Foot Locker Bundle

How did Foot Locker become a global athletic retail giant?

The story of Foot Locker is a captivating journey through the evolution of the sneaker industry. From its origins in 1974 as a specialized shoe store, Foot Locker has transformed into a global powerhouse, shaping athletic fashion and sneaker culture worldwide. This brief history explores the key moments that defined Foot Locker's rise.

Foot Locker's strategic focus on the footwear retail market, coupled with its ability to adapt to changing consumer trends, has been instrumental in its success. The company's expansion, including acquisitions and the development of diverse brands, has solidified its position. To understand the company's current standing, consider a detailed Foot Locker SWOT Analysis, which highlights its strengths, weaknesses, opportunities, and threats.

What is the Foot Locker Founding Story?

The story of Foot Locker begins in the 1970s as a strategic move by the F. W. Woolworth Company. Recognizing the growing demand for athletic footwear, Woolworth decided to diversify its business model. This led to the creation of a specialty retail format focused on athletic shoes and apparel.

The first Foot Locker store opened on September 12, 1974, in the Puente Hills Mall in the City of Industry, California. This marked the beginning of the company's journey in the footwear retail industry. There wasn't a single founder, as the store emerged from a corporate initiative.

Foot Locker's initial concept was to offer a curated selection of athletic footwear and apparel from top brands. This approach contrasted with the general merchandise offerings of Woolworth's traditional stores, providing a more focused and engaging experience for customers. The store's name, evoking images of gym lockers, was chosen to immediately communicate its focus on sports. You can learn more about the company's values by reading Mission, Vision & Core Values of Foot Locker.

Foot Locker emerged from F. W. Woolworth Company's diversification strategy to tap into the growing athletic wear market.

- The first store opened on September 12, 1974, in the Puente Hills Mall, California.

- The initial funding came from F. W. Woolworth Company.

- The name 'Foot Locker' was chosen to reflect its focus on athletic footwear.

- The business model was to offer a curated selection of athletic footwear and apparel.

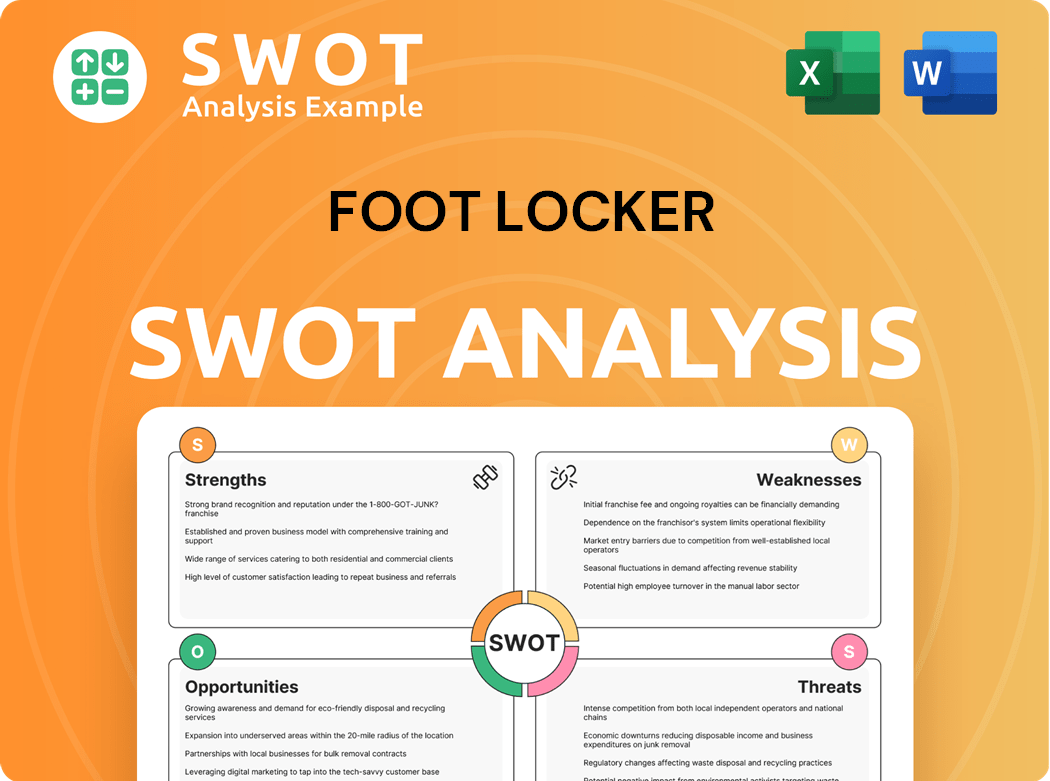

Foot Locker SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Foot Locker?

The early growth of the Foot Locker company was significantly aided by its parent company, F. W. Woolworth, which provided the necessary retail infrastructure and financial backing. Following the successful launch of its first store, Foot Locker initiated a steady expansion across the United States. This expansion was marked by strategic partnerships with major athletic brands and the introduction of new store formats. By the early 1980s, Foot Locker had established itself as a prominent player in the footwear retail industry.

Foot Locker's initial expansion strategy involved opening stores in shopping malls across various states. This approach allowed the company to capitalize on high foot traffic and reach a broad customer base. The focus was on creating a specialized retail environment that offered a wide selection of athletic footwear and knowledgeable staff. By the early 1980s, Foot Locker had established a recognizable presence in the sneaker industry.

Early product launches were centered on securing partnerships with leading athletic brands, which provided access to the latest footwear. This strategy was crucial in attracting customers and establishing Foot Locker as a destination for performance and lifestyle shoes. The company's ability to secure these partnerships helped it to differentiate itself from competitors and build a strong brand image.

A key element of Foot Locker's early growth was the introduction of new store formats under the Woolworth umbrella. Lady Foot Locker, launched in 1982, catered specifically to women's athletic wear, while Kids Foot Locker targeted the children's market. This diversification enabled Foot Locker to capture a broader market segment and increase its overall market share. This strategy proved effective in meeting diverse customer needs.

The competitive landscape during Foot Locker's early years included independent sporting goods stores and department store athletic sections. However, Foot Locker's dedicated focus on athletic footwear and knowledgeable staff gave it a significant edge. The company's specialized selection and customer service helped it to stand out and build a loyal customer base. This strategy helped to establish Foot Locker as a leader in the shoe store market.

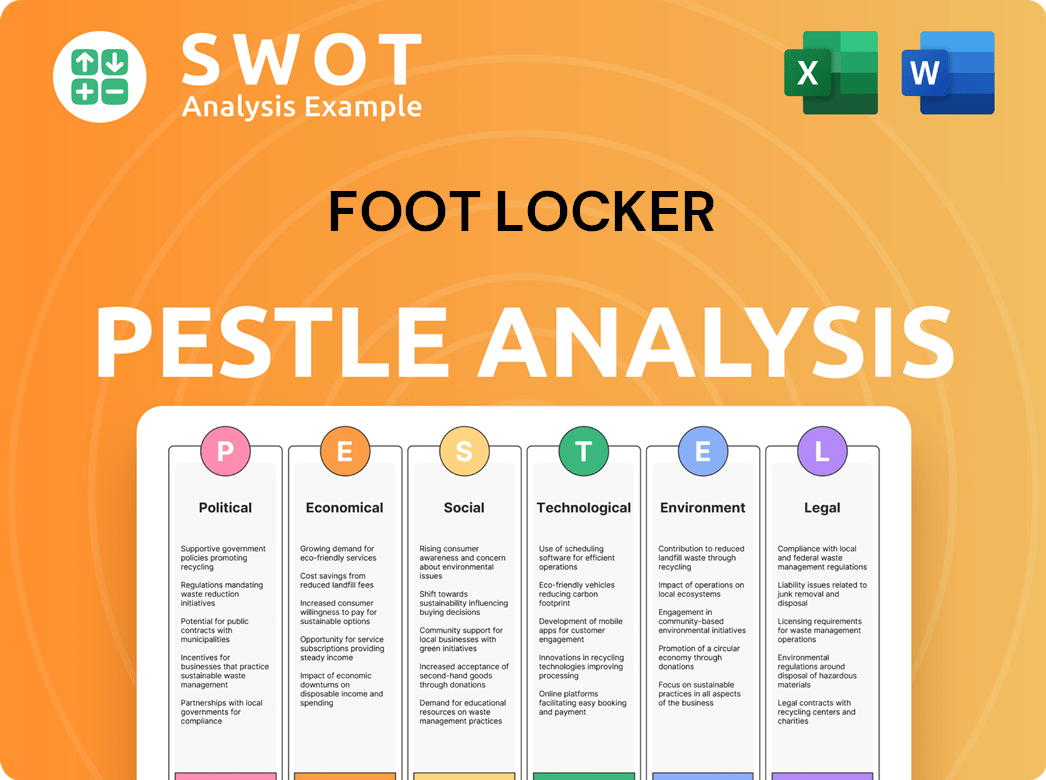

Foot Locker PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Foot Locker history?

The Foot Locker history is marked by significant milestones, from its origins to its evolution into a leading footwear retail company. A key moment was its spin-off, allowing for independent strategic development and a focused approach to the sneaker industry.

| Year | Milestone |

|---|---|

| 2001 | Spin-off from Venator Group (formerly F.W. Woolworth Company), becoming an independent publicly traded company, Foot Locker, Inc. |

| 1980s-1990s | Innovated in-store experience, becoming a destination for sneaker enthusiasts with knowledgeable staff and a vast selection. |

| 2023 | Approximately 75% of product assortment is exclusive to Foot Locker. |

Foot Locker has consistently innovated within the footwear retail sector, particularly in its approach to the sneaker industry. The company created a distinct in-store experience and introduced exclusive product releases.

Foot Locker frequently collaborates with major brands to offer exclusive products. This strategy drives customer traffic and fosters a strong connection with sneaker culture, setting it apart in the shoe store landscape.

Foot Locker focused on creating a unique in-store experience, with knowledgeable staff and a wide selection of sneakers. This helped establish the brand as a destination for sneaker enthusiasts, enhancing its appeal within the competitive footwear retail market.

Foot Locker is evolving from a traditional brick-and-mortar retailer to an omnichannel leader. This shift involves integrating its digital platforms and physical stores to provide a seamless customer experience.

Despite its successes, Foot Locker has faced several challenges, especially with the rise of e-commerce and direct-to-consumer strategies. The company's reliance on major vendors and the impact of the COVID-19 pandemic have also presented significant hurdles.

The growth of e-commerce and direct-to-consumer (DTC) models by brands like Nike has intensified competition. This shift requires Foot Locker to invest in its digital platforms and adapt its business strategies to maintain its market position.

Foot Locker's dependence on major vendors, such as Nike, presents a challenge. Nike represented 60% of total purchases in 2021, and Foot Locker aims to reduce this to 55% by 2025, indicating a strategic move towards diversification.

The COVID-19 pandemic forced temporary store closures and accelerated the shift to online shopping. This situation prompted Foot Locker to launch its 'Lace Up' plan to adapt to changing consumer behavior and market conditions.

Foot Locker plans to close 400-600 underperforming mall-based stores by 2026. Simultaneously, it intends to open 200-300 new, larger format 'power stores' and 100-200 'community' stores, optimizing its real estate footprint.

Foot Locker aims to expand its private label offerings to 10% of total sales by 2026. This strategy is part of its broader plan to diversify its brand mix and reduce its reliance on external vendors.

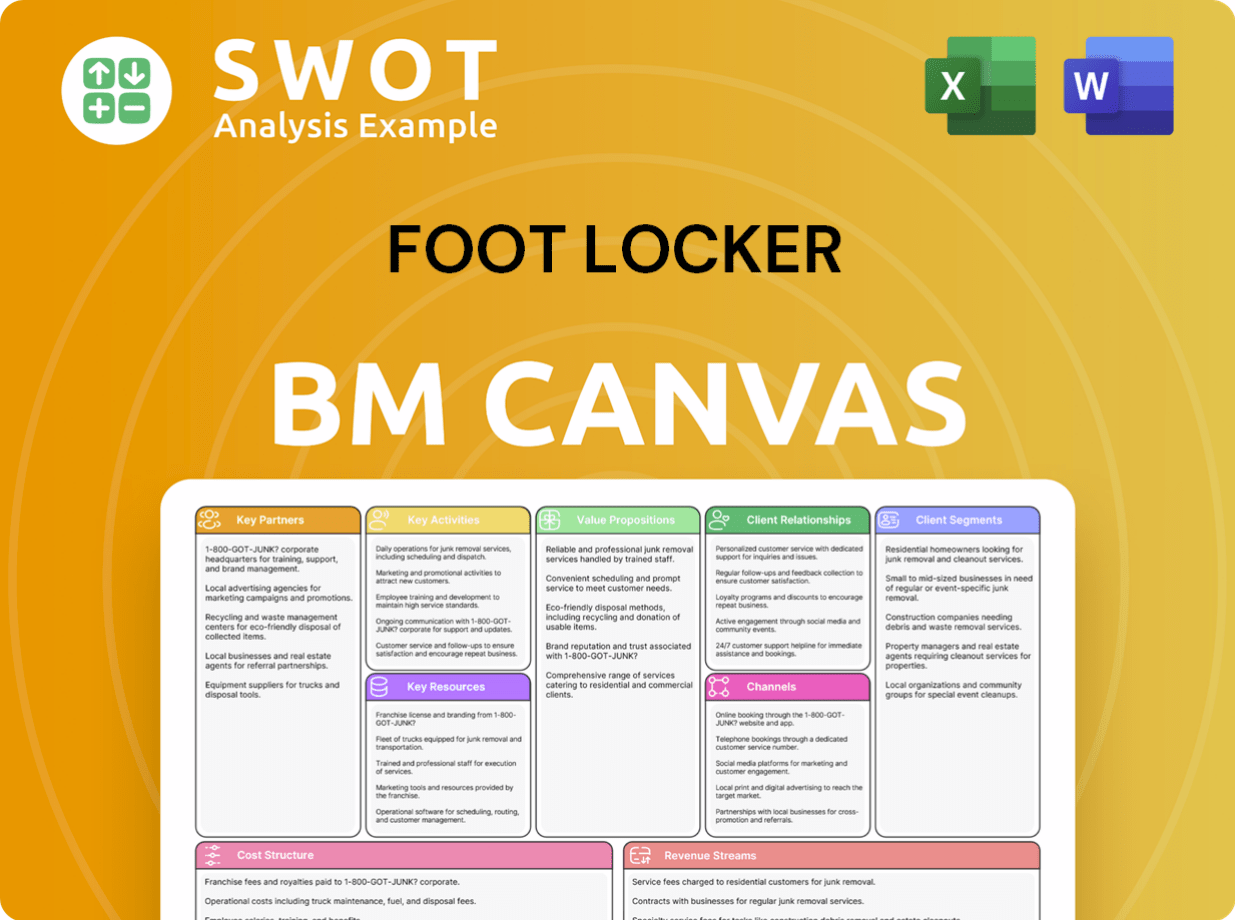

Foot Locker Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Foot Locker?

The Foot Locker history is marked by strategic expansions and adaptations to the evolving retail landscape. From its inception in 1974 as part of F. W. Woolworth Company to its current position as a leading footwear retailer, the company has consistently evolved. Key milestones include the launch of Lady Foot Locker in 1982, the acquisition of Champs Sports in 1988, and the spin-off from Venator Group in 2001. Digital transformation began in 2004 with the launch of its e-commerce platform, and continued with acquisitions like Runners Point, Sidestep, Atmos, and WSS. The 'Lace Up' strategic plan, introduced in 2023, underscores the company's focus on future growth.

| Year | Key Event |

|---|---|

| 1974 | First Foot Locker store opens in Puente Hills Mall, California, as part of F. W. Woolworth Company. |

| 1982 | Lady Foot Locker is launched, expanding the company's reach into women's athletic wear. |

| 1988 | Foot Locker acquires Champs Sports, further diversifying its retail portfolio. |

| 1997 | F.W. Woolworth Company officially renames itself Venator Group, signaling a shift towards specialty retail. |

| 2001 | Foot Locker, Inc. officially spins off from Venator Group, becoming an independent publicly traded company. |

| 2004 | Foot Locker launches its e-commerce platform, adapting to the growing digital retail landscape. |

| 2013 | Acquires Runners Point and Sidestep, expanding its European presence. |

| 2020 | Navigates the challenges of the COVID-19 pandemic, accelerating its digital transformation. |

| 2021 | Acquires Atmos and WSS, significantly expanding its market share and diverse customer base. |

| 2023 | Introduces the 'Lace Up' strategic plan, focusing on simplifying the business, strengthening customer connections, and diversifying its brand portfolio. |

| 2024 | Continues to execute the 'Lace Up' plan, optimizing its store fleet and enhancing its omnichannel capabilities. |

The 'Lace Up' plan is central to Foot Locker's future, aiming for sustained growth and profitability. The plan includes optimizing its store network by closing underperforming locations and opening larger power stores. The company is also focused on enhancing its omnichannel capabilities and improving customer experience through technology and supply chain improvements.

Foot Locker projects to achieve $9.5 billion in sales by 2026, with a significant contribution from digital channels. The company plans to diversify its brand mix, reducing reliance on any single vendor. Private label offerings are expected to reach approximately 10% of total sales by 2026, contributing to increased profitability.

Key initiatives include optimizing store footprint, with a shift towards larger, community-focused stores. Investments in technology and supply chain are aimed at improving omnichannel capabilities. Foot Locker is also focused on strengthening its connection with sneaker culture and serving the global sneaker community.

The company will be influenced by the continued growth of athleisure wear and the increasing importance of digital engagement. Analyst predictions are mixed, with some highlighting the challenges of a competitive market. The focus on the 'Lace Up' plan is expected to revitalize the company and strengthen its position in the shoe store market.

Foot Locker Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Foot Locker Company?

- What is Growth Strategy and Future Prospects of Foot Locker Company?

- How Does Foot Locker Company Work?

- What is Sales and Marketing Strategy of Foot Locker Company?

- What is Brief History of Foot Locker Company?

- Who Owns Foot Locker Company?

- What is Customer Demographics and Target Market of Foot Locker Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.