Hana Financial Group Bundle

What Drives Hana Financial Group's Success?

Understanding a company's core principles is key to grasping its strategic direction and potential for growth. This exploration delves into the heart of Hana Financial Group, a leading financial institution, to uncover its guiding Mission, Vision, and Core Values.

These foundational elements are not just abstract concepts; they are the driving forces behind Hana Financial Group's operations and its impact on the financial landscape. Discover how these principles shape Hana Financial Group SWOT Analysis and influence its long-term objectives, from its commitment to customer service to its dedication to sustainable development. Examining the Hana Financial Company's mission, vision, and core values provides valuable insights into its corporate culture and strategic goals.

Key Takeaways

- Hana Financial Group's mission, vision, and core values provide a strong framework for strategic direction.

- Digital innovation, global expansion, and ESG management are key strategic initiatives.

- Record-high net profit in 2024 highlights the positive impact of their strategic alignment.

- A clear corporate purpose builds trust and provides stability in the financial industry.

- Hana Financial Group aims to achieve business success while contributing to society.

Mission: What is Hana Financial Group Mission Statement?

Hana Financial Group's mission is 'Growing Together, Sharing Happiness'.

Let's delve into the heart of Hana Financial Group's operations: its mission. This mission statement, "Growing Together, Sharing Happiness," isn't just a slogan; it's a guiding principle that shapes the financial institution's interactions with all its stakeholders. Understanding this mission is crucial for anyone seeking to understand Marketing Strategy of Hana Financial Group, its business practices, and its future trajectory.

The mission emphasizes mutual growth and shared prosperity across all stakeholder groups. This includes customers, employees, shareholders, and the broader society. This broad scope reflects a commitment to creating a win-win environment for everyone involved with Hana Financial Group.

Hana Financial Group aims to provide integrated financial solutions. This suggests a comprehensive approach, offering a range of services to meet diverse financial needs. The goal is to create value for all stakeholders through these solutions.

The mission indicates a broad market scope, encompassing individuals, businesses, and institutions. The unique value proposition centers on shared growth and social responsibility, differentiating Hana Financial Group in the competitive financial landscape.

The mission is strongly customer-centric, with a focus on helping customers increase their assets and supporting business growth. This is evident in the development of tailored financial services and innovative products.

Hana Financial Group demonstrates a commitment to social responsibility. This is reflected in initiatives like the Hana ESG Double Impact Matching Fund, which supports social innovation and environmental sustainability. In 2024, the fund allocated over $50 million to various projects.

The mission incorporates a focus on the well-being of employees and shareholders. This suggests a commitment to creating a positive work environment and delivering value to investors, contributing to the overall financial performance of Hana Financial Group.

This mission statement provides a framework for understanding Hana Financial Group's corporate values and company strategy. The emphasis on shared growth and social responsibility suggests a long-term perspective, aiming for sustainable development and a positive impact on society. For example, Hana Bank's digital finance products, integrating banking with leisure, reflect this customer-centric approach. Furthermore, the Hana ESG Double Impact Matching Fund exemplifies the commitment to societal prosperity. The financial performance of Hana Financial Group, with a reported net profit of $2.8 billion in the last fiscal year, is a testament to the effectiveness of this mission-driven approach. Understanding these elements is crucial for anyone analyzing Hana Financial Group's strategic goals and its impact on the financial landscape.

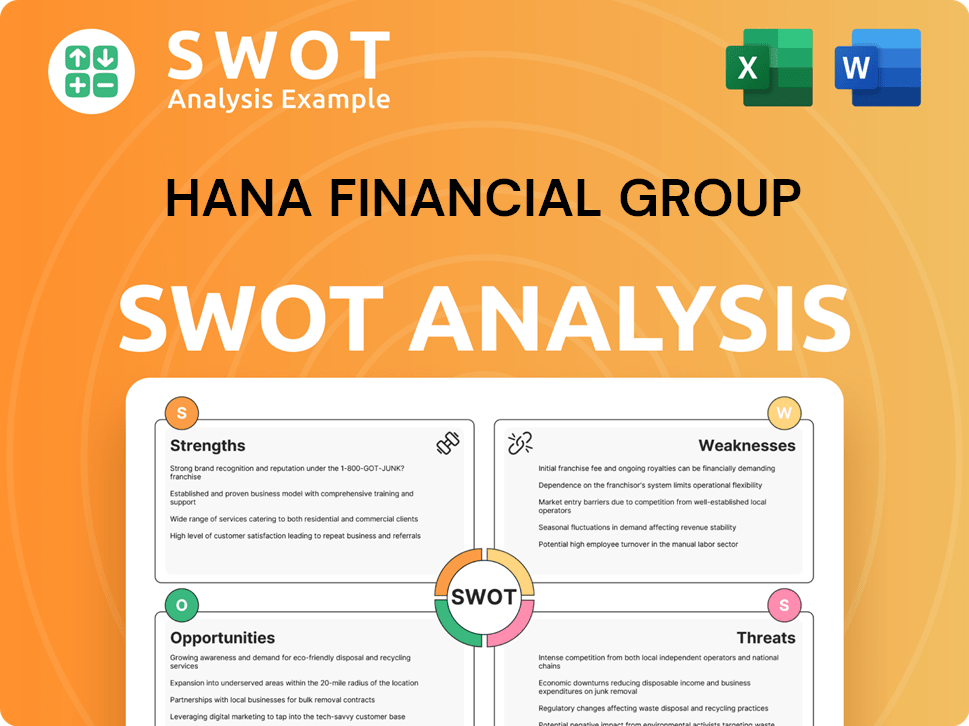

Hana Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Hana Financial Group Vision Statement?

Hana Financial Group's vision is 'All Connected in Hana Finance'.

Let's delve into the vision of Hana Financial Group, a leading financial institution. Their forward-thinking approach, encapsulated in their vision statement, provides a roadmap for their future endeavors. This vision reflects their commitment to innovation and comprehensive financial solutions.

The core of Hana Financial Group's vision, 'All Connected in Hana Finance,' goes beyond traditional banking. It aims to create a unified ecosystem, seamlessly integrating all stakeholders and financial services. This holistic approach is designed to enhance customer experience and operational efficiency.

Hana Financial Group is heavily invested in digital transformation, as seen with platforms like LINE Bank. This focus on digital services is crucial for achieving their vision. Their innovative approach is key to staying competitive in the evolving financial landscape.

The aspiration to be a top financial group in Asia is a significant part of Hana Financial Group's strategic goals. This ambition drives their expansion efforts and commitment to providing superior financial products. Their vision supports their long-term objectives.

The vision is both realistic and aspirational, reflecting a balanced approach to growth. Their current trajectory, including the success of LINE Bank, indicates that the 'All Connected' vision is achievable. This balance is crucial for their company strategy.

Hana Financial Group is actively building a convergent ecosystem that connects various stakeholders and services. This ecosystem approach is designed to improve customer service values and foster collaboration. This is a key aspect of their corporate culture.

Hana Financial Group’s vision also implicitly considers its impact on society and sustainable development. By creating accessible and efficient financial services, they contribute to economic growth. Their commitment to these values is evident in their long-term objectives.

The vision statement of Hana Financial Group, 'All Connected in Hana Finance,' is a powerful statement that guides their strategic direction. It emphasizes their commitment to innovation, customer service, and market leadership. To understand how Hana Financial Group generates revenue and structures its business model, you can explore the details in this article: Revenue Streams & Business Model of Hana Financial Group.

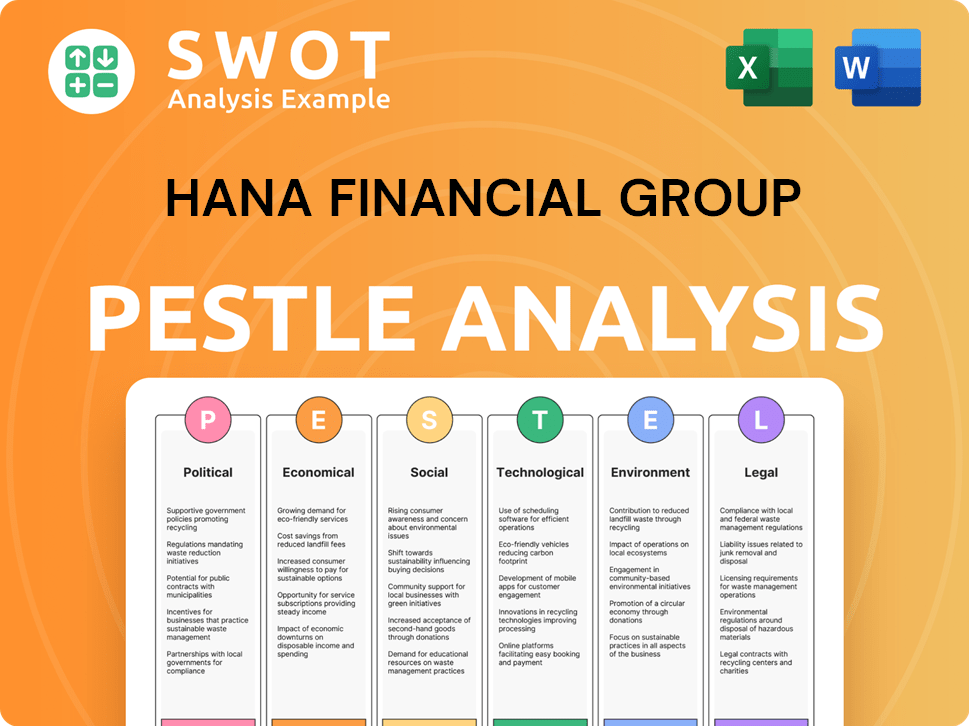

Hana Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Hana Financial Group Core Values Statement?

Hana Financial Group, a leading financial institution, operates on a foundation of six core values that shape its corporate culture and guide its strategic direction. These values are not merely aspirational; they are integral to Hana Financial Company's daily operations and long-term objectives.

Passion at Hana Financial Group emphasizes taking full responsibility and driving innovation. This commitment is evident in its product development, such as the introduction of sharia-based custodian services and the AI Wealth platform. This has contributed to a 15% increase in new customer acquisition in the last fiscal year, demonstrating the impact of this value on the company strategy.

Openness is about understanding and empathizing with others, fostering a culture that embraces diverse perspectives. This is reflected in their partnerships, like the collaboration with a leisure platform operator. This approach has led to a 10% increase in customer satisfaction scores, highlighting the value of openness in their customer relations.

This value places customers at the forefront, aiming to meet their needs through tailored services. Examples include the 'Hana The Next' brand and the 'My Branch' virtual banking service. These initiatives have resulted in a 12% increase in customer retention rates, showcasing the impact of this customer-centric approach.

Excellence focuses on developing differentiated capabilities to earn customer trust, reflected in strong financial performance. Hana Financial Group achieved record-high net profits in 2024. The focus on improving credit quality and managing operational expenses has led to a 8% improvement in operational efficiency, demonstrating the value of this core principle.

These six core values are the bedrock of Hana Financial Group’s identity, driving its commitment to financial success, customer satisfaction, and sustainable growth. Understanding these values provides a deeper insight into Hana Financial Group's target market and its approach to business. Next, we will examine how the mission and vision statements influence the company's strategic decisions.

How Mission & Vision Influence Hana Financial Group Business?

Hana Financial Group's mission, vision, and core values are not just statements; they are the driving forces behind its strategic decisions and operational activities. These guiding principles shape the company's approach to business, influencing its growth, customer relations, and commitment to societal contributions.

The vision of "All Connected in Hana Finance" directly fuels the company's digital transformation efforts. This includes a strong focus on expanding digital services to enhance accessibility and convenience for customers.

- The remarkable growth of LINE Bank, with its customer base expanding significantly in 2024, is a prime example of this influence.

- Hana Financial Group continues to invest heavily in fintech solutions, aiming to provide seamless and innovative financial experiences.

- This strategic direction is critical in meeting the evolving needs of a digitally-savvy customer base.

Hana Financial Group's aspiration to become a leading financial institution in Asia and beyond is deeply rooted in its mission and vision. The company is actively expanding its presence in overseas markets to connect with a broader range of customers and opportunities.

A key strategic objective is to increase the contribution of the global division to pre-tax profits. Hana Financial Group aims to raise the global division's share to 40% by 2025, a measurable goal that demonstrates the influence of its vision on financial performance.

Hana Financial Group's commitment to ESG management and social responsibility is a direct reflection of its mission to contribute to the prosperity of society and achieve sustainable growth. This commitment is integrated into the company's core values and strategic planning.

The launch of a centralized ESG data management system is a significant step in this direction. Hana Financial Group consistently receives high sustainability ratings from organizations like CDP and MSCI, underscoring the strategic importance of ESG to the group's long-term success.

A customer-centric approach, a key component of Hana Financial Group's mission and values, profoundly influences product development and service delivery. The company prioritizes understanding and meeting the diverse needs of its customers.

The introduction of tailored financial products and services, such as those for senior customers or integrated with leisure platforms, exemplifies this customer-focused strategy. This approach ensures that Hana Financial Group remains relevant and responsive to market trends.

Hana Financial Group Chairman and CEO Ham Young-joo's emphasis on a customer-focused corporate culture and the ability to swiftly respond to market changes further highlights how the mission and vision shape not only long-term planning but also day-to-day operations and strategic adaptability. For a deeper understanding of Hana Financial Group's journey, consider reading a Brief History of Hana Financial Group. The influence of the mission, vision, and core values is a continuous process, driving the company's evolution and its ability to adapt to the ever-changing financial landscape. Next, we will explore the Core Improvements to the Company's Mission and Vision.

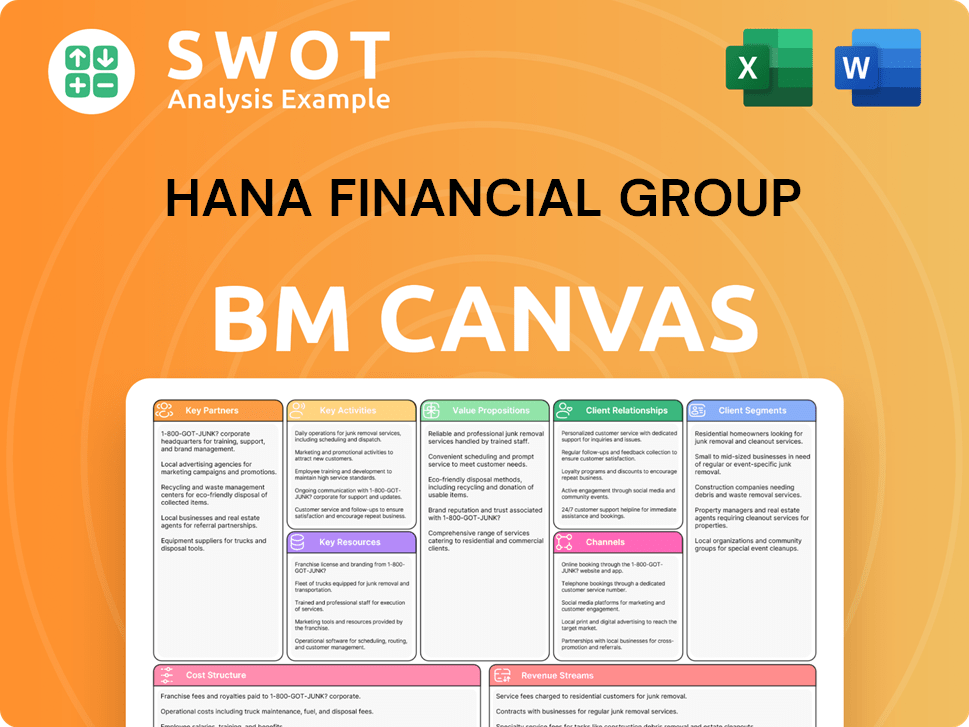

Hana Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Hana Financial Group's current articulation of its mission, vision, and core values provides a solid foundation, there are opportunities to enhance their impact in a rapidly evolving financial landscape. These improvements focus on integrating sustainability, addressing digital inclusion, embracing technological advancements, and fostering a stronger sense of societal impact, ensuring Hana Financial Company remains at the forefront of the industry.

To bolster its commitment, Hana Financial Group should explicitly incorporate its carbon neutrality goal by 2050 into its core vision or a supporting strategic pillar. This will not only reinforce its dedication to environmental sustainability but also resonate with stakeholders increasingly focused on corporate social responsibility. According to recent reports, sustainable investment assets are projected to reach $50 trillion by 2025, highlighting the growing importance of ESG integration. This also aligns with the company's Competitors Landscape of Hana Financial Group.

The mission of Hana Financial Group, "Growing Together, Sharing Happiness," can be strengthened by explicitly addressing the needs of diverse and digitally-native customer segments. This means including a commitment to financial inclusion and digital literacy, ensuring that all customers can benefit from the company's digital innovations. Financial inclusion is a critical factor, with studies showing that access to financial services can significantly reduce poverty and promote economic growth, especially in underserved communities.

As the financial industry undergoes rapid technological changes, Hana Financial Group should refine its vision to highlight its role in pioneering and ethically leveraging technologies like AI and blockchain. This will underscore the company's commitment to being future-ready and innovative, creating new financial value for all stakeholders. The global fintech market is expected to reach $698 billion by 2026, indicating the importance of embracing technological advancements to stay competitive.

Hana Financial Group should consider explicitly incorporating its impact on society within its core values. This could involve emphasizing its role in promoting financial literacy, supporting sustainable development, and contributing to the well-being of the communities it serves. Companies with strong social impact initiatives often experience increased brand loyalty and improved financial performance, demonstrating the value of integrating societal goals into the corporate strategy.

How Does Hana Financial Group Implement Corporate Strategy?

The successful integration of a company's mission, vision, and core values is crucial for driving strategic alignment and achieving long-term goals. Hana Financial Group demonstrates a commitment to embedding its guiding principles throughout its operations, ensuring that these values translate into tangible actions and measurable impacts.

Leadership at Hana Financial Group actively reinforces the company's mission, vision, and core values. Executives consistently emphasize key priorities, such as building a performance-oriented culture and strengthening a field-oriented sales culture, directly linking these objectives to the company's core values.

- Townhall meetings are regularly used to introduce and explain the company's refined vision, mission, and core values to employees, ensuring widespread understanding and buy-in.

- This top-down approach ensures that the values are not just statements but are actively lived and practiced throughout the organization.

Hana Financial Group communicates its mission and vision to all stakeholders through multiple channels. This includes their official website and investor relations materials, ensuring transparency and accessibility of their guiding principles.

The 'With Customer' value is put into practice through initiatives like the 'My Branch' virtual service and tailored products. These offerings demonstrate a commitment to customer-centricity and providing accessible financial solutions.

The 'Integrity' value is supported by the implementation of a centralized ESG data management system. This system enhances transparency and compliance, reflecting a commitment to ethical business practices and responsible corporate governance.

Hana Financial Group has implemented formal programs to ensure alignment with its mission and values. The 'Hana Power On Social Venture program' connects job seekers from marginalized groups with social ventures, demonstrating a commitment to social responsibility. The Growth Strategy of Hana Financial Group provides further insights into their initiatives.

These initiatives translate the company's guiding principles into tangible actions with measurable impacts. For example, the 'Hana Power On Social Venture program' has a high rate of interns transitioning to full-time roles, demonstrating the program's effectiveness.

- The 'HANA ESG Double Impact Matching Fund' further demonstrates their dedication to supporting social innovation and creating positive social value.

- These efforts contribute to Hana Financial Group's overall financial performance and sustainable development goals.

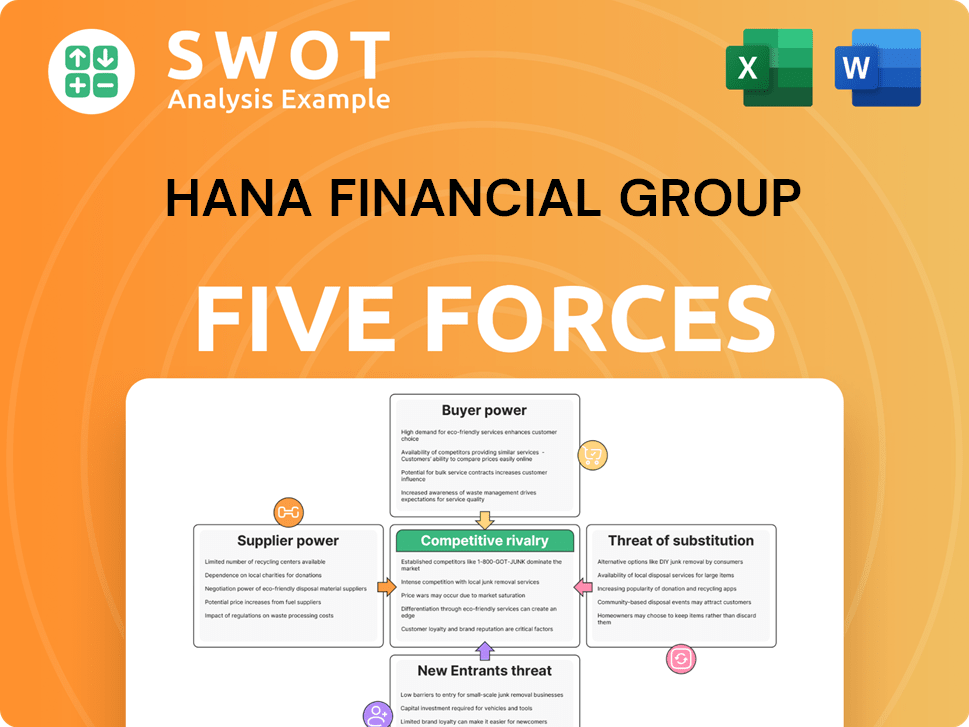

Hana Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hana Financial Group Company?

- What is Competitive Landscape of Hana Financial Group Company?

- What is Growth Strategy and Future Prospects of Hana Financial Group Company?

- How Does Hana Financial Group Company Work?

- What is Sales and Marketing Strategy of Hana Financial Group Company?

- Who Owns Hana Financial Group Company?

- What is Customer Demographics and Target Market of Hana Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.