Hana Financial Group Bundle

How Does Hana Financial Group Stack Up in South Korea's Banking Battleground?

The South Korean banking industry is a dynamic ecosystem, constantly shifting with technological advancements and evolving consumer expectations. Within this competitive arena, Hana Financial Group, a prominent financial company, strives to maintain its leading position. Understanding the competitive landscape is crucial for investors and strategists alike. This analysis provides a comprehensive look at Hana Financial Group's market position and future prospects.

Established in 1971, Hana Financial Group has transformed from a specialized finance company into a comprehensive financial services provider. This Hana Financial Group SWOT Analysis will explore its market share, key competitors, and strategic initiatives. We'll delve into its financial performance, examining its digital banking strategies and risk management approaches. Furthermore, we will analyze the company's position within the banking industry and its future growth prospects, providing a detailed competitive analysis report.

Where Does Hana Financial Group’ Stand in the Current Market?

Hana Financial Group holds a strong market position within the South Korean financial industry. The group offers a wide array of services, including banking, investment banking, asset management, and insurance. A thorough financial company analysis reveals its robust performance and strategic initiatives.

As of the end of 2024, Hana Financial Group reported a net profit of KRW 3.4 trillion, demonstrating its financial health amidst market fluctuations. Its total assets reached approximately KRW 600 trillion, highlighting its significant scale within the industry. This financial performance underscores its strong standing in the banking industry.

The company's core offerings include retail banking services like deposits and loans, corporate banking solutions for SMEs and large corporations, investment banking services such as mergers and acquisitions advisory, and wealth management services. The group's strategic focus on digital transformation and non-banking businesses has enabled it to maintain a competitive edge. For more details, read about the Revenue Streams & Business Model of Hana Financial Group.

Hana Financial Group maintains a significant market share in South Korea, supported by its comprehensive service offerings and strong brand recognition. Its strategic focus on digital transformation and expanding non-banking businesses has allowed the company to adapt to changing consumer preferences. The group's diverse customer base ranges from individual consumers to large corporations.

The company's geographic presence is predominantly strong within South Korea, with a growing global network, particularly in Asia. This expansion enhances its ability to serve a diverse customer base and capture international opportunities. The focus on Asia reflects a strategic move to tap into high-growth markets.

Hana Financial Group's strategic initiatives include digital transformation and expanding non-banking businesses. These initiatives are designed to enhance digital offerings and diversify revenue streams. This strategic pivot allows the company to maintain its competitive edge and adapt to changing consumer preferences.

- Digital Transformation: Enhancing digital offerings to meet evolving customer needs.

- Non-Banking Business Expansion: Diversifying revenue streams and reducing reliance on traditional banking.

- Global Network Growth: Expanding its presence in key markets, particularly in Asia.

- Customer-Centric Approach: Focusing on providing tailored services to diverse customer segments.

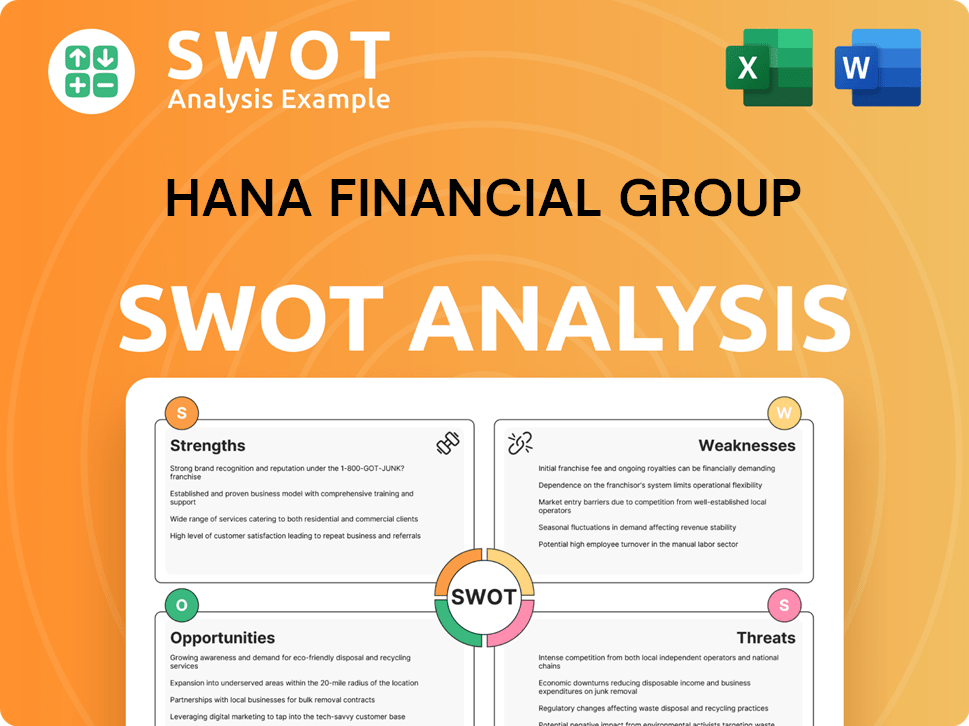

Hana Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Hana Financial Group?

The competitive landscape for Hana Financial Group is intense, shaped by both traditional financial institutions and emerging fintech companies. This analysis, part of a broader financial company analysis, examines the key players and strategic challenges that Hana Financial Group faces in the South Korean market. Understanding the competitive dynamics is crucial for assessing Hana Financial Group's market position and future growth prospects.

The banking industry in South Korea is highly competitive, with players vying for market share across various financial services. A thorough competitive analysis report is essential for investors and stakeholders to understand the strategic initiatives of Hana Financial Group and its ability to navigate the evolving financial landscape. The competitive environment is also impacted by mergers and acquisitions history and strategic partnerships.

Hana Financial Group operates in a dynamic market where the latest financial results and strategic initiatives are constantly evolving. The competitive landscape includes traditional financial institutions and emerging fintech companies. This analysis will help to understand the challenges and opportunities for Hana Financial Group.

Hana Financial Group's primary competitors include major Korean financial groups such as Shinhan Financial Group, KB Financial Group, and Woori Financial Group. These institutions compete across various financial sectors, including banking, securities, and insurance. These competitors challenge Hana Financial Group across multiple fronts.

Shinhan Financial Group is a major competitor, reporting a net profit of KRW 4.3 trillion in 2024. Its strong performance across banking, securities, and insurance makes it a formidable rival. Shinhan's financial performance reflects its robust market position and strategic initiatives.

KB Financial Group is another key competitor, leveraging its extensive branch network and digital platforms. It maintains a leading position in retail banking and asset management. KB's strong presence and innovative strategies contribute to its competitive edge.

Woori Financial Group, despite undergoing restructuring, remains a significant competitor, particularly in the banking sector. Its market presence and strategic adjustments impact the competitive landscape. Woori’s performance is crucial for understanding the overall market dynamics.

Emerging fintech companies are reshaping the competitive landscape, specializing in areas like peer-to-peer lending and online payment systems. These disruptors attract younger, digitally native customers. These companies pose a growing challenge to traditional business models.

The competitive dynamics involve price competition, innovation in digital banking, brand loyalty, and distribution channel expansion. Intense battles exist for market share in mobile banking and digital payment solutions. Strategic partnerships also impact competitive dynamics.

Hana Financial Group faces competition across several key factors that determine its market position. These factors influence the company's ability to attract and retain customers and drive financial performance. A thorough analysis of these factors is essential for understanding the competitive landscape.

- Price Competition: Intense competition in loan and deposit products impacts profitability.

- Digital Banking: Innovation in digital services and user experience is crucial.

- Brand Loyalty: Strong brand reputation and customer trust are essential.

- Distribution Channels: Expansion and optimization of distribution networks are vital.

- Strategic Partnerships: Collaborations with technology firms impact market reach.

For more detailed information, consider reviewing Owners & Shareholders of Hana Financial Group, which provides insights into the company's structure and stakeholders.

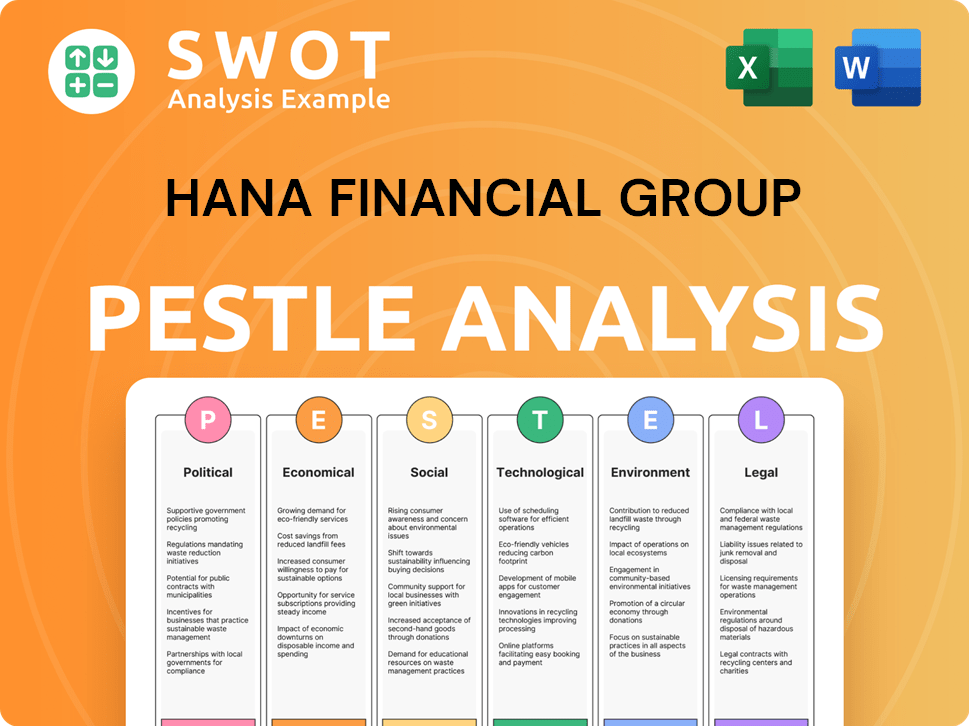

Hana Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Hana Financial Group a Competitive Edge Over Its Rivals?

Hana Financial Group's competitive edge in the South Korean banking industry stems from its comprehensive financial ecosystem, digital innovation, and strong brand reputation. The group offers a wide range of services, from banking to investment and insurance, fostering customer loyalty and cross-selling opportunities. Its digital transformation, particularly through the Hana 1Q app, enhances customer convenience and operational efficiency.

The group's decades-long reputation for stability and trustworthiness is a significant advantage in the financial sector. Hana Financial Group also benefits from economies of scale and an extensive distribution network. These factors allow it to optimize costs and ensure broad market penetration, further solidifying its position within the competitive landscape.

However, Hana Financial Group faces challenges from rapid technological advancements and evolving regulatory environments, which could impact its competitive advantages. Despite these threats, the group continues to leverage its strengths through targeted marketing, product innovation, and strategic partnerships to maintain its market position.

Hana Financial Group's integrated services, including banking, investment, and insurance, create a 'one-stop-shop' experience. This approach enhances customer loyalty. Cross-selling opportunities also contribute to revenue growth and market share.

The group has invested heavily in digital platforms, such as the Hana 1Q app. This enhances customer convenience and operational efficiency. These initiatives are crucial for attracting and retaining customers in the digital age.

Hana Financial Group's strong brand reputation, built over decades, is a significant asset. Customer trust is paramount in the financial sector, and this trust provides a competitive edge. This is a key factor in the Growth Strategy of Hana Financial Group.

Economies of scale allow Hana Financial Group to optimize operational costs and offer competitive pricing. Its extensive distribution network ensures broad market penetration. This combination enhances its ability to compete effectively.

Hana Financial Group's competitive advantages include a comprehensive financial ecosystem, robust digital initiatives, and strong brand equity. These advantages are crucial in the competitive landscape. However, the group faces challenges from technological imitation and evolving regulations.

- Comprehensive Financial Services: Provides a range of services from banking to insurance.

- Digital Innovation: Investments in mobile banking and digital payment solutions.

- Brand Reputation: Strong brand equity built on trust and stability.

- Economies of Scale: Optimized operational costs and competitive pricing.

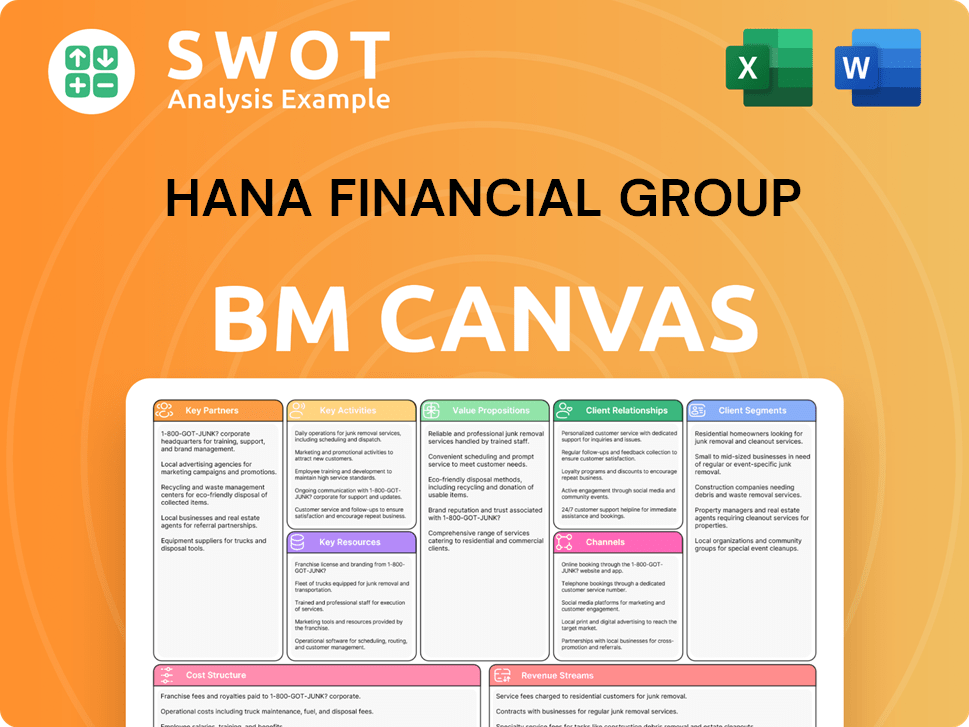

Hana Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Hana Financial Group’s Competitive Landscape?

The South Korean financial industry is experiencing significant shifts, creating both challenges and opportunities for companies like Hana Financial Group. The competitive landscape is evolving rapidly due to technological advancements, changing consumer preferences, and regulatory changes. Understanding these dynamics is crucial for any financial company analysis.

Hana Financial Group's future hinges on its ability to adapt to these trends. The company must navigate increasing competition, potential economic downturns, and cyber security threats. Simultaneously, it can leverage opportunities in digital transformation, personalized services, and expansion into emerging markets to maintain and grow its market share within the banking industry.

Technological advancements, including AI and blockchain, are driving digital transformation. Consumer preferences are shifting towards convenient, personalized, and digital financial services. Regulatory changes, such as stricter data privacy laws, are also impacting the industry.

Intensified competition from global tech giants and fintech firms is a key challenge. Cyberattacks and potential economic downturns pose significant risks. Adapting to regulatory changes and managing operational costs are also crucial.

Expanding digital offerings and developing hyper-personalized financial products are key. Exploring new business models like platform banking presents growth potential. Strategic partnerships and expansion into emerging markets, especially Southeast Asia, offer opportunities.

Continued investment in digital capabilities is essential for maintaining a competitive edge. Diversifying the business portfolio and focusing on customer-centric innovation are crucial. These initiatives will help Hana Financial Group navigate the evolving landscape.

Hana Financial Group faces a dynamic environment. The company must invest in digital capabilities and customer-centric innovation to remain competitive. For a deeper understanding of the company's origins and development, consider reading Brief History of Hana Financial Group.

In 2024, the digital banking sector in South Korea continues to grow, with increased adoption rates. Fintech investment is projected to reach new heights, with a focus on AI and blockchain applications. Hana Financial Group's strategic initiatives will be crucial for maintaining its market position.

- Digital banking adoption rates have increased by approximately 15% in the last year.

- Fintech investment in South Korea is expected to exceed $2 billion in 2025.

- Hana Financial Group is investing $500 million in digital transformation initiatives.

- Customer-centric innovation is expected to drive a 10% increase in customer satisfaction.

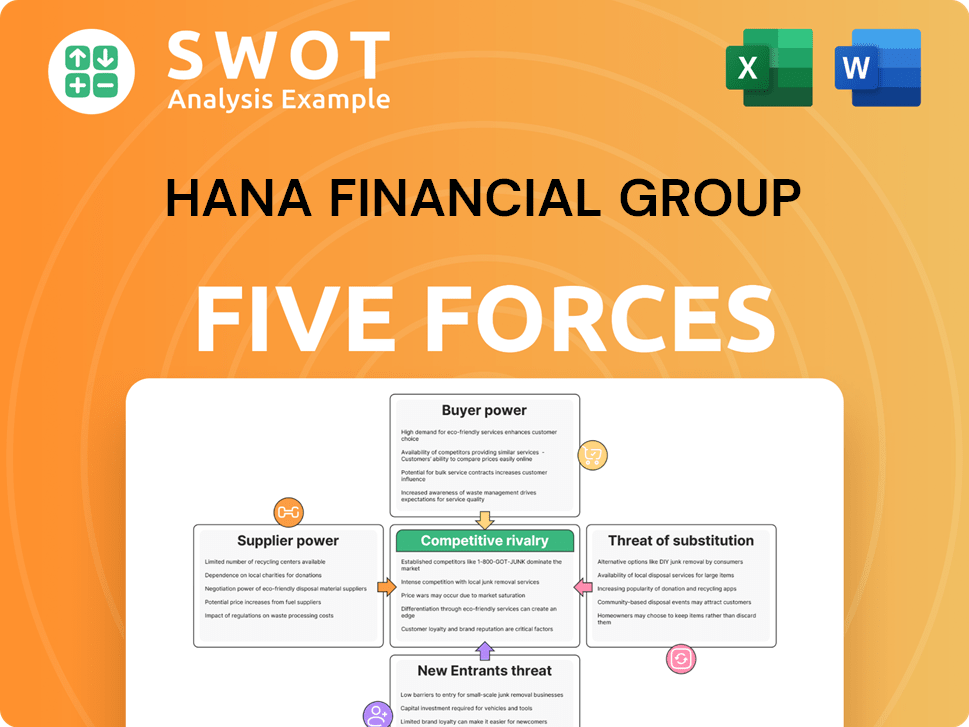

Hana Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hana Financial Group Company?

- What is Growth Strategy and Future Prospects of Hana Financial Group Company?

- How Does Hana Financial Group Company Work?

- What is Sales and Marketing Strategy of Hana Financial Group Company?

- What is Brief History of Hana Financial Group Company?

- Who Owns Hana Financial Group Company?

- What is Customer Demographics and Target Market of Hana Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.