Japan Post Holdings Bundle

How is Japan Post Holdings Transforming Its Sales and Marketing?

Japan Post Holdings, a giant in postal, banking, and insurance services, is navigating a dynamic market landscape. The company's 'JP Vision 2025' plan, highlighted by the 'post office app' launched in October 2023, showcases a commitment to digital transformation. This strategic shift towards a 'Co-creation Platform' aims to enhance customer and community engagement through integrated digital and physical services.

From its roots as a state-owned entity to its current status as a publicly traded conglomerate, Japan Post Holdings' Japan Post Holdings SWOT Analysis reveals a fascinating evolution. The company's sales and marketing strategy is crucial for its continued success. This analysis will explore how Japan Post Group adapts its business model and marketing plan to thrive in the competitive Japanese market, examining its postal services and digital marketing strategy.

How Does Japan Post Holdings Reach Its Customers?

The sales and marketing strategy of Japan Post Holdings centers on a multi-channel approach, with a strong emphasis on its extensive network of post offices. These physical locations serve as the primary touchpoints for a variety of services, including postal, banking, and insurance offerings. This strategy is crucial for the company's operations within the Japanese market strategy, ensuring accessibility and convenience for its customer base.

Japan Post Holdings' business model also involves a significant push towards digital transformation and strategic partnerships to enhance its sales channels. The company is actively integrating digital solutions and collaborating with various entities to expand its reach and improve service delivery. This approach is essential for adapting to evolving customer preferences and maintaining a competitive edge in the market.

The company's 'JP Vision 2025' plan highlights its commitment to digital transformation, with initiatives such as the 'post office app' launched in October 2023. This app aims to enhance customer convenience and streamline operations. Japan Post Holdings' marketing plan is also influenced by its strategic partnerships, which contribute to growth by expanding reach and offering integrated services.

The core of Japan Post Holdings' sales strategy relies on its vast network of post offices. These offices are multi-functional hubs providing postal, banking, and insurance services. As of March 2024, approximately 20,000 directly managed post offices adopted cashless payments, indicating a shift towards modernizing in-person transactions.

Digital adoption is a key focus, with the 'JP Vision 2025' plan driving digital transformation. The 'post office app', launched in October 2023, is designed to improve customer convenience. Japan Post Bank is expanding its digital services to strengthen its functions within local communities.

Partnerships are essential for expanding reach and service offerings. A collaboration with the Yamato Group led to services like Kuroneko Yu-Packet and Kuroneko Yu-Mail, although there are challenges. In February 2024, an agreement with JR East was made to strengthen collaborations, focusing on community hubs and sustainable logistics.

Japan Post Holdings is working on omnichannel integration to provide seamless customer experiences. This involves connecting physical post offices with digital platforms, ensuring that customers can access services through various channels. This approach aims to enhance customer relationship management and improve overall sales performance.

Japan Post Holdings' sales channels are evolving through digitalization and strategic alliances. The company's approach involves leveraging its extensive physical network while embracing digital solutions to enhance customer experience and operational efficiency. The company's efforts are also influenced by the competitive landscape, as highlighted in the Competitors Landscape of Japan Post Holdings.

- Post Office Network: The primary sales channel, offering postal, banking, and insurance services.

- Digital Transformation: Initiatives like the 'post office app' to improve customer convenience and streamline operations.

- Strategic Partnerships: Collaborations with companies like JR East to expand reach and service integration.

- Cashless Payments: Adoption of cashless payments in approximately 20,000 post offices.

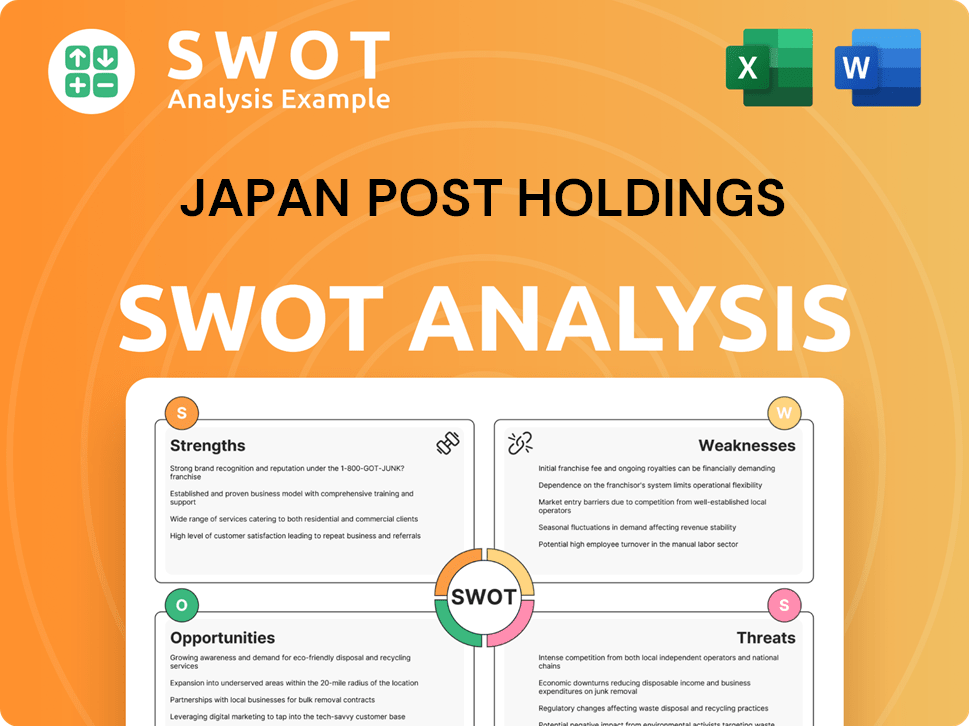

Japan Post Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Japan Post Holdings Use?

The marketing tactics of Japan Post Holdings are multifaceted, leveraging both traditional and digital channels to promote its postal, banking, and insurance services. The company is actively transforming its approach, as highlighted in its 'JP Vision 2025' plan, with a strong emphasis on digital initiatives. This strategy aims to enhance customer experience and streamline operations across its diverse business segments.

A key element of Japan Post Holdings' marketing strategy involves a data-driven approach. The company meticulously gathers and analyzes customer feedback to refine its products and services. This focus on customer-centricity is supported by structural changes, such as the establishment of the CX Promotion Liaison Committee and the CX Design Department, which are designed to implement improvements based on customer insights.

While specific details on advertising campaigns and digital marketing strategies are not extensively publicized, the company's continuous efforts to improve customer convenience through digital means suggest a strong focus on online engagement. The expansion of cashless payments and the streamlining of paperless procedures further indicate an adaptation to modern consumer preferences.

The launch of the 'post office app' in October 2023 is a key part of the digital transformation. This app serves as a group platform for various digital initiatives. The focus is on improving customer service through digital contact points and data infrastructure development.

Japan Post Group uses customer feedback, including complaints and surveys, to improve products and services. In April 2024, the CX Promotion Liaison Committee and the CX Design Department were established to implement cross-sectional improvements. This involves customer segmentation and personalization to provide tailored services.

The expansion of cashless payments to all directly managed post offices nationwide is a move towards modern consumer preferences. Japan Post Insurance expanded paperless procedures as of March 2024, streamlining customer interactions. These initiatives aim to enhance customer convenience and engagement.

The company focuses on enhancing and strengthening its core businesses, including universal services. Collaborations with external companies and local governments are also emphasized, likely involving targeted marketing efforts. This approach supports the overall Japan Post Holdings strategy.

Japan Post Holdings' sales and marketing Japan Post strategy is multifaceted, integrating traditional and digital approaches. The company's postal services Japan utilizes its extensive network, while also investing in digital solutions to improve customer experience and operational efficiency. The focus on data-driven insights and customer-centricity is central to its approach.

- Digital Initiatives: Launch of the 'post office app' and other digital transformation projects.

- Data Analysis: Utilizing customer feedback and surveys to improve products and services.

- Customer-Centric Approach: Establishment of the CX Promotion Liaison Committee and CX Design Department.

- Convenience: Expanding cashless payments and paperless procedures.

- Collaboration: Strengthening core businesses and expanding partnerships.

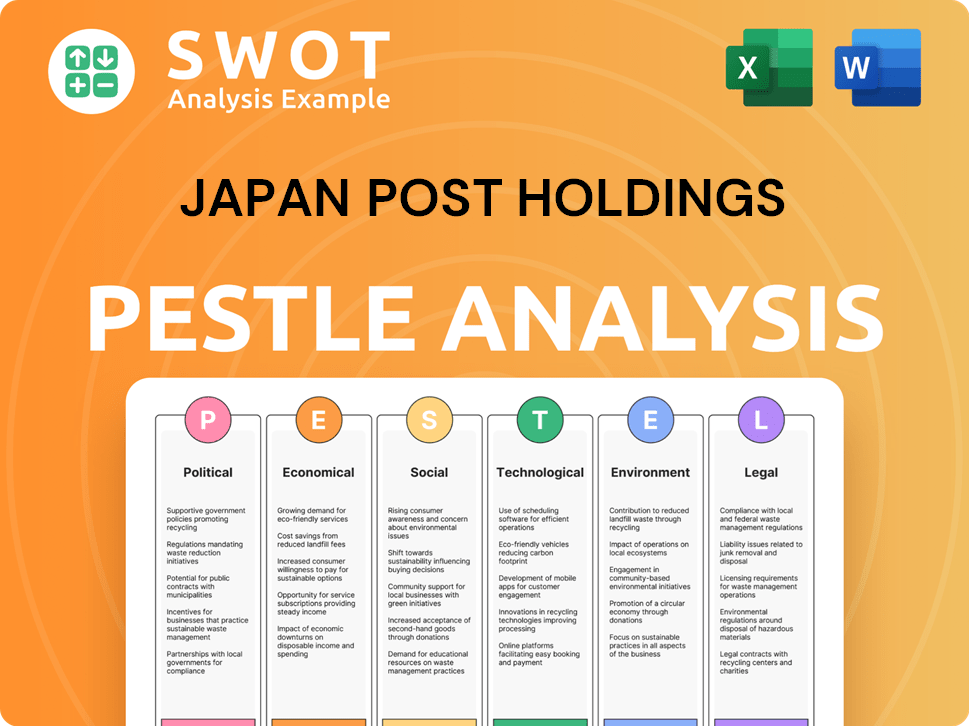

Japan Post Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Japan Post Holdings Positioned in the Market?

Japan Post Holdings positions its brand around security, confidence, and its extensive network. The company aims to be a trusted presence that supports the lives of customers in local communities. This strategy emphasizes its public nature and commitment to universal service in postal, savings, and life insurance.

The core message focuses on reliability and accessibility. This approach differentiates it from competitors by leveraging its deep integration into Japanese society and infrastructure. The brand's visual identity and tone of voice consistently reflect this established trust and community focus, aiming to maintain a strong presence in the Japanese market.

The company's customer experience promises convenience and reliability. For example, the expansion of cashless payments to approximately 20,000 directly managed post offices by March 2024 illustrates this commitment. Furthermore, initiatives like the introduction of cardless ATM transactions through the Yucho Bankbook App enhance customer convenience.

Japan Post Holdings focuses on being a reliable and accessible service provider. This is achieved through its extensive network and commitment to universal service. The brand's messaging consistently reinforces this trust and community focus.

The company emphasizes customer convenience and reliability through various initiatives. This includes expanding cashless payment options and streamlining processes. These efforts aim to improve the overall customer experience.

Ongoing digital transformation (DX) efforts are a key part of the strategy. The launch of the 'post office app' in October 2023 is a prime example. These initiatives aim to integrate services and improve customer experience.

Japan Post Holdings integrates sustainability-oriented management into its brand positioning. This is recognized through its inclusion in ESG indices like the FTSE Blossom Japan Index in March 2025. The company promotes well-being and contributes to safe communities.

The Japan Post Holdings strategy focuses on reinforcing its brand as a trusted entity. The company's sales and marketing Japan Post efforts are centered on convenience and reliability.

- Leveraging its extensive network to provide universal services.

- Expanding digital services to enhance customer experience.

- Integrating sustainability into its business practices.

- Actively using customer feedback to improve services.

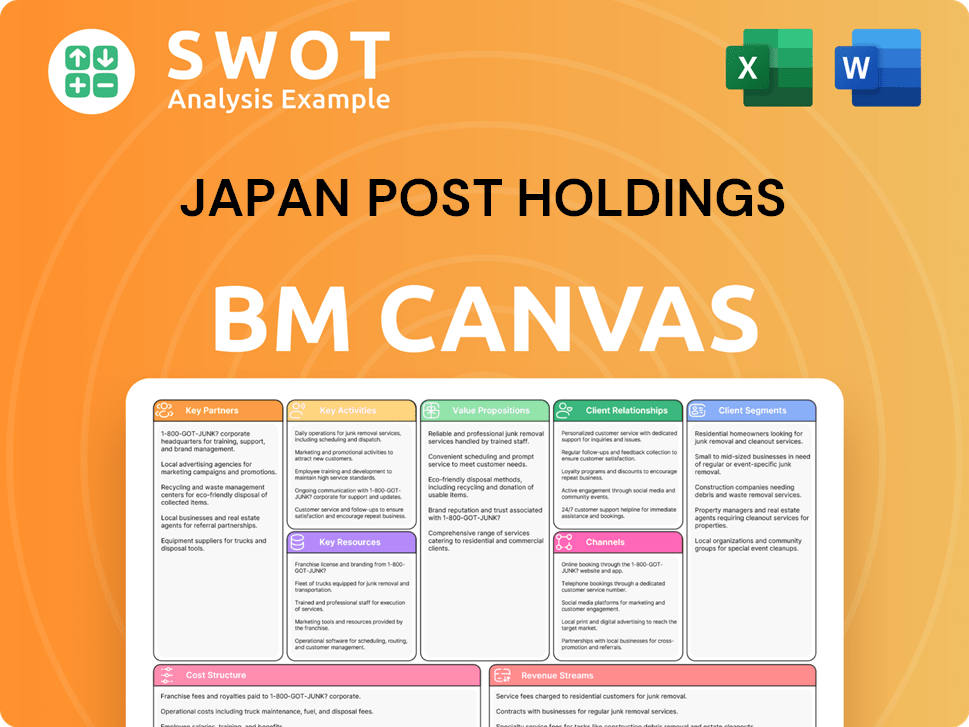

Japan Post Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Japan Post Holdings’s Most Notable Campaigns?

The sales and marketing strategy of Japan Post Holdings centers around several key initiatives designed to enhance customer engagement and drive business growth. The company's approach includes product launches, digital transformation, and strategic collaborations. These efforts aim to strengthen its position in the Japanese market and adapt to evolving customer needs.

A significant aspect of the Japan Post Holdings strategy involves leveraging digital platforms to improve customer convenience and expand service offerings. The 'JP Vision 2025' plan and the launch of the 'post office app' exemplify this commitment. Furthermore, the company focuses on tailored product offerings and partnerships to meet specific market demands, such as those of the middle-aged and elderly demographic.

The overall marketing plan for Japan Post Holdings is multifaceted, encompassing internal digital advancements and external partnerships. The company is focused on adapting to the changing needs of the Japanese market. This strategy is designed to ensure sustained growth and relevance in the postal and financial services sectors.

In October 2023, the company launched the 'post office app' as part of its digital transformation efforts. This app aims to unify various digital services and improve customer convenience. Success will be measured by app adoption rates and increased digital service usage.

Japan Post Insurance introduced a lump-sum payment whole life insurance policy in January 2024. This product targets the needs of middle-aged and elderly customers seeking lifetime death benefits. Sales figures and customer acquisition within this segment will indicate success.

In May 2024, Japan Post Bank introduced a commission-free service for first-time mutual fund buyers. The aim is to attract new investors to its financial products. The success of this initiative will be gauged by subscriptions and customer acquisition.

A partnership with JR East was established in February 2024 to strengthen collaborations. The collaboration focuses on using post offices and stations as community hubs. The success of this collaboration will be measured by community engagement and the sustainability of logistics services.

The 'JP Vision 2025' medium-term management plan serves as an overarching framework. Its main goal is to create a 'Co-creation Platform' supporting customers and local communities. Digital transformation (DX) is a key objective within this plan.

The product launches are designed to meet specific demographic needs. The insurance product and commission-free mutual funds exemplify this targeted approach. These launches aim to attract new customers and increase market share.

Collaborations play a crucial role in expanding reach and addressing social issues. The agreement with JR East and the previous collaboration with Yamato Transport highlight these efforts. These partnerships aim to improve efficiency and customer convenience.

The core of the Japan Post Holdings strategy is a customer-centric approach. This approach involves providing services that cater to the specific needs of different customer segments. The focus is on convenience and value.

Digital initiatives, such as the 'post office app,' are central to their modern approach. These initiatives aim to enhance customer experience and streamline service delivery. The goal is to increase digital service utilization.

The company's strategies are designed to adapt to the changing Japanese market conditions. This includes addressing the needs of an aging population and leveraging technological advancements. This is part of the Growth Strategy of Japan Post Holdings.

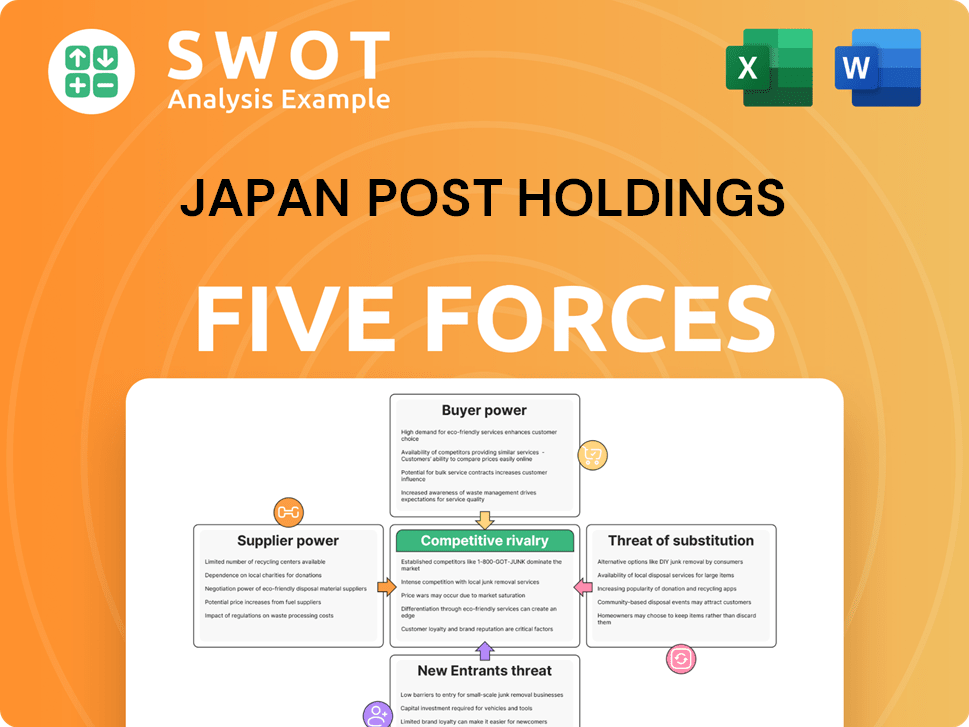

Japan Post Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Japan Post Holdings Company?

- What is Competitive Landscape of Japan Post Holdings Company?

- What is Growth Strategy and Future Prospects of Japan Post Holdings Company?

- How Does Japan Post Holdings Company Work?

- What is Brief History of Japan Post Holdings Company?

- Who Owns Japan Post Holdings Company?

- What is Customer Demographics and Target Market of Japan Post Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.