Frontdoor Bundle

How Did Frontdoor Become a Home Services Powerhouse?

Delve into the fascinating Frontdoor SWOT Analysis to understand its trajectory. Frontdoor, Inc. has reshaped the home services landscape, originating from the 1971 founding of American Home Shield (AHS), a pioneer in home service plans. This evolution culminated in 2018 with the spin-off from ServiceMaster, establishing Frontdoor as a standalone entity focused on revolutionizing home maintenance.

From its inception, the Frontdoor company has consistently adapted to meet the evolving needs of homeowners, solidifying its position as a leading provider of home warranty services. With a vast network of contractors and a commitment to financial growth, as evidenced by its Q1 2025 performance, Frontdoor continues to navigate the dynamic home services industry. Understanding the brief history Frontdoor provides critical insights into its strategic decisions and its relationship with companies like Angi Inc and others.

What is the Frontdoor Founding Story?

The story of Frontdoor, Inc. begins with American Home Shield (AHS), which was established in 1971. Frontdoor's journey as an independent entity started in 2018, when it spun off from ServiceMaster. This strategic move positioned Frontdoor as a distinct, publicly traded company focused on the home services market.

The company is headquartered in Memphis, Tennessee. The core mission of Frontdoor, inherited from AHS, was to address the financial burden and stress homeowners faced due to unpredictable home repair costs. Frontdoor aimed to provide a solution through home service plans.

Frontdoor's business model, originating from AHS, revolves around offering home warranties. These warranties cover the repair or replacement of essential home systems and appliances. This approach simplifies home maintenance by connecting homeowners with a network of qualified service contractors. The company's initial funding came from the assets allocated during its separation from ServiceMaster.

Frontdoor's roots trace back to American Home Shield (AHS), established in 1971, which pioneered the home service plan industry. The company was officially formed in 2018 as a spin-off from ServiceMaster, becoming a publicly traded entity. Frontdoor's operational strategy relies heavily on a vast network of independent contractors.

- Frontdoor's formation was a strategic move to focus on the home services sector.

- The company's initial capital came from the resources allocated during its separation from ServiceMaster.

- Frontdoor's business model is centered on providing home warranties, a concept inherited from AHS.

- As of June 2025, Frontdoor's network included over 150,000 technicians.

The core of Frontdoor's operations is its extensive network of independent contractors. This network, with over 150,000 technicians as of June 2025, is crucial for delivering its home service plans. This network allows Frontdoor to offer comprehensive solutions for home maintenance and repairs, providing homeowners with peace of mind. For more details, you can explore Owners & Shareholders of Frontdoor.

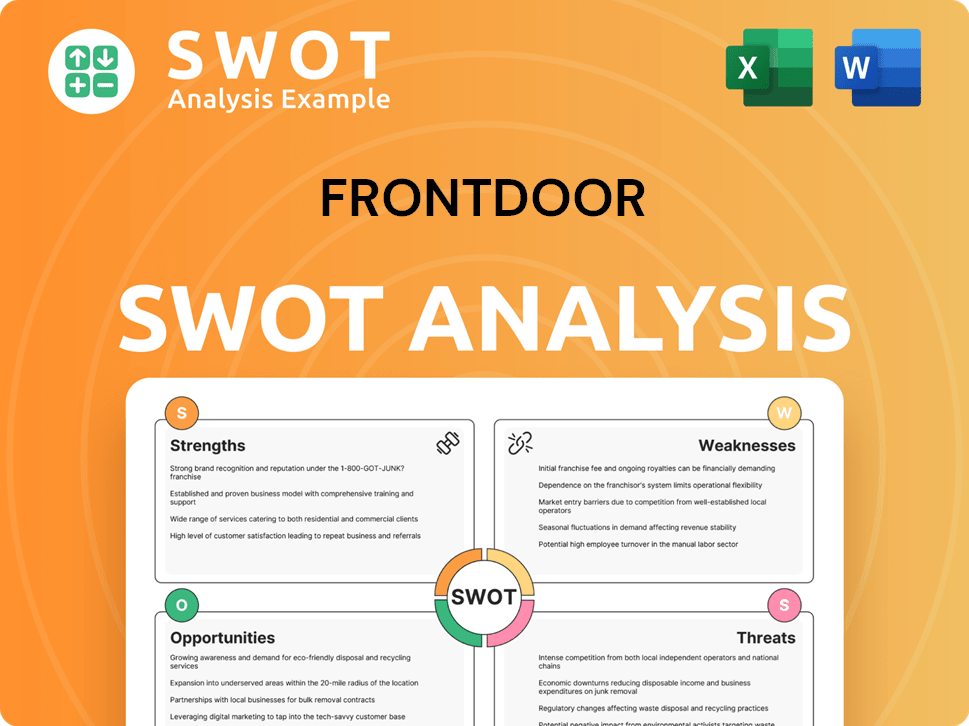

Frontdoor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Frontdoor?

Following its spin-off in 2018, the Frontdoor company quickly established itself as a key player in the home service plan industry. This period saw significant strategic moves aimed at expanding its service offerings and market reach. The company focused on both organic growth and strategic acquisitions to enhance its capabilities and broaden its customer base.

In 2019, the company expanded its service capabilities, which included more comprehensive home maintenance and repair options. This move was part of a broader strategy to provide more value to its customers and capture a larger share of the home services market. The expansion of services helped the company to meet a wider range of homeowner needs.

Also in 2019, Frontdoor acquired Streem, Inc., a technology platform. Streem used augmented reality, computer vision, and machine learning to assist service professionals with virtual diagnoses and pre-visit assessments. This acquisition improved customer experience and operational efficiency.

Frontdoor began diversifying its revenue streams beyond traditional home warranties. In 2020, the company launched American Home Shield ProConnect, an on-demand home maintenance service, which by 2025 was available in 37 markets. This expansion included partnerships, such as with Moen, to offer programs like the installation of Moen Flo Smart Water Monitor and Shutoff.

The New HVAC program's sales target was raised to $105 million, and the new home structural warranty business was expected to generate $44 million in revenue in 2025. In late 2024, the company completed the 2-10 Home Buyers Warranty acquisition for $585 million. In Q1 2025, revenue increased by 13% to $426 million, and the gross profit margin reached a record 55%.

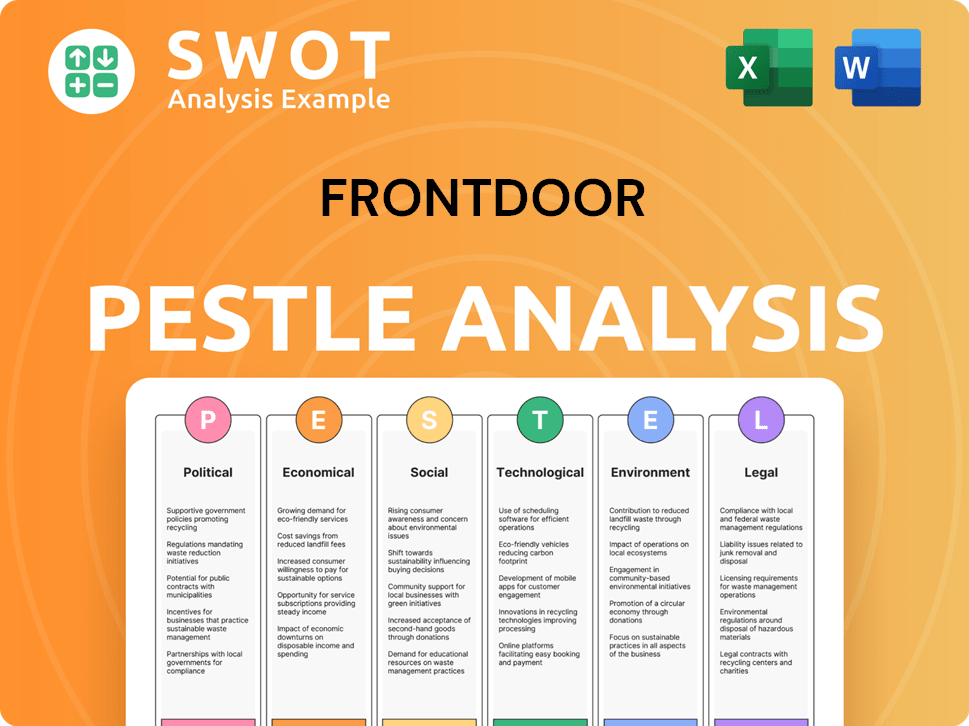

Frontdoor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Frontdoor history?

The Frontdoor company has undergone a significant journey, marked by strategic moves and operational enhancements. Its history reflects a commitment to innovation and adaptation within the dynamic home services sector.

| Year | Milestone |

|---|---|

| Late 2024 | Acquisition of 2-10 Home Buyers Warranty, diversifying revenue streams. |

| Q1 2025 | Achieved a record gross profit margin of 55%, a 380 basis point increase year-over-year. |

| Q1 2025 | Reported a 13% revenue growth, reaching $426 million. |

A key innovation has been the integration of technology to improve customer experience. The use of augmented reality and machine learning through the American Home Shield app has allowed for virtual diagnoses and remote issue resolution.

The integration of Streem's augmented reality and machine learning capabilities into the American Home Shield app has allowed for virtual diagnoses. This has led to a new video chat feature resolving 17% of issues remotely in Q1 2025.

Frontdoor emphasizes its preferred contractor network. 85% of services utilize pre-vetted contractors, improving service speed and quality.

The direct-to-consumer channel has shown strong performance. It experienced a 15% growth in home warranties, driven by brand relaunch efforts and targeted digital advertising.

Despite these achievements, Frontdoor has faced challenges within the home services industry. Macroeconomic factors and real estate market dynamics have presented hurdles.

Inflation and changing interest rates can impact consumer confidence and spending. These factors create uncertainty in the market.

The softness in the real estate market has affected first-year renewals. The company anticipates a 1-3% decline in home warranty member counts in 2025.

The fragmented home services industry necessitates continuous innovation. High service quality is essential to differentiate Frontdoor from its rivals.

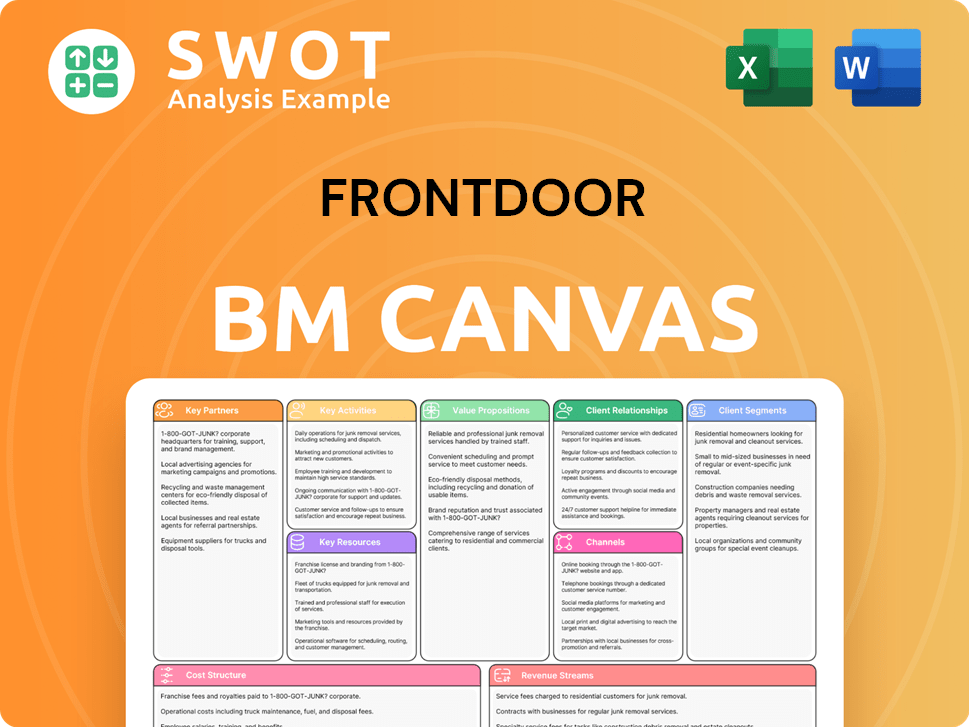

Frontdoor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Frontdoor?

The Revenue Streams & Business Model of Frontdoor reveals a journey marked by strategic moves and financial milestones. From its origins in 1971 as American Home Shield, pioneering the home service plan industry, to its spin-off from ServiceMaster in 2018, becoming the independent entity known today. The company has consistently adapted, expanded its services, and made key acquisitions. Recent developments include the acquisition of 2-10 Home Buyers Warranty in December 2024 for $585 million and the launch of innovative features like video chat with experts.

| Year | Key Event |

|---|---|

| 1971 | American Home Shield (AHS) is founded, a pioneering company in the home service plan industry. |

| 2018 | Frontdoor, Inc. is spun off from ServiceMaster, becoming an independent, publicly traded company. |

| 2019 | Frontdoor launches new offerings, expands service capabilities, and acquires Streem, Inc., integrating augmented reality technology. |

| 2020 | American Home Shield ProConnect is launched, offering on-demand home maintenance services. |

| November 2024 | Frontdoor expands its partnership with Moen to install smart water monitors in seven new states. |

| December 2024 | Frontdoor completes the acquisition of 2-10 Home Buyers Warranty for $585 million, expanding its structural warranty business. |

| February 27, 2025 | Frontdoor announces record full-year 2024 financial results, with revenue increasing 4% to $1.84 billion and net income up 37% to $235 million. |

| March 4, 2025 | American Home Shield launches an innovative video chat feature with an expert. |

| May 1, 2025 | Frontdoor delivers outstanding Q1 2025 financial results, reporting revenue of $426 million (up 13% year-over-year) and Adjusted EBITDA of $100 million (up 41%). |

| May 8, 2025 | Frontdoor Leadership presents at the J.P. Morgan Conference. |

| June 5, 2025 | Frontdoor announces its 2025 Contractor Quality Award Winners. |

Frontdoor is focused on enhancing its home warranty member count, scaling non-warranty services, and integrating the 2-10 acquisition. The company aims to leverage its existing infrastructure and expand its service offerings to drive growth. They are also working to improve customer experience through technological advancements and expanded service options.

For 2025, Frontdoor has increased its revenue outlook to a range of $2.03 billion to $2.05 billion, and its Adjusted EBITDA range to $500 million to $520 million. The company anticipates a 2-4% increase in realized price and a 7-8% increase in volume. They also plan to repurchase at least $200 million in shares in 2025.

Despite a forecasted 1-3% decline in home warranty member counts in 2025 due to real estate market softness, Frontdoor is betting on non-warranty growth and margin resilience. Expansion of the New HVAC program, with a raised sales target of $105 million, and the growth of its Moen partnership to 21 states are key to diversifying revenue.

Frontdoor's future trajectory is expected to be impacted by ongoing trends in the home services market, including an aging housing stock and a growing preference for cost-effective solutions. The company's leadership remains confident in its ability to deliver strong financial and operational performance, tying back to its founding vision of simplifying home maintenance and providing peace of mind to homeowners.

Frontdoor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Frontdoor Company?

- What is Growth Strategy and Future Prospects of Frontdoor Company?

- How Does Frontdoor Company Work?

- What is Sales and Marketing Strategy of Frontdoor Company?

- What is Brief History of Frontdoor Company?

- Who Owns Frontdoor Company?

- What is Customer Demographics and Target Market of Frontdoor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.