Hana Financial Group Bundle

How Did Hana Financial Group Rise to Global Prominence?

Journey back in time to uncover the remarkable transformation of Hana Financial Group, a titan among Korean financial institutions. From its humble beginnings, this financial powerhouse has navigated a complex landscape, consistently adapting and innovating to achieve its current global standing. Explore the pivotal moments and strategic decisions that have shaped Hana Bank history and its evolution.

Established in 1971 as Korea Investment Finance, Hana Financial Group's Hana Financial Group SWOT Analysis reveals a story of strategic growth. Its early years were marked by a focus on providing specialized financial solutions. Today, it stands as a leading global player, offering a wide array of services and showcasing a remarkable journey of expansion and diversification amongst South Korean banks. This overview will explore the key milestones that have contributed to Hana Financial Group's success.

What is the Hana Financial Group Founding Story?

The genesis of Hana Financial Group can be traced back to July 2, 1971, with the establishment of Korea Investment Finance Corporation. This pivotal moment occurred during South Korea's rapid industrialization phase, a time when specialized financial services were increasingly crucial for economic advancement. The formation of this financial institution stemmed from the collective recognition of the need for a robust financial intermediary to support a burgeoning economy. The initial challenge was the limited availability of diverse financial instruments and investment opportunities for both corporations and individuals.

The primary objective of Korea Investment Finance Corporation was to offer short-term financing and investment services, primarily targeting corporate clients. Its initial offerings included discounted bills and corporate bonds, designed to facilitate capital flow within the industrial sector. The initial funding likely came from a consortium of institutional investors and prominent business figures, a common practice for financial institutions established during that era in South Korea. The very name, 'Korea Investment Finance,' reflected its core mission: channeling investments into the nation's economic growth.

The cultural and economic landscape of the time, marked by government-led industrialization and a strong emphasis on export-driven growth, significantly shaped the company's creation and its initial focus on corporate finance. The early years of Hana Financial Group's growth strategy were deeply intertwined with supporting the expansion of South Korean industries. This strategic alignment helped the institution to establish a strong foundation within the evolving financial ecosystem.

The founding of Hana Financial Group was a response to the need for specialized financial services during South Korea's industrialization.

- Established on July 2, 1971, as Korea Investment Finance Corporation.

- Focused on providing short-term financing and investment services to corporate clients.

- Initial offerings included discounted bills and corporate bonds.

- Funding likely came from institutional investors and prominent business figures.

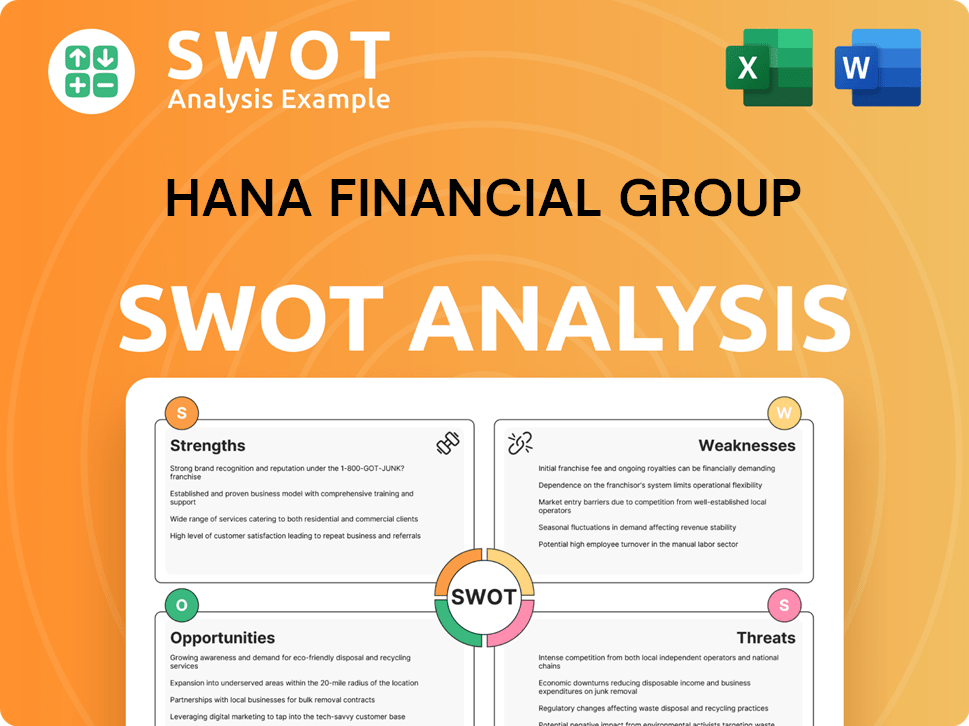

Hana Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Hana Financial Group?

The early years of Hana Financial Group, initially known as Korea Investment Finance, were marked by steady expansion within the Korean financial sector. This period included a significant transformation in 1991 when it transitioned into a commercial bank and rebranded as Hana Bank. This strategic move allowed for broader service offerings and an expanded customer base. The company also focused on expanding its branch network in South Korea.

The shift from a short-term finance company to a commercial bank in 1991 was a pivotal moment in the Target Market of Hana Financial Group. This change enabled Hana Bank to offer a wider range of services, including traditional banking products. The expansion of services helped Hana Bank to attract a more diverse customer base, including individuals and SMEs.

A key strategy for growth involved mergers and acquisitions. The merger with Seoul Bank in 2002 significantly boosted its market share. The establishment of Hana Financial Group as a holding company in 2005 further streamlined operations. The 2015 merger with Korea Exchange Bank (KEB) was transformational, enhancing its global presence.

These strategic integrations allowed Hana Financial Group to enter new market segments and enhance its product offerings. The mergers and acquisitions strategy helped achieve economies of scale. These moves fundamentally shaped its trajectory in the competitive Korean financial landscape. By 2023, the group's total assets reached approximately ₩700 trillion (around $520 billion USD).

The merger with KEB in 2015 was particularly important for international growth. This merger strengthened the group's foreign exchange capabilities and global network. As of 2024, KEB Hana Bank has a significant presence in major financial hubs worldwide, contributing substantially to the group's international revenue, with overseas business accounting for roughly 20% of its total operating income.

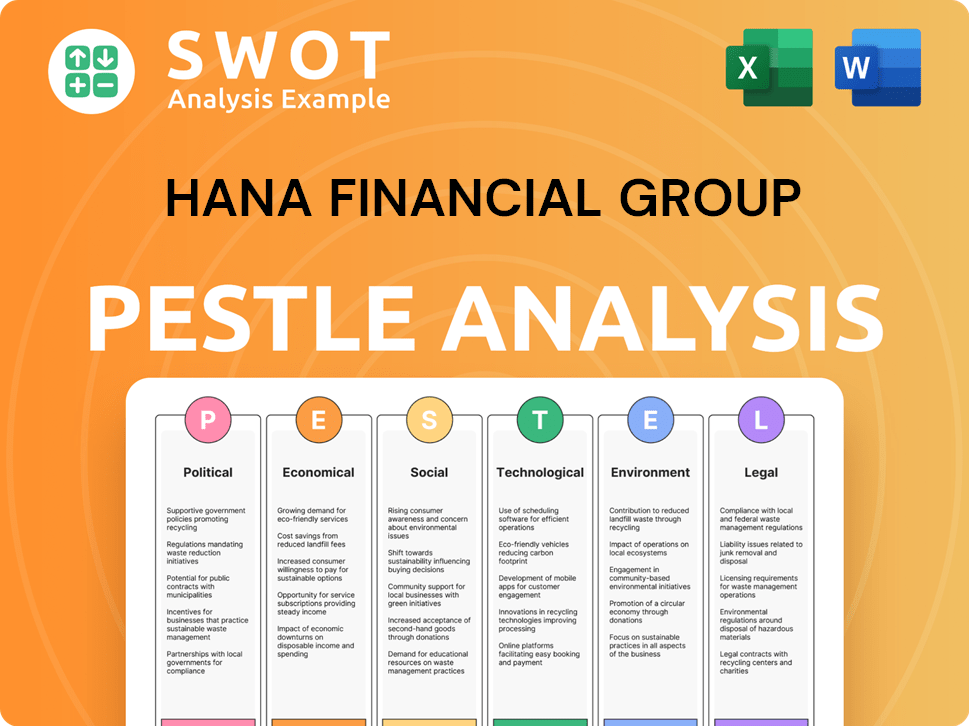

Hana Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Hana Financial Group history?

The Hana Financial Group has achieved several milestones, reflecting its growth and adaptation within the South Korean banking sector. These achievements highlight its evolution and strategic initiatives over time.

| Year | Milestone |

|---|---|

| Early Years | Early adoption of digital banking services, including online and mobile banking platforms. |

| 2017 | Launched 'Hana Members,' an integrated loyalty program consolidating points from various subsidiaries. |

| 2024 | Hana Bank announced a partnership with SK Telecom to develop an AI-based financial service. |

The group has consistently embraced innovation, particularly in digital banking. This forward-thinking approach has been crucial in meeting the demands of a tech-savvy customer base and maintaining a competitive edge among Korean financial institutions.

Early adoption of online and mobile banking platforms to serve a tech-savvy Korean population. This innovation streamlined banking processes and improved customer accessibility.

Launched in 2017, this program consolidated points from various subsidiaries, creating a customer-centric digital ecosystem. It enhanced customer engagement and loyalty.

In 2024, Hana Bank partnered with SK Telecom to develop AI-based financial services. This partnership aims to improve customer experience and operational efficiency. The goal is to personalize financial services.

Despite its successes, Hana Financial Group has faced various challenges, including intense domestic competition and the need to adapt to rapidly evolving technologies. These challenges have shaped its strategic decisions and operational adjustments.

The South Korean banking sector is highly competitive, requiring Hana Financial Group to continuously innovate. This competition drives the need for efficiency and customer-centric services.

The Asian Financial Crisis in the late 1990s presented significant hurdles for the entire Korean financial sector. This crisis necessitated restructuring and recapitalization efforts.

Adapting to the rapid pace of fintech disruption and the demand for personalized digital services has been a continuous challenge. This requires ongoing investment in technology.

Evolving regulatory landscapes require constant adaptation and compliance efforts. These changes impact operational strategies and financial planning.

Hana Bank introduced 'AI Loan' services in 2024, leveraging AI for credit assessment. This adaptation showcases its ability to meet market demands and enhance efficiency.

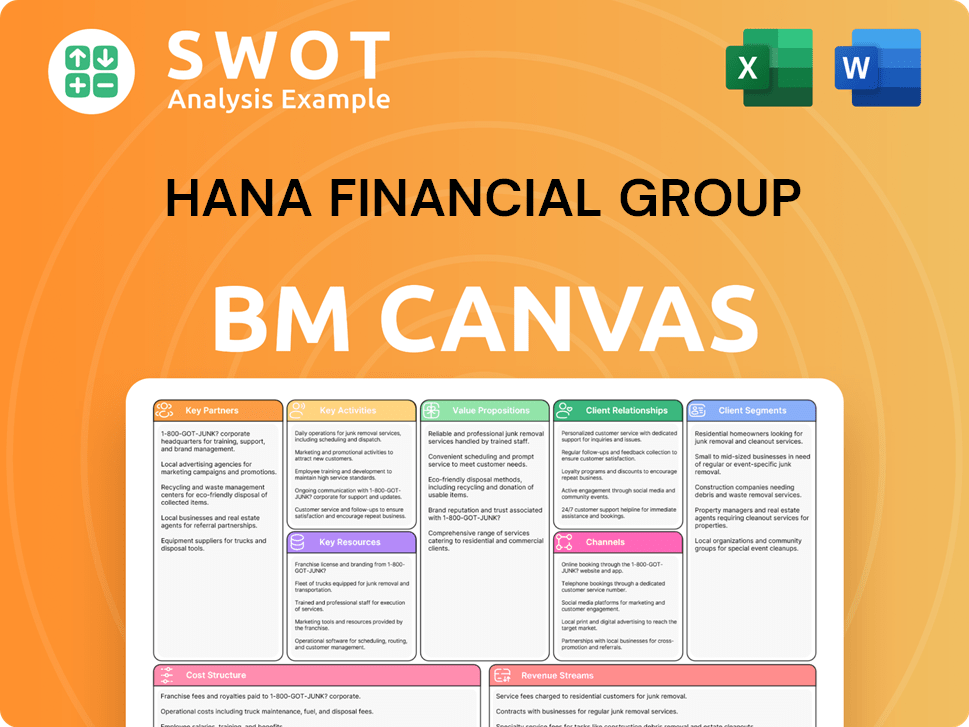

Hana Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Hana Financial Group?

The Brief history Hana Financial Group's journey reflects strategic pivots and significant achievements. Established in 1971 as Korea Investment Finance Corporation, it evolved into Hana Bank in 1991. Key milestones include the 2002 merger with Seoul Bank, the 2005 formation of Hana Financial Group, and the 2015 merger with Korea Exchange Bank (KEB) to create KEB Hana Bank. The group launched 'Hana Members' in 2017 and focused on digital transformation and ESG initiatives from 2020 onward. In 2023, Hana Financial Group reported a net profit of KRW 3.16 trillion (approximately USD 2.3 billion), showcasing its financial strength. Recent initiatives in 2024 include partnerships in AI-based financial services and sustainable finance, setting the stage for future growth.

| Year | Key Event |

|---|---|

| 1971 | Established as Korea Investment Finance Corporation, marking the initial step in its evolution. |

| 1991 | Transformed into a commercial bank, rebranding as Hana Bank, which signified a major shift in its operational focus. |

| 2002 | Merged with Seoul Bank, significantly expanding its asset base and market presence within the Korean financial landscape. |

| 2005 | Established Hana Financial Group as a holding company, streamlining its structure for broader financial services. |

| 2015 | Merged with Korea Exchange Bank (KEB) to form KEB Hana Bank, bolstering its global footprint and international capabilities. |

| 2017 | Launched 'Hana Members,' an integrated loyalty program designed to enhance customer engagement and retention. |

| 2020 | Focused on digital transformation and ESG (Environmental, Social, and Governance) initiatives, adapting to modern financial trends. |

| 2023 | Reported a net profit of KRW 3.16 trillion (approximately USD 2.3 billion), demonstrating robust financial performance. |

| 2024 | Announced partnerships and initiatives in AI-based financial services and sustainable finance, signaling innovation. |

| 2025 | Expected to continue its focus on digital innovation, global expansion, and ESG management, planning for future growth. |

Hana Financial Group is heavily investing in AI, big data, and cloud technologies. This is to enhance customer experience. Operational efficiency is another focus, aiming for a more streamlined service.

The group is expanding its presence in key emerging markets. Asia is a key area of focus for Hana Financial Group. Investment banking capabilities are being strengthened overseas.

Hana Financial Group integrates environmental and social considerations into its business. This aligns with global trends and investor expectations. They are committed to sustainable practices.

Analyst predictions for 2025 suggest continued strong earnings. The consensus net profit forecast is KRW 3.55 trillion (approximately USD 2.6 billion). This indicates a positive financial trajectory.

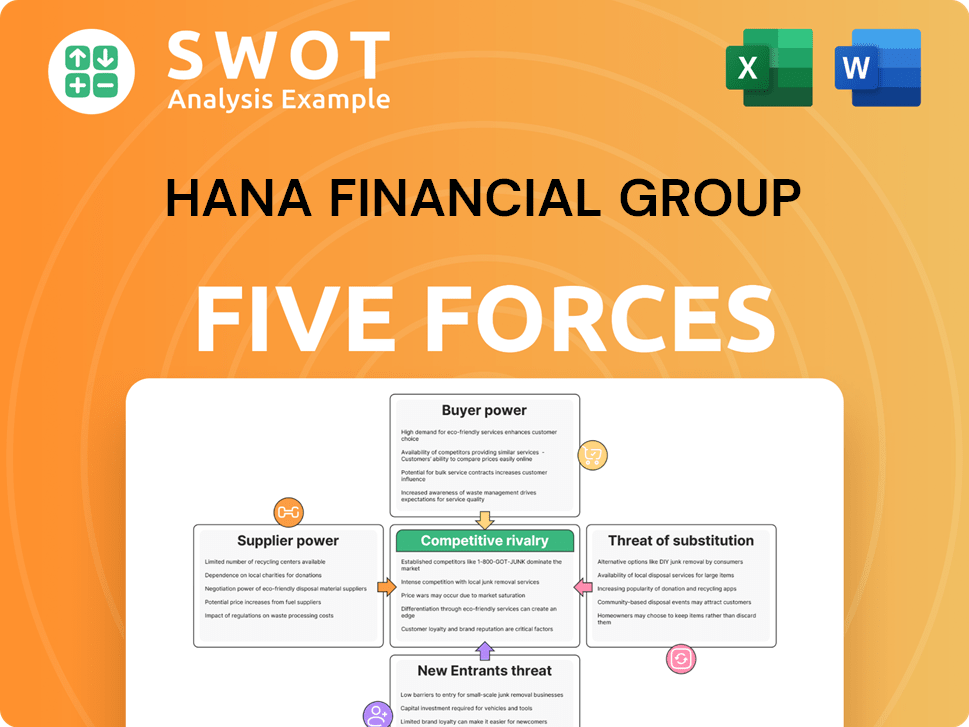

Hana Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Hana Financial Group Company?

- What is Growth Strategy and Future Prospects of Hana Financial Group Company?

- How Does Hana Financial Group Company Work?

- What is Sales and Marketing Strategy of Hana Financial Group Company?

- What is Brief History of Hana Financial Group Company?

- Who Owns Hana Financial Group Company?

- What is Customer Demographics and Target Market of Hana Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.