Intermex Bundle

Who Does Intermex Serve?

In the fast-paced world of international money transfers, understanding Intermex SWOT Analysis is crucial. This exploration dives deep into the Intermex's customer demographics and target market, revealing the core of its business strategy. Discover how Intermex adapts to the evolving needs of its target audience in a dynamic market.

The evolution of Intermex's customer base reflects significant shifts in the global financial landscape. Analyzing Intermex's market requires a look at their customer demographics, including Intermex customers' income levels, location data, and user behavior. Understanding these factors is key to grasping Intermex's success and future strategies.

Who Are Intermex’s Main Customers?

The primary customer segments for money transfer services like those offered by the company are typically individuals who send remittances. These are often migrant workers or people supporting family members in their home countries. The focus is on Business-to-Consumer (B2C) transactions, specifically from the United States to Latin American and Caribbean nations.

While precise demographic data for the company is not always publicly available, industry trends suggest a broad age range among senders. They generally have low to middle incomes and consistently transfer smaller amounts. Family support is a key driver for these transactions, with many senders providing for dependents abroad.

The company caters to both banked and unbanked populations, including those who prefer cash-based transactions or lack access to traditional banking. The company has historically concentrated on communities with significant Latin American and Caribbean immigrant populations. Expansion into digital platforms reflects an effort to attract tech-savvy customers, broadening the market reach.

The Intermex customers often include migrant workers and individuals sending money to family. The target market generally consists of people with low to middle incomes, supporting relatives abroad. This demographic includes both banked and unbanked individuals, with a focus on cash-based transactions.

The Intermex target audience is primarily driven by family support needs. The company's services cater to those who prefer cash transactions or have limited banking access. They are increasingly focused on expanding digital services. This expansion is crucial for capturing new revenue streams.

The core Intermex market includes individuals sending remittances to Latin America and the Caribbean. These customers often have consistent, smaller-value transfers. The company has expanded its digital offerings to cater to a broader audience.

The company focuses on serving communities with significant Latin American and Caribbean immigrants. Digital expansion aims to attract tech-savvy customers. This strategy helps capture new revenue streams and adapt to evolving customer preferences.

The ideal Intermex customer is often a migrant worker supporting family abroad. They may have limited access to traditional banking. The company's services are designed to accommodate cash-based transactions and digital preferences.

- Age: Adults in their working years.

- Income: Low to middle-income levels.

- Transaction Type: Consistent, smaller-value transfers.

- Preference: Cash-based or digital platforms.

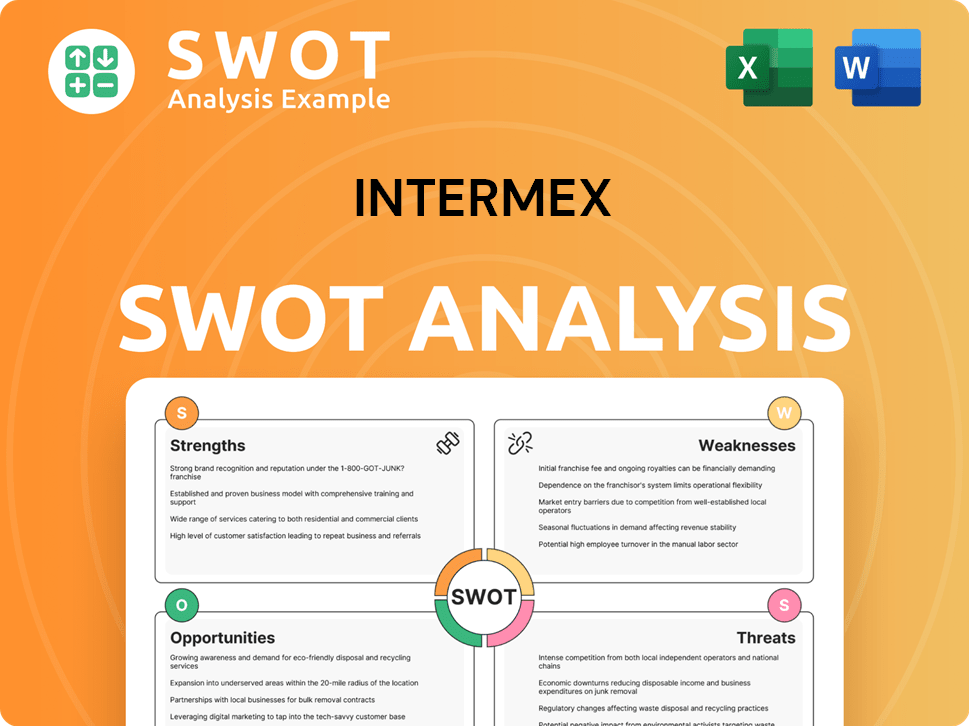

Intermex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Intermex’s Customers Want?

Understanding the customer needs and preferences is crucial for businesses like the one, as it directly influences their service offerings and marketing strategies. For Intermex, the primary focus is on providing reliable, accessible, and cost-effective money transfer services. This customer-centric approach helps in retaining existing customers and attracting new ones.

The key drivers for Intermex customers include the need for secure and timely money transfers, especially for those supporting families internationally. Factors such as competitive exchange rates, transparent fees, and convenient payout locations are also significant in the decision-making process. The company's success hinges on meeting these needs efficiently and effectively.

Customer loyalty is built on positive experiences, ease of use, and strong customer support. Intermex addresses common pain points such as long queues and high fees by offering a vast network of agent locations and expanding its digital presence. By understanding these preferences, Intermex can tailor its services and marketing to better meet customer expectations.

Intermex customers, or the Owners & Shareholders of Intermex, prioritize several factors when choosing a money transfer service. These include the reliability of the service, the speed of transfers, the cost-effectiveness, and the accessibility of the service. These preferences drive their purchasing behaviors and influence their loyalty to the service.

- Reliability and Security: Customers need to know that their money will arrive safely and on time.

- Speed of Transfers: Quick transfers are crucial, especially for urgent needs.

- Cost-Effectiveness: Competitive exchange rates and low fees are essential.

- Accessibility: Convenient agent locations and digital platforms are important.

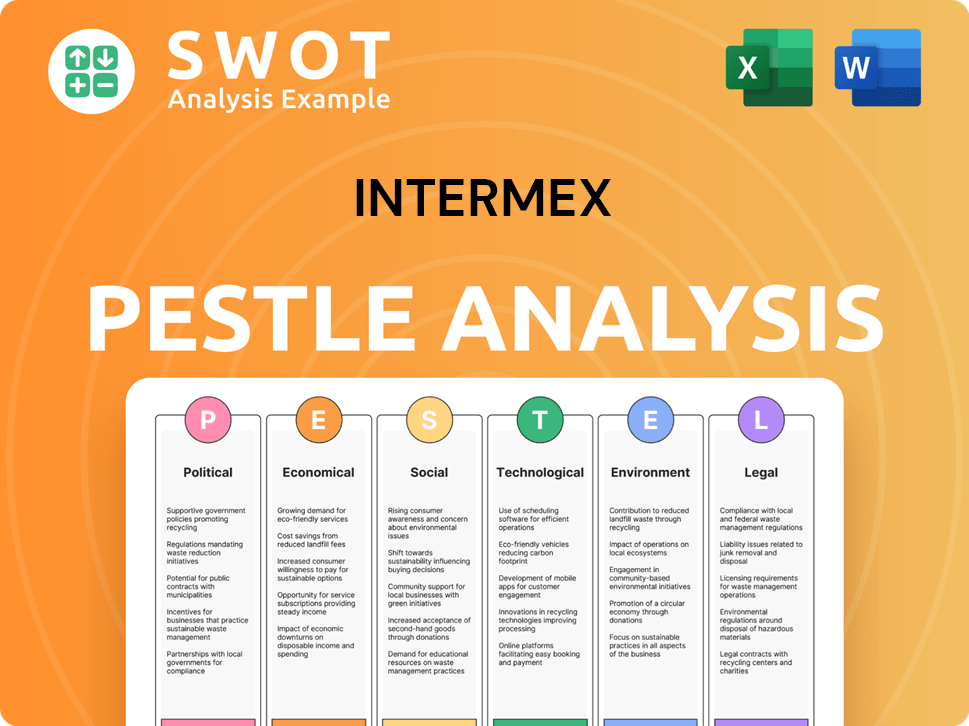

Intermex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Intermex operate?

Intermex strategically focuses on regions with significant populations of Latin American and Caribbean immigrants, primarily in the United States, to facilitate money transfers to their home countries. The company's core business revolves around the outbound market from the United States, making it the origin point for the majority of its transactions. This strategic focus allows Intermex to concentrate its resources and marketing efforts effectively.

The major recipient markets for Intermex include Mexico, Guatemala, Honduras, El Salvador, and the Dominican Republic, along with other countries across Latin America and the Caribbean. This geographic concentration reflects the company's deep understanding of the remittance corridors and the needs of its target market. Intermex has established a strong market share and brand recognition within these key remittance corridors.

The company's success is heavily reliant on its ability to navigate the diverse customer demographics, preferences, and buying power across these regions. For instance, transfer patterns and preferred payout methods vary significantly by country, influenced by local banking infrastructure and cultural norms. Intermex tailors its services to meet these specific needs, ensuring accessibility and relevance for its customers.

Intermex concentrates on the US-to-Latin America remittance corridor, which is the primary geographic focus. This specialization allows for targeted marketing and service offerings. This focus is a key element of the Growth Strategy of Intermex.

Intermex's customer base is primarily composed of immigrants sending money to family members in their home countries. The company segments its customer base by country of origin and destination, allowing for customized services. Understanding the specific needs of Intermex customers is crucial.

Intermex utilizes a vast network of payout agents in recipient countries to ensure accessibility, even in remote areas. The company is expanding its digital footprint to broaden its geographic reach beyond its traditional agent network. This multi-channel approach is essential for reaching the target audience.

Marketing efforts are culturally relevant and tailored to specific regional nuances. The company focuses on building brand recognition and trust within the communities it serves. Intermex's marketing strategies are designed to resonate with the target audience.

Intermex's geographic distribution of sales is heavily concentrated in the US-to-Latin America corridor, reflecting its specialized market focus. In recent years, the company has focused on strengthening its presence in existing high-volume corridors and exploring new opportunities within its core geographic focus. This strategic approach allows Intermex to maintain a strong position in the remittance market.

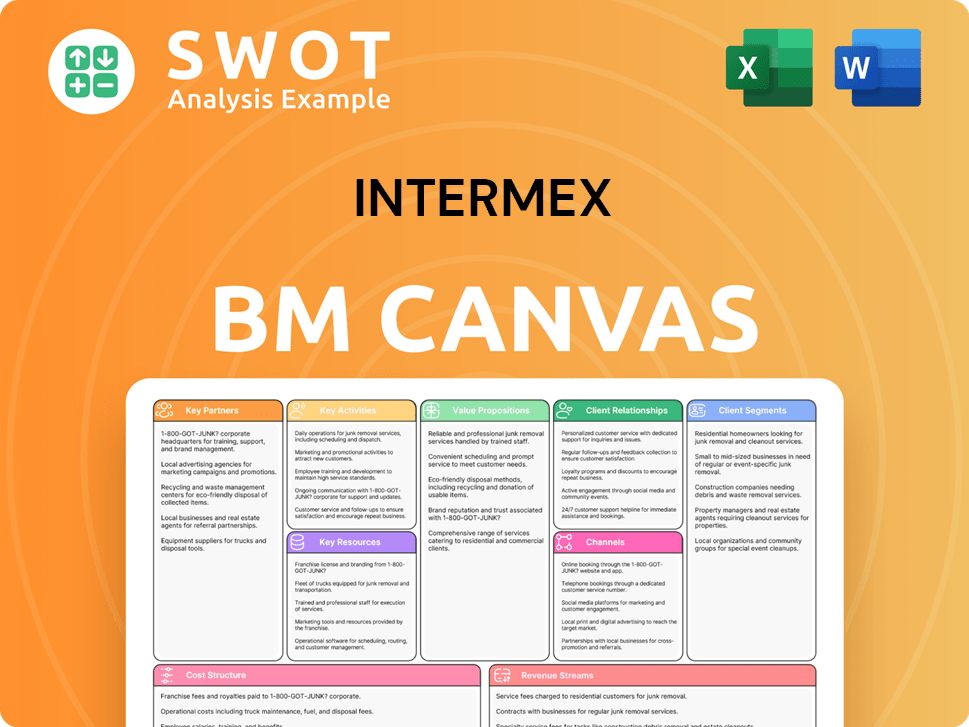

Intermex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Intermex Win & Keep Customers?

The company, like other remittance services, employs a blend of strategies to attract and retain customers. These strategies encompass both traditional and digital marketing approaches. The acquisition strategy hinges on a strong network of agent locations, which serve as key touchpoints for in-person transactions and word-of-mouth referrals within communities. The company also uses digital channels to reach a broader audience.

Traditional marketing may include local advertising in ethnic media and community outreach to connect with immigrant communities. The company leverages digital platforms like its online portal and mobile app to engage tech-savvy customers. Competitive exchange rates and transparent fees are key factors in attracting new customers.

Customer retention is a priority, focusing on consistent service and building loyalty through positive experiences. While specific loyalty programs may not be widely publicized, the recurring nature of remittances naturally fosters customer retention. Personalized interactions, such as tailored communications, can also play a role. Efficient after-sales service and problem resolution are crucial for maintaining trust and encouraging repeat business.

The extensive network of agent locations is a cornerstone of the acquisition strategy. Agents act as community hubs, facilitating in-person transactions and word-of-mouth referrals, which are powerful in the remittance industry. This approach is particularly effective in reaching demographics that prefer face-to-face interactions and trust local agents.

The company utilizes its online platform and mobile app to attract tech-savvy customers. Digital marketing channels like search engine marketing, social media advertising, and app store optimization are employed. This strategy broadens the reach and provides convenience for customers who prefer digital transactions. The Growth Strategy of Intermex includes digital initiatives.

Competitive exchange rates and transparent fee structures are critical for attracting customers. These factors are often key decision-making points, especially when customers are comparing different remittance services. Clear pricing helps build trust and encourages customers to choose the company over competitors.

Retention efforts focus on providing consistent, reliable service and building customer loyalty. Efficient after-sales service and problem resolution are crucial for maintaining trust and encouraging repeat business. Personalized experiences, such as tailored communications, can also play a role in retaining customers.

Customer data and CRM systems likely play a vital role in segmenting customers for targeted campaigns and understanding transaction patterns. The shift towards digital acquisition and retention strategies is aimed at meeting evolving customer preferences and competing in an increasingly digital landscape. This impacts customer lifetime value and churn rates by offering more convenient and accessible options. In 2024, the global remittance market was valued at approximately $689 billion, showcasing the significant opportunity for companies like the company to acquire and retain customers. The increasing use of mobile technology is also a key factor, with mobile remittances expected to grow significantly in the coming years, emphasizing the importance of digital strategies. These strategies are crucial for the company's success in the competitive remittance market.

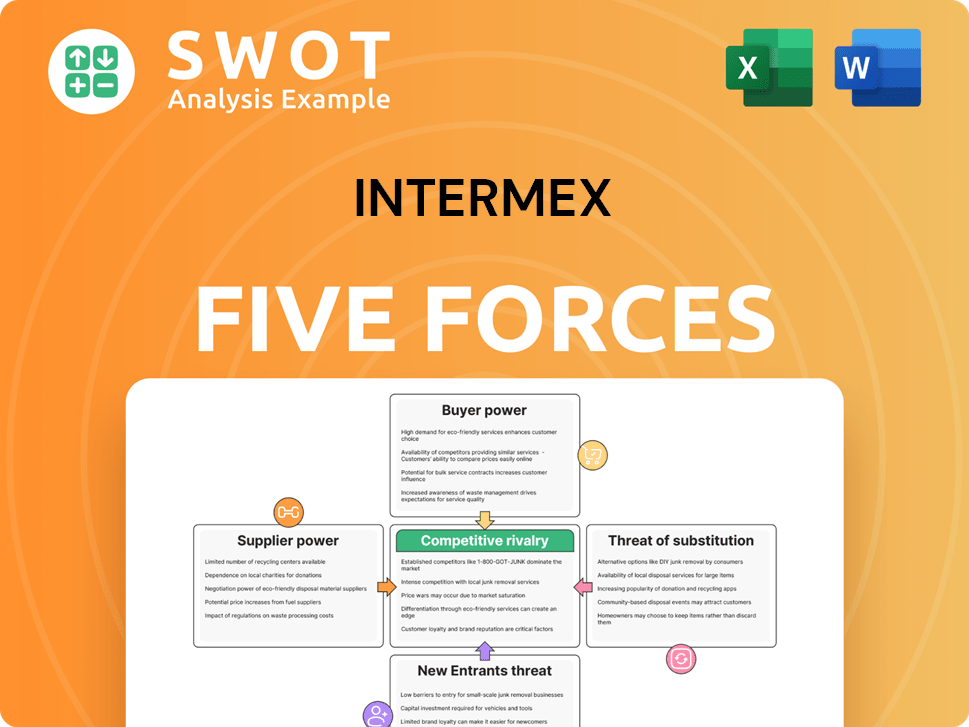

Intermex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Intermex Company?

- What is Competitive Landscape of Intermex Company?

- What is Growth Strategy and Future Prospects of Intermex Company?

- How Does Intermex Company Work?

- What is Sales and Marketing Strategy of Intermex Company?

- What is Brief History of Intermex Company?

- Who Owns Intermex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.