Frontdoor Bundle

Who Are Frontdoor's Ideal Customers?

In the ever-evolving home services landscape, understanding the Frontdoor SWOT Analysis is crucial for any investor or strategist. Frontdoor Company, a leader in home services, has significantly adapted its approach to meet the changing needs of homeowners. This analysis delves into the customer demographics and target market of Frontdoor, providing insights into its strategic evolution.

Frontdoor's transformation from a home warranty provider to a comprehensive home services solution mirrors a broader shift in the home services sector. The company's strategic moves, including the acquisition of 2-10 HBW, highlight its commitment to expanding its reach and services. This exploration will uncover the customer profile that Frontdoor actively cultivates, providing a detailed market analysis of its current and future strategies.

Who Are Frontdoor’s Main Customers?

Understanding the Marketing Strategy of Frontdoor requires a close look at its primary customer segments. The company, operating under brands like American Home Shield and HSA, primarily targets consumers (B2C) with its home service plans. However, the acquisition of 2-10 Home Buyers Warranty in December 2024 expanded its reach to include the B2B sector, providing structural warranties to home builders.

As of December 31, 2024, Frontdoor had approximately 2.1 million active home warranties across all brands. This customer base primarily consists of homeowners looking to manage and mitigate the costs of home repairs and maintenance. Revenue is largely driven by home warranty contracts, renewals, and real estate transactions, with direct-to-consumer sales also contributing significantly.

Frontdoor's strategic focus has evolved over time, particularly in response to shifts in the real estate market. The company has concentrated on diversifying its customer channels and enhancing its direct-to-consumer sales strategies. The 2-10 HBW acquisition was a pivotal move to accelerate revenue growth, broaden the customer base, and open new sales channels, especially within the new home segment.

While precise demographic breakdowns such as age, income, or education are not publicly available, Frontdoor's customer demographics generally include homeowners. These homeowners seek to protect themselves from unexpected home repair expenses. The focus is on providing solutions for home maintenance and repair needs.

Frontdoor has expanded its target market through acquisitions and strategic initiatives. The acquisition of 2-10 Home Buyers Warranty in late 2024 broadened the customer base. This move aimed to leverage cross-selling opportunities for home warranties and on-demand services.

Frontdoor generates revenue primarily through home warranty contracts. Renewals are a significant revenue driver, accounting for approximately 77% of total revenue in 2023. Direct-to-consumer sales and real estate transactions also contribute to the company's revenue streams.

Frontdoor's direct-to-consumer channel is experiencing growth. As of the first quarter of 2025, the direct-to-consumer ending member count increased by 15% to 310,000. This growth includes the 2-10 acquisition and 4% organic growth, indicating a successful expansion strategy.

Frontdoor's customer base is segmented into homeowners and, increasingly, home builders. Homeowners are the primary customer profile, seeking protection against repair costs. The company's market analysis has led to strategic shifts, including the expansion into the B2B sector.

- Homeowners seeking home warranty protection.

- Home builders looking for new home structural warranties.

- Customers acquired through renewals, real estate, and direct sales.

- Individuals interested in on-demand home services.

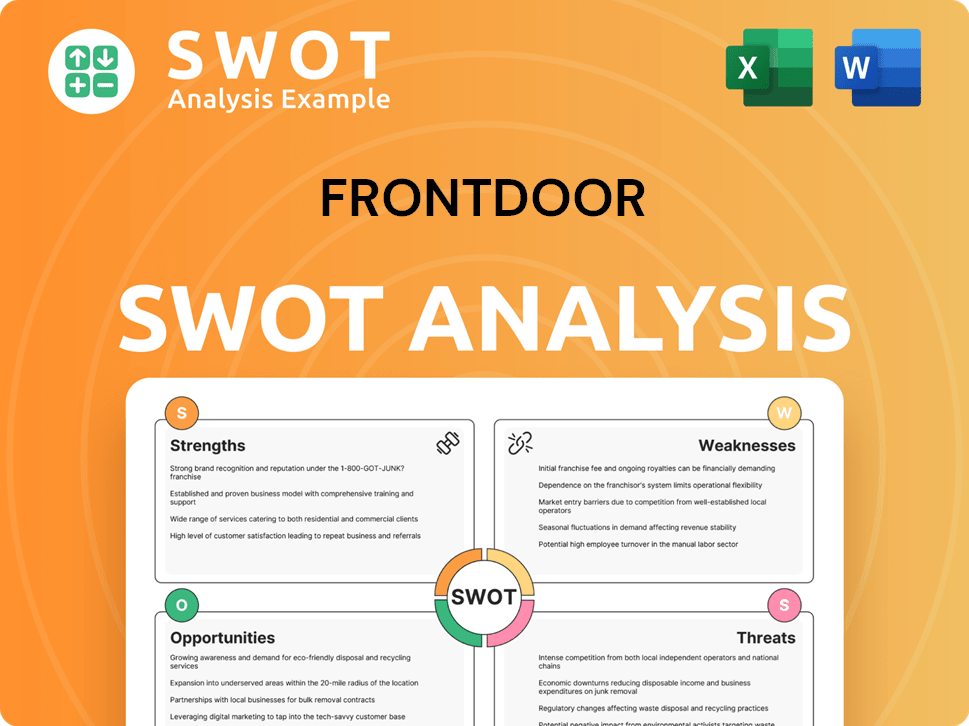

Frontdoor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Frontdoor’s Customers Want?

Understanding the needs and preferences of the customer base is crucial for the success of the Growth Strategy of Frontdoor. The company's customers are primarily driven by a desire for peace of mind and financial protection against unexpected home repair expenses. This need stems from a psychological aversion to the stress and financial burden associated with sudden breakdowns of home systems and appliances.

Customers seek convenience and reliable access to qualified contractors for a wide array of home issues. This includes everything from plumbing leaks to HVAC repairs. Frontdoor addresses these needs by offering comprehensive home service plans that cover up to 29 essential home systems and appliances. They also provide access to a nationwide network of approximately 17,000 pre-qualified contractor firms.

Purchasing decisions are often influenced by the need to protect a home, typically the largest asset most people own, from costly repairs. The decision-making process involves evaluating coverage scope, service plan costs, ease of filing claims, and the reputation of the service provider. Usage patterns involve submitting service requests when covered items break down and utilizing the contractor network for repairs.

Customer loyalty is significantly impacted by positive experiences, efficient problem resolution, and the perceived value of the service plan. Frontdoor's customer retention rate, excluding the 2-10 home warranties, was 78.5% as of December 31, 2024, indicating strong customer loyalty. Frontdoor continually adapts its product development and service offerings based on customer feedback and market trends.

- Expansion of non-warranty home services, such as new HVAC sales, contributed to increased other revenue in 2024.

- The Frontdoor app offers unlimited, real-time access to experts via video chat for diagnoses and solutions, along with DIY tips and discounts.

- Partnerships, like the one with Moen, provide installation of smart water monitors and shutoff systems, addressing the growing need for preventive measures against water damage.

- These initiatives demonstrate Frontdoor's commitment to meeting evolving customer needs, including the increasing demand for digital solutions and sustainability in home services.

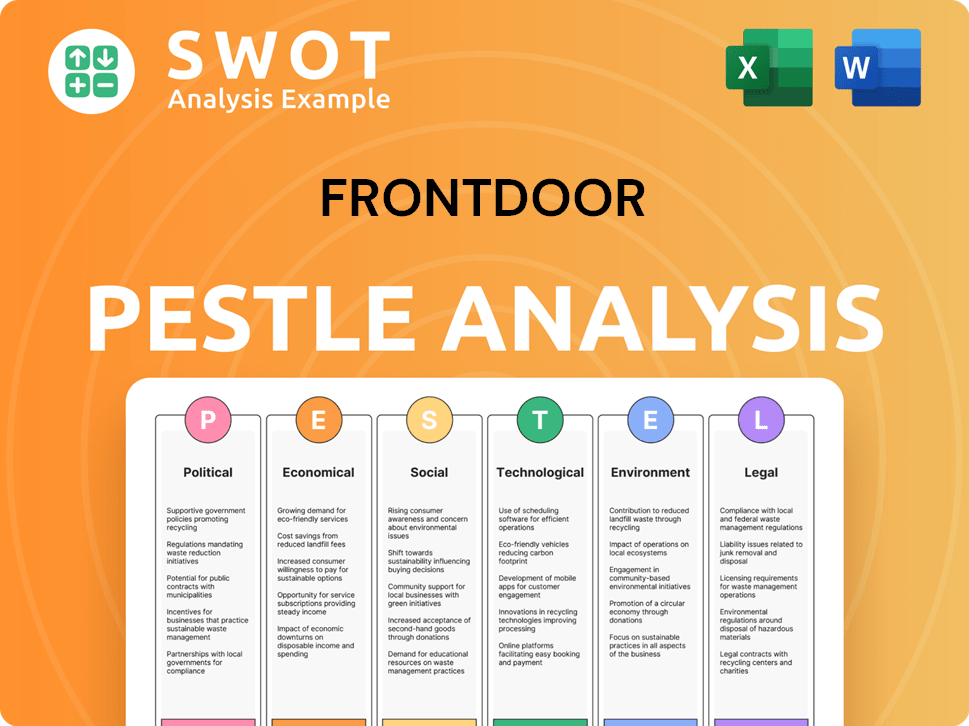

Frontdoor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Frontdoor operate?

The geographical market presence of the company, a key aspect of its operational strategy, is primarily concentrated within the United States. It operates across the contiguous 48 states, having previously served in Hawaii and Alaska before withdrawing from those markets. This focus allows for streamlined operations and targeted marketing efforts within a defined geographic area.

A significant portion of the company's revenue is generated in the western and southern regions of the U.S. These areas, including states like California, Florida, and Texas, likely represent strongholds where the company has established a solid market share and brand recognition. This concentration suggests a strategic focus on markets with high demand for home services.

The acquisition of 2-10 Home Buyers Warranty further diversified the company's revenue streams, particularly in the new home structural warranty sector. This expansion aligns with the states experiencing robust growth in new home sales, indicating a proactive approach to capitalize on market opportunities and expand its customer base.

The company tailors its offerings, marketing strategies, and partnerships to suit diverse regional markets. This localized approach is crucial for resonating with specific customer needs and navigating varying regulatory landscapes. For example, the expansion of its agreement with Moen for smart water monitor installations, initially focused on California, has extended to seven additional states, including Arizona, Utah, Idaho, Oregon, Texas, Georgia, and South Carolina.

The company leverages its nationwide network of independent contractors to ensure consistent service delivery and mitigate the impact of regional economic fluctuations. This network enables the company to maintain service quality across its operational areas, supporting its commitment to customer satisfaction. This strategy is particularly important for providing reliable home services.

The company's strategic decision to withdraw from Hawaii and Alaska indicates a focus on optimizing its core market presence for maximum efficiency and profitability. This approach allows the company to concentrate resources where it can achieve the greatest impact and sustain long-term growth. This focus is important for effective market analysis.

Continuous efforts to expand non-warranty home services and integrate acquisitions like 2-10 HBW highlight a dynamic approach to enhancing market presence. These initiatives demonstrate a commitment to capitalizing on growth opportunities within the U.S. home services industry. This includes strategies like customer acquisition to broaden its customer base.

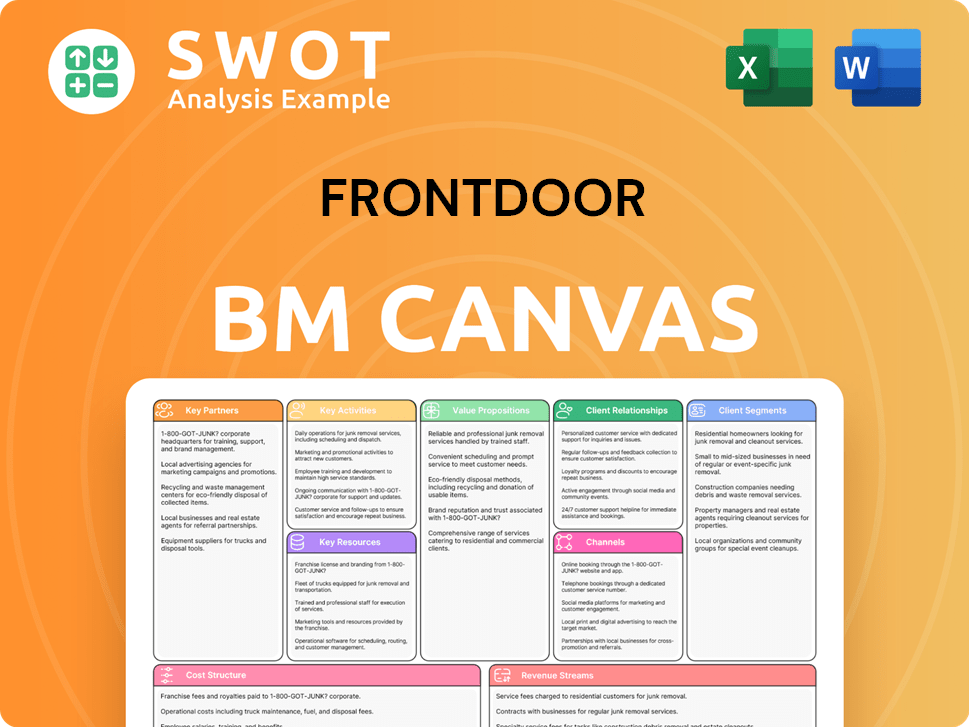

Frontdoor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Frontdoor Win & Keep Customers?

The Frontdoor company employs a multifaceted strategy for acquiring and retaining customers within the home services market. Their approach combines various marketing channels, strategic partnerships, and initiatives focused on enhancing customer experience. This comprehensive strategy aims to stabilize and grow its core business, particularly through its American Home Shield brand.

A key focus for Frontdoor is leveraging digital platforms, traditional advertising, and direct-to-consumer sales to reach its target market. They continuously invest in technology and marketing campaigns to drive growth and improve customer engagement. Promotional offers and strategic partnerships play a crucial role in expanding their customer base, as seen with the collaboration with Moen, offering free memberships to Moen Flo customers.

For customer retention, Frontdoor emphasizes personalized experiences and after-sales service. They have implemented initiatives to improve retention, such as better engaging consumers during the onboarding process, expanding dynamic pricing to minimize churn, and increasing the utilization of preferred contractors. These efforts have led to improved retention rates, demonstrating the effectiveness of their customer-centric approach.

Utilizes digital platforms, traditional advertising, and direct-to-consumer sales to reach potential customers. These channels are crucial for attracting new members to their home services offerings. They also leverage their app to drive new sales.

Runs promotional campaigns, such as the April 2024 offer allowing customers to gift memberships. These offers incentivize new sign-ups and increase brand visibility within the target market.

Forms partnerships with companies like Moen, offering free memberships to their customers. These collaborations expand reach and provide added value to consumers. Also, they seek partnerships with real estate agencies and home improvement retailers.

Focuses on personalized experiences and after-sales service to retain customers. Initiatives include improved onboarding, dynamic pricing, and increased use of preferred contractors. These efforts contribute to a higher customer retention rate.

The company's focus on customer acquisition and retention has yielded positive results. For a deeper dive, consider reading this article about Owners & Shareholders of Frontdoor.

- Customer retention rate improved to 78.5% as of December 31, 2024, excluding the 2-10 acquisition.

- Reached an all-time high of 76.6% in Q2 2024.

- Gross profit margin increased in 2024 due to higher service fees and process improvements.

- In 2024, $160 million was utilized to repurchase approximately 4 million shares, reflecting confidence in the company's growth strategy.

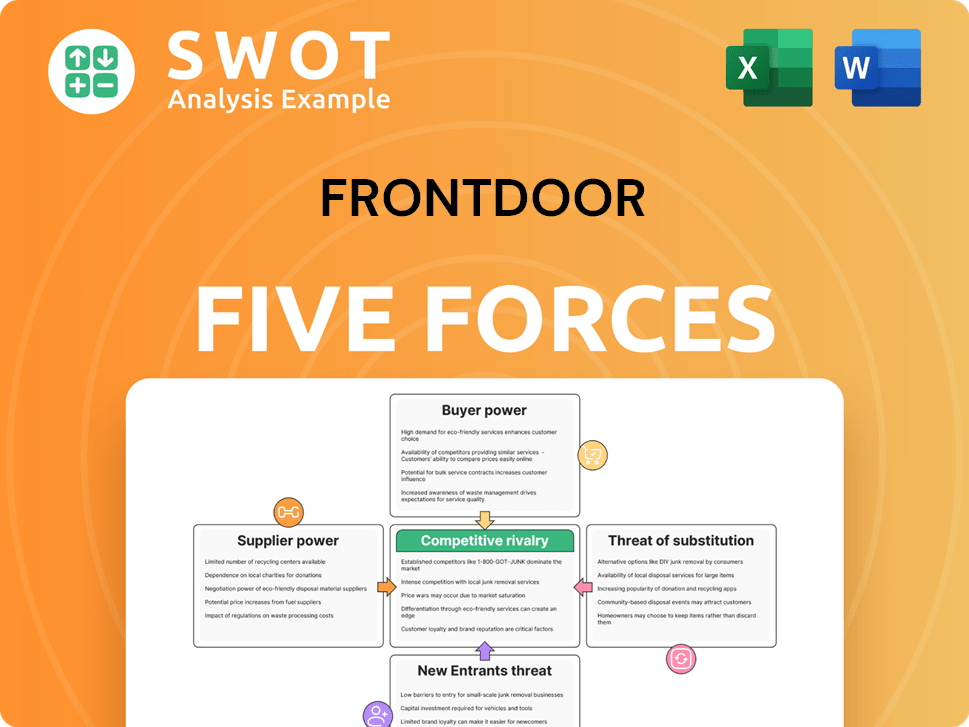

Frontdoor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Frontdoor Company?

- What is Competitive Landscape of Frontdoor Company?

- What is Growth Strategy and Future Prospects of Frontdoor Company?

- How Does Frontdoor Company Work?

- What is Sales and Marketing Strategy of Frontdoor Company?

- What is Brief History of Frontdoor Company?

- Who Owns Frontdoor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.