Exco Technologies Bundle

How Does Exco Technologies Navigate the Ever-Changing Manufacturing World?

In a sector driven by relentless innovation and global supply chain dynamics, understanding the Exco Technologies SWOT Analysis is crucial. Exco Technologies, a key player in automotive and industrial tooling, is increasingly vital due to the rising demand for lightweight materials in electric vehicles. Established in 1952, the company has evolved from a specialized tooling provider to a significant force in manufacturing solutions.

This deep dive into the Exco Technologies Competitive Landscape offers a detailed Market Analysis of its strategic positioning. We'll explore Exco Company's Industry Overview, dissecting its Competitor Analysis to reveal its Exco Technologies competitors list, Exco Technologies key rivals, and Exco Technologies competitive advantages. By examining its Exco Technologies business strategy and Exco Technologies growth potential, we aim to provide actionable insights for investors and industry professionals alike, considering its Exco Technologies product offerings and Exco Technologies geographical presence.

Where Does Exco Technologies’ Stand in the Current Market?

Exco Technologies specializes in two main areas: Automotive Solutions and Casting and Extrusion. The Automotive Solutions segment focuses on interior trim systems, while the Casting and Extrusion segment designs and manufactures tooling for aluminum die-casting and extrusion industries. This dual focus allows the company to serve both the automotive and industrial sectors.

The company's value proposition lies in its ability to deliver specialized products and services to key industries. By focusing on these niche markets, Exco Technologies aims to provide high-quality solutions that meet the specific needs of its customers. This approach helps the company maintain a competitive edge.

Exco Technologies operates in a market where specific market share data isn't always publicly available. However, its long-standing presence and specialized offerings suggest a significant position within its niche segments. The company's geographical reach includes North America, Europe, and other global regions, demonstrating its commitment to a diverse customer base.

Exco Technologies concentrates on the automotive and industrial tooling sectors. This specialization allows for a deep understanding of customer needs. Their focus enables them to provide tailored solutions.

Exco has a global footprint, with operations in North America, Europe, and other regions. This international presence supports a diverse customer base. It also helps in adapting to regional market demands.

The company serves original equipment manufacturers (OEMs) and Tier 1 suppliers in the automotive sector. It also caters to major players in the aluminum processing industries. This diverse customer base helps to stabilize revenue streams.

Exco's financial performance indicates a stable position, even considering the cyclical nature of its end markets. Strategic investments and consistent operations contribute to this stability. The company's financial health is crucial for long-term sustainability.

Exco Technologies' ability to adapt to industry changes, such as the rise of electric vehicles and sustainable manufacturing, will be crucial. The company's strategic focus on its core competencies, along with its global presence, positions it well for future growth. The company must continue to innovate to stay competitive.

- Market Analysis: Understanding the competitive landscape is vital.

- Industry Overview: Staying informed about industry trends is key.

- Competitor Analysis: Evaluating key rivals helps in strategic planning.

- Growth Potential: Identifying opportunities for expansion is crucial.

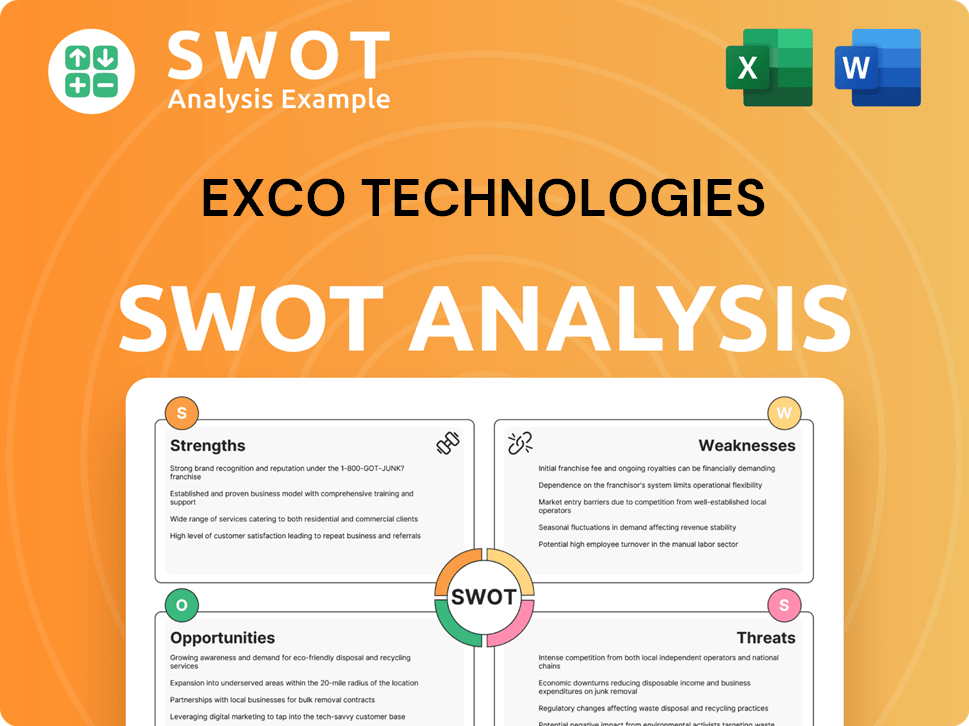

Exco Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Exco Technologies?

The competitive landscape for Exco Technologies is multifaceted, encompassing both direct and indirect competitors across its Automotive Solutions and Casting and Extrusion segments. Understanding this landscape is crucial for assessing the company's market position and potential for growth. This analysis delves into the key players and competitive dynamics shaping Exco's business environment.

In the Automotive Solutions segment, the competition is primarily driven by specialized manufacturers of automotive interior components and tooling providers. These firms often have established relationships with major automotive original equipment manufacturers (OEMs) and Tier 1 suppliers. The Casting and Extrusion segment faces competition from global tooling manufacturers specializing in consumable tooling for aluminum die-casting and extrusion, including large industrial manufacturers and niche players.

Competition in both segments hinges on factors like design innovation, manufacturing efficiency, cost-effectiveness, material science expertise, precision engineering, and the ability to deliver customized solutions. Emerging technologies and industry consolidation further influence the competitive dynamics.

Direct competitors in this segment include specialized manufacturers of automotive interior components. These companies compete on design innovation, manufacturing efficiency, and cost-effectiveness. They often have strong relationships with automotive OEMs and Tier 1 suppliers.

The Casting and Extrusion segment competes with global tooling manufacturers. These competitors range from large, diversified industrial manufacturers to highly specialized niche players. Competition often revolves around material science expertise and precision engineering.

Key factors include design innovation, manufacturing efficiency, cost-effectiveness, material science expertise, precision engineering, and tooling lifespan. The ability to deliver customized solutions is also a significant competitive advantage.

Emerging players leveraging advanced manufacturing techniques, such as additive manufacturing for tooling, could disrupt the market. Mergers and alliances within the manufacturing and tooling industries can also shift competitive dynamics, creating larger, more integrated competitors.

The automotive industry's shift towards electric vehicles (EVs) and lightweight materials influences the demand for Exco's products. Changes in global supply chains and regional economic conditions also affect the competitive landscape. The demand for aluminum die-casting and extrusion tooling is expected to grow, driven by the automotive and aerospace industries.

Exco Technologies operates globally, with a significant presence in North America, Europe, and Asia. The geographical distribution of its customer base and competitors varies by segment. The company's ability to serve customers in key automotive manufacturing regions is critical.

Exco's competitive advantages include its specialized expertise in automotive components and tooling, its global presence, and its ability to provide customized solutions. Challenges include intense competition, fluctuating raw material costs, and the need to adapt to technological advancements. The company's financial performance is influenced by its ability to manage these factors. In 2024, the global automotive tooling market was valued at approximately $70 billion, with an expected growth rate of 4-6% annually. The adoption of advanced manufacturing technologies is increasing, with additive manufacturing expected to grow at a rate of over 15% per year. Exco's market share is estimated to be between 1-3% in its core segments.

- Market Analysis: The automotive tooling market is competitive, with a focus on innovation and cost-effectiveness.

- Industry Overview: The industry is influenced by trends in EVs and lightweight materials.

- Competitor Analysis: Key competitors include specialized manufacturers and global tooling providers.

- Exco Technologies market share analysis: Exco holds a small but significant market share.

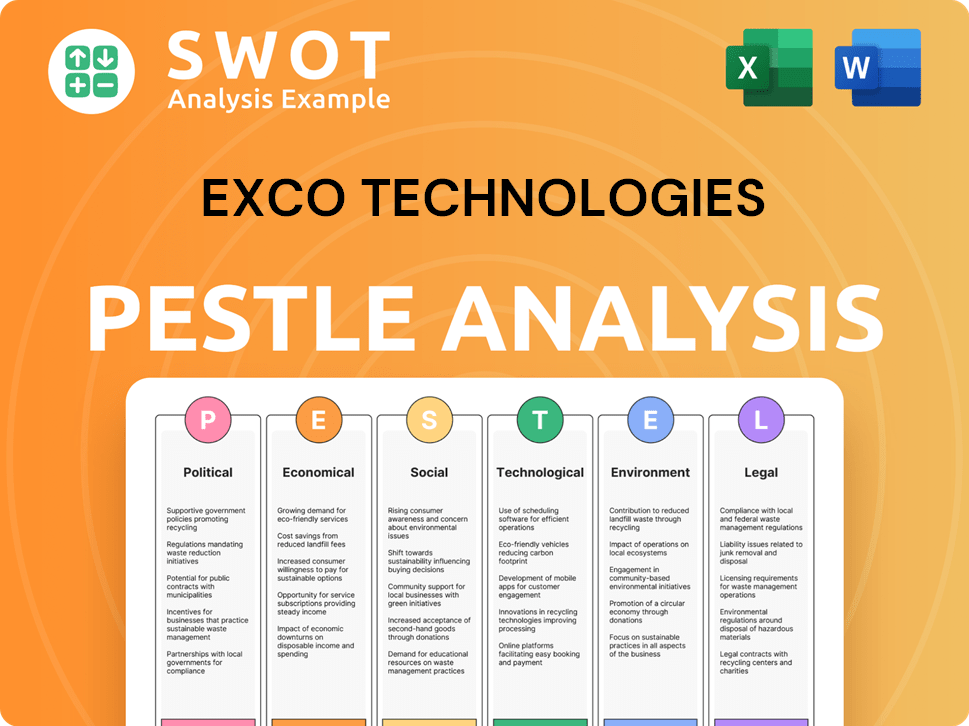

Exco Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Exco Technologies a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Exco Technologies requires a deep dive into its core strengths. The company's success hinges on its specialized expertise and established position within the manufacturing sector. This analysis focuses on the key advantages that enable Exco to maintain a strong competitive edge in a dynamic market.

Exco Technologies' competitive advantages are multifaceted, stemming from proprietary technologies, long-standing client relationships, and a focus on innovation. These strengths are critical for navigating the challenges and opportunities within the automotive and aluminum tooling industries. This detailed examination provides a clear picture of how Exco distinguishes itself from competitors.

The company's strategic approach, including its focus on recurring revenue streams and global distribution, further enhances its competitive position. By understanding these factors, stakeholders can better assess Exco's potential for sustained growth and market leadership. To gain a comprehensive view, consider reading about the Target Market of Exco Technologies.

Exco Technologies possesses key competitive advantages through its proprietary technologies and deep engineering know-how. This includes advanced design capabilities for complex automotive components and specialized metallurgical expertise. These capabilities allow Exco to provide high-quality products and solutions that meet the specific needs of its clients.

Exco has built long-standing relationships with major automotive OEMs and Tier 1 suppliers. These relationships, built on decades of reliable performance, represent significant customer loyalty. This strong brand reputation within the industry gives Exco a significant edge over competitors.

Economies of scale, particularly in its larger manufacturing facilities, allow Exco to achieve cost efficiencies. Its global distribution network further enhances its ability to serve international clients effectively. This global presence is a key factor in maintaining its competitive advantage.

Exco's focus on consumable tooling provides a recurring revenue stream. Continuous investment in research and development helps sustain its technological edge. These strategic decisions ensure Exco remains competitive and adaptable to market changes.

Exco Technologies' competitive advantages are rooted in its specialized expertise and strategic approach. The company's ability to maintain a competitive edge is supported by several key factors.

- Proprietary Technologies: Advanced design and engineering capabilities for automotive components and tooling.

- Customer Loyalty: Long-standing relationships with major automotive OEMs and Tier 1 suppliers.

- Cost Efficiencies: Economies of scale in manufacturing facilities.

- Global Presence: Effective service to international clients through a global distribution network.

- Recurring Revenue: Focus on consumable tooling providing consistent revenue streams.

- Innovation: Continuous investment in R&D to meet evolving industry needs.

Exco Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Exco Technologies’s Competitive Landscape?

The competitive landscape for Exco Technologies is significantly shaped by several key industry trends. The automotive sector's shift towards electric vehicles (EVs) and autonomous driving presents both challenges and opportunities. Simultaneously, the casting and extrusion industries are increasingly focused on sustainable manufacturing and advancements in material science, influencing the demand for more efficient tooling.

Potential risks include rapid technological change and economic downturns, while opportunities exist in emerging markets and strategic partnerships. Exco's ability to adapt, invest in R&D, and collaborate strategically will be crucial for its continued success. For a more detailed look at the company's origins, check out the Brief History of Exco Technologies.

The automotive industry's transition to EVs is a major driver, with demand for lightweight materials and new interior designs. The casting and extrusion sectors are seeing a rise in demand for sustainable manufacturing practices and advanced materials. These trends require companies to adapt their product offerings and manufacturing processes.

Rapid technological advancements, especially from new market entrants, pose a significant threat. Economic downturns and supply chain disruptions, particularly in the automotive sector, could negatively impact demand. Maintaining a competitive edge requires continuous innovation and strategic agility.

Emerging markets, both in automotive and industrial applications, offer significant growth potential. Strategic partnerships with EV manufacturers and companies developing advanced materials can create new revenue streams. Investment in R&D and strategic collaborations are vital for capitalizing on future growth.

Exco Technologies must focus on product portfolio adaptation to meet new industry standards. Continuous investment in R&D is crucial for staying ahead of technological changes. Strategic collaborations are essential for expanding market reach and developing innovative solutions.

The company's ability to navigate the changing automotive landscape and capitalize on emerging market opportunities will be critical. Adapting to sustainable manufacturing practices and investing in new technologies are essential for long-term success. The competitive landscape requires a proactive approach to innovation and strategic partnerships.

- Market Analysis: Understanding market trends and competitor strategies is crucial.

- Product Development: Continuously innovating and adapting product offerings.

- Strategic Partnerships: Collaborating with key players in the EV and materials sectors.

- Geographical Expansion: Exploring growth opportunities in emerging markets.

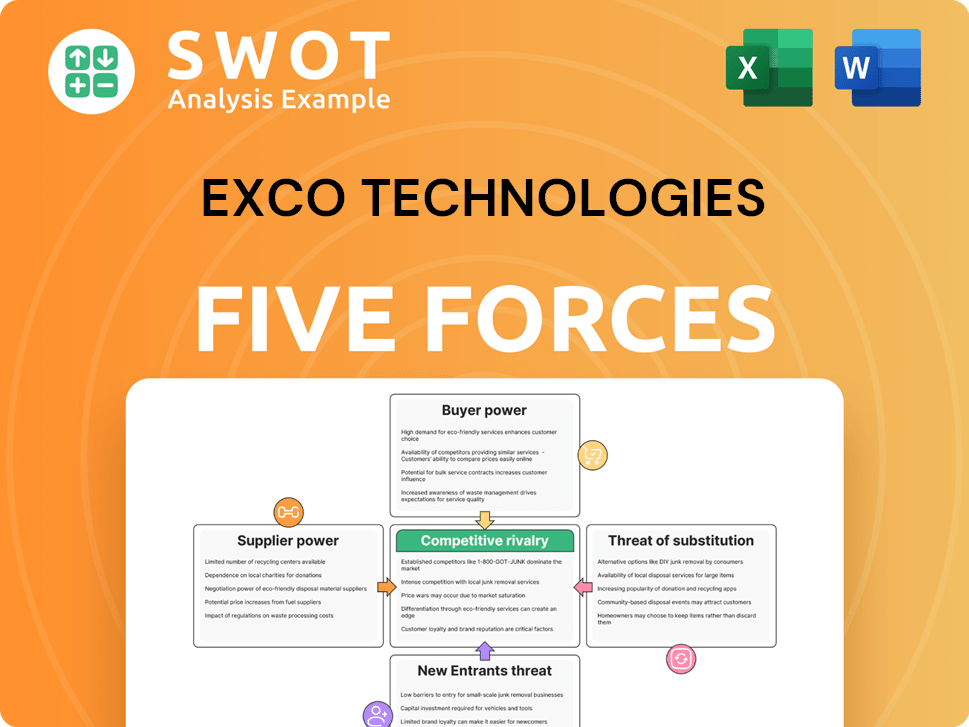

Exco Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exco Technologies Company?

- What is Growth Strategy and Future Prospects of Exco Technologies Company?

- How Does Exco Technologies Company Work?

- What is Sales and Marketing Strategy of Exco Technologies Company?

- What is Brief History of Exco Technologies Company?

- Who Owns Exco Technologies Company?

- What is Customer Demographics and Target Market of Exco Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.