Intermex Bundle

How Does Intermex Company Thrive in the Global Remittance Arena?

Navigating the complexities of international finance requires a keen understanding of key players like Intermex, a dominant force in Intermex SWOT Analysis. Founded in 1994, Intermex money transfer has become synonymous with reliable money transfer services, particularly for those sending funds from the United States to Latin America and the Caribbean. But how exactly does this international money transfer giant operate, and what strategies drive its success?

Despite facing market fluctuations, Intermex company continues to adapt, reporting significant revenue and strategic shifts. The company's focus on digital expansion and its established retail network underscores its commitment to providing accessible and efficient remittance services. Understanding Intermex's operational model is crucial for anyone seeking to grasp the dynamics of the global money transfer market and the future of money transfer services.

What Are the Key Operations Driving Intermex’s Success?

The core operations of the Intermex company revolve around providing international money transfer services. The company facilitates the sending of funds from several countries, including the United States, Canada, and parts of Europe, to over 60 countries worldwide, with a strong emphasis on Latin America and the Caribbean. Their service portfolio includes wire transfers, money orders, and foreign exchange, with the majority of revenue coming from wire transfers and money orders.

Intermex money transfer operates through a multifaceted system. This includes a proprietary technology platform that supports both its extensive network of agent retailers and its digital channels, such as its mobile app and websites. Transactions are processed and paid out through thousands of retail locations and banks globally, ensuring broad accessibility for both senders and recipients. The company manages vast networks of agents and payout locations, ensuring secure and efficient money movement. Strategic partnerships, like the collaboration with Ding for international top-up services across more than 130 countries, further expand its service offerings.

The company's value proposition lies in its ability to offer reliable, accessible, and increasingly convenient remittance services. This is achieved through an 'omnichannel' strategy, integrating a robust retail network with growing digital capabilities. This approach caters to diverse customer preferences, from those who prefer cash-based transactions to those who prefer the convenience of digital transfers. In Q4 2024, Intermex saw a significant 48.3% growth in revenues from digitally-sent money transfers. This dual approach allows the company to cater to diverse customer preferences. You can read more about the company's history in Brief History of Intermex.

Intermex offers a range of financial services focused on international money transfer. These services are designed to cater to a diverse customer base. The primary offerings include wire transfers, money orders, foreign exchange, and cash checking services.

The operational network of Intermex is extensive, involving thousands of retail locations and banks globally. This network ensures broad accessibility for both senders and recipients. The company's technology platform supports both its retail and digital channels.

Intermex is experiencing significant growth in its digital channels. This includes the mobile app and website. In Q4 2024, the company saw substantial revenue growth from digitally-sent money transfers, highlighting the effectiveness of its omnichannel strategy.

Intermex engages in strategic partnerships to expand its service offerings. An example is its collaboration with Ding to launch international top-up services. These partnerships help extend the company's reach and enhance customer value.

The value proposition of Intermex is centered around providing reliable, accessible, and convenient money transfer services. This is achieved through a blend of a strong retail presence and growing digital capabilities. The company's focus on customer convenience and technological innovation differentiates it in the competitive market.

- Reliability in fund transfers.

- Accessibility through a vast network of locations and digital channels.

- Convenience with both cash-based and digital transaction options.

- Innovation through technology, such as the Intermex SOMA app launched in April 2025.

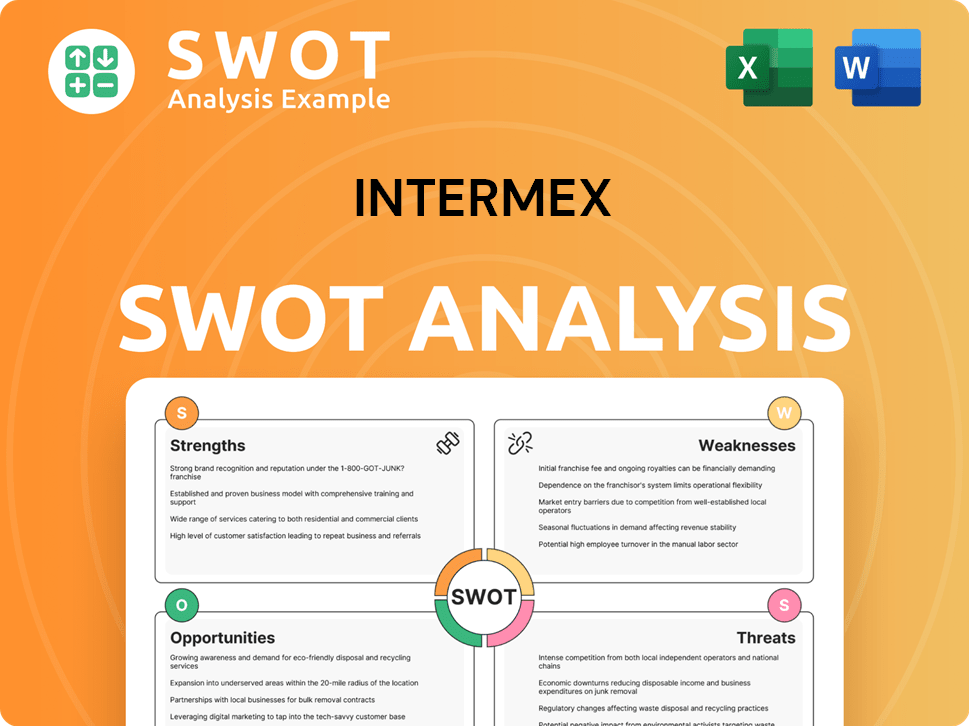

Intermex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Intermex Make Money?

The Intermex company primarily generates revenue through fees associated with its money transfer services. Wire transfers and money orders form the core of its business model. The company is strategically shifting towards digital transactions to boost profitability.

In 2024, Intermex's total revenue remained flat at $658.6 million, while wire transfer and money order fees saw a 1% decrease. However, the company is seeing significant growth in its digital revenue streams. This shift indicates a focus on higher-margin digital transactions.

For Q1 2025, total revenue was $144.3 million, reflecting a 4.1% year-over-year decrease. Digital money transfer revenue increased by 29.8% to $4.9 million in Q1 2025, and digital transactions grew by 68.5% year-over-year to 0.8 million, highlighting the company's digital expansion efforts.

Intermex's monetization strategy centers on transaction fees for its money transfer services. The company is actively investing in its digital business to increase its revenue and profitability. This includes aggressive expansion to capture digital customers through increased marketing and an improved mobile app. For more information about Intermex's target market, you can read this article: Target Market of Intermex.

- Transaction Fees: Revenue is primarily generated through fees charged for each money transfer transaction.

- Digital Expansion: Focus on growing digital money transfer services to increase revenue and profitability.

- Geographic Focus: The U.S. to Latin America and Caribbean corridor is a key revenue generator.

- New Services: Launch of international top-up services in partnership with Ding to diversify revenue streams.

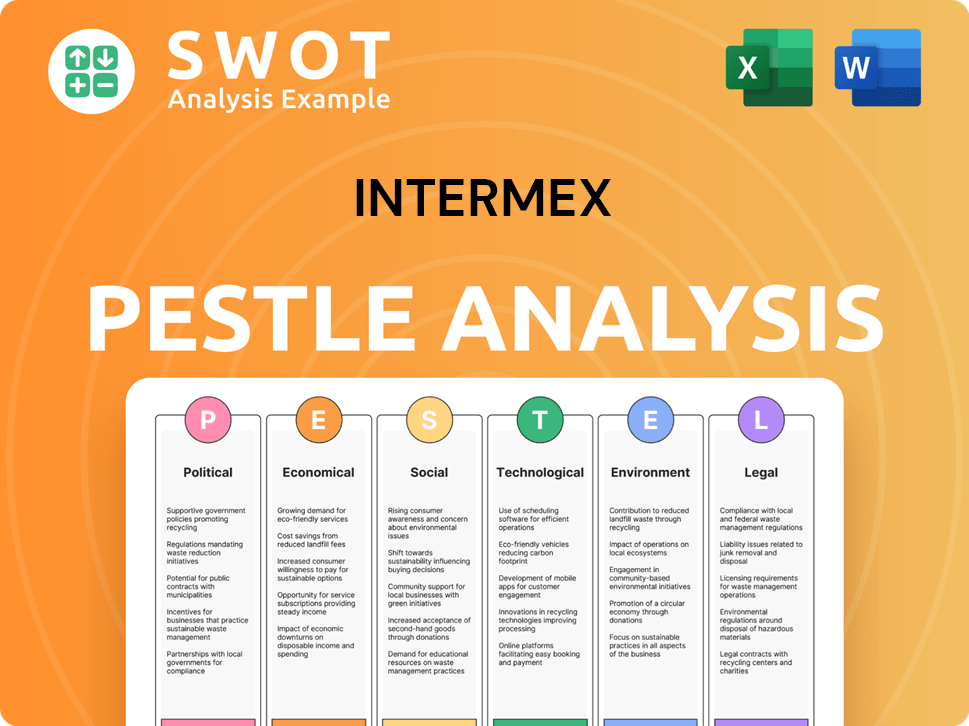

Intermex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Intermex’s Business Model?

The Intermex company has navigated a dynamic landscape, marked by strategic shifts and operational adjustments. A key decision in late 2024 involved evaluating strategic alternatives, including potential mergers or sales. However, this review was suspended in February 2025, as the company chose to focus on its existing business model and strategic plan, signaling a commitment to organic growth.

Operationally, Intermex has faced challenges, including a slowdown in the overall remittance market growth to Latin America in 2024 and Q1 2025. Despite these hurdles, the company has invested heavily in its digital offerings, with digital transactions and revenue experiencing significant growth. These strategic moves highlight Intermex's efforts to adapt to the evolving financial services landscape.

The company's competitive edge is built on its 'omnichannel' approach, combining a strong retail agent network with a growing digital presence. This strategy allows Intermex to cater to diverse customer preferences, supported by proprietary technology for efficient and secure money transfers. Furthermore, strategic partnerships, like becoming a founding partner of Dignity Health Sports Park and the Official International Remittance Partner of the LA Galaxy in May 2025, enhance its connection with its customer base.

In December 2024, Intermex acquired certain assets and operations of Amigo Paisano, expanding its presence in Central America. The launch of Intermex SOMA, a mobile app for agents, in April 2025, further enhanced its digital and omnichannel strategies. In February 2025, the company decided to continue focusing on its current business model.

The company suspended its strategic review in February 2025, opting to focus on organic growth. Investments in digital offerings, including the Intermex SOMA app, have been significant. Strategic partnerships, like the one with the LA Galaxy, aim to connect with the Latino community.

The 'omnichannel' approach, combining retail agents and a digital presence, is a key differentiator. Proprietary technology ensures efficient and secure money transfers. Strategic partnerships and culturally relevant initiatives strengthen customer connections. The company is adapting to the increasing digitalization of the remittance market.

In Q1 2025, total money transfer transactions decreased by 5.2% year-over-year, while the total principal sent increased by 3.7%. Digital transactions surged by 71.7% year-over-year in Q4 2024, and digital revenue was up 48.3%. The acquisition of Amigo Paisano is expected to yield an incremental adjusted EBITDA of $3.5 million to $5 million in 2025.

The Intermex company is actively responding to the increasing digitalization of the remittance market. This includes significant investments in digital marketing and improvements to its mobile app. The company’s focus on digital channels is a key strategy to maintain and grow its market share.

- Expanding digital offerings to cater to evolving customer preferences.

- Leveraging strategic partnerships to enhance brand visibility and customer engagement.

- Focusing on technological advancements to improve efficiency and security.

- Continuing to adapt to the changing dynamics of international money transfer.

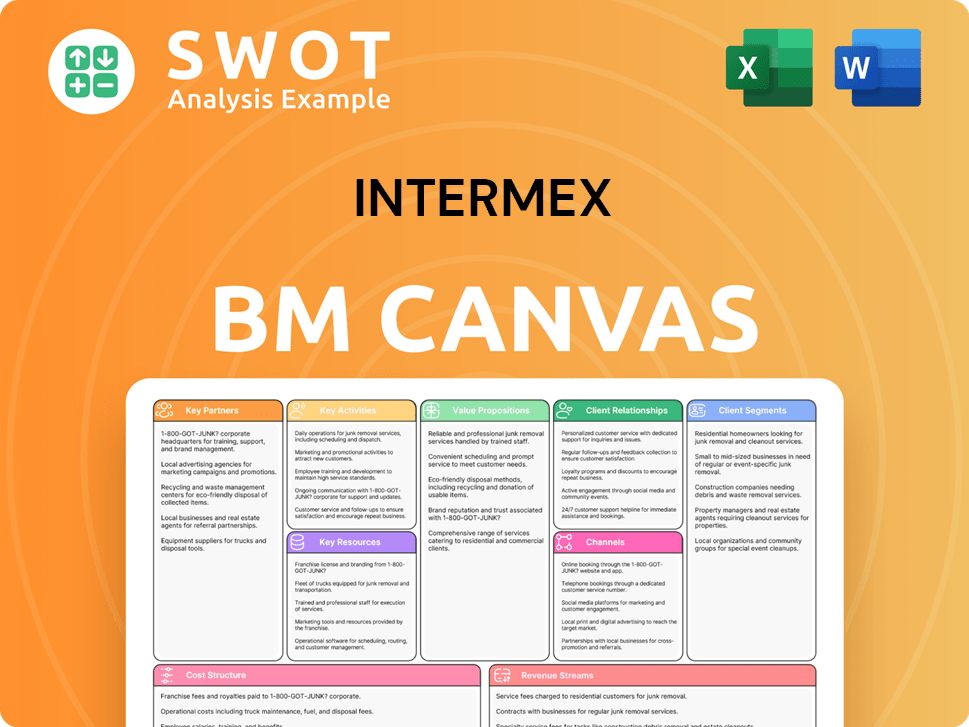

Intermex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Intermex Positioning Itself for Continued Success?

The Growth Strategy of Intermex positions the Intermex company as a significant player in the omnichannel money remittance services sector. It primarily focuses on the corridor connecting the United States to Latin America and the Caribbean. The company has demonstrated strong performance in digital growth, showing its commitment to maintaining and expanding its market presence.

Intermex faces several challenges, including a slowdown in remittance market growth, particularly affecting its revenue. Economic factors, regulatory changes, and competition pose additional risks. Despite these challenges, the company is focused on strategic initiatives to generate revenue and maintain a robust financial position.

Intermex holds a strong position in the international money transfer market. The company has a significant presence in the United States to Latin America and the Caribbean remittance corridor. The company's focus on digital growth and omnichannel strategy is key to maintaining its market share.

Several risks impact Intermex's operations. The slowdown in remittance market growth affects revenue. Regulatory changes, economic factors such as inflation, and increased competition pose ongoing threats to the business. These factors could impact the company's financial performance.

Intermex is focused on strategic initiatives to drive future growth. The company projects revenue between $634.9 million and $654.2 million for 2025. A key strategy involves aggressive investment in digital customer acquisition and enhancing its retail network.

Intermex is implementing an omnichannel strategy to leverage both digital and retail channels. This includes enhancements to its mobile app and increased digital marketing spend. The company's strong balance sheet, with $151.8 million in cash as of March 31, 2025, supports these growth initiatives.

Intermex's financial performance and future projections are critical for understanding its potential. The company's guidance for 2025 indicates solid revenue and adjusted EBITDA expectations.

- Revenue projected between $634.9 million and $654.2 million for 2025.

- Adjusted EBITDA expected to range from $103.6 million to $106.8 million.

- Digital transactions increased by 68.5% year-over-year in Q1 2025.

- The company had six million unique customers in 2024.

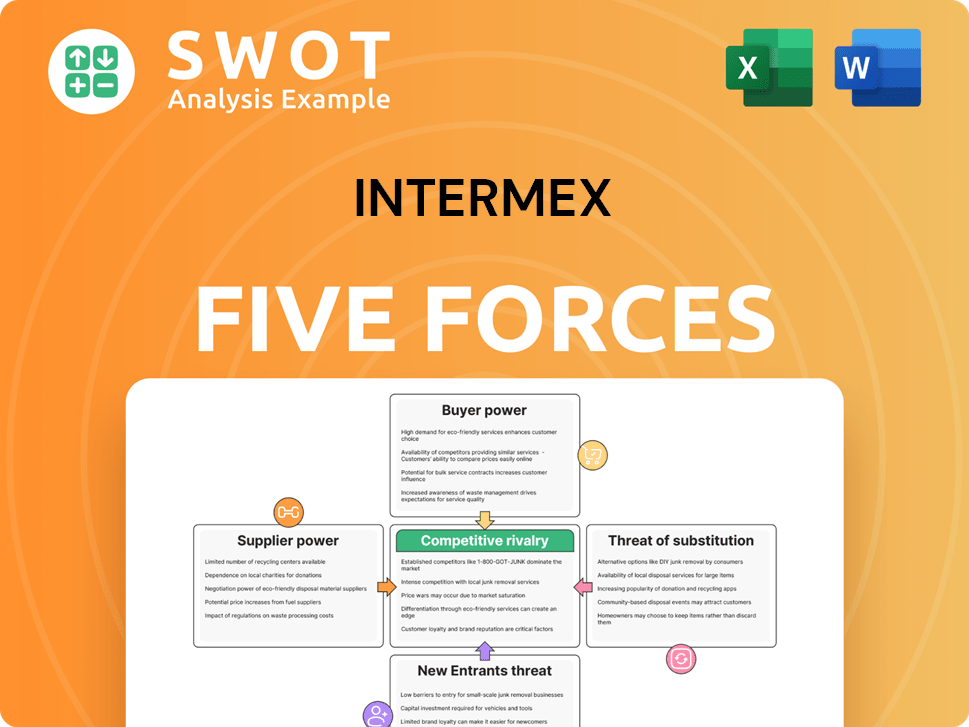

Intermex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Intermex Company?

- What is Competitive Landscape of Intermex Company?

- What is Growth Strategy and Future Prospects of Intermex Company?

- What is Sales and Marketing Strategy of Intermex Company?

- What is Brief History of Intermex Company?

- Who Owns Intermex Company?

- What is Customer Demographics and Target Market of Intermex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.