Japan Post Holdings Bundle

Can Japan Post Holdings Navigate the Future?

From its humble beginnings in 1871 as a postal service, Japan Post Holdings has evolved into a financial and logistical powerhouse. This deep dive explores the Japan Post Holdings SWOT Analysis, examining its journey from a state-owned entity to a publicly traded conglomerate. Discover how this pivotal player in the Japanese economy is adapting to the challenges and opportunities of the 21st century.

Understanding the growth strategy of Japan Post is crucial for anyone interested in Financial Services Japan and Postal Services Japan. This analysis will dissect Japan Post Holdings' strategic initiatives, financial performance, and market analysis, providing insights into its future outlook and investment opportunities. The company's impact on Japanese society and its ability to navigate the competitive landscape are also key considerations for investors and analysts alike, making this a critical study of the Japanese economy.

How Is Japan Post Holdings Expanding Its Reach?

Japan Post Holdings is actively pursuing several expansion initiatives to drive future growth, focusing on both new market penetration and service diversification. This strategic approach is crucial for navigating the evolving landscape of the Japanese economy and maintaining a competitive edge in financial and postal services.

A key element of Japan Post's growth strategy involves leveraging its extensive post office network to offer integrated services and explore new business models. This includes collaborations to enhance efficiency and expand parcel delivery capabilities, which is vital in the growing e-commerce sector. These initiatives are designed to meet the changing needs of consumers and businesses alike, ensuring that Japan Post remains a relevant and valuable entity in the Japanese market.

The company's expansion initiatives are multifaceted, encompassing both logistics and financial services. This diversification is aimed at creating a more resilient business model and tapping into new revenue streams. By strategically investing in these areas, Japan Post is positioning itself for long-term growth and sustainability in the face of evolving market dynamics.

In October 2024, Japan Post Co. launched the Kuroneko Yu-Packet service, utilizing its delivery network for small lightweight parcels handled by Yamato Transport. This partnership aims to enhance parcel delivery capabilities. In February 2024, the Kuroneko Yu-Mail service for booklet parcels was introduced across the nation through Japan Post Co.'s network.

In May 2024, Japan Post Bank and post offices nationwide introduced a commission-free service for first-time buyers of mutual funds. This initiative aims to meet customers' asset formation needs, especially with the launch of the new NISA system. In January 2024, a lump-sum payment whole life insurance policy was launched, specifically designed for middle-aged and elderly customers.

Japan Post Holdings completed the acquisition of Tonami Holdings for US$619 million in April 2025 through a tender offer. This strategic move strengthens its portfolio and expands its market presence. The acquisition demonstrates Japan Post's commitment to growth through strategic investments.

Japan Post continues its long-standing distribution relationship with Aflac Incorporated for cancer insurance policies through over 20,000 postal outlets and 76 directly managed sales offices. These partnerships are crucial for expanding product offerings and reaching a wider customer base. These collaborations are a key part of the company's Brief History of Japan Post Holdings expansion plans.

Japan Post's expansion strategy focuses on several key areas to ensure sustained growth and adapt to market changes. These initiatives are designed to enhance service offerings and strengthen its market position. The company's strategic investments are crucial for its future outlook.

- Enhancing logistics capabilities through partnerships and service diversification.

- Expanding financial product offerings to meet evolving customer needs.

- Strategic acquisitions to strengthen the portfolio and expand market presence.

- Leveraging existing distribution networks for product expansion and partnerships.

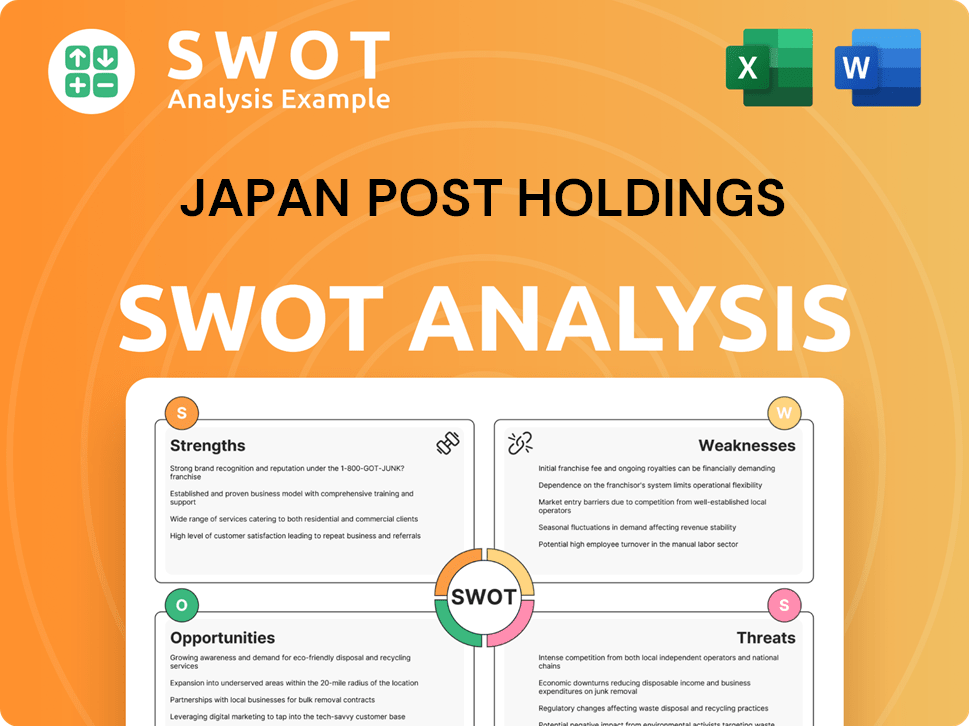

Japan Post Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Japan Post Holdings Invest in Innovation?

Innovation and technology are central to the growth strategy of Japan Post Holdings, driving efficiency and enhancing customer experiences across its diverse operations. The company is actively investing in digital transformation to maintain its competitive edge in the evolving financial services and postal services landscape in Japan. These initiatives are crucial for navigating the complexities of the Japanese economy and ensuring long-term sustainability.

A key focus is on leveraging technology to streamline processes and create new revenue streams. This includes the development of digital solutions for both postal and financial services, reflecting a commitment to adapting to changing customer needs and preferences. These efforts are aligned with the broader strategic goals of Japan Post Holdings, aiming to improve operational efficiency and enhance its market position.

The company's strategic initiatives are designed to create a more robust and adaptable business model. By embracing digital transformation and sustainability, Japan Post Holdings is positioning itself for future growth and resilience. The focus on innovation is critical for the long-term success of Japan Post in the dynamic Japanese market.

Japan Post launched a Digital Address System in May 2025, a seven-digit alphanumeric code designed to improve e-commerce and postal efficiency. This system streamlines transactions and reduces operational costs for retailers and logistics providers. It also boosts e-commerce conversion rates.

The Digital Address System aims to reduce operational costs by up to 30% for retailers and logistics providers. This is achieved by eliminating manual address entry and processing time. The system's efficiency directly impacts the bottom line.

The Digital Address System's API opens new revenue streams through partnerships with tech giants like Rakuten. This includes leveraging transaction fees and data analytics. These partnerships are crucial for expanding the system's reach.

The rollout strategy for the Digital Address System spans a decade, with phased implementations. Phase 1 (2025–2027) focuses on API partnerships and integration with e-commerce platforms. Subsequent phases will expand into IoT-enabled logistics and AI-driven route optimization.

Japan Post Bank released the 'Yucho Tetsuzuki App' for account opening and PIN resets via smartphones. The bank introduced 'Madotab,' a self-service branch terminal for various transactions. These innovations enhance customer convenience and operational efficiency.

Japan Post Group is committed to sustainability-oriented management, aiming for carbon neutrality by 2050. The company is also promoting DX measures across the Group through the post office app. These efforts align with the 'JP Vision 2025' plan.

Japan Post Holdings is focused on digital transformation and sustainability to drive growth and efficiency. The company's strategic initiatives aim to modernize operations and enhance customer experiences. These efforts are supported by a clear vision for the future.

- Digital Address System: Streamlines e-commerce and postal services, reducing costs and improving efficiency.

- Banking Segment Innovations: Enhances customer convenience through mobile apps and self-service terminals.

- Sustainability Efforts: Commits to carbon neutrality by 2050, aligning with global environmental goals.

- DX Measures: Promoting digital transformation across the Group to support customers and local communities.

- Partnerships: Collaborating with external companies and tech giants to expand services and revenue streams.

For more insights into the company's ownership structure, you can refer to Owners & Shareholders of Japan Post Holdings.

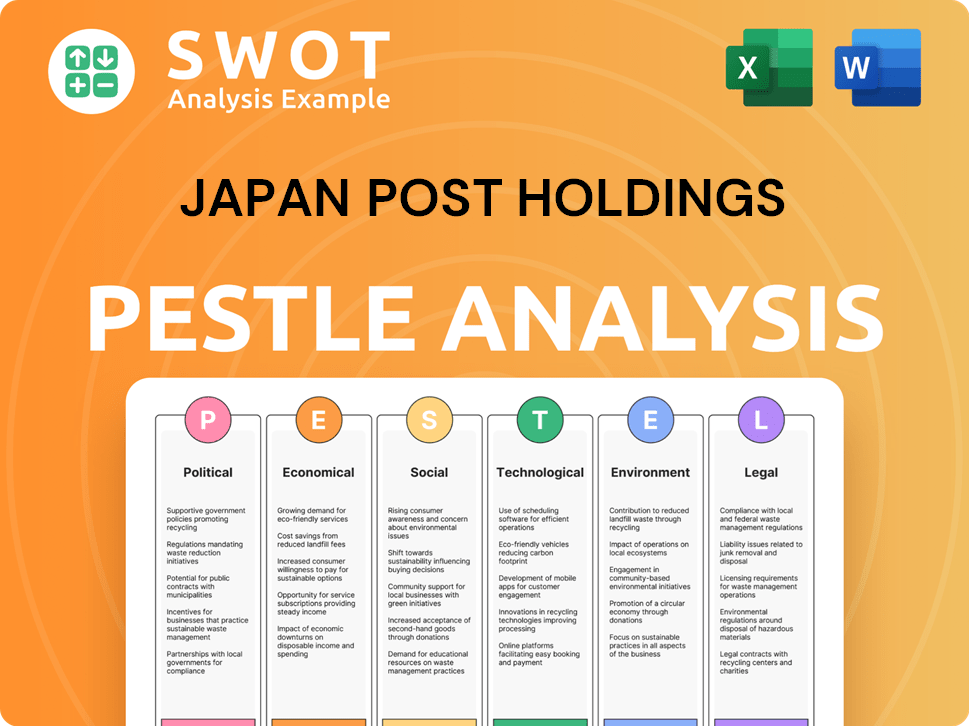

Japan Post Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Japan Post Holdings’s Growth Forecast?

The financial outlook for Japan Post Holdings reflects a strategic focus on enhancing profitability and achieving sustained growth. The company's performance in fiscal year 2024, which ended March 31, 2024, demonstrated a strong financial position, with increases in both ordinary and net ordinary income. This positive trend sets a solid foundation for future endeavors.

For the fiscal year ending March 31, 2025, Japan Post Holdings has revised its financial forecasts, indicating a positive trajectory. The revised projections anticipate growth in key financial metrics, driven by strategic initiatives and favorable investment conditions. This positive outlook is crucial for understanding the company's future prospects.

The financial performance of Japan Post Holdings is closely tied to the broader Japanese economy and the evolving landscape of financial and postal services. Understanding the company's financial outlook is essential for stakeholders, including investors and analysts, to assess its potential for long-term value creation and its role within the Japanese economy. For more information on the company's target market, you can read about the Target Market of Japan Post Holdings.

In FY2024, Japan Post Holdings reported consolidated ordinary income of ¥11,982.1 billion, a 7.57% year-on-year increase. Consolidated net ordinary income was ¥668.3 billion, up 1.61% year-on-year. Net income attributable to Japan Post Holdings for FY2024 was ¥268.685 billion.

For the fiscal year ending March 31, 2025, the company anticipates ordinary income of ¥11,450,000 million. The revised forecast includes net ordinary income of ¥810,000 million and net income attributable to Japan Post Holdings of ¥360,000 million. This represents a significant increase in net income.

The projected earnings per share (EPS) for FY2025 is ¥115.89, a substantial increase from ¥80.26 in FY2024. This growth reflects improved profitability and strategic financial management. The increase in EPS is a positive indicator for investors.

Revenue for FY2025 is projected to be ¥11 trillion, a decrease of 3.8% from FY2024. However, net income is expected to reach JP¥370.6 billion, up 38% from FY2024. The profit margin is anticipated to increase to 3.2% from 2.3% in FY2024.

Japan Post Holdings is strategically managing its equity interests in its financial subsidiaries. The company aims to reduce its stake in Japan Post Bank to 50% or less by fiscal year 2025. This is intended to relax regulations and increase management flexibility.

- As of March 31, 2024, voting rights in Japan Post Bank had decreased to 49.84%.

- Proceeds from the sale of Japan Post Bank shares are being utilized for shareholder returns and growth investments.

- These actions are part of a broader strategy to optimize the company's financial structure and enhance shareholder value.

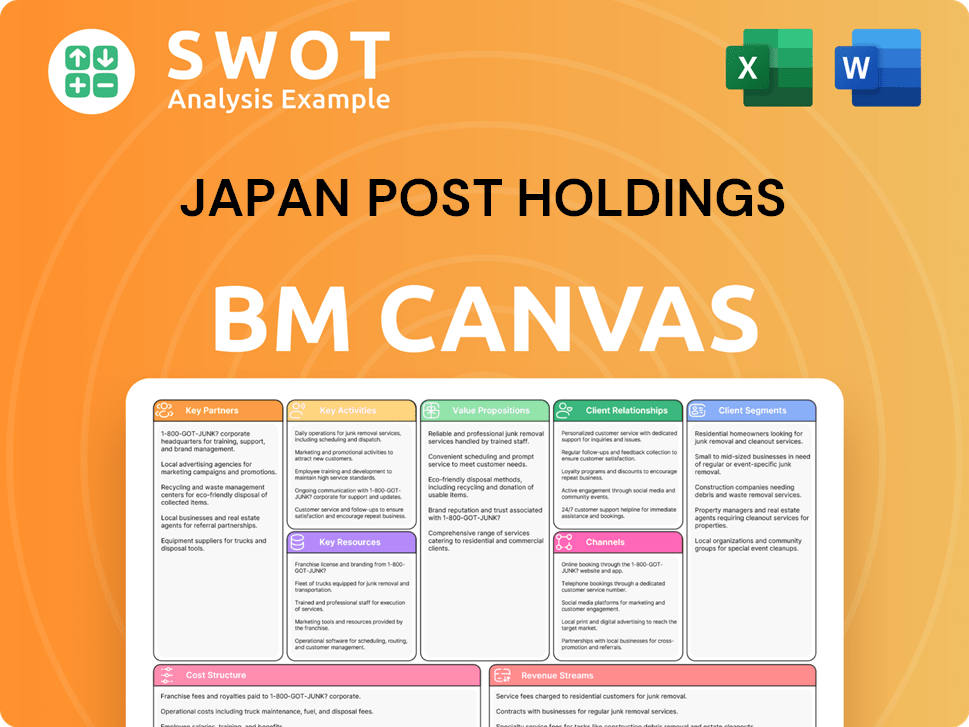

Japan Post Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Japan Post Holdings’s Growth?

The growth strategy of Japan Post Holdings faces several significant risks and obstacles that could impede its expansion and profitability. These challenges include intense market competition, regulatory uncertainties, and the need for rapid technological adaptation. Furthermore, internal issues and external events, such as natural disasters, pose additional threats to the company's operations and financial stability.

Market competition in the logistics sector is notably fragmented, with no single entity controlling more than a 15-20% market share. This competitive landscape, featuring major players like Sagawa Express and Yamato Holdings, requires Japan Post Holdings to continually innovate and improve its services to maintain its market position. The company's ability to navigate these challenges will be crucial for its future success.

Regulatory changes and technological disruptions add further complexity to the situation. The government's significant ownership stake and ongoing discussions about postal service privatization introduce uncertainty. Simultaneously, the fast-paced advancements in technology necessitate that Japan Post Holdings invest heavily in digital transformation to remain competitive. These factors highlight the need for a proactive and adaptable approach to risk management and strategic planning.

The logistics industry in Japan is highly competitive, with several major players vying for market share. The fragmented nature of the market, where no single company holds a dominant position, intensifies the pressure on Japan Post Holdings. This competitive environment demands continuous innovation and efficiency improvements to maintain and enhance its market presence.

Regulatory changes pose a significant risk to Japan Post Holdings, particularly due to the government's substantial ownership stake. Ongoing discussions regarding revisions to the Postal Service Privatization Law and potential changes in postal rates create uncertainty. These factors could impact the company's strategic flexibility and financial performance, requiring careful navigation of the regulatory environment.

Technological advancements, such as AI and IoT, are rapidly changing the business landscape, necessitating continuous adaptation by Japan Post Holdings. The company's investments in digital transformation are crucial to remain competitive. The ability to integrate and leverage new technologies effectively will be essential for maintaining its market position and driving future growth.

Internal issues, such as the data misuse controversy in Kampo Life Insurance, have highlighted potential governance failures. These incidents, along with the operational disruptions caused by the Noto Peninsula Earthquake in January 2024, underscore the importance of robust risk management and crisis response mechanisms. Addressing these internal challenges is critical for restoring trust and ensuring operational stability.

External events, such as natural disasters, pose significant risks to Japan Post Holdings' operations. The Noto Peninsula Earthquake in January 2024 disrupted operations, demonstrating the impact of such events on infrastructure and service delivery. The company must enhance its crisis management systems and strengthen its resilience to external shocks to mitigate these risks effectively.

Japan Post Holdings has implemented a comprehensive risk management framework, integrated with crisis management since April 2024. This framework focuses on 'crisis prevention,' 'early identification of risk manifestations,' and 'minimization of impact.' The Group Chief Risk Officer (CRO) oversees risk management, with the Group Risk Management Committee facilitating information sharing and discussion among group companies.

In its insurance arm, Kampo Life Insurance, a data misuse controversy affected up to 10 million customer accounts, highlighting potential systemic governance failures. Japan Post Holdings has responded with executive salary cuts and reforms to prevent similar incidents. This event underscores the need for enhanced governance and compliance measures across the organization to maintain stakeholder trust and operational integrity.

The Noto Peninsula Earthquake in January 2024 caused damage to post office buildings and disrupted operations, demonstrating the impact of natural disasters on infrastructure. This event highlighted the need for robust disaster preparedness and business continuity plans. The company's ability to quickly recover and resume services is crucial for maintaining customer satisfaction and minimizing financial losses.

To learn more about the competitive landscape of Japan Post Holdings, consider reviewing the Competitors Landscape of Japan Post Holdings.

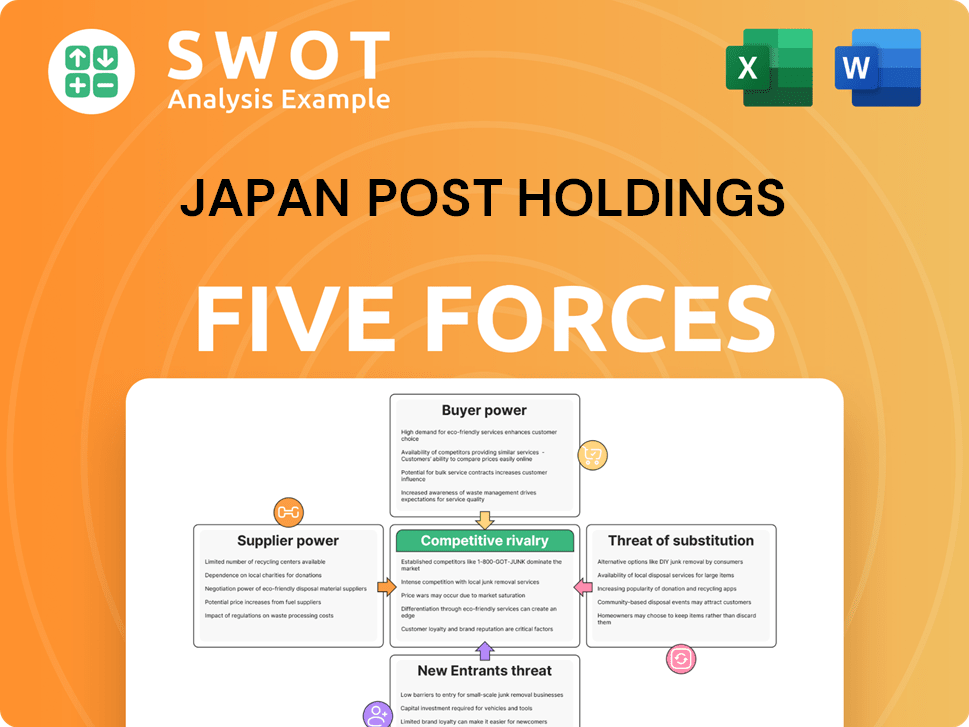

Japan Post Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Japan Post Holdings Company?

- What is Competitive Landscape of Japan Post Holdings Company?

- How Does Japan Post Holdings Company Work?

- What is Sales and Marketing Strategy of Japan Post Holdings Company?

- What is Brief History of Japan Post Holdings Company?

- Who Owns Japan Post Holdings Company?

- What is Customer Demographics and Target Market of Japan Post Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.