JetBlue Bundle

How Did JetBlue Transform Air Travel?

JetBlue Airways, a name synonymous with customer-focused air travel, has a compelling story. From its humble beginnings to its current status as a major airline, JetBlue's journey is a fascinating case study in innovation and adaptation within a challenging industry. Discover how this company redefined the flying experience.

Founded in August 1998 by JetBlue SWOT Analysis founder David Neeleman, JetBlue airlines quickly distinguished itself. The company's early focus was on providing low-cost flights with enhanced amenities, a strategy that resonated with travelers. This approach helped JetBlue grow and expand its routes, solidifying its position in the competitive aviation market. Understanding the JetBlue SWOT Analysis is key to understanding its success.

What is the JetBlue Founding Story?

The story of JetBlue Airways, a prominent player in the airline industry, began in August 1998. Founded by David Neeleman, the airline initially operated under the name 'NewAir.' This marked the inception of what would become a significant force in air travel, reshaping how people experience flying.

Neeleman's vision was rooted in a desire to improve the passenger experience, drawing from his experience in customer service. His previous venture, Morris Air, known for pioneering e-tickets, set the stage for his next endeavor. The aim was to create an airline that combined low-cost travel with enhanced amenities, setting JetBlue apart from its competitors.

The initial challenge Neeleman addressed was widespread dissatisfaction with air travel in the late 1990s. JetBlue's business model focused on low fares and added features like in-flight entertainment. The airline's early success was also supported by strong initial funding, making it one of the best-capitalized startup airlines at its launch.

David Neeleman founded JetBlue Airways in August 1998, initially as 'NewAir'. Neeleman aimed to create an airline with a focus on customer experience, drawing from his background in customer service and his previous success with Morris Air.

- JetBlue's initial business model aimed to offer low-cost travel with enhanced amenities, setting it apart from competitors.

- The airline's initial funding totaled $128 million, making it one of the best-capitalized startups at the time.

- The founders considered naming the airline 'Taxi' but changed it due to investor concerns.

- JetBlue's first flight took off in February 2000.

The early days of JetBlue saw the airline focusing on a streamlined fleet, primarily using the Airbus A320 family. This approach, similar to Southwest's strategy with the Boeing 737, helped in managing maintenance costs. The choice of aircraft and the focus on customer experience were key elements of JetBlue's business strategy.

One interesting aspect of JetBlue's history is the initial consideration of the name 'Taxi,' along with a yellow livery, to associate the airline with New York. However, this idea was abandoned due to pressure from an investor. This decision highlights the financial and strategic considerations that shaped the airline's early identity. JetBlue's ability to secure significant initial funding was crucial, with institutional investors and company directors contributing to the total of $128 million.

The airline's launch in February 2000 marked the beginning of its operations. The early routes and destinations were carefully selected to establish a strong presence in the market. JetBlue's focus on customer service and in-flight entertainment, including TV at every seat and Sirius XM satellite radio, set a new standard for budget carriers. For a deeper understanding of how JetBlue operates, consider reading about the Revenue Streams & Business Model of JetBlue.

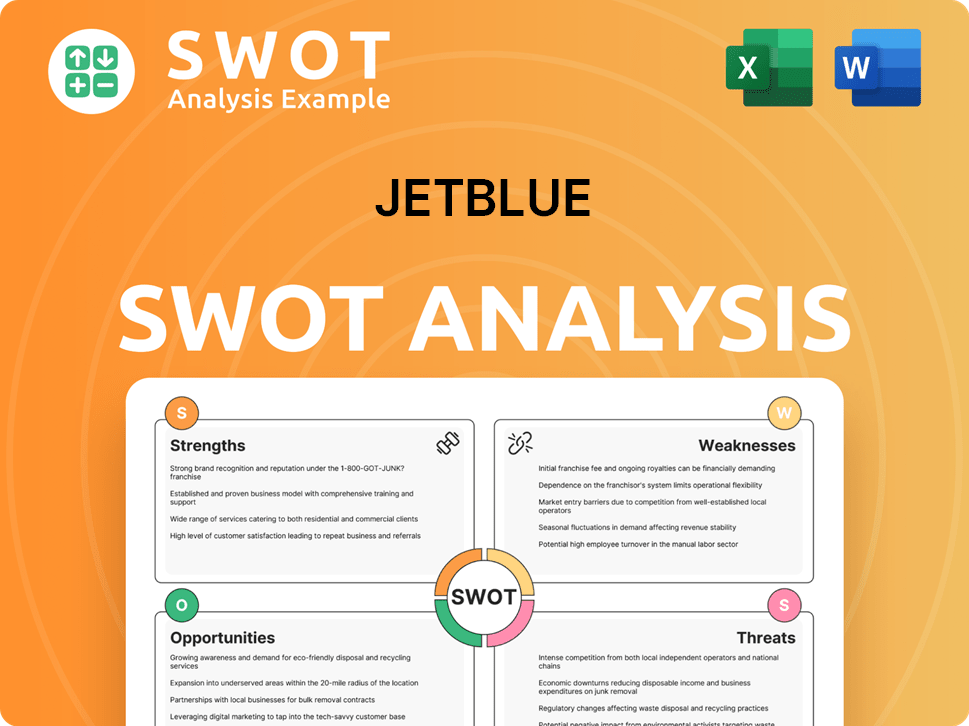

JetBlue SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of JetBlue?

The early years of the JetBlue company were marked by rapid growth and a focus on customer satisfaction. JetBlue airlines began operations on February 11, 2000, quickly establishing itself in the market. This period saw the airline expand its routes and fleet, setting the stage for its future development.

When was JetBlue founded? JetBlue's first flights took off from New York's John F. Kennedy International Airport (JFK) to Fort Lauderdale and Buffalo. In its first year, JetBlue flew over one million passengers, demonstrating strong early market reception. The initial destinations were limited, but the airline quickly added more routes.

By June 2001, JetBlue was operating 76 daily flights with a fleet of fourteen planes, mostly leased. A second base was established in Long Beach, California, in August 2001. This expansion showcases JetBlue's early commitment to growing its presence in the airline industry.

JetBlue's financial performance history includes its ability to remain profitable after the September 11 attacks. The company's initial public offering (IPO) took place in April 2002, raising $260 million at its NASDAQ debut. In 2002, JetBlue also acquired LiveTV, LLC for $41 million in cash.

Who is the CEO of JetBlue? Leadership transitions occurred, with Dave Barger replacing JetBlue founder David Neeleman as CEO in May 2007. By 2005, the company had added service between JFK and Boston Logan using its new Embraer 190 aircraft. In March 2008, JetBlue established a hub at Orlando International Airport, further extending its presence.

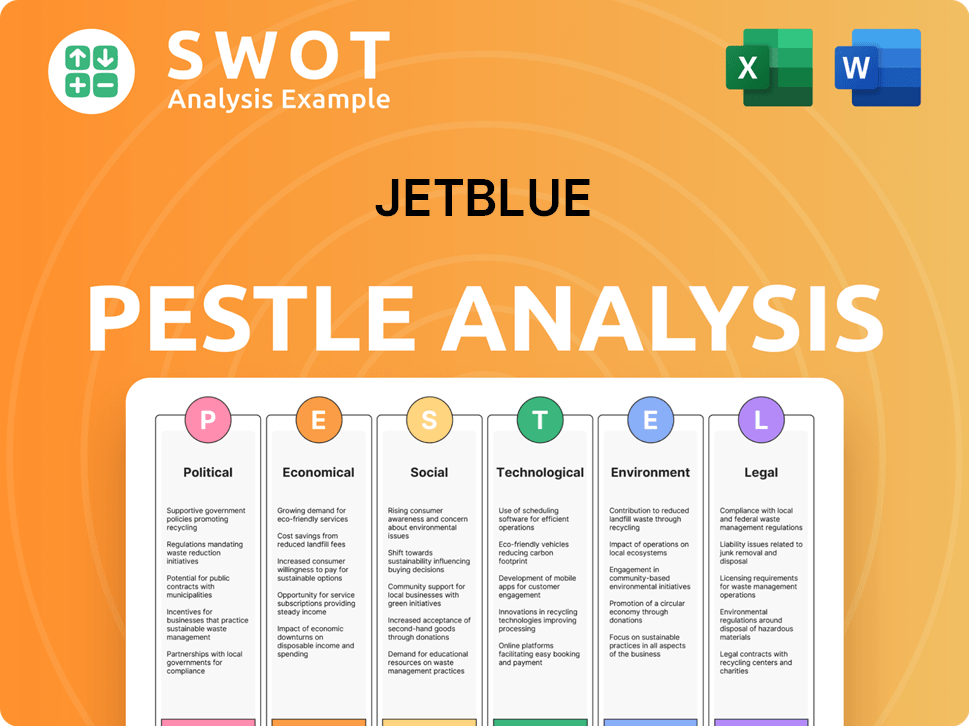

JetBlue PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in JetBlue history?

The JetBlue company has achieved several significant milestones throughout its history, shaping its identity and impact on the airline industry. These achievements reflect the airline's growth and its commitment to innovation and customer service.

| Year | Milestone |

|---|---|

| October 2008 | Inaugurated its flagship home at JFK Terminal 5, a substantial investment of $800 million. |

| October 2013 | Launched the Mint product, offering lie-flat seats initially on transcontinental and select Caribbean routes, a key innovation in premium service. |

| May 2015 | Received a license for charter flights to Cuba, with commercial services commencing in August 2016, marking the first commercial flight between the two nations in 54 years. |

| December 2020 | Took delivery of its first Airbus A220-300, diversifying its fleet. |

| February 2021 | Introduced the Mint Suite, installed on its A321LRs and select A321neos, further enhancing its premium offerings. |

| August 2021 | Launched its long-awaited transatlantic operations, with initial flights from JFK to London Heathrow, followed by London Gatwick a month later. |

| 2026 (Planned) | Plans to launch a domestic first-class experience across its non-Mint fleet. |

The airline has consistently sought to differentiate itself through innovation. From premium services like Mint to fleet diversification with the Airbus A220-300, the company has aimed to enhance the passenger experience and expand its market reach.

The introduction of the Mint product in October 2013 offered lie-flat seats, revolutionizing premium service on select routes. This innovation set a new standard for comfort in the airline's offerings.

Launching transatlantic flights in August 2021 marked a significant expansion, connecting JFK to London Heathrow and later to London Gatwick. This broadened the airline's international presence.

The addition of the Airbus A220-300 to its fleet in December 2020 showcased its commitment to modernizing its operations. This diversification improved efficiency and passenger experience.

The Mint Suite, introduced in February 2021, further enhanced premium offerings on A321LRs and select A321neos. This provided a more luxurious experience for premium passengers.

Despite its achievements, the company has faced considerable challenges, especially in recent years. These challenges have included financial losses, legal battles, and strategic setbacks, impacting its growth trajectory.

The airline experienced a net loss of $208 million in Q1 2025, with operating revenue decreasing by 3.1% year-over-year to $2.1 billion. This has prompted strategic adjustments.

The dissolution of its Northeast Alliance (NEA) with American Airlines in 2023 presented a strategic setback. This impacted its route network and market presence.

The blocked acquisition of Spirit Airlines in 2024 due to antitrust concerns limited its growth opportunities. This forced the company to reassess its expansion strategy.

In response to these challenges, the company initiated its 'JetForward' strategy in July 2024. This multi-year plan aims to restore profitability and enhance operational reliability.

The airline has grappled with negative profitability and mounting liabilities, with an EBIT margin at -21.3% and a high debt-to-equity ratio of 3.46 as of April 2025. These metrics highlight the financial strain.

The airline redeployed about 20% of its network in 2024, closing 15 cities and adjusting 50 routes to focus on core geographies. This was part of the strategic realignment.

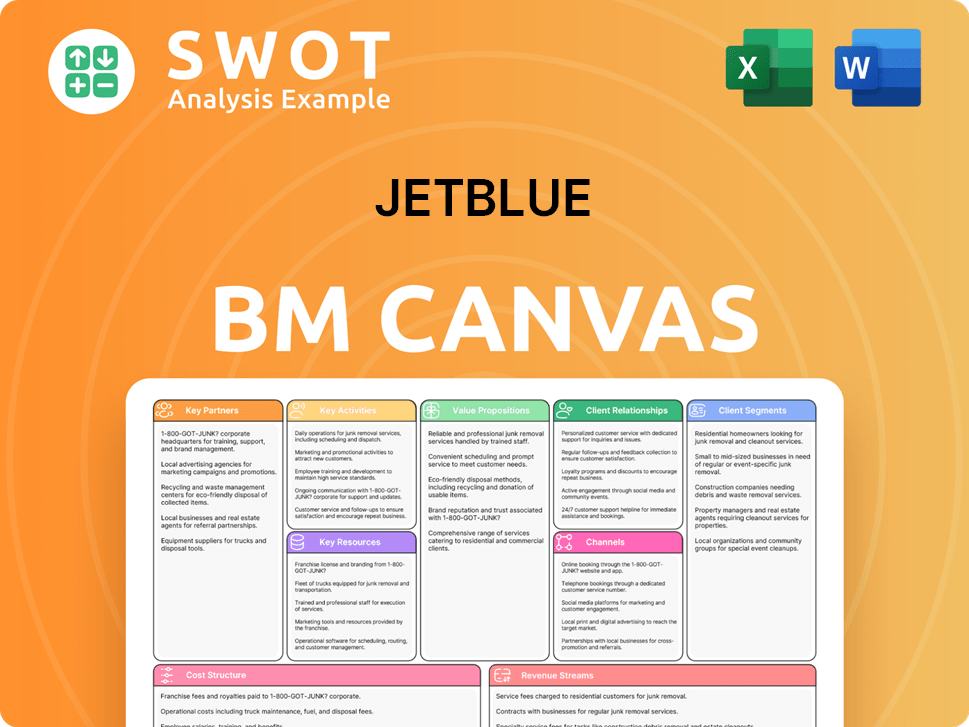

JetBlue Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for JetBlue?

The JetBlue company has a rich history, marked by significant milestones. From its incorporation in 1998 to its initial public offering in 2002, and the launch of its premium Mint service in 2013, the airline has consistently innovated. Strategic moves, such as establishing hubs and expanding routes, have shaped its growth. Recent years have seen the introduction of new aircraft and transatlantic operations, reflecting its evolving business model and commitment to customer experience.

| Year | Key Event |

|---|---|

| August 1998 | Incorporated in Delaware as 'NewAir.' |

| February 11, 2000 | Commenced operations with flights from JFK to Fort Lauderdale and Buffalo. |

| April 2002 | Initial Public Offering (IPO) on NASDAQ, raising $260 million. |

| 2002 | Acquired LiveTV, LLC for $41 million. |

| February 2006 | Reported its first quarterly loss. |

| May 2007 | David Neeleman replaced as CEO by Dave Barger. |

| March 2008 | Established a hub at Orlando International Airport. |

| October 2008 | Inaugurated flagship home at JFK Terminal 5. |

| October 2013 | Launched Mint premium service with lie-flat seats. |

| May 2015 | Granted license for charter flights to Cuba. |

| August 2016 | Operated first commercial service between the U.S. and Cuba. |

| December 2020 | Took delivery of its first Airbus A220-300. |

| February 2021 | Introduced Mint Suite on A321LRs and select A321neos. |

| August 2021 | Launched transatlantic operations to London Heathrow. |

| 2023 | Dissolution of Northeast Alliance with American Airlines. |

| February 2024 | Joanna Geraghty assumed role of CEO. |

| 2024 | Deferred approximately $3.0 billion in capital expenditures related to Airbus aircraft deliveries to 2030 and beyond. |

| July 2024 | Introduced the 'JetForward' strategic framework. |

The

Future plans include launching a domestic first-class product in 2026 and expanding the East Coast leisure network. The company is actively pursuing new partnerships with multiple airlines, including potential discussions with United Airlines. These partnerships are aimed at improving loyalty benefits and customer connectivity.

JetBlue aims to achieve a positive operating margin for the full year 2025, demonstrating a commitment to financial stability. The 'JetForward' program is expected to generate an incremental $200 million in EBIT. The company has deferred approximately $3.0 billion in capital expenditures to strengthen its financial position.

Long-term goals include achieving net-zero carbon emissions by 2040, highlighting the airline's commitment to environmental sustainability. This reflects a broader effort to align with industry standards and address climate change. The company also plans to open airport lounges at JFK and Boston Logan International Airports.

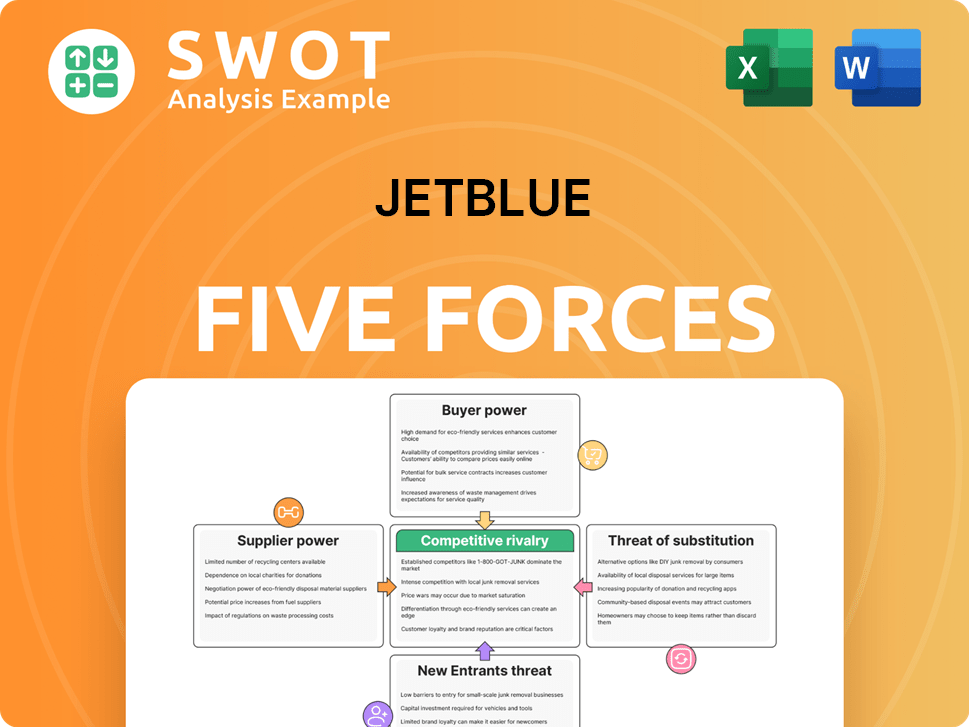

JetBlue Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of JetBlue Company?

- What is Growth Strategy and Future Prospects of JetBlue Company?

- How Does JetBlue Company Work?

- What is Sales and Marketing Strategy of JetBlue Company?

- What is Brief History of JetBlue Company?

- Who Owns JetBlue Company?

- What is Customer Demographics and Target Market of JetBlue Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.