Intermex Bundle

How Does Intermex Navigate the Cutthroat Money Transfer Market?

The global money transfer market is a dynamic arena, constantly reshaped by technological innovation and evolving consumer demands. Intermex, a key player in this space, has built a significant presence, particularly in the vital US-Latin America and Caribbean corridor. This Intermex SWOT Analysis provides a comprehensive view of the company's position within this complex landscape.

This exploration of the Intermex competitive landscape will dissect its market position through a detailed Intermex market analysis, identifying its main Intermex competitors and evaluating its competitive advantages. We will delve into Intermex's financial performance, examining its strategies for growth and its ability to withstand the challenges and capitalize on the opportunities within the money transfer market. Understanding Intermex's business strategy and competitive positioning is crucial for any investor or analyst.

Where Does Intermex’ Stand in the Current Market?

The company holds a significant market position within the money remittance industry, especially in the United States to Latin America and the Caribbean (LAC) corridor. It is recognized as a leading omnichannel money remittance service provider in this region. The company’s core operations revolve around money remittance services, with wire transfers and money orders being the main revenue drivers.

Intermex offers its services through a vast network of over 100,000 independent sending and paying agents, supplemented by 122 company-operated stores across the U.S., Canada, Spain, Italy, and Germany. Additionally, the company has expanded its reach through online and mobile platforms, offering a comprehensive omnichannel experience. Its value proposition lies in providing accessible, reliable, and convenient money transfer services to a large customer base, with a focus on the LAC corridor.

As of 2024, Intermex processed 19.7% of the aggregate volume of remittances to Mexico and 27.6% of the aggregate volume to Guatemala, according to data from the central banks of those countries. The company serves a customer base of over 4.5 million individuals.

Intermex demonstrates a strong market presence, particularly in key remittance corridors. The company's significant market share in Mexico and Guatemala highlights its competitive advantage. This market share indicates a strong position within the money transfer market.

The company has a broad service offering, including wire transfers, money orders, and digital payment options. Its extensive network of agents and company-operated stores, along with online and mobile platforms, ensures wide accessibility. This comprehensive approach is crucial in the Intermex competitive landscape.

For the full year 2024, Intermex reported revenues of $658.6 million, with a net income of $58.8 million and an adjusted EBITDA of $121.3 million. The company's financial health reflects its ability to generate substantial revenue and maintain profitability. This data is crucial for an Intermex market analysis.

Intermex has expanded its services to include remittances from the U.S. to Africa and Asia, and sending services from Canada to Latin America and Africa. This strategic move broadens its geographical reach and diversifies its revenue streams. This expansion is part of the company's strategy in the money transfer market.

In Q1 2025, Intermex experienced a slight decline in total revenues, down 4.1% to $144.3 million, and a decrease in net income by 35.5% to $7.8 million. However, total principal sent increased by 3.7% to $5.6 billion in the same period. This indicates a shift in consumer behavior towards larger transactions.

- Despite a decrease in revenue, the increase in principal sent shows continued customer usage.

- The company maintained a strong balance sheet with $152 million in cash and cash equivalents as of March 31, 2025.

- Total debt stood at $147 million, resulting in a conservative debt-to-adjusted EBITDA ratio of 1.3x.

- The shift towards larger transactions and growth in digital channels are helping to offset some revenue reduction.

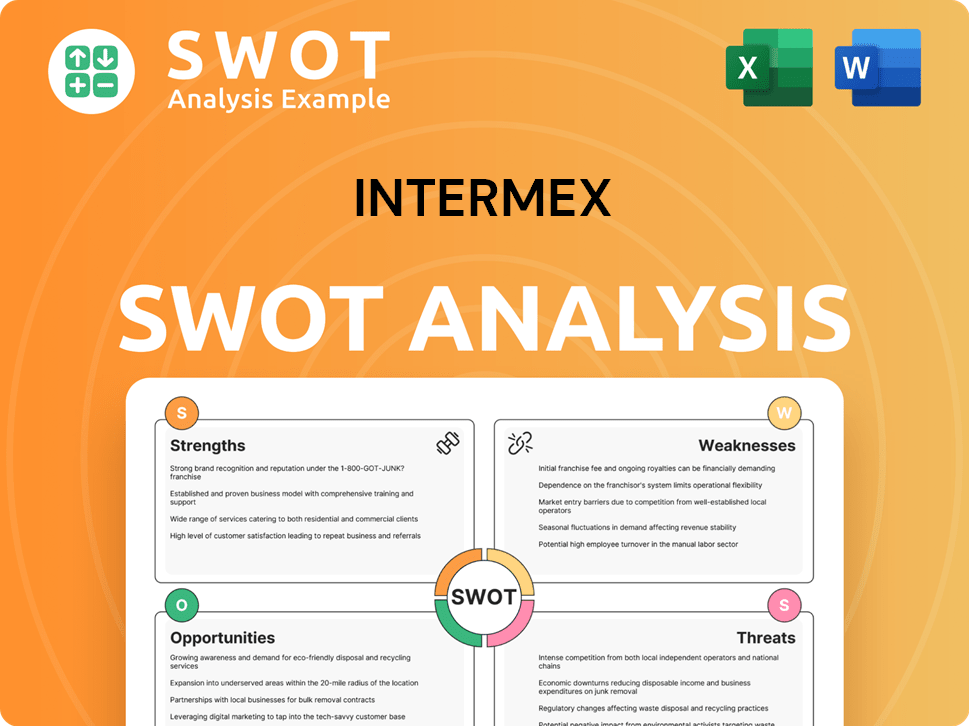

Intermex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Intermex?

The Intermex competitive landscape is shaped by a mix of established global players and emerging digital platforms. In the U.S.-Latin America and Caribbean (LAC) corridor, where Intermex is a key player, the market is highly competitive, with a few firms controlling a significant portion of the transactions.

Understanding the competitive dynamics in the money transfer market is crucial for assessing Intermex's position and future prospects. This analysis of Intermex's competitors provides insights into the challenges and opportunities the company faces.

Intermex's main rivals include Western Union, Remitly, MoneyGram, Ria Money Transfer, Xoom (a PayPal service), and Viamericas. These companies compete for market share in the money transfer market.

Western Union is a global leader with an extensive network, but its market share has been declining. It remains a significant competitor due to its brand recognition and established infrastructure.

Remitly is a strong digital-first competitor, gaining prominence in the money transfer market. It offers convenient online and mobile transfer options, appealing to tech-savvy consumers.

MoneyGram is a major global player in the remittance sector, though it has experienced fluctuations. It competes with a wide network and brand presence.

Ria Money Transfer is another established player with a global footprint. It challenges Intermex across various corridors.

Xoom, part of PayPal, is a strong digital competitor. It is a pioneer in internet-based money transfers.

Viamericas is an emerging player with a solid footprint in the U.S. and Latin American payment markets. It nearly doubled its market share from 5% to 10% by 2024.

The competitive landscape for Intermex is dynamic, with digital players like Remitly and Xoom leveraging technology for convenience. Traditional players such as Western Union and MoneyGram use their extensive physical networks and brand recognition. Intermex's digital transactions increased by 68.5% year-over-year in Q1 2025, while overall money transfer transactions decreased by 5.2% in the same period. Emerging platforms like FelixPago, which entered the market in 2022, are also disrupting the sector. Intermex's acquisition of Amigo Paisano in December 2024 is an example of how companies are reshaping competitive dynamics.

Intermex faces competition from various players, each employing different strategies. Understanding these strategies is key to analyzing Intermex's competitive position.

- Digital-first platforms focus on convenience and technology.

- Traditional players leverage established networks and brand recognition.

- Emerging players disrupt the market with new technologies and channels.

- Mergers and acquisitions reshape the competitive landscape.

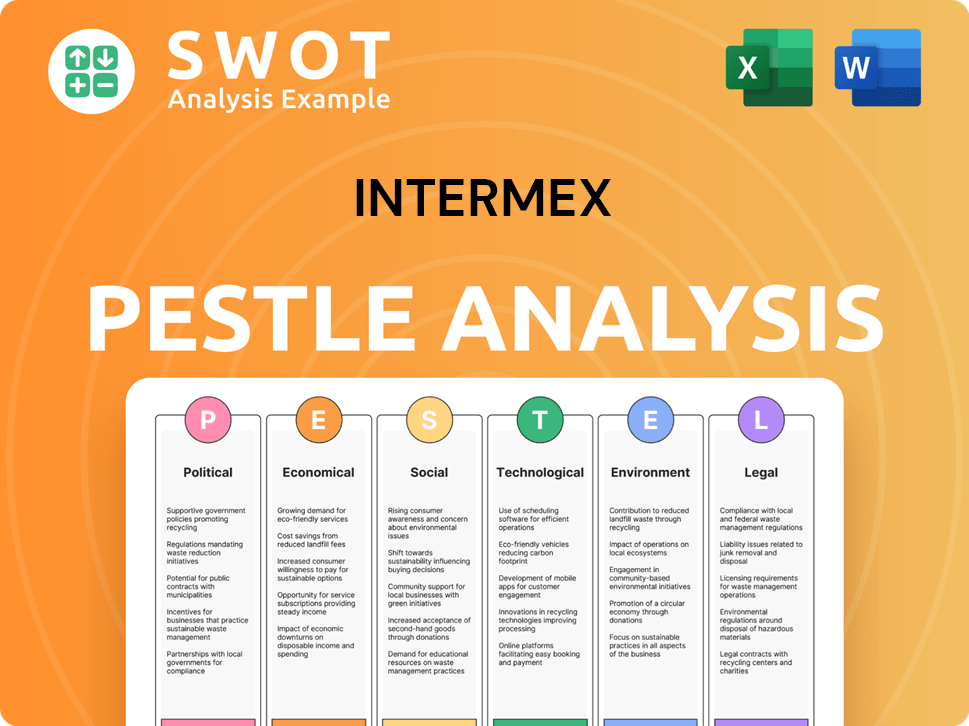

Intermex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Intermex a Competitive Edge Over Its Rivals?

Analyzing the Intermex competitive landscape reveals several key strengths that position it favorably within the money transfer market. The company has strategically built a robust network, leveraging both physical and digital channels to serve its diverse customer base. This multi-faceted approach, coupled with a focus on technological innovation and brand recognition, allows Intermex to maintain a competitive edge in a dynamic industry. For a deeper dive into its operational mechanics, consider exploring Revenue Streams & Business Model of Intermex.

Intermex's strategic moves include expanding its agent network and enhancing its technological infrastructure to improve service delivery. These initiatives are designed to increase market share and customer satisfaction. The company's ability to adapt to changing market demands and regulatory environments is crucial for its continued success. The company has demonstrated a commitment to innovation and customer-centric solutions, which helps to differentiate it from its Intermex competitors.

The company's competitive edge is further solidified by its established banking relationships, which are essential for efficient and reliable money transfers. These partnerships provide a stable foundation for operations and facilitate compliance with industry regulations. Through these advantages, Intermex aims to sustain its growth trajectory and strengthen its position in the competitive money transfer market. This strategy supports the company's long-term goals.

Intermex boasts an extensive network of independent agents and company-operated stores. As of early 2024, the company had over 100,000 independent agent locations and 122 company-operated stores. This widespread physical presence provides convenience and accessibility for customers, particularly those who prefer cash-based transactions. This network is a key component of Intermex's strategy to reach underserved communities.

Intermex utilizes proprietary technology to facilitate efficient and reliable money remittance services. This technology supports its omnichannel approach, including transactions through its agent network, online platform, and mobile app. The company's technological infrastructure includes embedded compliance systems that offer real-time transaction alerts and screening. This technological advantage allows for efficient transaction processing and compliance.

The Intermex brand is recognized for speed, cost-effectiveness, and reliability in money remittances. This strong brand equity fosters customer awareness and loyalty, with customers associating Intermex with safety and efficient fund transfers. The company promotes its brand through promotional events for agents and a loyalty program called 'Interpuntos'. The brand's reputation is a significant asset in the competitive money transfer market.

Intermex benefits from strong and long-term relationships with major banks and financial institutions. These relationships are crucial for an efficient and reliable remittance network, facilitating clearing, check processing, trading, exchange rate management, and cash management. These established relationships create a barrier to entry for new competitors. This network is essential for the company's operations.

Intermex's competitive advantages are multifaceted, encompassing a broad agent network, proprietary technology, strong brand recognition, and solid banking relationships. These elements work together to create a robust and resilient business model. The company's ability to integrate these elements effectively is key to its success.

- Extensive Agent Network: Provides broad reach and accessibility.

- Proprietary Technology: Enables efficient and reliable transactions.

- Strong Brand Recognition: Builds customer trust and loyalty.

- Established Banking Relationships: Supports efficient operations and compliance.

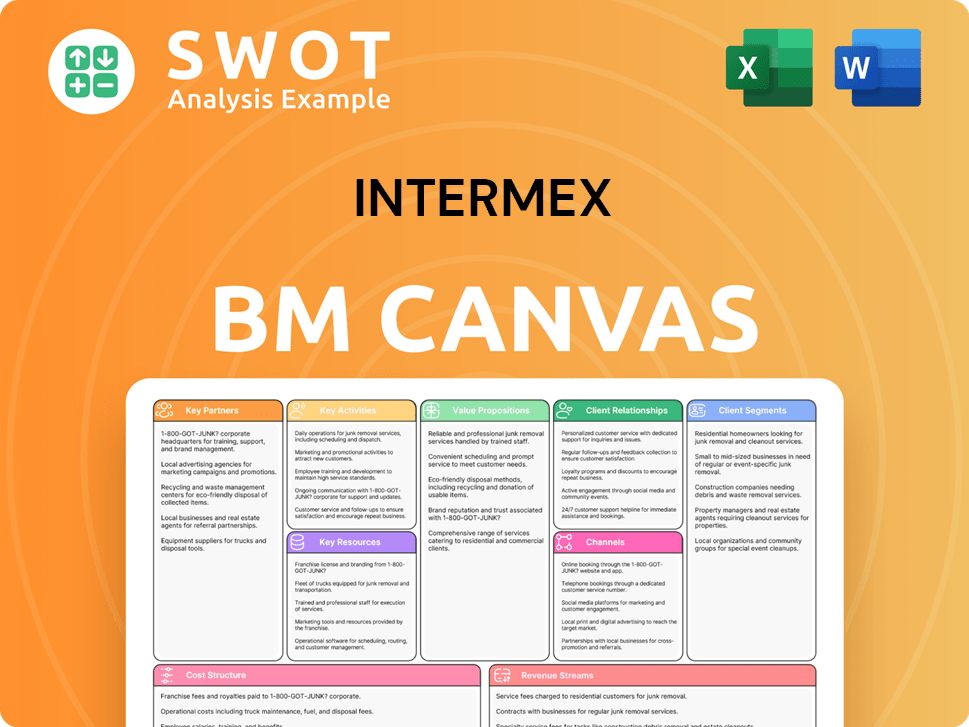

Intermex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Intermex’s Competitive Landscape?

The money remittance industry is currently undergoing significant changes, impacting companies like Intermex. This Intermex market analysis highlights how technological advancements and evolving consumer preferences are reshaping the landscape. The competitive environment is dynamic, with both challenges and opportunities for Intermex to navigate.

Intermex's competitive landscape is influenced by digital transformation, regulatory changes, and macroeconomic factors. Understanding these elements is crucial for assessing the company's future prospects. This analysis provides insights into Intermex's financial performance and strategic positioning within the money transfer market.

Technological advancements are driving the adoption of digital transactions. Digital wallets are projected to capture 35% of cross-border payment methods in 2024. Increased regulation, including cybersecurity and anti-money laundering (AML) measures, is also a key trend. Consumer demand for faster, more convenient, and cost-effective options is growing.

A potential slowdown in remittance market growth to Latin America, particularly on the retail side, could impact revenue. Increased regulation and aggressive new digital competitors pose threats. Macroeconomic conditions and immigration policies also influence transfer volumes. Intermex competitors are actively vying for market share.

Expansion into emerging markets and product innovation represent significant opportunities. Strategic partnerships and acquisitions can broaden reach and service offerings. Intermex is projecting full-year 2025 revenues between $657.5 million and $677.5 million. The company is also focused on expanding its digital offerings.

Intermex is investing in and expanding its digital business, which saw a 71.7% year-over-year growth in Q4 2024. The acquisition of Amigo Paisano aims to boost digital offerings. Partnerships, like the one with FelixPago, are broadening service offerings. The company is balancing its retail presence with digital expansion.

Intermex is adapting to market dynamics by focusing on digital expansion and maintaining a strong retail presence. The company's strategy involves leveraging both traditional strengths and emerging digital opportunities. Strategic actions, such as acquisitions and partnerships, are key components of Intermex's growth strategy.

- Digital Transformation: Prioritizing digital transaction growth.

- Strategic Partnerships: Collaborating to broaden service offerings.

- Market Expansion: Targeting emerging markets for growth.

- Financial Performance: Aiming for robust revenue and EBITDA in 2025.

For a deeper understanding of the company's ownership structure and financial background, you can refer to the article on Owners & Shareholders of Intermex.

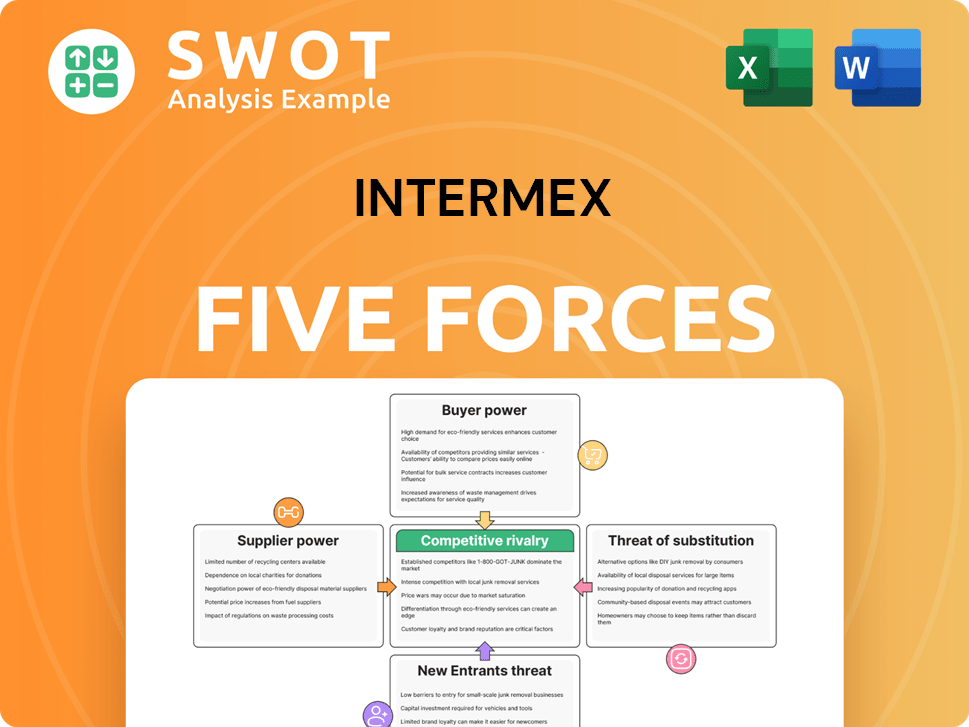

Intermex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Intermex Company?

- What is Growth Strategy and Future Prospects of Intermex Company?

- How Does Intermex Company Work?

- What is Sales and Marketing Strategy of Intermex Company?

- What is Brief History of Intermex Company?

- Who Owns Intermex Company?

- What is Customer Demographics and Target Market of Intermex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.