growth since its inception. From a small network of practices, it has evolved into a major player, offering comprehensive veterinary services across the UK, Ireland, and the Netherlands. But what does the future hold for this veterinary giant?

This analysis dives deep into the CVS Group SWOT Analysis, exploring the company's ambitious CVS Group Growth Strategy and assessing its CVS Group Future Prospects. We'll examine its expansion plans, technological innovations, and financial outlook to understand how CVS Group Company aims to navigate the dynamic Veterinary Services Market and maintain its competitive edge. Understanding the Animal Healthcare Industry landscape is crucial to assessing CVS Group's long-term growth potential and investment opportunities.

How Is CVS Group Expanding Its Reach?

The expansion initiatives of CVS Group are a cornerstone of its growth strategy, focusing on both geographical expansion and service diversification. The company's approach involves a blend of acquiring independent veterinary practices and organic growth through the launch of new services. This dual strategy allows CVS Group to broaden its market presence and enhance its service offerings, contributing to its overall growth and market leadership in the veterinary services market.

CVS Group's expansion strategy is primarily driven by acquisitions, especially within the UK, Republic of Ireland, and the Netherlands. This inorganic growth model enables the company to quickly increase its network, gain market share, and capitalize on economies of scale. Alongside acquisitions, CVS Group focuses on organic growth by introducing new services and improving existing ones, such as specialist referral services and online pharmacy offerings. This approach ensures a balanced growth model, supporting both short-term gains and long-term sustainability.

International expansion remains a key strategic pillar for CVS Group, with a particular emphasis on the European market. The Netherlands has been a primary target for recent growth, and CVS Group aims to further strengthen its presence in this region. These international ventures are driven by the desire to access new customer bases and reduce reliance on a single market. The company’s proactive approach to identifying and integrating new practices, coupled with its investment in specialized services and digital platforms, underscores its commitment to sustained expansion and market leadership.

CVS Group actively acquires independent veterinary practices to expand its network and market reach. In the first half of the 2024 financial year, the company acquired nine new practices, demonstrating its commitment to inorganic growth. This strategy allows for rapid expansion and the integration of established practices into the CVS Group network. This is a key component of the CVS Group Growth Strategy.

Beyond acquisitions, CVS Group focuses on organic growth by launching new services and enhancing existing ones. This includes expanding specialist referral services and online pharmacy offerings. Diversifying revenue streams through laboratory services and pet cremation offerings complements core veterinary practice operations. This approach supports long-term growth and strengthens CVS Group's position in the Animal Healthcare Industry.

International expansion is a key strategic pillar, with a focus on the European market, particularly the Netherlands. The company aims to strengthen its presence in this region to access new customer bases and reduce reliance on a single market. This strategic move is crucial for long-term sustainability and growth, directly impacting the CVS Group Future Prospects.

CVS Group is leveraging digital platforms to expand its online pharmacy services, reaching a wider customer base. This digital transformation strategy includes investments in advanced diagnostic equipment and specialized veterinary talent. These initiatives are designed to enhance service delivery and improve customer access to essential pet care products and services. You can find more about the Target Market of CVS Group.

CVS Group's expansion initiatives are designed to drive growth and enhance its market position. The company's strategy involves both acquisitions and organic growth, with a focus on international expansion and service diversification. These initiatives are crucial for sustaining long-term growth and capitalizing on opportunities within the Veterinary Services Market.

- Acquisition of veterinary practices in the UK, Republic of Ireland, and the Netherlands.

- Expansion of specialist referral services and investment in advanced diagnostic equipment.

- Development of online pharmacy services to reach a wider customer base.

- International expansion, particularly in the European market, to access new customer bases.

CVS Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CVS Group Invest in Innovation?

The CVS Group is strategically leveraging innovation and technology to enhance operational efficiency, improve patient care, and drive sustained growth within the veterinary services market. This approach involves a multifaceted innovation strategy, encompassing research and development investments, in-house technological development, and strategic collaborations to stay ahead in the animal healthcare industry.

A key focus area for CVS Group is digital transformation, aimed at streamlining administrative processes, improving client communication, and optimizing clinical workflows. This includes the implementation of advanced practice management software and digital record-keeping systems, which enhances data accessibility and operational efficiency across its extensive network of practices. These efforts are crucial for supporting CVS Group's expansion plans 2024 and maintaining a strong competitive landscape.

The adoption of cutting-edge technologies is also a priority for CVS Group. This includes the increasing use of advanced diagnostic imaging equipment, such as MRI and CT scanners, which enable more accurate and timely diagnoses for companion animals. The company also explores the potential of artificial intelligence (AI) in areas like diagnostic support and predictive analytics for animal health. Continuous investment in advanced medical equipment and digital infrastructure signifies its commitment to technological advancement in veterinary medicine, directly impacting its long-term growth potential.

Implementation of advanced practice management software. Digital record-keeping systems for improved data accessibility. Streamlining administrative processes and optimizing clinical workflows.

Use of MRI and CT scanners for accurate diagnoses. Exploring the potential of AI in diagnostic support. Investment in advanced medical equipment.

Improvements to the online pharmacy platform. Integration of telehealth services for remote consultations. Enhancing client accessibility and convenience through digital platforms.

AI applications in diagnostic support. Predictive analytics for animal health. Data-driven insights to improve patient outcomes and operational efficiency.

Partnerships to enhance technological capabilities. Collaborations for research and development. Leveraging external expertise to drive innovation.

Improving client communication through digital channels. Enhancing the user-friendliness of online services. Attracting new clients and improving client retention through enhanced service delivery.

CVS Group is focused on leveraging technology to enhance its online services, which includes improvements to its online pharmacy platform, aiming for a more seamless and user-friendly experience for pet owners. The integration of telehealth services, allowing for remote consultations and advice, represents another aspect of its digital strategy, particularly relevant for improving accessibility and convenience for clients. These technological advancements not only contribute to better patient outcomes but also support the company’s growth objectives by attracting new clients and improving client retention through enhanced service delivery.

- Digital tools improve client communication.

- Telehealth services improve accessibility.

- Advanced diagnostics enhance patient care.

- Data analytics optimize operational efficiency.

CVS Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is CVS Group’s Growth Forecast?

The financial outlook for CVS Group reflects a positive trajectory, driven by consistent growth and strategic investments. The company's performance in the six months ended December 31, 2023, showed a revenue increase of 11.2%, reaching £311.9 million. This demonstrates the strength of their business model within the Veterinary Services Market.

Adjusted EBITDA also saw a significant rise of 13.9%, reaching £57.6 million, indicating improved profitability. These financial results highlight the success of CVS Group's expansion initiatives and operational efficiencies. The company's focus on both organic growth and strategic acquisitions is a key component of its CVS Group Growth Strategy.

Looking ahead, CVS Group anticipates continued growth, supported by its strategic acquisitions and organic expansion. The company's long-term financial goals include sustained revenue growth and improved profit margins. This will be achieved through investments in new practices, technology, and specialist services. The company's commitment to growth is evident in its strategic approach to the Animal Healthcare Industry.

The company's financial strategy involves prudent capital management to support its growth ambitions. This includes utilizing cash flow from operations to fund acquisitions and capital expenditures. The consistent profitability and strong cash generation position CVS Group to self-fund a significant portion of its growth. The Brief History of CVS Group provides further context on its evolution.

Analysts generally align with this positive outlook, projecting continued earnings growth in the coming years. The company has indicated a positive outlook for the full financial year 2024, expecting to meet market expectations. CVS Group's strategic acquisitions are a key part of its expansion plans.

CVS Group's financial narrative is one of steady, managed growth, leveraging its established market position and strategic investments to deliver long-term shareholder value. The company's focus on the Veterinary Services Market has helped it maintain a strong market position. This growth strategy is crucial for the CVS Group Company.

The company's ability to maintain a healthy balance sheet supports its investment in new practices and specialist services. The consistent profitability and strong cash generation position CVS Group to self-fund a significant portion of its growth. This makes CVS Group an interesting prospect for investment.

CVS Group is growing its business through organic expansion and strategic acquisitions. Investments in new practices, technology, and specialist services support this growth. The company's strategic approach is a key driver of its success in the Animal Healthcare Industry.

Analysts project continued earnings growth in the coming years, indicating a positive revenue forecast. The company expects to meet market expectations for the full financial year 2024. This positive outlook supports the CVS Group Future Prospects.

CVS Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow CVS Group’s Growth?

The CVS Group Company, despite its positive CVS Group Growth Strategy, faces several potential risks and obstacles. These challenges could affect its future ambitions within the Veterinary Services Market. Understanding these risks is crucial for assessing the CVS Group Future Prospects.

Market competition remains a significant concern, with a fragmented but increasingly consolidating veterinary market. Regulatory changes, particularly concerning veterinary practice ownership and animal welfare, could also introduce operational complexities and compliance costs. Supply chain vulnerabilities, especially for veterinary pharmaceuticals and equipment, pose another potential risk.

Technological disruption and internal resource constraints, such as the ongoing shortage of qualified veterinary professionals, could hinder expansion plans. Attracting and retaining skilled staff is a persistent challenge across the Animal Healthcare Industry. Addressing these risks is vital for sustained CVS Group Financial Performance.

The veterinary market is competitive, with both large corporate groups and independent practices vying for market share. This requires continuous service differentiation and competitive pricing strategies. The CVS Group Company must innovate to maintain its position.

Changes in regulations regarding practice ownership, drug dispensing, and animal welfare can introduce operational complexities. Compliance with these regulations can also increase costs, affecting profitability. Staying ahead of these changes is essential.

Disruptions in the supply chain, particularly for pharmaceuticals and equipment, pose a risk. Geopolitical events or global issues can lead to shortages or price increases. This impacts operational costs and service delivery.

Rapid advancements in veterinary medicine and digital health platforms present both opportunities and risks. Failure to adapt to these changes could hinder the CVS Group Company's competitiveness. Investment in technology is crucial.

A shortage of qualified veterinary professionals and nurses can limit expansion and impact service quality. Attracting and retaining skilled staff is a persistent challenge. This impacts the ability to grow and maintain service standards.

Economic downturns can affect the demand for veterinary services. Reduced consumer spending on non-essential services can impact revenue. Diversification and cost management are important strategies.

CVS Group Company addresses these risks through strategic measures. Diversification of services and geographical presence helps mitigate market-specific downturns. The company maintains robust risk management frameworks, including scenario planning, to anticipate and respond to potential challenges. For example, to combat staff shortages, CVS Group Company has invested in recruitment and retention initiatives, including professional development programs and competitive remuneration packages.

While specific recent examples of overcoming major obstacles are not always publicly detailed, the company's consistent growth in a dynamic environment suggests an effective approach to risk mitigation and adaptability. For more details on CVS Group Company's financial performance and business model, you can read about the Revenue Streams & Business Model of CVS Group.

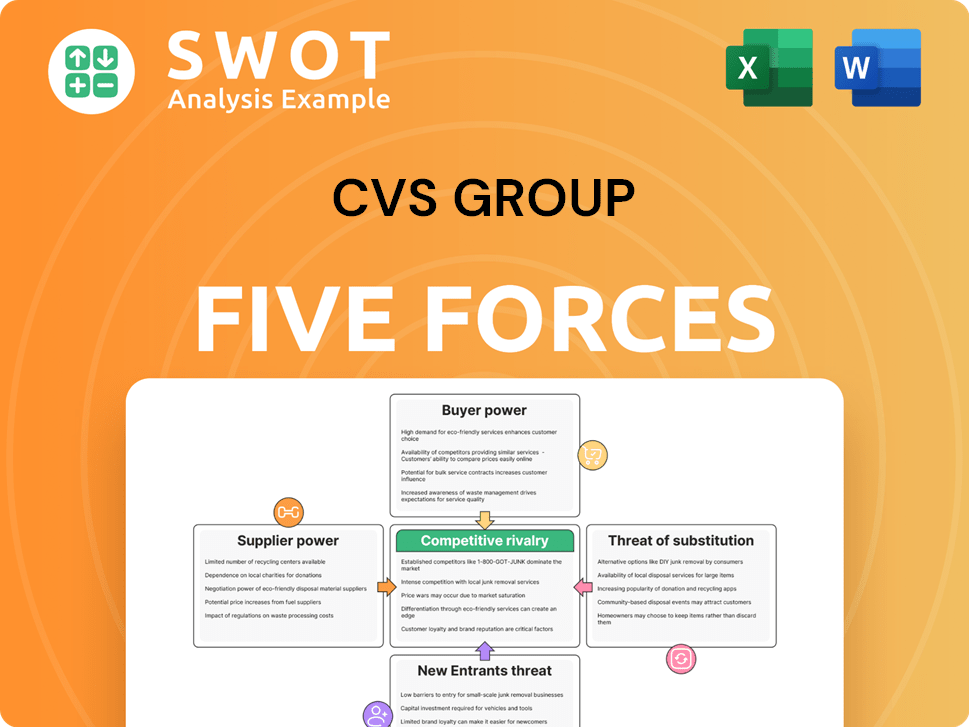

CVS Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CVS Group Company?

- What is Competitive Landscape of CVS Group Company?

- How Does CVS Group Company Work?

- What is Sales and Marketing Strategy of CVS Group Company?

- What is Brief History of CVS Group Company?

- Who Owns CVS Group Company?

- What is Customer Demographics and Target Market of CVS Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.