CVS Group Bundle

How Does CVS Group Thrive in the Veterinary Sector?

CVS Group, a leading player in the veterinary services market, operates primarily across the UK, Ireland, and the Netherlands, offering a wide array of services for companion, equine, and farm animals. Understanding the inner workings of this CVS Group SWOT Analysis is essential for anyone looking to understand the animal health industry. Its expansive network of veterinary practices and integrated services highlights its significance in the growing pet care market.

With a focus on strategic expansion through acquisitions, CVS Group has demonstrated consistent growth, as evidenced by its strong financial performance. This analysis will explore the core operations, value proposition, and revenue streams that drive CVS Group's success, providing a comprehensive overview of the CVS company's business model. This in-depth look will clarify how CVS veterinary services generate profit in the dynamic animal healthcare industry, offering valuable insights for investors and industry observers alike.

What Are the Key Operations Driving CVS Group’s Success?

CVS Group, a prominent player in the animal health sector, delivers value through its extensive network of veterinary practices and related services. Its core focus is on providing comprehensive veterinary care for companion animals, equine, and farm animals. The company's business model centers on offering a wide array of services, from preventative healthcare to advanced diagnostics and surgery, catering to diverse animal healthcare needs.

The company's operational strategy revolves around acquiring and integrating veterinary practices. This approach enables CVS Group to leverage economies of scale and implement centralized management practices. This includes standardized clinical protocols, shared administrative services, and centralized procurement of veterinary supplies. Through its vertically integrated model, CVS Group aims to provide seamless and high-quality animal healthcare experiences.

CVS Group's value proposition is centered on providing accessible, high-quality, and comprehensive veterinary services. This is achieved through a network of practices, supported by ancillary services like laboratories, pharmacies, and crematoria. The company's focus on customer convenience and consistent care quality positions it as a trusted provider in the animal health market. The Growth Strategy of CVS Group highlights the company's commitment to expansion and service excellence.

CVS Group offers a wide range of veterinary services, including preventative healthcare, diagnostics, and surgical procedures. These services cater to companion animals, equine, and farm animals. The company's comprehensive approach ensures that a broad spectrum of animal health needs are met, making it a one-stop solution for pet owners and agricultural businesses.

The operational efficiency of CVS Group is enhanced through the acquisition and integration of veterinary practices. This model allows for the standardization of clinical protocols and centralized management. Centralized procurement and supply chain optimization further contribute to cost efficiencies, supporting the company's financial performance.

CVS Group's vertical integration, encompassing practices, laboratories, pharmacies, and crematoria, sets it apart. This model allows for greater control over service quality and a seamless customer experience. The integration ensures that all aspects of animal healthcare are managed efficiently, providing consistent care.

The core capabilities of CVS Group translate into significant benefits for customers. These include convenient access to a wide range of services, consistent quality of care, and a trusted brand in animal health. The company's commitment to customer satisfaction is reflected in its service delivery and operational practices.

CVS Group's operational model is characterized by its focus on acquisition, integration, and vertical integration. This strategy allows the company to optimize its services and provide a seamless experience for customers. The company's success is driven by its ability to manage a large network of veterinary practices and related services efficiently.

- Acquisition and Integration: CVS Group actively acquires and integrates veterinary practices to expand its network and market presence.

- Centralized Management: The company employs centralized management practices to ensure consistency and efficiency across its operations.

- Vertical Integration: CVS Group's vertical integration encompasses veterinary practices, laboratories, pharmacies, and crematoria, creating a comprehensive service offering.

- Customer-Centric Approach: The company prioritizes customer convenience and consistent care quality, building trust and loyalty.

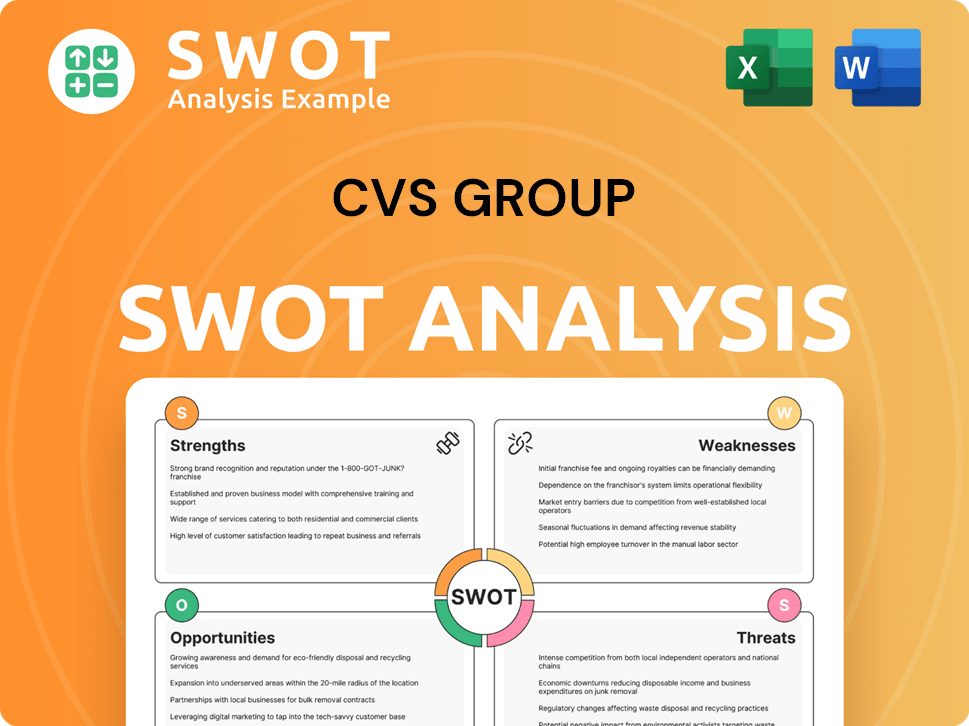

CVS Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CVS Group Make Money?

The CVS Group, a prominent player in the animal health sector, employs a multifaceted approach to generate revenue and sustain its business operations. Its financial strategy focuses on a blend of direct veterinary services, supplementary offerings, and strategic expansions. This diversified model allows the company to cater to a broad customer base while mitigating risks associated with reliance on a single revenue stream.

The core of the

In the six months ended December 31, 2023, practice-related income was the main driver of the reported 10.9% increase in revenue, reaching £329.9 million. This highlights the importance of direct services in the company's overall financial performance. The company's strategic acquisitions are also key to expanding its geographical footprint and service offerings, which in turn, broadens its potential revenue generation.

Beyond the primary income from veterinary practices, the

- Online Pharmacy: Animed Direct, the company's online pharmacy, contributes to revenue through the sale of pet medications and products.

- Laboratory Services: Diagnostic testing services are provided to both internal practices and external clients.

- Pet Cremation Services: This service provides a compassionate end-of-life option for pets.

- Healthy Pet Club: A subscription-based preventative healthcare scheme that offers discounted preventative care services to members, fostering customer loyalty and ensuring consistent patient visits.

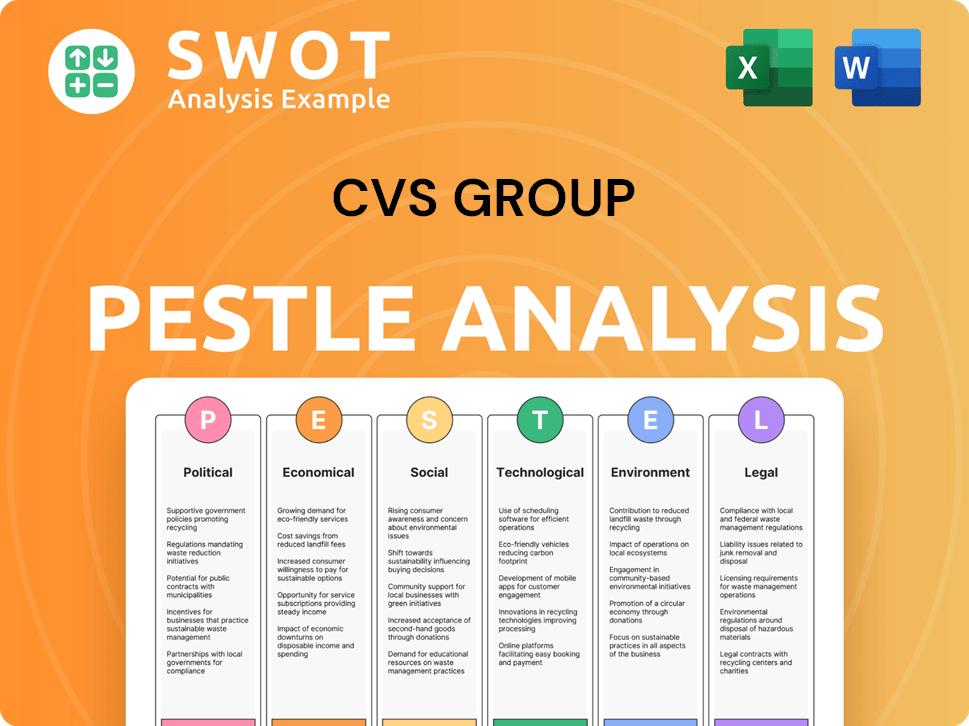

CVS Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CVS Group’s Business Model?

The journey of the CVS Group, a prominent player in the veterinary services sector, is marked by significant milestones and strategic initiatives. A key element of its strategy has been the consistent acquisition of veterinary practices, expanding its footprint across the UK, Republic of Ireland, and the Netherlands. This has driven revenue growth and increased market share, solidifying its position in the animal health industry.

CVS Group's operational approach involves navigating challenges such as labor shortages in the veterinary profession and managing post-acquisition integration. The company's competitive advantages are rooted in its extensive network, vertically integrated model, and customer loyalty programs. These elements collectively contribute to its ability to provide comprehensive veterinary services and maintain a strong market presence.

The company's strategic focus on acquisitions is evident in its financial performance. For the six months ended December 31, 2023, CVS Group completed 11 acquisitions, adding 10 ordinary practices and one referral center. This aggressive expansion strategy has enabled the company to achieve economies of scale and enhance its service network, demonstrating a commitment to growth and market leadership. To understand more about their growth strategy, you can read about the Growth Strategy of CVS Group.

CVS Group's expansion has been marked by numerous acquisitions, significantly increasing its network of veterinary practices. The company's 'Talent Strategy' addresses labor shortages, focusing on recruitment, retention, and development within the veterinary profession. This strategy is crucial for maintaining service quality and operational efficiency.

The company's acquisition strategy is a core strategic move, driving its growth and market share. Investments in technology and digital initiatives enhance client experiences and operational efficiency. Furthermore, CVS Group focuses on clinical excellence and staff well-being to attract and retain veterinary professionals.

CVS Group's extensive network provides significant geographical coverage and brand recognition. The vertically integrated model, including practices, laboratories, pharmacies, and crematoria, offers comprehensive service delivery. The 'Healthy Pet Club' fosters customer loyalty and recurring revenue, contributing to its competitive advantage in the veterinary services market.

In the six months ended December 31, 2023, CVS Group reported a revenue increase, driven by organic growth and acquisitions. The company's financial performance reflects its strategic focus on expansion and operational efficiency. CVS Group continues to adapt to industry trends by investing in technology and digital initiatives.

CVS Group's operational model includes a strong emphasis on both organic and inorganic growth. The company's commitment to clinical excellence and staff well-being is a key factor in attracting and retaining veterinary professionals. This approach supports the company's ability to provide high-quality veterinary services and maintain a competitive edge.

- Acquisition Strategy: CVS Group actively acquires veterinary practices to expand its network and market share.

- Vertical Integration: The company's vertically integrated model encompasses practices, laboratories, pharmacies, and crematoria.

- Customer Loyalty: Initiatives like the 'Healthy Pet Club' foster customer loyalty and recurring revenue.

- Technology Investment: CVS Group invests in technology to enhance client experience and operational efficiency.

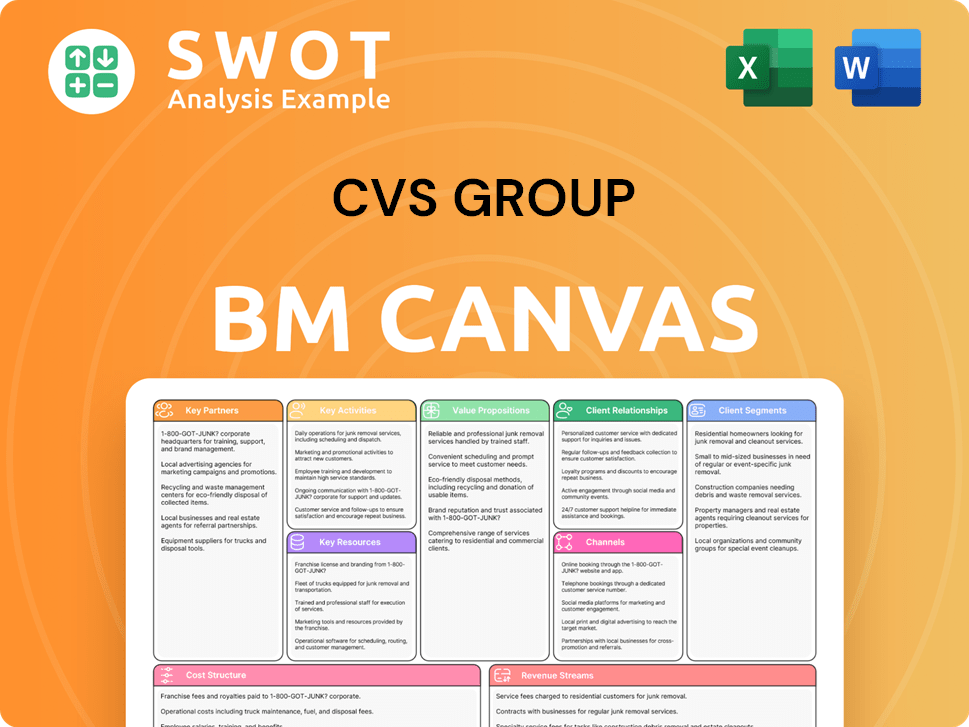

CVS Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CVS Group Positioning Itself for Continued Success?

CVS Group holds a significant position in the veterinary services market, particularly within the UK. As one of the largest integrated veterinary care providers, the company leverages an extensive network of practices and diverse service offerings. This strong market presence is further solidified by its strategic acquisition strategy, which allows it to compete effectively against smaller, independent practices. Brief History of CVS Group highlights the company's evolution and growth within the animal health sector.

However, CVS Group faces several risks. Regulatory changes, such as investigations into market concentration or pricing practices, could affect its operations. Labor shortages of veterinary professionals also pose a challenge, potentially affecting service delivery and costs. The emergence of new competitors or technological disruptions in pet healthcare could also necessitate continuous adaptation. The company must navigate these challenges while pursuing its growth objectives.

CVS Group is a leading player in the veterinary services industry, especially in the UK. Its large network and comprehensive services contribute to its strong market share. The company's acquisition strategy helps it maintain a competitive edge.

Regulatory scrutiny, such as the CMA investigation, poses a risk. Labor shortages and the potential for new competitors also present challenges. The company needs to adapt to these risks to sustain its operations.

CVS Group aims for organic growth, digital enhancement, and strategic acquisitions. Investments in technology and its 'Talent Strategy' are key. The company focuses on sustainable growth and navigating regulatory challenges.

The company is investing in technology to improve client experience and operational efficiency. It remains committed to its 'Talent Strategy' to address workforce challenges. These initiatives support its long-term growth and market position.

CVS Group's future depends on managing risks and leveraging opportunities. The company must address labor shortages and adapt to regulatory changes. Strategic investments and acquisitions will be crucial for sustained growth.

- Focus on organic growth and strategic acquisitions.

- Enhance digital capabilities for improved efficiency.

- Address workforce challenges through talent strategies.

- Navigate regulatory scrutiny and market competition.

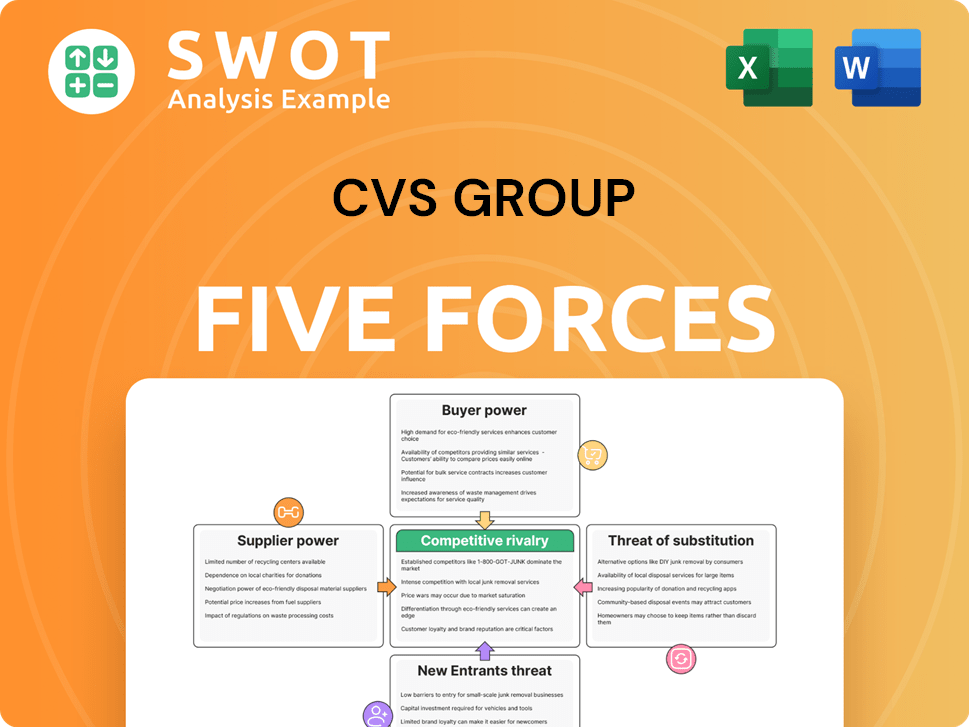

CVS Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CVS Group Company?

- What is Competitive Landscape of CVS Group Company?

- What is Growth Strategy and Future Prospects of CVS Group Company?

- What is Sales and Marketing Strategy of CVS Group Company?

- What is Brief History of CVS Group Company?

- Who Owns CVS Group Company?

- What is Customer Demographics and Target Market of CVS Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.