Frontdoor Bundle

Who Really Calls the Shots at Frontdoor?

Ever wondered who's steering the ship at Frontdoor, the home services giant? Understanding the Frontdoor SWOT Analysis is just the beginning. The ownership structure of a company is a critical factor that shapes its strategy and future. From its roots with ServiceMaster to its current standing, Frontdoor's ownership story is a fascinating look at how a company evolves.

This exploration of Frontdoor Company Ownership dives deep into the key players, from institutional investors to individual shareholders, who influence the company's direction. Knowing who owns Frontdoor, and how this has changed since its spin-off, is essential for anyone tracking Frontdoor stock or assessing its competitive position against rivals like Angi Homeservices. This analysis will provide insights into the company's strategic autonomy and growth potential, answering questions like, "Who are Frontdoor's major competitors?" and "How to invest in Frontdoor stock?"

Who Founded Frontdoor?

When considering the ownership of the Frontdoor Company, it's important to understand its unique origins. Unlike companies founded by individual entrepreneurs, Frontdoor, Inc. emerged from a spin-off. This means the concept of traditional 'founders' doesn't apply in the same way.

Frontdoor was created in October 2018, when it was spun off from ServiceMaster Global Holdings, Inc. This separation significantly shaped its initial ownership structure. The early ownership of Frontdoor was directly tied to the shareholders of ServiceMaster at the time of the spin-off.

Therefore, the initial owners of Frontdoor were the existing shareholders of ServiceMaster. Their stake in Frontdoor mirrored their pre-spin-off ownership in ServiceMaster. This distribution method meant there were no individual founders with a controlling interest; instead, ownership was broadly distributed among ServiceMaster's shareholders.

Frontdoor was spun off from ServiceMaster Global Holdings, Inc. in October 2018.

The initial shareholders of Frontdoor were the existing shareholders of ServiceMaster.

Ownership was distributed proportionally based on ServiceMaster holdings.

ServiceMaster had a complex ownership structure with institutional investors and private equity firms.

The spin-off was structured as a tax-free distribution to ServiceMaster shareholders.

Shareholders received one share of Frontdoor for every two shares of ServiceMaster held.

Understanding the Frontdoor Company ownership structure is crucial for investors. The company's origins as a spin-off from ServiceMaster significantly influenced its initial shareholder base. This structure means that the early backers of Frontdoor were largely the institutional investors and other shareholders of ServiceMaster before the spin-off. The distribution of shares was designed to be tax-free for ServiceMaster shareholders. For those interested in investing, understanding the ownership structure is a key part of analyzing the company. For more insights into the competitive landscape, consider exploring the Competitors Landscape of Frontdoor.

Frontdoor's ownership structure is unique due to its spin-off from ServiceMaster.

- Initial ownership was distributed to ServiceMaster shareholders.

- No traditional founders held a disproportionate stake at the beginning.

- Institutional investors and private equity firms that held shares in ServiceMaster became early backers of Frontdoor.

- The spin-off was structured to be tax-free for ServiceMaster shareholders.

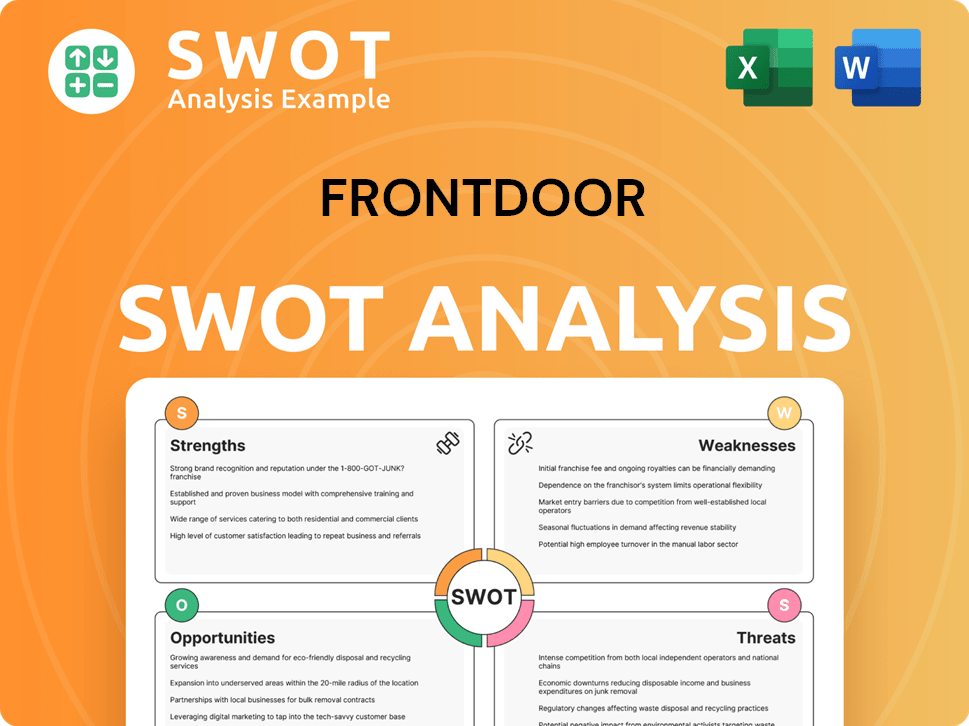

Frontdoor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Frontdoor’s Ownership Changed Over Time?

The ownership structure of Frontdoor Inc. has seen changes since its spin-off from ServiceMaster in October 2018. As a publicly traded entity on the NASDAQ under the ticker symbol FTDR, its ownership is influenced by market dynamics and the investment activities of major institutional shareholders. The company's stock is actively traded, leading to shifts in its major shareholding over time. The evolution of ownership is a key aspect for anyone interested in the Frontdoor Company Ownership.

In early 2025, institutional investors continue to hold a significant portion of Frontdoor's outstanding shares. These investors include large asset management firms, mutual funds, and index funds. Vanguard Group Inc. and BlackRock Inc. are often among the largest institutional holders. These firms manage funds that track various indices, leading them to hold shares in companies like Frontdoor.

| Event | Impact on Ownership | Year |

|---|---|---|

| Spin-off from ServiceMaster | Established Frontdoor as an independent publicly traded company. | 2018 |

| Institutional Investment | Increased institutional ownership through active and passive investment strategies. | Ongoing |

| Share Buyback Programs | Reduced the number of outstanding shares, potentially increasing the proportional ownership of remaining shareholders. | Variable |

Frontdoor's 2024 proxy statement and recent SEC filings, such as 13F reports, provide the most current details on major shareholders. These filings reveal the percentage of shares held by top institutional investors. While no single entity typically holds a controlling interest, the collective influence of institutional investors on company strategy and governance is substantial. Individual insider ownership, including shares held by executives and board members, represents a direct alignment with the company's performance. Changes in these holdings, such as share buybacks or new equity offerings, can also impact the ownership landscape. Understanding Who owns Frontdoor is crucial for investors.

Institutional investors hold a significant portion of Frontdoor's shares. This includes firms like Vanguard and BlackRock. Shareholder structure is detailed in SEC filings, such as 13F reports.

- Institutional investors are key stakeholders.

- SEC filings provide ownership details.

- Ownership structure is subject to change.

- Understanding ownership is vital for investors.

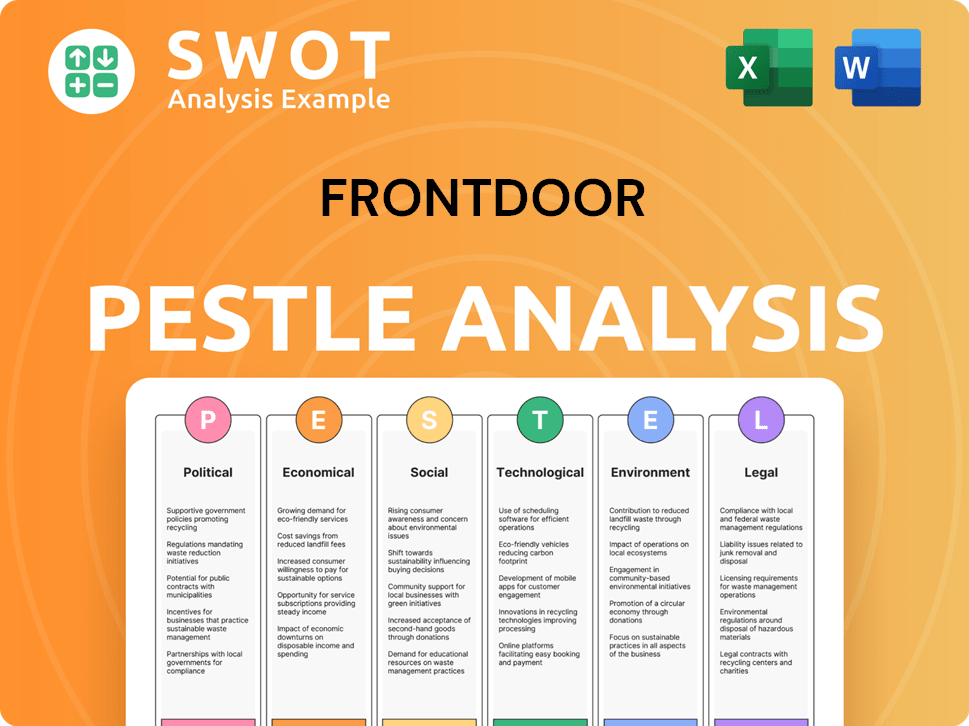

Frontdoor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Frontdoor’s Board?

The Board of Directors at Frontdoor, as of early 2025, is responsible for overseeing the company's management and representing shareholder interests. The board usually includes a mix of independent and executive directors, including the CEO. The composition of the board reflects the company's commitment to good corporate governance, with a majority of independent directors to ensure objective oversight. For specific board members and their affiliations, refer to Frontdoor's most recent proxy statement, such as the 2024 proxy statement.

Board members typically come from diverse backgrounds, including finance, technology, consumer services, and legal fields. Some members may represent significant institutional shareholders. The emphasis is generally on independent directors to mitigate potential conflicts of interest. The voting structure for Frontdoor's common stock is typically one-share-one-vote.

| Board Member | Title | Affiliation (as of 2024) |

|---|---|---|

| William J. Redding | Chairman of the Board | Independent |

| John E. Lauck | Director, President and CEO | Frontdoor |

| Marianne D. Short | Director | Independent |

The one-share-one-vote structure means each share of common stock grants one vote on shareholder matters, such as electing directors or approving major corporate actions. There are no indications of dual-class shares or special voting rights that would grant outsized control to specific entities. Recent proxy battles or activist investor campaigns for Frontdoor have not been prominently reported as of early 2025, suggesting a relatively stable governance environment. The board continuously addresses strategic decisions, capital allocation, and executive compensation, which are subject to shareholder scrutiny.

Frontdoor Inc. operates with a board of directors that oversees the company's governance and represents shareholder interests. The company's stock symbol is (FTDR). The board's structure aims to ensure that decision-making aligns with the interests of all shareholders. To learn more about the company's financial performance, you can review the Frontdoor company annual report.

- Frontdoor's board includes independent and executive directors.

- The voting structure is typically one-share-one-vote.

- The board focuses on strategic decisions and executive compensation.

- The company's headquarters are located in Memphis, Tennessee.

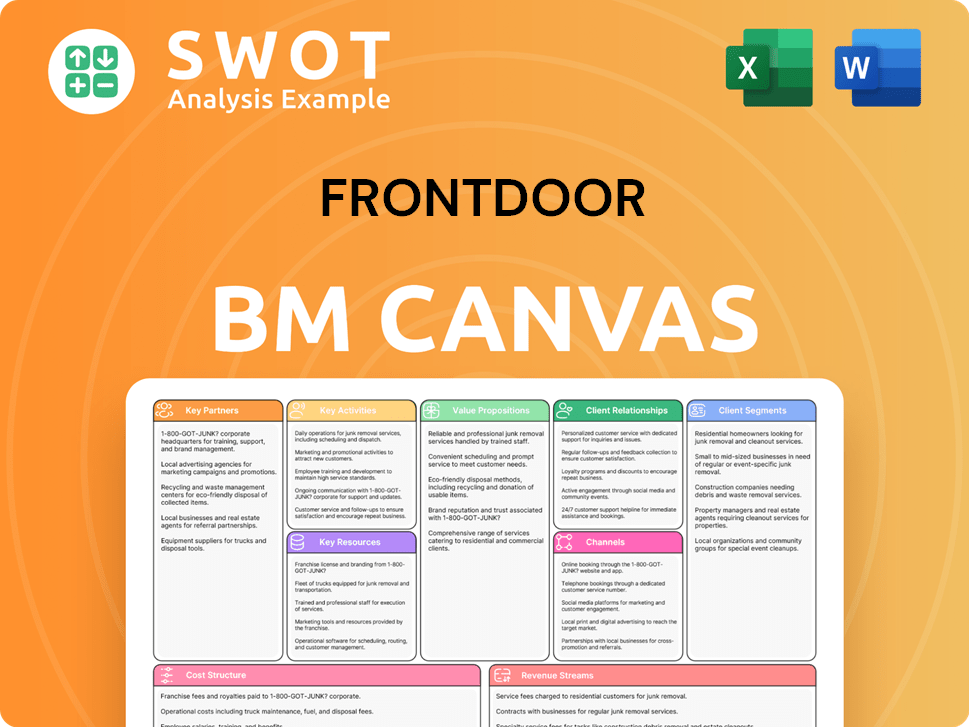

Frontdoor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Frontdoor’s Ownership Landscape?

Over the past few years, Frontdoor Company Ownership has been shaped by market dynamics and strategic moves. While there haven't been major acquisitions that significantly altered its ownership, the company's focus on organic growth, technological advancements, and operational efficiency has influenced investor confidence and stock performance. Key trends include the increasing presence of institutional investors, particularly passive index funds and ETFs, which acquire shares based on market capitalization.

A significant trend is the rise in institutional ownership, with funds like Vanguard and BlackRock holding substantial stakes. Frontdoor has also engaged in share repurchase programs, which can boost earnings per share and benefit shareholders. For example, in its Q4 2023 earnings call, Frontdoor highlighted its capital allocation strategy, including share repurchases. As of early 2025, there were no public announcements of privatization or major leadership changes that would fundamentally alter the ownership structure, suggesting a continued focus on operating as a publicly traded entity. The company's strategic initiatives aim to expand service offerings and enhance customer experience, attracting long-term investors.

| Metric | Details | Data Source (Approximate) |

|---|---|---|

| Institutional Ownership | Significant holdings by Vanguard, BlackRock, and other institutional investors. | Public filings, Q4 2024 |

| Share Repurchases | Ongoing share repurchase programs to return value to shareholders. | Company earnings calls, Q4 2023 |

| Stock Symbol | FTDR | Various financial data providers |

The strategic direction of Frontdoor, including its focus on enhancing service offerings and customer experience, is designed to strengthen its market position and attract long-term investors. The company's commitment to returning value to shareholders through share repurchases is a key element of its financial strategy. The absence of significant ownership changes or leadership transitions indicates a focus on sustained growth and operational excellence within the current publicly traded framework.

Frontdoor's stock performance is closely watched by investors, reflecting market confidence and company performance. Investors should monitor the stock's price history and financial reports to assess its value. The company's financial performance is a key indicator of its stability and growth potential.

Frontdoor's ownership is primarily distributed among institutional investors and public shareholders. Understanding the ownership structure helps in evaluating the company's stability and strategic direction. Key shareholders include institutional investors and public shareholders.

Frontdoor investors include a mix of institutional and individual shareholders. Investor relations are crucial for communicating company performance and strategy. Contacting investor relations can provide insights into the company's financial health and future plans.

The ownership structure of Frontdoor is influenced by its status as a publicly traded company. Major shareholders and their holdings are detailed in public filings. The ownership structure impacts the company's strategic decisions and financial performance.

Frontdoor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Frontdoor Company?

- What is Competitive Landscape of Frontdoor Company?

- What is Growth Strategy and Future Prospects of Frontdoor Company?

- How Does Frontdoor Company Work?

- What is Sales and Marketing Strategy of Frontdoor Company?

- What is Brief History of Frontdoor Company?

- What is Customer Demographics and Target Market of Frontdoor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.