JetBlue Bundle

How Does JetBlue Soar in the Airline Industry?

JetBlue, a leading low-cost carrier, has redefined air travel with its unique blend of affordability and customer-centric services. From its inception, JetBlue has focused on providing an enhanced in-flight experience, setting it apart from many budget airlines. This commitment to passenger comfort and satisfaction has been key to its success. Understanding the JetBlue SWOT Analysis is crucial to understanding its position in the market.

Delving into JetBlue operations reveals a strategic approach to the airline industry, focusing on efficient management and innovative services. This analysis will explore JetBlue's business model, examining how it generates revenue through its flights and services. Whether you're curious about JetBlue's history, route network, or customer service reviews, this exploration provides a comprehensive overview of the airline's operations and its competitive strategies.

What Are the Key Operations Driving JetBlue’s Success?

The core operations of JetBlue are centered around providing air transportation services. The airline focuses on delivering value through a combination of competitive pricing and a superior customer experience. Primarily, it caters to leisure and business travelers within the United States, along with destinations in Latin America and the Caribbean.

JetBlue offers various fare options, including Blue, Blue Plus, Blue Extra, and Mint, to accommodate different levels of flexibility and amenities. Mint, the premium offering, provides a more luxurious travel experience. The operational processes involve flight scheduling, aircraft maintenance, ground operations, and customer service.

The airline leverages a modern fleet, primarily consisting of Airbus A320 family aircraft and Embraer 190s, to optimize fuel efficiency and operational reliability. Distribution networks include its website, mobile app, and online travel agencies, ensuring broad accessibility for booking flights. JetBlue's focus on customer service, including free in-flight Wi-Fi and complimentary snacks, differentiates it from many ultra-low-cost carriers.

JetBlue's route network spans across the United States, Latin America, and the Caribbean. The airline strategically selects destinations to maximize its market reach and cater to diverse travel needs. This network is crucial for its business model, enabling it to serve a wide range of customers.

The airline operates a modern fleet, primarily consisting of Airbus A320 family aircraft and Embraer 190s. This fleet composition supports fuel efficiency and operational reliability. JetBlue's fleet management is a key aspect of its strategy to control costs and improve performance.

JetBlue differentiates itself through customer service, offering free in-flight Wi-Fi, seatback entertainment, and complimentary snacks and drinks. These amenities enhance the travel experience, building customer loyalty. This focus on customer satisfaction is a core element of JetBlue's value proposition.

JetBlue has engaged in strategic partnerships, such as the Northeast Alliance (NEA) with American Airlines. The NEA aimed to expand route options, but faced legal challenges. The Supreme Court declined to hear an appeal in March 2024, impacting JetBlue's strategic positioning.

JetBlue's operations are designed to provide a balance of affordability and a positive customer experience. The airline's success is built on its ability to manage costs, maintain a reliable fleet, and offer attractive services. Understanding JetBlue's target market helps to clarify its operational strategies.

- Fleet Management: JetBlue's fleet includes Airbus A320 family aircraft and Embraer 190s, which are chosen for their efficiency and reliability.

- Customer Experience: Free Wi-Fi, seatback entertainment, and complimentary snacks are key features that enhance the customer experience.

- Route Network: JetBlue serves destinations across the United States, Latin America, and the Caribbean.

- Partnerships: Strategic alliances, such as the NEA, have been used to expand route options, although these partnerships can face legal challenges.

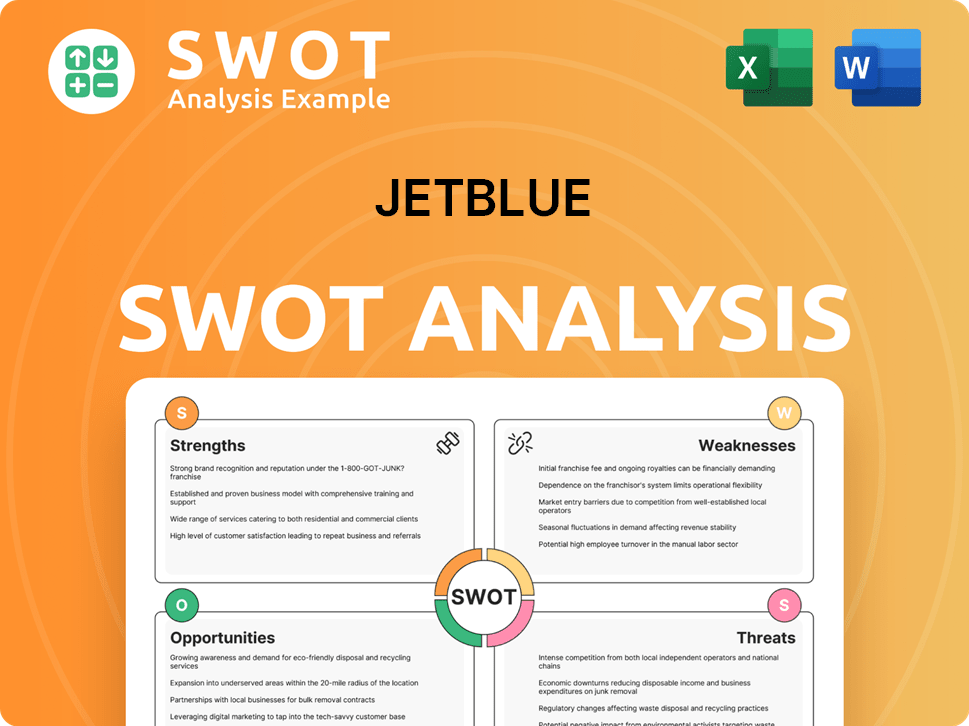

JetBlue SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does JetBlue Make Money?

JetBlue's revenue streams are primarily driven by passenger ticket sales, representing the core of its business model. This includes revenue from various fare classes, such as basic economy and the premium Mint experience. The airline strategically employs a mix of base fares and ancillary services to maximize revenue generation.

In the first quarter of 2024, JetBlue reported total operating revenues of approximately $2.2 billion, highlighting the significant impact of its passenger services. Beyond ticket sales, JetBlue leverages ancillary revenue strategies, including fees for checked bags, preferred seating, and booking changes or cancellations. Onboard sales of food, beverages, and other amenities also contribute to its revenue streams.

JetBlue's monetization strategies also encompass its loyalty program, TrueBlue, and co-branded credit card partnerships, which generate additional revenue through transaction and annual fees. The company also operates a cargo division, providing a smaller but consistent revenue stream. The dissolution of the Northeast Alliance (NEA) with American Airlines in March 2024 will require a re-evaluation of its impact on future revenue and strategic growth, especially in key markets like New York and Boston.

Passenger ticket sales are the primary revenue source for JetBlue, encompassing various fare classes. Revenue is generated from base fares and also from premium services like Mint.

Ancillary revenue includes fees for checked bags, seat assignments, and booking changes. Onboard sales of food and beverages also contribute to this revenue stream.

TrueBlue loyalty program and co-branded credit cards generate revenue. These partnerships boost customer retention and provide additional income through fees.

JetBlue operates a cargo division, offering a consistent though smaller revenue stream. This service involves the transportation of goods.

The dissolution of the NEA will lead to strategic adjustments. The company will need to re-evaluate its revenue strategies, particularly in key markets.

The revenue mix is heavily concentrated in passenger travel. This reflects JetBlue's core business as an airline.

JetBlue's financial performance is heavily reliant on passenger revenue, with ancillary services and loyalty programs adding to its financial structure. The airline's strategic focus includes optimizing its route network and managing its fleet efficiently. The company's ability to adapt to market changes and enhance customer experience is crucial for sustaining its financial health.

- Passenger Revenue: Ticket sales from various fare classes are the main source of income.

- Ancillary Services: Fees from baggage, seat selection, and booking changes provide additional revenue.

- Loyalty Programs: TrueBlue and credit card partnerships drive customer loyalty and revenue.

- Strategic Partnerships: The end of the NEA necessitates new strategies for market presence.

- Market Adaptation: Adjusting to changing market conditions is crucial for sustained growth. For more insights, consider exploring the Growth Strategy of JetBlue.

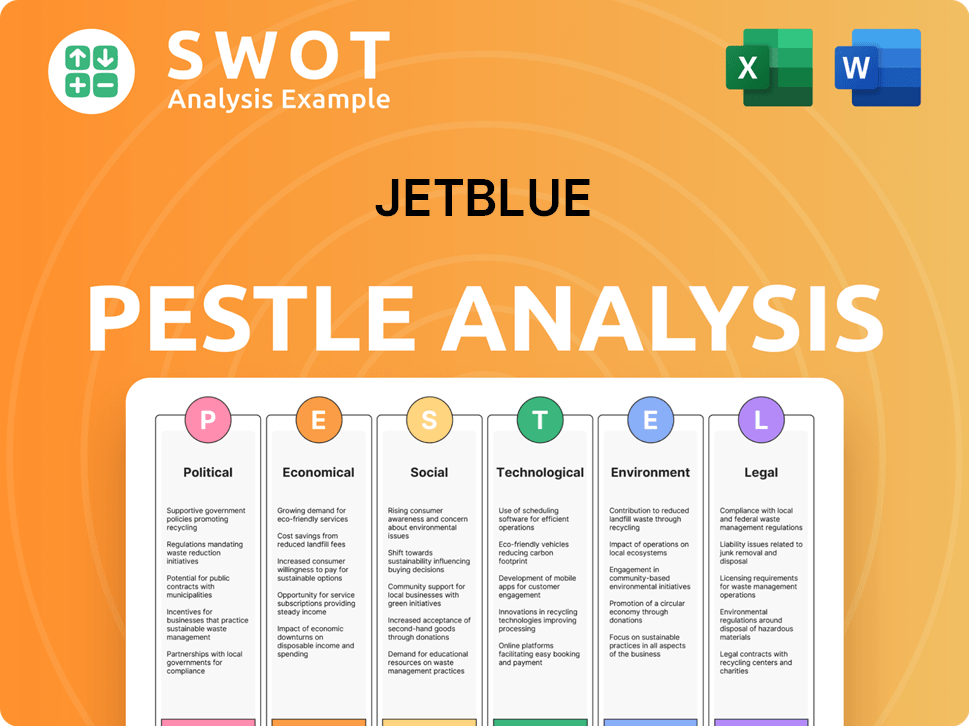

JetBlue PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped JetBlue’s Business Model?

The journey of JetBlue has been marked by significant milestones and strategic shifts. A key move was the introduction of its Mint premium service in 2014, enabling the airline to compete for higher-paying travelers. This expanded its appeal beyond budget-conscious customers. The attempted acquisition of Spirit Airlines in 2022 was a major strategic play to expand its scale.

However, this merger was blocked by a federal judge in January 2024, a decision upheld in March 2024, preventing JetBlue from realizing this expansion. This, coupled with the dissolution of the Northeast Alliance with American Airlines, presents considerable operational and market challenges. This requires the airline to re-evaluate its growth strategy.

JetBlue's competitive advantages are rooted in its strong brand recognition, built on its reputation for customer service and in-flight amenities. Its modern fleet also contributes to operational efficiency and a more comfortable passenger experience. The airline's ability to offer competitive fares while maintaining a distinct product has fostered customer loyalty. Despite recent setbacks, JetBlue continues to adapt by focusing on its core strengths, optimizing its existing network, and exploring organic growth opportunities.

The introduction of Mint premium service in 2014 was a pivotal moment, allowing the airline to compete for higher-paying travelers. The attempted acquisition of Spirit Airlines in 2022 was a strategic move to expand its network. The merger was blocked in January 2024 due to antitrust concerns.

JetBlue has focused on expanding its route network and enhancing its service offerings. The airline aimed to create the fifth-largest airline in the U.S. through the Spirit acquisition. Recent challenges include the blocked merger and the dissolution of the Northeast Alliance.

JetBlue distinguishes itself with its strong brand, customer service, and in-flight amenities. Its modern fleet contributes to operational efficiency and passenger comfort. The airline's ability to offer competitive fares while maintaining a distinct product has fostered customer loyalty.

The blocked merger with Spirit Airlines and the dissolution of the Northeast Alliance pose significant challenges. These events require JetBlue to re-evaluate its growth strategy. The airline is focusing on its core strengths and exploring organic growth opportunities.

JetBlue's operations are centered around providing a customer-focused experience with competitive fares. The airline has a modern fleet, which enhances efficiency and passenger comfort. Recent financial data indicates that JetBlue has faced challenges, including increased operational costs and the impact of the blocked merger.

- Focus on customer service and in-flight amenities differentiates JetBlue.

- The airline is adapting to recent setbacks by optimizing its network and exploring organic growth.

- JetBlue's route network includes destinations across the U.S., Caribbean, and Latin America.

- The airline's ability to offer competitive fares while maintaining a distinct product has fostered customer loyalty.

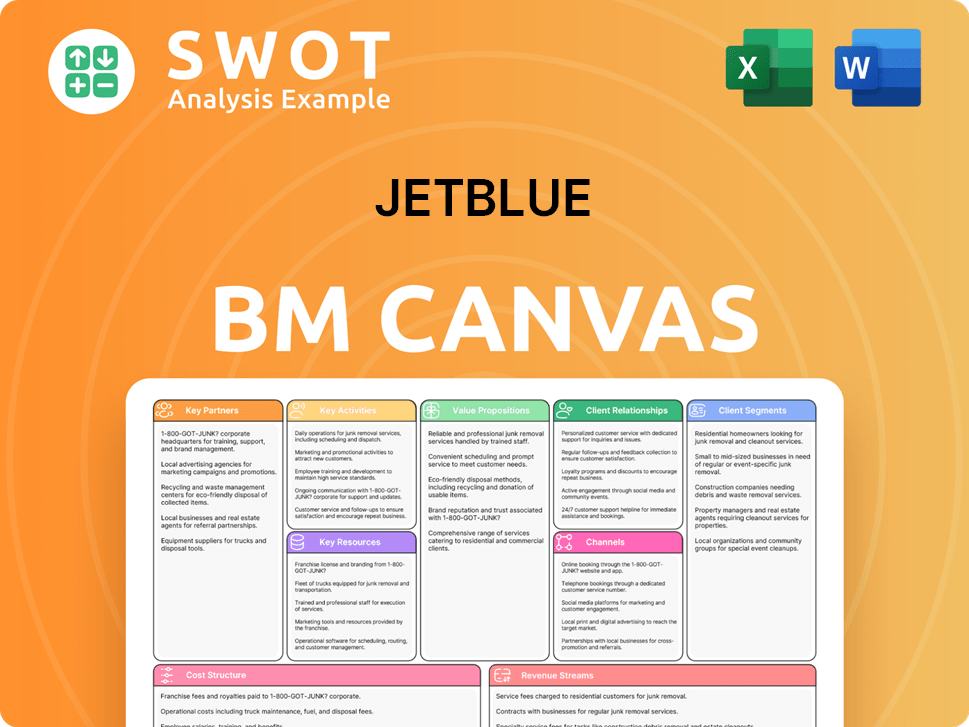

JetBlue Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is JetBlue Positioning Itself for Continued Success?

JetBlue occupies a distinct space in the U.S. airline industry, operating as a hybrid carrier. This positioning means it balances elements of both low-cost and traditional full-service airlines. While it isn't among the largest airlines by market share, it has a strong presence in key markets.

Several factors influence the company's performance. These include regulatory changes, competitive pressures, and fluctuating costs. The airline industry is also susceptible to external shocks like pandemics.

JetBlue's business model focuses on a hybrid approach, offering a balance between low fares and enhanced customer experience. It has a strong presence in major cities such as Boston and New York. Understanding its position is key for investors, analysts, and those studying Growth Strategy of JetBlue.

JetBlue faces risks such as regulatory hurdles, intense competition, and fluctuating fuel prices. The blocked merger with Spirit Airlines highlights the impact of regulatory scrutiny. These factors can significantly affect the airline's financial performance and operational efficiency.

The future outlook involves strategic adjustments, including optimizing its network and enhancing customer offerings. JetBlue is focusing on organic growth and improving its financial position. The ability to adapt to market changes will determine its long-term success.

JetBlue operations involve a complex network of flights, services, and customer interactions. The airline must manage its fleet efficiently and maintain high standards of customer service. The airline's route network and destinations are crucial for its success.

JetBlue faces challenges such as intense competition from both legacy and low-cost carriers. However, opportunities exist in enhancing operational efficiency and expanding its customer base. The company's ability to differentiate itself through its product offerings is crucial.

- Regulatory environment and antitrust enforcement.

- Fluctuations in fuel prices and labor costs.

- Impact of economic downturns and geopolitical instability.

- The ability to deliver competitive fares and a customer-centric experience.

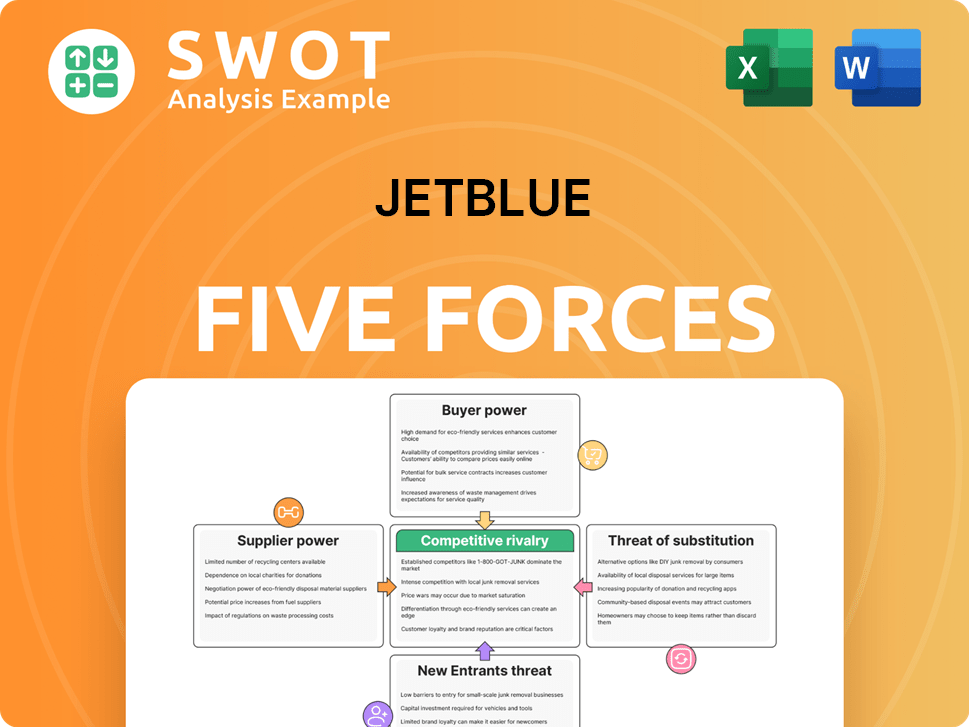

JetBlue Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JetBlue Company?

- What is Competitive Landscape of JetBlue Company?

- What is Growth Strategy and Future Prospects of JetBlue Company?

- What is Sales and Marketing Strategy of JetBlue Company?

- What is Brief History of JetBlue Company?

- Who Owns JetBlue Company?

- What is Customer Demographics and Target Market of JetBlue Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.