Foot Locker Bundle

How Does Foot Locker Dominate the Sneaker Game?

The athletic footwear and apparel industry is a battlefield of brands, constantly shifting with trends and technology. Foot Locker, a global powerhouse since 1974, has carved a significant niche in this dynamic market. This analysis dives deep into the Foot Locker SWOT Analysis, exploring its strategies and competitive positioning.

Understanding the Foot Locker competitive landscape is crucial for anyone tracking the footwear industry and sports retail. This report will identify Foot Locker competitors, assess its market analysis, and explore how it navigates the ever-changing athletic apparel market. We'll examine its market share analysis 2024, compare it to giants like Nike, and review its financial performance, offering insights into its strategic moves and future prospects.

Where Does Foot Locker’ Stand in the Current Market?

Foot Locker, Inc. is a significant player in the global athletic footwear and apparel retail industry. The company's core operations center around the sale of athletic footwear, apparel, and accessories, primarily sourced from major brands. Foot Locker's value proposition lies in offering a curated selection of athletic products, catering to both sneaker enthusiasts and everyday consumers.

As of early 2024, the company reported total sales of $8.185 billion for fiscal year 2023, reflecting a challenging retail environment. Foot Locker's extensive store network and growing digital presence provide multiple avenues for consumers to access its products. The company's strategic initiatives, such as the 'Lace Up' plan, aim to simplify operations and enhance the customer experience.

Foot Locker's market position is shaped by its ability to maintain strong brand relationships and adapt to evolving consumer preferences. Its geographic footprint spans North America, Europe, Asia, Australia, and New Zealand. The company's success is closely tied to its ability to navigate the changing retail landscape and compete effectively with both brick-and-mortar and online retailers.

Foot Locker primarily focuses on athletic footwear, apparel, and accessories. The company's product range includes items from top brands like Nike, Adidas, and Puma. This curated selection caters to a wide customer base, from sneakerheads to casual wearers.

Foot Locker has a broad international presence. Its stores are located across North America, Europe, Asia, Australia, and New Zealand. This widespread presence allows Foot Locker to tap into diverse markets and customer segments.

Foot Locker is implementing the 'Lace Up' plan to streamline operations. This plan aims to improve customer experience and diversify the brand portfolio. These initiatives are crucial for maintaining a competitive edge in the sports retail market.

In fiscal year 2023, Foot Locker reported sales of $8.185 billion. This figure reflects the challenges faced in the retail environment. The company's financial health is supported by strategic initiatives focused on enhancing its market position.

Foot Locker holds a significant position within the athletic footwear and apparel market. While specific market share figures fluctuate, the company remains one of the largest specialized athletic retailers globally. The Foot Locker competitive landscape includes both brick-and-mortar stores and online retailers.

- Key competitors include major sports retailers and direct-to-consumer channels.

- The company's store network and brand relationships contribute to its competitive advantages.

- Foot Locker's ability to adapt to changing consumer trends is vital for maintaining its market share.

- For a more detailed look, explore this article about the Foot Locker market analysis.

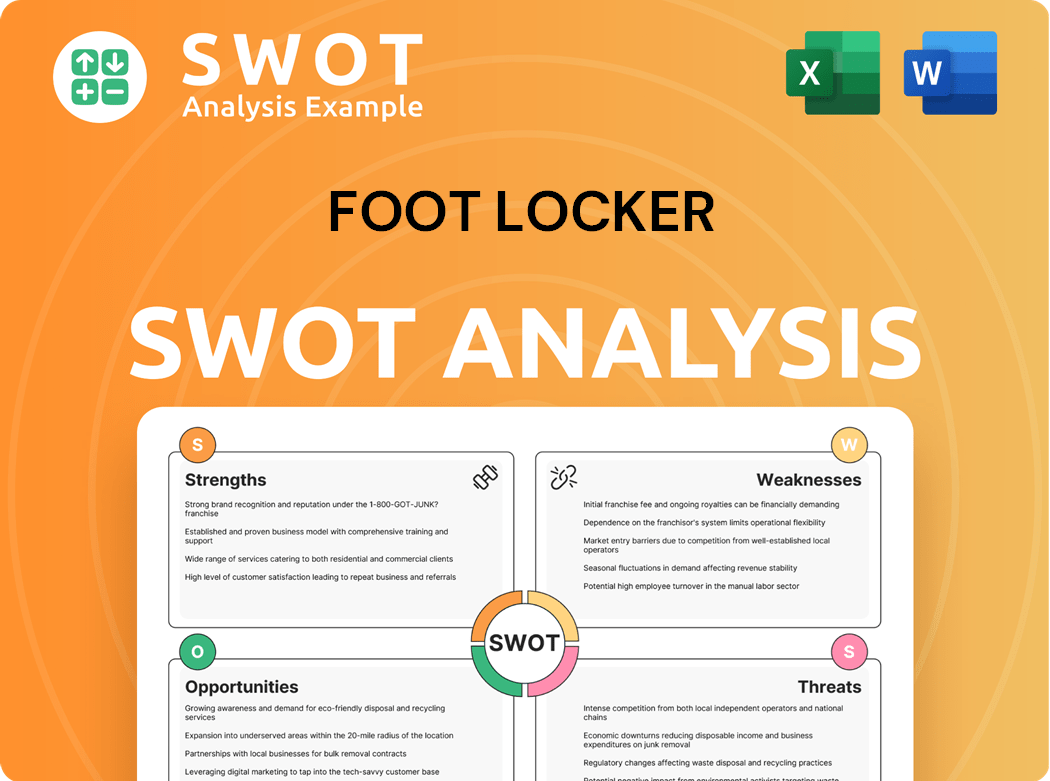

Foot Locker SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Foot Locker?

The Growth Strategy of Foot Locker is significantly shaped by the competitive landscape within the athletic footwear and apparel market. Understanding the key players and their strategies is crucial for assessing its market position and future prospects. The company's ability to navigate these competitive pressures directly impacts its financial performance and strategic decisions.

The athletic apparel market is dynamic, with constant shifts in consumer preferences, technological advancements, and the rise of e-commerce. This environment requires continuous adaptation and innovation to maintain market share and profitability. The company's success hinges on its ability to differentiate itself through product offerings, customer experience, and strategic partnerships.

The competitive landscape for the company is complex, involving both direct and indirect competitors. These competitors range from large-scale athletic retailers to major athletic brands and online platforms. The company must contend with various strategies, including exclusive product launches, pricing adjustments, and digital engagement initiatives, to stay relevant and competitive.

Direct competitors include other large-scale athletic retailers and department stores. These rivals often carry similar product assortments and target similar demographics. Competition is fierce, particularly in areas like pricing, product selection, and store location.

JD Sports is a prominent direct competitor, especially in Europe and is expanding in North America. It is known for its strong presence and similar product offerings. In 2023, JD Sports reported a revenue of approximately £12.4 billion.

DICK's Sporting Goods competes directly, offering a broader range of sporting goods. It leverages its extensive store network and online presence. DICK's reported net sales of approximately $12.9 billion in fiscal year 2023.

Major athletic brands like Nike, Adidas, and Under Armour are also direct competitors, particularly through their direct-to-consumer (DTC) channels. These brands have robust e-commerce platforms and flagship stores. Nike's revenue for fiscal year 2024 was approximately $51.2 billion.

Indirect competition comes from general merchandise retailers and online platforms. These entities offer athletic footwear and apparel as part of their broader product range. They often compete on price and convenience.

Amazon and Walmart represent indirect competition due to their vast e-commerce capabilities and competitive pricing. They can significantly impact the mass-market segment. Amazon's net sales in 2023 were approximately $574.8 billion.

The athletic apparel market is highly dynamic, with ongoing battles over exclusive product launches, pricing strategies, and digital engagement. The company must constantly adapt to changing consumer preferences and market trends. Understanding these dynamics is crucial for maintaining a competitive edge.

- Exclusive Product Launches: Securing exclusive releases from major brands is a key strategy.

- Pricing Strategies: Competitive pricing is crucial to attract and retain customers.

- Digital Engagement: Enhancing online presence and customer experience is essential.

- Resale Platforms: The rise of resale platforms adds another layer of competition.

- Market Share Analysis: Analyzing market share data helps to understand the competitive landscape.

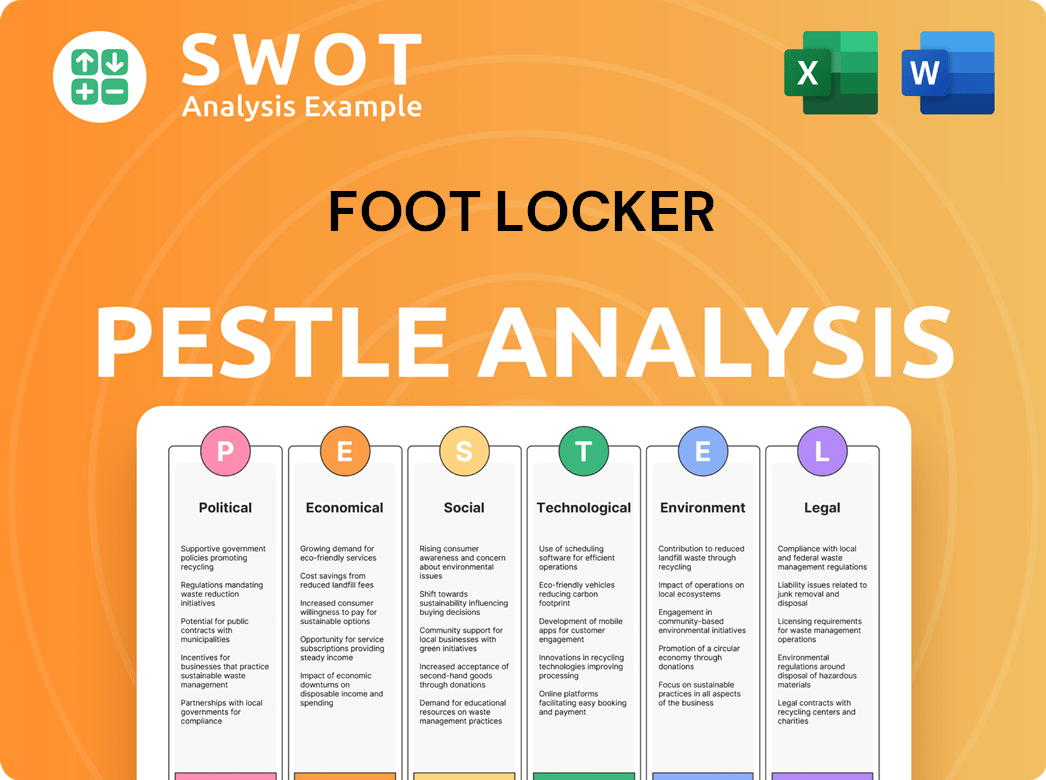

Foot Locker PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Foot Locker a Competitive Edge Over Its Rivals?

Understanding the competitive landscape is crucial for assessing any company's prospects. In the case of Foot Locker, several key factors contribute to its competitive advantages within the footwear industry and the broader sports retail sector. This analysis delves into the core strengths that enable Foot Locker to maintain its market position, even amidst evolving consumer behaviors and increased competition from both traditional rivals and online retailers. A thorough Foot Locker market analysis reveals the nuances of its strategy.

Foot Locker's success is not solely based on its product offerings; it's also about how it connects with its customers and manages its operations. The company's ability to adapt to changing trends, leverage its brand relationships, and invest in digital capabilities are essential elements of its competitive edge. This examination will explore these aspects, providing insights into Foot Locker's strategic approach and how it aims to stay ahead in a dynamic market. To understand the company's trajectory, it's important to consider the Growth Strategy of Foot Locker.

Foot Locker's competitive advantages are multifaceted, stemming from its extensive store network, strong brand relationships, and focus on customer engagement. These elements, combined with strategic investments in digital transformation, position the company to navigate the challenges of the athletic apparel market and maintain its relevance in the evolving retail landscape. The company's ability to secure exclusive product launches and cultivate a loyal customer base are critical differentiators.

Foot Locker maintains a significant global presence with stores strategically located in high-traffic areas. This physical footprint allows for a convenient shopping experience, enabling customers to try on products and receive in-person assistance. As of early 2024, Foot Locker operates over 2,600 stores globally, a testament to its broad reach and accessibility.

Foot Locker has established robust relationships with leading athletic brands, particularly Nike and Adidas. These partnerships often result in exclusive product launches and allocations, which attract sneaker enthusiasts and drive store traffic. These collaborations are crucial for maintaining a curated and desirable product assortment.

Foot Locker cultivates a strong brand image and customer loyalty through localized marketing and community engagement. The company's deep understanding of sneaker culture allows it to connect with its target demographic effectively. This approach is essential for building brand equity and fostering a loyal customer base.

Foot Locker invests in digital transformation to enhance its e-commerce platforms and loyalty programs. These initiatives aim to integrate the online and offline shopping experience, providing customers with seamless access to products and services. These efforts are critical for adapting to evolving consumer preferences.

Foot Locker's competitive advantages are built on its extensive store network, strong brand relationships, and customer-focused strategies. These elements work together to create a robust market position. Understanding these advantages provides valuable insights into the company's ability to compete effectively in the footwear and athletic apparel market.

- Extensive Store Network: A global presence with over 2,600 stores provides accessibility and supports omnichannel fulfillment.

- Brand Partnerships: Exclusive product launches with brands like Nike and Adidas drive customer traffic and loyalty.

- Customer Engagement: Localized marketing and community engagement build brand equity and connect with the target demographic.

- Digital Transformation: Investments in e-commerce and loyalty programs enhance the customer experience.

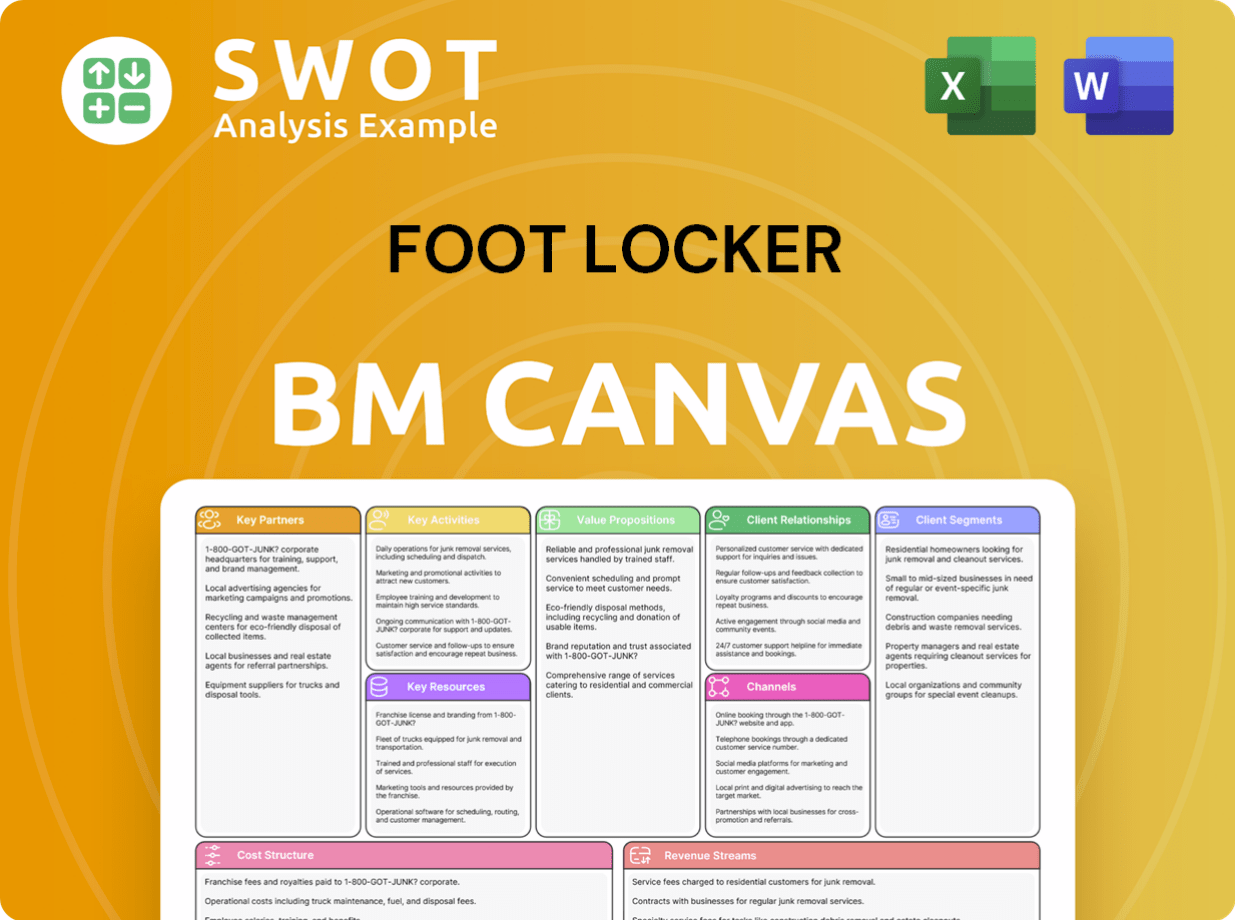

Foot Locker Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Foot Locker’s Competitive Landscape?

The athletic footwear and apparel market is a dynamic sector, constantly evolving due to shifts in consumer behavior, technological advancements, and the strategies of major players. Understanding the Foot Locker competitive landscape requires an examination of these trends and the challenges and opportunities they present. The Footwear industry and sports retail sectors are experiencing significant transformations, impacting companies like Foot Locker.

The Foot Locker market analysis reveals a complex environment influenced by both internal and external factors. The company faces challenges such as the increasing dominance of direct-to-consumer sales by key vendors and the need to adapt to changing consumer preferences. However, there are also opportunities for growth through digital innovation, international expansion, and strategic partnerships. This analysis is critical for investors, business strategists, and anyone interested in the athletic apparel market.

E-commerce continues to grow, with consumers increasingly preferring online shopping. Major athletic brands are expanding their direct-to-consumer (DTC) sales, potentially affecting Foot Locker's access to exclusive products. Sustainability and ethical sourcing are becoming more important to consumers, influencing purchasing decisions.

Navigating the evolving relationships with key vendors as they increase DTC efforts is crucial. Managing inventory effectively in a fast-paced fashion cycle presents ongoing challenges. Economic uncertainties and inflation could impact consumer spending. Adapting to changing consumer preferences is essential.

Expanding private label offerings and diversifying the brand portfolio could reduce reliance on key vendors. Further investment in digital innovation, including personalized shopping experiences, can enhance customer engagement. Growth in international markets presents opportunities for expansion.

Forming strategic partnerships with up-and-coming brands or technology companies could provide new growth avenues. Strengthening customer relationships and strategically diversifying offerings will be crucial. Adapting the business model to meet changing market dynamics.

Foot Locker must focus on strengthening its digital presence to compete effectively with online retailers. Diversifying its brand portfolio and expanding into international markets are also key strategies. The company needs to adapt its supply chain and logistics to meet the demands of e-commerce.

- Enhance digital marketing strategy to increase online sales.

- Analyze Foot Locker's target audience analysis to personalize shopping experiences.

- Develop a robust Foot Locker brand positioning strategy to maintain a competitive edge.

- Explore partnerships and collaborations for innovation and growth.

In 2024, the athletic footwear market continues to be highly competitive, with major players like Nike, Adidas, and Under Armour vying for market share. The growth of e-commerce has intensified competition, requiring retailers to invest heavily in their online platforms and supply chain efficiencies. For a deeper understanding of the company's history, refer to Brief History of Foot Locker.

Foot Locker Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Foot Locker Company?

- What is Growth Strategy and Future Prospects of Foot Locker Company?

- How Does Foot Locker Company Work?

- What is Sales and Marketing Strategy of Foot Locker Company?

- What is Brief History of Foot Locker Company?

- Who Owns Foot Locker Company?

- What is Customer Demographics and Target Market of Foot Locker Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.