Exco Technologies Bundle

How is Exco Technologies Shaping Its Future?

Exco Technologies, a key player in automotive and industrial tooling, has consistently demonstrated its strategic prowess since its inception in 1952. From its Canadian roots, the company has evolved into a global force, designing and manufacturing essential equipment for the automotive sector and beyond. This evolution highlights the crucial role of its Exco Technologies SWOT Analysis in navigating the ever-changing industrial environment.

This article delves into Exco Technologies' growth strategy and its future prospects, examining its strategic expansion plans and commitment to innovation. We'll explore how Exco Technologies aims to capitalize on market trends and drive business development, providing a comprehensive company analysis. Furthermore, we will assess the company's long-term growth potential and its approach to overcoming challenges and opportunities within the industry, offering insights into potential investment opportunities.

How Is Exco Technologies Expanding Its Reach?

The company, Exco Technologies, is actively pursuing several expansion initiatives to strengthen its market presence and diversify its revenue streams. These initiatives include entering new geographical markets, expanding product categories, and potentially engaging in mergers and acquisitions. These strategies are designed to access new customer bases, particularly in emerging automotive markets, and to mitigate risks associated with reliance on a single industry or region. The company continually evaluates partnership strategies and new business models to facilitate market entry and product deployment, ensuring it stays ahead of industry shifts and technological advancements.

In its Automotive Solutions segment, Exco is focused on broadening its portfolio of interior trim systems, including instrument panels, door panels, and console systems, to meet the evolving demands of the automotive industry. This expansion includes enhancing its offerings of consumable tooling for aluminum die-casting and aluminum extrusion industries. This is driven by the increasing adoption of lightweight materials in various sectors. These efforts are part of a broader growth strategy aimed at increasing market share and improving long-term financial performance.

For the Casting and Extrusion segment, the company aims to enhance its offerings of consumable tooling for aluminum die-casting and aluminum extrusion industries, driven by the increasing adoption of lightweight materials in various sectors. These initiatives are designed to access new customer bases, particularly in emerging automotive markets, and to mitigate risks associated with reliance on a single industry or region.

Exco Technologies is exploring new geographical markets to broaden its customer base and reduce its reliance on specific regional economies. This includes potential expansion into high-growth automotive markets in Asia and South America. The company is evaluating strategic partnerships and acquisitions to accelerate its market entry and increase its global footprint. These efforts are designed to capture new revenue streams and enhance long-term growth potential.

The company is expanding its product offerings within its existing segments to meet evolving market demands. In the Automotive Solutions segment, this involves developing new interior trim systems and components. For the Casting and Extrusion segment, Exco is focused on enhancing its tooling solutions for lightweight materials. This diversification aims to reduce dependence on specific product lines and increase overall market competitiveness.

Exco Technologies is actively seeking strategic partnerships and acquisition opportunities to accelerate its growth. These initiatives are aimed at gaining access to new technologies, expanding its market reach, and strengthening its competitive position. The company is evaluating potential mergers and acquisitions that align with its long-term strategic goals and enhance shareholder value. These moves support the company's overall business development strategy.

Exco Technologies is investing in technological advancements to improve its products and manufacturing processes. This includes exploring new materials and manufacturing techniques to enhance the performance and efficiency of its offerings. The company is also focused on integrating advanced technologies, such as automation and data analytics, to optimize its operations and drive innovation. These efforts are crucial for maintaining a competitive edge in the market.

Exco Technologies' strategic initiatives are expected to positively impact its financial performance. The company anticipates increased revenue from its expansion efforts, particularly in the automotive and casting segments. These initiatives are projected to improve profitability and enhance shareholder value. The company's focus on operational efficiency and cost management is expected to further boost its financial outlook.

- Revenue growth is anticipated through expansion into new markets and product lines.

- Profitability improvements are expected due to operational efficiencies and higher-margin products.

- Strategic investments in technology and innovation are designed to drive long-term growth.

- The company's financial performance outlook is supported by its strong market position and strategic initiatives.

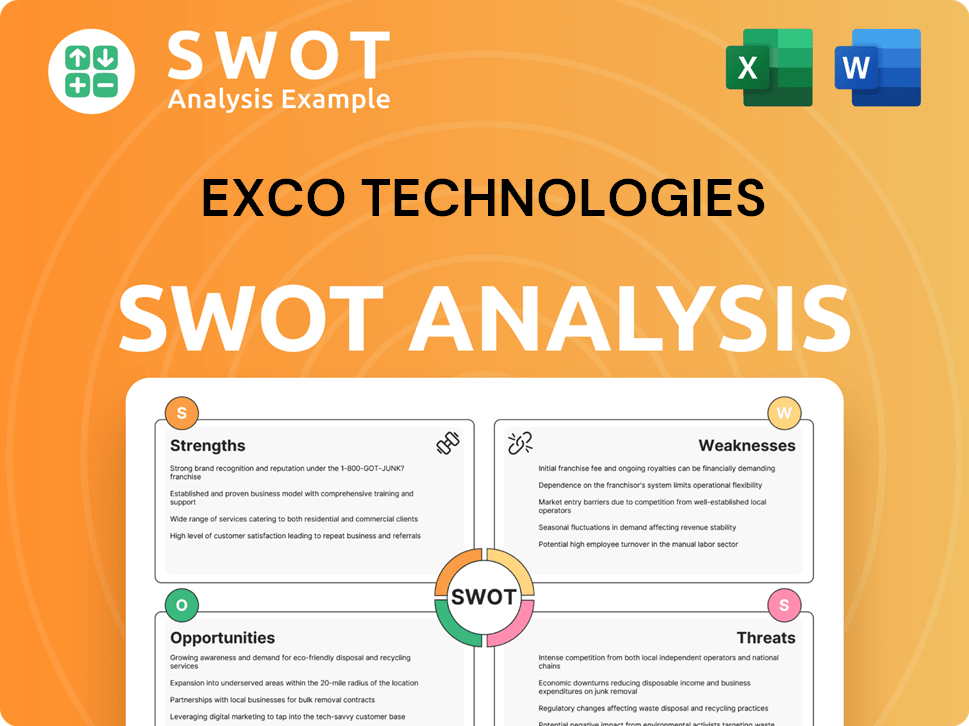

Exco Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Exco Technologies Invest in Innovation?

The innovation and technology strategy of Exco Technologies is a key driver of its sustained growth and competitive advantage. The company strategically invests in research and development (R&D) to foster in-house innovation and explore collaborative opportunities with external innovators. This approach ensures that Exco remains at the forefront of technological advancements within its industry.

A central element of Exco's strategy involves digital transformation, with a strong emphasis on automation and the integration of cutting-edge technologies. While specific details on recent patents or awards were not readily available in the latest public information, the company's commitment to advancing its tooling and equipment manufacturing processes is evident in its continuous efforts to enhance product performance and efficiency. This proactive approach is essential for meeting evolving market demands.

For instance, Exco's focus on high-quality tooling for aluminum die-casting and extrusion reflects its adaptation to industry trends, particularly the increasing demand for lightweight and high-strength materials in the automotive sector. This strategic alignment ensures that Exco's products and capabilities remain competitive, directly contributing to its growth objectives by providing superior solutions to its clients. Understanding the Marketing Strategy of Exco Technologies can provide further insights into how these technological advancements are brought to market.

Exco Technologies consistently invests in research and development to drive innovation. These investments are crucial for developing new products and improving existing processes. The company's focus on R&D helps maintain its competitive edge in the market.

Digital transformation is a core component of Exco's strategy. This involves the adoption of automation and the integration of advanced technologies. These initiatives aim to improve efficiency and product quality.

Exco's tooling for aluminum die-casting and extrusion caters to the growing demand for lightweight materials. This focus aligns with industry trends, particularly in the automotive sector. This strategic direction supports the company's growth.

Exco is committed to continuous improvement in its manufacturing processes. This involves ongoing efforts to enhance product performance and efficiency. This approach ensures the company remains competitive.

The company proactively adopts new technologies to stay ahead of the competition. This includes integrating advanced manufacturing techniques. This strategy helps Exco meet its growth objectives.

Exco adapts its products and services to meet evolving industry needs. This includes focusing on materials and processes that are in demand. This adaptability is key to its long-term success.

Exco's technological advancements are geared towards improving efficiency, product quality, and market competitiveness. These advancements are crucial for the company's future prospects.

- Automation: Implementing automated systems to streamline manufacturing processes and reduce costs.

- Advanced Materials: Utilizing advanced materials and techniques to meet the demands of the automotive and other industries.

- Digital Integration: Integrating digital technologies to improve product design, manufacturing, and customer service.

- R&D Focus: Continuous investment in research and development to drive innovation and stay ahead of market trends.

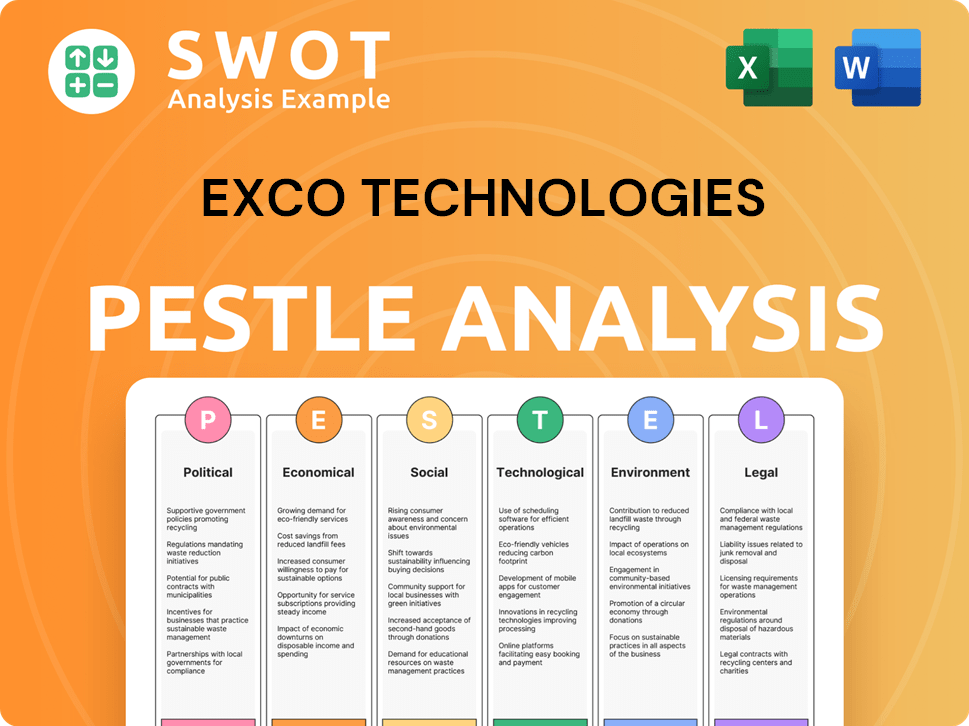

Exco Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Exco Technologies’s Growth Forecast?

The financial outlook for Exco Technologies is shaped by its strategic growth initiatives and its established position in the market. As of early 2025, specific forward-looking revenue targets or detailed profit margin projections for 2024-2025 were not explicitly detailed in publicly available summaries. However, the company's historical performance and strategic investments offer insights into its focus on sustainable growth. The company's business development strategy is focused on expanding its market share and capitalizing on market trends.

In the fiscal year that ended on September 30, 2023, Exco reported total revenues of $665.6 million. This represents an increase from $596.0 million in the prior year, demonstrating a positive revenue trajectory. This growth reflects the company's ability to adapt to industry changes and capitalize on investment opportunities. This financial performance outlook is crucial for understanding the company's long-term growth potential.

Exco's financial strategy supports its expansion and innovation efforts, including potential capital expenditures for new technologies and market entries. The company's ability to generate consistent cash flow and manage its debt levels will be crucial in funding future growth initiatives and navigating potential economic fluctuations. For more details, you can refer to an article discussing the company's performance: Exco Technologies; growth strategy analysis.

Exco Technologies experienced a notable increase in revenue, with total revenues reaching $665.6 million in fiscal year 2023. This represents a significant increase from the $596.0 million reported in the previous year. This growth indicates the effectiveness of the company's strategic initiatives and its ability to capitalize on market trends.

The company reported a net income of $30.8 million for fiscal year 2023. While this is a decrease compared to the $35.9 million reported in the previous year, it still reflects a solid financial performance. This demonstrates the company's ability to maintain profitability despite potential economic fluctuations.

Exco Technologies is focused on supporting its expansion and innovation efforts. This includes potential capital expenditures for new technologies and market entries. These investments are crucial for the company's long-term growth potential and its ability to remain competitive in the industry.

The company's ability to generate consistent cash flow and manage its debt levels is crucial for funding future growth initiatives. Effective financial management is essential for navigating potential economic fluctuations and ensuring the sustainability of the company's operations. This is a key aspect of Exco Technologies' financial performance outlook.

Exco Technologies is actively pursuing expansion into new markets as part of its growth strategy. This involves identifying and capitalizing on opportunities to increase market share and diversify its revenue streams. The company's expansion plans are a key component of its business development strategy.

The company is focused on leveraging technological advancements to improve its products and services. This includes investing in research and development to stay ahead of market trends. Technological advancements are crucial for maintaining a competitive edge and driving long-term growth.

Exco Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Exco Technologies’s Growth?

The path of Exco Technologies towards realizing its growth strategy and securing its future prospects is not without its hurdles. Several potential risks and obstacles could impede its progress, requiring careful navigation and strategic foresight. Understanding these challenges is crucial for a comprehensive company analysis and effective business development.

One of the primary challenges facing Exco Technologies is the intense competition within its core markets. The automotive industry, a significant revenue stream for the company, is highly competitive, with global players vying for market share. Furthermore, the cyclical nature of the automotive sector introduces volatility, as fluctuations in vehicle production can directly impact demand for Exco Technologies' products.

Additionally, external factors such as regulatory changes and supply chain disruptions pose significant risks. Environmental standards and trade policies can increase operational costs and introduce complexities. Supply chain vulnerabilities, including raw material availability and pricing volatility, can also threaten profitability. Finally, the rapid pace of technological advancements, particularly in the shift towards electric vehicles (EVs) and advanced manufacturing, necessitates continuous investment and adaptation to remain competitive. To learn more about the company's financial structure, consider reading Revenue Streams & Business Model of Exco Technologies.

The automotive and casting/extrusion markets are highly competitive, with numerous global players. Intense competition can lead to price pressures and reduced profit margins, impacting financial performance. The need to continuously innovate and improve efficiency is crucial to maintain a competitive edge.

The automotive industry is cyclical, with fluctuations in vehicle production directly affecting demand. Economic downturns or shifts in consumer preferences can lead to reduced orders and lower revenues. Diversifying the customer base and product offerings can help mitigate this risk.

Changes in environmental standards and trade policies can introduce complexities and increase operational costs. Compliance with new regulations may require significant investments in technology and processes. Staying abreast of these changes and adapting quickly is essential.

Disruptions in raw material availability or pricing volatility can negatively impact production and profitability. Geopolitical events, natural disasters, or other unforeseen circumstances can disrupt the supply chain. Developing robust supply chain management strategies is crucial.

The rapid pace of technological change, especially in EVs and advanced manufacturing, demands continuous R&D. Failure to adapt to new technologies can lead to obsolescence and loss of market share. Investing in innovation and staying ahead of the curve is vital.

Economic recessions can significantly reduce consumer spending on vehicles, impacting demand for Exco Technologies' products. Diversifying into less cyclical industries and maintaining a strong financial position can help weather economic storms. The automotive industry, for instance, saw a global sales decline of around 6% in 2023.

Exco Technologies can mitigate these risks through proactive measures. Diversifying its customer base across different regions and industries can reduce reliance on any single market. Implementing robust risk management frameworks and scenario planning allows the company to anticipate and prepare for potential disruptions. Investing in research and development to stay at the forefront of technological advancements is also essential.

Focusing on areas like tooling for aluminum die-casting and extrusion aligns with the lightweighting trend in the automotive industry. This strategic positioning can help mitigate risks associated with traditional vehicle manufacturing. The increasing demand for lightweight materials in EVs, driven by the need to extend range and improve efficiency, presents a significant opportunity. The global automotive aluminum die-casting market is projected to reach $18.4 billion by 2028.

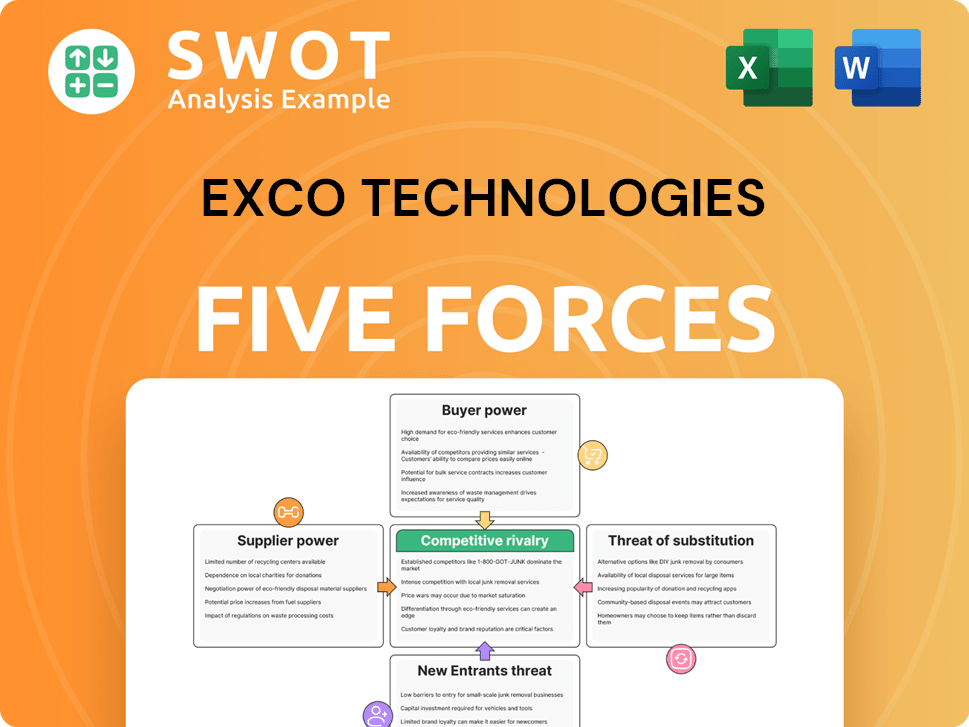

Exco Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exco Technologies Company?

- What is Competitive Landscape of Exco Technologies Company?

- How Does Exco Technologies Company Work?

- What is Sales and Marketing Strategy of Exco Technologies Company?

- What is Brief History of Exco Technologies Company?

- Who Owns Exco Technologies Company?

- What is Customer Demographics and Target Market of Exco Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.