Exco Technologies Bundle

What's the story behind Exco Technologies' rise in the manufacturing world?

From its humble beginnings in 1952, Exco Technologies has become a global force in the automotive and industrial sectors. This journey showcases a remarkable evolution, marked by strategic innovation and a commitment to excellence. Discover the key milestones that have shaped the Exco Technologies SWOT Analysis and its enduring legacy.

This exploration into the Exco history will uncover the pivotal moments that transformed a Canadian startup into a global enterprise. We'll examine the Exco company's strategic moves, including key Exco acquisitions, and its expansion into Exco manufacturing of diverse Exco products, offering a comprehensive understanding of its enduring influence in the industry.

What is the Exco Technologies Founding Story?

The story of Exco Technologies Limited begins in 1952 in Canada. This Exco Technologies history started with the recognition of a growing need in the industrial tooling sector. The company aimed to provide specialized solutions to improve manufacturing efficiency and product quality.

While specific details about the founders and their backgrounds aren't widely available, the creation of Exco reflects the post-war industrial boom in North America. The demand for precision manufacturing tools was increasing during this period. Exco Technologies focused on custom tooling solutions for local manufacturers, using engineering and design expertise to meet specific client needs.

The initial business model likely involved providing custom tooling solutions to local manufacturers, leveraging expertise in engineering and design to meet specific client requirements. Early products or services would have focused on fundamental tooling needs, laying the groundwork for more complex offerings in the future. Early funding came from bootstrapping or private investments. The 1950s, with its industrial growth and innovation, provided a good environment for companies like Exco to grow.

Exco Technologies was founded in Canada in 1952, responding to the growing need for specialized tooling solutions in the industrial sector.

- The company's early focus was on custom tooling solutions, leveraging engineering and design expertise.

- Early funding likely came from bootstrapping or private investments, typical for industrial ventures of the time.

- The economic climate of the 1950s, marked by industrial growth, supported Exco's establishment and early development.

- Exco's initial products and services were designed to meet fundamental tooling needs, setting the stage for future expansion.

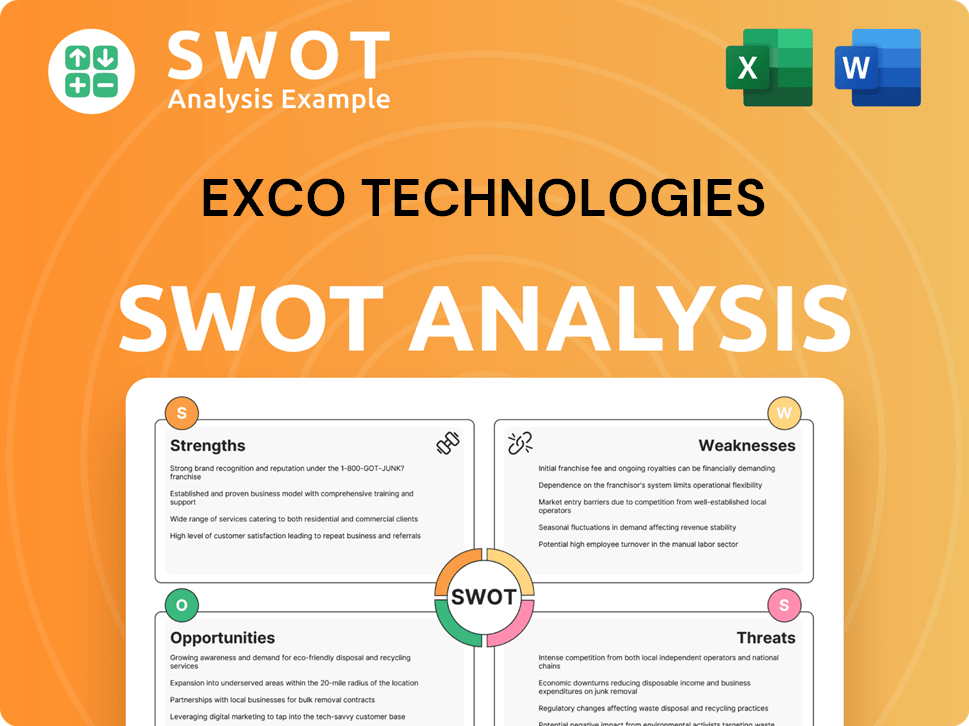

Exco Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Exco Technologies?

The early growth of Exco Technologies involved a strategic focus on expanding its capabilities and market reach within the tooling and equipment sector. This expansion included broadening its product portfolio and moving into specialized areas. The company's evolution from a regional player to one with a significant international footprint indicates successful market penetration strategies. This growth was fueled by both organic innovation and strategic Exco acquisitions.

Exco Technologies systematically expanded its product offerings, moving into areas like automotive interior trim systems and advanced tooling for aluminum processing. This expansion strategy was likely driven by a combination of organic growth and strategic Exco acquisitions. The company's growth reflects a commitment to innovation and market diversification within the Exco manufacturing sector.

By fiscal year 2024, Exco Technologies reported total revenue of $616.7 million, demonstrating sustained financial performance. This financial success supports its expansion efforts and investments in advanced Exco manufacturing technologies. The company's revenue reflects its strong position in the automotive and industrial tooling sectors.

Key developments in Exco Technologies' early growth included investments in advanced manufacturing technologies and the expansion of production facilities. These investments were crucial for establishing a robust supply chain, contributing to its competitive advantage. Such strategic moves helped cement its market leadership in the tooling and equipment sector.

The company's evolution from a regional player to one with a significant international footprint is a key aspect of its early growth. This expansion included operations in multiple countries, demonstrating successful market penetration strategies. This global presence has allowed Exco Technologies to serve a broader customer base.

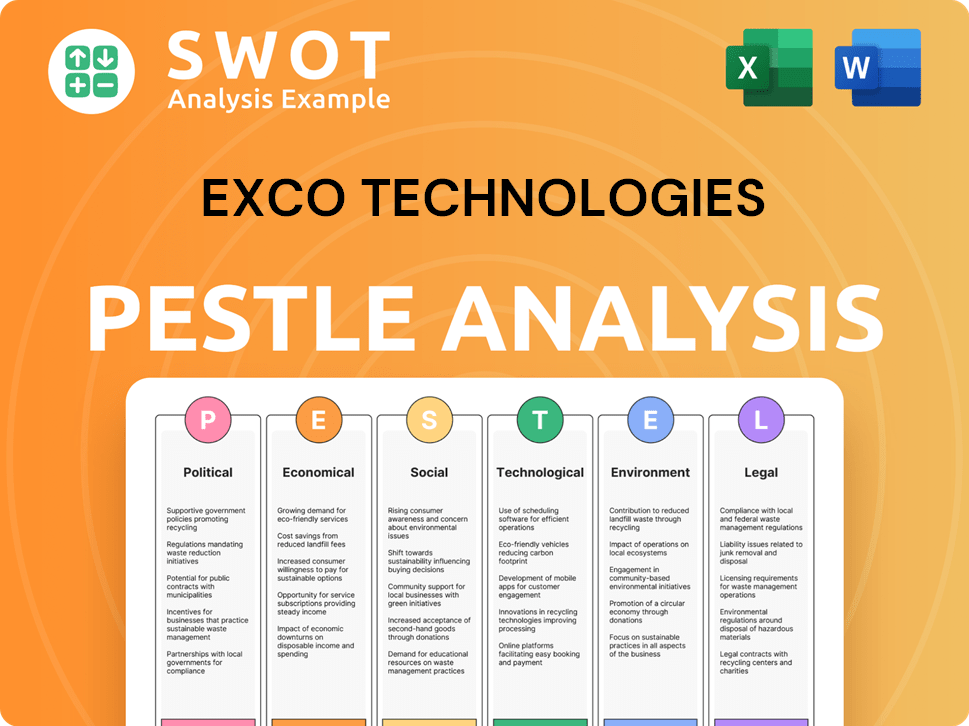

Exco Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Exco Technologies history?

The Exco Technologies has achieved several key milestones, establishing itself as a significant player in the automotive and industrial tooling sectors. These accomplishments highlight the company's growth and strategic focus over the years.

| Year | Milestone |

|---|---|

| Early Years | Establishment of the company, focusing on tooling and manufacturing solutions. |

| Mid-20th Century | Expansion into automotive components, including interior trim systems. |

| Late 20th Century | Strategic acquisitions to broaden product offerings and market reach. |

| Early 21st Century | Continued innovation in casting and extrusion technologies for various industries. |

| 2024 | Reported revenue of $616.7 million, demonstrating sustained demand for specialized products. |

Exco Technologies has consistently focused on innovation, particularly in its

Development of advanced interior trim systems, including instrument panels, door panels, and console systems, for the automotive sector.

Pioneering consumable tooling solutions for aluminum die-casting and aluminum extrusion.

Continuous investment in research and development to improve product performance and manufacturing processes.

Implementation of advanced manufacturing techniques to enhance efficiency and reduce costs.

Focus on enhancing the durability and functionality of automotive components through material science and design improvements.

Commitment to technological leadership in the casting and extrusion segment.

Despite its successes,

Navigating market downturns and economic fluctuations, particularly in the automotive industry.

Facing intense competition within the automotive and industrial tooling sectors.

Adapting to the cyclical nature of the automotive industry, which impacts demand for components.

Managing supply chain disruptions and ensuring a steady flow of materials and components.

Adapting to shifts in automotive manufacturing trends, such as the accelerating transition to electric vehicles.

Maintaining profitability despite market dynamics, with a net income of $32.4 million reported in fiscal year 2024.

Exco Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Exco Technologies?

The Exco Technologies journey reflects a history of strategic growth and adaptation within the manufacturing sector. While a comprehensive, detailed public timeline of every event is not readily available, key milestones can be inferred from its sustained presence and financial performance. The Exco history is characterized by its evolution and expansion in response to market demands and technological advancements.

| Year | Key Event |

|---|---|

| 1952 | Founding of Exco Technologies in Canada, marking the beginning of its operations. |

| 1970s-1990s | Period of early growth and expansion, including product diversification and entry into new industrial tooling markets. |

| Early 2000s | Established a strong presence in the automotive solutions segment, focusing on interior trim systems. |

| 2010s | Continued global expansion and strengthening of the Casting and Extrusion segment, enhancing its market position. |

| 2023 | Reported revenue of $607.7 million and net income of $33.6 million, demonstrating robust financial health. |

| 2024 | Achieved total revenue of $616.7 million and net income of $32.4 million, showcasing continued resilience and market presence. |

Exco Technologies is positioned for future growth as a leader in its specialized fields. Strategic initiatives include investments in advanced manufacturing technologies and expansion into emerging markets. The company plans to focus on innovation within both its Automotive Solutions and Casting and Extrusion segments to maintain a competitive edge.

The increasing global demand for lightweight materials, especially aluminum, is beneficial for the Casting and Extrusion business. The evolving automotive industry, driven by electric vehicles and autonomous driving, offers opportunities and challenges for the Automotive Solutions segment. The company is adapting its product development to align with these trends.

Exco Technologies is committed to operational efficiency, strategic acquisitions, and technological advancements. These initiatives support the company's founding vision of providing essential tooling and equipment solutions. To learn more about the company's performance and future plans, you can read more about the company's profile.

The company's recent financial results indicate a strong market presence and operational efficiency. The reported revenue in 2024 was $616.7 million, with a net income of $32.4 million. These figures reflect the company's ability to maintain its financial health.

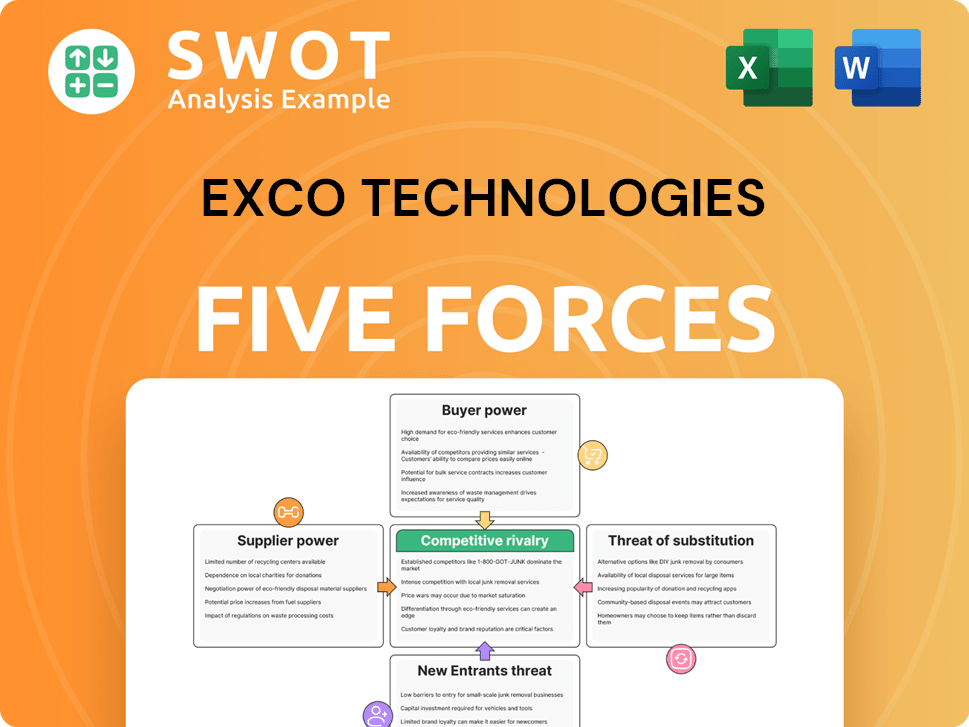

Exco Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Exco Technologies Company?

- What is Growth Strategy and Future Prospects of Exco Technologies Company?

- How Does Exco Technologies Company Work?

- What is Sales and Marketing Strategy of Exco Technologies Company?

- What is Brief History of Exco Technologies Company?

- Who Owns Exco Technologies Company?

- What is Customer Demographics and Target Market of Exco Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.