JetBlue Bundle

Who Really Owns JetBlue?

Understanding a company's ownership structure is crucial for investors and analysts alike. JetBlue, a major player in the airline industry, offers a compelling case study in evolving ownership dynamics. From its inception to its current status, the JetBlue SWOT Analysis reveals how its ownership has shaped its strategic direction and financial performance.

This exploration of JetBlue's ownership, including its parent company and key shareholders, reveals insights into its governance and future prospects. Examining the JetBlue ownership history, including its executives and major investors, provides a comprehensive view of the airline's trajectory. Knowing who owns JetBlue is vital for anyone interested in the company's stock and its long-term viability, including its current financial status and the influence of its board of directors.

Who Founded JetBlue?

The story of JetBlue's beginnings is rooted in the vision of David Neeleman. He established the airline in August 1998, initially calling it 'NewAir.' Neeleman's experience as an airline entrepreneur played a key role in shaping JetBlue's early strategies.

Neeleman's leadership was central to JetBlue's early success. He served as CEO from 1998 to 2007 and as Chairman from 2002 to 2008. While the precise initial equity split isn't public, his long tenure in these key roles highlights his significant ownership and influence during the company's formative years.

JetBlue's initial funding came from various sources, including early backers and angel investors, although specific details are not widely available. The airline's rapid growth in its early years suggests strong financial backing from these initial investors, setting the stage for its future expansion.

David Neeleman founded JetBlue in August 1998, initially under the name 'NewAir'. Neeleman's prior experience included co-founding Morris Air, later acquired by Southwest Airlines.

Neeleman served as CEO from 1998 to 2007 and as Chairman from 2002 to 2008. These roles underscore his significant influence and ownership during the company's early stages.

Early backers and angel investors provided initial support, though specific details are not publicly available. The company's rapid growth indicates strong initial financial backing.

JetBlue's IPO occurred on April 12, 2002. The company offered 5.9 million shares at $27 each, raising $158.4 million.

The IPO marked a transition from private ownership to a publicly traded structure. This allowed a wider range of investors to participate in JetBlue's ownership.

The initial strategy focused on low-cost fares with superior customer service. This included in-flight amenities such as seat-back televisions and satellite radio.

JetBlue's initial public offering (IPO) on April 12, 2002, was a pivotal moment, with the company offering 5.9 million shares at $27 each, raising $158.4 million. This move shifted the JetBlue ownership from a private structure to a publicly traded one, opening up investment opportunities to a broader audience. The IPO was a significant step in the airline's growth, allowing it to access more capital and expand its operations. Understanding the evolution of JetBlue ownership is essential for anyone looking to understand the company's financial structure and strategic direction. Key questions include: Who owns JetBlue, and who are the major investors in JetBlue? The company's financial health and strategic decisions are heavily influenced by its shareholder base and executive leadership.

JetBlue's journey began with David Neeleman's vision to create a customer-focused, low-cost airline. The IPO in 2002 was a crucial step in the company's evolution.

- David Neeleman founded JetBlue in August 1998.

- The IPO occurred on April 12, 2002, raising $158.4 million.

- Neeleman served as CEO from 1998-2007 and Chairman from 2002-2008.

- The IPO shifted ownership from private to public.

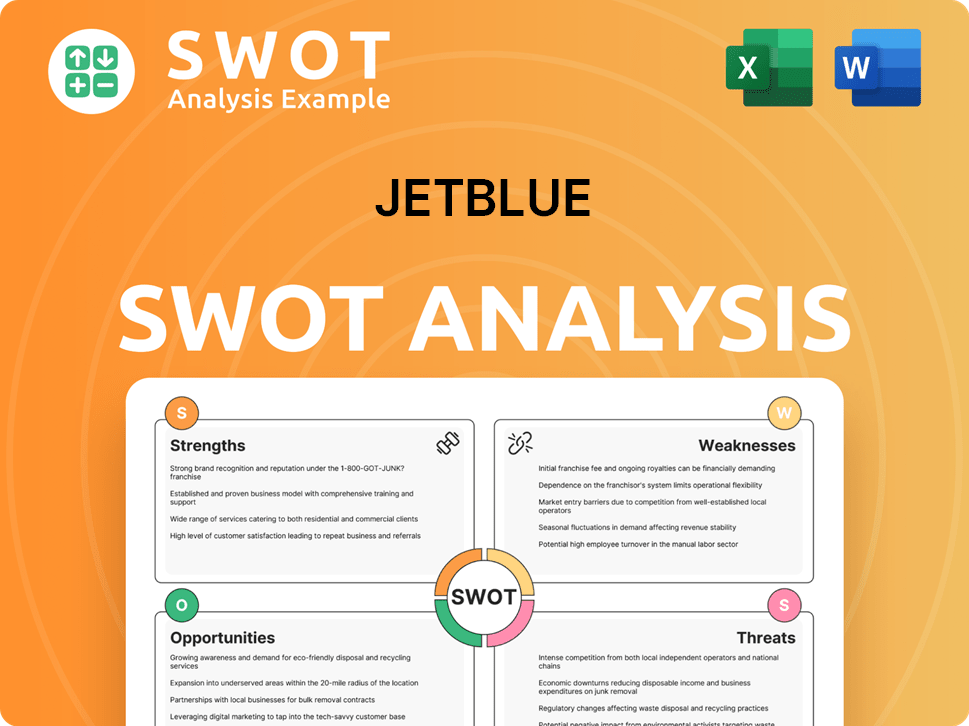

JetBlue SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has JetBlue’s Ownership Changed Over Time?

The ownership structure of JetBlue has undergone significant changes since its initial public offering (IPO) on April 12, 2002. Initially, the company had a different distribution of ownership, but over time, institutional investors have come to hold a dominant position. As of April 2025, institutional investors collectively own approximately 83.71% of JetBlue's outstanding shares. This shift reflects the evolving nature of the company's investor base and the influence of market dynamics on its stock.

The company's market capitalization has fluctuated since its IPO, which was valued at $1.83 billion. As of June 13, 2025, the market capitalization was approximately $1.58 billion. These figures highlight the impact of market conditions and investor sentiment on the valuation of JetBlue. Understanding the fluctuations in market capitalization and the evolution of its ownership structure is crucial for anyone looking to understand the history of JetBlue.

| Ownership Event | Date | Impact |

|---|---|---|

| IPO | April 12, 2002 | Transition from private to public ownership; initial distribution of shares. |

| Institutional Investment Growth | Ongoing | Increased institutional ownership; significant influence on stock performance. |

| Executive Stock Awards | Various | Stock grants to executives; alignment of interests. |

Several entities hold major stakes in JetBlue. BlackRock, Inc. held 61,172,802 shares as of September 30, 2023, representing about 18.4% of the outstanding shares. The Vanguard Group Inc. held approximately 36,705,537 shares as of April 2025. Other significant institutional investors include State Street Corporation and Dimensional Fund Advisors LP. Individual shareholders include former CEO Robin Hayes, current CEO Joanna Geraghty, and Brandon Nelson. The concentration of ownership among institutional investors means that their investment decisions can significantly affect the company's stock performance and strategic direction.

Institutional investors are the primary holders of JetBlue stock, influencing the company's strategic direction.

- BlackRock and The Vanguard Group are among the largest institutional investors.

- Executive compensation includes stock, aligning their interests with the company's performance.

- Changes in institutional holdings can significantly impact the stock's performance.

- Understanding the ownership structure is essential for assessing the company's financial health and future prospects.

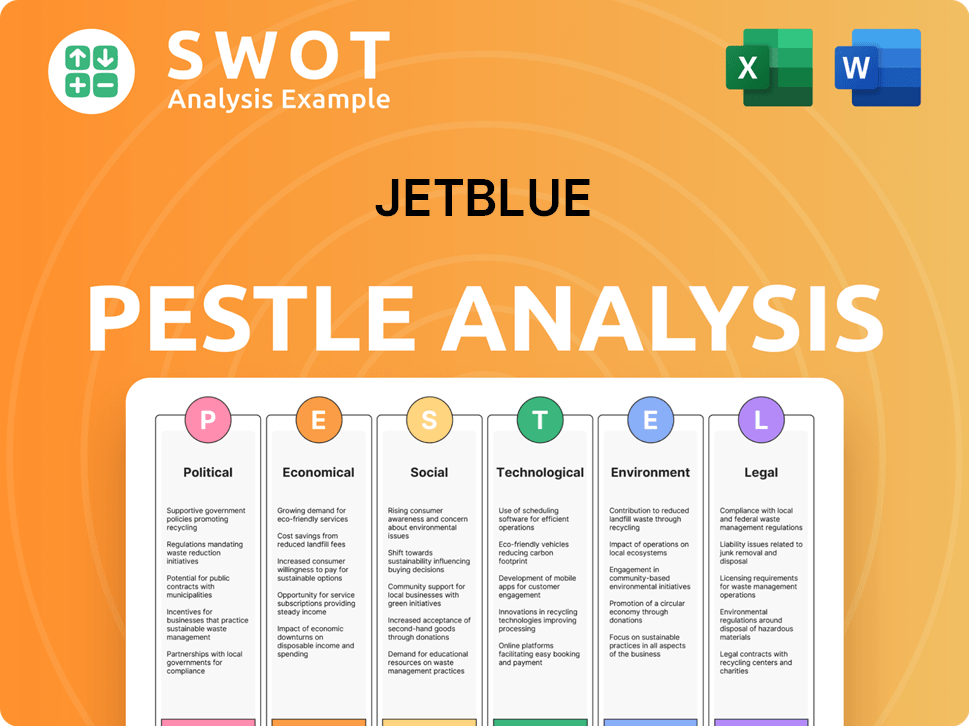

JetBlue PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on JetBlue’s Board?

The Board of Directors at JetBlue plays a significant role in guiding the airline's strategy and overseeing its operations. As of March 2025, the board includes a mix of individuals, such as the current CEO, Joanna Geraghty, who joined the board in February 2024, and Peter Boneparth, who serves as Chairman of the Board since May 2020. The board's composition reflects a blend of perspectives, including representation from major shareholders, current and former executives, and independent members. This structure helps ensure a variety of insights and expertise in the decision-making process.

The structure of the board and the influence of its members are crucial for understanding JetBlue's growth strategy. While specific details on the representation of all major shareholders are not always publicly detailed, the presence of individuals like activist investor Carl Icahn, who gained two board seats in 2024, highlights the impact significant shareholders can have. These board members help shape the company's direction and ensure accountability.

| Board Member | Position | Date Joined Board |

|---|---|---|

| Joanna Geraghty | CEO & Director | February 2024 |

| Peter Boneparth | Chairman of the Board | May 2020 |

| Carl Icahn | Director | 2024 |

JetBlue has one class of voting securities outstanding, with each share of common stock carrying one vote, subject to limitations for non-U.S. citizens. This structure ensures that shareholders have a direct say in the company's decisions. The board's composition and the voting power of shareholders are key elements in understanding who owns JetBlue and how the company is governed.

The Board of Directors at JetBlue includes the CEO, Chairman, and other members representing major shareholders.

- Joanna Geraghty became CEO and joined the board in February 2024.

- Peter Boneparth has been the Chairman of the Board since May 2020.

- Activist investor Carl Icahn gained board seats in 2024, showing shareholder influence.

- Each share of common stock has one vote, subject to limitations.

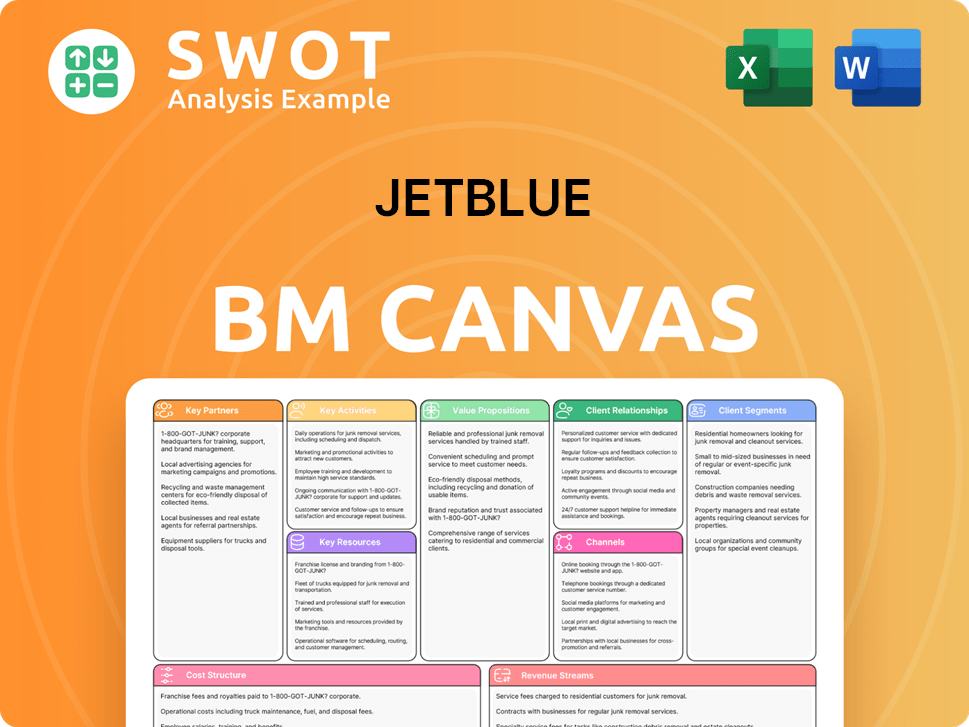

JetBlue Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped JetBlue’s Ownership Landscape?

Over the past few years, the ownership structure of the company has seen considerable shifts. The failed acquisition of Spirit Airlines significantly impacted the company's strategic direction. This was a major strategic focus for the company, leading to operational adjustments and leadership changes. This has led to what current CEO Joanna Geraghty described as 'three years of distractions' for the company.

In terms of leadership, Joanna Geraghty succeeded Robin Hayes as Chief Executive Officer on February 12, 2024, with other key appointments following in April 2024. The company has also seen changes in its board and executive roles, including the departure of Brandon Nelson in August 2024. These changes reflect the company's efforts to adapt to market challenges and streamline operations.

| Metric | Details | As of |

|---|---|---|

| Institutional Ownership | 636 institutional owners holding a total of 371,477,732 shares | April 2025 |

| Insider Activity | Board director Nik Mittal purchased 100,000 shares | February 2025 |

| Net Loss | $795 million | Full Year 2024 |

| Financing Raised | Approximately $2.8 billion through senior secured notes and a new term loan facility | 2024 |

The company's financial performance and strategic moves are key factors in understanding its current ownership dynamics. The company reported a net loss of $795 million for the full year 2024, a significant increase from the $310 million net loss in 2023. These financial moves, along with a focus on optimizing operations in core markets and enhancing customer experience, are part of the company's strategy to return to profitability. For more insights, consider reading about the Growth Strategy of JetBlue.

The ownership of the company is primarily held by institutional investors. These investors hold a significant portion of the company's shares, influencing its strategic decisions. The company is publicly traded, and its stock performance is closely watched by shareholders.

Recent changes in leadership, including the appointment of a new CEO, reflect the company's efforts to adapt to evolving market conditions. New appointments in key positions signal a shift in strategy. These changes are aimed at steering the company toward profitability and growth.

The company's financial results for 2024 show a net loss, indicating challenges in the current operating environment. The company is implementing various financial strategies to improve its financial position. These strategies include optimizing operations and enhancing customer experience.

The failed acquisition of Spirit Airlines had a significant impact on the company's strategic direction. This has led to operational adjustments and leadership changes. The company is now focused on optimizing operations and enhancing customer experience.

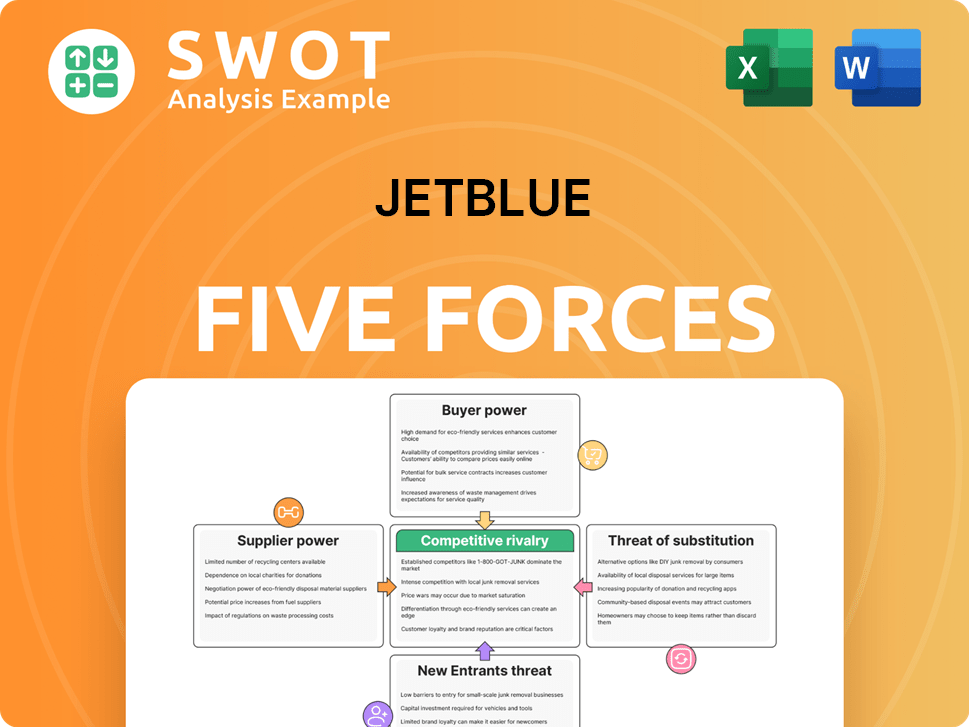

JetBlue Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JetBlue Company?

- What is Competitive Landscape of JetBlue Company?

- What is Growth Strategy and Future Prospects of JetBlue Company?

- How Does JetBlue Company Work?

- What is Sales and Marketing Strategy of JetBlue Company?

- What is Brief History of JetBlue Company?

- What is Customer Demographics and Target Market of JetBlue Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.