JetBlue Bundle

Who Flies JetBlue? Unveiling JetBlue's Customer Profile

In the dynamic world of air travel, understanding customer demographics and target markets is crucial for sustained success. JetBlue, a pioneer in low-cost, customer-centric flying since 1998, has built its brand on a unique approach. This exploration dives deep into JetBlue's customer base to understand their needs and preferences.

This analysis will help you understand the JetBlue SWOT Analysis, providing insights into the airline's strategic adjustments and future growth. We'll uncover who JetBlue's typical flyers are, from leisure travelers to business professionals, and how the airline strategically tailors its services to meet their needs. By examining JetBlue's market segmentation and customer preferences, we can gain a comprehensive understanding of its success factors.

Who Are JetBlue’s Main Customers?

Understanding the customer demographics JetBlue serves is key to grasping its market position. Historically, the airline has focused on leisure travelers seeking a 'premium travel experience at a low price,' a strategy that has defined its brand. However, JetBlue is evolving to attract a broader range of customers, including those willing to pay a premium for enhanced services.

JetBlue's JetBlue target market is expanding to include higher-value customers. This shift is evident in its premium service offerings and loyalty program enhancements. The airline's strategic moves suggest a refinement of its customer focus to capture a larger share of the premium and business travel markets, alongside its core leisure segment.

While specific demographic data isn't publicly available, JetBlue's actions indicate a strategic shift towards attracting more affluent travelers. The introduction of new premium products and the expansion of existing services, alongside loyalty program upgrades, signal a deliberate effort to cater to a more diverse and potentially higher-spending customer base.

JetBlue primarily targets consumers (B2C) with a broad focus on leisure travelers. The airline is increasingly focused on attracting high-value and premium customers through enhanced services and loyalty programs. This strategic shift is supported by the introduction of premium offerings and network adjustments.

The airline is investing in premium offerings, such as its new domestic first-class product debuting in late 2025, and expanding its Mint service. These initiatives are designed to attract more affluent travelers and increase revenue from higher-paying customers. These strategies are designed to increase the revenue in the coming years.

JetBlue's TrueBlue loyalty program contributes significantly to its revenue, accounting for 12% of total revenue. The program rewards high-value customers with new tiers and expanded benefits. The loyalty program is a key driver in retaining and attracting premium customers.

The passenger segment is projected to be the largest revenue driver, with $8.4 billion in revenues (92% of total revenues) over FY2025. This segment is also expected to be the fastest-growing, with a 4.1% growth over FY2024-26. JetBlue is strategically positioning itself to capitalize on these growth opportunities.

JetBlue is adapting to changing JetBlue customer profile preferences by offering more premium services and refining its network. The 'JetForward' strategy includes closing 15 cities and shifting 50 routes in 2024. This strategy aims to boost profitability and prioritize stronger routes, indicating a strategic focus on core markets and high-value customers.

- Focus on premium services and loyalty programs.

- Network adjustments to boost profitability.

- Emphasis on attracting high-value customers.

- Strategic moves to capture a larger share of the premium and business travel markets.

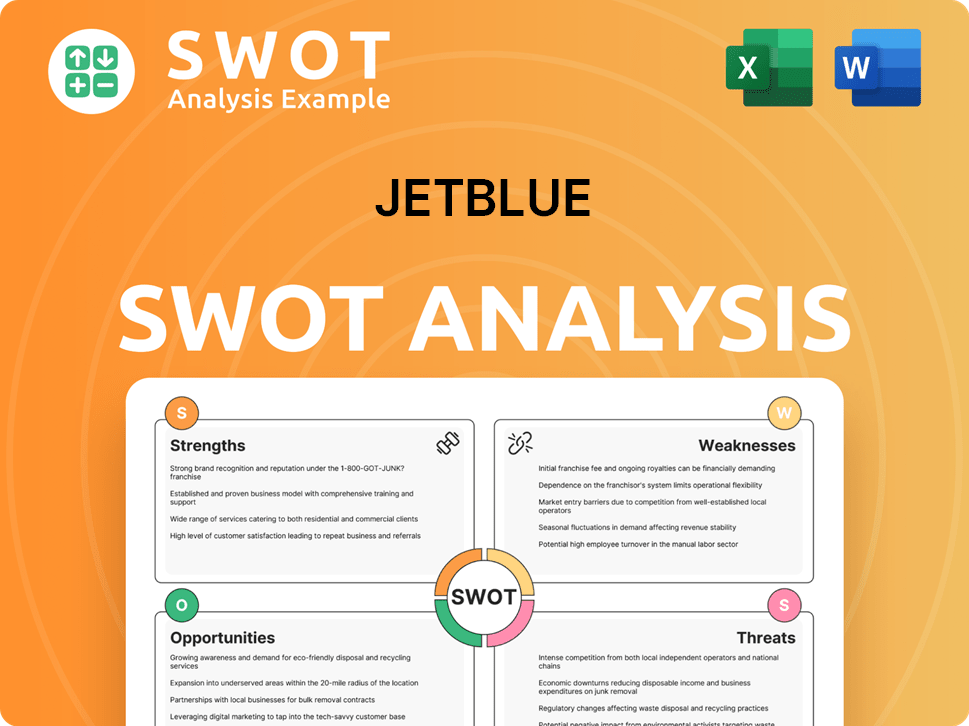

JetBlue SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do JetBlue’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for the airline industry, it's particularly important. JetBlue, with its focus on customer satisfaction, has developed a strong understanding of its passengers. This has enabled it to tailor its services to meet the demands of its target market effectively.

JetBlue's approach centers on providing a blend of affordability and a comfortable flying experience. This strategy includes offering amenities that enhance the overall travel experience, such as spacious seating, complimentary Wi-Fi, and a variety of in-flight entertainment options.

By focusing on these elements, JetBlue aims to create a positive customer experience that encourages loyalty and repeat business. The airline's commitment to understanding and meeting customer needs is a key factor in its success.

JetBlue's customers are driven by a desire for both value and comfort, seeking competitive fares alongside a pleasant flying experience. Key preferences include comfortable seating and a robust in-flight entertainment system. A 2023 passenger satisfaction survey highlighted in-flight entertainment and seating comfort as key factors, with 85% of respondents citing these features as reasons for choosing JetBlue.

- In-Flight Entertainment: JetBlue offers personal seatback screens with live TV and on-demand content.

- Comfort and Amenities: Spacious seating, complimentary Wi-Fi, snacks, and beverages are provided.

- Personalization: The 'Blueprint by JetBlue' platform, launched in April 2024, offers watch parties and content recommendations.

- Operational Reliability: Predictive analytics for maintenance helps minimize delays.

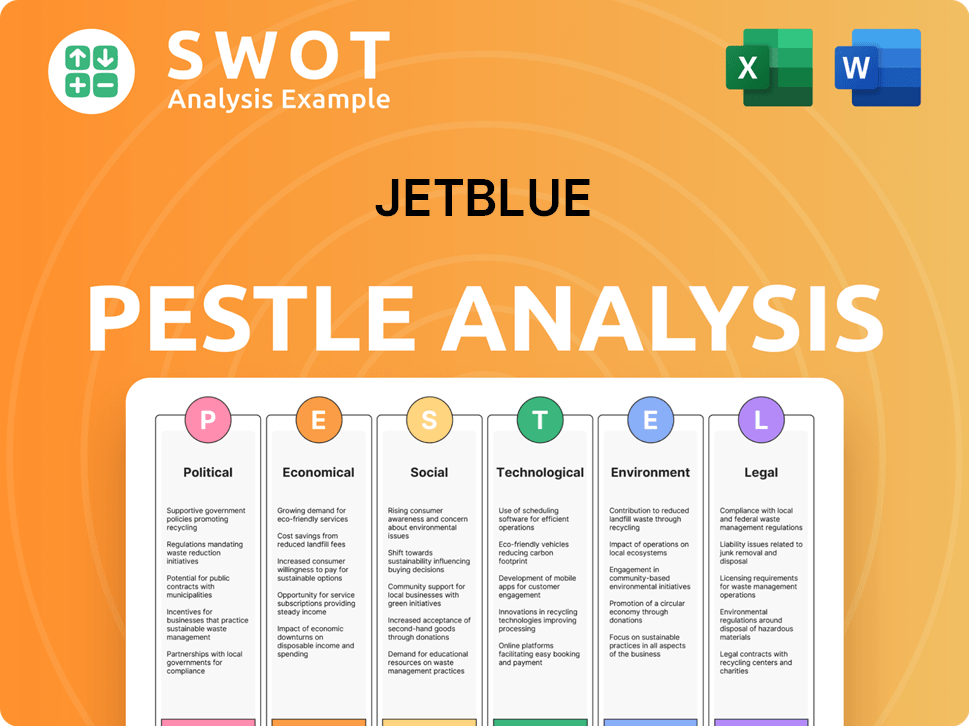

JetBlue PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does JetBlue operate?

The geographical market presence of the airline is primarily concentrated in the United States, Latin America, and the Caribbean. It strategically focuses on six key cities: New York, Boston, Orlando, Fort Lauderdale, Los Angeles, and San Juan. The airline is known as 'New York's Hometown Airline,' leveraging its base in one of the largest travel markets in the nation.

The airline's international reach has expanded significantly, particularly into Europe. In 2024, it added new routes to Dublin and Edinburgh from Boston and New York, complementing existing services to London (Heathrow), Paris, and Amsterdam. As of summer 2025, the airline serves European markets including France, Ireland, Netherlands, Scotland, Spain, and the United Kingdom.

The airline is also bolstering its presence in Latin America and the Caribbean, launching new flights to Honduras and expanding in Guatemala City, starting April 30, 2025. However, the airline is also streamlining its operations, reducing its Los Angeles operations by 34% from June 2024 and discontinuing certain routes to boost profitability. This strategic shift involves a 4% reduction in seats in Q1 2025.

The airline's strategic focus on six key cities—New York, Boston, Orlando, Fort Lauderdale, Los Angeles, and San Juan—is a cornerstone of its operational strategy. These cities serve as hubs, enabling efficient route networks and enhanced customer service.

The airline maintains a strong presence in the United States, with a significant portion of its routes operating domestically. The airline's strategy includes optimizing routes to maximize profitability and operational efficiency.

The airline has expanded its international reach, particularly in Europe, with routes to cities like London, Paris, and Amsterdam. New routes to Dublin and Edinburgh further enhance its transatlantic presence.

The airline is making strategic adjustments to its network, including reducing Los Angeles operations and discontinuing certain routes to improve profitability. This includes exiting the London Gatwick route in 2025.

The airline's geographical strategy is dynamic, adapting to market demands and operational efficiencies. This includes a focus on core markets and strategic adjustments in response to changing conditions. For a deeper dive into the strategic planning of the airline, consider the Growth Strategy of JetBlue.

- The airline's route network is continually optimized to enhance profitability.

- International expansion focuses on high-demand markets, particularly in Europe.

- Strategic adjustments include exiting underperforming routes and consolidating operations.

- The airline is enhancing connections across Latin America and the Caribbean.

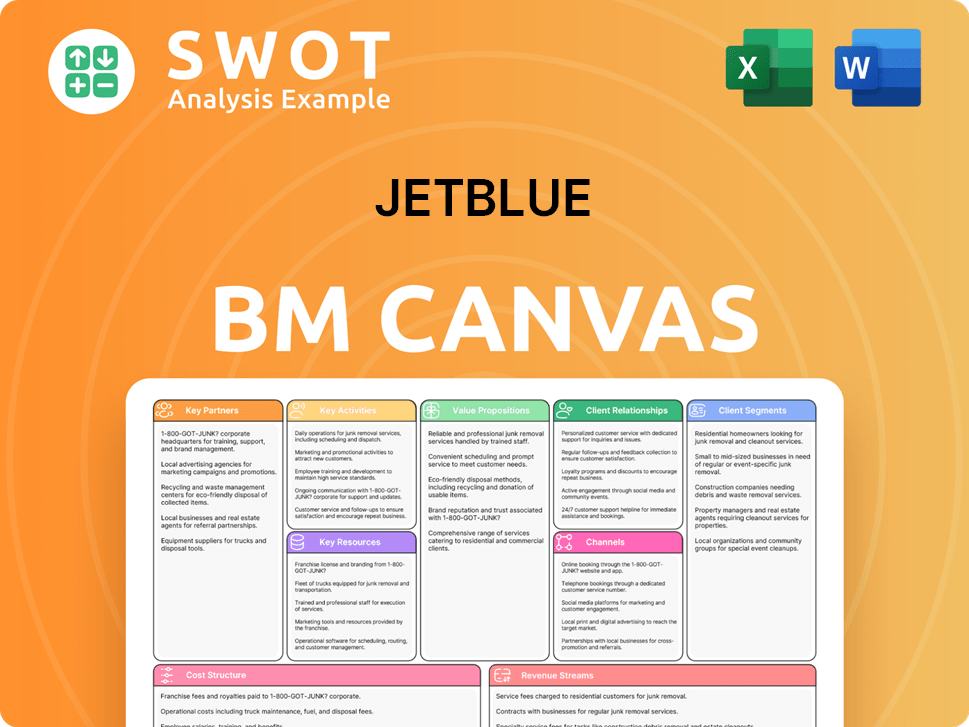

JetBlue Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does JetBlue Win & Keep Customers?

To acquire and retain customers, JetBlue employs a comprehensive strategy that uses various marketing channels, loyalty programs, and personalized experiences. Digital media, including social platforms like Twitter, Instagram, and Facebook, is crucial for building brand awareness and engaging with customers. This allows for real-time communication and rapid issue resolution. Traditional advertising methods, such as print, magazines, television ads, and online websites, also play a significant role.

Customer acquisition campaigns often highlight competitive fares and the airline's customer-centric experience, supported by catchy slogans. The 'JetForward' strategy, implemented in 2024, features revenue initiatives, including changes to its route network and charges for preferred seat assignments, which generated an additional $395 million in revenue last year. Moreover, the airline is expanding its payment options by becoming the first carrier to accept Venmo for flight bookings. Partnerships, like the codeshare enhancement with Etihad Airways in May 2024 and the 'Blue Sky' loyalty and network-sharing alliance with United Airlines in May 2025, are designed to broaden reach and offer more travel connections.

Customer retention is significantly supported by the TrueBlue loyalty program, which was updated in 2023 with new tiers and increased point-earning opportunities through co-branded credit cards and travel spending. This program is a significant revenue driver, with TrueBlue membership growing by 12% in 2023. JetBlue aims for a 20% increase in loyalty program enrollment by 2025. Furthermore, the airline offers personalized experiences through data-driven insights, tailoring recommendations and promotions, and investing in technology like AI-powered virtual assistants for faster customer support. These strategies, together with a focus on operational reliability and customer service, aim to improve customer loyalty, lifetime value, and reduce churn. To understand more about the airline, you can read a Brief History of JetBlue.

JetBlue uses social media platforms such as Twitter, Instagram, and Facebook to increase brand awareness and interact with customers. These platforms enable real-time communication and quick solutions to customer concerns. The airline uses targeted digital advertising to reach specific customer segments and promote special offers.

JetBlue uses traditional advertising channels, including print media, magazines, and television ads, to reach a wide audience. These methods are used to promote the airline's services and highlight its customer-focused approach. Advertising campaigns highlight competitive fares and the airline's customer-centric experience.

The TrueBlue loyalty program is key to retaining customers, with a 12% increase in membership in 2023. The program offers various tiers and rewards, including increased point-earning opportunities through co-branded credit cards. JetBlue aims for a 20% increase in loyalty program enrollment by 2025.

JetBlue forms partnerships, such as the codeshare enhancement with Etihad Airways in May 2024, to broaden its reach and offer more travel options. The 'Blue Sky' loyalty and network-sharing alliance with United Airlines, starting in May 2025, will further expand its network. These alliances help the airline reach a wider customer base.

JetBlue focuses on providing excellent customer service and a comfortable flying experience. The airline invests in operational reliability to ensure on-time flights and reduce disruptions. This focus improves customer satisfaction and encourages repeat business.

JetBlue uses data-driven insights to tailor recommendations and promotions to individual customers. The airline invests in technology, like AI-powered virtual assistants, to provide faster customer support. This personalization enhances customer satisfaction and loyalty.

The 'JetForward' strategy, implemented in 2024, includes revenue initiatives such as changes to its route network and charges for preferred seat assignments. These initiatives drove $395 million in additional revenue last year. JetBlue is also expanding payment options, including Venmo.

JetBlue plans to introduce its first airport lounges at JFK and Boston Logan by the end of 2025. These lounges will enhance the premium customer experience. This initiative aims to foster loyalty and attract high-value customers.

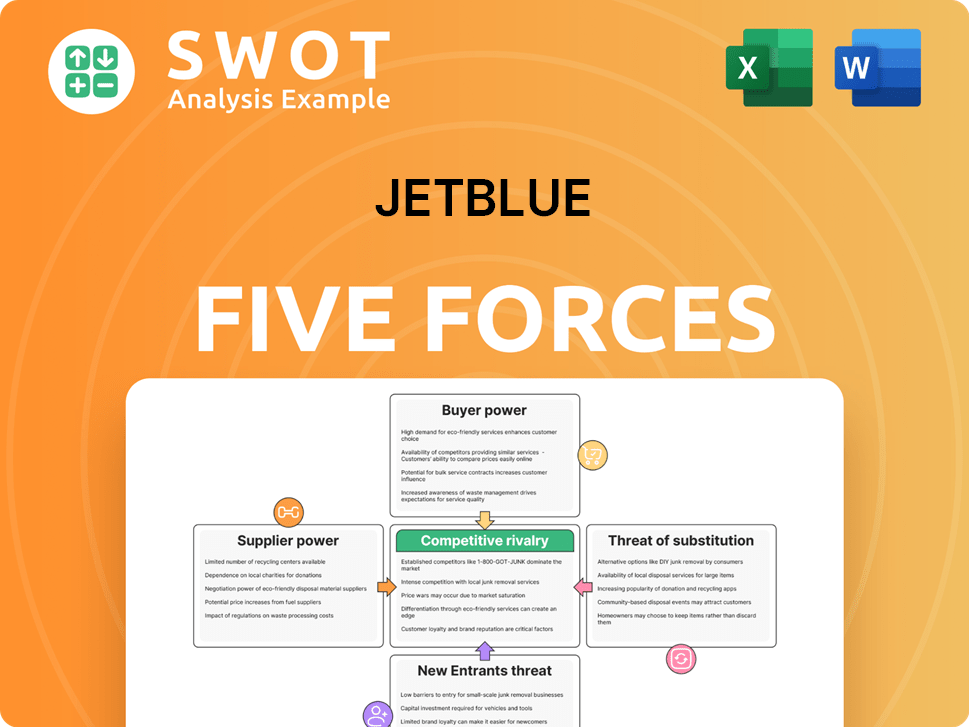

JetBlue Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JetBlue Company?

- What is Competitive Landscape of JetBlue Company?

- What is Growth Strategy and Future Prospects of JetBlue Company?

- How Does JetBlue Company Work?

- What is Sales and Marketing Strategy of JetBlue Company?

- What is Brief History of JetBlue Company?

- Who Owns JetBlue Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.