Japan Post Holdings Bundle

What's the Story Behind Japan Post Holdings?

Ever wondered how a single company touches nearly every aspect of life in Japan? From its humble beginnings in 1871 with the Japanese postal service, Japan Post Holdings has evolved into a financial and logistical powerhouse. This journey, marked by pivotal moments and strategic shifts, offers a fascinating look at the evolution of a national institution.

The Japan Post Holdings SWOT Analysis reveals the intricate details of this transformation. Understanding the Japan Post history is crucial for grasping its current influence. The company's structure, including its subsidiaries like Japan Post Bank and Japan Post Insurance, reflects a strategic adaptation to the changing financial landscape. Exploring the Japan Post Group's evolution, from its privatization timeline to its financial performance, provides invaluable insights into its enduring impact on the Japanese economy.

What is the Japan Post Holdings Founding Story?

The story of Japan Post Holdings begins with the establishment of Japan's modern postal service in 1871. Hisoka Maejima is a key figure, credited with setting up the groundwork for the postal system. This system would eventually evolve into the integrated services offered today.

The primary goal was to create a reliable communication and delivery system across Japan, crucial for a developing nation. The initial focus was on mail delivery, with the first product being the efficient transportation of letters and goods. This early focus laid the foundation for the extensive services offered by the company today.

While the formal incorporation of Japan Post Holdings Co., Ltd. was on January 23, 2006, it was part of a larger privatization initiative by the Japanese government. This move aimed to boost competitiveness in the financial and logistics sectors. The cultural and economic background of this creation involved a shift towards greater market liberalization and efficiency in public services. The initial funding for the modern postal service came from government allocations, reflecting its status as a state-owned enterprise for many years.

The evolution of Japan Post Holdings reflects significant changes in Japan's economic and social landscape.

- 1871: Establishment of Japan's modern postal service.

- 2006: Formal incorporation of Japan Post Holdings Co., Ltd. as part of a government privatization initiative.

- 2015: Initial Public Offering (IPO) of Japan Post Holdings, Japan Post Bank, and Japan Post Insurance.

- Ongoing: Adaptation to digital services and global market trends.

The privatization of Japan Post Holdings was a significant event in Japan's economic history. The IPO in 2015 was one of the largest in the world that year, underscoring the scale of the company. This move was intended to enhance efficiency and competitiveness within the financial and logistics sectors. For more details on the company's target market, consider reading about the Target Market of Japan Post Holdings.

The structure of Japan Post Holdings includes several subsidiaries, such as Japan Post Bank and Japan Post Insurance. These subsidiaries offer a range of financial products and services, expanding the company's reach beyond traditional postal services. The company's financial performance is closely watched, with its stock price reflecting its market position and strategic decisions.

The impact of Japan Post Holdings on the Japanese economy is considerable, providing essential services and acting as a major employer. The company's evolution over time has been marked by adaptation to technological changes and global market trends. Key figures in Japan Post Holdings history have played crucial roles in shaping its direction and growth. The company continues to explore opportunities for global expansion, seeking to broaden its reach and services.

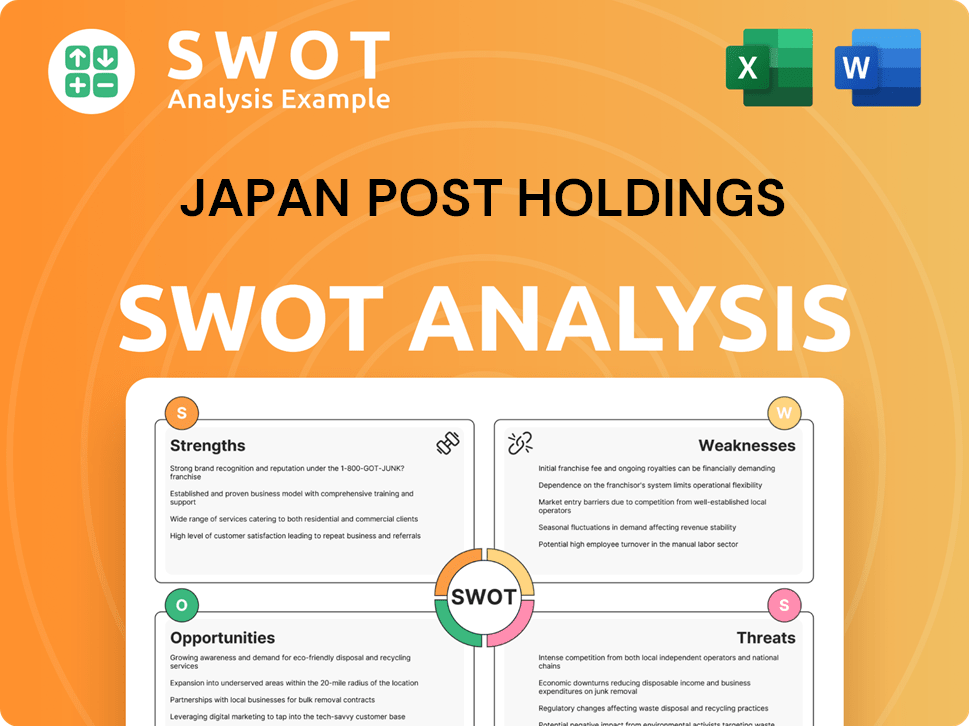

Japan Post Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Japan Post Holdings?

The early years of the Japanese postal service were marked by significant growth and expansion, setting the stage for its future as a diversified conglomerate. The establishment of the postal service in 1871 laid the groundwork, followed by the introduction of postal savings and international collaborations. These initial steps were crucial in building a strong national infrastructure. This period highlights the evolution of the Owners & Shareholders of Japan Post Holdings.

In 1875, the Japanese postal service expanded its offerings by introducing the postal savings service. This move marked an early entry into financial services, providing a secure and accessible way for citizens to save money. The postal savings system quickly gained popularity, contributing to the financial inclusion of the population. This expansion was a key step in the evolution of the Japanese postal service.

Japan's commitment to international standards was evident when it joined the Universal Postal Union in 1877. This membership facilitated efficient international mail delivery and underscored Japan's integration into the global postal network. This international collaboration was vital for both communication and trade. The Japanese postal service was committed to global standards.

The establishment of the Ministry of Communications in 1885 further cemented the importance of the postal system. This ministry provided governmental oversight, ensuring the postal service's smooth operation and strategic alignment with national interests. The adoption of the '〒' mark in 1887 as the logo for the Ministry of Communications became an iconic symbol. This symbol is still in use today.

A significant expansion occurred in 1916 with the introduction of postal life insurance services. This move diversified the services offered and provided financial security to the public. The addition of insurance marked a strategic shift towards providing comprehensive financial solutions. This was an important step for the future of the JP Holdings.

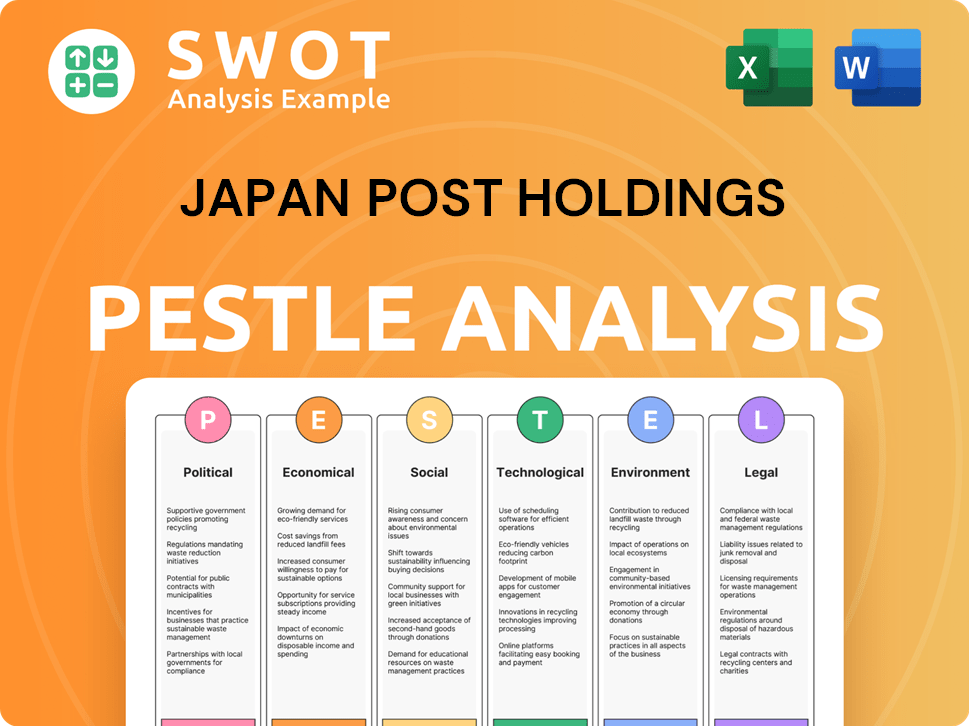

Japan Post Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Japan Post Holdings history?

The Japan Post Holdings has a rich history marked by significant milestones, particularly its transformation from a government-owned entity to a publicly traded company. The Japan Post Group's journey includes major strategic shifts and adaptations to the evolving financial and logistical landscape, reflecting its commitment to innovation and responsiveness to market demands. This evolution is a key part of understanding the Japan Post history.

| Year | Milestone |

|---|---|

| 2015 | Triple Initial Public Offering (IPO) on the Tokyo Stock Exchange, including Japan Post Holdings, Japan Post Bank, and Japan Post Insurance. |

| 2015 | Acquisition of Toll Group, a significant move to expand logistics operations. |

| 2021 | Sale of part of the unprofitable Australian logistics company Toll Holdings. |

| 2025 | Acquisition of Tonami Holdings for US$619 million, further expanding logistics operations. |

Japan Post Holdings has consistently pursued innovations to enhance its services and adapt to market changes. The company has invested heavily in technology and infrastructure, allocating over ¥100 billion to improve its e-commerce logistics capabilities.

Japan Post Holdings has invested over ¥100 billion to adapt to the growing e-commerce logistics sector, improving its delivery capabilities. This investment underscores the company's commitment to staying competitive in the evolving market.

The acquisition of Tonami Holdings in April 2025 for US$619 million is a strategic move to broaden its logistics operations. This acquisition is part of Japan Post Group's expansion strategy to enhance its service offerings.

In January 2024, Japan Post launched a lump-sum payment whole life insurance policy, targeting middle-aged and elderly customers. This initiative aims to cater to the specific financial needs of this demographic.

In May 2024, Japan Post Bank and post offices introduced a commission-free service for first-time buyers of mutual funds. This initiative is designed to encourage investment and expand its customer base.

Despite its successes, Japan Post Holdings has faced several challenges, including financial losses and reputational damage. The acquisition of Toll Group in 2015 led to a ¥40 billion ($360 million) loss in its first full financial year as a listed company in 2017.

The acquisition of Toll Group resulted in significant financial losses, impacting the company's performance. This challenge highlighted the complexities of integrating and managing large-scale acquisitions.

Improper sales practices of insurance policies led to regulatory scrutiny and reputational damage, causing top executives to resign in December 2019. This issue necessitated significant restructuring and reform within the company.

Japan Post Holdings has undertaken restructuring efforts, including selling part of its unprofitable Australian logistics company, Toll Holdings. The company continues to adapt to competitive pressures from other financial institutions and logistics providers.

The company faces ongoing challenges from competitors in the financial and logistics sectors. Japan Post Holdings must continuously innovate and adapt to maintain its market position.

For a deeper understanding of the company's core values, consider exploring the Mission, Vision & Core Values of Japan Post Holdings.

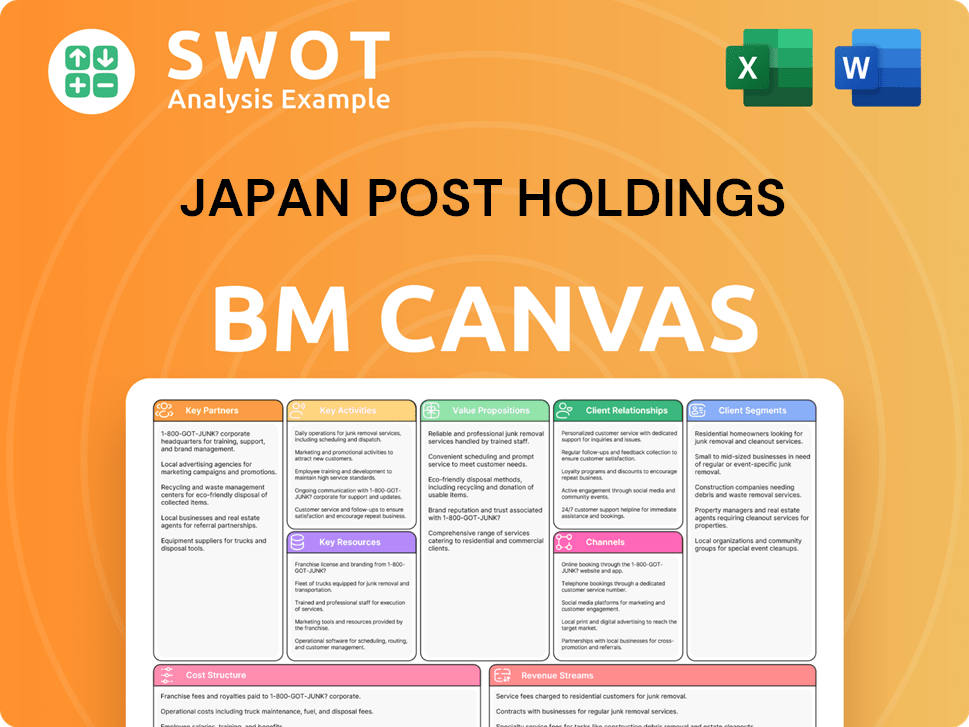

Japan Post Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Japan Post Holdings?

The Japan Post history is a story of transformation and adaptation within the Japanese postal service. From its origins in 1871 as a modern postal service, it has evolved through privatization and strategic acquisitions to become a significant player in the financial and logistics sectors. Key milestones include the establishment of postal savings and life insurance services, the formation of Japan Post Holdings in 2006, and the 2015 triple IPO. The company's journey also includes challenges, such as losses from acquisitions and internal restructuring, which have shaped its current structure and future direction.

| Year | Key Event |

|---|---|

| 1871 | Modern postal service established by Hisoka Maejima. |

| 1875 | Postal savings service established. |

| 1916 | Postal life insurance service established. |

| 2003 | Japan Post established. |

| 2006 (January 23) | Japan Post Holdings Co., Ltd. incorporated. |

| 2007 (October 1) | Japan Post Group established and began operations under the Postal Service Privatization Act. |

| 2012 | Japan Post Group reorganized into a four-company structure (Japan Post Holdings, Japan Post Co., Japan Post Bank, Japan Post Insurance). |

| 2015 (November 4) | Japan Post Holdings, Japan Post Bank, and Japan Post Insurance listed on the Tokyo Stock Exchange (triple IPO). |

| 2015 | Acquired Toll Group, an Australian logistics company. |

| 2017 | Announced a ¥40 billion loss for its first full financial year as a listed company due to Toll Group acquisition. |

| 2019 (December) | Heads of Japan Post Holdings resigned over improper insurance sales. |

| 2021 (April) | Agreed to sell part of its unprofitable Australian logistics company Toll Holdings. |

| 2021 (October) | Japanese government completed the final stage of privatization with a $9 billion tranche of shares sold, abandoning majority ownership while retaining the most stock. |

| 2024 (January) | Launched a lump-sum payment whole life insurance policy. |

| 2024 (May) | Introduced a commission-free service for first-time mutual fund buyers. |

| 2025 (February 27) | Announced a partial sale of shares in Japan Post Bank, aiming to reduce its stake to 49.9% by fiscal year 2025 to increase management flexibility for the banking unit. |

| 2025 (April) | Completed the acquisition of Tonami Holdings for US$619 million. |

Japan Post Holdings aims for an operating profit of ¥500 billion by FY2025. This target reflects the company's strategic focus on enhancing profitability and efficiency across its diversified business segments.

The company is actively pursuing digital transformation initiatives. This includes leveraging technology to improve service delivery and customer experience across all its business units, from postal services to financial products.

Japan Post Holdings is investing in its logistics and digital services. This strategic focus is driven by the growth of e-commerce and the increasing demand for efficient and reliable delivery solutions, and the expansion of digital financial services.

In May 2025, Japan Post Holdings announced an equity buyback for 250,000,000 shares, representing 8.41% for ¥250,000 million. This move aims to enhance shareholder returns and improve the company's capital efficiency, reflecting confidence in its financial stability.

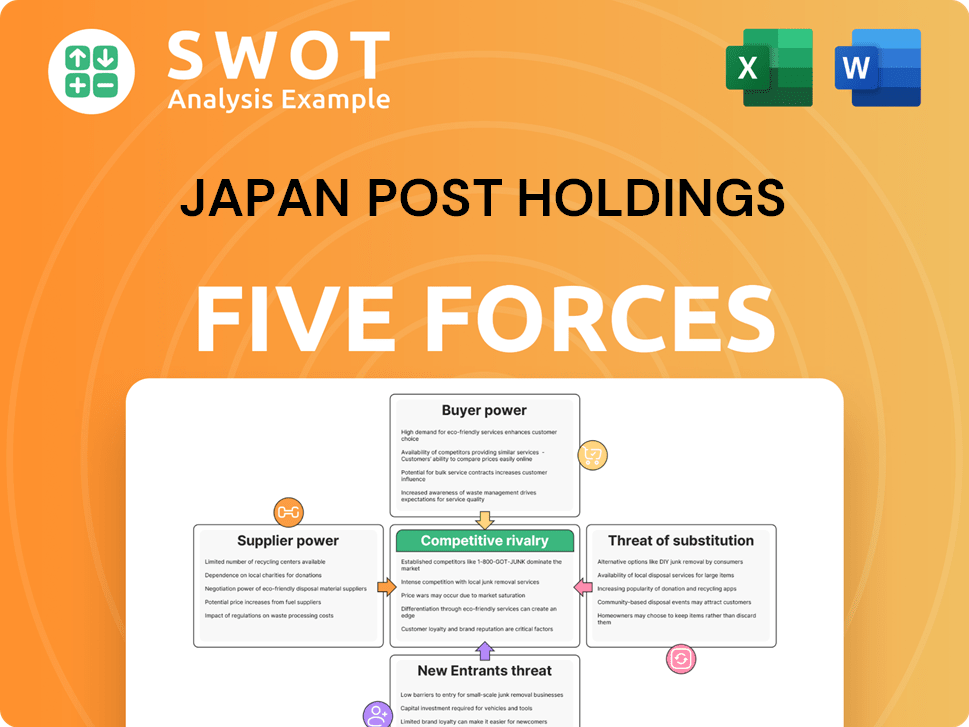

Japan Post Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Japan Post Holdings Company?

- What is Growth Strategy and Future Prospects of Japan Post Holdings Company?

- How Does Japan Post Holdings Company Work?

- What is Sales and Marketing Strategy of Japan Post Holdings Company?

- What is Brief History of Japan Post Holdings Company?

- Who Owns Japan Post Holdings Company?

- What is Customer Demographics and Target Market of Japan Post Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.