Hana Financial Group Bundle

How is Hana Financial Group Shaping the Future of Financial Services?

Hana Financial Group, a leading financial institution in South Korea, has a compelling story of growth and transformation. From its origins in 1971, it has evolved into a financial powerhouse, offering a wide array of services. Understanding its journey and future ambitions is key to grasping the dynamics of the Hana Financial Group SWOT Analysis and the broader financial landscape.

This exploration of Hana Financial Group delves into its strategic initiatives and future prospects within the competitive Banking Industry. Analyzing its Growth Strategy reveals how the company plans to navigate challenges and capitalize on opportunities in the global financial market. We will examine its Future Prospects, considering factors like its market share, expansion plans, and the impact of economic trends, to provide a comprehensive view of its trajectory in South Korea and beyond.

How Is Hana Financial Group Expanding Its Reach?

The Hana Financial Group is actively pursuing several expansion initiatives to strengthen its market position and diversify revenue streams. A key element of its growth strategy involves expanding its global footprint, particularly in emerging markets. This strategic move aims to capitalize on the high growth potential and the expanding middle classes in these regions.

The company's expansion efforts often include acquiring stakes in local financial institutions or establishing new branches and subsidiaries. This approach helps cater to both corporate and retail clients. Domestically, the focus is on expanding non-banking business sectors to reduce reliance on traditional interest income. These initiatives are designed to capture new customer segments and deepen existing customer relationships.

The company is exploring new business models, such as platform-based financial services, to reach a broader customer base and create new revenue streams. These initiatives are crucial for staying ahead of evolving industry trends. For an in-depth look at how the company approaches its marketing, consider reading about the Marketing Strategy of Hana Financial Group.

Hana Financial Group is targeting Southeast Asia for significant growth. Countries like Vietnam, Indonesia, and the Philippines are key focus areas. The company aims to leverage the high growth potential and burgeoning middle classes in these markets. These efforts often involve strategic partnerships and M&A.

Domestically, the company is focused on expanding its non-banking business sectors. This includes bolstering investment banking, asset management, and insurance arms. The goal is to reduce reliance on traditional interest income. New financial products and services are being tailored to specific customer segments.

Hana Financial Group is actively developing new financial products and services tailored to specific customer segments. This includes digital-native generations and small and medium-sized enterprises (SMEs). There is a concerted effort to enhance its wealth management offerings, providing more sophisticated and personalized investment solutions.

The company is exploring new business models, such as platform-based financial services, to reach a broader customer base. This approach aims to create new revenue streams. These initiatives are designed to capture new customer segments. The aim is to deepen existing customer relationships and stay ahead of evolving industry trends.

The future prospects for Hana Financial Group look promising, driven by strategic expansions and diversification. The company's focus on emerging markets and non-banking sectors positions it well for sustained growth. By leveraging digital transformation and strategic partnerships, the company aims to enhance its market share and profitability.

- Continued expansion in Southeast Asia, with potential for increased revenue from international operations.

- Growth in non-banking sectors, such as asset management and investment banking, to diversify income streams.

- Focus on digital transformation initiatives to improve customer experience and operational efficiency.

- Strategic partnerships and acquisitions to strengthen market presence and expertise.

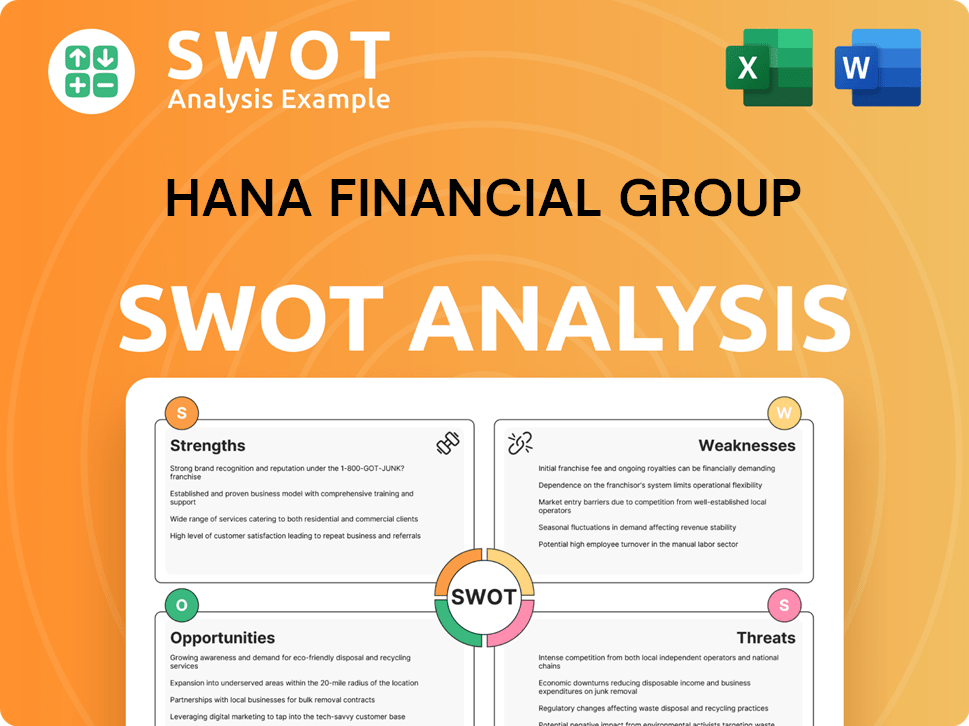

Hana Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hana Financial Group Invest in Innovation?

Hana Financial Group is significantly investing in innovation and technology as a core component of its growth strategy. This focus is designed to enhance its competitive position within the financial services sector and drive sustainable growth. The company's approach involves substantial research and development (R&D) efforts, strategic collaborations, and a commitment to digital transformation.

The company's digital transformation strategy is multifaceted, encompassing considerable R&D investments in areas such as artificial intelligence (AI), big data analytics, and blockchain technology. These technologies are being leveraged to improve operational efficiency, enhance customer experience, and develop new digital products and services. This strategy is crucial for the company's future prospects in the dynamic South Korean banking industry.

A key element of the strategy is the development of robust digital platforms that offer seamless and integrated financial services across various channels. This is complemented by the exploration of blockchain applications for secure transactions and enhanced data management. Furthermore, sustainability initiatives are integrated into its technology strategy, with efforts to develop green financial products and leverage technology for environmental, social, and governance (ESG) reporting and analysis.

AI-powered chatbots and personalized financial advisory services are being implemented to provide more convenient and tailored solutions to customers. The company is also focusing on automating internal processes to reduce costs and improve service delivery speed.

Collaborations with external innovators, including fintech startups and technology companies, are a crucial part of Hana Financial Group's innovation strategy. These partnerships allow the company to quickly adopt new technologies and integrate them into its existing infrastructure.

The company is focused on developing robust digital platforms that offer seamless and integrated financial services across various channels. This ensures customers can access services easily and efficiently.

The company is exploring the application of blockchain for secure transactions and enhanced data management. This technology aims to improve security and efficiency in financial operations.

Sustainability initiatives are being integrated into its technology strategy, with efforts to develop green financial products and leverage technology for ESG reporting and analysis. This demonstrates a commitment to environmental and social responsibility.

Hana Financial Group is making significant R&D investments in areas like AI, big data analytics, and blockchain technology. These investments are crucial for driving innovation and maintaining a competitive edge.

These technological advancements are central to Hana Financial Group's objective of maintaining leadership in the digital financial landscape. The company's focus on innovation is a key part of its overall growth strategy, as detailed in the Brief History of Hana Financial Group.

- AI-Driven Solutions: Implementing AI for chatbots and personalized financial advice.

- Process Automation: Automating internal processes to reduce costs and increase speed.

- Digital Platforms: Developing integrated digital platforms for seamless service delivery.

- Blockchain Technology: Exploring blockchain for secure transactions and data management.

- Green Financial Products: Developing sustainable financial products and ESG reporting tools.

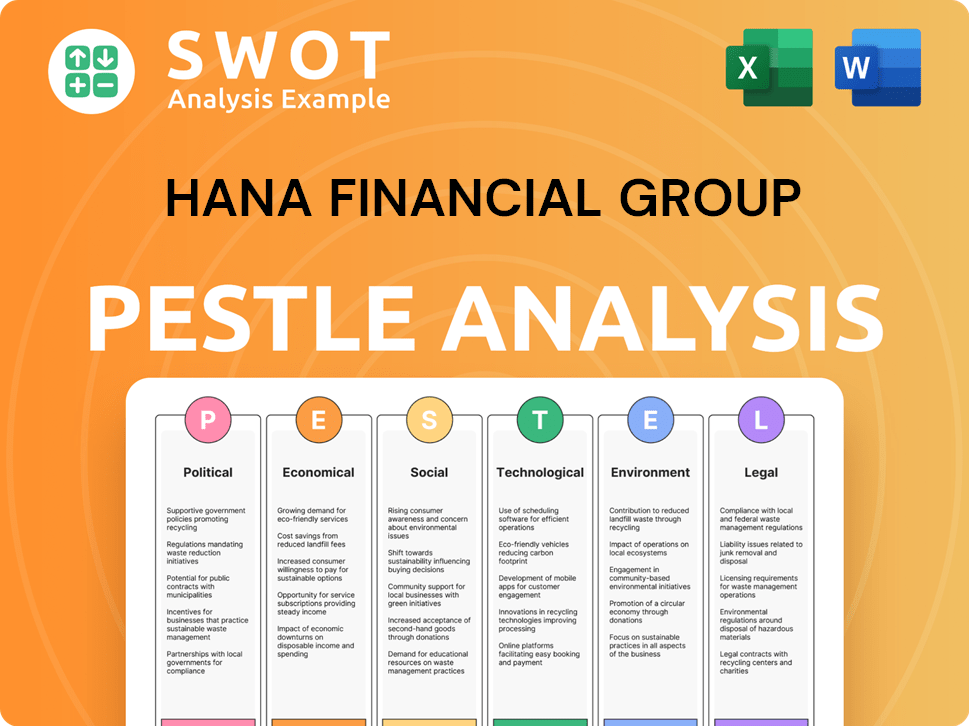

Hana Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Hana Financial Group’s Growth Forecast?

The financial outlook for Hana Financial Group (HFG) is centered on sustainable growth, supported by strategic initiatives and technological advancements. The company aims to achieve robust revenue growth and improve profit margins. In Q1 2024, HFG reported a net profit of approximately USD 680 million, demonstrating a strong start to the year.

Hana Financial Group's strategy focuses on efficient capital utilization and shareholder value creation, targeting a double-digit return on equity (ROE). Management is committed to investing in digital transformation and global expansion, which are expected to be key drivers of future earnings. The company's diverse business portfolio and focus on non-interest income growth are expected to support stable to increasing profitability, according to analyst forecasts for 2024 and beyond.

Hana Financial Group's financial planning includes optimizing its funding structure and exploring capital raise opportunities to support large-scale M&A activities or technological investments. The company is committed to prudent risk management while pursuing growth in domestic and international markets. The company's loan portfolio quality remains strong, and its capital adequacy ratios are well above regulatory requirements, providing a solid foundation for expansion.

Analysts generally project stable to increasing profitability for Hana Financial Group in 2024 and beyond. This is supported by a diversified business portfolio and a strategic focus on non-interest income growth. The company’s strong financial performance in Q1 2024, with a net profit of USD 680 million, indicates a positive trajectory.

Hana Financial Group maintains robust capital adequacy ratios, exceeding regulatory requirements, which provides a solid base for future expansion. The company emphasizes prudent risk management, which is crucial for sustainable growth. This approach helps manage potential risks while the company aggressively pursues growth opportunities.

Hana Financial Group is investing heavily in digital transformation and global expansion. These initiatives are expected to be key drivers of future earnings. The company's strategic focus on technological advancement and international growth is designed to enhance its competitive position and drive long-term value.

Hana Financial Group's strategic financial planning includes optimizing its funding structure and exploring capital raise opportunities. This proactive approach supports large-scale M&A activities and significant technological investments. The company's financial strategy is designed to support its growth objectives.

Hana Financial Group demonstrates a strong financial performance and strategic focus. The company’s financial outlook is positive, supported by key initiatives.

- Q1 2024 Net Profit: Approximately USD 680 million.

- ROE Target: Double digits, indicating efficient capital use.

- Strategic Focus: Digital transformation and global expansion.

- Financial Planning: Optimizing funding and potential capital raises.

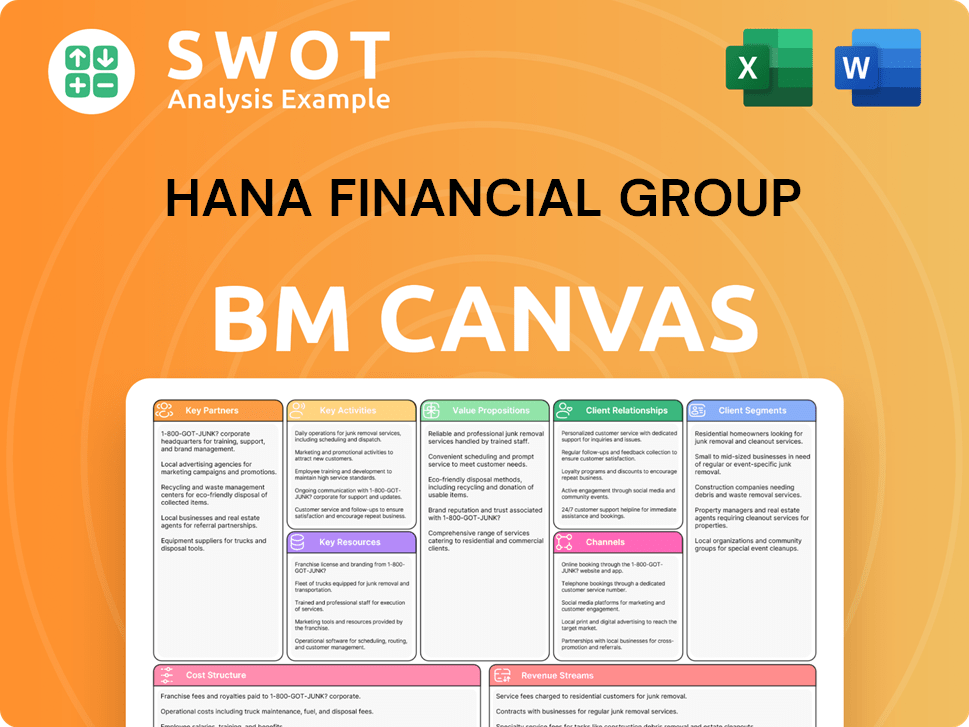

Hana Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Hana Financial Group’s Growth?

The Hana Financial Group faces several potential risks and obstacles that could impact its Growth Strategy and Future Prospects. These challenges range from intensifying competition in the Financial Services sector to navigating complex regulatory landscapes. Understanding these risks is crucial for assessing the company's long-term sustainability and investment potential within the Banking Industry, especially in South Korea and its international markets.

One major hurdle is the increasing competition from both traditional financial institutions and innovative fintech companies. The rapid advancements in technology require continuous investment and adaptation to stay competitive. Furthermore, geopolitical risks and economic downturns, particularly in key markets targeted for expansion, pose significant threats to asset quality and profitability. For instance, economic volatility in 2024 could affect the performance of its overseas branches.

Internally, the integration of new acquisitions and maintaining a cohesive corporate culture across diverse subsidiaries present operational challenges. Cybersecurity threats also remain a constant concern, demanding substantial investment in robust security measures to protect customer data and maintain trust. Analyzing the Target Market of Hana Financial Group is essential to understand how these risks could impact its customer base.

Increased competition from both traditional banks and fintech companies pressures margins and market share. The rise of digital banking and innovative financial products requires constant adaptation and investment in technology. Competitors like KB Financial Group and Shinhan Financial Group are also vying for market dominance, intensifying the competitive landscape.

Rapid technological advancements necessitate continuous investment in digital infrastructure and innovation. Failure to adapt to new technologies, such as AI and blockchain, could lead to a loss of competitiveness. Cybersecurity threats also increase with technological advancements, requiring robust security measures and data protection strategies.

Changes in financial regulations can introduce uncertainties and increase compliance costs. The financial sector is highly regulated, and new rules regarding capital requirements, data privacy, and consumer protection can significantly impact operations. Compliance with international regulations, particularly in markets where the company operates, adds further complexity.

Geopolitical instability and economic downturns in key markets can affect asset quality and profitability. The global economic outlook, including potential recessions or financial crises, can significantly impact the company's international business outlook. Fluctuations in currency exchange rates and interest rates also pose financial risks.

Integrating new acquisitions and ensuring a cohesive corporate culture across diverse subsidiaries can be operationally challenging. Mergers and acquisitions require significant effort to align systems, processes, and corporate cultures. Successfully integrating acquired entities is crucial for realizing the expected synergies and achieving strategic goals.

Cybersecurity threats remain a constant concern, requiring substantial investment in robust security measures. The financial sector is a prime target for cyberattacks, necessitating continuous monitoring, advanced security protocols, and employee training. Data breaches can lead to financial losses, reputational damage, and regulatory penalties.

Hana Financial Group employs a comprehensive risk management framework to mitigate these challenges, including diversification of its business portfolio across different segments and geographies. The company engages in rigorous scenario planning to prepare for various market conditions and potential disruptions. In 2024, the company is focusing on expanding its digital banking services and strengthening its cybersecurity measures to address emerging risks. The company's proactive credit risk management helped maintain asset quality during the global pandemic.

Emerging risks include climate change-related financial risks and the increasing demand for sustainable finance, which could shape its future trajectory. The company is also facing the challenge of adapting to changing customer preferences and behaviors, particularly the growing preference for digital banking services. The company's strategic focus on sustainable growth strategies and innovation in financial products is essential to navigate these challenges.

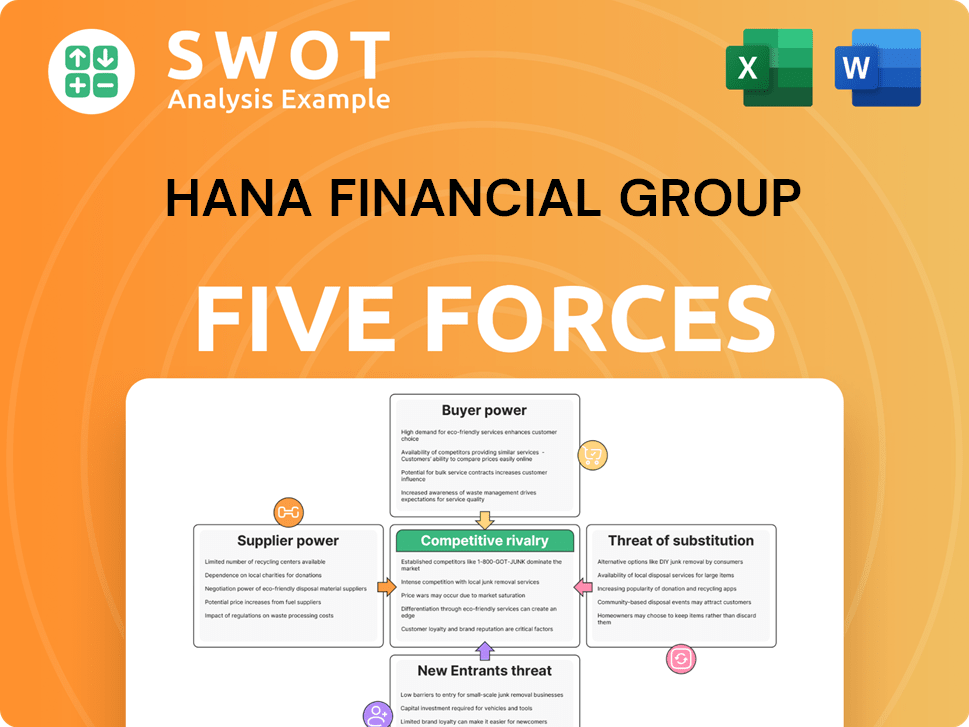

Hana Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hana Financial Group Company?

- What is Competitive Landscape of Hana Financial Group Company?

- How Does Hana Financial Group Company Work?

- What is Sales and Marketing Strategy of Hana Financial Group Company?

- What is Brief History of Hana Financial Group Company?

- Who Owns Hana Financial Group Company?

- What is Customer Demographics and Target Market of Hana Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.