Intermex Bundle

What's the Story Behind Intermex's Rise?

From its humble beginnings in 1994 as Intermex Wire Transfer, this financial powerhouse has transformed the money transfer landscape. Initially focused on serving Latin American communities, Intermex SWOT Analysis reveals the strategic shifts that propelled its growth. Discover how Intermex, now a Nasdaq-listed company, navigated challenges and capitalized on opportunities to become a leading omnichannel provider.

This brief history of Intermex explores the key milestones that shaped the company's trajectory. Examining the Intermex company background reveals its evolution from a regional player to a significant force in the Intermex financial services sector. Understanding the Intermex money transfer history provides valuable insights into its strategic decisions and market positioning, including its IPO and recent news regarding potential acquisitions, making it a compelling case study for investors and business strategists alike.

What is the Intermex Founding Story?

The story of Intermex begins in 1994, when it was established as Intermex Wire Transfer. This marked the start of a journey that would transform it into a significant player in the financial services sector. The company's early days were focused on a specific mission: to simplify and streamline money transfers, primarily from the United States to Latin America.

Initially, Intermex set up its operations in Washington and Oregon. The founders aimed to serve the needs of the growing Hispanic populations in the United States, recognizing the increasing demand for international money transfers. This strategic move laid the groundwork for the company's future expansion and its focus on providing accessible and reliable financial services. For a deeper understanding of the company's core values, you can read more here: Mission, Vision & Core Values of Intermex.

The company's initial business model centered on wire transfer services, which were facilitated through a network of agents. The early strategy involved building a strong, cash-focused agent network, which was crucial for reaching its target demographic. While specific details about the initial funding are not readily available, the focus on establishing an agent network suggests a gradual, organic approach to growth. The company's headquarters relocated to Miami in 1996, expanding its operational base.

By 2000, Intermex was licensed in 10 states.

- This expansion demonstrated the company's ability to adapt and grow.

- Agents started using computers for remote communication.

- This technological shift improved the efficiency of money transfer operations.

- The company's growth was deeply rooted in serving the demand for remittances to Latin American and Caribbean countries from the United States.

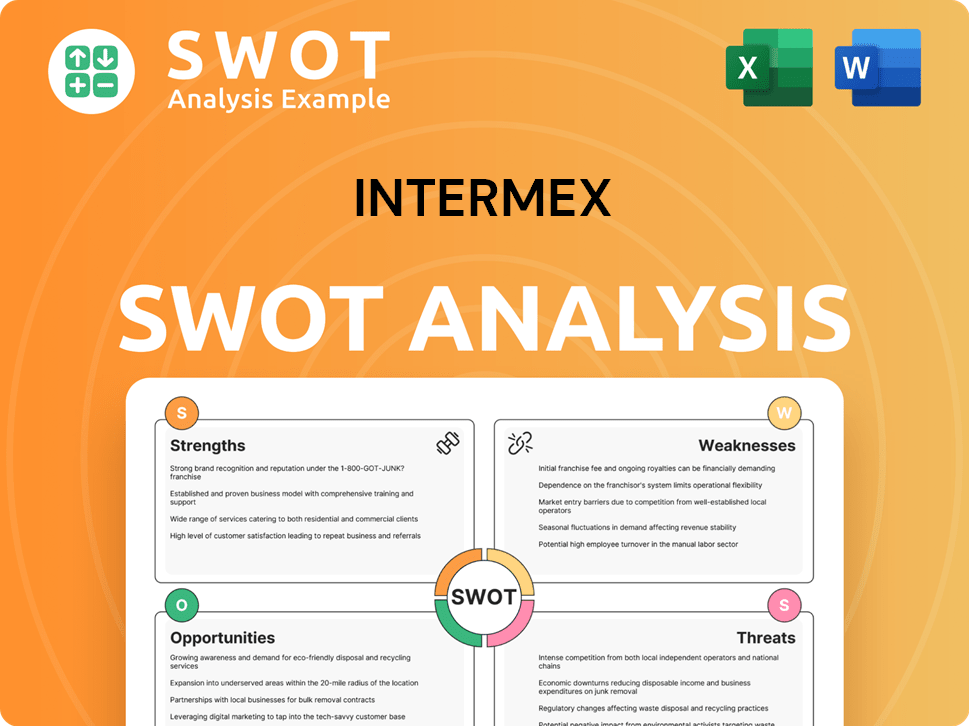

Intermex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Intermex?

The early years of the Intermex company saw a strategic focus on expanding its agent network and geographic reach. This expansion began shortly after its 1994 founding. The company's trajectory included key acquisitions and leadership transitions that propelled its growth and market presence.

By 2000, the company, having moved its headquarters to Miami in 1996, was licensed in 10 states. The integration of computer-based communication for its agents also occurred during this time. A significant expansion into Texas happened in 2004 through the acquisition of a Dallas-based money order firm.

The acquisition of Servimex, Inc. in 2007 extended the company's reach into eight additional states. In 2008, the company acquired Americana de Servicios and Maniflo, which opened up operations in key markets such as New York and California. These moves were pivotal in establishing the company's presence in major remittance corridors.

In 2009, Robert Lisy became President and CEO, with plans to expand into Mexico, Central, and South America. Between 2015 and 2017, the company experienced a substantial 71% growth in remittance transactions. The 2017 acquisition by Stella Point, a private equity firm, set the stage for further strategic moves.

The company entered the public market in 2018 through a merger with Fintech Acquisition Corp II, becoming Intermex International Money Express and listing on Nasdaq. By 2019, the company expanded its market to Africa and Canada. In 2022, the company launched an improved app to support sending from the US, signaling a significant move into the digital space.

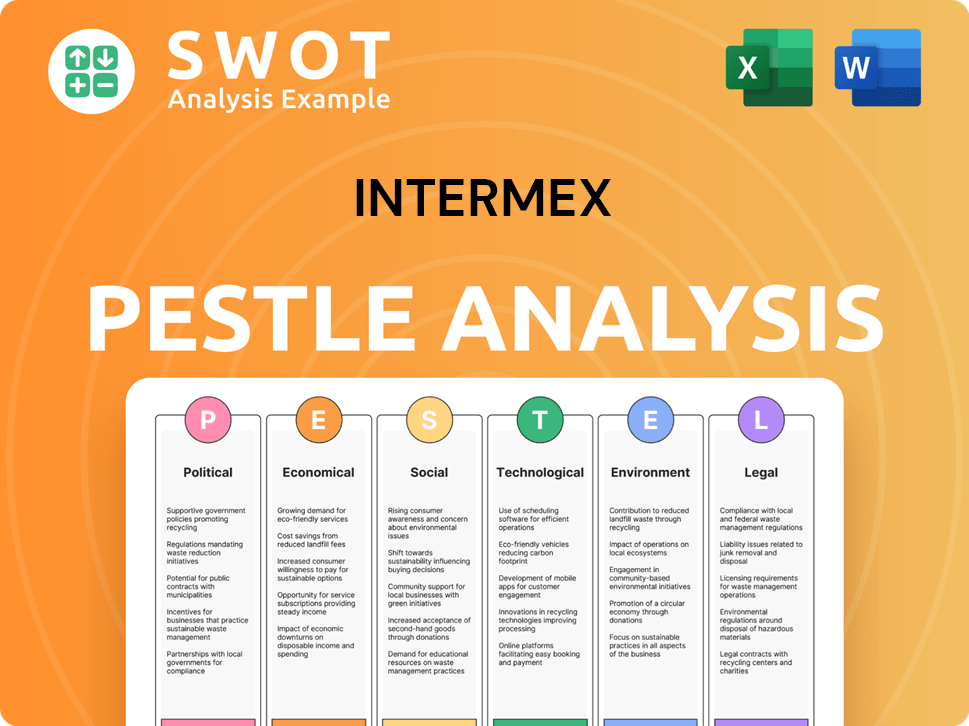

Intermex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Intermex history?

The Intermex company has achieved several significant milestones in its history, marked by strategic expansions and technological advancements in the financial services sector. These achievements have shaped the company's trajectory and its standing in the money transfer industry.

| Year | Milestone |

|---|---|

| 2022 | Announced the acquisition of La Nacional and I-Transfer, expanding its market reach. |

| 2023 | Completed the acquisitions of La Nacional and I-Transfer, bolstering its presence in key markets. |

| December 2024 | Acquired certain assets and operations of Amigo Paisano, strengthening its digital coverage in Central America. |

| February 2025 | Introduced wire transfers via WhatsApp, enhancing digital accessibility for its users. |

| April 2025 | Launched Intermex SOMA, a mobile app for agents providing real-time business insights. |

Intermex has consistently focused on innovation to enhance its services and user experience. A key innovation is its proprietary technology enabling money transfers to over 60 countries from various locations. In February 2025, the introduction of wire transfers via WhatsApp showcased its commitment to digital integration, aligning with high smartphone usage among its target demographic.

Intermex developed proprietary technology to facilitate money transfers to over 60 countries. This technology is a core component of Intermex's service offerings, enabling efficient and reliable international transactions.

The company's 'omni-channel strategy' combines its traditional retail agent network with digital platforms. This approach allows customers to send money through multiple channels, including the Intermex website and mobile app.

In 2022, Intermex launched an improved mobile app to enhance user experience. The app's updates and features reflect Intermex's commitment to providing accessible and user-friendly financial services.

In February 2025, Intermex introduced wire transfers via WhatsApp. This integration further enhances digital accessibility.

In April 2025, Intermex launched Intermex SOMA, a mobile app designed to provide real-time business visibility for its agents. This app offers performance metrics and commission tracking.

Despite its successes, Intermex has faced challenges, particularly a slowdown in its core Latin American remittances market. This led to revenue growth deceleration in 2023 and 2024. The company experienced a slight reduction in top-line revenues in Q3 2024, with full-year 2024 revenue remaining flat at $658.6 million. The company has responded by focusing on operational efficiencies and investing in digital growth, as detailed in the Growth Strategy of Intermex.

The core Latin American remittances market experienced a slowdown, impacting Intermex's revenue growth. This slowdown led to a deceleration in revenue growth during 2023 and 2024.

In Q3 2024, Intermex reported a slight reduction in top-line revenues of -0.3% to $171.9 million. Full-year 2024 revenue remained flat at $658.6 million.

Intermex is focusing on operational efficiencies to address financial challenges. This includes reducing operating expenses to improve profitability.

The company is significantly investing in digital growth to enhance its services. They plan to increase digital marketing spending to approximately $9 million in 2025.

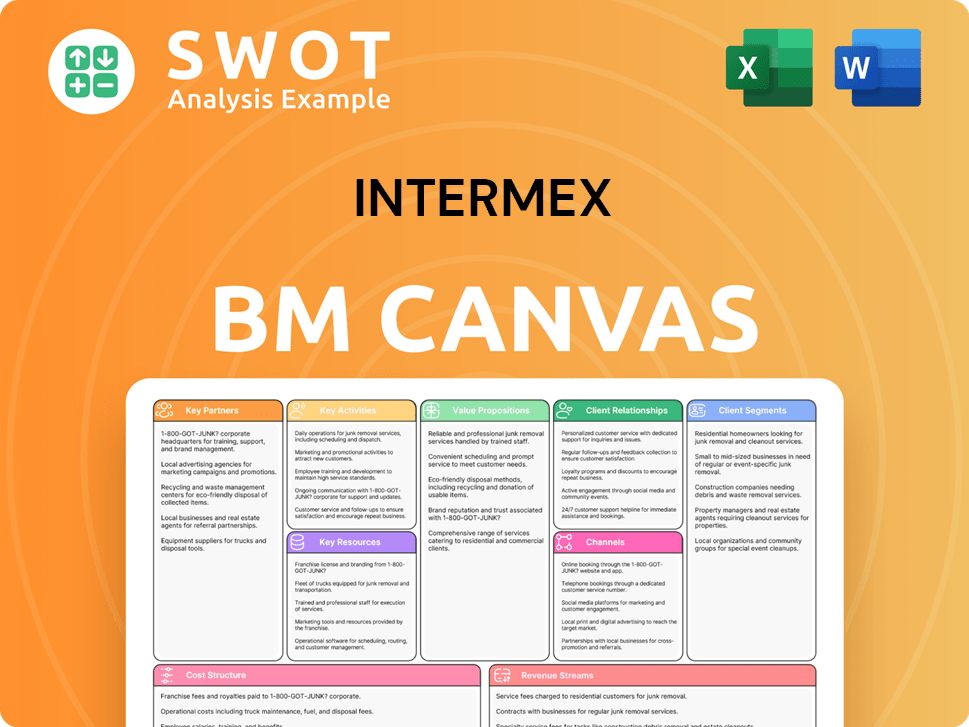

Intermex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Intermex?

The Intermex story began in 1994 with its founding as Intermex Wire Transfer, initiating operations in Washington and Oregon. Over the years, Intermex has grown significantly through strategic acquisitions and expansions, moving its headquarters to Miami in 1996, and later going public in 2018. Recent developments include the launch of new services and partnerships aimed at enhancing its market reach and digital capabilities. This Intermex company timeline reflects its evolution in the money transfer industry, highlighting key milestones and strategic shifts.

| Year | Key Event |

|---|---|

| 1994 | Intermex Wire Transfer founded, starting operations in Washington and Oregon. |

| 1996 | Company expands and moves headquarters to Miami. |

| 2000 | Licensed in 10 states; agents begin using computers for remote communication. |

| 2004 | Expands into Texas via acquisition of a Dallas-based money order firm. |

| 2007 | Acquires Servimex, Inc., expanding to eight more states. |

| 2008 | Purchases Americana de Servicios and Maniflo, opening operations in New York and California. |

| 2009 | Robert Lisy becomes President & CEO. |

| 2017 | Acquired by Stella Point Capital. |

| 2018 | Merges with FinTech Acquisition Corp II; goes public on Nasdaq as Intermex International Money Express. |

| 2019 | Expands market to Africa and Canada. |

| 2022 | Launches improved mobile app; announces acquisition of La Nacional and I-Transfer. |

| 2023 | Acquisitions of La Nacional and I-Transfer fully close. |

| 2024 (Q3) | Explores potential sale to optimize growth. |

| 2024 (Q4) | Suspends strategic review for sale; full-year revenue flat at $658.6 million. |

| 2024 (December) | Launches international top-up services across 130+ countries in partnership with Ding; acquires Amigo Paisano's business. |

| 2025 (February) | Launches wire transfers via WhatsApp. |

| 2025 (April) | Launches Intermex SOMA app for agents. |

Intermex is focused on significantly increasing digital marketing spending in 2025 to capture more digital customers. This strategy is aimed at expanding its digital footprint and improving customer acquisition through online channels. The company's investment in digital services aligns with its broader omnichannel approach.

For 2025, Intermex initially projected revenues between $657.5 million and $677.5 million, with adjusted EBITDA between $113.8 million and $117.3 million. However, revised guidance in May 2025 adjusted revenue expectations to $634.9 million to $654.2 million. This reflects the current challenges and the company’s efforts to navigate market conditions.

Intermex is targeting the US to Latin America and Caribbean transactions, a total addressable market valued at $122 billion. The company is also looking at the European market, estimated at $315 billion, to expand its global presence. This expansion strategy builds on its strong retail foundation.

The company is committed to its omnichannel strategy, balancing its strong retail presence with digital growth initiatives. Intermex aims to continue its growth by investing in digital services and expanding its agent network, as it has done since its founding. For more details, read this detailed Intermex company analysis.

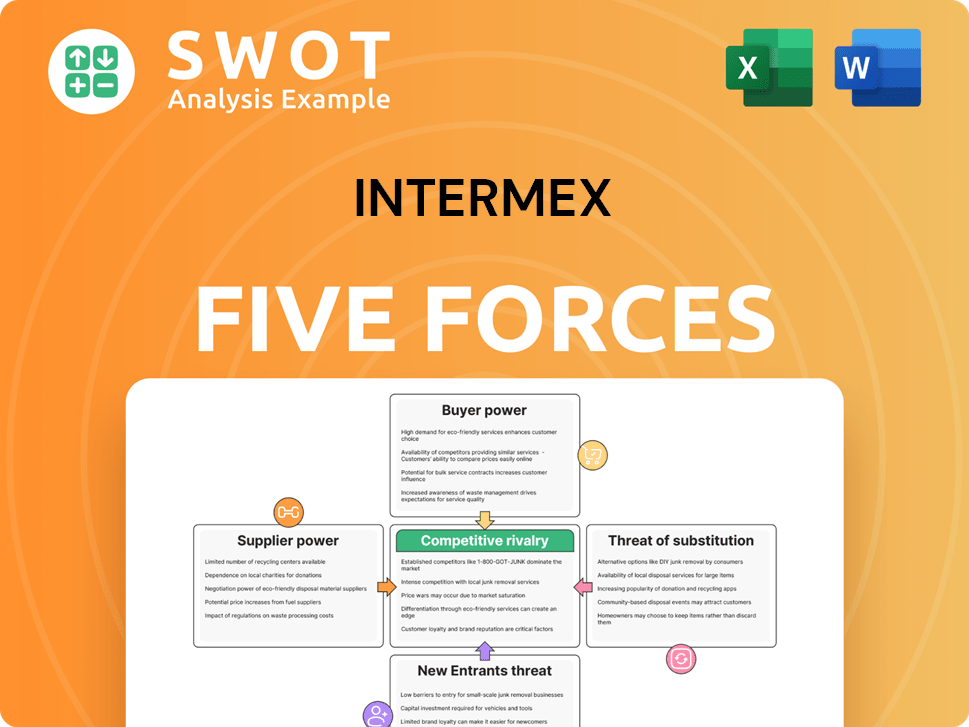

Intermex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Intermex Company?

- What is Growth Strategy and Future Prospects of Intermex Company?

- How Does Intermex Company Work?

- What is Sales and Marketing Strategy of Intermex Company?

- What is Brief History of Intermex Company?

- Who Owns Intermex Company?

- What is Customer Demographics and Target Market of Intermex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.