Intermex Bundle

Can Intermex Continue to Dominate the International Money Transfer Market?

Founded in 1994, Intermex has evolved from a pioneer in international money transfers into a leading player, processing millions of transactions annually. Its strategic focus on digital expansion and customer acquisition has fueled impressive growth, particularly in the crucial U.S. to Latin America and Caribbean corridors. To understand the trajectory of this financial services powerhouse, let's dive into the Intermex SWOT Analysis to uncover its strengths, weaknesses, opportunities, and threats.

This analysis explores Intermex's growth strategy, examining its expansion plans, innovative approaches, and strategic financial planning within the dynamic remittance industry. We will delve into Intermex's future prospects, evaluating its market share, competitive landscape, and potential for long-term investment. Understanding the company's business model and revenue growth drivers is key to assessing its impact on the international money transfer market.

How Is Intermex Expanding Its Reach?

The expansion initiatives of the company are primarily focused on capturing digital customers and broadening its market reach. A key aspect of this strategy involves significant investment in digital growth. This forward-thinking approach aims to capitalize on the increasing demand for convenient and accessible financial services, positioning the company for sustained growth in the evolving remittance industry.

The company is aggressively investing in digital growth for 2025, with plans to increase digital marketing spending from approximately $1 million to $9 million. This strategic move underscores the company's commitment to strengthening its digital presence and attracting a wider customer base. By focusing on digital channels, the company aims to enhance its service offerings and accessibility, catering to the evolving preferences of its customers.

Geographical expansion is another key component of the company's strategy. The acquisition of La Nacional has further penetrated key Latin American and Caribbean markets. Additionally, the company has expanded its European operations with a presence in the UK, Spain, Italy, and Germany. These initiatives are being pursued to access new customer segments, diversify revenue streams, and stay competitive in the evolving money transfer industry. For a detailed look at the competitive environment, consider exploring the Competitors Landscape of Intermex.

The company is significantly increasing its investment in digital marketing. The aim is to double the number of transactions with digital send/receive capabilities. Digital transactions accounted for 35% of the company's transactions in 2024, up from 23% in 2021.

The company recognizes the continued importance of its retail network. The retail network contributed over $600 million in annual revenue in 2024. The company will continue to invest in staff and marketing for this core business.

The acquisition of La Nacional has expanded its presence in Latin America and the Caribbean. The company has expanded its European operations, including the UK, Spain, Italy, and Germany. The acquisition of Amigo Paisano enhances digital coverage in Central America.

The company launched a new global mobile top-up service in December 2024. This service, in partnership with Ding, allows customers to send mobile credit to over 130 countries through its retail and digital channels. These initiatives are designed to access new customer segments.

The company's expansion strategy includes significant digital investments and geographical diversification. The acquisition of Amigo Paisano, completed in December 2024, is expected to generate an incremental adjusted EBITDA between $3.5 million and $5 million in 2025. The company is also focused on enhancing its digital capabilities and reaching new customer segments.

- Increase digital marketing spending from $1 million to $9 million.

- Target to double digital transactions.

- Acquisition of Amigo Paisano.

- Launch of a global mobile top-up service.

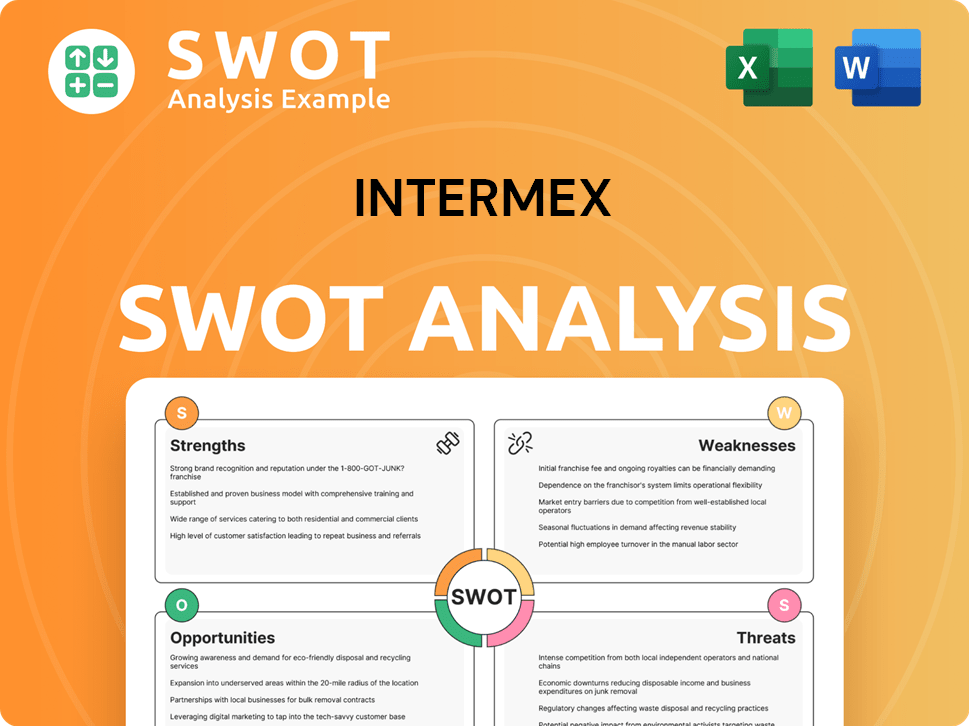

Intermex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Intermex Invest in Innovation?

The company is strategically leveraging technology and innovation to drive sustained growth. This approach focuses on digital transformation and enhancing its omnichannel capabilities. A key aspect of the Intermex growth strategy involves significant investment in its digital business offerings to boost revenue and profitability.

This includes an aggressive focus on digital customer acquisition. The company is adapting to the evolving needs of its customers by providing seamless and efficient digital solutions. This is crucial for maintaining a competitive edge in the remittance industry.

The company's commitment to innovation is evident in its strategic investments in digital infrastructure and security. This commitment is essential for achieving its growth objectives within the financial services sector, as highlighted in an article on Mission, Vision & Core Values of Intermex.

The company is actively pursuing digital transformation to improve its services. This involves enhancing its digital platforms and expanding its reach through online channels. These efforts aim to streamline operations and improve customer experiences.

The company focuses on building strong omnichannel capabilities to serve customers better. This strategy integrates various channels, including digital platforms and physical locations. This approach provides customers with multiple options for transactions.

A significant portion of the company's investment goes into its digital business offerings. This investment is intended to increase the contribution of digital services to both revenue and profitability. The focus is on enhancing digital customer acquisition strategies.

The company is developing technology solutions for its agents to improve their efficiency. This includes tools that provide real-time insights and streamline business operations. These tools aim to enhance agent performance and support.

The company is enhancing its mobile app for customers to drive digital growth. These improvements are designed to provide a better user experience and encourage more digital transactions. The goal is to attract and retain customers through user-friendly apps.

Robust cybersecurity measures are a priority for the company to protect its operations. This involves implementing advanced security platforms and practices. These measures are essential for safeguarding customer data and ensuring secure transactions.

In April 2025, the company launched Intermex SOMA (Store Owner Management App). This mobile platform provides agents with real-time business visibility. The app helps agents track performance metrics, monitor commissions, and connect with Intermex teams. The company is also focused on advanced cybersecurity measures.

- Intermex SOMA Launch: In April 2025, the company launched Intermex SOMA (Store Owner Management App), a new mobile platform for agents.

- Agent Benefits: The app allows agents to track performance metrics, monitor commissions, and receive real-time alerts.

- Cybersecurity Focus: The company adopts AI-native platforms like CrowdStrike Falcon for robust cybersecurity.

- Compliance Systems: Embedded compliance systems provide real-time transaction alerts and OFAC screening.

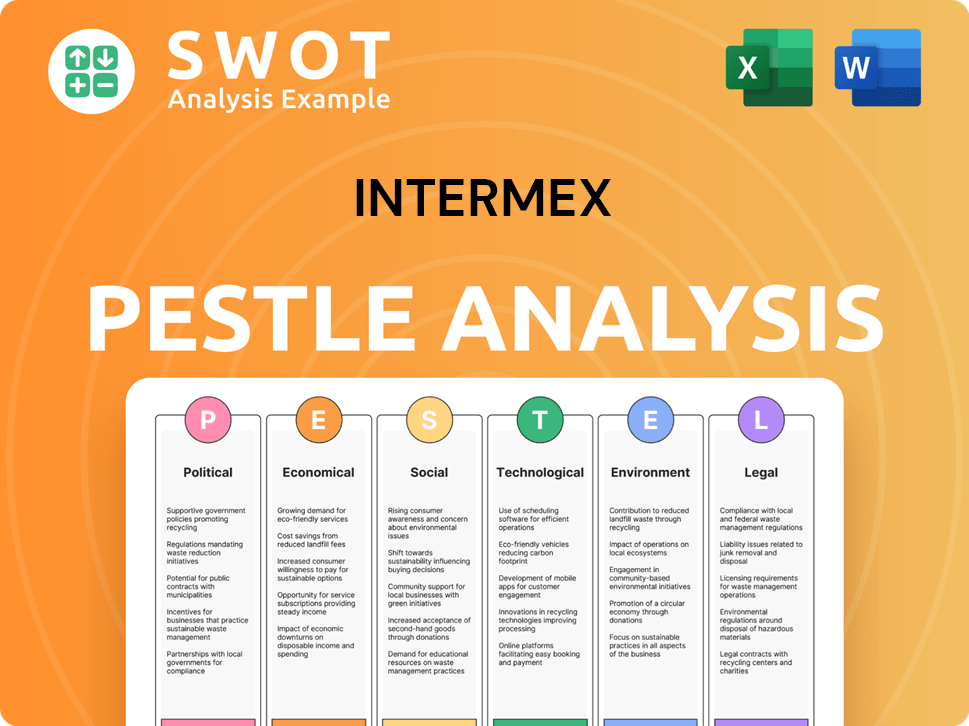

Intermex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Intermex’s Growth Forecast?

The financial performance of the company in 2024 and the first quarter of 2025 provides insights into its current standing and future trajectory. This analysis is crucial for understanding the company's Intermex growth strategy and evaluating its Intermex future prospects within the dynamic remittance industry and financial services sector.

The company's performance highlights its resilience and adaptability in a competitive market. Investors and stakeholders should pay close attention to the company's strategic initiatives and their impact on long-term growth. A detailed review of the financial data is essential for a comprehensive Intermex company analysis.

In 2024, the company reported revenues of $658.6 million, with a net income of $58.8 million and adjusted EBITDA of $121.3 million. Diluted EPS for the full year was $1.79, and adjusted diluted EPS was $2.14. The company's ability to maintain profitability amidst market challenges is noteworthy. For a deeper dive into the company's structure, consider reading about the Owners & Shareholders of Intermex.

Total revenue remained relatively flat in 2024 due to a slowdown in the Latin American remittance market. However, the company saw a 48.3% growth in revenues from digitally-sent money transfers. This indicates a successful shift towards digital international money transfer services.

For the full year 2025, the company projects revenues between $634.9 million and $654.2 million. Adjusted EBITDA is expected to range from $103.6 million to $106.8 million. Diluted EPS is forecast between $1.53 and $1.65, and adjusted diluted EPS is expected to be between $1.86 and $2.02.

In the first quarter of 2025, the company reported revenues of $144.3 million, a 4.1% decrease year-over-year, and net income of $7.8 million, a 35.5% decrease. Adjusted EBITDA for Q1 2025 was $21.6 million, a 15.0% decrease. Total principal transferred increased by 3.7% to $5.6 billion.

The company's capital allocation priorities include reinvesting in the business, returning capital to shareholders through share repurchases (with $5.0 million repurchased in Q1 2025), and pursuing value-focused acquisitions. The company has suspended its review of strategic alternatives.

The company's financial performance reflects both challenges and opportunities in the current market environment. The company's focus on digital remittances and strategic capital allocation are key factors.

- Revenue: $658.6 million (2024), Projected $634.9 - $654.2 million (2025)

- Adjusted EBITDA: $121.3 million (2024), Projected $103.6 - $106.8 million (2025)

- Digital Revenue Growth: 48.3% (2024)

- Q1 2025 Revenue: $144.3 million

- Q1 2025 Net Income: $7.8 million

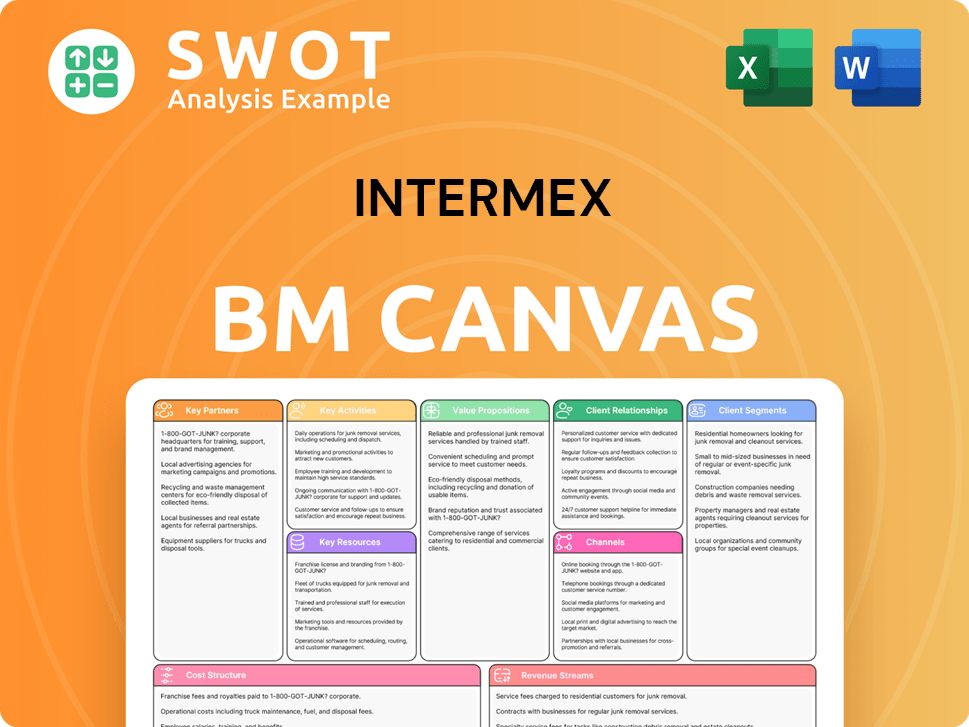

Intermex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Intermex’s Growth?

The potential risks and obstacles facing Intermex significantly influence its Intermex growth strategy and future prospects. The company operates in a competitive market, and its performance can be affected by economic conditions and regulatory changes. Understanding these challenges is crucial for assessing the company's long-term investment potential and its ability to maintain its market position.

The remittance industry is subject to various risks, including market dynamics, regulatory changes, and internal resource constraints. These factors can impact Intermex's financial performance and its ability to execute its strategic plans. To navigate these challenges, Intermex employs a comprehensive compliance process and risk management strategies.

Intermex's company analysis reveals several key areas of concern. Competition within the international money transfer market poses a constant challenge. The company must also adapt to evolving consumer behavior and the increasing scrutiny from regulatory bodies. These factors can affect Intermex's financial performance and its ability to execute its strategic plans.

The remittance industry is highly competitive, which presents a significant challenge to Intermex. The company faces competition from both established players and new entrants. This competitive landscape can impact Intermex's market share and revenue growth.

The financial services industry is heavily regulated, with increasing focus on cybersecurity, anti-money laundering (AML), and consumer protection. Intermex must comply with evolving regulations to maintain its operations. Changes in regulations can increase operational costs and compliance burdens.

Geopolitical developments and international political factors, including ongoing conflicts and potential restrictions on remittances, can affect Intermex's operations. These factors can disrupt money transfer flows and impact the company's financial performance. The company must carefully monitor these developments and adapt its strategies accordingly.

Intermex relies on key paying agents, making it vulnerable to supply chain disruptions. The loss of a major partner could significantly impact its operations. For example, Elektra accounted for approximately 25% of Intermex's total remittance volume in fiscal year 2024.

The remittance industry is constantly evolving with new digital solutions. Intermex's ability to continue its strong digital growth is critical. Failure to adapt to technological changes could lead to loss of market share to competitors.

Recruiting and retaining key personnel can pose a challenge for Intermex. The company needs to attract and retain talent to support its growth initiatives. Competition for skilled employees can increase costs and impact operational efficiency.

Intermex employs a rigorous compliance process, including policies, procedures, and internal controls to exceed regulatory requirements. Regular risk assessments are conducted using frameworks like NIST and CIS to identify and address control gaps. The company partners with industry-leading managed service providers for continuous security monitoring and threat detection. The company's decision to suspend its strategic review process indicates a belief that its current business model and strategic plan, with a significant investment in digital services, offer the best long-term value. For more details on the company's financial performance, you can read Revenue Streams & Business Model of Intermex.

A slowdown in the overall remittance market growth to Latin America has already influenced Intermex's performance, contributing to flat revenues in FY 2024 and a decline in Q1 2025. Changes in consumer sending behavior, such as sending fewer transactions but in larger amounts, also impact revenue. The company's performance is closely tied to the economic conditions in key remittance corridors and the evolving needs of its customer base.

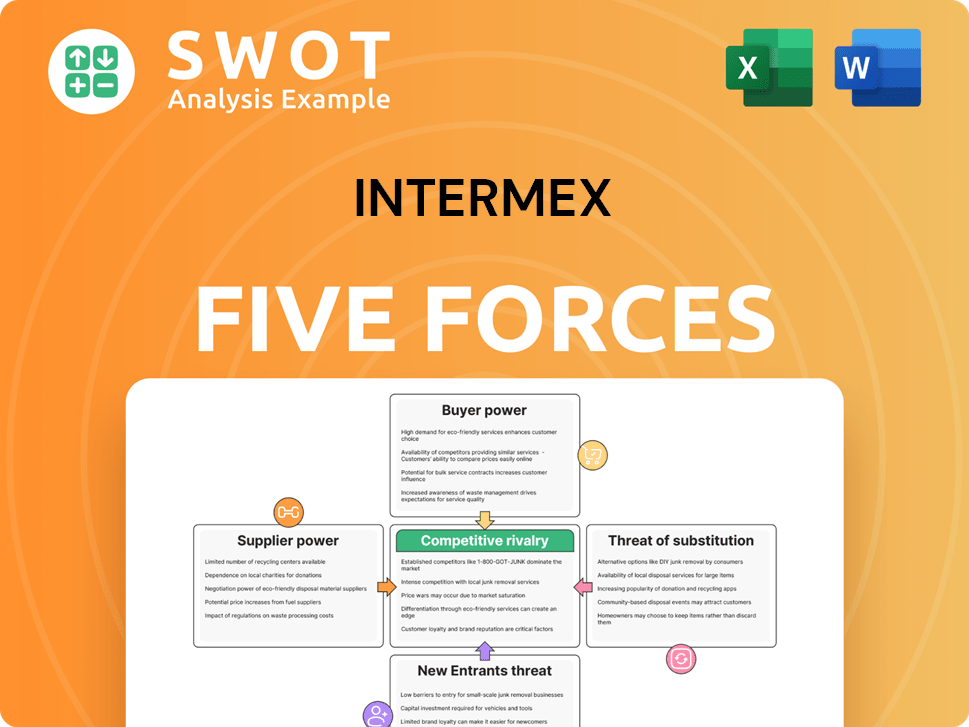

Intermex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Intermex Company?

- What is Competitive Landscape of Intermex Company?

- How Does Intermex Company Work?

- What is Sales and Marketing Strategy of Intermex Company?

- What is Brief History of Intermex Company?

- Who Owns Intermex Company?

- What is Customer Demographics and Target Market of Intermex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.