Hana Financial Group Bundle

Decoding Hana Financial Group: How Does It Thrive?

Hana Financial Group, a powerhouse in the South Korean financial sector, achieved record profits in 2024, exceeding its previous best. With a market capitalization of nearly $15 billion as of June 2025, the group's influence on the global financial stage is undeniable. This financial services giant offers a wide array of solutions, from banking to insurance, making it a key player for investors and businesses alike.

Given its impressive Hana Financial Group SWOT Analysis, and strategic moves, understanding the inner workings of Hana Financial Group is essential. This includes exploring the roles of Hana Bank and other subsidiaries, its commitment to digital transformation, and its global expansion strategy. This in-depth analysis will provide valuable insights into the group's financial performance and future prospects, specifically for those interested in Korean banking and the broader financial services industry.

What Are the Key Operations Driving Hana Financial Group’s Success?

Hana Financial Group (HFG) delivers value through a diverse array of financial services. Its core operations are segmented into banking, financial investment, credit cards, and other services. These services cater to a broad spectrum of customers, including individuals, SMEs, large corporations, and institutional investors, making it a comprehensive financial solutions provider in Korean banking.

The group's value proposition centers on offering a wide range of financial products and services. This includes traditional banking services, investment banking activities, and credit card services. HFG also provides asset management, insurance, and other financial solutions. This diversified approach allows the group to meet various financial needs and maintain a strong market position.

Operational efficiency is a key focus for Hana Financial. The group emphasizes digital transformation and innovation. This includes significant investment in digital banking services, such as the MyHana Mobile Banking app and Internet Banking. They also use AI-based products and services, like an AI Lab for startups and an AI-based real-time interpretation service in branches, particularly beneficial for foreign customers. To learn more about their strategies, consider reading about the Marketing Strategy of Hana Financial Group.

Hana Bank, a subsidiary of Hana Financial Group, offers traditional banking services. These services include loans, deposits, and various other financial products. The bank focuses on enhancing customer experience and operational efficiency through digital channels.

Hana Financial Group engages in investment banking activities. This includes securities trading, brokering, and other related services. The group aims to provide comprehensive financial solutions to its clients through its investment banking segment.

Hana Financial Group provides credit card services through its subsidiaries. These services include a variety of credit card products and related financial services. The credit card segment is a key part of the group's diversified financial offerings.

HFG offers a range of other financial services, including asset management and insurance. These services complement the core offerings and cater to a wide range of customer needs. The group aims to provide comprehensive financial solutions.

Hana Financial Group heavily invests in digital transformation to improve customer experience and operational efficiency. This includes digital banking services, AI-based products, and smart teller systems. These innovations enhance accessibility and convenience for customers.

- MyHana Mobile Banking and Internet Banking offer convenient online services.

- AI-based services, such as the AI Lab, support startups and enhance customer service.

- Smart teller systems streamline transactions and improve efficiency.

- Digital channels are used for almost all transactions.

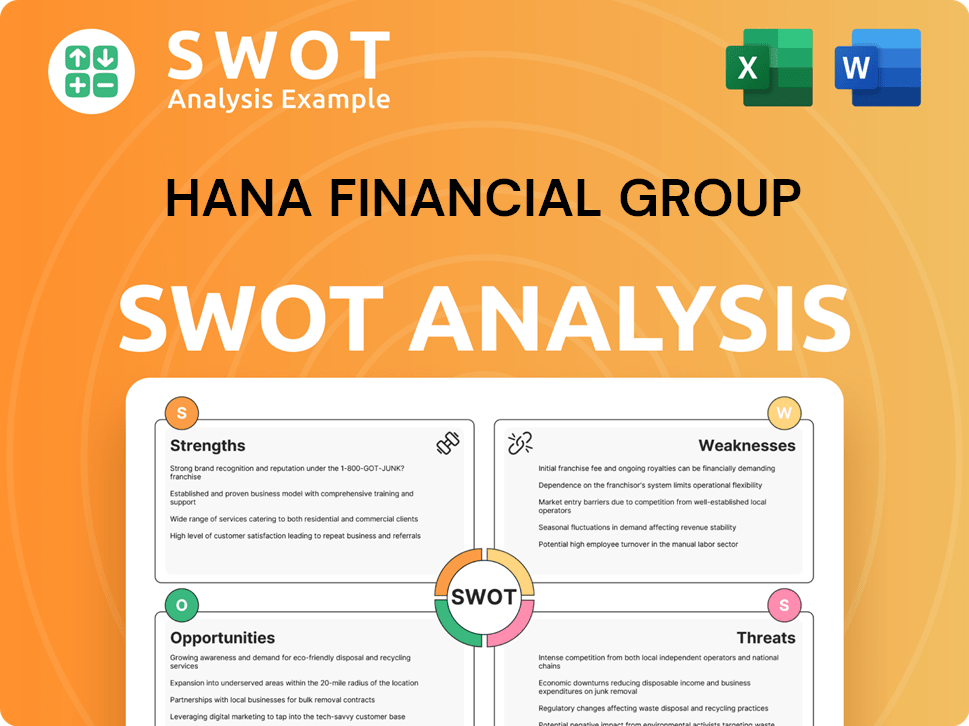

Hana Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hana Financial Group Make Money?

Hana Financial Group, a prominent player in the financial services sector, generates revenue through diverse streams. The company's primary revenue sources include interest income and fee income, which are key drivers of its financial performance. Understanding these revenue streams provides insight into how Hana Financial Group operates and achieves its financial goals.

In 2024, Hana Financial Group's financial performance showcased its revenue generation strategies. The group's net profit reached a record 3.70 trillion won, reflecting its robust financial health. This growth was supported by strategic diversification and effective management across its various business segments.

The company's monetization strategies are multifaceted, focusing on both traditional banking services and innovative financial products. Hana Financial Group is expanding its digital offerings and focusing on wealth management to diversify its revenue sources beyond traditional interest income. The group's approach highlights its adaptability and commitment to meeting evolving customer needs in the financial services market.

Interest income is a significant revenue stream for Hana Financial Group, primarily from its banking operations. In 2024, interest gains totaled 8.76 trillion won, although this represented a slight decrease of 1.3% year-on-year. This income is generated from loans, investments, and other interest-bearing assets.

Fee income is another crucial revenue source, driven by services such as investment banking, retirement pensions, and credit cards. Fee income saw a substantial increase of 15.2% year-on-year, reaching 2.07 trillion won in 2024. This growth highlights the success of the group's diversification efforts.

The banking segment, mainly Hana Bank, is the dominant revenue driver, accounting for 94% of the group's earnings in 2024. While Hana Bank's net profit decreased slightly, non-banking arms performed well. This segment's performance is critical to the overall financial health of Hana Financial Group.

Hana Financial Group is expanding its digital services, such as the LINE Bank by Hana Bank. By the end of 2024, LINE Bank had 1.2 million customers, a 44% increase from the previous year. These digital initiatives are designed to attract a broader customer base and diversify revenue sources.

The company focuses on wealth management, offering tailored services like customized tax planning and total life care services. This strategy targets high-net-worth individuals and institutional investors. This approach helps to increase fee income and strengthen customer relationships.

Subsidiaries like Hana Securities Co. and Hana Card Co. contributed positively to the group's revenue. Hana Securities Co. swung to a profit of 225.1 billion won, while Hana Card Co. earned 221.7 billion won. This diversified portfolio of financial services supports overall revenue generation.

Hana Financial Group employs various strategies to monetize its services and increase revenue. These strategies include expanding digital offerings, focusing on wealth management, and leveraging its subsidiaries. The group's financial performance in 2024 demonstrates the effectiveness of these strategies.

- Diversification: Diversifying revenue streams beyond traditional interest income is a key strategy.

- Digital Expansion: Investing in digital platforms to attract more customers.

- Wealth Management: Providing tailored services for high-net-worth individuals.

- Subsidiary Contributions: Leveraging subsidiaries like Hana Securities and Hana Card.

For more insights into the strategies of Hana Financial Group, you can read about the Growth Strategy of Hana Financial Group.

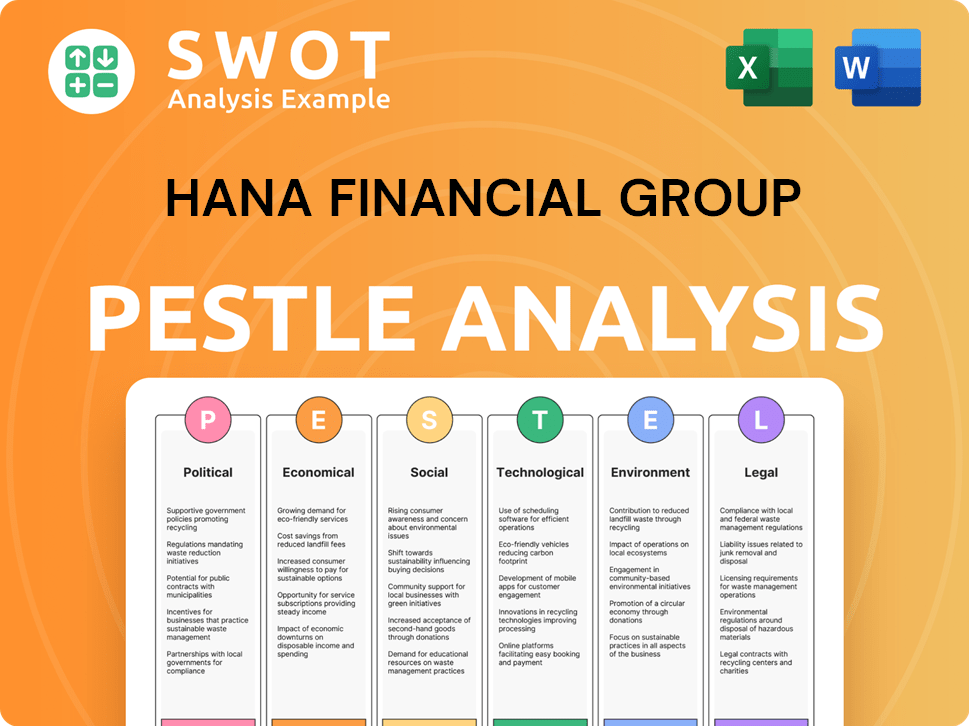

Hana Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hana Financial Group’s Business Model?

Hana Financial Group has significantly advanced its operations and financial performance, marked by key milestones and strategic initiatives. A notable achievement includes a record net profit of 3.70 trillion won in 2024. This success is coupled with strategic moves aimed at enhancing shareholder value and expanding its digital footprint. The group's commitment to innovation and growth is evident in its ongoing investments in digital transformation and AI capabilities.

The group's strategic focus includes digital transformation and expansion of its non-banking services. The launch of LINE Bank by Hana Bank in 2021, which reached 1.2 million customers by the end of 2024, highlights its digital innovation. Furthermore, the group is strengthening its non-banking services, aiming to increase their contribution to net profit from 16% at the end of 2024 to 30% by 2027. These initiatives demonstrate a forward-thinking approach to adapting to the evolving financial landscape.

Despite facing challenges like market volatility, Hana Financial Group maintains a competitive edge. This is supported by its strong brand recognition, extensive global network, and ongoing digital innovation efforts. The group's ability to navigate economic fluctuations while pursuing strategic growth initiatives underscores its resilience and commitment to long-term value creation. For more insights, consider reading about the Growth Strategy of Hana Financial Group.

Achieved a record net profit of 3.70 trillion won in 2024. Conducted the largest-ever share repurchase of 400 billion won ($280 million).

Prioritized digital transformation, including the launch of 'My Branch'. Launched LINE Bank in 2021, reaching 1.2 million customers by the end of 2024. Focused on AI development, including an AI code of ethics.

Strong brand recognition and an extensive global network across 26 regions. Ongoing digital innovation efforts. Strengthening non-banking services, aiming for a 30% contribution to net profit by 2027.

Aims to raise its total shareholder return (TSR) to 50% by 2027, up from 38% in 2024. Despite a 4.8% drop year-on-year in operating profit in Q1 2025 to 1.48 trillion won, net profit rose 9.3% to 1.13 trillion won in Q1 2025.

Hana Financial Group's strategic initiatives and financial results demonstrate its commitment to growth and shareholder value. The company is focused on digital transformation and expanding its non-banking services to maintain its competitive edge in the financial services sector.

- Record net profit in 2024.

- Significant investment in digital banking and AI.

- Expansion of non-banking services.

- Strong global presence and brand recognition.

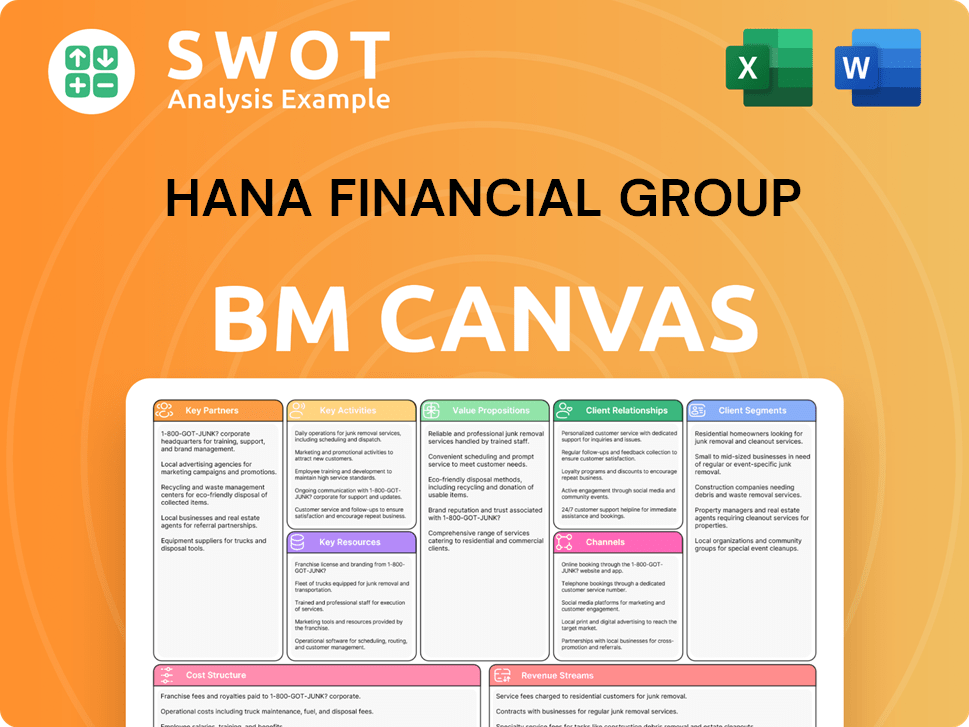

Hana Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hana Financial Group Positioning Itself for Continued Success?

Hana Financial Group holds a significant position in the Korean banking sector, ranking as the third-largest financial services group in South Korea. In 2024, the Financial Services Commission designated it as a domestic systemically important bank (D-SIB), highlighting its crucial role within the financial system. The company focuses on enhancing customer loyalty through digital services and tailored financial products. For example, remittances through Hana Bank by foreigners in South Korea are projected to exceed $3 million in 2024.

The group faces several risks, including market volatility, regulatory changes, and intense competition. Recent challenges include foreign exchange losses and a decrease in interest income due to lower market interest rates. In the first quarter of 2025, there was a deterioration in soundness indicators, with the non-performing loan (NPL) ratio rising to 0.70% and the delinquency rate reaching 0.59%.

Hana Financial Group is a leading financial services provider in South Korea. It is recognized as a D-SIB, indicating its importance to the country's financial stability. The group's efforts to attract and retain customers through digital services and customized financial products have been key.

The company faces risks such as market volatility and regulatory changes. The decline in interest income and rising NPLs are significant concerns. Intense competition within the financial sector also poses a challenge to profitability.

Hana Financial Group is focusing on bolstering its non-banking businesses. The group aims for these businesses to contribute 30% of net profit by 2027. Digital innovation and global expansion are also key strategies.

The group plans to strengthen its asset management capabilities, particularly in target-date funds. Investments in AI and cloud computing are ongoing. Strategic partnerships, like the one with Credit Agricole, are aimed at global expansion.

Looking ahead, Hana Financial Group is implementing several strategic initiatives to sustain and expand its profitability. A primary focus is on strengthening non-banking businesses, with a target for them to contribute 30% of the group's net profit by 2027. This includes enhancing asset management capabilities, especially in target-date funds for retirement and exchange-traded funds. The group continues to invest in digital innovation, including AI and cloud computing. They have also launched a 'future growth' unit to integrate strategy, digital, and brand divisions. Furthermore, Hana Financial Group is expanding its global presence, forming strategic partnerships, such as the one with Credit Agricole Corporate and Investment Bank, to strengthen cooperation in Europe. Understanding the Target Market of Hana Financial Group is crucial for the company’s strategic planning.

The group is strategically focused on several key areas to enhance its market position and future growth.

- Enhancing asset management capabilities, particularly in target-date funds and ETFs.

- Ongoing investments in AI and cloud computing to drive digital innovation.

- Expanding its global presence through strategic partnerships.

- Focus on stable leadership and strategic execution with the reappointment of Chairman Ham Young-joo until March 2028.

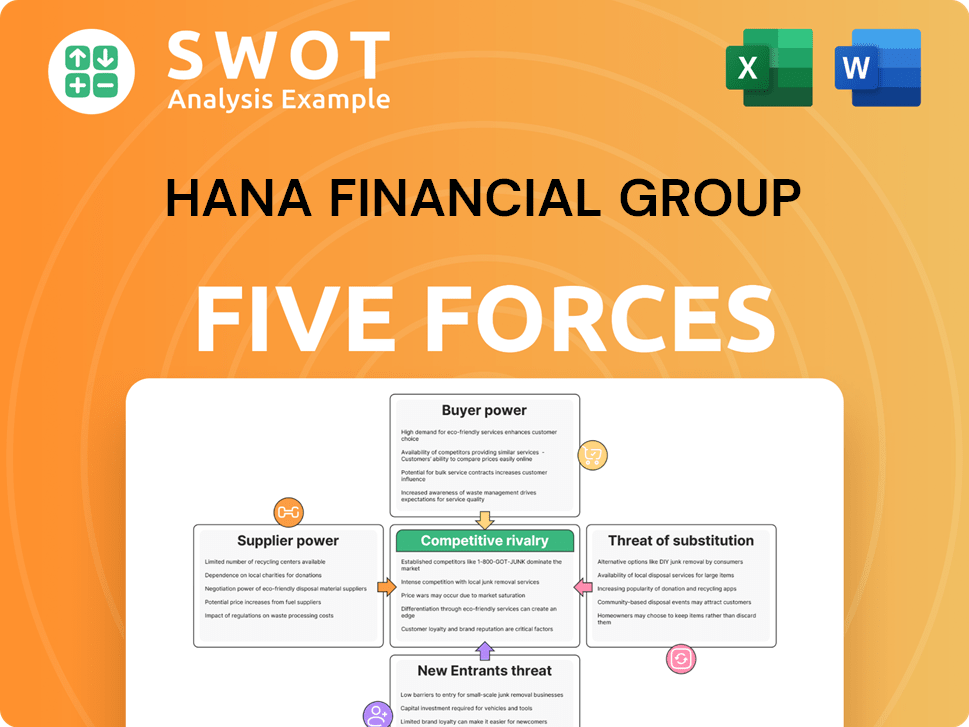

Hana Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hana Financial Group Company?

- What is Competitive Landscape of Hana Financial Group Company?

- What is Growth Strategy and Future Prospects of Hana Financial Group Company?

- What is Sales and Marketing Strategy of Hana Financial Group Company?

- What is Brief History of Hana Financial Group Company?

- Who Owns Hana Financial Group Company?

- What is Customer Demographics and Target Market of Hana Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.