Exco Technologies Bundle

Who Really Controls Exco Technologies?

Unraveling the Exco Technologies SWOT Analysis and understanding its ownership structure is paramount for anyone seeking to understand its strategic direction and future potential. Knowing who calls the shots at Exco, from major investment decisions to leadership appointments, offers critical insights into its long-term prospects. This exploration dives deep into the Exco company, examining its evolution from a family-run operation to a global player in the automotive and manufacturing sectors.

From its humble beginnings as Extrusion Machine Company in 1952, Exco Technologies has transformed into a publicly traded entity, but who are the major Exco shareholders and how has this shaped its trajectory? This analysis will dissect the Exco ownership landscape, including the influence of key investors and the dynamics of Exco stock, providing a comprehensive understanding of the forces that influence the company's strategic decisions and its position in the competitive market. Gaining insights into Exco executives and their roles is also crucial. Furthermore, we'll touch upon where is Exco Technologies headquarters located and how to contact Exco Technologies.

Who Founded Exco Technologies?

The origins of Exco Technologies trace back to 1952, when Harry Robbins established the company, initially known as Extrusion Machine Company. He started the business in the basement of his home in Scarborough, Ontario. The primary focus of the company in its early days was the production of custom aluminum extrusion dies.

During its initial phase, the company operated as a small, family-owned business. While specific details about the early equity splits or shareholding percentages are not readily available in public documents, it is reasonable to assume that Harry Robbins and potentially his immediate family held the majority of the ownership during this period. This concentrated ownership structure is typical for startups and small businesses.

As the company expanded its operations and technical capabilities, it transitioned from a private, family-owned entity to a publicly traded corporation. This evolution typically involves an initial public offering (IPO), which broadens the ownership base beyond the founders and early investors. However, specific details about early investors, such as angel investors or family members, or agreements like vesting schedules or buy-sell clauses from the initial phase, are not extensively detailed in publicly accessible information.

The early ownership of

- Exco ownership began with Harry Robbins in 1952.

- The company evolved from a family-owned business to a publicly traded corporation.

- The Robbins family maintained a presence in the company's leadership over time.

- Details on early angel investors or specific agreements are not widely available in public records.

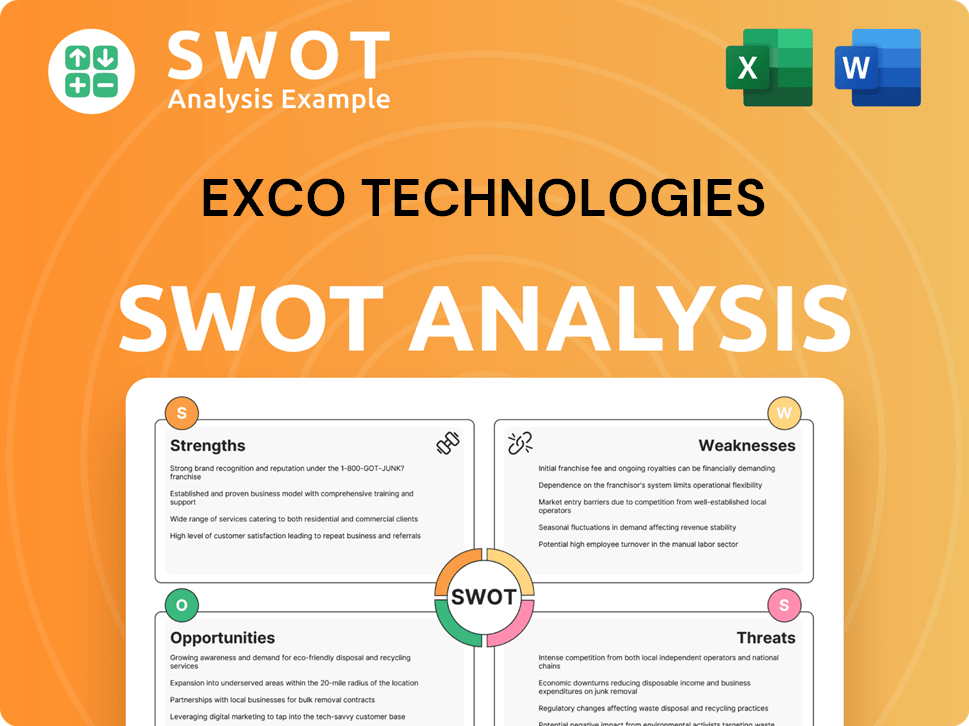

Exco Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Exco Technologies’s Ownership Changed Over Time?

The evolution of Exco Technologies from a family-owned business to a publicly traded entity on the Toronto Stock Exchange (TSX: XTC) marks a significant shift in its ownership structure. As of May 1, 2025, insiders, including founders, management, and board members, hold a substantial 54% of the company's shares. This indicates a strong internal alignment and commitment to the company's performance. The current market capitalization for Exco Technologies is $193 million with 38.4 million shares outstanding as of June 11, 2025, reflecting its market valuation and investor interest.

Institutional investors and the general public also play crucial roles in Exco's ownership. As of May 14, 2025, 24 institutional owners and shareholders have filed 13D/G or 13F forms with the SEC, collectively holding 1,308,607 shares. The general public holds approximately 40.8% of the shares, while individual insiders hold about 54.2%, representing 20,772,319 shares as of March 2025. This distribution highlights the diverse shareholder base and the influence of both institutional and individual investors on the company's direction.

| Ownership Category | Percentage of Shares | Share Count (Approximate) |

|---|---|---|

| Insiders | 54% | 20,772,319 |

| General Public | 40.8% | 15,643,200 |

| Institutional Investors | Various | 1,308,607 |

Exco Technologies has employed strategic acquisitions and share buybacks to influence its ownership. The acquisition of Techmire Limited and TecSyn International in 2000 expanded its operational capabilities. Between February 20, 2024, and February 19, 2025, the company purchased 356,400 common shares on the TSX at a weighted average price of $7.63 per share. Furthermore, a new Normal Course Issuer Bid (NCIB) was approved, allowing Exco to repurchase up to 1,770,513 common shares, representing 10% of its public float, between February 20, 2025, and February 19, 2026. These actions indicate a strategy to return value to shareholders and potentially consolidate ownership, impacting the overall shareholding percentages.

Exco Technologies' ownership is primarily held by insiders and the general public, with significant institutional investor involvement.

- Insiders hold a substantial portion of shares, demonstrating confidence in the company.

- Share buybacks are a key strategy for returning value to shareholders and potentially consolidating ownership.

- Institutional investors play a crucial role in the company's financial stability and growth.

- Understanding the ownership structure is essential for investors analyzing Exco stock.

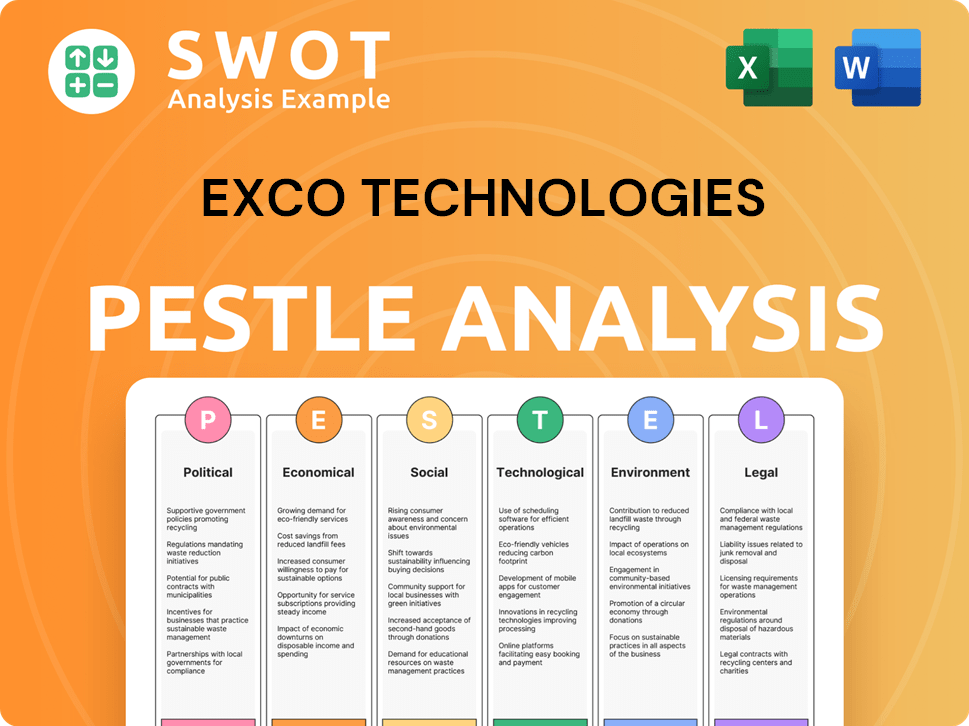

Exco Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Exco Technologies’s Board?

The Board of Directors at Exco Technologies Limited oversees the company's strategic direction and financial health. According to the company's articles, the board can have a minimum of 3 and a maximum of 15 directors. Currently, the number of directors elected at each annual meeting is set at 6. The board is composed primarily of unrelated directors, and the Chairman of the Board is not part of the management team. The board is responsible for reviewing and approving the selection of candidates for nomination and election by the shareholders.

The company operates with a single class of common shares, where each share has one vote, adhering to a one-share-one-vote structure. There are no voting restrictions beyond those required by law. The bylaws state that directors are elected by a plurality of votes from shareholders. If the votes withheld for a nominee exceed the votes in favor, the nominee must submit their resignation, which the Board will then consider promptly.

| Director Name | Position | Date of Appointment |

|---|---|---|

| David S. Watt | Chairman of the Board | 2017 |

| John P. Gethin | Director | 2014 |

| John A. MacIntyre | Director | 2014 |

| John R. McDougall | Director | 2017 |

| John R. Wood | Director | 2018 |

| John Yancich | Director | 2024 |

Insider ownership significantly influences Exco Technologies. As of March 2025, individual insiders collectively own approximately 54.2% of the outstanding common shares, totaling 20,772,319 shares. This substantial ownership, including board members and executives, gives them considerable influence over company decisions. For example, at the 2024 Annual Meeting held on January 22, 2025, all director candidates were elected with strong majority support, with approval rates ranging between 95.7% and 99.2%. The Brief History of Exco Technologies provides additional context on the company's evolution.

Exco Technologies' board structure and voting mechanisms are designed to ensure effective governance. The board is composed of a majority of independent directors. The company's one-share-one-vote system ensures fair shareholder representation.

- Strong insider ownership provides significant influence.

- Director elections typically receive high approval rates.

- The board actively reviews and approves director nominations.

- The company has not reported any recent proxy battles or activist investor campaigns.

Exco Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Exco Technologies’s Ownership Landscape?

Over the past few years, Exco Technologies has shown a commitment to managing its capital effectively. The company has consistently paid a quarterly dividend of $0.105 per common share, with the most recent payment scheduled for June 30, 2025, demonstrating financial stability. This consistent dividend payout, maintained for 23 consecutive years, reflects a strong financial health and commitment to Exco shareholders.

Share buybacks have been a key strategy for Exco ownership. From February 20, 2024, to February 19, 2025, the company repurchased 356,400 common shares on the TSX at an average price of $7.63 per share. Following this, a new Normal Course Issuer Bid (NCIB) was approved by the Toronto Stock Exchange, allowing Exco to repurchase up to 1,770,513 common shares, which is 10% of its public float, between February 20, 2025, and February 19, 2026. These actions aim to increase shareholder value by reducing the number of outstanding shares.

| Financial Metric | Value (as of March 31, 2025) | Change |

|---|---|---|

| Consolidated Sales | $166.1 million | 1% increase |

| Net Income | $6.4 million | 21% decrease |

| Cash | $18.1 million | N/A |

| Bank and Long-Term Debt | $82.0 million | N/A |

| Available Credit Facility | $51.4 million | N/A |

Darren Kirk currently leads Exco Technologies as President and CEO. For the second quarter ending March 31, 2025, consolidated sales increased by 1% to $166.1 million, but net income decreased by 21% to $6.4 million due to restructuring charges and a higher tax rate. Despite these challenges, the company maintains a solid financial position with $18.1 million in cash and $51.4 million available in its credit facility as of March 31, 2025. Due to global trade uncertainties, the company has withdrawn its fiscal 2026 financial targets. The management team remains confident in its strategic investments and competitive positioning.

The current President and CEO of Exco Technologies is Darren Kirk.

Exco Technologies is involved in the design, development, and manufacturing of dies, molds, and components for the automotive and recreational vehicle industries.

Yes, Exco Technologies is a publicly traded company.

Contact information can be found on the company's investor relations page, which includes details for inquiries.

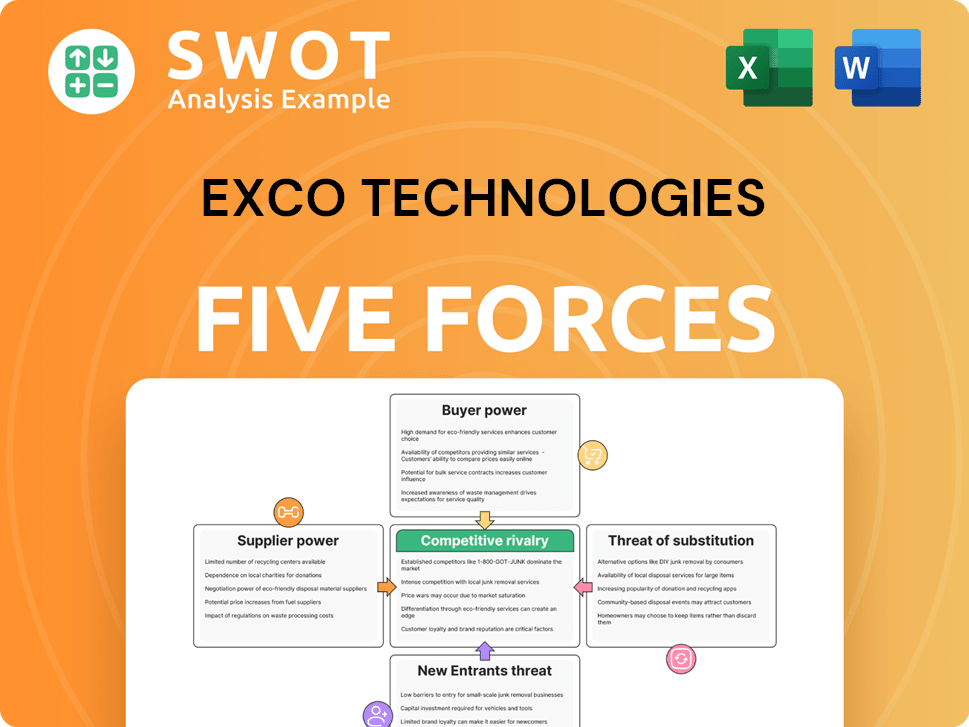

Exco Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exco Technologies Company?

- What is Competitive Landscape of Exco Technologies Company?

- What is Growth Strategy and Future Prospects of Exco Technologies Company?

- How Does Exco Technologies Company Work?

- What is Sales and Marketing Strategy of Exco Technologies Company?

- What is Brief History of Exco Technologies Company?

- What is Customer Demographics and Target Market of Exco Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.