Foot Locker Bundle

Who Buys Sneakers at Foot Locker?

Foot Locker, a titan in the footwear retail industry, has evolved significantly since its inception. Understanding the company's customer demographics and target market is essential for grasping its current market position and future strategies. This analysis explores the core of Foot Locker's consumer base, revealing the "who" behind the brand and how it adapts to their needs.

Foot Locker's strategic shift, particularly with the 'Lace Up' plan, highlights the importance of knowing its Foot Locker audience. This plan aims to capture a larger share of the "sneaker mavens" and "fashion forward expressionists" market while also expanding its reach. To truly understand Foot Locker's trajectory, a deep dive into its customer profile, including factors like Foot Locker customer age range, income levels, and buying behavior, is crucial. For a deeper understanding of the company's strengths and weaknesses, consider the Foot Locker SWOT Analysis.

Who Are Foot Locker’s Main Customers?

Understanding the customer demographics and Foot Locker target market is crucial for the company's success. Historically, the primary Foot Locker audience has been centered around 'sneakerheads' and athletic enthusiasts. The company has strategically positioned itself to cater to a diverse consumer base interested in athletic and fashion-inspired footwear and apparel.

The company's brand portfolio, including Foot Locker, Kids Foot Locker, Champs Sports, WSS, and atmos, allows it to target various segments within the footwear retail market. While specific demographic breakdowns by age, gender, income, or education aren't always publicly available in detail, the company's strategies reveal key insights into its target customers. The "Lace Up" plan, introduced in 2023, highlights a focus on 'sneaker mavens' and 'fashion forward expressionists'.

The company's customer base is evolving, and its marketing and sales strategies are adapting to meet changing consumer preferences. This includes expanding its brand offerings beyond its traditional partnerships, such as Nike, to include brands like Adidas and New Balance. The focus on loyalty programs like FLX Rewards also provides valuable insights into customer behavior and preferences.

Kids Foot Locker specifically targets children, showing strong growth with a 6.4% increase in comparable sales in Q1 2024. This segment indicates a robust market share within the children's footwear and apparel market. The success of this banner highlights the importance of catering to specific age groups and their unique needs and preferences.

Champs Sports, another key banner, has undergone repositioning efforts. It saw positive comparable sales growth in the second half of 2024, with gains of 1.8% in Q4 2024. This suggests a stabilization and return to growth within its specific target segment. The focus on repositioning indicates a strategic approach to adapt to market changes and consumer demands.

The company's FLX Rewards program is a key element in understanding and engaging with its most loyal customers. The company increased its loyalty sales capture rate to 33% in 2024 from 23% in 2023. The Q4 2024 penetration rate of 49% shows a strong focus on customer retention and building lasting relationships.

The company is diversifying its brand portfolio beyond Nike, with significant growth observed from brands like Adidas and New Balance. This adaptation reflects changing consumer preferences and a broader appeal across different brand loyalties. This strategic shift helps to capture a wider sneaker market.

The primary customer segments include sneaker enthusiasts, athletic individuals, children, and fashion-conscious consumers. The company's strategy is to cater to a broad demographic while focusing on building strong customer relationships through loyalty programs. The company's approach involves understanding Foot Locker customer profile and adapting to changing trends.

- 'Sneakerheads' and athletic enthusiasts form the core customer base.

- Kids Foot Locker targets children, indicating a focus on family-oriented consumers.

- Champs Sports caters to a specific segment, with repositioning efforts to drive growth.

- The company is diversifying its brand portfolio to appeal to a wider range of consumers.

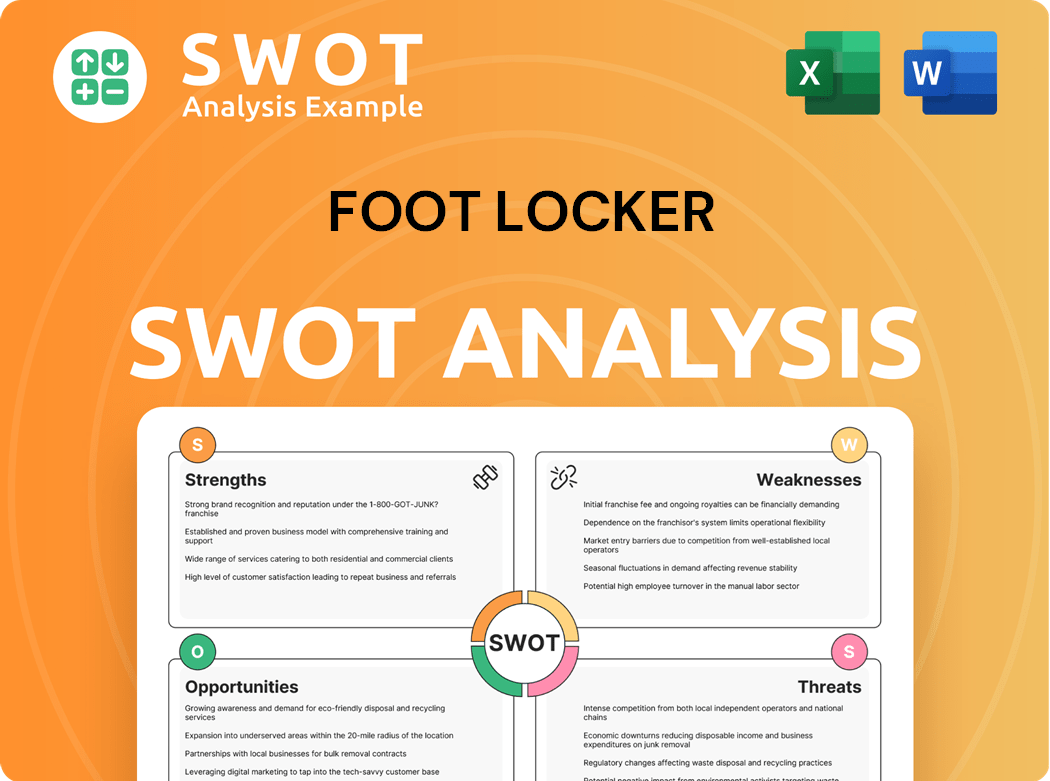

Foot Locker SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Foot Locker’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and the athletic footwear and apparel industry is no exception. For the [Company Name], a deep dive into the customer base reveals a complex interplay of desires that drive purchasing decisions. This includes the pursuit of the latest sneaker releases, a seamless shopping experience, and a connection to brand partnerships and cultural relevance.

The company's ability to adapt to these evolving needs is reflected in its strategic initiatives, such as the revamped FLX Rewards program and the rollout of 'Reimagined' concept stores. These efforts aim to enhance customer loyalty and engagement. The company's focus on customer satisfaction and brand building is evident in its marketing strategies and product offerings.

The company's target market, or the Foot Locker audience, is driven by a combination of psychological, practical, and aspirational factors. The company's strategy to cater to these diverse needs is a key factor in its continued success in the competitive sneaker market.

A primary driver for the Foot Locker customer profile is the desire for the newest and most exclusive sneaker releases, often referred to as 'drops'. The company emphasizes priority access to highly anticipated launches through its FLX Rewards program. This focus caters to the customer's aspiration to own the latest and most sought-after footwear.

The revamped FLX Rewards program, relaunched in the U.S. in 2024 after a successful pilot in Canada in 2023, allows members to redeem points for 'FLX Cash' (discounts of $5, $10, or $20 off). This shift from a previous system demonstrates the company's responsiveness to customer feedback. This program offers tangible benefits to its members.

Customers seek a seamless and engaging shopping experience, both in-store and online. The company is addressing this through its 'Lace Up' plan, which includes evolving in-store experiences and enhancing digital capabilities. The company aims to deliver a customer-centric, fun, and immersive experience.

The company is rolling out 'Reimagined' concept stores that aim to deliver a customer-centric, fun, and immersive experience, supporting brand storytelling. As of February 1, 2025, there are eight 'Reimagined' concept stores across North America, Europe, Asia, and Australia, with plans to accelerate this rollout in 2025 with 80 more doors.

The upgraded mobile app, rolled out in the US in November 2024, includes features like a 'Heat Monitor' for tracking pre-launch hype, improved search and filtering, and seamless FLX Rewards integration. In early 2025, a 'Store Mode' feature will be added to the app, allowing customers to scan in-store SKUs to check availability and sizes.

Beyond product and experience, customers are influenced by brand partnerships and cultural relevance. The company leverages its multi-brand leadership position to serve more sneaker occasions and provide more choices, with strong growth from non-Nike brands like Adidas and New Balance. The company also engages in brand building through compelling campaigns and partnerships.

The Foot Locker target market demonstrates specific preferences that the company actively caters to. These preferences influence Foot Locker customer buying behavior and are central to the company's marketing and product strategies. Understanding these preferences is key to tailoring the Foot Locker marketing strategy effectively.

- Exclusive Products: Customers prioritize access to limited-edition sneakers and apparel.

- Convenient Shopping: Customers value a seamless shopping experience, both online and in-store.

- Rewarding Loyalty: Customers appreciate tangible benefits and exclusive perks through loyalty programs.

- Cultural Relevance: Customers are drawn to brands that align with their interests and values.

- Brand Partnerships: Customers respond positively to collaborations with popular brands and influencers.

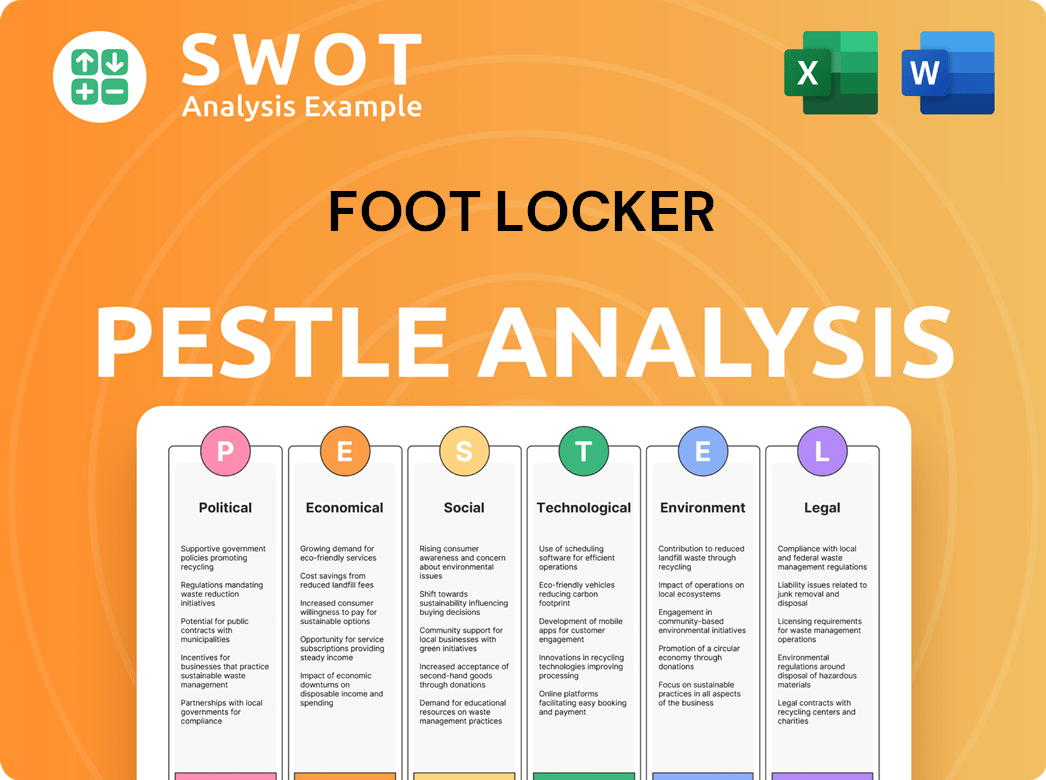

Foot Locker PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Foot Locker operate?

The geographical market presence of Foot Locker, Inc. is extensive, with a significant global retail footprint. As of May 3, 2025, the company operated a total of 2,363 stores across 20 countries, including North America, Europe, Asia, Australia, and New Zealand. Additionally, there were 236 licensed stores operating in the Middle East, Europe, and Asia.

The company's strategy involves a blend of expansion and optimization, with a focus on key markets. Foot Locker's presence spans multiple continents, showcasing its commitment to reaching a broad customer base. This global reach is a key factor in understanding the company's customer demographics and target market.

As of February 1, 2025, the company had 2,410 stores across 26 countries. This includes a licensed store presence in the Middle East, Europe, and Asia. The company continues to adapt its strategy to align with market dynamics and consumer preferences.

North America remains a critical market for the company. Strong comparable sales growth was seen in Foot Locker North America and Kids Foot Locker North America. In Q1 2024, North America's overall comparable sales decreased by 2.5%, but Foot Locker North America saw a 0.8% increase, and Kids Foot Locker comps were up 6.4%.

The company is strategically optimizing its real estate footprint. As of February 1, 2025, 42% of its off-mall store gross square footage in North America, increased from 39% in February 2024. This strategy aims to enhance accessibility and adapt to evolving consumer shopping behaviors.

Foot Locker is rolling out its 'Reimagined' concept stores globally. As of February 1, 2025, there were eight such locations across North America, Europe, Asia, and Australia. Plans include opening 80 more in 2025, mainly through conversions or relocations.

A significant store refresh program is underway. In 2024, 407 refreshes were completed, bringing 44% of Foot Locker, Kids Foot Locker, and Champs Sports gross store square footage to current brand standards. Approximately 300 more refreshes are planned for 2025.

Foot Locker is also making strategic adjustments to its international presence. In 2024, the company announced plans to exit certain international markets, including Denmark, Norway, Sweden, and South Korea by mid-2025. Decisions to convert select European markets to a licensed model have also been made. For example, the businesses in Greece and Romania were sold to a license partner in April 2025. These moves are part of a broader strategy to streamline operations and focus on markets where performance and outperformance are achievable. To understand the complete picture, it's helpful to review the Marketing Strategy of Foot Locker.

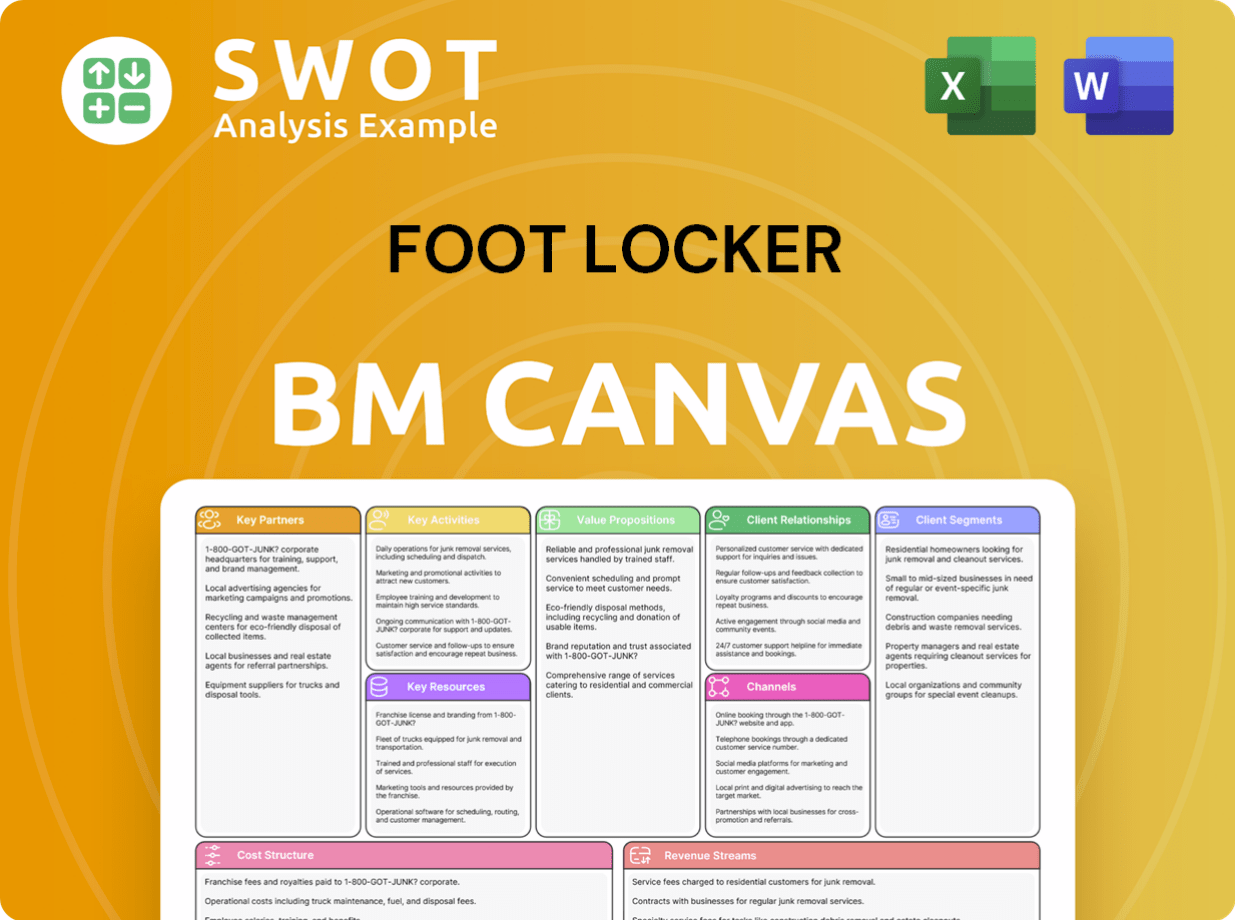

Foot Locker Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Foot Locker Win & Keep Customers?

To attract and keep customers, employs a multi-pronged approach, central to which is its 'Lace Up' strategy. This plan focuses on enhancing customer loyalty and expanding its digital presence. The company also invests in improving the in-store experience to create a more engaging environment for its customers. This strategy is designed to cater to its diverse customer base and maintain its position in the competitive footwear retail market.

A key element of this strategy is the revamped FLX Rewards Program, which has shown promising results. Digital channels are equally important, with a new mobile app playing a crucial role in engaging customers. Furthermore, the company is committed to improving its in-store experience through store renovations and immersive brand activations, all aimed at enhancing customer satisfaction and driving sales. These efforts are designed to resonate with the company's target market and drive long-term growth.

The company's approach to customer acquisition and retention is multifaceted, focusing on loyalty programs, digital channels, in-store experiences, and strategic partnerships. This integrated strategy is designed to appeal to its varied customer base and strengthen its market position. By focusing on these key areas, the company aims to foster lasting relationships with its customers and drive continued growth in the sneaker market.

The enhanced FLX Rewards Program is a core component of the 'Lace Up' strategy. It was relaunched in the United States in 2024, after a successful pilot in Canada in 2023. This program has significantly boosted customer loyalty and sales.

Digital channels are crucial for customer acquisition and retention. The company rolled out a new mobile app in the US in November 2024. This app offers real-time launch updates and upgraded search capabilities.

Investing in 'Reimagined' store concepts and a store refresh program is essential. Eight 'Reimagined' stores were open as of February 1, 2025, with plans for 80 more in 2025. The company aims to create an immersive brand experience.

Engaging in compelling campaigns and partnerships is another strategy. The company's basketball activations at NBA All-Star 2025 are an example. Diversifying the brand portfolio also helps attract a broader customer base.

The company's customer acquisition and retention strategies are designed to strengthen its connection with its Foot Locker audience. The success of these strategies is evident in the increased loyalty sales capture rate, which reached 33% in 2024, up from 23% in 2023. The digital initiatives, such as the new mobile app, are also contributing to the company's ability to reach its Foot Locker target market. For additional insights, consider exploring the Growth Strategy of Foot Locker.

The FLX Rewards Program allows members to redeem points for discounts and provides access to exclusive launches. Members also receive free returns and upgraded birthday gifts. The program features tiered benefits, rewarding loyal members.

The new mobile app offers real-time launch updates with a 'Heat Monitor' feature. It also includes upgraded search and filtering options. A 'Store Mode' feature is planned for early 2025 to enhance the omnichannel experience.

The store refresh program aims to elevate and standardize the customer experience. The company completed 407 store refreshes in 2024 and plans for around 300 more in 2025. The goal is to have 800 renovated stores by the end of 2025.

The company aims to achieve 50% loyalty penetration by 2026, with a long-term goal of 70%. The increased loyalty sales capture rate demonstrates the effectiveness of the program.

The new mobile app contributed to increasing digital penetration by 100 basis points to 18.2%. This growth highlights the importance of digital channels in reaching customers.

The company fulfills a large number of its digital orders from the back of its stores. This strategy leverages its physical footprint for enhanced omnichannel capabilities, improving the overall customer experience and catering to the Foot Locker customer profile.

Foot Locker Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Foot Locker Company?

- What is Competitive Landscape of Foot Locker Company?

- What is Growth Strategy and Future Prospects of Foot Locker Company?

- How Does Foot Locker Company Work?

- What is Sales and Marketing Strategy of Foot Locker Company?

- What is Brief History of Foot Locker Company?

- Who Owns Foot Locker Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.