Japan Post Holdings Bundle

Can Japan Post Holdings Maintain Its Dominance?

Japan Post Holdings, a cornerstone of Japan's financial and logistical landscape, boasts a history rooted in the nation's postal service since 1871. This evolution highlights its critical role in the Japanese economy, offering a unique blend of postal, banking, and insurance services. Its extensive network of post offices underscores its unparalleled reach, making it a central hub for various financial transactions and services across the country.

As Japan Post Holdings navigates an increasingly competitive environment, understanding its Japan Post Holdings SWOT Analysis is crucial. This analysis explores the company's competitive landscape, identifying its main rivals and strategic advantages. The study will also delve into the impact of deregulation, market share analysis, and future outlook of Japan Post, providing a comprehensive view of its financial performance and business strategy within the Japanese market.

Where Does Japan Post Holdings’ Stand in the Current Market?

Japan Post Holdings maintains a strong market position in Japan's postal, banking, and insurance sectors. Its extensive network and historical significance contribute to its dominance. While specific 2025 market share figures are emerging, the company's presence is solidified by its vast network of approximately 24,000 post offices across the country, as reported in fiscal year 2023.

This widespread network allows it to be a key provider for mail delivery. It is also a significant player in the savings market through Japan Post Bank and a leading insurer via Japan Post Insurance. The company's legacy infrastructure and established customer relationships provide a solid foundation, particularly when serving the elderly population and those in less urbanized areas.

In the financial sector, Japan Post Bank is one of the largest financial institutions in Japan by deposits. It serves a broad customer base, including individuals and small businesses, focusing on traditional savings accounts. Japan Post Insurance holds a substantial share in the life insurance market, offering a range of policies to a diverse demographic. The company is actively pursuing digital transformation initiatives to enhance its offerings and improve customer experience.

Japan Post Holdings boasts an expansive network of approximately 24,000 post offices nationwide, as of fiscal year 2023. This extensive reach allows the company to maintain a significant market share in postal services, banking, and insurance. The company's widespread presence is a key factor in its competitive advantage.

For the fiscal year ended March 31, 2024, Japan Post Holdings reported operating revenues of approximately 9.9 trillion yen. This demonstrates the company's substantial scale in the Japanese market. The company's financial performance underscores its strong position within the financial services industry.

Japan Post Bank caters to a broad customer base, including individuals and small businesses, with a focus on traditional savings accounts. Japan Post Insurance offers a range of policies to a diverse demographic. The company's services are designed to meet the needs of a wide range of customers.

Japan Post Holdings is actively pursuing digital transformation initiatives to enhance its offerings and improve customer experience. This includes efforts to modernize services and adapt to evolving consumer preferences. These initiatives are crucial for maintaining competitiveness in the modern market.

Japan Post Holdings benefits from a robust physical network and established customer relationships, particularly in serving the elderly and those in less urbanized areas. Its strong brand recognition and trust within the Japanese market provide a significant competitive edge. The company's focus on accessibility and traditional financial products also contributes to its market position.

- Extensive network of post offices across Japan.

- Strong brand recognition and customer trust.

- Focus on traditional savings accounts and insurance products.

- Commitment to digital transformation to enhance customer experience.

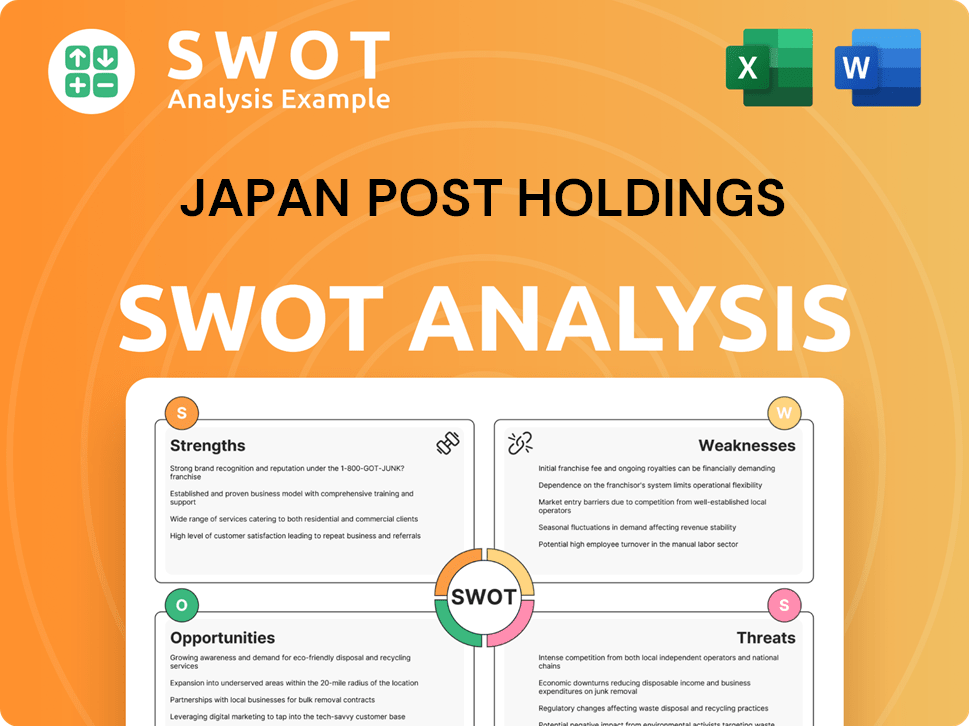

Japan Post Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Japan Post Holdings?

The competitive landscape for Japan Post Holdings is complex, encompassing various sectors such as postal services, banking, and insurance. Understanding its key rivals is crucial for assessing its market position and strategic challenges. The company faces both direct and indirect competition, each with its own strengths and strategies. A thorough analysis of these competitors provides insights into the dynamics shaping Japan Post's future.

In the postal and logistics sector, Japan Post Holdings competes with major players like Yamato Holdings and Sagawa Express. These companies offer similar services, often vying for market share in the rapidly growing e-commerce delivery space. In the financial services sector, Japan Post Bank competes with major commercial banks and emerging fintech companies. For its insurance arm, Japan Post Insurance faces competition from established private insurers and innovative insurtech startups.

The competitive environment is constantly evolving due to mergers, acquisitions, and technological advancements. This necessitates that Japan Post Holdings adapts its strategies to maintain its market position and address emerging challenges. The company's ability to innovate, improve efficiency, and respond to market changes will be key to its success in the coming years. For a deeper dive into the company's ownership structure, consider exploring Owners & Shareholders of Japan Post Holdings.

Yamato Holdings, known for 'Takkyubin,' is a significant competitor in parcel delivery. Sagawa Express focuses on corporate clients, competing vigorously in the B2B market. These companies compete on speed, specialized services, and pricing, particularly in the expanding e-commerce sector.

Major commercial banks such as MUFG, SMFG, and Mizuho Financial Group offer comprehensive financial services. Regional banks and credit unions compete in their local markets with personalized services. Fintech companies disrupt the traditional banking model with digital payment solutions.

Nippon Life Insurance, Dai-ichi Life Holdings, and Meiji Yasuda Life Insurance are key competitors in the insurance market. These established insurers offer a wide range of products and compete through extensive sales networks. Insurtech startups are emerging with digital insurance products.

Competitors focus on speed, efficiency, and specialized services in postal and logistics. In banking, they emphasize product diversity and technological innovation. Insurance companies compete on product offerings, sales networks, and marketing.

The growth of e-commerce has intensified competition in the postal and logistics sectors. Companies are investing in faster delivery options and advanced logistics. This trend is reshaping the competitive dynamics, requiring agility and innovation.

Fintech and insurtech companies are driving technological disruption in financial services. These companies offer innovative digital solutions, challenging traditional business models. Japan Post Holdings must adapt to stay competitive.

Several factors influence the competitive landscape of Japan Post Holdings. These include service quality, pricing strategies, technological adoption, and the ability to adapt to changing customer needs. The company's success depends on its ability to effectively manage these factors.

- Service Quality: Delivering reliable and efficient services is crucial for customer satisfaction and retention.

- Pricing: Competitive pricing strategies are essential for attracting and retaining customers in all sectors.

- Technology: Embracing technological advancements is vital for improving efficiency and offering innovative services.

- Adaptability: The ability to adapt to changing market conditions and customer preferences is critical for long-term success.

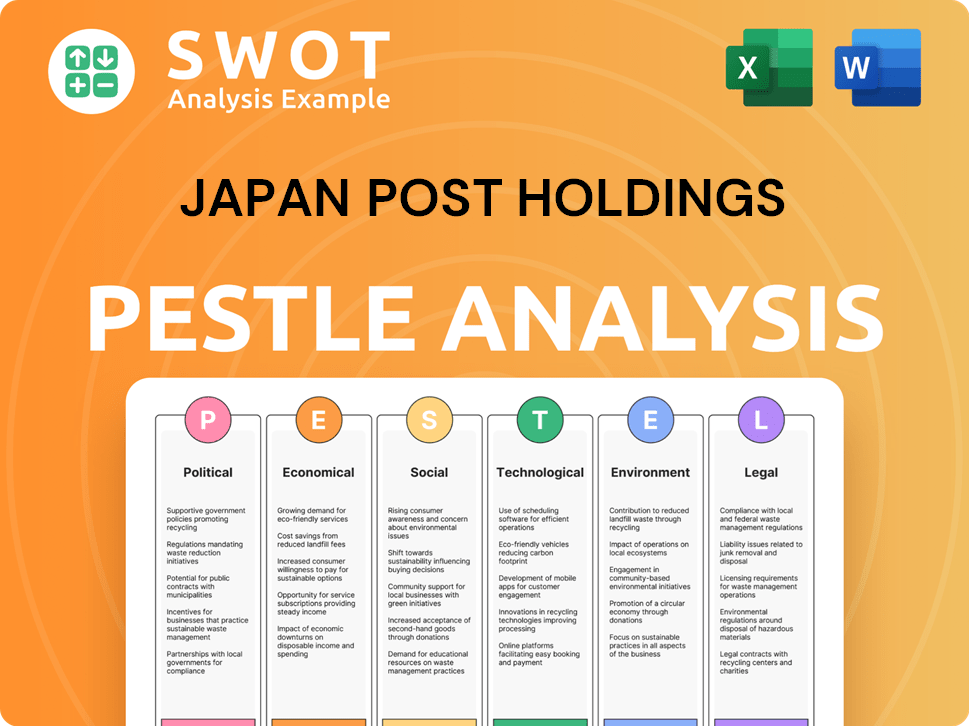

Japan Post Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Japan Post Holdings a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Japan Post Holdings requires a deep dive into its inherent strengths. The company, a significant player in the Japanese market, holds a unique position due to its historical roots and expansive infrastructure. This overview examines the key advantages that set Japan Post apart from its rivals, focusing on its extensive network, brand equity, and economies of scale.

Japan Post's competitive edge stems from a blend of traditional strengths and modern adaptations. The company has successfully navigated the transition from a public entity to a privatized corporation while maintaining its relevance in a rapidly changing market. This analysis will explore how Japan Post leverages its vast resources and customer trust to compete effectively in the postal service and financial services sectors. For more insights, you can explore the Target Market of Japan Post Holdings.

The competitive landscape is shaped by factors such as technological advancements and evolving consumer behaviors. Japan Post Holdings faces the challenge of adapting to these changes while leveraging its core strengths. By examining its advantages, we can better understand its strategic positioning and future prospects in the Japanese market.

Japan Post's extensive network is a cornerstone of its competitive advantage. As of fiscal year 2023, the company operated approximately 24,000 post offices across Japan. This vast infrastructure provides unparalleled accessibility for postal services, banking transactions, and insurance sales. This widespread presence allows Japan Post to reach customers in both urban and rural areas, a reach unmatched by its competitors.

The company's long history in Japan has cultivated strong brand recognition and customer loyalty. Japan Post has been an integral part of Japanese life for over 150 years, fostering high levels of trust. This trust is especially strong among older generations and those in less urbanized regions. The perceived stability and government-backed history further reinforce customer loyalty.

Japan Post benefits from economies of scale across its diverse business lines, including postal services, banking, and insurance. This allows for cost efficiencies and cross-selling opportunities that smaller competitors cannot easily replicate. The ability to offer multiple services under one roof creates a convenient 'one-stop shop' for many Japanese citizens. This integrated approach enhances customer convenience and operational efficiency.

The sheer volume of transactions and customer interactions handled daily provides valuable data and insights. This data informs future service development and strategic decision-making. Legacy systems may present challenges, but the vast amount of data collected offers a significant advantage in understanding customer needs and market trends. This data-driven approach supports innovation and service improvement.

Japan Post Holdings' competitive advantages are rooted in its extensive network, brand equity, economies of scale, and data-driven insights. The company's vast physical presence and long-standing reputation foster strong customer loyalty. These factors enable Japan Post to maintain a strong position in the Japanese market, despite the challenges of evolving consumer behaviors and technological advancements.

- Extensive Physical Network: Approximately 24,000 post offices nationwide.

- Strong Brand Recognition: Over 150 years of operation in Japan.

- Economies of Scale: Benefits from diverse business lines.

- Data-Driven Insights: Valuable data from high transaction volumes.

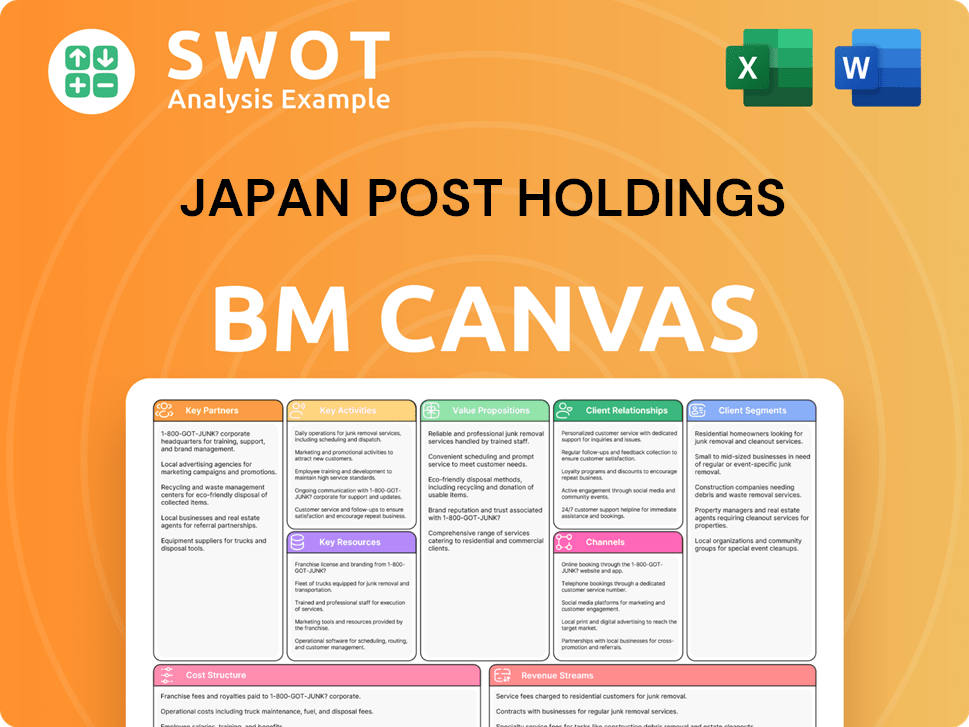

Japan Post Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Japan Post Holdings’s Competitive Landscape?

The competitive landscape for Japan Post Holdings is shaped by digital transformation, regulatory shifts, and global economic conditions. The company faces challenges in its traditional postal and financial sectors due to evolving consumer preferences and technological advancements. However, these changes also present opportunities for growth through e-commerce logistics, digital financial services, and tailored insurance products. Understanding the dynamic forces at play is crucial for assessing the future of Japan Post Holdings.

Japan Post Holdings' strategic positioning is influenced by its ability to adapt to industry trends, capitalize on opportunities, and mitigate risks. The company's performance is closely tied to its ability to innovate and respond to changes in the market. This includes managing the decline in traditional mail volumes, navigating the rise of fintech, and addressing demographic shifts, all of which require strategic agility and forward-thinking initiatives.

Digital transformation is reshaping postal services, financial services, and insurance. E-commerce is driving the need for advanced logistics solutions. Fintech and insurtech are altering traditional business models. Regulatory changes and demographic shifts also significantly influence the competitive environment.

Declining mail volumes and competition from digital communication pose challenges. The rise of fintech and insurtech threatens traditional models. Adapting to regulatory changes and global economic shifts requires strategic adjustments. Cyberattacks and the need to update legacy systems are significant operational risks.

Expanding logistics services for e-commerce growth is a key opportunity. Developing new financial products tailored to an aging society can boost revenue. Leveraging the trusted brand for new digital services can attract customers. Strategic partnerships can enhance market position and service offerings.

Focusing on digital transformation to improve efficiency and customer experience. Optimizing the physical network to reduce costs and enhance service delivery. Exploring strategic partnerships to gain access to new technologies and markets. Investing in data analytics for personalized services.

To thrive, Japan Post Holdings must prioritize digital transformation across all business segments. This involves investing in technology to modernize operations and enhance customer experiences. Strategic partnerships and acquisitions can provide access to new markets and technologies, improving competitiveness.

- Digital Transformation: Implementing advanced technologies in postal services, banking, and insurance.

- Network Optimization: Streamlining physical infrastructure to reduce costs and improve efficiency.

- Strategic Partnerships: Collaborating with fintech companies and logistics providers.

- Product Innovation: Developing new financial products and insurance policies tailored to changing demographics.

The Marketing Strategy of Japan Post Holdings must adapt to current market dynamics. The postal service sector, for example, faces declining mail volumes, with a drop of approximately 5% annually in recent years. In the financial sector, the rise of fintech has led to increased competition, with digital banking users growing by about 15% annually. Furthermore, the aging population in Japan presents both challenges and opportunities. While there is a decrease in the workforce, there is also an increased demand for specialized financial and healthcare services.

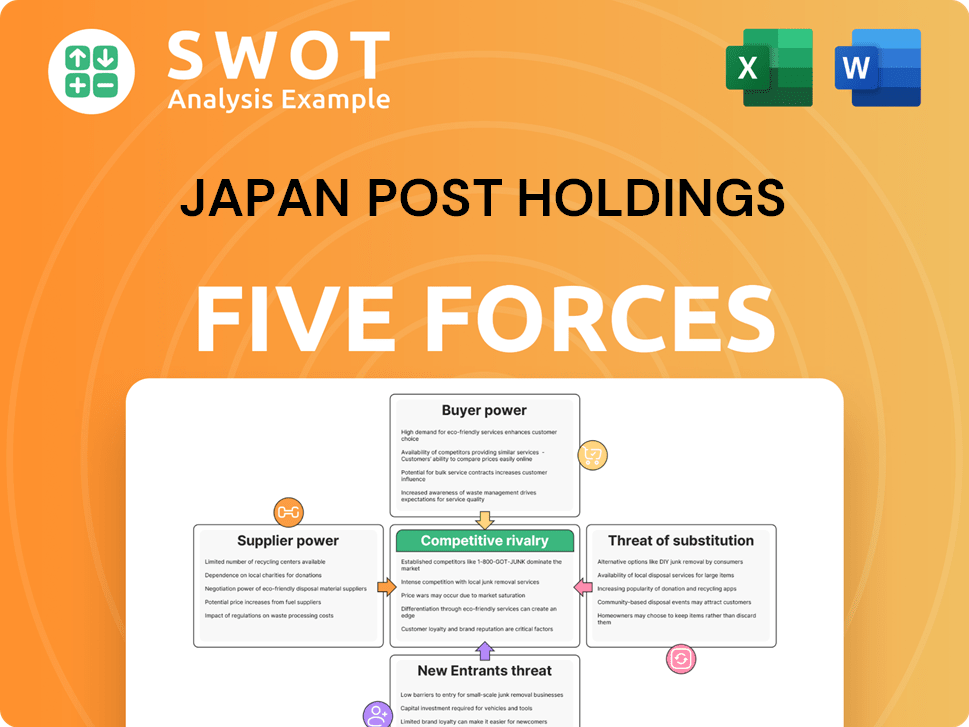

Japan Post Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Japan Post Holdings Company?

- What is Growth Strategy and Future Prospects of Japan Post Holdings Company?

- How Does Japan Post Holdings Company Work?

- What is Sales and Marketing Strategy of Japan Post Holdings Company?

- What is Brief History of Japan Post Holdings Company?

- Who Owns Japan Post Holdings Company?

- What is Customer Demographics and Target Market of Japan Post Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.