Foot Locker Bundle

How Does Foot Locker Thrive in the Sneaker Game?

Foot Locker, a global leader in athletic footwear and apparel, has become a cornerstone in the retail industry. With a rich history and a strong presence in the market, Foot Locker has successfully catered to sneaker enthusiasts and athletes. As of early 2025, the company continues to navigate the ever-changing retail landscape, adapting to consumer preferences and digital advancements.

Foot Locker's success hinges on its Foot Locker SWOT Analysis, and understanding its multifaceted approach is key. From its expansive network of stores, including Foot Locker, Kids Foot Locker, and Champs Sports, to its robust e-commerce platforms, the company's multi-channel strategy caters to a diverse customer base. This in-depth exploration will help investors, customers, and industry observers understand the intricacies of the Foot Locker business model, operations, and how it generates revenue within the competitive footwear retailer market.

What Are the Key Operations Driving Foot Locker’s Success?

The core of the Foot Locker business model revolves around offering a wide selection of athletic footwear and apparel from top brands. This caters to a diverse customer base, from serious athletes to fashion-forward sneaker enthusiasts. The company's operations are designed to ensure a steady supply of in-demand products, including exclusive releases, driving customer traffic and maintaining a competitive edge in the retail industry.

Foot Locker's value proposition centers on providing access to sought-after items, personalized service, and a consistent retail experience across its physical and digital platforms. This includes a blend of physical retail locations and a growing digital presence. Strategic partnerships for exclusive product drops also play a crucial role, differentiating it within the sneaker store market.

The company's operational processes are critical to its value delivery, encompassing strategic sourcing, logistics, and inventory management. Sales channels include physical retail locations and e-commerce platforms, supported by integrated customer service. The Foot Locker supply chain is characterized by strong vendor relationships and efficient distribution networks.

Foot Locker maintains strong relationships with major athletic brands such as Nike and Adidas. This ensures a consistent supply of popular products, including limited-edition releases. These exclusive items are a key driver of customer interest and sales, differentiating Foot Locker from its competitors.

Efficient distribution networks are vital for delivering products to stores and online customers. This includes rapid replenishment systems to maintain optimal inventory levels. Effective logistics are crucial for meeting the high demand for specific product launches.

Foot Locker focuses on providing a seamless shopping experience across all channels. This includes knowledgeable staff in physical stores and user-friendly e-commerce platforms. Customer service is integrated to ensure customer satisfaction and loyalty.

Foot Locker's e-commerce platforms offer convenience and broader product accessibility. The company continues to invest in its digital channels to enhance the online shopping experience. This includes mobile apps and website improvements.

Foot Locker's success depends on integrating its physical and digital operations effectively. This includes leveraging its store network for online order fulfillment and returns. The company's ability to adapt to changing consumer preferences is crucial.

- Strategic Partnerships: Collaborations with brands for exclusive product drops.

- Inventory Management: Efficient systems to manage and distribute merchandise.

- Customer Service: Providing support across all channels.

- Digital Investments: Enhancing the online shopping experience.

The company's revenue breakdown shows a significant portion from footwear sales, followed by apparel and accessories. For a deeper dive into the financial aspects, including ownership and shareholder information, you can explore the details in this article about Owners & Shareholders of Foot Locker.

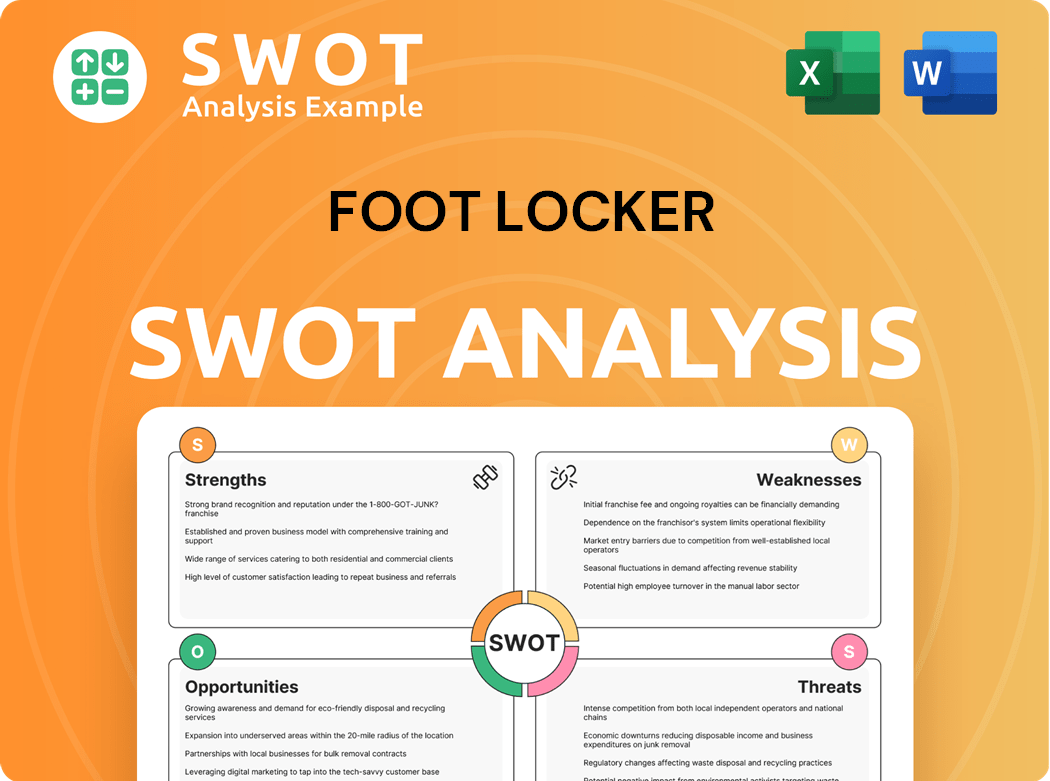

Foot Locker SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Foot Locker Make Money?

The core of Foot Locker's financial success lies in its revenue streams and how it monetizes its offerings. As a prominent footwear retailer, the company has established a robust business model. This model focuses on selling athletic footwear and apparel through various channels.

Foot Locker's revenue is primarily generated from selling athletic footwear, apparel, and accessories. Its monetization strategy involves a multi-channel approach, including physical stores and e-commerce platforms. The company also uses exclusive product launches and collaborations with major brands to drive sales.

The company's Foot Locker business model is designed to maximize sales through both physical and digital channels. By understanding how Foot Locker operations work, investors and analysts can better assess its financial performance and growth potential. For example, in fiscal year 2024, the company reported total sales of $8.1 billion.

Foot Locker's primary revenue stream is the sale of athletic footwear and apparel. This includes sneakers, running shoes, activewear, and accessories. The company uses a multi-channel retail approach to generate revenue.

- Footwear Sales: The majority of revenue comes from selling sneakers and athletic shoes.

- Apparel and Accessories: Sales of clothing and accessories contribute to overall revenue.

- Physical Stores: Prime locations and in-store experiences drive direct sales.

- E-commerce: Online platforms provide convenience and broader reach, contributing significantly to sales.

- Exclusive Products and Collaborations: These drive demand and full-price sales.

- Loyalty Programs: Encourage repeat purchases and customer engagement.

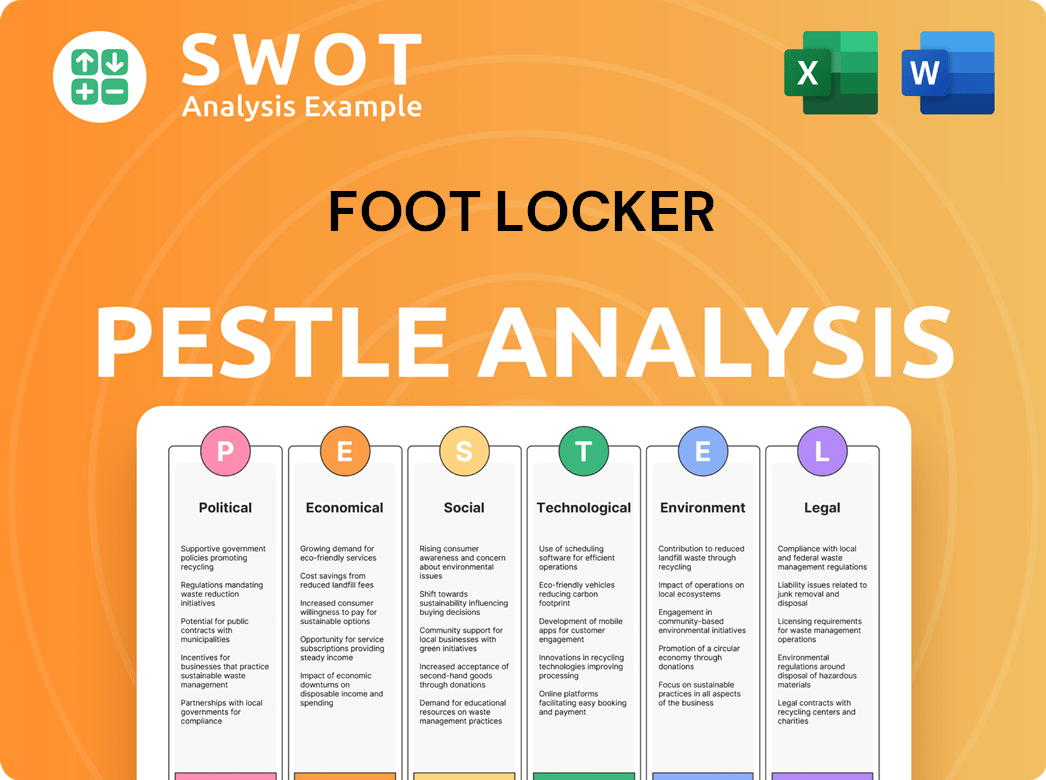

Foot Locker PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Foot Locker’s Business Model?

The journey of Foot Locker, a prominent footwear retailer, has been marked by significant milestones and strategic shifts. These moves have been crucial in shaping its operational framework and financial performance within the retail industry. One of the ongoing strategic initiatives is the 'Lace Up' plan, designed to streamline operations, boost efficiency, and enhance profitability. This plan includes optimizing the store network, focusing on closing underperforming locations while investing in high-performing stores and digital capabilities.

Foot Locker's strategy also involves diversifying its brand portfolio to lessen its dependence on any single vendor. The company aims to have Nike represent 55-60% of its vendor spend by 2026, a decrease from 65% in 2022. This diversification strategy is a key element in adapting to changes in consumer preferences and market dynamics. The company's ability to secure exclusive product releases from leading athletic brands also provides a significant competitive edge, driving traffic and demand.

Operational challenges, such as supply chain disruptions and shifts in consumer shopping habits, have prompted Foot Locker to accelerate its digital investments and enhance its omnichannel capabilities. These adaptations are vital for maintaining a strong market position. The company's strong brand recognition and global retail footprint provide widespread accessibility and a loyal customer base, supporting its long-term growth.

Foot Locker has a long history, evolving from its origins to become a global leader in athletic footwear and apparel. Key milestones include expansions, acquisitions, and strategic partnerships. These developments have shaped its brand and market position. The company continually adapts to changing consumer trends.

The 'Lace Up' plan is a major strategic move, focusing on store optimization and digital enhancements. Diversifying the brand portfolio is another key strategy to reduce reliance on single vendors. Investments in technology and supply chain improvements are ongoing to enhance the customer experience and operational efficiency.

Foot Locker's strong brand recognition and global retail footprint provide a significant competitive advantage. Securing exclusive product releases from leading athletic brands drives traffic and demand. The company's ability to adapt to new trends by investing in technology helps sustain its business model in a dynamic retail environment.

Foot Locker's operations involve managing a vast network of stores and an online presence. The company's supply chain, store layout, and customer service are critical components of its operations. The online shopping experience is also continually enhanced to meet consumer expectations. For more insights, check out the Competitors Landscape of Foot Locker.

In fiscal year 2023, Foot Locker closed 117 stores and opened 40 new ones, resulting in a net reduction of 77 stores. The company exited its Champs Sports banner in Canada in early 2024, converting some locations to Foot Locker stores. These actions reflect the company's ongoing efforts to streamline its store portfolio.

- Foot Locker is focused on enhancing its digital capabilities to improve the online shopping experience.

- The company is investing in technology to personalize customer interactions and improve inventory management.

- Supply chain improvements are a key focus to streamline operations and reduce costs.

- Foot Locker continues to adapt to changing consumer preferences and market dynamics.

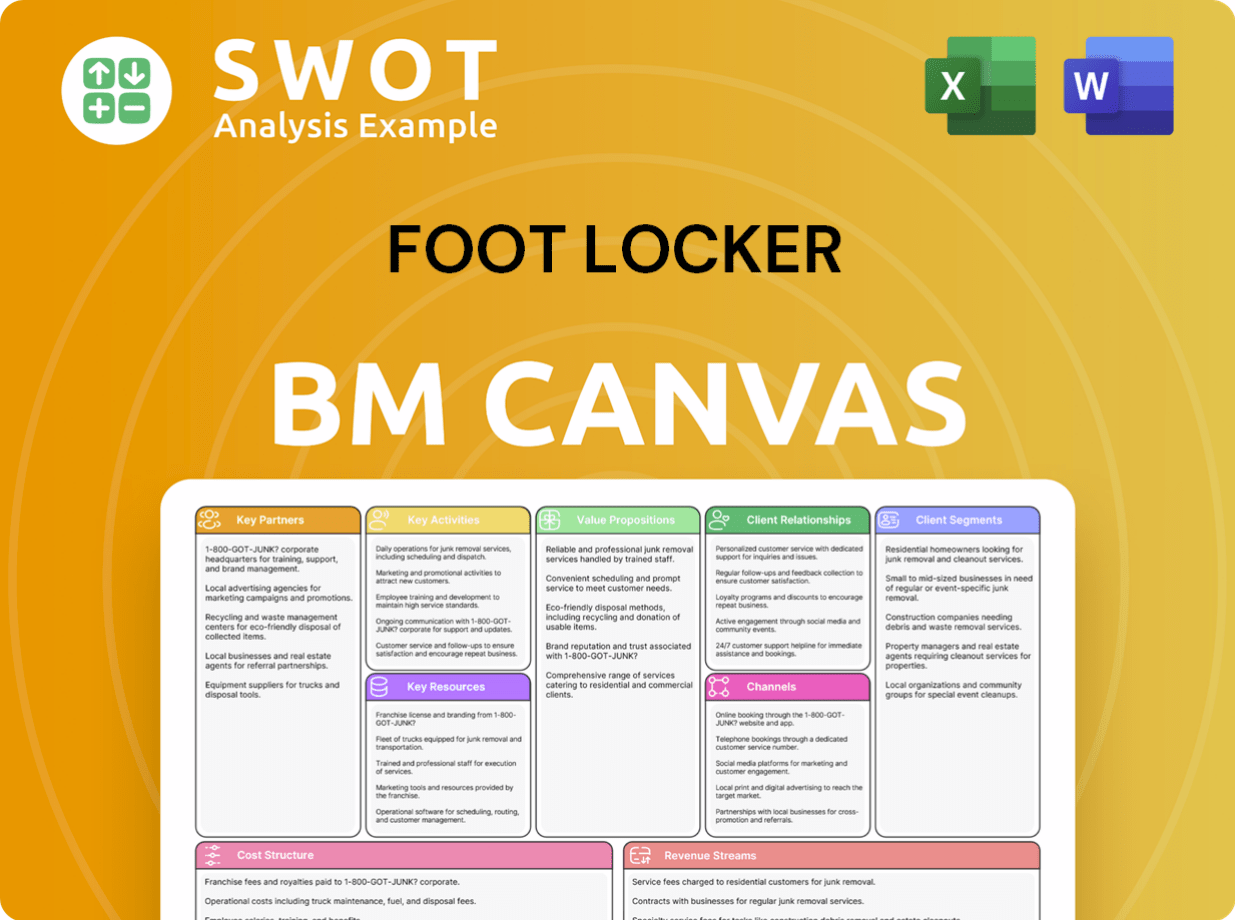

Foot Locker Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Foot Locker Positioning Itself for Continued Success?

Foot Locker maintains a prominent position as a leading global footwear retailer within the athletic footwear and apparel industry. Its extensive network of stores and strong brand relationships contribute to its significant market presence. Customer loyalty is fostered through curated product offerings, exclusive releases, and a comprehensive shopping experience, both in-store and online. Recent strategic adjustments include optimizing its international footprint, such as exiting the German market in 2023.

The company's operations are subject to various risks, including intense competition from other multi-brand retailers, direct-to-consumer strategies of major athletic brands, and e-commerce platforms. Economic downturns, changing consumer preferences, and geopolitical factors also pose challenges. Foot Locker's strategic initiatives, like the 'Lace Up' plan, aim to mitigate these risks by optimizing its store fleet, enhancing digital capabilities, and diversifying its brand portfolio. The company is focused on driving long-term growth by strengthening its connection with sneaker culture and delivering an elevated customer experience.

Foot Locker is a major player in the retail industry, particularly within the footwear retailer sector. It competes with other multi-brand retailers and direct-to-consumer channels. The company's global presence and brand partnerships are key to its market position.

Key risks include competition, changing consumer preferences, and economic downturns. Supply chain disruptions and geopolitical factors also pose challenges. Foot Locker's ability to adapt to these risks will influence its future performance.

Foot Locker aims to drive growth through its 'Lace Up' plan, focusing on store optimization and digital enhancements. The company is committed to strengthening its connection with sneaker culture. Continued adaptation to market trends and strategic initiatives will be important.

Foot Locker is focused on enhancing its digital capabilities and optimizing its store fleet. The company is also diversifying its brand portfolio to reduce reliance on any single vendor. These initiatives are part of its strategy to improve operational efficiency.

In 2023, Foot Locker reported net sales of approximately $7.4 billion. The company is implementing its 'Lace Up' plan to drive growth. This plan includes store fleet optimization, digital enhancements, and brand diversification. For more details on their marketing approach, check out this article: Marketing Strategy of Foot Locker.

- Focus on digital transformation to enhance the online shopping experience.

- Emphasis on exclusive product releases and collaborations to attract customers.

- Strategic store closures and relocations to optimize the retail footprint.

- Investments in supply chain improvements to manage costs and improve efficiency.

Foot Locker Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Foot Locker Company?

- What is Competitive Landscape of Foot Locker Company?

- What is Growth Strategy and Future Prospects of Foot Locker Company?

- What is Sales and Marketing Strategy of Foot Locker Company?

- What is Brief History of Foot Locker Company?

- Who Owns Foot Locker Company?

- What is Customer Demographics and Target Market of Foot Locker Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.