Foot Locker Bundle

Who Really Owns Foot Locker?

Understanding the ownership structure of a company is crucial for grasping its future. With the sports retail landscape constantly evolving, a major shift is on the horizon for Foot Locker, Inc. The announced acquisition by DICK'S Sporting Goods, slated for late 2025, marks a pivotal moment for the well-known footwear retailer.

Foot Locker, a global leader in athletic footwear and apparel, has a fascinating history, evolving from its roots in the F.W. Woolworth Company to the brand we know today. With a market capitalization of approximately $1.95 billion as of January 2025, and operating over 2,500 stores worldwide, the company's ownership is key to understanding its strategic direction. This analysis explores Foot Locker SWOT Analysis, key investors, and the implications of the upcoming acquisition, providing insights into the future of this major player in the market, including its relationship with giants like Nike and Adidas.

Who Founded Foot Locker?

The origins of Foot Locker are closely tied to the F.W. Woolworth Company, established in 1879 by F.W. Woolworth. While Santiago Lopez is also listed as a founder, the brand emerged as part of Woolworth's expansion strategy. The acquisition of Kinney Shoe Corporation in 1963 by F.W. Woolworth Company led to the development of specialty shoe stores, including the first Foot Locker.

The first Foot Locker store opened its doors on September 12, 1974, in the Puente Hills Mall in City of Industry, California. Initially, the Foot Locker brand was a subsidiary of the F.W. Woolworth Company. Kinney Shoe Corporation, which owned the Foot Locker brand, was acquired by Woolworth in 1964. The initial ownership structure and equity splits are not publicly detailed as Foot Locker was an internal development.

As Woolworth's department stores declined, the company shifted its focus to its specialty retail operations. In April 1989, the F.W. Woolworth Company was reincorporated as the Woolworth Corporation, which was responsible for Foot Locker and other chains. This period saw the acquisition of Champs Sports and the renaming of the athletic retail division to the Woolworth Athletic Group. There are no readily available records of initial ownership disputes or significant founder buyouts specific to the Foot Locker brand during its early years.

F.W. Woolworth Company was the parent company of Foot Locker. The company's diversification efforts led to the creation of Foot Locker. Woolworth acquired Kinney Shoe Corporation, which then launched Foot Locker.

Kinney Shoe Corporation was acquired by Woolworth in 1963. Kinney's acquisition was a key step in the development of the Foot Locker brand. Kinney's expertise in footwear retail was crucial for Foot Locker's early success.

Foot Locker's early ownership was as a subsidiary of the F.W. Woolworth Company. Details of initial ownership agreements are not publicly available. The focus was on expanding specialty retail formats within Woolworth's structure.

In April 1989, F.W. Woolworth Company became the Woolworth Corporation. This change reflected a shift towards specialty retail, including Foot Locker. The Woolworth Athletic Group was also established during this period.

There are no records of significant founder buyouts in Foot Locker's early years. The brand's development was part of a larger corporate strategy. The focus was on expanding the retail footprint.

The first Foot Locker store opened in Puente Hills Mall, California. This marked the beginning of Foot Locker's expansion. This location was key to establishing the brand's presence.

The history of Foot Locker is closely tied to the evolution of the F.W. Woolworth Company and its strategic acquisitions. The initial ownership structure was as a subsidiary within the Woolworth corporate framework, with the brand's growth driven by the acquisition of Kinney Shoe Corporation. For a deeper dive into the company's history, consider reading the Brief History of Foot Locker.

- Foot Locker originated as a specialty retail format within the F.W. Woolworth Company.

- Kinney Shoe Corporation played a crucial role in the early development of the brand.

- The company's early ownership structure was part of a larger corporate strategy.

- The first store opened in California, marking the beginning of its expansion.

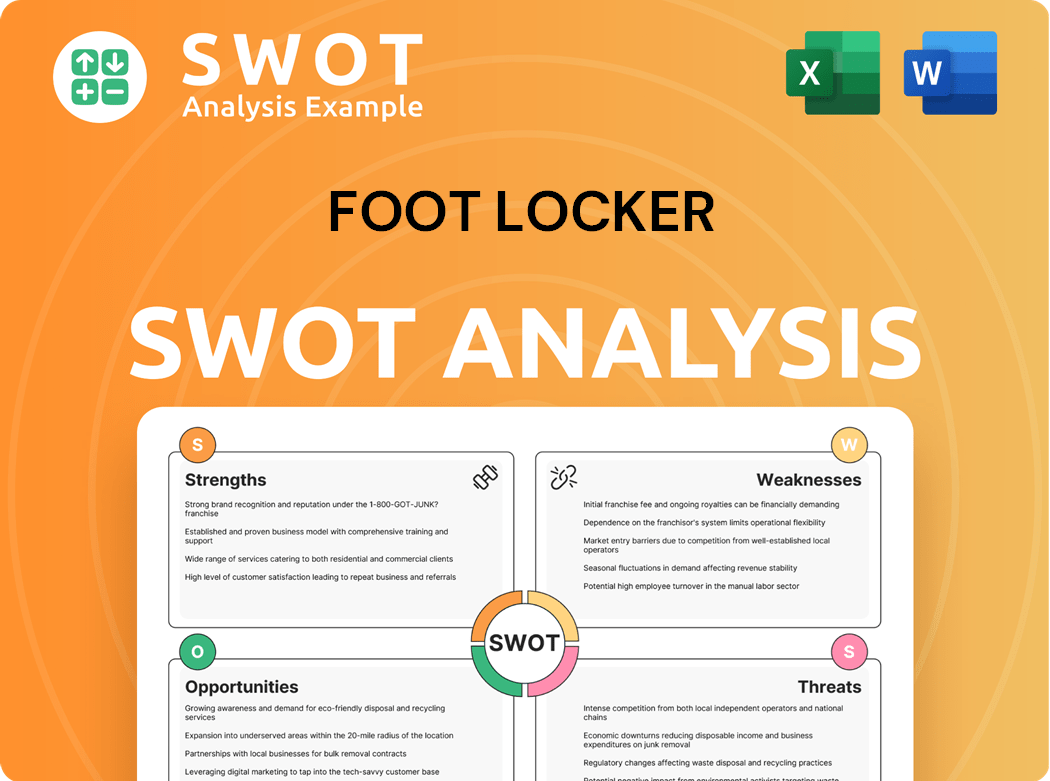

Foot Locker SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Foot Locker’s Ownership Changed Over Time?

The evolution of Foot Locker's ownership reflects its journey from a division of F.W. Woolworth Company to a standalone entity. The company, which began as a department store, transitioned through name changes, including Venator Group, Inc., before adopting the Foot Locker, Inc. name in 2001. This shift solidified the focus on its most successful retail brand. Today, Foot Locker is a publicly traded company on the NYSE under the ticker symbol FL, showcasing its growth and adaptation in the competitive footwear market.

As of February 1, 2025, Foot Locker had approximately 94,946,126 common shares outstanding, illustrating the scale of its public ownership. The ownership structure is diverse, with institutional investors holding a significant portion of the shares, followed by insiders and public/individual investors. This mix highlights the confidence and interest from various investor groups in the footwear retailer. Major institutional shareholders include BlackRock, Inc., Vanguard Group Inc, and Vesa Equity Investment S.a r.l. Other notable institutional holders as of May 2025 include Goldman Sachs Group Inc. and Invenomic Capital Management LP.

| Shareholder Type | Percentage of Ownership (approximate) | Notes |

|---|---|---|

| Institutional Investors | 60.11% | Includes firms like BlackRock and Vanguard. |

| Insiders | 12.23% | Individuals within the company. |

| Public Companies and Individual Investors | 27.66% | Represents the remaining shares held by the public. |

Key events, such as acquisitions, have significantly impacted Foot Locker ownership and its strategic direction. The acquisition of WSS for $750 million in September 2021 and atmos for $360 million in November 2021 expanded its market reach and brand portfolio. Additionally, a strategic minority investment of $100 million in GOAT Group in February 2019 has diversified its business. These moves underscore Foot Locker's commitment to growth and adapting to market trends, as discussed in the Growth Strategy of Foot Locker.

Foot Locker's ownership is a blend of institutional, insider, and public investors, reflecting its status as a publicly traded company. Institutional investors hold the largest share, indicating significant confidence from major financial entities. Strategic acquisitions have broadened its market presence and brand portfolio.

- Publicly traded on the NYSE under the ticker FL.

- Significant institutional investor holdings.

- Strategic acquisitions have diversified the business.

- The company has a strong relationship with Nike and Adidas.

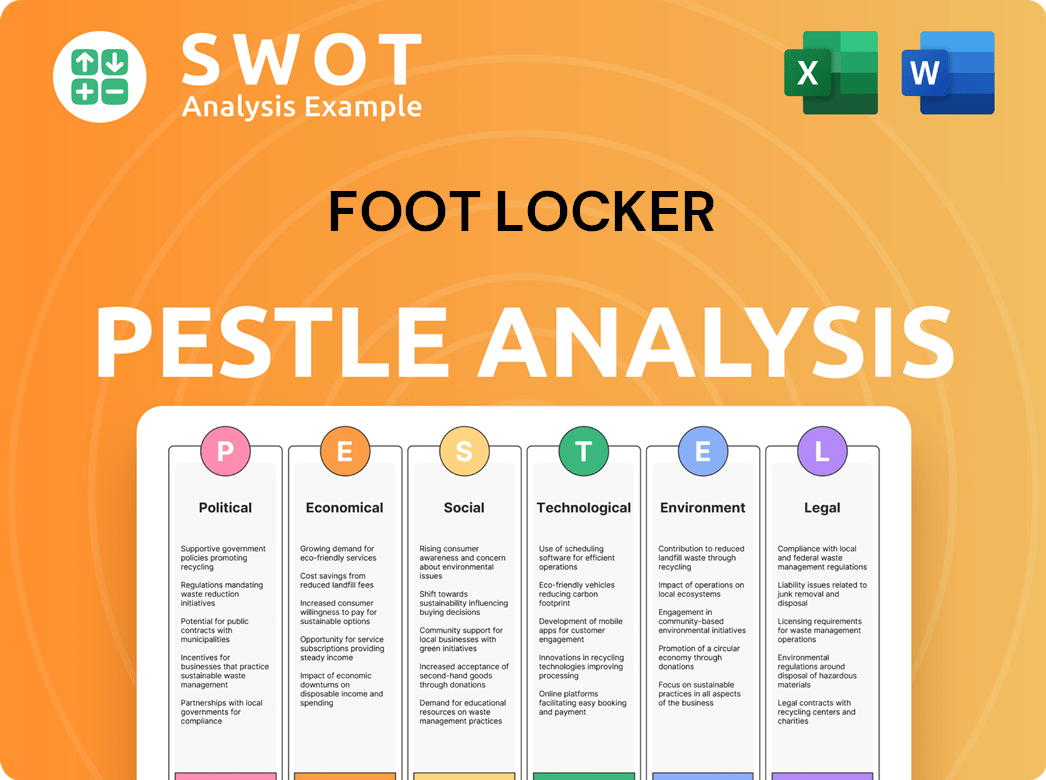

Foot Locker PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Foot Locker’s Board?

The current board of directors of Foot Locker, a prominent footwear retailer, is responsible for the company's governance and strategic oversight. While specific details on board member representation (major shareholders, founders, or independent seats) for 2024-2025 are not fully available in the provided search results, the company's proxy statement for its 2025 annual meeting of shareholders would contain this information. Mary Dillon currently serves as the President & CEO of Foot Locker.

Understanding the board's composition is crucial for investors and stakeholders interested in Foot Locker's direction. The board's decisions impact various aspects, including financial performance and strategic partnerships, such as those with Nike and Adidas. For more insights, consider reading about the Target Market of Foot Locker.

| Board Member Role | Details | Relevance |

|---|---|---|

| President & CEO | Mary Dillon | Oversees the company's operations and strategic direction. |

| Board of Directors | Specific members and their affiliations will be detailed in the 2025 proxy statement. | Provides oversight and makes key decisions on behalf of shareholders. |

| Shareholder Voting | One-share-one-vote structure. | Ensures that shareholders have a say in major corporate actions. |

Foot Locker's voting structure generally operates on a one-share-one-vote basis, which is common for publicly traded companies. There is no indication of dual-class shares or special voting rights that would grant outsized control to specific individuals or entities. Shareholder activism is a recognized risk for publicly-traded companies like Foot Locker, potentially influencing corporate governance and strategic direction. A significant recent development impacting the company's future is the announced acquisition by DICK'S Sporting Goods, which is subject to Foot Locker shareholder approval and regulatory conditions.

The board of directors oversees Foot Locker's strategic direction. Shareholder voting is typically one-share-one-vote, influencing major corporate actions. The acquisition by DICK'S Sporting Goods underscores the importance of shareholder approval.

- Mary Dillon is the current President & CEO.

- Shareholder approval is needed for the DICK'S Sporting Goods acquisition.

- Shareholder activism can impact corporate governance.

- The 2025 proxy statement will provide detailed board member information.

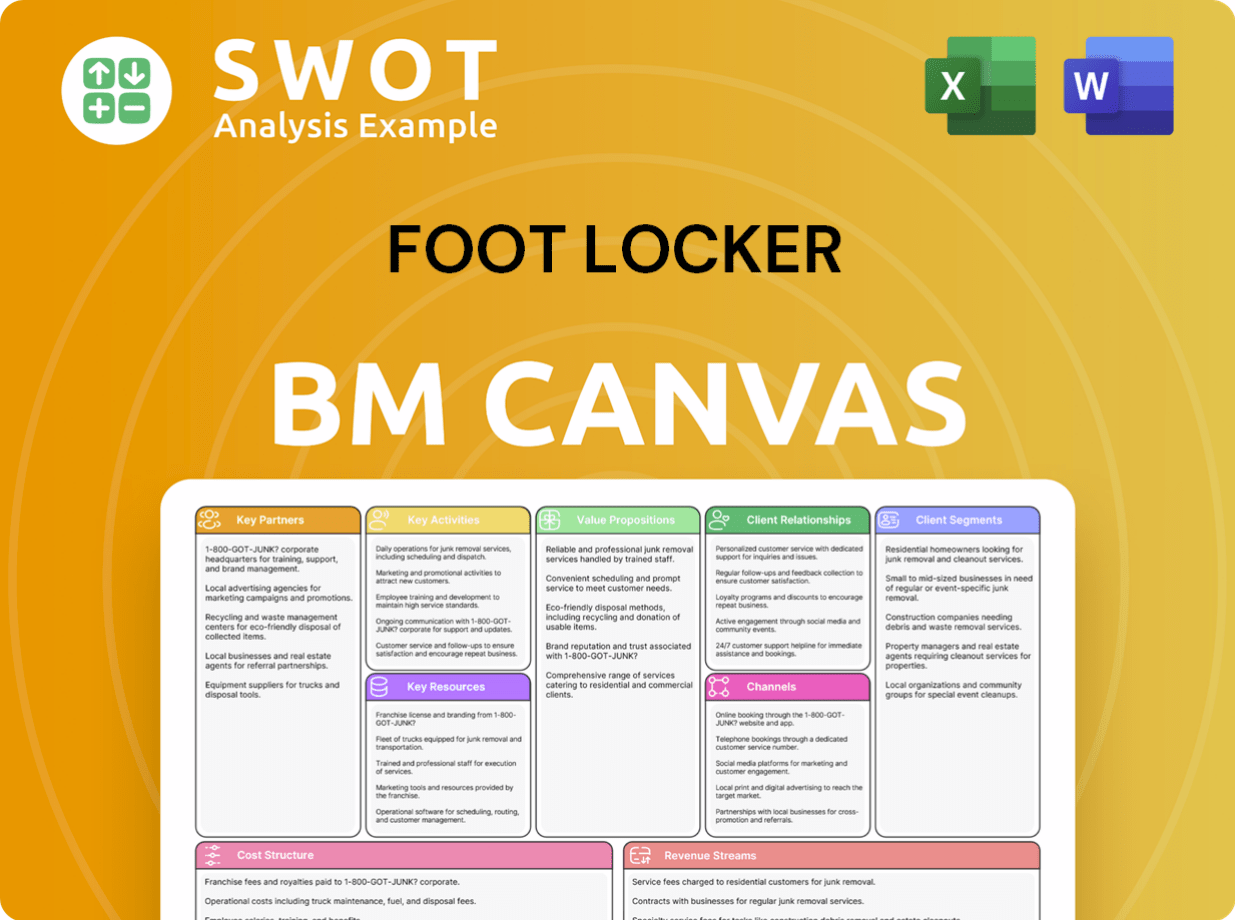

Foot Locker Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Foot Locker’s Ownership Landscape?

The landscape of Foot Locker ownership has been significantly reshaped by recent strategic moves. In May 2025, DICK'S Sporting Goods announced its plan to acquire Foot Locker for approximately $2.4 billion. This acquisition, expected to finalize in the second half of 2025, will integrate Foot Locker into DICK'S global operations while maintaining its standalone business unit. This is a major shift in Foot Locker ownership, impacting its future trajectory.

Foot Locker is also executing its 'Lace Up Plan,' which involves optimizing its store portfolio and digital capabilities. This includes refreshing over 400 stores in fiscal 2024 and planning for another 300 in 2025, with 80 new 'Reimagined' store concepts expected in fiscal 2025. The company plans to close about 400 mall-based stores by 2026, shifting towards new off-mall locations. Digital comparable sales saw a 12.4% increase in the fourth quarter of fiscal 2024, indicating a strong focus on digital growth.

| Metric | Value | Year |

|---|---|---|

| Net Global Sales | $7.97 billion | 2024 |

| Net Global Sales | $8.15 billion | 2023 |

| Share Buybacks | $118.61K | Ending January 30, 2025 |

Mary Dillon leads the company as CEO, overseeing a significant turnaround strategy. Furthermore, Foot Locker is relocating its corporate headquarters from New York City to St. Petersburg, Florida, by late 2025, a move designed to lower costs. The company has also been active with share buybacks, with reported buybacks valued at $118.61K for the period ending January 30, 2025. The company's net global sales reached $7.97 billion in 2024, down from $8.15 billion in 2023.

Mary Dillon is the current CEO of Foot Locker, spearheading the company's strategic initiatives. The company is undergoing significant changes under her leadership, including a headquarters relocation and a focus on digital growth.

Foot Locker's net global sales were $7.97 billion in 2024, a decrease from $8.15 billion in 2023. The company is actively managing its financial strategy through share buybacks and cost-saving measures, such as the headquarters move.

The 'Lace Up Plan' includes refreshing stores and expanding digital capabilities. The company plans to close about 400 mall-based stores by 2026 and open new off-mall locations. Digital comparable sales increased by 12.4% in Q4 2024.

The planned acquisition by DICK'S Sporting Goods for $2.4 billion will significantly impact Foot Locker's ownership structure. This acquisition is expected to close in the second half of 2025 and will integrate Foot Locker into DICK'S operations.

Foot Locker Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Foot Locker Company?

- What is Competitive Landscape of Foot Locker Company?

- What is Growth Strategy and Future Prospects of Foot Locker Company?

- How Does Foot Locker Company Work?

- What is Sales and Marketing Strategy of Foot Locker Company?

- What is Brief History of Foot Locker Company?

- What is Customer Demographics and Target Market of Foot Locker Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.