Exco Technologies Bundle

How Does Exco Technologies Thrive in a Competitive Market?

Exco Technologies, a key player in automotive and industrial tooling, leverages specialized manufacturing to maintain its industry influence. Known for its innovative tooling and equipment, Exco has carved a strong niche, particularly in automotive interior trim systems and aluminum processing. Investors and industry watchers alike need to understand Exco's operational framework to gauge its financial health and strategic direction.

With a global footprint, Exco Technologies SWOT Analysis reveals the company's substantial scale and industry standing. This deep dive explores how Exco's advanced tooling solutions meet evolving client needs, generating profit and adapting to market dynamics. Understanding Exco's business operations is crucial for anyone interested in the Exco Company's future, including its Exco business model and Exco manufacturing processes.

What Are the Key Operations Driving Exco Technologies’s Success?

Exco Technologies operates through two main segments, delivering value to its customers in the automotive and aluminum industries. The company's core business revolves around manufacturing and engineering solutions, focusing on high-quality products and services. This dual approach allows Exco to serve diverse markets with specialized offerings.

The Exco Company's value proposition centers on providing innovative and reliable solutions. In the automotive sector, this means delivering superior interior trim systems. For the casting and extrusion industries, it translates to offering durable and precise tooling. This strategy helps Exco maintain a competitive edge through technological advancements and customer-focused solutions.

Exco's operational processes are designed to ensure efficiency and quality. These processes include advanced design, engineering, and manufacturing techniques, often utilizing specialized molding and assembly lines. The company's supply chain management and distribution networks are also critical to its success, ensuring timely delivery and customer satisfaction. The company's deep expertise in material science and precision engineering translates into tooling that enhances efficiency and reduces downtime for its customers, thereby offering a significant competitive advantage.

This segment focuses on designing and manufacturing interior trim systems. These systems include instrument panels, door panels, and console systems. The goal is to provide automotive manufacturers with integrated, aesthetically pleasing, and functionally superior interior systems.

This segment specializes in the design and manufacture of tooling for aluminum die-casting and extrusion. This involves producing dies, molds, and related equipment. The focus is on ensuring the longevity and performance of the tooling through precision machining and material science expertise.

Exco's operations involve advanced design, engineering, and manufacturing. The company uses specialized molding and assembly lines. Precision machining, heat treatment, and material science expertise are key in the Casting and Extrusion segment.

The value proposition includes providing integrated and aesthetically pleasing interior systems for the automotive industry. For the Casting and Extrusion segment, it involves offering durable and precise tooling. This approach enhances efficiency and reduces downtime for customers.

Exco focuses on two main areas: Automotive Solutions and Casting and Extrusion. The Automotive Solutions segment provides interior trim systems. The Casting and Extrusion segment offers tooling for aluminum die-casting and extrusion.

- Exco employs advanced design and manufacturing techniques.

- Supply chain management and distribution networks are essential.

- The company emphasizes precision engineering and material science.

- Exco aims to enhance efficiency and reduce downtime for its customers.

For more details on the target market of Exco Technologies, you can read about it in Target Market of Exco Technologies.

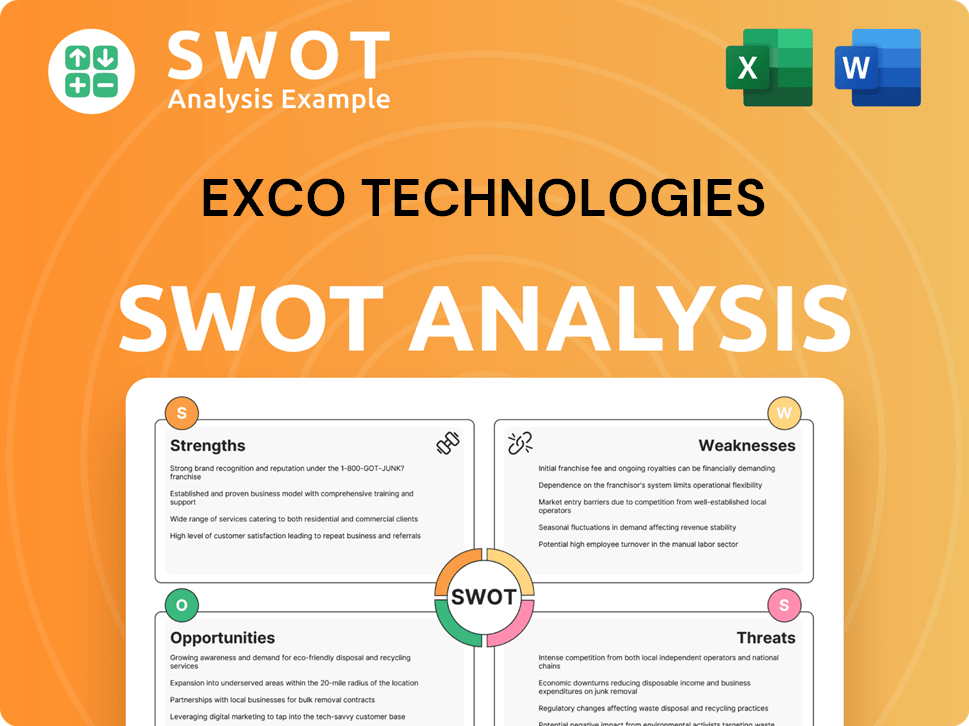

Exco Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Exco Technologies Make Money?

The revenue streams for Exco Technologies, also known as Exco Company, are primarily driven by the sale of its manufactured products. The company operates through two main segments: Automotive Solutions and Casting and Extrusion. These segments contribute significantly to the overall financial performance of Exco.

Exco's monetization strategies focus on delivering high-value, specialized tooling and components. The company leverages its technical expertise and established customer relationships to secure contracts. These contracts often involve recurring orders and repeat business, which solidifies customer relationships.

In the Automotive Solutions segment, revenue comes from direct sales of interior trim systems and components to original equipment manufacturers (OEMs). The Casting and Extrusion segment generates revenue from the sale of consumable tooling, such as dies and molds, to aluminum die-casting and extrusion companies.

Exco generates revenue through a product-based sales model. The company's success is tied to its ability to deliver high-quality products and maintain strong customer relationships. The company's operations are supported by its manufacturing capabilities. This approach allows Exco to secure long-term contracts and generate recurring revenue streams.

- Direct sales of interior trim systems and components to OEMs in the automotive industry.

- Sales of consumable tooling (dies and molds) to aluminum die-casting and extrusion companies.

- Aftermarket services or maintenance related to tooling, which can provide additional income.

- Long-term contracts with recurring orders based on vehicle production cycles or tooling replacement needs.

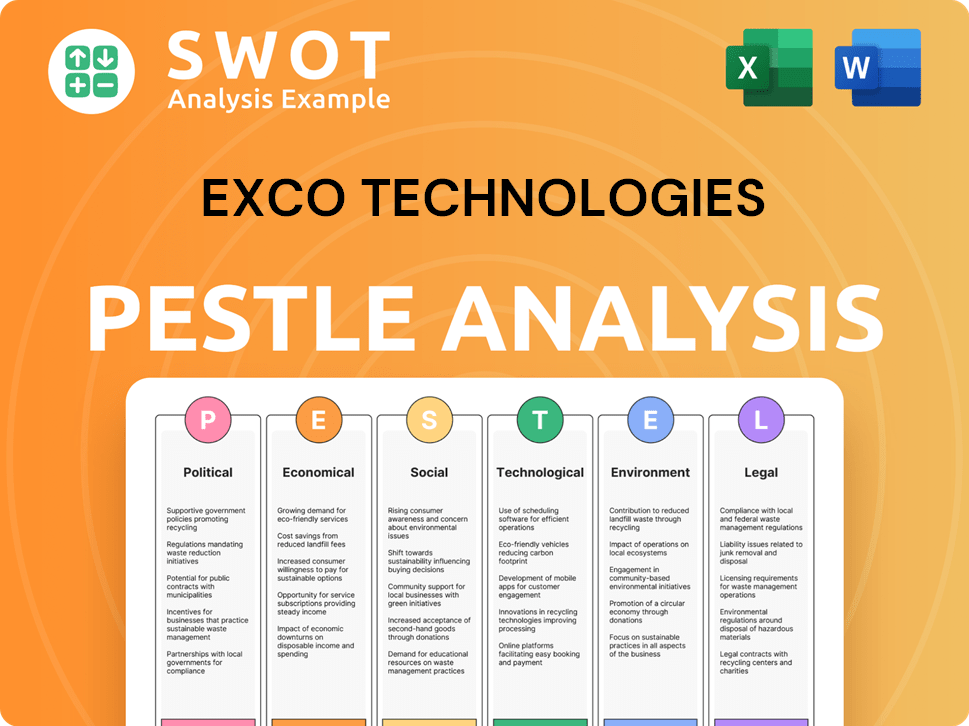

Exco Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Exco Technologies’s Business Model?

Understanding the operational dynamics of Exco Technologies (Exco Company, Exco) involves examining its key milestones, strategic initiatives, and competitive strengths. While specific details of recent product launches or market entries in 2024-2025 are not immediately available, the company's commitment to research and development in advanced materials and manufacturing processes remains a consistent strategic focus. This continuous investment is crucial for maintaining its position in the industry.

Exco Technologies has likely adapted to challenges such as supply chain disruptions, which have impacted the broader automotive and manufacturing sectors. This adaptability is demonstrated through strategies like diversifying its supplier base and optimizing inventory management. The company's ability to navigate these challenges is essential for its ongoing success.

The company's competitive advantages include specialized engineering expertise, particularly in complex tooling and automotive interior components, which fosters strong customer loyalty. Its established reputation for quality and precision also provides a significant edge. The company continues to adapt to new trends, such as the increasing demand for lightweight materials in vehicles and the push towards more sustainable manufacturing processes, by innovating its product offerings and operational methods. For more insights into the company's growth strategy, consider reading Growth Strategy of Exco Technologies.

Exco Technologies has a history of strategic acquisitions and expansions that have broadened its manufacturing capabilities. These moves have allowed the company to enter new markets and strengthen its position. The company's evolution reflects its adaptability and strategic foresight in the face of changing market demands.

Exco's strategic moves often involve investments in advanced manufacturing technologies and processes. The company focuses on operational efficiency and cost optimization to remain competitive. These investments are aimed at improving productivity and reducing operational costs.

Exco's competitive edge is built on its specialized expertise and strong customer relationships. The company's ability to provide high-quality products and services is a key differentiator. This emphasis on quality and precision helps Exco maintain a strong market position.

Exco operates within the manufacturing sector, serving industries such as automotive. The company's focus on innovation and customer satisfaction drives its business operations. Exco's business model is designed to adapt to changing market demands.

Exco Technologies leverages several competitive advantages to maintain its market position. These advantages include specialized engineering expertise and a strong reputation for quality. The company's focus on innovation and customer satisfaction further strengthens its position.

- Specialized Engineering: Exco's expertise in complex tooling and automotive interior components creates high barriers to entry for competitors.

- Quality and Precision: A strong reputation for delivering high-quality products and services is a key differentiator.

- Customer Relationships: Building strong customer loyalty through reliable service and innovative solutions.

- Adaptability: The company's ability to adapt to new trends, such as the demand for lightweight materials and sustainable manufacturing, is crucial for long-term success.

Exco Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Exco Technologies Positioning Itself for Continued Success?

The company, maintains a strong market position within its specialized niches in the automotive and aluminum processing industries. Its market share is supported by long-standing relationships with major automotive OEMs and aluminum producers, which indicates strong customer loyalty. The company's global reach, with operations and sales across various regions, reinforces its industry standing. This is crucial for understanding Growth Strategy of Exco Technologies.

However, key risks include the cyclical nature of the automotive industry, which can impact demand for its products, and potential disruptions in global supply chains. The emergence of new manufacturing technologies or materials could also pose a competitive threat if the company does not adapt swiftly. The company's ability to navigate these challenges will be crucial for its future success.

The company holds a significant market share in its specialized sectors, benefiting from established relationships with key automotive and aluminum industry players. Its global presence allows for diversified revenue streams, reducing dependence on any single region. Strong customer retention rates and strategic partnerships further solidify its market position.

The automotive industry's cyclical nature poses a risk, potentially affecting demand. Supply chain disruptions and the emergence of new technologies could also negatively impact the company. Economic downturns and fluctuations in raw material costs present additional challenges. There is a need to adapt quickly to maintain a competitive edge.

The company's strategic initiatives likely focus on innovation in tooling design and materials science to boost product performance and efficiency. Exploration of opportunities in emerging automotive technologies, such as electric vehicles, is also anticipated. The company aims to expand its market reach and leverage its core competencies.

Focus on operational excellence, technological advancement, and expanding market reach. Potential strategic acquisitions or partnerships may align with growth objectives. Adapting to industry shifts and leveraging core competencies are key strategies. Continued investment in research and development is crucial.

The company's success hinges on its ability to innovate and adapt to changes in the automotive and aluminum industries. Maintaining strong customer relationships and managing supply chain risks are critical. Strategic investments in research and development and potential acquisitions will be important for future growth.

- Focus on operational efficiency to mitigate risks.

- Adapt to the evolving demands of the automotive industry.

- Explore opportunities in electric vehicle components and tooling.

- Expand market reach through strategic partnerships.

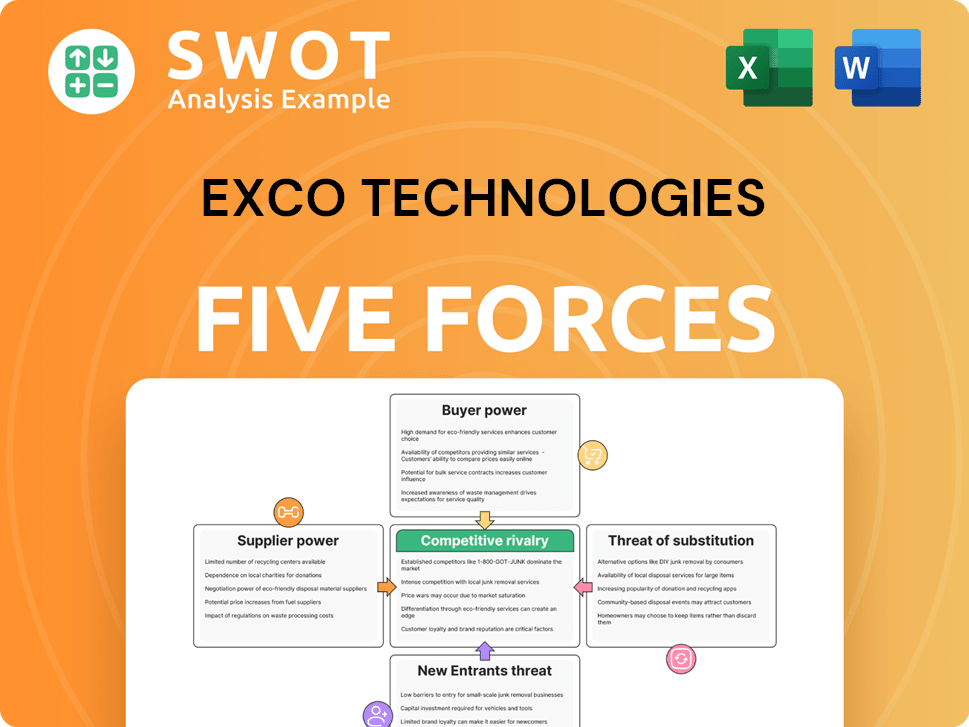

Exco Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exco Technologies Company?

- What is Competitive Landscape of Exco Technologies Company?

- What is Growth Strategy and Future Prospects of Exco Technologies Company?

- What is Sales and Marketing Strategy of Exco Technologies Company?

- What is Brief History of Exco Technologies Company?

- Who Owns Exco Technologies Company?

- What is Customer Demographics and Target Market of Exco Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.