Hana Financial Group Bundle

Who Does Hana Financial Group Serve?

In today's dynamic financial world, understanding customer demographics and target markets is crucial for success. Hana Financial Group, a leading player in Korean banking and financial services, continually adapts to evolving consumer needs. This exploration delves into the heart of Hana Financial Group's strategy, examining its customer base and how it tailors its offerings.

Hana Financial Group's strategic approach to customer segmentation is evident in its diverse service offerings and expansion strategies. The company's digital transformation, with almost all transactions conducted online, and the launch of services like 'Hana The Next' for senior customers, showcase its commitment to meeting specific demographic needs. For a deeper dive into the company's strategic positioning, consider reviewing a comprehensive Hana Financial Group SWOT Analysis.

Who Are Hana Financial Group’s Main Customers?

Understanding the customer base of Hana Financial Group is crucial for effective market analysis. The company's target market spans various segments, including consumers (B2C), businesses (B2B), and institutional investors. This diverse approach reflects the group's comprehensive financial services offerings, designed to cater to a wide range of needs.

Hana Financial Group's primary customer segments are defined by several factors, including demographics, business type, and financial needs. The group strategically segments its customers to provide tailored financial solutions. This segmentation enables a more focused approach to customer acquisition and retention.

Analyzing the customer demographics and target market of Hana Financial Group reveals a dynamic strategy. The company continually adapts to changing market conditions and customer preferences. This adaptability is key to maintaining a competitive edge in the Korean banking sector.

The B2C segment includes individual consumers. A significant focus is on senior customers, particularly those reaching retirement age. The 'Hana The Next' initiative, launched in October 2024, targets South Korea's baby boomers for retirement planning.

Another important B2C segment comprises foreign individual customers residing in South Korea. The number of foreign residents rose significantly in recent years. As of August 2024, approximately 3.1 million foreigners had accounts at Hana Bank.

Hana Financial Group provides corporate finance, microfinance, and auto finance solutions to businesses. Corporate clients contribute significantly to net interest income. Hana Bank's total loan disbursement reached KRW 37.12 trillion in 2024.

Hana Financial Group aims to increase the profit contribution from its non-banking businesses. This diversification strategy suggests a broader customer base. Further insights into the company's financial model can be found in Revenue Streams & Business Model of Hana Financial Group.

The customer demographics of Hana Financial Group are diverse and evolving. The company adapts its strategies based on market trends. Understanding these segments is crucial for investors and analysts.

- Focus on senior customers and foreign residents.

- Significant B2B presence with corporate finance solutions.

- Strategic diversification to increase non-banking revenue.

- Proactive adaptation to changing demographics.

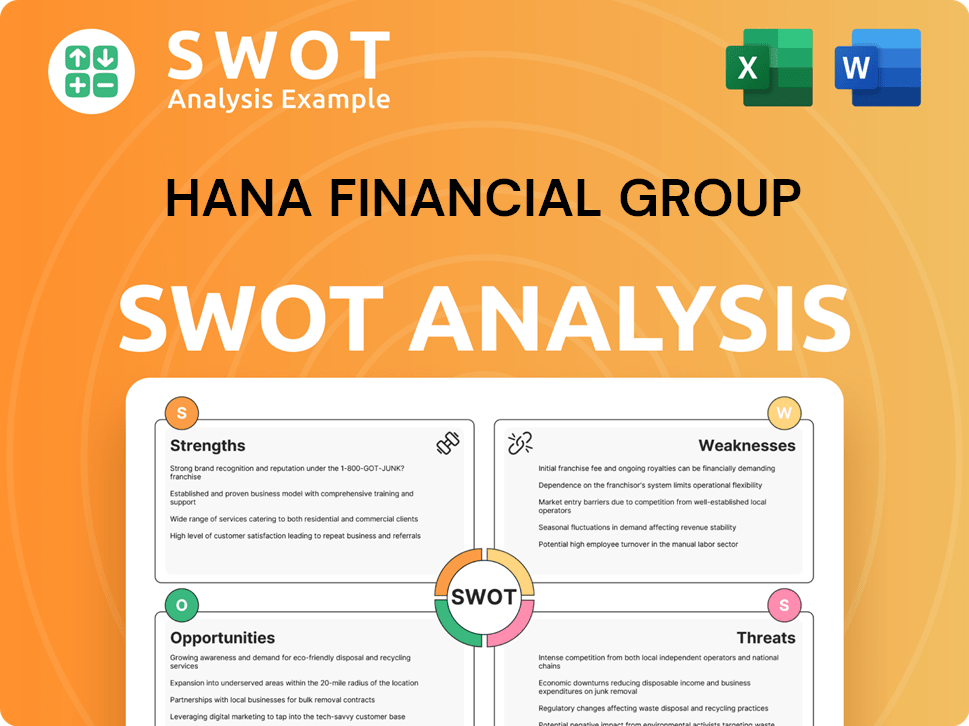

Hana Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Hana Financial Group’s Customers Want?

Understanding the customer needs and preferences is crucial for any financial institution. For Hana Financial Group, this involves a deep dive into the diverse needs of its customer base, which includes individual customers, senior citizens, and corporate clients. This analysis is essential for effective customer segmentation and tailoring financial services to meet specific demands.

The financial landscape is constantly evolving, and customer expectations are rising. Customers are looking for seamless, personalized, and convenient financial experiences across various channels. This requires financial institutions to adapt and innovate continually to stay competitive and meet the demands of their target market.

Hana Financial Group's approach to meeting customer needs involves a multi-faceted strategy that considers various demographics and preferences. This strategy includes a focus on digital banking, specialized services for the senior segment, and tailored solutions for corporate clients. By understanding these needs, the group can enhance customer satisfaction and loyalty.

Individual customers of Hana Financial Group prioritize convenience, personalization, and digital access. They increasingly rely on digital banking platforms for their financial transactions. For example, the 'Hana 1Q Credit Loan' allows customers to check credit limits and get a loan within three minutes, demonstrating the focus on speed and ease of use.

- Digital Banking: The primary channel for transactions, with platforms like MyHana Mobile Banking and Internet Banking being heavily utilized.

- Speed and Convenience: Customers seek faster transaction times and easy access to services.

- Personalized Services: Tailored financial solutions that meet individual needs.

The senior customer segment, identified through initiatives like 'Hana The Next,' has specific needs related to retirement planning and wealth management. These customers are motivated by the desire for stable income sources and specialized investment products. The launch of 'Hana The Next' in October 2024 underscores the group's commitment to this segment.

- Retirement Planning: Services and products focused on securing income during retirement.

- Wealth Management: Investment options like Target Date Funds (TDFs) and monthly dividend ETFs.

- Life Care Services: Comprehensive services that extend beyond traditional finance, including healthcare and quality of life support.

Corporate clients require sophisticated solutions for foreign exchange (FX) risk management, financing, and customized banking services. Hana Bank addresses these needs by offering specialized FX risk management solutions and providing financing that considers liquidity positions. The demand for currency diversification due to foreign exchange hedges and global inflation is also a key preference.

- FX Risk Management: Solutions to mitigate risks associated with currency fluctuations.

- Financing: Tailored financing options that consider liquidity positions.

- Customized Banking Services: AI-based exchange rate prediction models for tailored consulting.

Hana Financial Group continually innovates its product and service offerings to address common pain points and unmet needs. The expansion of digital banking services aims to meet the demand for convenient financial solutions, particularly for younger demographics. Market trends and feedback influence product development, leading to initiatives like sharia-based custodian services and becoming an Appointed Cross Currency Dealer (ACCD) Bank Indonesia.

- Digital Banking Expansion: Meeting the demand for convenient and accessible financial solutions.

- Sharia-Based Services: Providing services that align with Islamic finance principles.

- Local Currency Transactions: Facilitating Rupiah-Won transactions through ACCD Bank Indonesia.

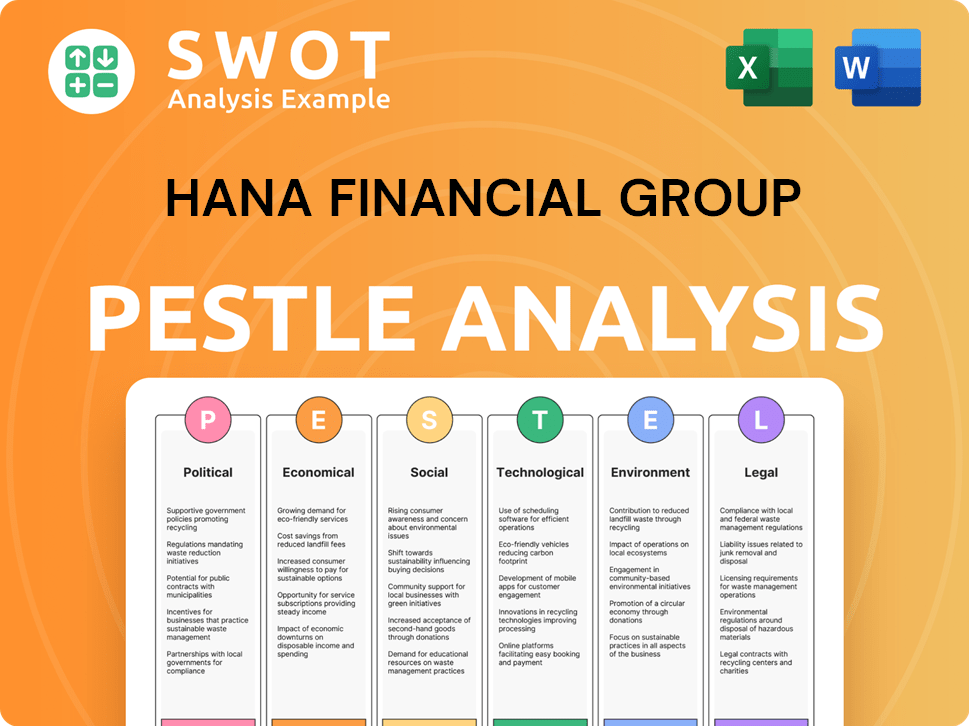

Hana Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Hana Financial Group operate?

Hana Financial Group's geographical market presence is primarily rooted in South Korea, where it holds a significant market share. Its headquarters in Seoul serve as the central hub for its operations. The group is the third-largest financial services group in South Korea, demonstrating strong brand recognition and a solid domestic foundation.

Beyond its home market, the group strategically expands its global footprint, particularly focusing on emerging markets. Asia is a key region for international growth, with a notable presence in Indonesia through PT Bank KEB Hana Indonesia (Hana Bank Indonesia). This expansion strategy aims to boost profitability and secure growth momentum through entry into emerging markets.

The group's international strategy includes expanding sales activities for local customers and localizing workforces in these markets. This approach is complemented by strategic alliances and potential mergers and acquisitions to enhance its global competitiveness. The opening of global trading rooms like 'Hana Infinity Seoul' and 'Hana Infinity London,' with plans for 'Hana Infinity Singapore,' underscores the group's commitment to providing 24-hour services in major FX markets.

In South Korea, the group leverages its strong brand recognition and market share. The focus remains on providing comprehensive financial services to a diverse customer base. The group's domestic operations are essential for its overall financial performance.

Asia is a crucial region for the group's international growth, with a focus on Indonesia. PT Bank KEB Hana Indonesia (Hana Bank Indonesia) is a key subsidiary. In 2024, Hana Bank Indonesia achieved a net profit growth of 14.61% year-on-year.

The group emphasizes digital banking services, such as LINE Bank, to cater to the digitally-savvy population in Indonesia. This focus helps in acquiring and retaining customers by offering convenient and accessible financial solutions. This approach is a key element in its customer acquisition strategies.

The group tailors its services to specific customer segments. For example, 'Hana The Next' targets the aging population in South Korea. It also provides financial education to foreign students. This approach helps in understanding Hana Financial Group's growth strategy.

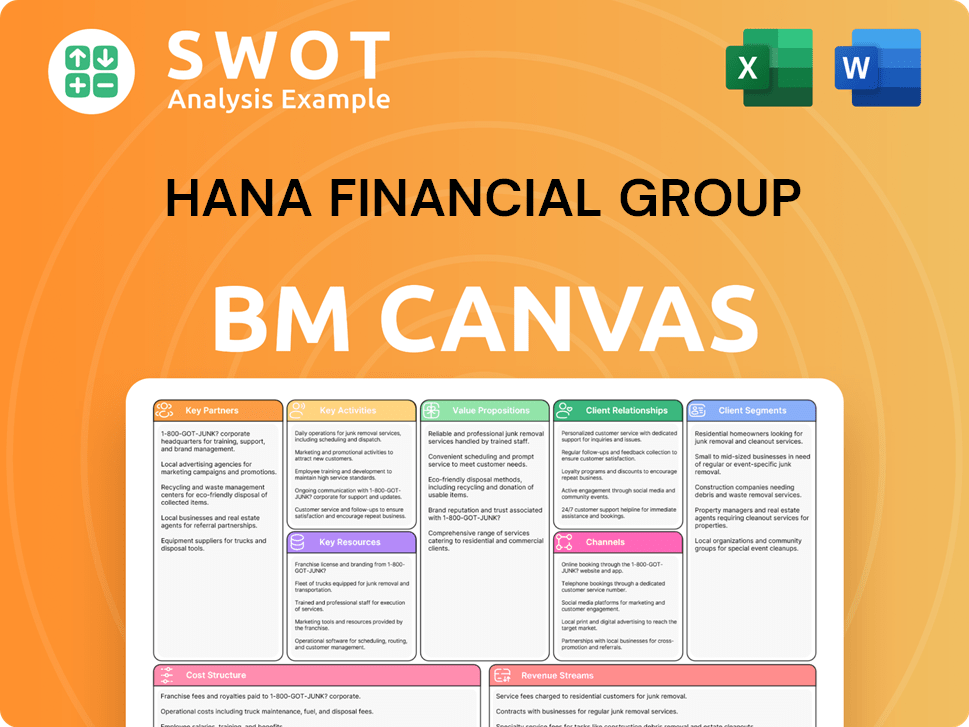

Hana Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Hana Financial Group Win & Keep Customers?

Hana Financial Group's approach to customer acquisition and retention is multi-faceted, combining digital innovation, targeted marketing, and personalized services. The company focuses on enhancing customer experience through digital channels, strategic partnerships, and tailored financial solutions. This strategy is crucial for attracting and retaining customers in a competitive market, as consumer preferences evolve towards convenience and personalized interactions.

A key element of their strategy is digital transformation, with a strong emphasis on expanding digital services. This includes initiatives like the 'Digital First' campaign, which aims to digitize products and services. The group also launches targeted initiatives to acquire new customers, particularly those in specific demographics. These efforts are supported by data-driven insights into customer preferences and behaviors, allowing the group to refine its offerings and strengthen customer relationships.

The company's customer acquisition strategies involve digital channels, targeted initiatives, and strategic partnerships. Customer retention strategies focus on personalized experiences and addressing specific customer needs. The group's commitment to ESG initiatives and its focus on long-term value creation also play a role in building customer loyalty and confidence.

Hana Financial Group prioritizes digital transformation to enhance customer experience. A significant portion of transactions are conducted through digital channels like MyHana Mobile Banking and Internet Banking. By the end of 2024, LINE Bank by Hana Bank had reached 1.2 million customers, marking a 44% increase from the previous year.

To acquire new customers, Hana Financial Group launches targeted initiatives. 'Hana The Next' brand, launched in October 2024, focuses on senior customers. Hana Bank has a dedicated task force to serve the growing foreign resident population in South Korea. The number of foreigners who opened accounts at Hana Bank reached 3.1 million as of end-August 2024.

Hana Financial Group aims to provide custom-tailored offerings, such as AI-based exchange rate prediction models and Robo-Advisor services for corporate FX customers. New products and services, including sharia-based custodian services and time deposit products like 'Goal Savings' through LINE Bank, contribute to retention.

The group focuses on enhancing customer value and satisfaction by offering product bundles that solve real problems, which helps build trust and strengthen relationships. Hana Financial Group's internship program connects job seekers from marginalized groups with social ventures. The group's total shareholder return climbed to 38% in 2024 from 33% the previous year, with a target to reach 50% by 2027.

The company's strategy includes a focus on customer segmentation Hana Financial Group, understanding customer demographics, and tailoring services to meet specific needs. By leveraging digital channels and data analytics, Hana Financial Group aims to deepen customer relationships and drive long-term value. A deep dive into the competitive landscape and market analysis is essential for any financial institution.

Hana Financial Group uses digital channels, such as MyHana Mobile Banking and Internet Banking, to attract customers. Targeted initiatives like 'Hana The Next' brand specifically cater to senior customers. The company also focuses on the foreign resident population, offering services in multiple languages.

Retention strategies emphasize personalized experiences and addressing specific customer needs. The group offers custom-tailored offerings, such as AI-based exchange rate prediction models and Robo-Advisor services. Development of new products and services, including sharia-based custodian services and time deposit products through LINE Bank, also contributes to retention.

Digital banking is a core focus, with almost all transactions conducted through digital channels. LINE Bank by Hana Bank had 1.2 million customers by the end of 2024. This digital focus enhances convenience and attracts customers who prefer online experiences.

Hana Financial Group launches targeted initiatives to acquire new customers, particularly in specific demographics. The 'Hana The Next' brand is designed for senior customers. The company has a dedicated task force to serve the growing foreign resident population.

The ability to deliver tailored experiences and targeted campaigns suggests a sophisticated use of customer data and CRM systems. Personalization is implicitly highlighted through the emphasis on understanding customer behavior. This data-driven approach enables more effective customer acquisition and retention.

Hana Financial Group's commitment to ESG initiatives, including responsible finance and social contributions, serves as a retention strategy. The internship program connects job seekers from marginalized groups with social ventures. This approach enhances brand image and customer loyalty.

Hana Financial Group's performance is reflected in its financial results. The total shareholder return climbed to 38% in 2024. The company aims to reach 50% by 2027, indicating a focus on long-term value creation. For more detailed insights, read this article about Hana Financial Group's investor relations.

- Digital transformation is a core strategy.

- Targeted initiatives focus on specific demographics.

- Personalized services are key to retention.

- ESG initiatives and social responsibility enhance brand image.

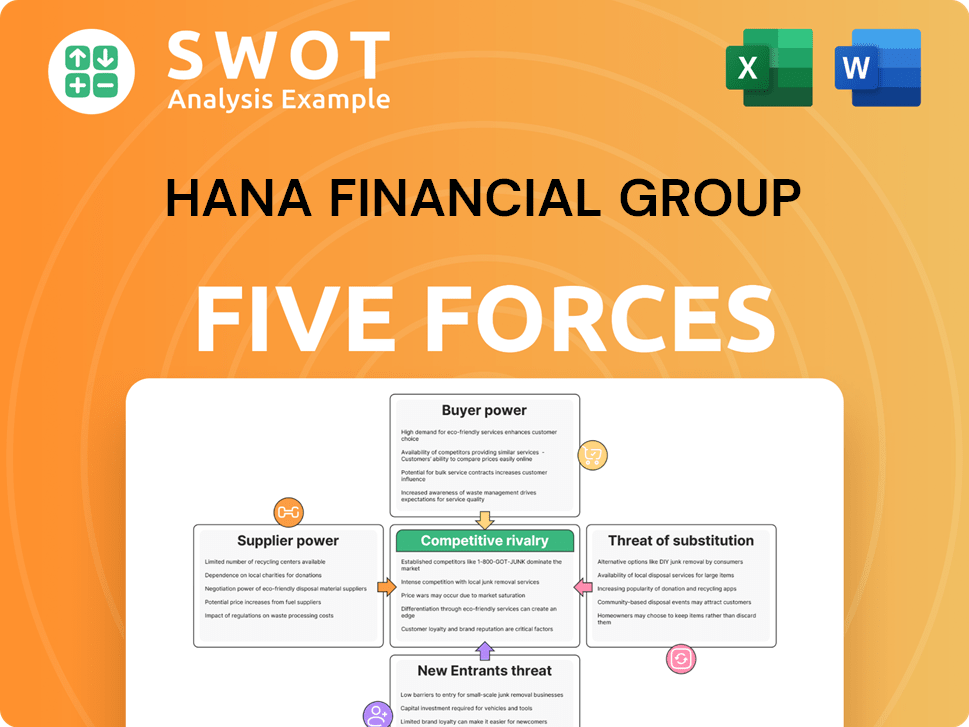

Hana Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hana Financial Group Company?

- What is Competitive Landscape of Hana Financial Group Company?

- What is Growth Strategy and Future Prospects of Hana Financial Group Company?

- How Does Hana Financial Group Company Work?

- What is Sales and Marketing Strategy of Hana Financial Group Company?

- What is Brief History of Hana Financial Group Company?

- Who Owns Hana Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.