Exco Technologies Bundle

Who are Exco Technologies' Key Customers?

Understanding the customer demographics and target market is crucial for Exco Technologies' success. The automotive industry's evolution, especially with the rise of electric vehicles and demand for lightweight materials, directly impacts Exco. This exploration dives into Exco Technologies' customer base, offering a detailed market analysis of their needs and preferences.

Exco Technologies, a global leader since 1952, has significantly evolved its customer base. This Exco Technologies SWOT Analysis helps to understand the company's strategic direction. Its global presence, with 21 locations across 9 countries, reflects a diverse customer segmentation strategy. We will delve into identifying the target market segments for Exco Technologies, analyzing their customer profile examples, and exploring their customer acquisition strategies.

Who Are Exco Technologies’s Main Customers?

Understanding the customer demographics and target market of a company like Exco Technologies is crucial for assessing its market position and growth potential. Exco Technologies, operating primarily in the B2B sector, focuses on two main segments: Automotive Solutions and Casting and Extrusion. This structure helps define its customer base and market approach. A detailed market analysis reveals key insights into its customer segments.

The Exco Technologies company profile indicates that the Automotive Solutions segment is a major revenue generator, supplying components like instrument panels and door panels to automotive manufacturers and Tier 1 suppliers. The Casting and Extrusion segment designs and manufactures consumable tooling for industries like aluminum die-casting and extrusion. This dual approach allows Exco to serve a diverse range of industrial clients.

Analyzing the customer segmentation provides a clearer picture of Exco's market focus. The Automotive Solutions segment derived approximately 60% of its sales directly from OEMs in fiscal year 2024. The Casting and Extrusion segment generates about 30% of Exco's consolidated revenue, with roughly 60% of this segment's revenue coming from non-automotive markets.

Exco's customer base is diverse, with automotive revenues derived from 25 OEMs globally. The top OEM automotive customer represents 9% of consolidated revenues, and the top five OEMs account for 40%. This demonstrates a concentration of sales among a few key clients.

While specific age, gender, or income demographics are not applicable for B2B customers, Exco targets businesses within the automotive manufacturing supply chain and various industrial sectors utilizing aluminum. The increasing use of aluminum in multiple industries and the growth of OEM vehicle accessories are significant secular trends supporting the demand for Exco's products.

Exco has observed changes in target segments over time, notably the rising adoption of giga-presses in die-casting. This trend increases demand for Exco's additive (3D printed) tooling due to the growing size and complexity of die-cast tooling. This shift highlights the company's ability to adapt to technological advancements.

- The Automotive Solutions segment focuses on OEMs and Tier 1 suppliers, providing interior components.

- The Casting and Extrusion segment serves diverse non-automotive markets, including building and construction.

- The company's customer base includes 25 global OEMs, with a concentration among the top five.

- The increasing use of aluminum and the adoption of giga-presses are significant market trends.

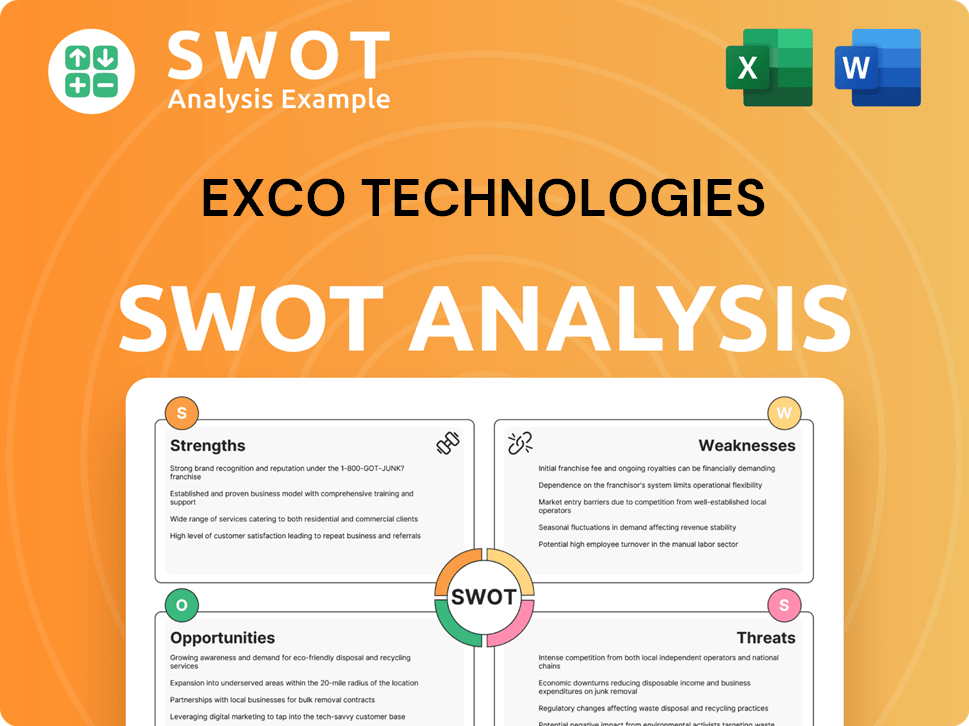

Exco Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Exco Technologies’s Customers Want?

Understanding the customer needs and preferences is crucial for Exco Technologies to tailor its offerings and maintain a competitive edge. The company's success hinges on its ability to meet the evolving demands of its diverse customer base, which spans several industries. This involves a deep dive into the specific requirements of each segment and adapting to the latest market trends.

The primary focus of Exco Technologies' customer base is on efficiency, quality, and adaptability. This is particularly evident in the Casting and Extrusion segment, where customers are seeking tooling solutions that can handle larger and more complex die-cast machines. Simultaneously, in the Automotive Solutions segment, there's a strong emphasis on high-quality interior trim systems and components.

Exco's ability to quickly adapt to these needs is reflected in its market share gains, which demonstrate its responsiveness to customer feedback and market trends. The company's approach is also evident in its powertrain-agnostic products, which cater to both ICE and EV architectures, showcasing its forward-thinking strategy.

Customers in the Casting and Extrusion segment prioritize efficiency. They require tooling that supports larger and more complex die-cast machines, including those using giga-presses. This includes a demand for consumable tooling components that significantly improve overall efficiency.

There is a growing preference for advanced manufacturing solutions. The demand for Exco's 3D-printed tooling highlights a shift towards solutions that enhance productivity and reduce lead times. This indicates a desire for innovation and cutting-edge technology within the customer base.

Customers in the Automotive Solutions segment, primarily automotive manufacturers and Tier 1 suppliers, seek high-quality interior trim systems and components. This focus on quality is crucial for meeting the stringent requirements of the automotive industry. The industry also shows a trend towards higher-margin accessory products.

Exco's products are designed to be powertrain agnostic, catering to both ICE, EV, and hybrid vehicle architectures. This adaptability ensures that Exco can meet the evolving needs of the automotive market. This strategy allows Exco to serve a broader customer base.

Exco addresses the increasing use of aluminum in vehicles, driven by environmental sustainability trends and the demand for lightweighting. This aligns with the industry's shift towards more sustainable and efficient vehicles. The shift towards lightweighting is a key trend in the automotive sector.

Exco's responsiveness to customer feedback and market trends has led to market share gains. This demonstrates the company's ability to adapt and meet customer needs effectively. For example, a report from 2024 indicated that Exco's market share increased by approximately 5% in the die-cast tooling segment.

Exco Technologies' success is built on understanding and meeting the diverse needs of its customers. Key factors include the demand for efficiency, quality, and adaptability.

- Efficiency: Customers in casting and extrusion require tooling solutions that improve operational efficiency, including those for larger machines and giga-presses.

- Quality: In the automotive segment, customers prioritize high-quality interior trim systems and components.

- Adaptability: Exco's products cater to both ICE and EV architectures, reflecting the evolving automotive market.

- Innovation: The demand for 3D-printed tooling shows a preference for advanced manufacturing solutions.

- Sustainability: Supporting the increasing use of aluminum in vehicles aligns with environmental trends.

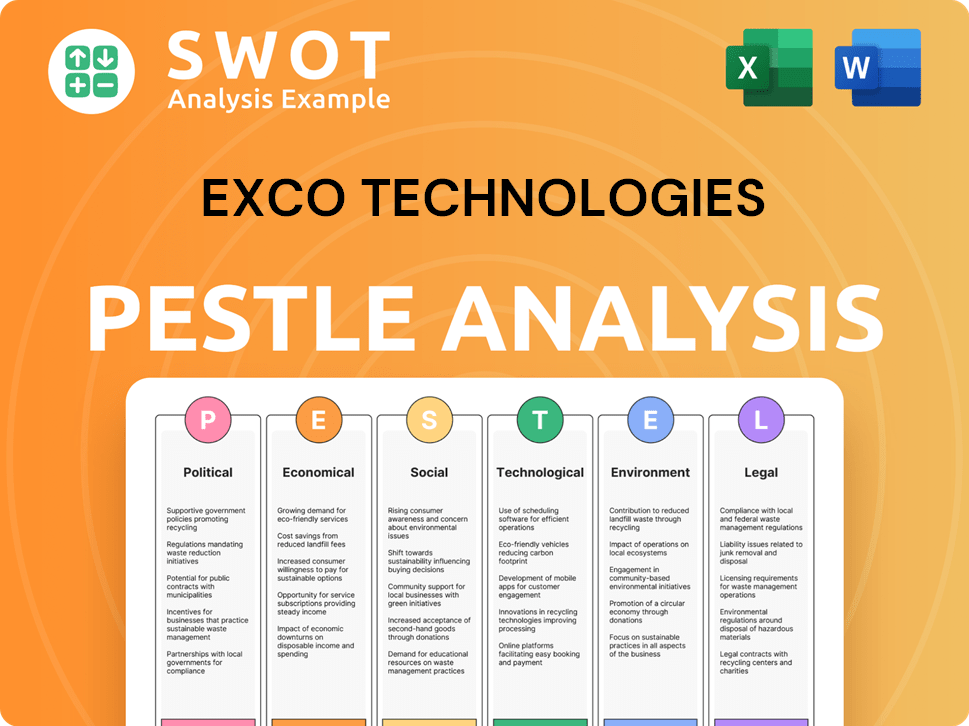

Exco Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Exco Technologies operate?

The geographical market presence of Exco Technologies is a crucial aspect of its business strategy. The company operates across a wide range of locations, ensuring a strong global footprint. This strategic approach helps in serving diverse customer needs and capitalizing on growth opportunities in various regions. Understanding the geographical spread is key to grasping the company's market penetration and future prospects.

Exco Technologies has a significant global presence, with operations spanning 21 strategic locations across 9 countries. This extensive network is supported by a workforce of approximately 5,000 employees. The company's primary focus is on markets in the United States, Europe, Mexico, and Canada, which collectively generate the majority of its revenue. This broad geographical reach allows Exco to cater to a wide customer base and adapt to regional market dynamics.

In fiscal year 2024, Exco Technologies' sales distribution by customer location revealed a strong presence in key markets. The United States accounted for 60% of sales, demonstrating its importance to the company. Europe contributed 21%, while Mexico and Canada represented 7% each. Other regions made up the remaining 5%. This data highlights the company's reliance on the US market while also showing a significant presence in Europe and growing markets in Latin America.

Exco Technologies is actively expanding its market share in Europe and Latin America. This includes the establishment of new locations in Morocco and Mexico. These expansions are designed to improve proximity to local customers.

The Casting and Extrusion segment of Exco Technologies primarily serves the automotive and other industrial markets. Operations are heavily concentrated in North America and Europe. This focus allows Exco to specialize in these key sectors.

North America is projected to be the fastest-growing market for aluminum extrusion during the forecast period of 2025-2033. This presents a significant growth opportunity for Exco Technologies. This highlights the importance of the North American market for Exco.

Exco Technologies is adept at adjusting its operations to meet diverse regional demands. This capability is crucial for capitalizing on market growth in specific geographies. This adaptability is a key element of their strategy.

The strategic expansion into new locations aims to provide better proximity to local customers. This proximity helps in reducing lead times, enhancing product quality, and increasing capacity. This customer-centric approach is vital for success.

Exco Technologies' market strategy is heavily influenced by geographical presence and market analysis. Growth Strategy of Exco Technologies provides insights into the company's strategic direction. The company uses detailed market research to make informed decisions.

Exco Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Exco Technologies Win & Keep Customers?

Customer acquisition and retention strategies at the company are built around operational excellence, technological innovation, and strategic geographic expansion. These strategies aim to enhance product quality and broaden capacity, which are critical for attracting and retaining customers. The company focuses on delivering superior products and services to maintain a competitive edge in the market.

The company's approach involves standardizing manufacturing processes and centralizing support functions across its global plants. This strategic move is designed to reduce lead times and improve overall efficiency. Furthermore, expanding its global footprint, particularly in regions like Morocco and Mexico, is a direct acquisition strategy to capture new business by improving service and accessibility for local customers.

The company leverages its leading market positions and expertise in niche industries. This strategic positioning, combined with its focus on customer needs, supports customer retention. The company's long-term relationships, indicated by a robust backlog, suggest a strong emphasis on customer satisfaction and repeat business. The company aims for substantial revenue and earnings growth, targeting approximately $750 million in annual revenue by the end of fiscal 2026.

The company strategically invests in new locations to expand its market share. This includes facilities in Morocco and Mexico. These locations are designed to improve proximity to local customers in Europe and Latin America.

The company holds leading market positions in niche industries. It is the world's largest independent provider of tooling for extrusion and die-cast markets. The company also excels in 3D printed tooling solutions for die-casting.

The company focuses on addressing key customer needs, such as efficiency and complex tooling solutions. It consistently delivers high-quality products and tailors offerings to specific segments. This approach supports customer loyalty and repeat business.

The company aims for substantial financial growth. By the end of fiscal 2026, the company targets approximately $750 million in annual revenue, $120 million in annual EBITDA, and annual EPS of roughly $1.50. These targets rely on effective customer acquisition and retention.

Analyzing the Competitors Landscape of Exco Technologies provides insights into the competitive environment and how the company positions itself to attract and retain customers. Understanding the market dynamics is crucial for refining customer acquisition strategies and ensuring long-term customer retention. The company's success hinges on its ability to meet the evolving needs of its target market while maintaining a strong competitive advantage.

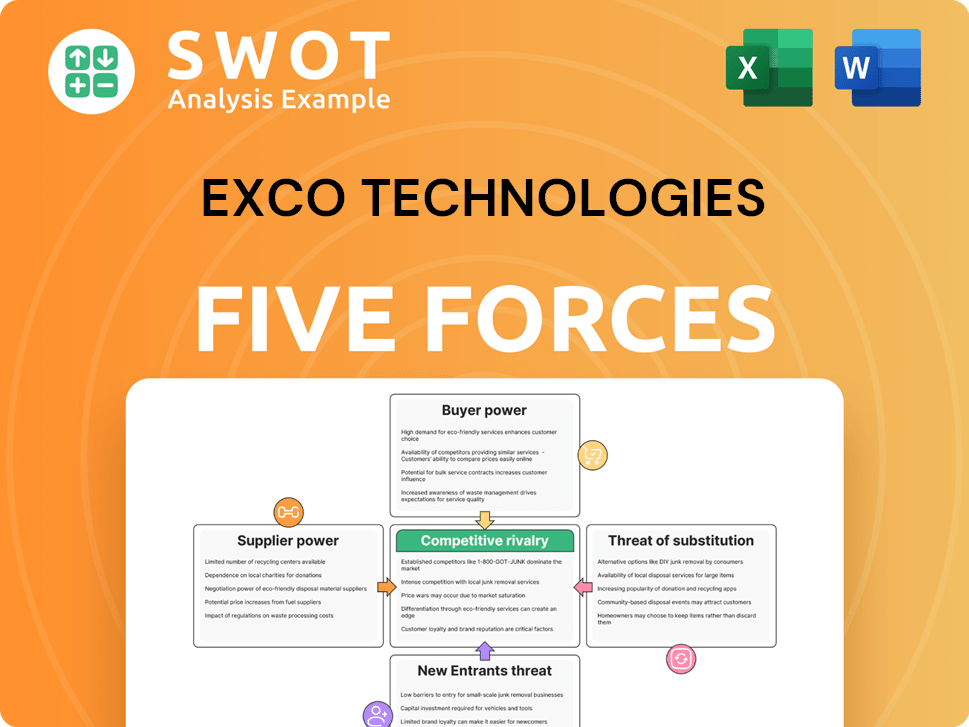

Exco Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exco Technologies Company?

- What is Competitive Landscape of Exco Technologies Company?

- What is Growth Strategy and Future Prospects of Exco Technologies Company?

- How Does Exco Technologies Company Work?

- What is Sales and Marketing Strategy of Exco Technologies Company?

- What is Brief History of Exco Technologies Company?

- Who Owns Exco Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.