Japan Post Holdings Bundle

Who are Japan Post Holdings' Key Customers in a Changing Japan?

Japan Post Holdings, a cornerstone of Japan's infrastructure, faces a critical need to understand its customer base. The nation's demographic shifts, with an aging population and declining birth rates, directly impact the demand for its services, including postal, banking, and insurance products. This requires a deep dive into the evolving needs of its customers to remain competitive.

This exploration delves into the Japan Post Holdings SWOT Analysis, examining the company's customer demographics and target market. Understanding the Japan Post customer profile, including their age range, income levels, and location data, is vital for effective market analysis. We'll analyze Japan Post's target audience for both financial services and logistics, examining customer segmentation and preferences to uncover how Japan Post adapts to meet the needs of its evolving customer base and maintain market share.

Who Are Japan Post Holdings’s Main Customers?

Understanding the customer demographics of Japan Post Holdings is crucial for grasping its market position. The company, through its various subsidiaries, serves a broad spectrum of customers. This includes both individual consumers (B2C) and, to a lesser extent, businesses (B2B).

For postal services, the Japan Post customer profile encompasses individuals and businesses across all age groups and income levels due to the universal nature of mail delivery. However, the financial services arms, Japan Post Bank and Japan Post Insurance, focus on more specific segments of the Japan Post target audience.

This Japan Post market analysis reveals that the company's customer base is significantly shaped by Japan's demographic trends, particularly its aging population. The company's services are essential for many, especially in rural areas.

The postal service primarily caters to a diverse group, including individuals and businesses. This segment includes all age groups and income levels due to the universal need for mail delivery. The service remains essential for various communication and logistical needs across the country.

Japan Post Bank primarily serves individual customers. These customers are seeking savings accounts, payment services, and other simple financial products. A significant portion of its customer base consists of older individuals who rely on the bank for pension disbursements and traditional savings.

Japan Post Insurance predominantly serves individual consumers. These consumers are offered a range of life and medical insurance policies. This segment includes young families, working professionals planning for retirement, and older individuals seeking long-term care solutions.

The company's extensive network of post offices, often the only financial institution in rural areas, makes it a critical service provider for elderly populations and those in remote regions. This widespread presence ensures accessibility across various Japan Post customer location data.

The aging population in Japan significantly influences the Japan Post customer age range and revenue streams. Older individuals likely represent a significant share of revenue for both banking and insurance services due to their accumulated wealth and greater need for financial planning and healthcare coverage. The company is also focused on attracting younger demographics.

- Older individuals are a significant portion of the customer base, especially for financial services.

- Digital offerings are being introduced to attract younger, digitally-savvy customers.

- The company is adapting to changing demographics and consumer preferences.

- The vast network of post offices plays a vital role in serving rural and elderly populations.

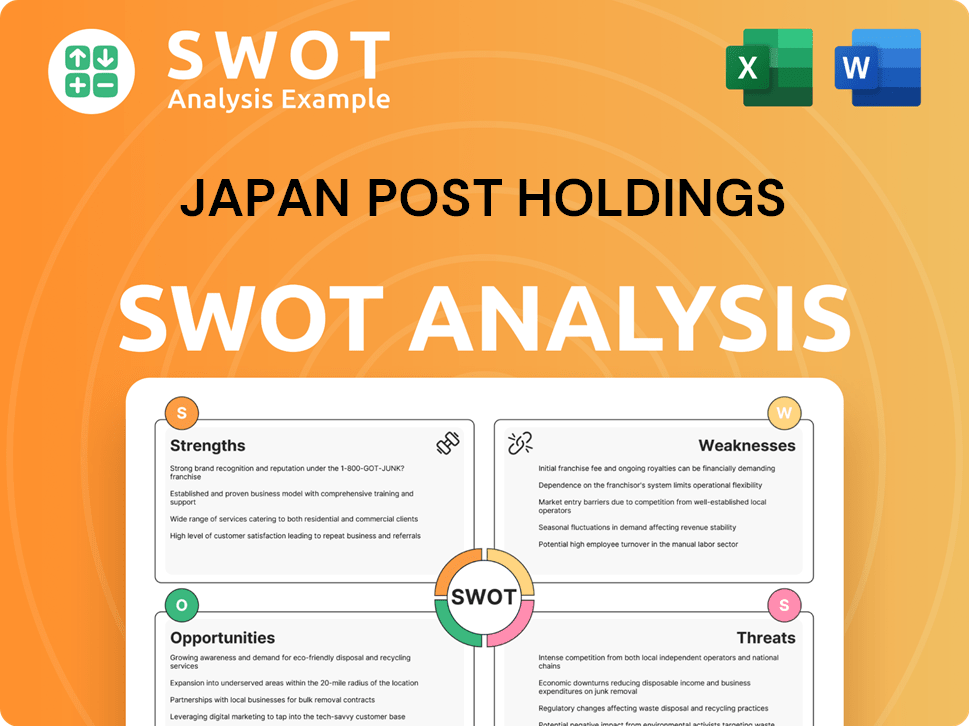

Japan Post Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Japan Post Holdings’s Customers Want?

Understanding the customer needs and preferences is crucial for Japan Post Holdings. Their diverse customer base drives the company's service offerings across postal, banking, and insurance sectors. The Japan Post customer profile is varied, reflecting the wide range of services they provide.

For postal services, customers value reliability and speed. In the financial sector, particularly with Japan Post Bank, customers often prioritize security and convenience. The company caters to a broad Japan Post target audience, ensuring services meet varied needs.

Customer preferences significantly influence Japan Post Holdings' strategies. The company continually adapts to evolving demands, as highlighted in a recent analysis of the Revenue Streams & Business Model of Japan Post Holdings. This adaptability is key to maintaining its market position.

Customers of postal services prioritize reliability, speed, and accessibility. They depend on the vast network of post offices for convenient access. The nationwide presence of post offices is a key factor.

Japan Post Bank customers often seek security, convenience, and low-risk savings options. Face-to-face interactions are valued by many, especially older customers. They often prefer a conservative approach to finances.

Customers of Japan Post Insurance are driven by the need for financial security and peace of mind. They seek protection against life events like illness or death. Increasingly, they are looking for long-term care options.

Loyalty is influenced by the extensive physical presence of post offices. Trust in the long-established national institution is also significant. Accessibility, especially in rural areas, is a key factor.

Japan Post Holdings addresses pain points by offering simplified financial products. They provide extensive in-person support to assist customers. They are working to improve digital convenience.

Customer feedback influences product development, leading to online services. More flexible insurance offerings are being introduced to cater to evolving preferences. Digital banking platforms are being enhanced.

The Japan Post customer demographics include a mix of age groups and income levels. The target market for financial services includes both older and younger demographics. Understanding these segments allows for tailored services.

- Older customers value traditional banking services and in-person support.

- Younger customers are increasingly seeking digital banking solutions and flexible insurance options.

- Rural customers depend on the accessibility of post offices for various services.

- Businesses use postal services for logistics and financial transactions.

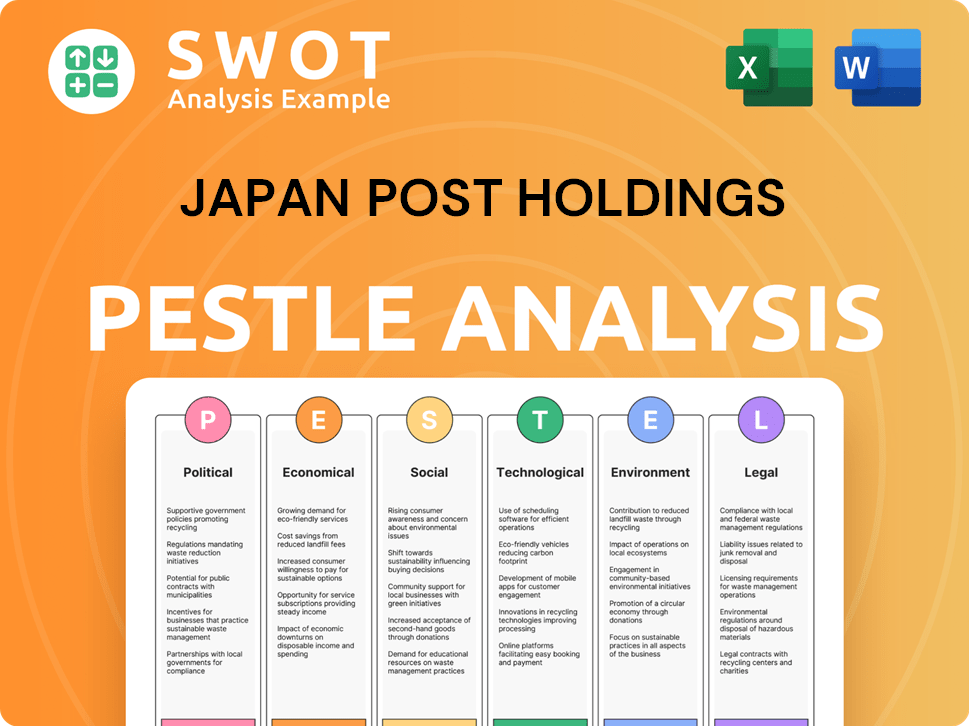

Japan Post Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Japan Post Holdings operate?

The geographical market presence of Japan Post Holdings is overwhelmingly concentrated within Japan, leveraging its extensive network of post offices to serve its diverse customer base. Its primary market is entirely domestic, covering every prefecture, city, town, and village across the Japanese archipelago. This widespread presence is a critical factor in its dominant position in postal services and other financial services.

The company's extensive network provides widespread brand recognition and accessibility across the nation. This strong geographical footprint is a key element of its customer acquisition strategies, allowing it to reach a broad spectrum of the population. The company's ability to serve both urban and rural areas underscores its commitment to universal service and its deep understanding of the Japan Post customer profile.

While specific market share data for 2024-2025 is not readily available, its established nationwide network ensures that it remains a central part of the lives of many Japanese citizens. The company continuously evaluates the geographic distribution of its sales and growth to optimize resource allocation and service provision, adapting to regional demographic shifts and economic conditions. This focus on local needs helps Japan Post Holdings maintain its strong position in the market. For more insights into the competitive environment, consider exploring the Competitors Landscape of Japan Post Holdings.

Customer demographics and preferences vary significantly between urban and rural areas. Urban centers, like Tokyo and Osaka, tend to have a higher concentration of younger, digitally-savvy customers. These customers often prefer online banking and mobile applications, influencing Japan Post's digital service offerings.

Rural areas, characterized by an older population, rely heavily on physical post office branches. These branches provide a wider range of services, including traditional mail, banking transactions, and insurance consultations. This highlights the importance of understanding Japan Post customer preferences in different regions.

The company localizes its offerings by ensuring that post office staff are equipped to handle the specific needs of local communities. In aging rural areas, there is a greater emphasis on services for the elderly, such as pension consultations and home delivery of certain services. This approach is key to understanding Japan Post's target market for financial services.

Japan Post Holdings continuously evaluates the geographic distribution of its sales and growth to optimize resource allocation and service provision. This includes adapting to regional demographic shifts and economic conditions. This strategic approach helps maintain its relevance and market share.

Given Japan's aging population, services tailored to the elderly are increasingly important. These include pension consultations and home delivery options. This focus is part of Japan Post's broader strategy to meet the evolving needs of its customer base. This is a key aspect of Japan Post's customer segmentation.

Due to its established nationwide network, there have been no significant recent expansions or strategic withdrawals in terms of geographical presence within Japan. The company's focus remains on optimizing its existing network to meet the diverse needs of its customer base. This highlights the importance of its customer location data.

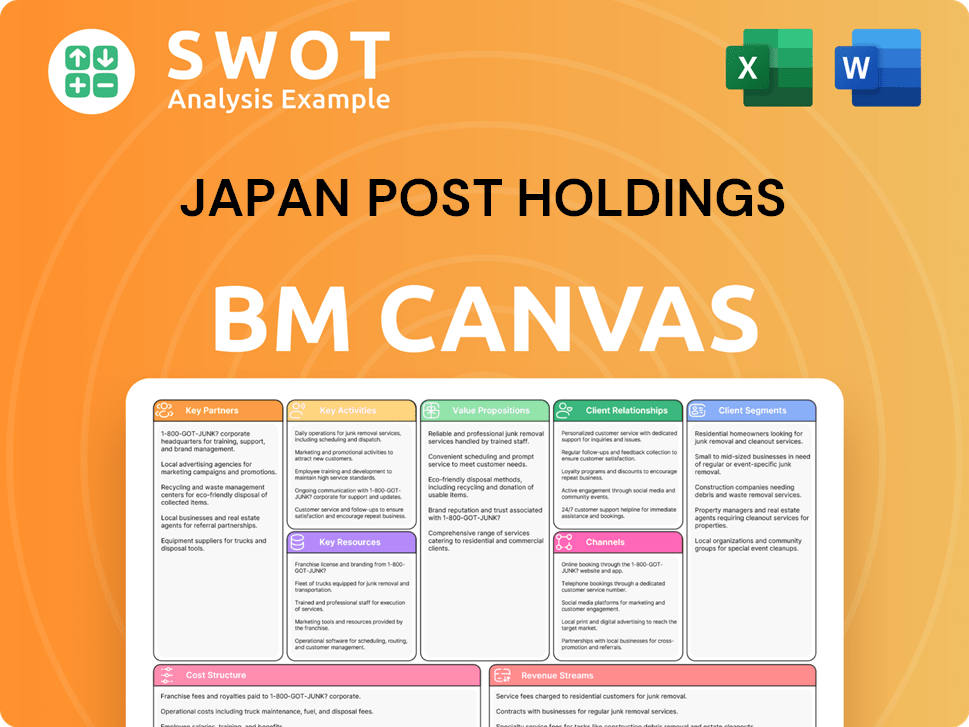

Japan Post Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Japan Post Holdings Win & Keep Customers?

Customer acquisition and retention strategies are critical for the success of Japan Post Holdings. The company leverages its extensive network of over 24,000 post offices across Japan as a primary channel for reaching customers, especially those in older demographics and rural areas. This physical infrastructure is complemented by a growing emphasis on digital channels to attract younger customers to its banking and insurance services. Marketing efforts utilize a mix of traditional and digital media, focusing on trust, reliability, and convenience to build and maintain customer relationships.

For customer acquisition, Japan Post employs a multi-faceted approach. They use traditional media such as television advertisements and direct mail to reach a broad audience. Digital marketing and social media are increasingly utilized to target younger demographics. Personalized consultations at post office branches help explain financial products and insurance policies, which is a key sales tactic. These strategies are designed to highlight the company's long-standing reputation and the accessibility of its services.

Retention strategies center on customer loyalty programs and personalized experiences. The company focuses on providing competitive interest rates, convenient payment services, and reliable customer support for banking customers. For insurance, they emphasize transparent policy terms, efficient claims processing, and ongoing customer service. Customer data is used to some extent for segmentation, allowing for targeted promotional campaigns. The aim is to enhance customer lifetime value and reduce churn rates, especially as younger generations increasingly prefer digital interactions. The company's digital transformation efforts aim to improve customer experience.

Japan Post utilizes a wide range of channels to acquire customers. Traditional media like television and direct mail are still used. Digital marketing and social media are growing in importance, especially for attracting younger customers. The extensive network of post offices serves as a key sales and marketing channel, particularly for older demographics.

Retention strategies are focused on customer loyalty and personalized experiences. Banking customers benefit from competitive interest rates and convenient services. Insurance customers receive transparent policies and efficient claims processing. Customer data is used to segment and target promotional campaigns, enhancing customer lifetime value.

Digital transformation is a key focus for improving customer experience. This includes enhancing digital platforms to provide better services and attract new demographics. The goal is to enhance customer lifetime value and reduce churn rates. Digital initiatives are crucial to meet the preferences of younger generations.

Customer segmentation is used to tailor marketing efforts. The company uses customer data to create targeted campaigns. This allows for more effective promotion of specific financial products and insurance offerings. Segmentation helps in personalizing the customer experience and improving engagement.

Japan Post's customer acquisition strategies are designed to reach a wide audience, including the historical context of Japan Post Holdings. They use a combination of traditional and digital channels to attract new customers. Retention efforts focus on building long-term relationships through excellent service and tailored offerings. The company continues to adapt its strategies to meet the evolving needs of its customer base, with a significant emphasis on digital transformation to enhance customer experience and engagement. The goal is to maintain and grow its customer base, especially among younger demographics. The company is focused on providing clear, understandable information about its financial products and services, which is particularly valued by its aging customer base.

Primary acquisition methods include post office branches, traditional media, and digital marketing. Post offices serve as a primary sales channel, especially for older customers. Digital marketing targets younger demographics with online services. Personalized consultations at post offices help explain products.

Retention strategies include customer loyalty programs, competitive interest rates, and efficient service. For banking customers, competitive rates and convenient services are crucial. Insurance retention relies on transparent policies and efficient claims processing. The focus is on providing excellent customer service.

Digital transformation is a key focus to improve customer experience and attract new demographics. This includes enhancing online account opening and mobile applications. The goal is to enhance customer lifetime value and reduce churn. Digital efforts are particularly important for younger customers.

Customer segmentation allows for more targeted marketing campaigns. The company uses customer data to segment its audience. This allows for more effective promotion of specific financial products and insurance offerings. Segmentation helps personalize the customer experience.

Providing clear and understandable information is a priority, especially for older customers. This includes simplifying complex financial products. Efficient claims processing and reliable support are key for insurance retention. The aim is to build trust and long-term relationships.

The company continuously adapts its strategies to meet evolving customer needs. This includes efforts to simplify financial products. Innovation includes a greater emphasis on digital transformation. The focus is on enhancing customer lifetime value.

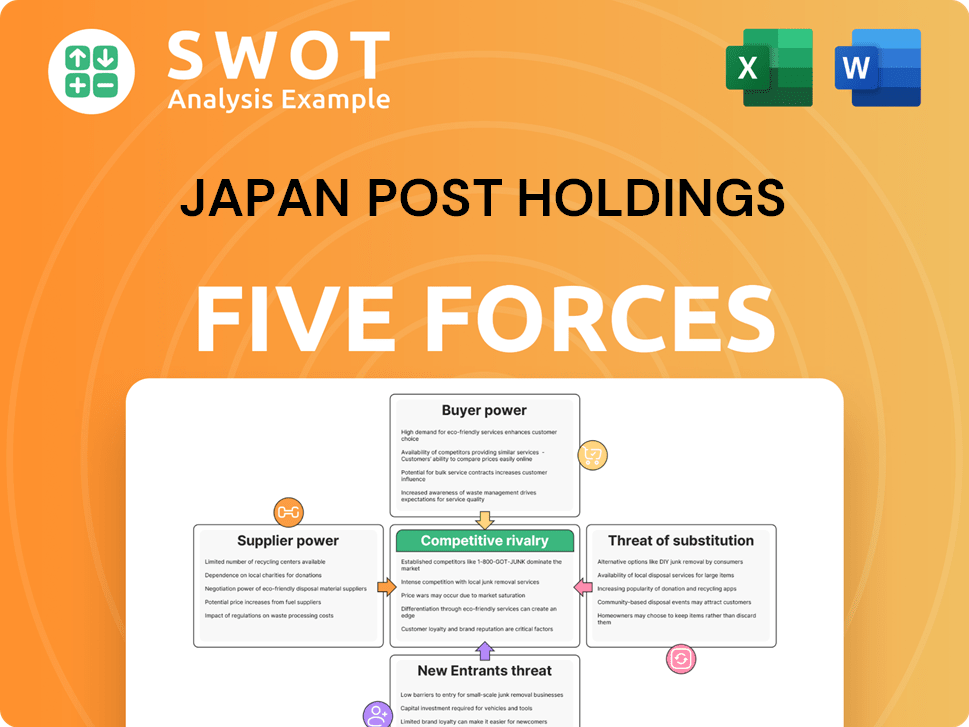

Japan Post Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Japan Post Holdings Company?

- What is Competitive Landscape of Japan Post Holdings Company?

- What is Growth Strategy and Future Prospects of Japan Post Holdings Company?

- How Does Japan Post Holdings Company Work?

- What is Sales and Marketing Strategy of Japan Post Holdings Company?

- What is Brief History of Japan Post Holdings Company?

- Who Owns Japan Post Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.