Frontdoor Bundle

How is the Frontdoor Company Revolutionizing Home Services?

Frontdoor, Inc. (NASDAQ: FTDR) is making waves in the home services sector, and its recent financial performance is a testament to its success. With impressive Q1 2025 results, including a 13% year-over-year revenue increase and a surge in Adjusted EBITDA, Frontdoor is demonstrating its robust market position. As the parent company of American Home Shield and 2-10 Home Buyers Warranty, Frontdoor offers comprehensive Frontdoor SWOT Analysis and service contracts, providing peace of mind to millions of homeowners.

This in-depth analysis will explore how the Frontdoor company operates, examining its strategic focus on expanding its Frontdoor services, including Frontdoor home warranty offerings and its ability to navigate the dynamic home services market. We'll delve into the core components of its business model, assessing how it generates revenue and creates value for both its customers and investors. Understanding the intricacies of Frontdoor's operations is key to appreciating its current success and future potential in the home maintenance and home repair landscape, especially for those considering a subscription service.

What Are the Key Operations Driving Frontdoor’s Success?

The core operations of the Frontdoor company center on streamlining home maintenance through comprehensive home service plans. These plans offer coverage for essential home systems and appliances, including plumbing, electrical, and HVAC. This approach caters to a diverse customer base seeking protection against unexpected repair expenses. As of Q1 2025, Frontdoor served 2.1 million members, demonstrating its significant market presence.

Frontdoor's value proposition is rooted in simplifying homeownership by managing the complexities of home maintenance and repairs. The company's subscription-based model provides predictable recurring revenue, while its focus on contractor excellence ensures reliable service delivery. This translates into customer benefits such as budget protection, convenience, and guaranteed repair completion, setting Frontdoor apart in the market.

Frontdoor's operational process is facilitated by a vast network of independent service contractors, numbering around 17,000 firms. These contractors undergo vetting, and 85% of services are now performed by preferred contractors, improving both service speed and quality. The company leverages technology, including a mobile app, to streamline repairs and enhance customer satisfaction. The investment in technology, such as its mobile app, is crucial for improving customer experience and operational efficiency.

Frontdoor relies on a network of approximately 17,000 independent service contractors. These contractors are vetted to ensure quality and reliability. The company focuses on using preferred contractors, with 85% of services delivered by them, enhancing service speed and quality.

Frontdoor utilizes technology to improve customer experience and operational efficiency. The mobile app, with 200,000 downloads, streamlines repairs. Video chat resolved 17% of issues remotely in Q1 2025, reducing costs and boosting satisfaction. This focus on technology is key for the company's success.

The subscription-based model provides predictable recurring revenue for Frontdoor. This model ensures a consistent income stream and allows for strategic planning. This financial structure supports the company's ability to invest in service quality and customer satisfaction.

Frontdoor offers comprehensive home service plans to simplify home maintenance. These plans cover major home systems and appliances, providing peace of mind to homeowners. The plans are designed to protect against unexpected repair costs, making homeownership easier.

Frontdoor's supply chain management involves overseeing its extensive network of service professionals. The company faced challenges in 2023, including increased costs for parts and materials. For instance, HVAC parts experienced a 27.6% increase in costs, impacting operational expenses.

- The subscription model ensures predictable revenue.

- Frontdoor focuses on contractor excellence to ensure reliable service.

- The company's mission is to simplify homeownership.

- The company's ability to provide home repair services is a key differentiator.

Frontdoor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Frontdoor Make Money?

The Frontdoor company generates revenue through its subscription-based home service plans, which cover the repair or replacement of essential home systems and appliances. These plans provide a steady stream of income through annual or monthly fees. In 2024, the company reported total revenue of approximately $1.84 billion.

The company's revenue streams are diversified, including renewal revenue, direct-to-consumer (DTC) channels, and real estate partnerships. The company is also expanding its offerings and services to increase its revenue. For the first quarter of 2025, the revenue increased by 13% year-over-year, reaching $426 million.

The company has provided an updated full-year 2025 revenue outlook of $2.03 billion to $2.05 billion.

The company's revenue streams are driven by a combination of subscription services, service fees, and strategic acquisitions. The company's focus on expanding its service offerings and improving customer retention is expected to drive growth in the coming years. Read more about the Growth Strategy of Frontdoor.

- Renewal Revenue: Increased by 12% in Q1 2025 due to better pricing and higher volume. In 2024, renewal revenue grew by 4%.

- Direct-to-Consumer (DTC) Channel Revenue: Expected to see a low-to-mid single-digit increase in 2025. DTC members grew by 15% in Q1 2025, reaching 310,000. In 2024, DTC revenue decreased by 16%.

- Real Estate Channel Revenue: Anticipated to have a high-single-digit increase in 2025. Real estate revenue was flat year-over-year in Q1 2025 and decreased by 3% in 2024 due to market challenges.

- Other Revenue: Projected to be $165 million to $175 million in 2025, an increase of approximately $55 million compared to the prior year. This increase is primarily due to the addition of new home structural warranty revenue and increases in its New HVAC and Moen programs. Non-warranty services, such as the New HVAC program, are projected to become a $100 million business by 2025. The new home structural warranty business from the 2-10 acquisition is expected to generate $44 million in revenue in 2025.

Frontdoor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Frontdoor’s Business Model?

The journey of the Frontdoor company has been marked by strategic moves and key milestones that have significantly shaped its market position. A notable development was the acquisition of 2-10 Home Buyers Warranty in December 2024, a deal valued at $585 million. This move diversified Frontdoor services by integrating new home structural warranties, thereby expanding its member base and revenue streams.

Operationally, Frontdoor has focused on enhancing its gross profit margins, achieving a record 55% in Q1 2025, a substantial increase from 43% in 2022. The company has also improved its customer retention rates, with a 79.9% retention rate in Q1 2025, up from 75.7% in 2022. These improvements reflect Frontdoor's commitment to operational excellence and customer satisfaction.

Despite facing challenges such as macroeconomic conditions, particularly the softness in the real estate market, and supply chain issues in 2023, Frontdoor has demonstrated resilience. The company has responded by focusing on non-warranty growth and margin resilience, showcasing its ability to adapt and thrive in a dynamic market environment. For more insights into the company's performance, you can explore the details at Owners & Shareholders of Frontdoor.

The acquisition of 2-10 Home Buyers Warranty in December 2024 for $585 million. This strategic move expanded Frontdoor's services. The company's gross profit margins reached a record 55% in Q1 2025.

Focus on non-warranty growth and margin resilience. Improved customer retention rates, reaching 79.9% in Q1 2025. Technological innovation, such as the mobile app and Streem augmented reality platform.

Strong brand recognition, especially through American Home Shield. Extensive service network with approximately 17,000 contractor firms. Data analytics used for customer insights and service optimization.

Expansion into non-warranty services like HVAC. Exploration of new areas such as water heaters, appliances, and roof repair. Adapting to new trends by expanding into non-warranty services.

Frontdoor distinguishes itself through several key competitive advantages. These include strong brand recognition, particularly through American Home Shield, which fosters customer trust and loyalty, and an extensive service network.

- Strong brand recognition and customer loyalty.

- Extensive service network with about 17,000 professional contractor firms.

- Technological innovation, including a mobile app and Streem augmented reality platform.

- Data analytics to understand customer needs and optimize service delivery.

Frontdoor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Frontdoor Positioning Itself for Continued Success?

The Frontdoor company holds a leading position in the U.S. home warranty market. With its brands, including American Home Shield and 2-10 Home Buyers Warranty, Frontdoor provides home warranty services to over two million members, demonstrating a significant market share. The company is focused on being the leading provider of home service solutions in the United States.

Frontdoor faces risks such as macroeconomic conditions, including inflation and interest rate changes, which can affect consumer confidence and demand. Intense competition in the home service industry also poses a challenge, potentially leading to pricing pressures. Other risks include reliance on third-party contractors and supply chain disruptions, along with operational hurdles from the integration of the 2-10 Home Buyers Warranty acquisition.

Frontdoor is a leader in the U.S. home warranty market. Its brands, such as American Home Shield, serve a large customer base. Customer loyalty is strong, with a retention rate of 79.9% in Q1 2025.

Key risks include macroeconomic factors like inflation and interest rates. Competition within the home service sector is intense. The company also faces risks tied to its contractor network and potential supply chain issues.

Frontdoor plans to grow its member base and expand non-warranty services. The company aims to sustain profitability through margin expansion and share repurchases. The full-year 2025 revenue outlook is between $2.03 billion and $2.05 billion.

Adjusted EBITDA guidance for 2025 is set at $500 million to $520 million. Frontdoor anticipates a 2-4% increase in realized price and a 7-8% increase in volume. They are targeting at least $200 million in share repurchases in 2025.

Frontdoor's strategic plan includes growing its membership, scaling non-warranty services, and completing the 2-10 acquisition integration. The long-term vision involves using technology and data to offer proactive home service solutions and broaden service offerings.

- Expand member base and service offerings.

- Leverage technology for proactive solutions.

- Focus on margin expansion and capital allocation.

- Target at least $200 million in share repurchases in 2025.

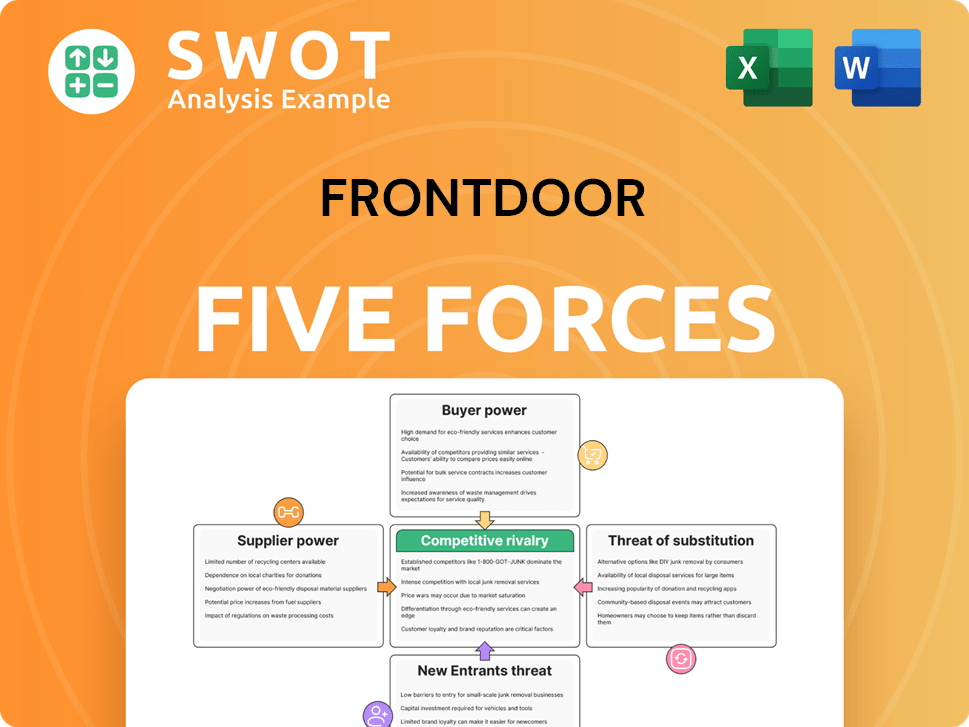

Frontdoor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Frontdoor Company?

- What is Competitive Landscape of Frontdoor Company?

- What is Growth Strategy and Future Prospects of Frontdoor Company?

- What is Sales and Marketing Strategy of Frontdoor Company?

- What is Brief History of Frontdoor Company?

- Who Owns Frontdoor Company?

- What is Customer Demographics and Target Market of Frontdoor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.